Lazy Investor Blog > Need to Know

The end of the year and the beginning of the next is the time when everyone takes stock. Investors do not deviate from this tradition either. First, taxes will need to be paid soon. Secondly, this is a good reason to evaluate the profitability of the portfolio. Today the subject of my review is the so-called FIFO principle and its application in the stock market. This rule is the basis for calculating the tax base, so every investor needs to know it.

FIFO method, basic information

This method has a second name - “natural queue”, it serves traffic regulations, information structures and other areas of the sphere, and is also used in accounting.

Gives the accountant the opportunity to bypass complex calculation algorithms, without taking into account inflation, with its help it is possible to calculate the material resources of enterprises and the flow of their receipts into warehouses. FIFO evaluates resources in chronological order. The method is based on the principle of “first-in-first-out” (First in, first out). Accounting assumes: the earlier received material is consumed at the beginning, then the later received material is consumed. In practical use, products are written off in production, sales in the sizes and at the original price, then the write-off occurs according to the indicators of the second, until all materials are not taken into account and written off.

When using the usual method, the accountant does not make assumptions, but only takes into account the volumes of the 1st, 2nd, 3rd and so on income that were spent in the process of production activities. Result: difficulties in calculation and balances for the past monthly or other reporting period from the 1st batch with the same cost and from the 2nd with a different price.

Principles of FIFO, FEFO, LIFO, FPFO, BBD and how they differ

Depending on the requirements and competitive environment, types of product processing are used that will be optimal, convenient and effective. How we set up business processes, including logistics, will depend on our efficiency and accuracy. FiFo principle, what is it? How is it different from FeFo, LiFo and other types of product or information processing?

Today we will analyze all these questions in a simple and accessible way. Based on this, it will be much easier for you to choose the best option. So, let's begin.

The FeFo principle - what is it in logistics

The abbreviation

FEFO - first expire, first out.

Literally from English - what ends first, comes out first. The classic FeFo principle is used for goods that have a limited shelf life. That is, the product with the shortest shelf life is shipped and sold first. The FeFO principle includes food or other goods with a short shelf life. We observe in supermarkets that on the shelves closest to the buyer they put out goods whose expiration dates are shorter than the goods that are located in the depths of the shelves. As we understand, if the expiration date has not expired, there is no crime here. Managers and merchandisers of grocery stores wisely use the FeFo principle.

The same FeFo principle may be basic in food or medical warehouses, where this method may also be appropriate for a number of goods.

In a warehouse, it is impossible to visually keep track of such goods. Here you need a good automated accounting system.

Even upon acceptance to the warehouse, the warehouseman enters into the WMS (warehouse program) not only the general characteristics of the goods, but also, necessarily, data with expiration dates. When tasked with shipment, the warehouse WMS, according to a given algorithm, pulls up those goods that have priority in terms of expiration dates.

Based on this, the warehouse topology should be built in such a way that access to goods is free. Rack storage is often used. Or, if the storage conditions of the goods allow it, an option is possible with inclined cells, stuffed racks, where the product is stored on one or higher side, and its removal is on the other side.

inclined rack for storage and selection of goods

The FiFo principle - what is it in logistics

FiFo - first-in-first-out. Literally from English, first in, first out. Here it is determined not by expiration dates, but by arrival dates. What came first must be the first to leave, to leave. The FiFo principle is the same principle as the first-come-first-served queue. Whichever customer came first should be served first.

The FiFo principle is the main method of processing goods as consolidated cargo for transport and logistics companies. It is important for such companies that their customers receive goods in different parts of the country within the deadlines they stated.

For example, various customer cargoes are being assembled from one point for delivery to different destinations. Warehouse processes must be configured spatially and at the warehouse program level so that customer goods are not lost in terms of shipment priorities. Everything that arrived today to move to point “A” must be shipped at the same time.

But no cargo arriving in 10 minutes or tomorrow should be included in the shipment document before the previous cargo.

