Methods for receiving proceeds to a current account

In accounting, revenue is income received from ordinary activities - from the sale of products and goods, performance of work, provision of services (clause 2, 5 of PBU 9/99).

Revenue recognition is always reflected by an entry in the credit of account 90 “Sales”, subaccount “Revenue”. Debit shows the amount owed by the buyer. That is, the wiring is like this:

- Debit 62 “Settlements with buyers and customers” Credit 90, subaccount “Revenue”

.

But the proceeds can be transferred to the current account in different ways.

Methods for receipt of proceeds to the current account may be as follows:

- transfer from the counterparty's current account;

- cash from the cash register;

- via terminal;

- through collection.

That's why the wiring will be different.

Important nuances

- The company retains a receipt as confirmation. It must have a signature and stamp made by an employee of the collection service.

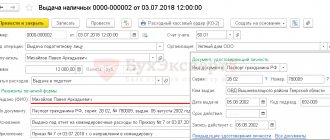

- Transferring money to the collector using a forwarding slip involves issuing a cash receipt order (COS) in the name of the employee who is handing over the package of cash. This document is drawn up on the KO-2 form established by the State Statistics Committee (Resolution No. 88 of 1998).

- Force majeure circumstances may occur. For example, loss of cash by cash collection service employees. Therefore, accounting entries should always show the real state of affairs. When the delivery of money to the collector is recorded as an accounting entry and the documents are drawn up correctly, it will be easier to compensate for the damage.

Also see “Who is responsible for organizing and maintaining accounting.”

The proceeds came from the current account

Most often, companies and individual entrepreneurs pay each other non-cash - through current accounts. If proceeds from the sale of products (services, works) are transferred to the current account, the posting will be as follows:

- Debit 51 (52) Credit 62

When revenue is received in foreign currency, account 52 “Currency accounts” is used in accounting instead of account 51 “Currency accounts”. It reflects the availability and movement of funds in foreign currency in the company’s foreign currency accounts opened in banks of the Russian Federation and abroad.

Rules and procedure for collecting cash from the cash desk - registration, accounting, postings

Cash collection is often referred to as the procedure of transportation, the physical movement of cash from one place to another.

A typical example is the transfer of cash proceeds from retail outlets to the servicing financial institution. As a rule, in such situations we are talking about transporting fairly large amounts of cash.

This is a serious and responsible operation, therefore it is always carried out according to certain rules, strictly regulated by the regulatory documents of the Central Bank of the Russian Federation.

Cash collection involves performing specific actions.

This applies to the procedure itself, its documentation and accounting.

The proceeds came from the cash register

The company’s revenue is not always transferred immediately to its current account. In some cases, it arrives at the cash desk in the form of cash. In this case, the wiring will be as follows:

- Debit 5o “Cash” Credit 62

- proceeds have been received at the cash desk;

- cash is deposited in the bank.

If, by law, a company is not exempt from operating cash register systems, then in case of cash payments it must use an online cash register registered with the Federal Tax Service.

You also need to remember about the cash limit at the cash register. The company calculates the cash limit independently.

Read in the berator “Practical Encyclopedia of an Accountant”

Cash balance limit

If the cash limit at the cash desk is exceeded, the excess money must be handed over to the bank. The company can use funds within the limit for permitted purposes.

Read in the berator “Practical Encyclopedia of an Accountant”

For what purposes can money be given out from the cash register?

Don’t forget about another limit - the cash payment limit for payments between legal entities and individual entrepreneurs. This limit is set at 100,000 rubles.

Read in the berator “Practical Encyclopedia of an Accountant”

Cash payment limit

What are cash transactions

Cash transactions mean operations in which an organization issues and accepts cash in the form of banknotes or coins. The organization can issue and accept funds to both legal entities and individuals. Conducting cash transactions is regulated by the procedure described by the Tax Code of the Russian Federation.

