In our country, the pension insurance system has been operating for two decades. Based on the principle of insurance, it is available to citizens of the Russian Federation, regardless of social status. Let's look at what compulsory insurance is, how insurance protection works, and the possibilities of personal influence on the amount of your upcoming pension. In order to develop an objective understanding of the existing order in the compulsory pension system, let us recall the differences in the state pension. One - insurance, which is basic, is spent on the principle of solidarity between generations, when the pensions of today's pensioners are financed. And the funded part of the pension, it is accumulated in a personal account, can be invested in various projects and bring dividends. According to your application, adjusted for the year of birth, in the funded part you can declare 6% of the total rate of contributions that the employer transfers to compulsory pension insurance.

What is compulsory pension insurance?

Compulsory pension insurance (MPI) is a statewide procedure of measures to compensate Russians for lost income due to termination of work upon reaching age or in cases approved by law. To become a respondent to the state program, you must register in the individual/personalized pension accounting system. Afterwards, an account will be opened in your name, linked to your individual personal account insurance number (SNILS). For your future pension, it will reflect contributions recalculated to pension coefficients. Russians registered under an agreement/contract, from whose wages the organization/employer calculates and transfers payments, automatically become insured persons. From such contributions, a budget is formed, mostly spent on social payments to that part of the non-working population that has a reason to receive it.

Concepts and subjects

In addition to the insured persons, the participants in the pension program include policyholders and insurers. The first is the party that makes payments for its employee. These include legal entities, individual entrepreneurs (IP), among individuals - notaries, lawyers registered as an employer.

In addition to conducting commercial activities, they have the opportunity to take part in managing the system, namely:

- Receive information regarding the work of the security service.

- Transfer funds to create an additional pension for your employees.

Insurers - Pension Fund of Russia and Non-State Pension Funds, which manage incoming contributions on a state scale, they have the right to:

- Monitor the entities involved in the work of the security organization and demand the elimination of detected violations.

- Interact with Tax Services.

- Give orders for the expenditure of the Fund's budgetary funds.

The fundamental concepts of the system, described in professional terms, speak for themselves:

- OPS funds - finances under management

- Pension Fund budget - a subject’s financial plan for pension purposes

- Mandatory payments are insurance contributions for compulsory pension insurance that have a purposeful application. With their help, the rights of the insured to receive pensions provided for by compulsory insurance are realized.

- Mandatory insurance coverage - the fulfillment by the Fund of its obligations to respondents upon the occurrence of a precedent, by providing pensions, fixed subsidies, benefits from compulsory pension insurance funds

System principles

The action of the OPS is based on principles, adhering to and monitoring the implementation of which, the state ensures the stability and productivity of the system. Basic:

- The state guarantees the interests of all insured persons

- Regular payments for employees of the organization are the responsibility of employers

- The state monitors the rational and targeted use of finances

- OPS is subordinated to the interests of the country's citizens

- The system provides a sustainable standard of living for Russians who have reached retirement age

- Compensatory support for pensioners is equal to the total contributions accumulated by the insured person in the system

- Return of funds

- Accounting for contributions is personal for each citizen

What laws regulate OPS in Russia?

The legislative framework guarantees receipt of a pension is enshrined in Article 39 of the country’s fundamental law - the Constitution. The main provisions regarding its formation and compulsory pension insurance are reflected in Federal laws of different years: No. 165 of July 16, 1999, No. 400 and No. 424 of December 28, 2013, No. 27 of April 1, 1996, and other newly adopted Federal Laws on compulsory pension insurance , which are of a clarifying nature, on their basis additional regulatory documents are created.

Who has the right to enter into an OPS agreement?

Insured persons with SNILS or categories of citizens can become participants in the OPS system:

- Carry out labor activities at enterprises on a contractual basis, including under GPC agreements

- Self-employed, including entrepreneurs, lawyers, notaries, farmers, others

- Citizens who make their own payments

SNILS contains information about its owner and the identification number of the account in the Pension Fund. Parents can receive the document directly from the birth of the child, guardians after adoption. You can independently obtain a document upon reaching the age of 14. Or when you are officially hired for the first time. SNILS is also used to obtain services in state and municipal departments. Required to receive benefits and benefits.

From April 2022, the issuance of SNILS, a type of green laminated card, was abolished, which does not at all mean the abolition of the certificate itself. Currently, when registering in the individual accounting system, a paper notification form is provided in the approved form, indicating a unique number.

Tariffs for reduced-size security insurance

Insurance premiums for compulsory pension insurance in a fixed amount apply to all taxpayers, with the exception of a few categories.

