Criteria and procedure for writing off unrealistic (uncollectible) and doubtful debts

Accounts receivable can be written off from the balance sheet on two grounds (letters of the Ministry of Finance of Russia dated April 17, 2019 No. 02-07-10/27662, dated October 25, 2019 No. 02-07-10/82363, dated March 6, 2020 No. 02-06-10 /17162, dated June 25, 2020 No. 02-07-05/54811):

- If the debt is recognized as doubtful;

- If the debt is deemed uncollectible.

Doubtful debt is the amount of recognized income for which a receivable has been identified that was not fulfilled by the debtor (payer) on time and does not meet the criteria for recognition of an asset (clause 11 of the “Revenue” Standard, approved by order of the Ministry of Finance of Russia dated February 27, 2018 No. 32n).

Debt is considered doubtful if there are documents confirming the uncertainty regarding the receipt of economic benefits or useful potential.

The grounds for recognizing a debt as doubtful (not corresponding to an “asset”) include the lack of confidence that funds will be received in the foreseeable future (at least three years from the year in which the statements are prepared) to repay the receivables.

Doubtful debts are written off from the balance sheet and taken into account as off-balance sheet. On the off-balance sheet, doubtful debts are taken into account until they are recognized as unrecoverable (uncollectible).

Uncollectible (uncollectible) debt is the amount of recognized income for which the obligation to pay the debt, the right to collect the debt has been terminated, and there is uncertainty regarding the receipt of economic benefits or useful potential.

The grounds for recognizing a debt as unrealistic (unreliable) for collection are listed in Art. 47.2 of the Budget Code of the Russian Federation, clause 7 of the Standard “Event after the reporting date”, approved. by order of the Ministry of Finance of Russia dated December 30, 2017 No. 275n.

More on the topic: KVR 851, 852 and 853: what is it and how to use it without violations?

These include:

- death of an individual - debtor or declaration of death;

- declaring the debtor bankrupt;

- liquidation of the debtor organization in terms of debt on payments not repaid due to the insufficiency of the organization’s property and (or) the impossibility of repayment by the founders (participants) of the said organization;

- adoption by the court of an act according to which the institution loses the ability to collect debt from the debtor due to the expiration of the collection period (statute of limitations), including the court’s issuance of a ruling refusing to restore the missed deadline for filing an application to the court for debt collection;

- the issuing of a resolution by the bailiff to terminate the enforcement proceedings and to return the writ of execution to the recoverer.

The list of documents required to make a decision to recognize a debt as uncollectible is contained in paragraphs. “c” clause 3 of the order, approved. Decree of the Government of the Russian Federation dated May 6, 2016 No. 393.

A debt that is unrealistic (uncollectible) when written off from the balance sheet is not accepted for off-balance sheet accounting (clause 339 of the Instructions, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n, hereinafter referred to as Instruction No. 157n). Recognizing the debt as unrealistic (bad) is also the basis for writing off amounts from the off-balance sheet account.

The decision to write off unrealistic (uncollectible) or doubtful debts is made by the commission for the receipt and disposal of assets (clause 339 of Instruction No. 157n). The procedure and documentation of this procedure is established in the accounting policy (letter of the Ministry of Finance of Russia dated February 18, 2014 No. 02-06-10/6776).

When writing off debt from accounting, the following can be issued:

- inventory list of settlements with buyers, suppliers and other debtors and creditors (f. 0504089) with the attachment of documents confirming the existence of debt;

- documents confirming the uncertainty regarding the receipt of economic benefits or useful potential;

- decision of the institution’s commission on the receipt and disposal of assets;

- written justification for the decision to write off debt;

- order (instruction) of the head of the institution to write off the debt;

- accounting certificate (f. 0504833).

Who can create a reserve for doubtful debts?

The Tax Code provides the taxpayer with the opportunity to create a reserve for doubtful debts. Creating a reserve is a right, not an obligation of the organization (Letter of the Ministry of Finance of Russia dated May 16, 2011 N 03-03-06/1/295). Those taxpayers who recognize income and expenses when calculating income tax using the accrual method can exercise their right. When using the cash method, a reserve for doubtful debts is not created (Resolution of the Federal Antimonopoly Service of the Central District dated October 3, 2005 N A48-550/05-8).