The main cash operations include receiving and issuing cash, storing funds in the cash register and transferring them to the bank. All operations are carried out subject to mandatory compliance with the cash limit, the amount of which is determined by each enterprise individually and recorded in the relevant documents.

The following receipts can be made to the cash desk:

- payment by the buyer (customer) for goods, services, work;

- return of funds by an accountable person previously issued for business needs or travel expenses;

- revenue from the sale of products in a retail chain;

- loan settlements;

- payment of interest on shares;

- refund by the supplier;

- receipt of funds purchased by the organization from the bank.

The basis for depositing cash into the cash register is a cash receipt order.

Funds can be disbursed from the cash register for the following purposes:

- payment of remuneration to employees (wages, bonuses, bonuses, etc.);

- payment for goods, works, services (both in the form of an advance payment and for goods actually received);

- insurance compensation, the payment of which is provided for in the insurance contract;

- issuing funds to employees on account (both for household needs and for travel expenses).

Only funds received as proceeds from sold goods (works, services) can be issued from the cash register. If the organization is an intermediary or is engaged in commission trading, then all funds received for payment in favor of third parties must be transferred to the bank.

The basis for issuing cash from the cash register is an expense cash order.

All cash transactions must be reflected in the cash book.

Revenue was received through the terminal

Instead of making daily trips to the bank to deposit cash, you can deposit it into a bank terminal. To do this, the company enters into an agreement with the bank, which issues it a special access code, which the cashier enters when depositing cash.

When revenue is credited to the account through the terminal, you need to use account 57 “Transfers in transit.” It serves to reflect information about the movement of funds that have not yet been credited to the organization’s current account.

The postings in this case will be as follows:

- Debit 57 “Transfers in transit” Credit 62

- payment has been received for products (work, services) through a terminal or bank card;

- funds are credited to the current account.

With this method of crediting revenue, the bank charges a commission, which is calculated by posting:

- Debit 91 “Other income and expenses” Credit 57

.

As you can see, the money is transferred to the current account minus this commission.

Postings for basic cash transactions

To account for cash in the cash register, as well as to reflect cash turnover, use account 50.

Let's look at the basic cash register transactions using examples.

Cash receipts and write-offs

The issuance of funds to employees on account, as well as the issuance of wages, are the most common basis for the receipt of funds from the bank for their subsequent write-off.

Receipt of cash to the cash desk can be carried out by an accountable person when returning the balance of funds that were not used for business needs or during a business trip.

Let's look at each of the situations described above using examples.

Bonus LLC pays wages to employees through the cash register. The amount to be issued is RUB 964,000.

The following entries will be made in the accounting of Bonus LLC:

| Dt | CT | Description | Sum | Document |

| 50.01 | Money was received from the bank to the cash desk of Bonus LLC to pay wages | RUB 964,000 | Receipt cash order | |

| 50.01 | Salaries were paid to employees of Bonus LLC | RUB 964,000 | Expense cash order, payroll sheet |

Let's consider another example with the issuance and receipt of funds through the cash register:

Mercury 1 LLC issued funds on account to employee A.G. Medvedev. in the amount of 500 rubles. The money was issued for the purpose of purchasing paper for accounting needs. Upon purchase of the paper, Medvedev provided an advance report and a receipt for payment in the amount of 9,840 rubles, VAT 1,501 rubles. Balance of unused funds Medvedev A.G. deposited into the cash register.