When goods turn over quickly or delivery conditions require quick processing, the floor storage method is used. The arriving cargo is immediately moved to the opposite section of the warehouse, from the receiving gate, to the shipping gate, to the accumulation area.

accumulation area in a warehouse

If the goods do not require quick shipment, then it is appropriate to store them on racks with an address storage system, where the goods will also have deadlines for receipt at the warehouse.

The LiFo principle - what is it in logistics

LiFo - last-in-first-out. From English, what came last was shipped first. The LiFo principle is the exact opposite of the FiFo principle.

The LiFo principle is sometimes called the bureaucratic method, since those documents that are on top are the first to be considered. In fact, in logistics, the LiFo principle is widely used when the cargo is almost unlimited by expiration dates and is not bound by FiFo shipment priorities. For example, it could be some kind of blanks, stone blocks.

laying workpieces using the Lifo method

Also, a warehouse may have only one gate for entry and shipment, or be limited in space. In this case, what entered the warehouse last is shipped first.

Lifo principle in accounting

The Lifo principle is also used in accounting. For example:

According to the LiFo method, the inventory items purchased last will be sold first. Accordingly, the items remaining in inventory at the end of the period were the earliest purchased or produced.

Or more.

Writing off materials for production at the last purchase price allows you to eliminate inflationary underestimation of the estimated cost of finished products. Thus, avoiding premature payment of part of the income tax.

FpFo method

FpFo - First Product First Out. Which means, first produced, first out. FpFo is used in manufacturing plants. Manufactured goods have batches and must be shipped based on the earliest production batch.

One might ask what is the difference between FiFo and FpFo then. It seems the principle is the same. In essence, yes, but a division has been made between the product that was born within the walls of production (FpFo) and the product that, in finished form, entered the walls of production, warehouse, store (FiFo).

BBD method

BBD - Best Before Day. The recommended period comes first, the first one comes out, subject to shipment.

Such products are rotated in accordance with the minimum remaining recommended periods. To give you an idea, a good example would be wine products, where the recommended expiration date for the product is used. As we understand, such products do not pose any health risks at all, but have their own specific preparation and use.

A similar example would be the preparation of cheeses. Some of its varieties also have specifics with a recommended date for its full readiness and consumption.

The principle of FiFo, FeFo, LiFo. Summary.

At the very beginning, we said that when building a business model, the company’s business processes, we need to have a clear understanding of how the goods, cargo, and information will be processed. We need to take a fairly broad look, because we also need to start from the requirements of the market, competition, and our clients.

And for example, the FiFo principle in a warehouse may not be the only type of processing. The same warehouse may require two or three types of processing, which will significantly complicate its work. Will one warehouse be able to do this? I worked in a warehouse where 3 principles of product processing were used at once. Everything here should work as a single, well-coordinated mechanism.

After the selected model or models, a warehouse topology is required, taking into account the maximum load on each section and the throughput load on the warehouse gate. From my experience in calculating the topology of a warehouse, I will say that this is a very important work, since for a business it immediately determines the optimal and maximum load on the warehouse.

It is extremely important to understand the bottleneck of the warehouse in advance.

I can recommend the book by Gavin Richards - “Managing a Modern Warehouse.” Usually, I try to provide a link to free material, but I couldn't find anything here. Therefore, only a link to purchase this book on the Internet. https://book24.ru/product/upravlenie-sovremennym-skladom-1650401/

I hope the article, the principle of FiFo, FeFo, LiFo, was useful. We've broken down the core classics; the FiFo principle - what is it in logistics, the FeFo principle - what is it in logistics and the LiFo principle - what is it in logistics. Write in the comments and ask questions. Be healthy and happy!

Advantages of the FIFO principle

This method has its positive properties or advantages:

- Simple accounting. The method significantly reduces calculation time and helps to cope with a large amount of residual products during the last reporting period;

- Convenient to use in organizations, where initially received resources are spent at the very beginning. FIFO is more profitable and convenient when the “assumption” made by the accountant when using the method is appropriate;

- The best indicators are attracting investment resources. FIFO is the most convenient and profitable accounting method if the head of an organization is involved in attracting investors or receiving a loan for development.

