Penalty: concept, types, collection rules

By concluding a business agreement on cooperation, each partner expects that its counterparty will fulfill its obligations efficiently and on time. Unfortunately, this does not always happen. The legislation of the Russian Federation provides for several ways to ensure the implementation of business agreements (Article 329 of the Civil Code of the Russian Federation). One of them is a penalty (Article 330 of the Civil Code of the Russian Federation), which can be in the form of:

- A fine is a fixed amount collected for non-compliance with the terms of the business agreement by one of the partners. However, the duration of the violation is not important here. The fine can be set not only as a fixed amount, but also as a percentage.

- Penalty accrued continuously until the breached obligations are fulfilled. In order to ensure this continuity, it is necessary to fix the period for which the penalty is calculated. Otherwise, it will not be difficult to later re-qualify it as a one-time fine, which can be extremely disadvantageous for the creditor.

Read about the relationship between the concepts of “fine” and “forfeit” in the article “ Fine and forfeit - what is the difference?” .

This publication will tell you what grounds there are for reducing the penalty.

If you have access to ConsultantPlus, check whether you have correctly reflected the costs of fines and penalties under contracts in tax accounting when determining the amount of profit. If you don't have access, get a free trial of online legal access.

A penalty can be applied to non-compliance with a variety of terms of a business agreement: late payment or delivery, low-quality goods, etc. Moreover, it is possible to simultaneously prescribe both sanction measures in the contract: a fine and penalties (determination of the Supreme Arbitration Court of the Russian Federation dated February 15, 2013 No. VAS-800/ 13).

IMPORTANT! The agreement on penalties must be drawn up in writing, regardless of the form in which the violated business agreement was concluded. Otherwise, it will be impossible to collect it (Article 331 of the Civil Code of the Russian Federation). In this case, it is possible to draw up both an additional agreement and introduce provisions on penalties into the main agreement. In the agreement, indicate for which violation it is provided (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated September 4, 2012 No. A31-11425/2011).

See a sample of such an agreement here.

When concluding agreements, the parties, as a rule, provide for the partner’s liability for failure to fulfill obligations.The concept of a penalty is defined in Art. 330 of the Civil Code of the Russian Federation, according to which a penalty (fine, penalty) is a certain amount of money that the debtor is obliged to pay for non-fulfillment or improper fulfillment of his contractual obligations. This amount is determined in the manner prescribed by the agreement, the terms of which were violated. The parties can establish any procedure for calculating penalties that suits them.

Accounting for penalties

In accounting, the amount of fines received for violating the terms of contracts in accordance with clause 7 of PBU 9/99 “Organizational Income”, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n, is recognized as other income.

Accordingly, the amount of fines paid for violation of contractual obligations is taken into account as part of other expenses on the basis of clause 11 of PBU 10/99 “Expenses of the organization,” approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. ZZn.

Fines, penalties, penalties for violations of the terms of contracts, as well as compensation (compensation) for losses caused to the organization (organization) are accepted for accounting in amounts awarded by the court or recognized by the debtor (organization) (clause 10.2 of PBU 9/99 and clause 14.2 of PBU 10/99) in the reporting period in which the court made a decision to collect them or they were recognized as a debtor (clause 16 of PBU 9/99).

According to clause 76 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, fines, penalties and penalties recognized by the debtor or for which court decisions on their collection have been received are attributed to the financial results of a commercial organization and before their receipt or payment are reflected in the balance sheet of the recipient and the payer, respectively, under the headings of debtors or creditors.

In the organization’s accounting, received and paid penalties are reflected using account 76 “Settlements with various debtors and creditors”, subaccount “Settlements on claims”, with the following entries:

D 91-2 “Other expenses” K 76-2 “Settlements on claims” - reflects the organization’s debt to pay fines, penalties and penalties recognized for payment or for which court decisions on their collection have been received; D 76-2 “Settlements on claims” K 91-1 “Other income” - reflects the amounts due for fines, penalties and penalties recognized by debtors or for which court decisions on their collection have been received.

