The concept of “total difference” was excluded from accounting terminology. All operations falling under this definition began to be called exchange rate differences. This significantly simplified accounting and contributed to the convergence of requirements in accounting and tax accounting.

Question: Is the positive exchange rate difference arising from the intermediary taken into account in non-operating income for profit tax purposes when the principal (principal, principal) reimburses expenses incurred by him (clause 11, article 250 of the Tax Code of the Russian Federation)? View answer

The concept of exchange rate differences

The term exchange rate difference is collective; it includes information about the difference in the cost of one object arising in connection with the valuation in different currencies. If an asset was purchased at a price set in a foreign currency, then the purchase and sale transaction is reflected in the ruble equivalent.

Question: Are positive exchange differences from the revaluation of targeted financing funds (targeted revenues) included in non-operating income for income tax purposes (clause 11 of Article 250 of the Tax Code of the Russian Federation)? View answer

Conversion into national currency units is carried out at the rate approved by the Central Bank of the Russian Federation on the date of fulfillment of the existing obligation. Before the actual acceptance of the object for accounting, time may pass during which the exchange rate value will be updated. The difference between the valuations converted into rubles at the time the obligations arose and the day the asset was placed on the balance sheet will be considered the exchange rate.

FOR REFERENCE! The use of the term exchange rate differences is typical for companies engaged in export-import activities.

The occurrence of differences in valuation is not inherent in all operations. This phenomenon occurs only when the price of the ruble fluctuates. The price of ruble banknotes in relation to other currencies has a direct impact on the discount price. Recalculation must be carried out for all types of assets that are purchased or sold in foreign currency. The norm is enshrined in Art. 271 and 272 of the Tax Code of the Russian Federation.

How do exchange rate differences affect VAT taxation ?

When do exchange differences occur?

Exchange rate differences may arise as a result of the revaluation of currency values, including in bank accounts. The reason for these manipulations may be a change in the official ruble exchange rate. The resulting exchange rate difference can be:

- positive if there is an increase in the value of objects listed on active accounts (for the category of passive accounts the opposite condition is a depreciation);

- negative when the exchange rate decreases in relation to objects for which accounting is kept on active accounts (for the group of passive accounts, one should focus on the increase in the exchange rate).

What are realized and unrealized exchange rate differences?

The fact of recalculating the valuation of an asset into the ruble equivalent can be done with reference to one of the dates:

- crediting money in foreign currency to a bank account;

- debiting resources from a foreign currency bank account;

- receipt of cash in the form of foreign currency to the organization’s cash desk;

- recognition of income receipts denominated in foreign currency;

- the fact of recognition of costs calculated in foreign banknotes;

- reflection in accounting of costs aimed at purchasing inventories;

- recognition of expenses for the service received;

- the moment of approval by the company management of the employee’s advance report, which contains information about costs in foreign currency;

- repayment of a bill in foreign currency.

Question: Who should pay the exchange rate difference when collecting a debt in foreign currency as part of enforcement proceedings? View answer

There is no talk of exchange rate differences if the transfer was made as a full prepayment (or an advance payment of 100% was received). The norm is explained in the Letter of the Ministry of Finance dated June 22, 2015 under No. 03-03-06/1/35865. There is no need to calculate the difference between exchange rate fluctuations in the situation with deposits issued or received.

Reflection of exchange rate differences according to the rules of accounting and tax accounting

In accounting, the amount of exchange rate differences is shown as part of other income receipts or other costs. Account 91 is intended for this. An exception is made for the exchange rate difference indicator, the occurrence of which is due to settlements made with the founders and revaluation of the resource base used outside the Russian Federation. In this case, the accounting data contains correspondence not with 91, but with 83 accounts.

When making entries on exchange rate differences in accounting, you must focus on PBU 3/2006. The initial value for calculating the value of exchange rate fluctuations is represented by the exchange rate on the date of the payment made. Debts to suppliers must be revalued at the time of repayment. If the debt transfers to the next month, then it must be converted into ruble equivalent at the end of the month as of its last day.

In tax accounting, all resulting exchange differences must be included in non-operating income or expenses. The recalculation of this indicator with its further reflection in the accounting data is carried out as business transactions are carried out or as of the last day of the reporting interval (month). For assets held in bank foreign currency accounts, recalculation of the valuation must be carried out in each case of exchange rate fluctuations recorded by the Central Bank of the Russian Federation.

NOTE! The calculation of exchange rate differences in accounting and tax accounting is carried out according to general rules.

In tax accounting, non-operating income receipts in the amount of exchange rate differences appear when revaluing assets (goods, claims on counterparties) expressed in foreign currencies (clause 11 of Article 250 of the Tax Code of the Russian Federation). The second source of income generation is the reduction of liabilities calculated in foreign currency. The occurrence of non-operating costs is due to the depreciation of assets and an increase in the share of liabilities (Clause 1, Article 265 of the Tax Code of the Russian Federation).