LIFO method

This accounting method is the exact opposite of the FIFO method.

Just like in the latter, each new batch of goods is received as a separate group. However, when writing off retired assets, first of all, the cost of a unit from the last arrived batch is taken into account. Let's compare the LIFO method with the already familiar stack of statements. Now the admissions committee member will begin processing documents from the top.

The LIFO method is most effective in conditions of rising inflation. In this case, the financial result shown in the reporting will be more realistic, and the company will not have to pay taxes at inflated rates.

Based on what was written above, we can say that the FIFO method is a convenient and effective way to account for material and production assets that left the enterprise’s warehouse during the reporting period. Of course, it is not without a number of disadvantages, but in certain situations its use brings unexpected benefits.

A professional economist must master all four accounting methods.

Disadvantages of the FIFO principle

In addition to the positive properties, the method also has disadvantages, these include:

- Inflation is not taken into account: when an organization has a tendency to unevenly spend resources, and the cost of the 1st batch is written off for products that were received at a higher cost (increase due to inflation and other reasons) - the total financial results may be overestimated, this has negative consequences for enterprises;

- Overestimation of financial indicators and tax payments. In accounting using the FIFO method, uneven consumption of materials can increase the amount of tax deductions that the company pays;

- Incorrect figures for managing and planning amounts for the organization’s expenses. The manager may draw up an incorrect policy for the development of the organization, due to receiving inflated data, this will negatively affect the work of the enterprise.

FIFO must be taken into account in the process of financial planning and development of enterprise policy for subsequent periods.

Why should an investor remember the FIFO principle?

If you invest through a Russian company, then all taxes are calculated by the broker. You do not need to calculate the tax base yourself. But I write about this because I think it is important to understand how it is formed. This will enable you to manage your taxes effectively. Let me give you an example:

- During the year you received a positive financial result.

- You have positions for which the first securities were purchased at an inflated price. Let's say that in 2022 you started investing in Surgutneftegaz preferred shares on the eve of the dividend gap, which at the end of December 2022 has not yet been closed.

- You can sell these shares and reduce your tax basis due to the recorded loss. Simply re-enter a position if you don't have a better investment idea.

The services of financial advisors are popular in the United States, looking for similar ways to save on taxes while optimizing their portfolio.

In addition, the FIFO principle must be taken into account not only when making payments to the Federal Tax Service. It directly affects your average purchase price of an asset. And that means on your personal dividend yield, if we are talking about stocks. This method is good to use if you actively bought more during a drawdown. If the price has returned to the levels at which you first opened the position and there is no reason to expect that the increase will continue, it may be advisable to sell shares purchased at a high price. This will increase your return on investment and help free up money for more promising ideas.

I also recommend reading:

Electronic payment systems: advantages and risks for investors

Electronic payment systems - pros and cons

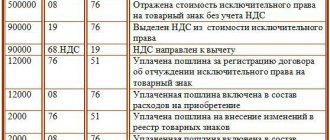

Methods for calculating cost using the FIFO principle

FIFO is the most common method of calculating cost, based on the principle of priority. As mentioned above, the materials supplied first are written off first, hence the abbreviation. Exceptional cases are considered to be cases called assumption, in which expiration dates are more important, and not the earlier time of affixing the goods. Thus, the cost of resources sold first is calculated based on the prices of the remaining products from the earliest delivery. In case of quantitative depletion, inventory and materials are written off at a different cost - the next delivery and then the same.

The mechanism for calculating cost using FIFO can be considered in more detail using the following example:

A musical instrument store sells guitars. There are 20 guitars for 10,000 rubles each and subsequent deliveries in two batches of 30 guitars each - the first for 9,500 rubles, the second for 9,000 rubles. 70 guitars sold for 15,000 rubles. Profit calculation.

At the beginning, 20 guitars are written off at 10,000 rubles = 200,000 rubles. Then - 30 guitars for 9,500 rubles = 285,000 rubles. There are 20 guitars left for 9,000 rubles = 180,000 rubles.