Tax accounting of penalties

For tax accounting purposes, expenses in the form of fines, penalties and (or) other sanctions for violation of contractual or debt obligations recognized by the debtor or payable by the debtor on the basis of a court decision that has entered into legal force, as well as expenses for compensation for damage caused are included in non-operating expenses. expenses that reduce taxable profit on the basis of subparagraph. 13 clause 1 art. 265 Tax Code of the Russian Federation.

According to paragraph 3 of Art. 250 of the Tax Code of the Russian Federation, fines, penalties and (or) other sanctions for violation of contractual obligations, recognized by the debtor or payable on the basis of a court decision that has entered into legal force, are recognized as part of non-operating income.

The norms of Art. 317 of the Tax Code of the Russian Federation provides that when determining non-operating income in the form of fines, penalties or other sanctions for violation of contractual obligations, as well as amounts of compensation for losses or damages, taxpayers determining income on the accrual basis reflect the amounts due in accordance with the terms of the agreement. We emphasize that it does not matter whether your organization files claims against its partner and whether the latter pays the fine.

Based on this, the increase in taxable profit by the amount of fines and penalties received depends on how the agreement is drawn up, namely: whether the amount of penalties for violation of contractual obligations is specifically determined or whether the payment of fines is not provided for by the terms of the agreement.

If the agreement does not provide for the accrual of penalties, then the organization does not generate non-operating income for profit tax purposes (Article 317 of the Tax Code of the Russian Federation).

When collecting a debt in court, the taxpayer’s obligation to accrue this non-operating income arises on the basis of a court decision that has entered into legal force (Article 317 of the Tax Code of the Russian Federation).

According to sub. 4 p. 4 art. 271 of the Tax Code of the Russian Federation for non-operating income in the form of fines, penalties and (or) other sanctions for violation of contractual obligations, the date of receipt of income is the date of recognition by the debtor or the date of entry into legal force of the court decision.

The tax accounting system is formed by organizations independently, based on the principle of consistency in the application of tax accounting norms and rules, i.e., it is applied consistently from one tax period to another.

The procedure for maintaining tax accounting is established by the organization in its accounting policy for tax purposes, approved by the relevant order (instruction) of the head. Tax and other authorities do not have the right to establish mandatory forms of tax accounting documents for taxpayers.

The amount of sanctions accrued under each business agreement is reflected in the Register of Accounting for Settlements of Penalties. The details of the agreement, the date of accrual of penalties, the procedure for accruing sanctions and their amount are also indicated there.

The amount of fines and penalties, which reduces the taxable income of the current period, is reflected in the Calculation-register of the amounts of accrued penalties for the reporting period. This amount is transferred to the Register of non-operating expenses of the current period.

If the terms of the agreement do not establish the amount of penalties, the recipient organization does not have an obligation to accrue non-operating income for this type of income at the time of filing a claim with the partner.

Such an obligation will arise on the date of the partner’s documentary confirmation of his agreement to pay penalties.

We recommend that you draw up an agreement, protocol or letter of appropriate content as such documentary evidence. A document drawn up in this way will serve as the basis for reflecting recognized penalties as non-operating income for profit tax purposes.

Consequently, in the situation under consideration, it is necessary for the counterparty-debtor to voluntarily acknowledge his obligation to pay penalties for violation of contractual obligations.

In accordance with paragraph 1 of Art. 330 of the Civil Code of the Russian Federation, the debtor’s obligation to pay a penalty (fine, penalty) to the creditor occurs only in the event of non-fulfillment or improper fulfillment of the obligation under the contract.

Penalty is the most common way of securing obligations in economic activity.

The obligation to pay a penalty may arise, inter alia, in the event of delay in fulfilling contractual obligations.

There are two types of penalties: fines and penalties.

A fine is a one-time amount of money, which can be determined either as a firmly established absolute value or as a percentage (share) of a certain amount.

