An enterprise necessarily owns certain property of various types. It is necessary not only to ensure the activities of the company, but also to manage it, as well as for other purposes. A certain part of the property consists of fixed assets, they are subject to mandatory accounting.

- What are fixed assets?

- What are the principles of their accounting and reflection in financial documentation?

- Where do they come from and where do they go?

- How does their value and, accordingly, accounting change?

More details about everything.

What is the essence of fixed assets?

The concept of “fixed assets” does not include any property of an enterprise. These are material objects that a company uses for various types of its activities: production of goods, provision of services, performance of work, rental and other functions. All of the following must apply to these tangible assets:

- they do not intend to be sold or processed in the near future;

- they serve for the benefit of the entrepreneur for at least 12 months (or one operating cycle if it exceeds a year);

- potentially capable of generating income for the owner (now or in the future);

- may be subject to wear and tear and lose value (everything except land plots).

REFERENCE! In the specialized literature, the identical definition of “fixed assets” is sometimes used. But in modern business vocabulary, both domestic and international, it is considered outdated. We do not recommend using it, so as not to seem like an “economic dinosaur.”

What is an “inventory file” and why it may be needed

1 July 2022 12:07

Quantity

There is currently no definition of the concept of “inventory” in the legislation of the Russian Federation. However, it is quite simple to understand what exactly is meant by this concept.

In accordance with the legislation of the Russian Federation, accounting of the housing stock is carried out, inter alia, by conducting a technical inventory. The unit of technical inventory is an inventory object (residential buildings, buildings, structures and other objects). For each such object, a set of technical documentation is prepared, which is recorded in the inventory file.

Thus, each inventory object has its own unique inventory file, which is formed from the technical and legal parts.

Technical part

inventory file includes

a technical passport of the object

(contains information that allows you to uniquely identify and describe the property: technical, quantitative, qualitative, economic characteristics of the property),

assessment documentation

(includes information about the inventory value of the property),

accounting and technical documentation

(contains additional technical data and information regarding registration of the object).

Legal part

The inventory file includes information about the copyright holders of the property, including all changes in relation to the owners (possessors) of the property. This information corresponds to the information in the title documents.

Since the establishment of a new inventory file in relation to the same object is not provided, when conducting the second and subsequent inventories, the information contained in the legal part of the inventory file is supplemented with up-to-date information.

From the above we can draw the following conclusion:

Inventory business

- this is a set of technical and legal documentation, subject to storage in the established manner, obtained as a result of technical accounting (inventory) and characterizing the history of the emergence and changes of a real estate property.

Accounting and technical documentation, including inventory files for objects, has been formed on the territory of the Tula region since 1927 and is currently the property of the constituent entity of the Russian Federation.

On the territory of Tula and the Tula region, the organization authorized by the government of the subject to permanently store accounting and technical documentation, provide copies of such documentation and information from it is the state institution of the Tula region “Regional Bureau of Technical Inventory”. More than four hundred thousand inventory files were transferred to the archives of the institution, which contain documents and information about objects of technical accounting and technical inventory until 2013. Currently, inventory files are updated with data obtained during the ongoing inventory.

Since 2016, GU TO "Regional BTI" not only stores and replenishes the archive of accounting and technical documentation, but also provides services to the population for familiarization with inventory files, as well as for providing copies and information contained in the materials of inventory files, which, beyond those established by law exceptions are publicly available.

The need for such services arises when the owner of the object partially or completely lacks the documents included in the inventory file and they need to be restored, or if it is simply necessary to find out all the technical characteristics of the object.

In addition, with the help of an inventory file, you can gradually track the entire history of the existence of a particular property from the date of its formation: such a “historical certificate” will be an excellent proof of the rights to the inventory item of a specific person.

In practice, there are also frequent cases in which one of the parties to a trial needs to provide copies of these documents to the judicial authorities. In this case, before or during the trial, the interested person can contact the State Technical Institution “Regional BTI” in order to receive appropriate services.

You can order services/work of the institution in person at the institution or in any separate territorial division of the institution, on the official website ( bti-tula.ru ), by email:

[email protected] , as well as by post.

You can obtain detailed information on the provision of services/performing work of the institution on the specified website, as well as by phone and (ext. 76-02).

We are always glad to see you in our establishment

.

- ← Prev. news

- Track. news →

What is included in fixed assets?

