An enterprise that produces a particular product invests certain funds in it. An important concept in the formation of profit and profitability of an enterprise is the cost of production. Funds that are invested in the general organization of production, its management, maintenance, etc., make up a significant part of the generated cost.

Let's consider what is included in general business expenses (GEE), what types they can be, how to account for them, and on what basis they are written off. We will analyze the main nuances regarding general operating expenses in production in this article.

General production expenses in the Chart of Accounts for accounting financial and economic activities of organizations.

What are overhead costs

Production of products involves direct expenses (for raw materials, equipment, wages, etc.), as well as indirect expenses. In addition to the costs directly for the manufacture of products, funds must be spent on the organization of this process itself; it must be continuously managed, regulated, and at all production levels (management of a team, workshop, department, site, line, etc.).

Funds spent on organizing and managing the production process in all structural divisions of the organization are considered general production expenses. Previously, this type of expense was called “shop expenses.”

IMPORTANT INFORMATION! In the current situation, the national accounting system is gradually being brought in line with international market standards. Related to this is the revision of the mechanisms for the formation of ODA in domestic accounting. In this article we consider only current provisions.

Composition of overhead costs

Expenses that the Accounting Rules in paragraph 15 classify as general production expenses include expenses that are ultimately included in the cost of production, such as:

- Production management funds:

- salaries, bonuses, financial assistance and other payments to heads of structural units;

- medical insurance for management staff;

- funds allocated for social activities carried out for management;

- travel allowances for production and management personnel;

- payment for trainings, seminars, etc., conducted for employees;

- various expenses, such as purchasing office supplies, writing out teaching literature, paying for postal services, internet, etc.

- Expenses on fixed assets and non-current assets (their use and/or maintenance):

- direct costs of operating assets (cost of auxiliary products such as lubricants, wages of auxiliary workers, costs of fuel, electricity and other types of energy for production, utilities and other expenses for the premises);

- rent if non-current assets are leased;

- costs of security services - guard and fire safety (salaries and insurance of own personnel or expenses for third-party hired specialists);

- costs for the restoration of fixed assets (repair of buildings, equipment, transport, including amounts spent on spare parts and materials and on the services themselves);

- expenses for repairs of leased assets (by agreement with the owner).

- Depreciation of general production fixed assets and intangible assets (for different structural divisions).

- Maintenance costs:

- salaries for personnel servicing the production process;

- social and other payments;

- funds spent on control over the production process and its quality.

- Progressive costs – costs for modernization and improvement of the production process:

- remuneration of relevant personnel (directly involved in development, modernization, efficiency improvement, etc.);

- costs of prototypes, models, samples, tests, etc.;

- payment for consultations, examinations, third-party studies and other similar procedures;

- other expenses aimed at improving production.

- Expenses for labor protection of workers:

- money for alarms;

- means for installing and maintaining protective structures, fences, hatches, etc.;

- maintenance of auxiliary equipment, if provided for in the employment contract - locker rooms, lockers for storing personal belongings and clothing, showers, laundries, dryers, disinfection room, etc.;

- finances for workwear, footwear and personal and group protective equipment;

- purchase of medical nutrition or means for the prevention of diseases (if the profession provides for their issuance);

- costs of medical examinations of personnel;

- other expenses for labor protection.

- Environmental costs:

- wastewater treatment plant costs;

- funds for hazardous waste disposal;

- other environmental expenditures.

- Mandatory government payments:

- taxes (land, transport, utilities);

- fees (for environmental pollution, use of natural resources).

- Other ODA:

- costs of moving goods within production;

- shortages, losses, decreases identified as a result of inventory;

- payment for downtime;

- other expenses that cannot be included in categories other than ODA.

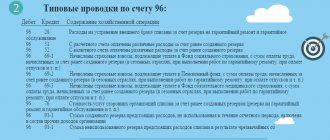

Subaccounts

The chart of accounts establishes that it is recommended to open two sub-accounts for this account:

- 25 subaccount 1 - “Maintenance and operation of equipment”, which summarizes the costs of operating the organization’s equipment;

- 25 subaccount 2 - “General shop expenses”, which is supposed to summarize the costs of managing and servicing the main production facilities.

However, since account 25 can accumulate expenses of various natures, to analyze them it will be more convenient to open a separate sub-account for each type:

- Salaries of general production workers;

- Contributions to social funds;

- Raw materials and materials;

- fuels and lubricants;

- Depreciation of fixed assets;

- Depreciation of intangible assets;

- Public utilities;

- Etc.

Attention! With this type of accounting, a “Closing” subaccount must be opened. Its essence is that during the closing procedure, first the costs of all subaccounts are written off to it, and then distribution from it to the accounts of other productions begins.

Types of overhead costs

General production costs can be divided into:

- variables - those expenses that can change depending on the dynamics of production volumes, resource savings, modernization technologies, etc.;

- constants - those that are not affected by production dynamics (mainly accounting and management costs).

NOTE! This is a conditional division, and in some cases expenses may move from one group to another. An enterprise has the right to independently determine the list of those and other costs, recording this in its accounting policies.