Penalty is a type of penalty calculated continuously over a certain period of time, the final value of which depends on the length of the time period.

The law or contract may provide for the application of one of the types of penalties, or both simultaneously.

As practice shows, the scope of application of a contractual penalty is much wider than that of a legal penalty.

An example of a legal penalty is the penalty provided for in paragraph 2 of Art. 9 of the Federal Law of June 30, 2003 No. 87-FZ “On Freight Forwarding Activities” and recovered from the carrier for violation of the established deadline for fulfilling obligations under the transport expedition agreement, if the client is an individual using the services of a forwarder for personal, family, household and other needs not related to the client’s business activities.

Penalty should be distinguished from compensation for losses (actual damage, lost profits).

Please note that, on the basis of Art. 15 of the Civil Code of the Russian Federation, a claim can require compensation not only for actual damage, but also for lost profits.

Real damage is the cost of the injured party to restore the damaged property.

Lost profits are lost income that the injured party would have received under normal conditions of civil transactions if its right had not been violated.

There is a certain relationship between a penalty and a loss.

A person whose right has been violated may demand full compensation for the losses caused to him, but only if the law or contract does not provide for compensation for losses in a smaller amount. It should be borne in mind that the right to compensation for damage can arise both from contractual relations and as a result of unlawful actions of a person.

When collecting fines or penalties from the violator, he compensates for losses only in the part not covered by this penalty (clause 1 of Article 394 of the Civil Code of the Russian Federation). Exceptions to this rule can only be provided by contract or law. It should be noted that the mere fact of signing an agreement means that the counterparty becomes obligated to pay penalties upon the occurrence of corresponding obligations.

At the same time, confirmation of the occurrence of such circumstances caused by the non-fulfillment (improper fulfillment) by the counterparty of its obligations under the contract must be recognized by it voluntarily or confirmed by a court decision that has entered into legal force.

This means that the right to receive penalties provided for in the contract arises after the party that has violated its obligations recognizes the fact of non-fulfillment or improper fulfillment, which must be formalized by the signing of the relevant document (in particular, an agreement) by both parties.

An agreement on a penalty must be made in writing, regardless of the form of concluding the main obligation. In this case, failure to comply with the written form entails the invalidity of the agreement on a penalty (Article 331 of the Civil Code of the Russian Federation). However, if the main obligation, as required by law, must be notarized or subject to state registration, then this requirement does not apply to the penalty agreement.

If the penalty payable is clearly disproportionate to the consequences of the violation of the obligation, then it can be reduced, but only on the basis of a court decision.

As a rule, the agreement on penalties is formulated as a separate clause in the main agreement. If the parties subsequently come to an agreement to pay a penalty in an amount less than that provided for in the contract, then such an agreement must be drawn up in writing as an addendum to the contract. Otherwise, the tax authorities may raise the issue of the organization including for profit tax purposes the amount determined in accordance with the terms of the agreement, regardless of the amount of funds actually received.

Based on clause 20 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 12, 2001 No. 15 and the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 15, 2001 No. 18 “On some issues related to the application of the provisions of the Civil Code of the Russian Federation on the limitation period” to actions indicating the recognition of a debt and, therefore, the grounds for its occurrence may include, in particular, recognition of the claim.

If the counterparty does not agree with the claim, penalties may be collected through the court. When collecting a debt in court, the obligation to accrue this non-operating income to the recipient organization arises on the basis of a court decision that has entered into legal force.

We also note that the recognition of penalties by the debtor does not mean their actual receipt.

In the situation under consideration, an organization (seller or buyer, other counterparties) that has suffered losses due to a violation of the terms of the contract by an unscrupulous partner has the right to present a claim to him in writing.

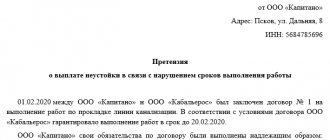

The claim procedure is a form of pre-trial dispute resolution. In this case, one party to the transaction turns to the other party with a demand to change, perform or terminate the contract, to compensate for losses, to pay a penalty or to apply other measures of civil liability.