Exchange differences must be shown on tax return forms. When calculating the taxable amount for VAT linked to the date of shipment of goods (if payment for them is carried out in foreign currency), the conversion of the value into the ruble equivalent must be carried out at the rate of the Central Bank of the Russian Federation. The exchange rate value is taken to be the one recorded at the time of actual unloading of goods at the recipient’s facility. On the day of receipt of payment for delivered products, revaluation is not provided for by law. As a result, exchange rate differences are not generated for VAT purposes. The magnitude of exchange rate differences is significant for income taxes.

IMPORTANT! Exchange differences are not shown in the VAT return, but are necessarily reflected in the profit return in the category of non-operating income and expenses.

How to manage exchange rate differences in conditions of strong fluctuations in the ruble exchange rate?

Author: Maria Stepanova, Financial controller

What is the impact of foreign exchange differences on the income statement?

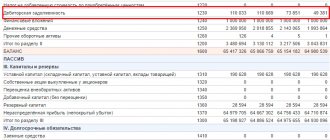

Current financial reporting practices often do not take into account the most dangerous risks associated with exchange rate differences, which can lead to an incorrect interpretation of a company's financial condition. From an accounting perspective, positive or negative exchange rate differences reflect changes in the exchange rate of the ruble against foreign currencies if the organization has export or import contracts denominated in foreign currencies. For accounting purposes, exchange rate differences are reflected in the items of other income and other expenses. Moreover, if goods or services are paid for 100% in foreign currency in advance, then revaluation will not be required; they are accepted in accounting at the exchange rate of the Central Bank of the Russian Federation on the date of the transaction. In addition to transactions of export or import of goods, the following transactions expressed in foreign currency are also subject to revaluation: cash balances in bank accounts, financial investments, settlements with suppliers (except for advances), settlements with customers (except for advances), loan settlements and loans. Also, exchange rate differences appear when investing in the authorized capital in foreign currency.

What are the most obvious risks associated with exchange rate differences?

One of the risks arises due to different dates of receipt of funds or payment and recognition of income and expenses in accounting.

Another risk appears when buying or selling currency in conditions of sharp fluctuations in the ruble exchange rate, and it is perhaps the most obvious. In most cases, such risk is short-term, and the company can take advantage of various hedging instruments offered by banks. In some cases, a sharp depreciation of the ruble may lead to negative consequences in the long term, but the company's management has time to discuss new terms of contracts and other actions.

What is the most underestimated risk that can affect most companies?

It comes precisely from a situation where management is more focused on the profit and loss statement rather than on changes in cash flows from the organization’s activities. However, its influence can also be seen in changes in the company’s revenue and expenses; the difficulty is that such an influence is not reflected separately, and management does not see the real picture, and accordingly, may make incorrect management decisions. Such a risk will not be significant if the company carries out all transactions exclusively in local currency or if there is a small share of export and import transactions denominated in foreign currency. It manifests itself fully if the share of transactions in foreign currency is significant. This risk is associated with the company's cost and income structure.

Okay, are there any practical examples?

For example, a Russian company that purchases raw materials in the United States, a significant part of which constitutes a significant part of the cost structure, sells its products in the Russian Federation. Let's assume the following conditions. As you can see, with an increase in the USD exchange rate, the company’s sales profitability decreases; in one of the unfavorable scenarios, when an increase in the exchange rate accompanies a decrease in sales, the organization may go into the red.

The same scenario, but the rate is 1USD=55RUB

| RUB part | USD part | Total, RUB |

| RUB revenue | 10 000 000 | 10 000 000 |

| USD expenses* | 140 000 | 7 000 000 |

| RUB income | 2 000 000 | 2 000 000 |

| Gross profit* | 1 000 000 | |

| Return on sales** | 10 |

The same scenario, but the rate is USD 1= RUB 55

| RUB part | USD part | Total, RUB |

| RUB revenue | 10 000 000 | 10 000 000 |

| USD expenses* | 140 000 | 7 700 000 |

| RUB expenses | 2 000 000 | 2 000 000 |

| Gross profit* | 300 000 | |

| Return on sales** | 0.03 |

An unfavorable scenario – an increase in the rate of 1USD=57RUB is accompanied by a decrease in revenue by 20%.

| RUB part | USD part | Total, RUB |

| RUB revenue | 8 000 000 | 8 000 000 |

| USD expenses* | 112 000 | 6 384 000 |

| RUB expenses | 1 600 000 | 1 600 000 |

| Gross profit* | 16 000 | |

| Return on sales** | 0 |

* The USD portion of expenses is determined as the USD amount multiplied by the exchange rate. ** Gross profit is defined as RUB revenue minus RUB expenses and USD expenses, recalculated at the exchange rate. *** Return on sales is determined as RUB revenue divided by Gross profit.

What strategies do companies use to minimize risks associated with exchange rate differences?