Account characteristics

The chart of accounts gives the answer which account 25 is active or passive. Since it is designed to record company expenses, it collects information about the company's assets. Therefore the account is active.

The peculiarity of this account is that it does not have balances at the beginning and end of the period, as it relates to collection and distribution accounts.

They tend to write off the accumulated turnover at the end by distributing it among other accounting accounts. That is, every month the amounts are written off, and from the beginning of the period information about the costs incurred is again accumulated.

The debit reflects expenses incurred by the company for general production purposes. The loan reflects the distribution of accumulated expenses for the month according to the methodology chosen by the enterprise.

Attention! A calculation coefficient is often used that reflects how many indirect costs are per ruble of direct costs (materials, salaries of key personnel).

Sometimes the number of workers employed in the production of a certain type of product, the area of production premises, and machine-hours of operation of capital equipment are used as the basis for distribution.

You might be interested in:

Account 03 in accounting “Profitable investments in material assets”, what is taken into account, correspondence of accounts, postings

When choosing a method for distributing cost write-offs, management must first of all be guided by the specifics of the activity being performed.

This must be approached with full responsibility, since costs written off as cost will subsequently affect the financial result of the activity.

Attention! The chosen method of distribution must be fixed in the company's accounting policy. So the account does not have beginning and ending balances, information about it is not reflected in the balance sheet.

Accounting for overhead costs

ODA must be taken into account separately for each structural unit. To do this, you must first make a distribution.

ODA distribution

For correct accounting, you need to clearly understand what amount is allocated to each type of product, as well as work or services. To do this you need:

- separate the amount of ODA written off to cost from the unallocated amount;

- divide the constants and variables of the OPR between all accounting objects.

To distribute permanent ODA, you need to perform the following procedures:

- select a unit of measurement – distribution base;

- establish a standard for the normal activities of the enterprise (usually planned for several years);

- based on the planned norm, calculate the planned amount of ODA;

- divide this quantity by the selected unit (this will give you the expected amount of ODA during normal production operations).

The standard value of constant ODA for the selected base unit is calculated using the following formula:

NOPRconst = OPRnorm. / Bnorm.

Where:

- NOPRconst – rate of constant general expenses;

- OPRnorm. – OPR indicator at normal power;

- Bnorm. – indicator of the distribution base at normal capacity.

Next, you need to compare the actual indicator with the established standard. To calculate the total amount of actual allocated ODA, it is convenient to use the following formula:

∑OPRconst = NOPRconst x Bfact.

Where:

- ∑OPRconst – the amount of allocated fixed overhead costs;

- Bfact. – the basis for the distribution of constant ODP at actual capacities.

NOTE! If you add up the allocated and undistributed ODA constants, the total should be their actual value. If it turns out to be less than the calculated standard, the cost includes the actual indicator, and not the calculated standard. If the calculation exceeds the actual indicators, then the cost will include the calculated norm, that is, only part of the constant ODA.

The result of the distribution is reflected in a special statement.

Distribution coefficient

It is necessary in order to correctly calculate the cost of manufactured products. For it you need to know the amount of indirect costs and the selected indicator of the distribution base. Calculated using the following formula:

Kraspr. = (∑OPR / B) x 100%

Where:

- Kraspr. – distribution coefficient;

- ∑OPR – the amount of indirect costs;

- B – indicator of the selected base.

So, if ODA is 100,000 rubles, and the salary is chosen as the base, which in this case is equal to 10,200 rubles, then the distribution coefficient will be 100,000 / 10,200 x 100 = 98%. This indicator means that when setting prices for finished products, it is necessary to take into account that the wages of workers involved in the production of each unit are practically equal to the cost of the product itself.

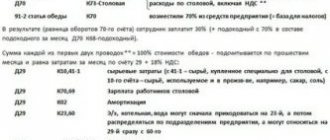

Example

During the reporting period, the furniture workshop produced bedside tables and chests of drawers. Issue costs include:

- material costs - 25,500 rubles. (15,000 rubles for chests of drawers and 10,500 rubles for stools);

- remuneration for work of workshop workers - 12,000 rubles. (6 thousand rubles for the manufacture of each type of product);

- other direct expenses – 16,200 rubles. (9,200 rubles for chests of drawers and 7,000 rubles for stools);

- ODA to be distributed – RUB 80,000.

The amount is 133,700 rubles.

The enterprise itself decides on which basis to distribute these funds. If material costs are selected, the standard will be 133,700 / 25,500 = 5.2. If we choose labor costs as the base, the standard will be 133,700 / 12,000 = 11.1.

To calculate the amount of ODA included in the cost of each type of product, you can proceed in two ways, depending on the selected base. OPR as part of the cost price is calculated by multiplying the calculated standard by the actual value of the base.

If we take into account material costs, then the share of ODA in the cost is 5.2 x 15,000 = 78,000 for chests of drawers and 5.2 x 10,500 = 54,600 for stools. Accordingly, the production cost will be the sum of these values with wages and other direct expenses: for dressers - 78,000 + 9200 + 6,000 = 93,200 rubles, for stools - 54,600 + 7000 + 6000 = 67,600 rubles.