The claim is made in any form. But at the same time, it must contain the following information: - an indication of which obligation was violated by the partner, with reference to the relevant norms of law; — determination of the requirements imposed on him in this regard; — the amount of the claim and its calculation; — determination of the period for consideration of the claim and response to it.

Typically, the period for consideration of a claim is determined by the terms of the contract. Otherwise, according to Art. 314 of the Civil Code of the Russian Federation, a response to a claim must be given within 7 days after its receipt.

The claim must be accompanied by supporting documents: notarized copies of the contract, invoices, payment documents, acts, certificates, etc. A document confirming the direction of the claim may be a receipt or other postal document confirming the sending of a registered letter with acknowledgment of delivery or a second a copy of the claim with the counterparty’s note on its receipt (incoming number, date, stamp and signature of the official).

If an organization takes into account income and expenses for profit tax purposes on a cash basis, penalties for violation of contractual obligations are recognized in tax accounting only after they have been received (repaid), as established by the provisions of Art. 273 Tax Code of the Russian Federation. This means that the date of receipt of penalties for violation of contractual obligations is in this case the day the funds are received in bank accounts and (or) at the cash desk.

Let us recall that the cash method has the right to apply only those organizations whose average amount of revenue from the sale of goods (work, services) excluding VAT and sales tax over the previous 4 quarters did not exceed 1 million rubles. for every quarter.

As for the procedure for calculating and paying VAT on penalties received for violation of contractual obligations, it should be noted that the current version of Chapter. 21 of the Tax Code of the Russian Federation does not directly indicate the need to pay VAT on the specified amounts.

Nevertheless, the position of the tax authorities on the need to pay VAT on penalties is based on a broad interpretation of subsection. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, according to which the tax base for VAT “increases by amounts received for sold goods (work, services) in the form of financial assistance, to replenish special-purpose funds, to increase income or otherwise related to payment for sold goods (work, services) "

The explanations of the tax authorities boil down to the fact that it is the last phrase of the above norm that allows them to calculate VAT on the amount of penalties received for violation of contractual obligations, which, in their opinion, are directly related to payment for goods (work, services).

However, this position of the tax authorities does not find support among judges of arbitration courts. The Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 11144/07 dated 02/05/2008 in case No. A55-3867/2006-22, came to the conclusion that the amount of the penalty as liability for late fulfillment of obligations received by the company from the counterparty under the contract is not related to payment for the goods in sense of the mentioned provision of the Tax Code of the Russian Federation, therefore they are not subject to VAT.

Tax accounting for the recipient of the penalty: income tax

The main points that will help to correctly reflect the penalty are given in the table:

How to correctly draw up an agreement, include sanctions in it, and also about many other things related to consolidating economic relations, the materials in our special section tell you.

The concept of penalties

The legal concept of “fine” is established in paragraph 2 of Article 330; a penalty is a sum of money that the debtor is obliged to pay in case of improper performance of his obligations. Such payments may be:

- established by legislative act;

- are specified in the contract.

The condition on the accrual of a penalty for improper fulfillment of any obligations must be established in writing without fail. The only exceptions are statutory penalties (for taxes and fees).

Value added tax on the received penalty

This issue was repeatedly discussed in letters from government departments, and their opinion changed periodically. Explanations in recent years are such that sanctions for non-compliance with contractual relations do not appear among the amounts subject to VAT (subclause 2 of clause 1 of Article 162 of the Tax Code of the Russian Federation), and therefore the tax on penalties will not have to be paid (letter of the Ministry of Finance of the Russian Federation dated 06/08/2015 No. 03-07-11/33051). Previously, controllers interpreted this situation differently and took the exact opposite position.