In the accounting of Mercury 1 LLC, these transactions were reflected as follows:

| Dt | CT | Description | Sum | Document |

| 71 | 50.01 | Medvedev A.G. funds were issued on account | 500 rub. | Account cash warrant |

| 10 | 71 | The purchased paper was accepted for accounting (RUB 9,840 - RUB 1,501) | RUB 8,339 | Advance report, payment receipt |

| 19 | 71 | The amount of VAT from the cost of purchased paper has been allocated | RUB 1,501 | Receipt of payment |

| 68.02 | 19 | The VAT amount is accepted for deduction | RUB 1,501 | Payment receipt, invoice |

| 50.01 | 71 | Medvedev A.G. the amount of unused funds was returned to the cash desk (500 rubles - 9,840 rubles) | RUB 1,660 | Receipt cash order |

Cash collection

Let's say:

LLC "Magnit Plus" was transferred to the collector in cash retail proceeds for delivery to the bank and crediting to the current account in the amount of 856,000 rubles. According to the agreement, the cost of collection services is 0.15% of the collected amount.

The following entries were made in the accounting of Magnit Plus LLC:

| Dt | CT | Description | Sum | Document |

| 57 | 50.01 | Cash proceeds are transferred to the collector for delivery to the bank | 856,000 rub. | Expenditure cash order, receipt for collection bag |

| 57 | The funds were received by the bank and credited to the current account of Magnit Plus LLC | 856,000 rub. | Bank statement | |

| 91.02.1 | The amount of collection services for accepting and counting cash was written off (RUB 856,000 * 0.15%) | RUB 1,284 | Bank statement |

How to deposit money into an account using self-service devices in Sberbank

There are 2 ways:

- Entry using login and password received via SMS in SBBOL;

- Depositing cash using a self-collection code;

Let's consider the self-collection algorithm by code.

- Find the nearest Sberbank ATM with the function of accepting money;

- On the ATM screen, find the items: < Other services > → < Self-collection by code >;

- Following the prompts, enter your identification code → select the deposit account, cash symbol;

- After checking that all data is correct, click ;

- Deposit funds into the bill acceptor;

- Receive a receipt confirming the transaction;

- The check is an accounting document, so keep it in your “account”.

Accounting for cash delivery to the bank through a collector

The procedure for handing over money to collectors

The following is attached to the agreement: a list of organizations, indicating the address, telephone number, full name of the manager and cashier; application for collection; protocol for agreeing prices for collection, temporary storage and reception, recalculation for cash transfers.

The legislation does not contain special and specific requirements for the collection and transfer of funds to the bank using the organization’s own resources. Such actions and financially responsible persons for delivery are established independently by the internal regulations of the organization.

Rules for transferring funds to collectors

In addition, collection rules may be regulated by a signed agreement on the provision of collection services, which, for example, provides for the frequency of transfer of funds and other specific conditions. Cash packed in bags is handed over to the collector. This action is performed by the cashier of the transferring organization in a special room. The auditor, financial controller, chief accountant, and head of the organization have the right to control this procedure.

The collection procedure is as follows . Before the collection service departs, the following is received :

1. Empty bags for organization.

2. Powers of attorney to receive funds from the company. The person who will transfer funds is required to check its availability each time and pay special attention to the validity period of such a certificate.

3. Appearance card.

4. Certificates that this person is indeed an active employee of the collection service.

Compliance with the requirement to transfer funds to a banking institution in accordance with the regulations of the Bank of Russia “On the procedure for conducting cash transactions on the territory of the Russian Federation.” Acceptance of cash and valuables by banking institutions from serviced enterprises and organizations is classified as cash banking operations and is carried out in the manner established by the regulations on issuance and cash operations and the conduct of cash operations in credit institutions on the territory of the Russian Federation.

A transmittal sheet and a register of transactions are included in the bag. The amounts in the documents and in the bag must match.

The bank teller checks the amount actually transferred with the amount indicated in the advertisement. If they agree, he signs each document and gives a receipt to the organization employee. If the amounts differ, then the announcement for the contribution must be issued again - for the actual amount.

If a collector comes for cash, and the cashier refuses to give him cash, he must write on the appearance card about the refusal and its reason and certify the entry with his signature.

Each business entity must record income and expenses. Legislation obliges entrepreneurs to maintain cash discipline by following the rules for handling cash. In what order does an individual entrepreneur withdraw proceeds and is collection required by an individual entrepreneur?