Fixed assets are classified in the All-Russian Classifier of Fixed Assets (OKOF). According to this register, accounting classifies the following tangible assets as main ones:

- building structures;

- land;

- mechanisms;

- instruments and devices;

- tools, equipment;

- equipment for computing and organizing activities;

- transport;

- number of livestock;

- planted perennial plants;

- natural objects in use;

- capital investments in leased inventory and land improvement;

- some other types of material objects.

These funds are not basic

If an item has served the owner for less than one year, it has not yet reached the status of a fixed asset.

There is also a limitation on cost: if a tangible asset costs less than 40 thousand rubles, it is not classified as fixed assets. This limit was established by the new edition of Order of the Ministry of Finance of the Russian Federation No. 186n dated December 24, 2010. It also clarifies that the cost limit does not apply to agricultural implements, livestock, construction machinery and weapons: all of these are fixed assets, no matter how much they cost .

In addition, the list of fixed assets does not include :

- equipment intended for fishing;

- temporary buildings that are not going to be used for more than two years;

- replaceable equipment that constitutes replaceable elements of other fixed assets;

- special and uniform clothing and shoes;

- devices for working in the forest: chainsaws, loppers, alloy cables, temporary railway lines, roads, etc.;

- storage containers;

- planting material, even if it is perennial;

- young animals, bee families, birds, rabbits, fur-bearing animals, dogs.

NOTE! Any tangible asset intended for sale or rental cannot be a fixed asset.

Inventory of fixed assets

Inventory purposes:

- Obtaining current information about the technical condition and actual availability of fixed assets;

- Reconciliation of actual availability with accounting information.

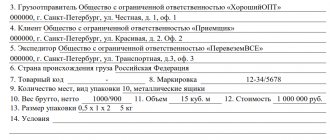

Information indicating the full name of assets and their technical parameters is entered into the “Inventory lists of fixed assets”, which are subsequently sent to the accounting department of the subject.

For fixed assets transferred for temporary use or storage, received or leased, the legality of contracts and availability are checked.

Before inventory, the presence and condition of:

- Documents for fixed assets;

- Technical documentation (for example, technical passports);

- Inventory lists, cards.

Set up the Virtual Warehouse module in 1C to maintain records of accompanying invoices for goods in 1C

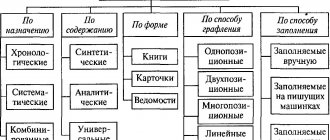

Inventory of inventory cards for accounting of fixed assets

The missing documentation is completed or obtained again. If necessary, amendments are made to technical documents or accounting registers.

During the inventory, the commission examines the assets and records in the inventory:

- Full name of objects;

- Data on the purpose of assets;

- Key operational and technical parameters;

- Inventory numbers.

When inspecting real estate, the commission monitors the availability of documentation proving ownership rights, as well as the assignment of the relevant objects to the subject.

If assets are found with incorrect characteristics or no data at all, objects not accepted for registration, members of the commission make the necessary corrections to the cards and inventory. Suppose that for buildings their useful and/or total area, construction materials, and number of floors can be indicated.

Unaccounted for objects are assessed taking into account current reproduction conditions and prices. The commission must determine when objects discovered during the inventory and not previously taken into account were purchased or built, and indicate this in the protocol.

Fixed assets are included in the inventory by name according to the key purpose of the assets. If an object has changed its main purpose as a result of refurbishment, expansion, reconstruction or restoration, it is indicated under the name corresponding to the new purpose.

If it is discovered that the partial liquidation of a structure, the addition of new premises, floors or other capital measures are not reflected in the accounting registers, it is necessary to estimate the cost of reducing or increasing the original price using documents and indicate information about the changes in the inventory. In addition, it is necessary to identify the reasons for the data on changes in accounting, as well as the persons responsible for this.

Transport, equipment, machines are entered into the inventory individually: displaying power, purpose, year of manufacture, manufacturing company, factory inventory number, etc.

Set up integration with the ESF IS and maintain a unified record of goods in the Virtual Warehouse in 1C.

Machine tools, tools, the same type of household equipment and other objects of the same price, simultaneously received by one structural unit, for example, a workshop, are indicated in the inventories under the name with their quantity displayed.

The numbers given to fixed assets do not change. An exception is situations where assets ended up in one or another category of fixed assets by mistake, or as a result of incorrect numbering.

The inventory does not include data on fixed assets that cannot be restored and are not suitable for use. For such assets, the commission creates a separate inventory, which displays the time when the objects were put into operation and the reasons why the assets became unusable (complete wear and tear, breakdown, etc.).