IMPORTANT! Penalties that ensure compliance with contractual terms should be distinguished from sanctions associated with payment for goods or services (those called hidden fees). A classic example is a fine for transport downtime when loading and unloading operations take longer than provided for in the business agreement between the customer and the contractor (letter of the Ministry of Finance of the Russian Federation dated April 1, 2014 No. 03-08-05/14440). According to controllers, these amounts fall into the VAT base (letter of the Ministry of Finance of the Russian Federation dated October 30, 2014 No. 03-03-06/1/54946).

In this case, the recipient of the fine must:

- calculate tax on the received amount at the rate of 20/120 or 10/110 (clause 4 of article 164 of the Tax Code of the Russian Federation);

- issue an invoice and record it in the sales book; it is not issued to the other party.

To find out what other opinions officials have on this issue and whether judges support them, read the material “Are fines and penalties under contracts subject to VAT?”

We create the wiring manually

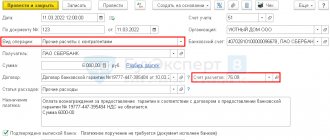

Step 1. Create a new manual operation in 1C 8.3

Go to the “Operations” section (1) and click on the “Manually entered operations” link (2). The manual operations window will open.

In the window that opens, click the “Create” button (3) and select the “Operation” link (4). A window will open in which you can create the necessary transactions for calculating penalties and fines in 1C 8.3.

Step 2. Make an entry for calculating a fine in 1s 8.3 using a manual operation

In the “Operation (creation)” window, fill in several fields. In the “Organization” field (5), indicate your organization, enter the posting date (6), and click the “Add” button (7). A form for accounting entries will open.

In the “Debit” field (8), indicate account 99.01.1 “Profits and losses”, after which the directory will open, in it select “Tax sanctions due”. In the “Credit” field (9), indicate the accounting account on which you account for calculations for the tax for which sanctions have been assessed. For example, 68.01 “NDFL”, and select from the directory “Fine: accrued / paid”. In the “Amount” field (10), enter the amount of the fine or penalty. Below, write the contents of the posting (11), for example, “Calculation of a fine upon request No. 256.”

Next, click “Record” (12). Now in 1C 8.3 entries for penalties and fines have been created in accounting.

Tax accounting of penalties for the violator

Income tax

The rules are generally similar to those discussed above for the lender. Differences are provided, perhaps, only for simplifiers:

VAT

Here the situation is similar to that discussed in the previous section of the article: VAT is not charged on penalties paid by the violator (Articles 153-154, paragraph 1 of Article 162 of the Tax Code of the Russian Federation).

Read about other business operations not subject to VAT here.

How to account for tax penalties

Penalties are not tax sanctions, and therefore we will consider their accounting separately.

A penalty is an amount of money that a company (IP) must pay to the budget if taxes (contributions, fees) are not paid on time (Article 75 of the Tax Code of the Russian Federation).

Penalties are accrued for each calendar day of delay in fulfilling the obligation to pay a tax or fee, starting from the day following the day of payment of the tax or fee established by law. If the tax payment deadline falls on January 25, then penalties must be accrued from January 26.

Whether to charge penalties for the day on which the debt is repaid is a controversial issue. Over the years, regulatory authorities and courts have defended different points of view. The Russian Ministry of Finance believes that penalties do not need to be accrued for the day on which the arrears were paid (letter dated July 5, 2016 No. 03-02-07/2/39318). The courts also agree with this opinion. But the Federal Tax Service often insists that penalties must be accrued even for the day on which the arrears were paid (Explanations of the Federal Tax Service of the Russian Federation dated December 28, 2009). If the amount of penalties for one day is not large, it is safer to act according to the position of the tax service. If we are talking about significant amounts, you need to be prepared for the fact that you will have to prove your position in court.

The penalty for each day of delay is determined as a percentage of the debt. The interest rate of the penalty is 1/300 of the current refinancing rate. The refinancing rate is equal to the key rate; as of March 1, 2017, it is equal to 10% (Information of the Central Bank of the Russian Federation dated September 16, 2016).

Penalties = Amount of tax not paid on time x Number of calendar days of delay x 1/300 of the refinancing rate.