Table 1. Reduced tariffs apply

| Contribution amount | Taxpayer category |

| 20,00% | For individual entrepreneurs working under the patent tax system. For companies and individual entrepreneurs working under the simplified tax system. Organizations whose activities are related to the pharmacological field. Organizations working in the field of science, culture and healthcare and using the simplified tax system. Companies involved in charitable activities. |

| 14,00% | Participants of the Skolkovo project. |

| 8,00% | Companies and individual entrepreneurs operating in special economic zones. Companies operating in the field of information technology. Organizations founded by scientific institutions. |

| 6,00% | Insureds working in Crimea and Sevastopol, as well as in areas with advanced economic development. Companies and individual entrepreneurs registered in the free port of Vladivostok. |

Insurance contributions for the payment of compulsory pension insurance may be canceled if the categories of taxpayers listed in the table reach the limit of the contribution base.

Main functions of the OPS

The Pension Fund of Russia not only generates lists of potential pensioners, its function is to streamline interaction with policyholders, the fund issues maternal certificates. Analyzing international experience, it improves the national system of pension formation.

The main task solved in the Russian Federation with the help of the OPS system is to protect the interests of the country’s citizens and, in fact, to perform 4-step functionality, namely:

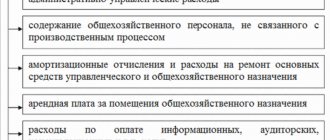

- Investment - replenishment of funds occurs both through mandatory contributions and with the involvement of other resources, which consist of fines and similar payments, or the investment of temporarily free funds

- Accumulating - money is added to the general budget, without splitting into funding sources

- Regulating - funds received are redistributed taking into account the time intervals of payments

- Guaranteed - citizens who meet the criteria for a pensioner can rest assured that they will receive a payment

What are ambiguous terms?

Before you find out the decoding of the abbreviation in question, it is worth clarifying why it belongs to the category of words that are characterized by ambiguity.

This abbreviation illustrates the ability of names to have not one, but several lexical meanings at once.

In the case of terms (a specialized word/phrase that means a specific concept and is used within a certain environment), polysemy is characteristic of them only due to homonymy.

This means that there are several parallel phenomena whose names look identical. However, they are in no way related to each other, and their similarity is the result of an ordinary coincidence. The existence of many options for deciphering the abbreviation OPS is just that case.

Types of pensions in the system

Pension insurance in the national compulsory pension insurance system provides for several types:

- Insurance – monthly payments upon reaching a specified age

- State - payments to the military, government employees. Depending on length of service or health reasons, in case of harm, pensions are also awarded to victims of natural disasters. Social subsidies are provided for the disabled population

- Cumulative - pensions formed from payments from employers and dividends received from investing savings in investments

- Voluntary – money received by licensed Non-State Funds (NPF)

Insurers

Since OPS is a mandatory procedure, when receiving a pension insurance card, all participants are subject to fairly strict requirements.

The insurer is, by and large, the main administrator of the insurance policy system. In this case, its role is played by the Pension Fund of the Russian Federation. The insurer can also be a non-state governing body or even a management company. However, the last two categories have the right to carry out activities only in relation to funded pension contributions.

When determining the decoding of OPS and its features, it is worth saying that any citizen has the right to choose through which body he will be insured.

How are contributions to OPS calculated?

For part of the population with formalized contractual relations, employers must pay contributions to the OPS. In 2022, the adopted levy rate is 22 percent of wages. The Pension Fund transfers the received money into coefficients. For those born before 1967, only the insurance part is formed, which means that the funded part can only be formed independently - through payments under the state co-financing program. It is also possible to replenish with maternity capital.

For individuals

Based on the conditions set out in Federal Law No. 56, future pensioners have the right to independently send payments to the funded part of their labor pension. With this option, no more than 20 days after the end of the reporting quarter, copies of payment orders with a mark of the financial organization that carried out the transaction should be sent to the local branch of the Fund. According to the provisions of the same Law, the submission of documents can be carried out through the organization where the payer works if it has an agreement on electronic document management with the Pension Fund of the Russian Federation.

For individual entrepreneurs and legal entities

Individual entrepreneurs without employees are nevertheless required to form their pension savings. Individual entrepreneurs pay a one-time fixed payment based on the results of the reporting period. This year its size is 32,448 rubles. with an annual income of no more than 300 thousand rubles. With greater income, an additional 1% is transferred to the Fund from the excess amount. Legal entities and individual entrepreneurs with employees are required to make transfers before the 15th day following the estimated date.

The amount of personal contributions of an entrepreneur is limited; for the current reporting period, the maximum is 259,584 rubles.

Policyholders

This role can be played by both individuals and legal entities. An insurer is an employer who pays a certain percentage of the Pension Fund every month for each working employee. This is how the future pension is formed.

Each future pensioner is issued a personal account with the Pension Fund. It is to him that all payments from the policyholder (employer) come. Today, the insurance premium is 22%, which is taken from the annual wage fund. However, if the volume of the fund exceeds 796 thousand rubles per year, then the policyholder can pay not 22%, but 10%.

All insurance contributions made allow you to form 6% of the funded part of the pension and 16% of the insurance share. However, according to the new conditions, a citizen may not share future payments, but most often everyone tries to keep both parts.