Transportation (physical movement, transportation) of transferred funds directly to the servicing bank.

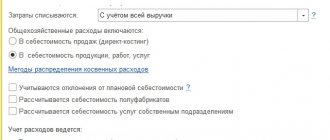

Under the simplified tax system (income - expenses), collection refers to expenses associated with paying for bank services and reducing the tax base.

The cashier gives the collector a sample of the seal, a bag with cash, an invoice and a receipt for the bag. The collector checks the integrity of the bag and seal, the seal's compliance with the existing sample, the correctness of filling out the invoice for the bag and the receipt for the bag.

Make sure that the assembly inspector attaches them to the left wrist. Notify the group security inspector about the end of accepting funds. See how the bags are loaded into the cash collectors' car. Report to your superiors about their dispatch and successful collection.

It is necessary that these terms coincide or that receipts occur before payments. At the same time, imperfection...

For VSPs that do not store cash, the amount of the minimum cash balance is not established.

The organization enters into an agreement for the collection of funds, so that the collector takes the cash and transfers it to the organization's current account. How to record cash collection in accounting?

When establishing the amount of the minimum cash balance, the credit institution takes into account the peculiarities of the organization of cash operations, the volume of average daily cash turnover passing through the cash desks of the credit institution and its VSP, including operations using software and hardware.

There are two ways to deposit cash proceeds to the bank: yourself at the bank’s cash desk or through the collection service of a credit institution. The organization enters into an agreement for the collection of funds, so that the collector takes the cash and transfers it to the organization's current account. How to record cash collection in accounting?

In accordance with the regulation of the Bank of Russia dated October 12, 2011 No. 373-P “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation,” all organizations are required to hand over to bank institutions the cash received at their cash desks in excess of the established cash balance limit funds for subsequent crediting to their accounts.

Of course, each individual company, production, and retail outlet ensures the safety of money on its own by employing security guards, watchmen, installing alarms, and video surveillance systems.

The amount of money that will be transported. As a rule, the amount of payment is calculated as a certain percentage of the amount collected, from 0.1 to 2% of its value.

Thus, the cash collection procedure of a business entity is carried out in strict accordance with the procedure provided for both by the generally binding norms of the Central Bank of the Russian Federation and by private agreements concluded between the enterprise and the collection service (serving bank).

The cost of depositing cash yourself depends on bank rates and averages 0.2% of the amount. An entrepreneur deposits money through the cash desk of a banking institution or through a deposit machine. The deposited amount is deposited into the businessman’s account immediately, without waiting for ATM collection.

All organizations are required to hand over proceeds exceeding the permissible cash limit to the bank. For large amounts, enterprises resort to the services of the bank's collection service.

The procedure for storing, transporting, and collecting cash in Russian banks is enshrined in Regulation of the Central Bank of the Russian Federation No. 318-P dated April 24, 2008 (hereinafter referred to as Regulation 318-P) and Law No. 86-FZ dated July 10, 2002. According to the documents, collection can only be carried out by organizations of the Bank of Russia system.

Is it true that there is no requirement for an organization to ensure the safe movement of assets when collecting on its own?

There shouldn't be any problems with this. Attach three receipts indicating the amount for transportation. Let the cashier verify them.

Most organizations are forced to resort to the services of cash collectors. A clear knowledge of the collection procedure can not only save time, but also protect against fraud and loss of large sums of money.

The procedure for handing over money to collectors

The following is attached to the agreement: a list of organizations, indicating the address, telephone number, full name of the manager and cashier; application for collection; protocol for agreeing prices for collection, temporary storage and reception, recalculation for cash transfers.

The legislation does not contain special and specific requirements for the collection and transfer of funds to the bank using the organization’s own resources. Such actions and financially responsible persons for delivery are established independently by the internal regulations of the organization.