From October 1, 2017, penalties will be calculated based on 1/150 of the refinancing rate if the delay in payment exceeds 30 days (Federal Law of November 30, 2016 No. 401-FZ).

In practice, penalties are taken into account in different ways: some experts attribute tax penalties to account 91, while others - to account 99. Not a single regulatory act gives a clear answer on which account penalties should be taken into account. The decision must be made independently and consolidated in the accounting policy of the enterprise.

Option No. 1. Penalties are taken into account on account 91

If you read the definition of penalties, you can conclude: penalties do not relate to tax sanctions, and therefore cannot be taken into account on account 99. The characteristics of account 99 are presented in the chart of accounts and literally read as follows: “account 99 reflects the amounts of accrued conditional expenses for income tax, permanent liabilities and payments for recalculation of this tax from actual profit, as well as the amount of tax penalties due.” There is no talk of penalties here.

Since penalties are not taken into account for tax purposes (clause 2 of Article 270 of the Tax Code of the Russian Federation), only account 91-2 remains for their accounting. However, the chart of accounts explains that under account 91 only penalties for violation of contractual terms can be taken into account. The list of expenses is disclosed in PBU 10/99, and among those listed there are also no tax penalties. But in PBU 10/99 there is an article “other expenses”, and penalties can be attributed to it. The main thing is to fix the reflection of penalties on account 91 in the accounting policy of the organization.

Taking into account the penalties on account 91, a permanent tax liability will have to be accrued (PBU 18/02).

Example. received a request to pay interest on income tax in the amount of 1,450 rubles. The organization records penalties on account 91.

The accountant made the following entries:

Debit 91-2 Credit 68 1,450 - penalties accrued;

Debit 99 Credit 68,290 - permanent tax liability is reflected (1,450 x 20%).

Option No. 2. Penalties are taken into account on account 99

It is much more convenient to take into account penalties on account 99. Then the accountant will not have to accrue PNO.

In the instructions for using the chart of accounts, neither account 91 nor account 99 is directly suitable for accounting for penalties. However, in its economic content, the concept of penalties is very close to tax sanctions that must be taken into account in account 99. Transactions in accounting must be reflected based on their economic content , which takes precedence over the legal status of the operation (clause 6 of PBU 1/2008).

Example. received a request to pay interest on income tax in the amount of 421 rubles. The organization records penalties on account 99.

The accountant made the following entries:

Debit 99 Credit 68,421 - penalties accrued.

Regardless of the chosen option for reflecting penalties, you must remember that penalties do not reduce profits for tax purposes. In the financial statements, penalties are reflected depending on the selected accounting account. Ultimately, the net profit will be the same for any option for accounting for penalties. If the amount of penalties is significant, it is advisable to disclose information about it in an explanatory note.

An example of calculating penalties. LLC "Spring Wind" sent the VAT return for the fourth quarter of 2016 on 01/30/2017 instead of the established deadline of 01/25/2017. The tax payable according to the declaration is 360,000 rubles. The company paid the due tax only on March 30, 2017. The Federal Tax Service issued requirement No. 4587 dated 04/05/2017, according to which it is necessary to pay a fine in the amount of 5% of the tax amount - 18,000 rubles. The accountant calculated the amount of penalties and reflected all sanctions in postings. Penalties are recorded on account 99. Penalties are also accrued for the day of payment.

Debit 99 Credit 68 18,000 - reflected the fine in accordance with requirement No. 4587 dated 04/05/2017.

The accountant calculated the penalties. VAT can be paid at 1/3 per quarter. Thus, on January 25, 2017, the company had to pay 120,000 rubles (360,000: 3). 120,000 rubles each should have been sent to the budget on 02/27/2017 and 03/27/2017 (due to weekends, the payment deadline is postponed). The refinancing rate is 10%.

Penalties on the first payment are calculated for 64 days (from January 26, 2017 to March 30, 2017).