Many organizations focus on currency risk hedging instruments offered by various financial institutions. This also includes special currency exchange rates offered by banks. One of the popular measures for foreign exchange contracts between Russian companies was the transition to ruble rates. However, for a successful strategy it is impossible to use only one method. The optimal strategy is one that relies not only on the financial statements, but also on an understanding of how changes in exchange rates can affect the company's future profits and expenses. This approach will also give investors a clear picture of what risks the company may incur and how to counter them.

Are there reporting options to reflect the impact of exchange rate differences?

In addition to other classifications of exchange rate differences, there is also a division of exchange rate differences into realized and unrealized. The difference between them is that realized exchange rate differences are the result of revaluation of mutual settlements during the execution of transactions on them, and unrealized ones are the result of revaluation of items denominated in foreign currency at the end of a period.

For management accounting purposes, you can use additional items that separately reflect exchange rate differences on accounts receivable, accounts payable, loan debt, etc. This approach helps to understand the reason for changes in financial statements during periods of changes in currency exchange rates.

Postings

Typical correspondence is presented in two options: with debiting (for a negative difference) or crediting (for a positive difference) account 91. In pairs with it, accounts 50, 52, 57, 55, 58, 76, 67, 62, 60, 66 can be recorded If the company has funds in a foreign currency account, it is necessary to re-evaluate the resources whenever the exchange rate of the Central Bank of the Russian Federation changes. Examples of reflecting such transactions in accounting:

- There was an increase in the exchange rate, which led to an increase in the value of the ruble equivalent of foreign currency money in accounts. For the company, the resulting difference is recognized as income. An entry is made in accounting between debit 52 and credit 91.1. Provided that the money was in cash and was at the cash desk at the time of revaluation, it is necessary to debit account 50 rather than 52.

- Fluctuations in the exchange rate downward caused a decrease in the indicator of foreign currency in terms of rubles. The enterprise incurred an expense for the difference in valuation, which is shown by posting D91.2–K52. If the foreign currency was not in bank accounts, but in the organization’s cash desk, then the correspondence will be in the form D91.2–K50.

In relation to materials, fixed assets and other property assets purchased for foreign currency, the cost is fixed on the date the object is accepted for accounting. For reflection in accounting records, the Central Bank exchange rate in effect on the day the property was placed on the balance sheet is used. Changes in the value of assets due to currency fluctuations are not provided for by law (clause 9 of PBU 3/2006). But the revaluation will affect the buyer's outstanding obligations to the supplier:

- D91.2 – K60, if a negative exchange rate difference has formed before the payment;

- D60 – K91.1 – in settlements with the supplier, a positive exchange rate difference was recorded.

Activities for the acquisition of currency associated with the formation of exchange rate differences are shown in accounting by the following correspondence:

- D57 – K51 – there was a transfer of funds allocated for the purchase of foreign currency;

- D52 – K57 – foreign currency resources were converted and transferred to the company’s current account;

- D57 – K91.1 – based on the calculation certificate, a positive exchange rate difference is reflected;

- D91.2 – K57 – according to the data from the calculation certificate, a negative exchange rate difference was recorded.

Similar transactions will be generated during currency sales transactions.

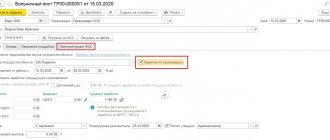

Example and postings for positive exchange rate differences

In March 2016, Stella LLC sold Bounty LLC for the amount of CU 11,800, including VAT of CU 1,800. Payment was made in rubles at the Central Bank exchange rate on the day of payment. The terms of the agreement provide for a 50 percent advance payment. Currency rate on the date of advance payment was 62.00 rubles, on the date of shipment - 62.40 rubles, on the date of payment for goods - 63.00 rubles.

Postings from Stella LLC at the time of advance payment:

| Dt | CT | Operation description | Amount, rub. | Document |

| 51 | 62.2 | Receipt of advance payment reflected (62*5,900) | 365 800 | Payment order in. |

| 76 (advances) | 68 | Reflected VAT on advance payment (365,800*18/118) | 55 800 | SF issued |

Postings at the time of shipment:

| Dt | CT | Operation description | Amount, rub. | Document |

| 62 | 90.1 | The shipment of goods is reflected (62.4*11800) | 736 320 | Invoice |

| 90 (VAT) | 68 | VAT on shipment(55800+62.4*900) | 111 960 | SF issued |

| 62.2 | 62.1 | Advance offset | 365 800 | Accounting information |

| 68 | 76 (advances) | Acceptance of VAT deduction from advance payment | 55 800 | Book of purchases |

Postings at the time of final payment:

| Dt | CT | Operation description | Amount, rub. | Document |

| 51 | 62.1 | Final payment reflected (63*5900) | 371 700 | Payment order in. |

| 62 | 91.1 | A positive exchange rate difference is reflected in the transaction ((62.4-63)*5900) | 3 540 | Accounting information |