Rules for transferring funds to collectors

In addition, collection rules may be regulated by a signed agreement on the provision of collection services, which, for example, provides for the frequency of transfer of funds and other specific conditions. Cash packed in bags is handed over to the collector. This action is performed by the cashier of the transferring organization in a special room. The auditor, financial controller, chief accountant, and head of the organization have the right to control this procedure.

The collection procedure is as follows . Before the collection service departs, the following is received :

1. Empty bags for organization.

2. Powers of attorney to receive funds from the company. The person who will transfer funds is required to check its availability each time and pay special attention to the validity period of such a certificate.

3. Appearance card.

4. Certificates that this person is indeed an active employee of the collection service.

Compliance with the requirement to transfer funds to a banking institution in accordance with the regulations of the Bank of Russia “On the procedure for conducting cash transactions on the territory of the Russian Federation.” Acceptance of cash and valuables by banking institutions from serviced enterprises and organizations is classified as cash banking operations and is carried out in the manner established by the regulations on issuance and cash operations and the conduct of cash operations in credit institutions on the territory of the Russian Federation.

A transmittal sheet and a register of transactions are included in the bag. The amounts in the documents and in the bag must match.

The bank teller checks the amount actually transferred with the amount indicated in the advertisement. If they agree, he signs each document and gives a receipt to the organization employee. If the amounts differ, then the announcement for the contribution must be issued again - for the actual amount.

If a collector comes for cash, and the cashier refuses to give him cash, he must write on the appearance card about the refusal and its reason and certify the entry with his signature.

Each business entity must record income and expenses. Legislation obliges entrepreneurs to maintain cash discipline by following the rules for handling cash. In what order does an individual entrepreneur withdraw proceeds and is collection required by an individual entrepreneur?

Transportation (physical movement, transportation) of transferred funds directly to the servicing bank.

Under the simplified tax system (income - expenses), collection refers to expenses associated with paying for bank services and reducing the tax base.

The cashier gives the collector a sample of the seal, a bag with cash, an invoice and a receipt for the bag. The collector checks the integrity of the bag and seal, the seal's compliance with the existing sample, the correctness of filling out the invoice for the bag and the receipt for the bag.

Make sure that the assembly inspector attaches them to the left wrist. Notify the group security inspector about the end of accepting funds. See how the bags are loaded into the cash collectors' car. Report to your superiors about their dispatch and successful collection.

It is necessary that these terms coincide or that receipts occur before payments. At the same time, imperfection...

For VSPs that do not store cash, the amount of the minimum cash balance is not established.

The organization enters into an agreement for the collection of funds, so that the collector takes the cash and transfers it to the organization's current account. How to record cash collection in accounting?

When establishing the amount of the minimum cash balance, the credit institution takes into account the peculiarities of the organization of cash operations, the volume of average daily cash turnover passing through the cash desks of the credit institution and its VSP, including operations using software and hardware.

There are two ways to deposit cash proceeds to the bank: yourself at the bank’s cash desk or through the collection service of a credit institution. The organization enters into an agreement for the collection of funds, so that the collector takes the cash and transfers it to the organization's current account. How to record cash collection in accounting?

In accordance with the regulation of the Bank of Russia dated October 12, 2011 No. 373-P “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation,” all organizations are required to hand over to bank institutions the cash received at their cash desks in excess of the established cash balance limit funds for subsequent crediting to their accounts.

Of course, each individual company, production, and retail outlet ensures the safety of money on its own by employing security guards, watchmen, installing alarms, and video surveillance systems.

The amount of money that will be transported. As a rule, the amount of payment is calculated as a certain percentage of the amount collected, from 0.1 to 2% of its value.

Thus, the cash collection procedure of a business entity is carried out in strict accordance with the procedure provided for both by the generally binding norms of the Central Bank of the Russian Federation and by private agreements concluded between the enterprise and the collection service (serving bank).