120,000 x 64 days. x 10%: 300 = 2,560 rubles.

Penalties for the second payment are calculated for 31 days (from 02/28/2017 to 03/30/2017).

>Tax fines and penalties: accounting and postings

Results

The principles for reflecting penalties in the tax accounting of the recipient and the debtor are very similar. Penalties for incorrect compliance with the terms of business contracts are shown in non-operating income (expenses). However, simplifiers cannot reflect them in expenses.

Penalties are generally not subject to VAT. At the same time, the recipient of fines should distinguish between sanctions aimed at fulfilling business obligations and those fines that actually relate to payment for goods or services.

Do you have any questions?

We invite you to our forum, where you can quickly receive a comprehensive answer from colleagues and experts. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

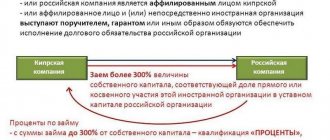

Forms of penalties for loans

Banks have several mechanisms for securing loan obligations - a guarantee, a pledge, and the imposition of a penalty. By receiving a penalty, a credit institution tries to compensate for losses associated with late repayment of debt and accrued interest. To impose a penalty, it is not necessary to prove the fact of losses incurred. Sufficient conditions are the existence of contractual terms and their violation in the form of delay.

The legislation provides ample opportunities for imposing penalties, determined in the form of penalties or fines.

| Type of penalty | Accrual form | Basic amount |

| Penalty | Interest rate for each day of delay | Accrued from the annuity payment or the amount of the remaining debt |

| Fine | Fixed amount | Accrued as a percentage of the violated obligation or a fixed amount |

When calculating penalties, interest on the use of credit funds is not taken into account. The law does not provide for the accrual of interest on interest. A number of banks use a combined option in the contract for collecting penalties - assigning a penalty for each day of delay and a monthly fine.

Tax liability for late payment of tax

For non-payment of tax or incomplete payment on time, the Tax Code provides for consequences both in the form of a fine (Article 122 of the Tax Code of the Russian Federation) and in the form of a penalty (Article 75 of the Tax Code of the Russian Federation),

Fine under Art. 122 of the Tax Code of the Russian Federation is presented based on the results of consideration of tax audit materials (letter of the Ministry of Finance of Russia dated June 28, 2016 No. 03-02-08/37483) in cases where non-payment or incomplete payment of tax resulted from incorrect calculation.

If non-payment of tax is caused by the fact that when calculating the tax base it was underestimated as a result of unintentional errors, then in this case the taxpayer will be presented with a fine in the amount of 20% of the amount of unpaid tax (clause 1 of Article 122 of the Tax Code of the Russian Federation)

If the tax authority proves a deliberate understatement of the tax base, then the amount of the fine will double (clause 3 of Article 122 of the Tax Code of the Russian Federation).

If the taxpayer filed a declaration in which the amount of tax was calculated correctly, but he did not pay it on time, then in such a situation only penalties are collected, and a fine under Art. 122 of the Tax Code of the Russian Federation is not assigned (letter of the Ministry of Finance of Russia dated June 28, 2016 No. 03-02-08/37483, paragraph 19 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57). This rule also applies in the case where the taxpayer filed an updated tax return without paying the tax on the initial return (letter of the Federal Tax Service of Russia dated August 22, 2014 No. SA-4-7/16692).

Late payment of VAT (as well as any other tax), either due to an understatement of the tax base or in case of violation of the deadline for payment of a correctly calculated tax, entails the collection of a penalty (Article 75 of the Tax Code of the Russian Federation).

Penalties are calculated as a percentage of the amount of unpaid tax based on 1/300 of the refinancing rate for each day of delay, but these conditions are reserved only for individuals and individual entrepreneurs. For legal entities, the calculation formula applies only if the number of days of delay in tax payment does not exceed 30. Starting from the 31st day of delay for legal entities, the penalty will be calculated based on 1/150 of the refinancing rate, i.e. the amount of penalties is doubled.