60 X 15000 – (200000+285000+180000) = 235000 (rubles).

This indicator is usually less than the average cost, therefore the amount of income tax is much lower.

Similarities and differences from LIFO

A similar principle that is often mentioned at the same time as FIFO is the first-in-last-out (LIFO) scheme. This model of working with cargo will be appropriate in situations where the volumes of deliveries and cargo turnover are very significant, with stacked storage areas. Based on the fact that some consignments may remain in the warehouse complex for quite a long time, LIFO in logistics is not suitable for working with perishable products.

The general principle of each option is as follows:

- FIFO

. The earlier the arrival, the earlier the dispatch. A solution that is widely used in logistics, but is not always optimal. - LIFO

. The later the arrival, the earlier the dispatch. Priority for new products over those that have been in stock longer.

FIFO write-off method

In practice, it is rarely fashionable to observe the purchase of necessary products or materials of a homogeneous group that are necessary for work for the same long time. Typically, resources come from several manufacturing companies and have different costs. High turnover makes it difficult to track the cost of certain goods used in production activities.

According to the law, you can write off funds for expenses in the process of disposal in several ways. Let's look at everything for a better understanding. According to “Accounting for inventories” (PBU 5/01), accounting can use several methods:

- Focus on the cost of individual units. This method is good when accounting for expensive goods, when it is possible to track the disposal of all batches of goods, as well as inventories.

- Focus on average cost. Total costs are calculated as the ratio of the average cost (the price of the remaining products and the amount of goods received) and the total quantity, which is determined in a similar way.

- The FIFO method, when goods from stocks received earlier are consumed first, first in time.

The FIFO method is often called the conveyor method, that is, the product that was originally received is disposed of.

Write-off according to FIFO is carried out according to the previous scheme, namely, the disposal of homogeneous inventories is carried out sequentially, in the order of their receipt at warehouses. Therefore, goods from subsequent receipts are not withdrawn until the previously received ones are fully used up.

The FIFO method involves writing off for household needs or for production at the cost of inventories upon the fact, which were received first in order. Consequently, the cost of goods from inventory that were received later and not consumed is included in the price of residual goods at the end of the period.

FIFO principle in warehouse

Let's imagine that your store has purchased three lots of certain goods in the last 3 months. This is what the table with the amounts will look like:

| Month | Cost price | Sale |

| June | 1000 | 4000 |

| July | 2000 | 4000 |

| August | 3000 | 4000 |

Using the FIFO principle, it turns out that in the first month you spent 1,000 rubles on purchasing goods and received a profit from it in the amount of 3,000 rubles. The next purchase in July brought you less - about 2,000 rubles. And in the third month, the supplier increased the purchase prices for the products even more and your income was only 1000 rubles.

What we have? When selling goods using the FIFO principle, the products that were delivered first are sold first. This means that if we had not sold all the goods in three months and calculated the profit, then in the case of FIFO the value would be higher due to the low cost of production at the beginning. While with the LIFO principle the opposite picture would have turned out due to the recent inflated prices for goods in August.

The sales method does not affect the number of goods sold or the actual profit received: it allows you to dispose of the goods more practically and accurately. While the accounting statements will differ in case of implementation through FIFO and LIFO.

The FIFO principle is suitable for seasonal businesses that sell clothing or household items and other similar products. However, it is not suitable for companies selling electronic goods. It all depends on your specific business: choose the type of sales that will allow you to sell more goods and get more customers.

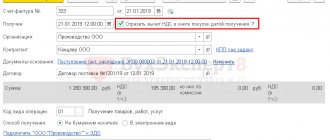

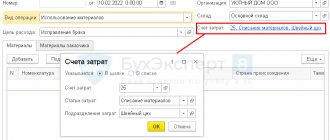

FIFO method in 1C UT

In 1C Trade Management, the FIFO method is used:

- According to classic patrionic accounting, when the system stores information about the price of all batches received for all receipts. The principle also encourages the disposal of goods in a sequential order, starting with the earliest batch.