The cost of depositing cash yourself depends on bank rates and averages 0.2% of the amount. An entrepreneur deposits money through the cash desk of a banking institution or through a deposit machine. The deposited amount is deposited into the businessman’s account immediately, without waiting for ATM collection.

All organizations are required to hand over proceeds exceeding the permissible cash limit to the bank. For large amounts, enterprises resort to the services of the bank's collection service.

The procedure for storing, transporting, and collecting cash in Russian banks is enshrined in Regulation of the Central Bank of the Russian Federation No. 318-P dated April 24, 2008 (hereinafter referred to as Regulation 318-P) and Law No. 86-FZ dated July 10, 2002. According to the documents, collection can only be carried out by organizations of the Bank of Russia system.

Is it true that there is no requirement for an organization to ensure the safe movement of assets when collecting on its own?

There shouldn't be any problems with this. Attach three receipts indicating the amount for transportation. Let the cashier verify them.

Most organizations are forced to resort to the services of cash collectors. A clear knowledge of the collection procedure can not only save time, but also protect against fraud and loss of large sums of money.

Rules and procedures for cash in an enterprise

There are generally binding legal norms that clearly regulate the procedure for cash collection in an organization.

These rules, as mentioned earlier, must be strictly observed by all participants in this process - the cashier of the enterprise transferring cash, and the collector delivering the transferred money to the bank.

In addition, collection rules may be regulated by a signed agreement on the provision of collection services, which, for example, provides for the frequency of transfer of funds and other specific conditions.

The cash collection procedure itself involves the sequential performance of the following actions by its participants:

- The transferred cash is prepared by the cashier of the business entity for dispatch. At this stage, a thorough counting and packaging of funds are carried out, which are then placed in bags. A set of necessary documents is prepared in several copies. The completed papers are also placed in collection bags with money. This stage ends with the sealing of bags to be handed over to collectors.

- Cash packed in bags is handed over to the collector. This action is performed by the cashier of the transferring organization in a special room. The auditor, financial controller, chief accountant, and head of the organization have the right to control this procedure. The cashier checks the identity and papers of the collector, enters information into the appearance card, provides a sample of the seal, and gives the bag with money and documentation to the collector. The collector verifies his identity, presents the necessary papers to the cashier and returns empty bags, accepts bags with money, checks the serviceability of seals, verifies document data, signs and dates the receipt, and puts a stamp.

- Transportation (physical movement, transportation) of transferred funds directly to the servicing bank. This procedure is carried out by an authorized collector along a route developed and approved in advance.

- Delivery and acceptance of bags with cash at a financial institution. The collector transfers the bags of money to the servicing bank, which duly accepts these funds. The acceptance procedure is carried out according to established rules. If it is completed successfully, the collector’s full financial responsibility for the transferred money ceases.

- The transferred cash is accepted and received by a bank employee who checks the bags, the integrity of the seals, and the correctness of the information in the accompanying papers.

Documenting

In order to correctly transfer cash to the collector for transportation to the bank, the cashier draws up the following documentation:

- The accompanying statement in three copies (one - in the bag, the second - to the cashier, the third - to the collector);

- a register of completed transactions (placed in a bag), the amount of which must correspond to the amount of the statement;

- money bag invoice;

- receipt for money bag.

The collector verifies his identity, presents a power of attorney, and gives the cashier an appearance card to fill out.

The cashier enters the necessary information into the appearance card and returns it to the collector. Subsequently, this card is checked by a bank employee and compared with the cash order.

Accounting and postings

In the accounting of a business entity that transfers cash to the bank through collection, certain correspondence accounts are used, accompanied by the preparation of the necessary documents:

| Operation | Debit | Credit | Document |

| The cashier handed over the cash to the collector | 57 | 50 | RKO, receipt |

| The collected amount is credited to the bank account | 51 | 57 | Bank account statement |

| The corresponding commission has been paid to the bank | 91 | 51 | Bank account statement |