Inspection of own fixed assets is carried out simultaneously with the inventory of fixed assets held in custody or leased. For such assets, inventories are created (separately for each enterprise), in which they provide links to documentation certifying the acceptance of assets for safekeeping or lease. In addition to the established data, the inventory contains information about the name of the lessor company, the storage or rental period. Landlord companies receive one copy of the inventory list.

The cost of objects discovered and not taken into account since the previous inspection of fixed assets is calculated using expert methods. Depreciation of these assets is determined based on their current technical condition.

The results of the inspection must be indicated in the accounting of the month of completion of the inventory. New cards are generated for unaccounted assets and placed in the “Archive” of the card index.

Information from the inventory lists is included in the “Comparison sheet of the results of the inventory of fixed assets.” Please note: only those positions for which discrepancies with accounting information are identified are recorded in the statement.

The key document during the inspection of fixed assets is the commission protocol. It contains complete information about the persons responsible for the violations and the reasons for the occurrence of shortages and surpluses. And, in addition, about the responsibility that should be applied to the perpetrators and measures to prevent negative phenomena in the future.

Protocol of the commission on write-off of fixed assets

Related Concepts

Let's analyze the key terms directly related to fixed assets.

Depending on what actions entrepreneurs perform with their fixed assets, several important concepts can be distinguished.

- Audit. The term used to account for fixed assets is "inventory object" is a single asset, part of fixed assets, considered as a separate independent value. These can be:

- a separate object with its own attributes;

- a structure designed to perform one or another separate function;

- a complex of objects that makes up a single whole, intended for a specific activity.

- Multiplication . The enterprise, in an effort to expand its activities, pays attention to the acquisition of fixed assets, their creation, modernization, improvement, etc. Costs allocated for such needs are called capital investments .

- Depreciation . Over time, any thing loses some of its useful properties, which means it loses in value. Regularly subtracting this loss, that is, taking into account depreciation, is called ascertaining the residual value . After depreciation is deducted, what remains is net fixed assets .

- Increased efficiency. If inventory items are subject to restoration and correction, they are repaired:

- current - worn parts are replaced, for which such replacement was initially provided;

- medium – the object is disassembled and restored to the extent possible;

- capital – complete replacement of all worn-out elements or their restoration.

Funds love accounting

Fixed assets in the Russian Federation are accounted for on the basis of PBU-6/01.

Accounting means clarifying information on the name and cost of the organization’s fixed assets. To do this, the cost of each inventory item is initially established: it depends on the way in which the asset was included in the fixed assets of the enterprise. Then this cost is reduced monthly by a certain depreciation amount, which is reflected in the balance sheet as the residual value. In this document, fixed assets appear as non-current assets .

Depreciation is an accounting of the changed value of an asset during its useful life , that is, the period when it is planned to receive income from this asset. It may be revised if capital investments were made into the facility for the purpose of its modernization, restoration, technical reconstruction, repair, etc. The amount of such investments is called replacement cost .

NOTE! The useful life often depends on the operating documents, for example, the probable service life of a tool indicated by the manufacturer is three years, which means that this will be the useful life of this item, despite the fact that theoretically the item can last longer.

Regulatory regulation

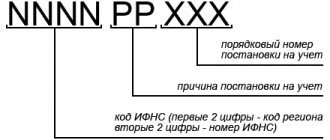

It is not uncommon for an inventory item initially accepted for accounting to later need to be divided into several items and/or re-equipped. For example, a set of furniture was accepted for accounting as one object, and then it was necessary to separate out some of the items as separate inventory objects. How to reflect destaffing in accounting? Previously, methodologists proposed writing off an asset to account 106.00, and then registering new inventory items from it - to account 101.00, or material reserves - to account 105.00.

As amended on August 17, 2015 No. 127n Instructions for the use of the Chart of Accounts for Budget Accounting, approved. By order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n, a different solution was proposed.

Clause 10 of Instruction No. 162n as amended by Order No. 127n of the Ministry of Finance of Russia dated August 17, 2015, has been supplemented with new paragraphs:

By Order of the Ministry of Finance of Russia dated November 16, 2016 No. 209n, paragraph 10 of Instruction No. 162n was amended - the KOSGU codes of analytical accounts of account 0 101 00 000 were clarified.

|

How do fixed assets appear?

The receipt of fixed assets determines their initial cost. The material assets of an enterprise can be:

- purchased from suppliers for a certain fee, which is the original cost;

- contributed by the founders as a contribution to the authorized capital (the value will be the monetary value of the founders);

- created (built) – production costs are taken into account;

- transferred free of charge - the initial value will be the current market value;

- received under an exchange agreement - the cost is determined according to the norms of clause 11 of PBU 6/01.