- With advanced cost accounting analytics, when the calculation of product balance is expressed quantitatively. Then comes the determination of the valuation of the balance at the end of the month, the weighted average, equal to the calculation of prices according to FIFO.

At the same time, the sizes and prices for the remaining products are lined up in order: from the last batch, because, following the FIFO logic, the initially received goods have already been written off.

Next, the volumes of goods removed from the warehouse during the month are determined. The price of received goods is determined, taking into account the price of the initial goods from the balance, then the price of the remaining goods at the end of the month, which was calculated according to the FIFO principle, is subtracted from this indicator. This indicator is the cost of writing off monthly production.

The following formulas are also used:

- The write-off price of a unit of goods = the price of products (during the month)/number of products disposed of during the month.

- Cost of shipment = unit cost of goods X number of goods to be written off.

Features of the application of the FIFO principle

The FIFO principle seems simple and logical, but in fact it has a number of subtleties. The first of these is that the broker accounts for all the investor’s sub-accounts together. Therefore, if you want to maintain several portfolios with different strategies or use them to save for different purposes, it is better to contact different companies.

For example, an investor bought 10 shares of issuer A in his main account, and a week later the same amount in a sub-account. A month later, I decided to change the strategy on the subaccount and sold the recently purchased securities. As a result, in the trading terminal he will see a portfolio where the shares of company A are accounted for in the main account, but they are not in the subaccount. But at the same time, the broker will calculate the tax base based on the value of the shares at the time of the first purchase made on the main account.

An exception to the above situation would be an IIS. According to the law, this is a dedicated account. The assets held on it must be accounted for separately from the rest of the investor's securities. One more example:

- On July 30, you bought 10 shares of MTS at 325 rubles. on a regular account.

- On August 10, you bought shares of this company again, but for 329 rubles. and on an IIS opened with the same broker.

- On October 30, you again bought 10 pieces on a regular account for 311.5 rubles.

- On December 1st you sold for 323 rubles. 15 shares from a regular account.

The formula for calculating the tax base will be as follows:

Shares accounted for in an IIS will not be written off, although this would happen if they were accounted for in a special account. Another feature of the application of the FIFO principle is that securities are recorded not from the moment of their purchase, but from the date when they were accepted onto the balance sheet. This should be taken into account if you have accounts with different brokers and you want to combine them by transferring your assets to one company. In this case, you will need to provide the broker with information about the date of purchase of the securities and the amount paid for them. But this information will be taken into account only when calculating the tax base, and when selling shares, those that were registered by the broker earlier will be the first to go, even if they were actually purchased later.

I also recommend reading:

Why do investors need the Industrial Production Index?

Industrial production index: what it can warn about

Example:

- On 09.2020, the investor bought 10 shares of Norilsk Nickel through broker A;

- On 10.2020, he bought the same securities through broker B;

- in November 2022, he closed his account with broker A and transferred the entire portfolio to broker B;

- when he decided to sell 5 shares of Norilsk Nickel, securities purchased in October and not in September were written off; accordingly, the broker will calculate the tax base from the price as of 10/01/2020.

FIFO method in WMS system

The WMS system helps solve warehouse management problems and automates warehouse operations.

Main functions of WMS:

- Helps place goods around the perimeter of the warehouse;

- Issues tasks;

- Manages the selection of goods;

- Participates in personnel supervision;

- Automates work regarding replenishment of residual goods from the warehouse.

One of the methods used by the system in question is FIFO.

According to this method, goods from the first batch are shipped first, then subsequent ones, thus opening access to the first categories from the list occurs after analyzing all subsequent goods. This principle also applies to clients, that is, they serve the client who arrived earlier than others.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Inventory accounting: FIFO, LIFO, average

View this article in PDF

Options for reflecting inventories in accounting

In their work, companies purchase raw materials and supplies, the production of products takes some time, and then the finished products are stored in a warehouse until they are shipped. All this forms the reserves that the company displays in its financial statements. Since stockpiling can require significant capital, there are a number of financial indicators aimed at analyzing the state of a company's reserves and the efficiency of their use.