Is it necessary to include a provision for doubtful debts in accounting policies?

Organizations are required to include information on the formation of a reserve for doubtful debts in their accounting policies for tax purposes. The opinion of tax authorities is that after making a change in the accounting policy, an organization can form a reserve for doubtful debts only from the beginning of a new tax period (Letters of the Ministry of Finance of Russia dated October 21, 2008 N 03-03-06/1/594, Federal Tax Service of Russia for the city of Moscow dated 04/09/2007 N 20-12/031921). To do this, the head of the organization needs to issue an appropriate order (instruction), which will make additions to the accounting policy. Arbitration practice, on the contrary, recognizes the creation of a reserve without changes in accounting policies as legitimate (resolutions of the FAS of the Volga-Vyatka District dated 03/19/2008 in case No. A79-3573/2007, FAS of the North-Western District dated 07/03/2008 in case No. A56-12980/2007 , By the decision of the Supreme Arbitration Court of the Russian Federation dated November 12, 2008 N 14387/08, the transfer of this case to the Presidium of the Supreme Arbitration Court of the Russian Federation, the Federal Antimonopoly Service of the Ural District dated December 22, 2005 N F09-5913/05-S7 was refused.

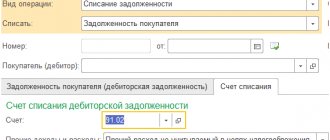

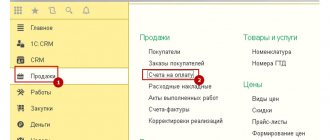

Accounting records for writing off unrealistic (uncollectible) and doubtful debts

Write-off of unrealistic (uncollectible) and doubtful receivables (for income, sources of financing the budget deficit, granted loans, advances) relates to subarticle 173 “Extraordinary income from transactions with assets” of the KOSGU (clause 9.7.3 of the procedure, approved by order of the Ministry of Finance Russia dated November 29, 2017 No. 209n, hereinafter referred to as Procedure No. 209n).

More on the topic: Repair of property that does not belong to an institution with the right of operational management: how and on the basis of what documents should it be reflected in the records?

Unrealistic (unreliable) for collection, doubtful receivables for expenses (for advance payments made, for state and municipal guarantees for which equivalent claims do not arise on the part of the guarantor to the debtor) are written off to subarticle 273 “Extraordinary expenses for transactions with assets” of KOSGU ( clause 10.7.3 of Order No. 209n).

Transactions are reflected in accordance with paragraphs. 78, 80, 82, 84 instructions, approved. by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n (for government institutions), paragraphs. 94, 98, 102, 106, 152 instructions, approved. by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n (for budgetary institutions), paragraphs. 97, 101, 105, 109, 180 instructions, approved. by order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n (for autonomous institutions).

Accounting entries are reflected in correspondence with accounts 040110173 “Extraordinary income from transactions with assets”, 040120273 “Extraordinary expenses on transactions with assets”. In 1 – 17 digits of accounts the same code is indicated as that of the settlement account corresponding to them.

Doubtful debts written off from the balance sheet are accounted for in off-balance sheet account 04 (clause 339 of Instruction No. 157n).

Example 1. A budgetary educational institution provides paid educational services. The accounts include doubtful accounts receivable for the education of children who graduated from school. The institution's commission decided to write off the debt from the balance sheet to the off-balance sheet to monitor the possibility of collection.

Debit KDB 2,401 10,173 Credit KDB 2,205 31,667 – doubtful debts are written off from the balance sheet;

Increase in off-balance sheet account 04 – debt accepted on off-balance sheet.

Example 2. A budgetary educational institution has accounts receivable for advance payment for materials. The counterparty is declared insolvent. The institution's commission decided to write off doubtful debts from the balance sheet to the off-balance sheet to monitor the possibility of collection.

Debit KRB 2,401 20,273 Credit KRB 2,206 34,664 – doubtful debts are written off from the balance sheet;

Increase in off-balance sheet account 04 – debt accepted on off-balance sheet.