If we take labor costs as the base, we will have to calculate in the same way, but with different indicators. OPR in the cost price of chests of drawers will be 11.1 x 6,000 = 66,600 rubles, as well as stools. Production cost - the sum of material costs, the calculated planned value and other direct costs - for chests of drawers will be 66,600 + 15,000 + 9,200 = 90,800 rubles, and for stools 66,600 + 10,500 + 7,000 = 84,100 rubles.

As we can see, the cost of products can vary significantly depending on the established distribution base for ODA.

How to choose the right distribution base

Since the cost ultimately depends on the correct choice of the base unit indicator, you need to approach this issue carefully. If the base is assigned incorrectly, this may distort the amounts of ODA for individual sectors of activity or types of products. The choice of base may be influenced by the following factors:

- reflection of the relationship between the causes of overhead costs and the costs themselves;

- dynamics of base units that directly change the amount of overhead costs.

Depending on the characteristics of the industry, such a base can serve as:

- quantity of products produced (in pieces, kilograms, meters, liters, etc.);

- direct production costs;

- material costs;

- machine hours;

- man hours;

- production volume in terms of value;

- equipment operating costs (if there is such a costing item), etc.

Depreciation charges for ODA funds

Typically, annual depreciation is calculated, although it is charged monthly: it is necessary to determine the amount of expenses spent on the restoration of all fixed assets of production and administrative apparatus. To calculate it, it is legitimate to use the following formula:

∑A = (∑PS x NA) / 100

Where:

- ∑А – depreciation amount;

- ∑PV – initial cost of assets;

- NA – standard for depreciation.

Accounting and write-off of ODA

General production expenses are reflected on account 25 “OPR”, according to the loan, depending on the specific type of expense. When the billing month expires, the balance on this account is debited:

- 20 “Main production”;

- 23 “Auxiliary production”;

- 29 “Service industries and farms.”

The postings will be as follows:

- debit 25, credit 10 – write-off of the cost of materials and spare parts for maintenance and repair;

- debit 25, credit 02, 05 – depreciation on intangible assets and fixed assets;

- debit 25, credit 70 – payroll for general production employees;

- debit 25, credit 69 – contributions to extra-budgetary funds;

- debit 25, credit 60, 76 – write-off of expenses for maintaining premises;

- debit 20, credit 25 – write-off of ODA for the activities of the main production;

- debit 23, credit 25 – write-off of ODA for the activities of auxiliary production;

- debit 29, credit 25 – write-off of ODA for the activities of service production.

How to reflect in accounting the distribution of overhead costs between individual types of products ?

Responsibilities of an accountant regarding overhead costs

When performing accounting for ODA, the accounting department must perform the following operations:

- correctly take into account indirect costs in a timely manner;

- correctly reflect them in accounting documents;

- include the amount of overhead costs in the actual cost per unit of production;

- control indirect costs - promote the efficient and careful use of materials, energy, and other resources;

- analyze the composition and level of ODA in each billing period;

- develop plans and recommendations to reduce ODA;

- draw up estimates for the maintenance of administrative staff and production equipment;

- monitor compliance with these estimates.

In the reporting period, the wages of production shop workers amounted to 120,000 rubles, deductions in the form of insurance premiums - 37,500 rubles, costs for electricity and other utility bills - 190,000 rubles, depreciation of the production building - 33,500 rubles. What entries should be made in accounting based on the results of the reporting period? View answer

Tax accounting of overhead costs

Tax accounting for ODA depends on the taxation system used in production:

- General tax system. A businessman pays a regular income tax of 20%, and when calculating profit, you need to subtract expenses from income, which include general production expenses.

- "Simplified." “Simplified” entrepreneurs need to take ODA into account if they pay income tax. If income tax is paid under the simplified tax system, then, naturally, general production expenses will not be included in the tax base.

- UTII. This system does not require the entrepreneur to take into account indirect costs, including general production expenses, because UTII payers do not need to take into account income and expenses, and therefore profit, for tax control.

- UTII + general system. With a combined taxation option, that is, several production sectors, you need to try to highlight the actual share of ODA in each of them. If this is impossible or too difficult to do, it is necessary to distribute ODA in proportion to income for each area of production.

Tax features of accounting for overhead expenses.

What is included in the account

To understand what is reflected in account 25, you need to know what costs are included in general production costs.

These include:

- Costs for maintenance and servicing of industrial premises - rent, depreciation, costs for heating, lighting, air conditioning, ventilation of industrial premises, etc.

- Maintenance costs for production equipment - electricity, fuel, spare parts, etc.

- The cost of paying general shop personnel is the salary of engineering and technical junior service personnel.

- Deductions accrued on the salaries of general production personnel.

- Insurance costs, both compulsory and voluntary.

- Third-party services that are included in overhead costs.

- Other expenses included by the company in overhead costs in accordance with the characteristics of the activities performed.

Attention! The enterprise, for the most part, independently decides which expenses can be classified as general production expenses. However, the company's management must remember that when taxing profits, it is quite problematic to take into account indirect expenses as expenses taken into account for tax accounting. Therefore, many business entities try to include the maximum list of expenses in direct costs.