Inventory accounting can be based on several principles:

- FIFO , “first in, first out” . In this case, when units of materials or products are consumed, those units that were purchased first are written off first. Thus, recently purchased or produced items remain in inventory. On the one hand, this approach provides the most accurate reflection of the cost of inventories, since recent purchases are taken into account at prices that are as close as possible to today's prices. On the other hand, in conditions of rapidly changing prices, such accounting can seriously distort the cost.

Example : A cable factory regularly purchases copper for production and keeps two months' worth of supplies. In 2020-21, the price of copper has been growing rapidly at an average rate of up to 8% per month. During this period, the plant, which will always write off the oldest inventory, that is, copper purchased 2 months ago, will constantly underestimate its cost by 16%, and this will create distorted profitability indicators.

- LIFO , "last in, first out" . With this approach, write-off is carried out in the reverse order, that is, the cost of production is covered by the cost of materials at the most current prices, and those units of products and materials that were there at the very beginning remain in inventory. With this approach, the company's profitability will be calculated more accurately (and in conditions of rising prices will be lower), but inventories will be calculated on the basis of completely irrelevant prices.

The LIFO method is not allowed by International Financial Reporting Standards and is not used in Russia and many other countries. However, there are countries where it is allowed, and the most famous case is the United States, where the LIFO method is not only possible, but also the main one in tax accounting.

- On average . In this case, each unit of materials and products that is written off as costs is reflected at the average price, calculated taking into account the purchase prices of all units of this material present in inventories. This gives an intermediate result between FIFO and LIFO, that is, some misstatements relate to both the cost of inventory and the cost of production.

The influence of the accounting method on indicators

Let's assume that in the 1st quarter of the year the company purchased 100 units of goods for 10 thousand rubles each and sold 50 of them.

Then, in the second quarter, she purchased another 50 units, already at a price of 14 thousand. In the second quarter, she again sold 50 units, the selling price was 16 thousand rubles.

Here's what financial results, profitability, and inventory turnover would look like under different accounting principles:

Here, for simplicity, inventory turnover is calculated based on balances at the end of the period. It can be noted that the company's performance indicators very seriously depend on the method of inventory accounting.

LIFO reserve

If a company accounts using the LIFO method, its inventory is gradually recorded based on increasingly outdated prices.

For example, a stock of 1000 units was created 5 years ago and has remained unchanged since then, that is, every year the company bought as many materials as needed for production. The unit price during this time increased from 2 thousand rubles. to 3, but the company’s balance sheet still shows exactly those 1000 units in inventory at a price of 2 thousand rubles, that is, the cost of inventory is estimated at 2 million rubles.

Meanwhile, it is obvious that the real market value of these 1000 units is determined by their market price, that is, the cost of inventory is 3 * 1000 = 3 million. And if accounting were carried out on the basis of the FIFO system, then we would see a value of about 3 million rubles in the reporting.

The difference between the cost of inventory under the FIFO and LIFO systems is called LIFO reserve :

LIFO Reserve = FIFO Reserve – LIFO Reserve

We publish such articles regularly. To receive information about new materials, as well as keep up to date with training programs, you can subscribe to the newsletter. If you need to develop specific skills in investment or financial analysis and planning, check out our seminar programs.

Disadvantages of the FIFO technique

No matter how universal the method may seem, it still has its negative sides, which can affect the activities of the enterprise. These include:

- ignoring inflationary processes when accounting, which leads to an overestimation of the cost of inventories;

- an increase in the amount of tax liabilities due to an increase in the size of the organization’s financial results;

- complication of the cost planning process;

- deterioration in enterprise management and forecasting of future activities.

Perhaps all of the above points boil down to the first: insufficient attention to inflation processes. Uneven consumption of inventories can lead to the write-off at a much lower price of property that originally cost many times more. The result is inflated indicators that confuse management when drawing up a further development plan.

To avoid negative consequences, first of all, do not forget about the features of the method when analyzing the results of financial activities and planning the further development of the enterprise. Before using the FIFO method, it is advisable to carefully consider its need for an organization's accounting.