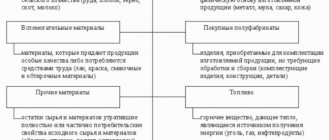

Accounting for reserves – accounting or tax?

The features of creating a reserve for doubtful debts in accounting and tax accounting differ significantly, since these types of accounting have different purposes. Let's compare the rules specific to accounting and tax accounting regarding the reserve.

- Mandatory creation. In accounting, such a reserve is required, since it is required by paragraph. 1 clause 7 of the Accounting Regulations. If an organization uses the accrual method for tax accounting, then the accountant himself decides whether to create such a reserve for tax accounting or not (this right is reflected in clause 3 of Article 266 of the Tax Code of the Russian Federation).

- Characteristics of deductions. Accounting defines reserve contributions as “other expenses,” and for tax accounting they must be taken into account among non-operating expenses.

- Interpretation of the doubtfulness of debt. For accounting purposes, any debt that is not repaid on time or in full is eligible for compensation as a reserve, but for tax purposes, only late payment for goods, services, and work can be recognized as such.

- Determining the amount of deductions . For accounting, the priority of establishing the size remains with the accountant (taking into account the characteristics of the debt), and for tax accounting the sizes are clearly defined by the Tax Code of the Russian Federation.

- The total size of the reserve fund . In accounting it is not limited, and in tax accounting it cannot be more than one tenth of revenue.

Do provisions for doubtful debts count as estimated liabilities ?

Accounting entries for debt recovery

When funds are received to repay doubtful debts, the amounts are written off from off-balance sheet accounting and taken into account in the corresponding balance sheet accounts for accounting for settlements. The balance sheet records entries that are “reverse” to those entries that were used when writing off receivables from the balance sheet (letter of the Ministry of Finance of Russia dated February 11, 2016 No. 02-07-10/7306).

More on the topic: CVR 242 and 244: reflecting expenses in the field of information and communication technologies

Example. The institution's commission decided to write off doubtful receivables for prepayment for materials from the balance sheet to the off-balance sheet to monitor the possibility of collection. The debtor's property status has changed and funds to repay receivables have been transferred to the personal account.

Decrease in off-balance sheet account 04 – debt is written off from off-balance sheet accounting;

Debit KRB 2,206 34,564 Credit KRB 2,401 20,273 – the debt was accepted onto the balance sheet.

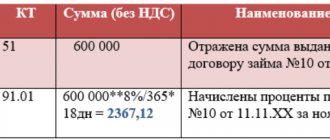

Amount of deductions to the reserve for doubtful debts

Contributions to the reserve are taken into account as part of non-operating expenses on the last day of the reporting period (month or quarter). The amount of the reserve depends on the period of debt occurrence:

- more than 90 calendar days - 100% of the identified debt

- from 45 to 90 calendar days - 50%

- up to 45 days - the amount of the created reserve does not increase

In this case, the total amount of contributions to the reserve accepted for tax purposes cannot exceed 10% of the proceeds from the sale of goods (works, services) (excluding VAT) for the reporting (tax) period.

Features of the accounting reserve

The distinctive features of the reserve created in accounting are that it:

- Must be created when a doubtful debt is identified.

- Formed by all (without any exceptions) organizations that have discovered that they have a debt that is problematic for collection.

- It does not depend on whether a similar reserve is created in tax accounting.

- Can be formed in relation to receivables of any type.

- It allows its creation not only in relation to already overdue debts, but also those whose payment period has not yet arrived, but the probability of non-receipt of payment is quite high.

- Assumes independence in determining the criteria:

- recognizing the debt as doubtful;

- assessing the solvency of the counterparty and the likelihood of receiving payment from it;

- determining the amount of the reserve created.

- Requires the write-off (restoration) of reserve amounts that were unspent at the end of the year following the year the reserve was created, which does not prevent the creation of a new reserve for the same debt.

When it is necessary to restore the reserve for doubtful debts, ConsultantPlus experts explained. Learn the material by getting trial access to the system for free.

Thus, the reserve formed in accounting, while its formation is mandatory, allows for the presence of one’s own estimates on a number of key issues that determine both the moment of creation of the reserve and its amount.