Which bodies carry out OPS?

It is the prerogative of the Pension Fund to carry out individual accounting of those insured in the pension fund. The Pension Fund processes and updates information about employment at enterprises, periods of work of respondents, and is engaged in the transformation of pension coefficients for calculating pensions in the future. Other bodies are involved in work related to medical care of the population, control cash receipts to pay for insurance cases, and at the same time carry out direct interaction with the Pension Fund of the Russian Federation.

Pension Fund

The Pension Fund of the Russian Federation and its divisions monitor the accuracy of calculations and the timely transfer of payments for compulsory health insurance premiums. Documentation of the insured persons is recorded. Establish, calculate and make payments of funds to insured pensioners.

Social Insurance Fund

The Social Insurance Fund and territorial divisions pay and monitor the correctness of accrual of insurance compensation for sick leave and maternity-related sick leave. The Foundation's efforts are also aimed at maintaining social and economic stability and developing industries with a social focus.

Federal Compulsory Medical Insurance Fund

Together with local authorities and medical associations, takes part in the development of basic health insurance programs; carries out information exchange of electronic documents to provide PFR employees with up-to-date information.

Basic Concepts

Each citizen must be aware of the issue of mandatory pension insurance, since the insurance pension payment is the main monthly source of income for the vast majority of citizens who retire upon reaching a certain age.

All working citizens are subjects of compulsory pension insurance who pay contributions to the Pension Fund every month. The size of the deduction directly depends on the level of the employee’s official income, but cannot be less or more than the norms established in the current legislation.

All questions regarding how OPS is implemented are recorded in state regulatory documents. The main federal laws are: Federal Law No. 167 dated December 15, 2001 (as amended on December 19, 2016) “On compulsory pension insurance in the Russian Federation (as amended and supplemented, entered into force on January 1, 2017) .

On the territory of Russia there is a structure of bodies providing insurance benefits to citizens.

Insurers under compulsory pension insurance are:

- Federal Pension Fund;

- Non-state PF.

It is to the above-mentioned institutions that cash collections are received, personalized accounts of employees are maintained, and benefits are accrued to insured citizens in a timely manner.

Monthly insurance is transferred to an individual account, on which a savings system operates for each individual citizen.

In addition, it contains information about:

- Official work experience;

- Transfers of funds towards the formation of the insured’s own pension.

The size of the pension payment directly depends on the amount of accumulated funds on the specified personal SNILS.

The individual number code of this account is indicated in the insurance certificate issued directly to the citizen.

In addition, a pension insurance policy can also be formed in non-state pension funds.

To do this, an agreement (certificate) on additional compulsory insurance is drawn up between the employee and this institution, which contains data on possible insured events and payments from the non-state pension fund in such situations.

People make such investments in pursuit of additional pension benefits in old age.

Let's sum it up

The formation of pension savings is an important process on which the well-being of the future pensioner depends. Therefore, in order to decide which pension option is best to choose, it is necessary to take into account the features of the insurance system.

- It is not necessary to choose a pension option . If you are satisfied with the option of an insurance pension, then you do not need to write any applications for the transition.

- In the OPS system, by default, each person generates only an insurance payment. Your future pension may also be funded.

- Each of the OPS options has pros and cons: The main advantage of forming only an insurance pension is the stability of saving funds and indexation. For a savings account, this is the opportunity to receive income above inflation and inherit funds to your spouses and children. The disadvantage of forming a funded pension is that the profitability of the funds is not guaranteed, but only the amount of paid contributions without the investment result is insured.

The choice of pension is yours: insurance or funded?

Budget of the Russian Pension Fund

The Pension Fund Board is responsible for drawing up the budget annually. It consists of funds that are federal property . Formed by:

- insurance premiums;

- federal budget funds;

- income from investing free funds of the joint venture;

- voluntary contributions from individuals or legal entities;

- pension savings funds of persons who have been assigned an urgent payment;

- other sources.

The budget, as well as the report on its implementation, is adopted by the State Duma and approved by the Federation Council on the proposal of the Government of the Russian Federation. The PFR budget is expressed in the form of a federal law, first on the budget, then on budget execution, and it is also consolidated .

Who can choose the pension option?

In 2022, not all people can choose the proposed pension option, but only those who have just started working or have not reached the age of 23. For 5 years they can freely make their choice in favor of one of the options.

If during this period they do not apply for a transfer, for example, to a non-state pension fund to form a funded part, then by default they will only have the option of an insurance pension.

For all other persons born in 1967 and younger, the right to choose their pension provision was until 2016. The option chosen at that time remains to this day. The only difference for them: you can refuse the funded pension and return the first option, but not vice versa.

In case of refusal, the accumulated funds will not go anywhere. They will remain in your individual personal account and will continue to be invested. Upon retirement, they will be returned in the form of an urgent or funded payment.