Received funds are formalized by an acceptance certificate, and then by an order from the manager to put them into operation. At the same time, their initial cost is formed, which accountants will reflect on account 01 “Fixed Assets”.

Definition of unit of account for fixed assets

The accounting unit for fixed assets is an inventory item. An inventory item of fixed assets is recognized as:

- an object with all fixtures and accessories,

- a separate structurally isolated object intended to perform certain independent functions,

- a separate complex of structurally articulated objects that constitute a single whole and are intended to perform a specific job. A complex of structurally articulated objects is one or more objects of the same or different purposes, having common devices and accessories, common control, mounted on the same foundation, as a result of which each object included in the complex can perform its functions only as part of the complex, and not independently.

If one object has several parts, the useful lives of which differ significantly, each such part is accounted for as an independent inventory item. (Accounting policy element)

For accounting purposes, there are three types of valuation:

1. initial cost.

2. replacement cost.

3. residual value.

Table 1.

Types of valuation of fixed assets for accounting and reporting.

| Type of assessment | Definition of assessment |

| Initial cost | Determined at the time the object is accepted for accounting, depending on the source of receipt of fixed assets |

| Replacement cost | Determined as a result of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets |

| Residual value | Determined at the reporting date as the difference between the original (replacement) cost and the amount of depreciation |

Fixed assets are accepted for accounting at their original cost.

Table 2.

Rules for the formation of the initial cost depending on the direction of acquisition of fixed assets.

| No. | Type of assessment | Rules for the formation of initial cost | Normative base |

| Purchase for a fee | The amount of actual expenses of the organization for acquisition, construction and production, excluding value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation). The actual costs for the acquisition, construction and production of fixed assets are: - amounts paid in accordance with the contract to the supplier (seller), - amounts paid for delivering the object and bringing it into a condition suitable for use; — amounts paid to organizations for carrying out work under a construction contract and other contracts; — amounts paid to organizations for information and consulting services related to the acquisition of fixed assets; — customs duties and customs fees; - non-refundable taxes, - state duty paid in connection with the acquisition of fixed assets; — remunerations paid to the intermediary organization through which the fixed asset was acquired; — other costs directly related to the acquisition, construction and production of fixed assets. General and other similar expenses are not included in the actual costs of acquisition, construction or production of fixed assets, except when they are directly related to the acquisition, construction or production of fixed assets. | clause 8 of PBU No. 6/01 | |

| making a contribution to the authorized (share) capital | The initial cost of fixed assets is their monetary value, agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation. | clause 9 of PBU No. 6/01 | |

| fixed assets received by an organization under a gift agreement (free of charge) | The initial cost of fixed assets is their current market value on the date of acceptance for accounting as investments in non-current assets. The current market value is understood as the amount of cash that can be received as a result of the sale of the specified asset on the date of acceptance for accounting. When determining the current market value, data on prices for similar fixed assets received in writing from manufacturing organizations can be used; information on the price level available from state statistics bodies, trade inspectorates, as well as in the media and specialized literature; expert opinions (for example, appraisers) on the value of individual fixed assets. | clause 10 of PBU No. 6/01 clause 29 of the Guidelines | |

| fixed assets received under contracts providing for the fulfillment of obligations (payment) in non-cash | The initial cost is the value of assets transferred or to be transferred by the organization. The value of assets transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets. If it is impossible to determine the value of assets transferred or to be transferred by the organization, the value of fixed assets received by the organization under contracts providing for the fulfillment of obligations (payment) in non-monetary means is determined based on the cost at which similar fixed assets are acquired in comparable circumstances. | clause 11 of PBU No. 6/01 | |

| when they are produced by the organization itself | The initial cost is determined based on the actual costs associated with the production of these fixed assets. Accounting and formation of costs for the production of fixed assets is carried out by the organization in the manner established for accounting for the costs of the corresponding types of products manufactured by this organization. | Clause 26 of the Guidelines | |

| Fixed assets identified during the inventory | Accepted for accounting at current market value | Clause 36 of the Guidelines |

The initial cost of fixed assets accepted for accounting in accordance with paragraphs 2, 3, 4, 5 is determined in relation to the procedure given in paragraph 1 of Table 2.

Costs for completion, additional equipment, reconstruction, modernization of fixed assets are taken into account in the account for investments in non-current assets.

Upon completion of the completion of construction, additional equipment, reconstruction, modernization of a fixed asset item, the costs recorded in the account for investments in non-current assets increase the initial cost of this fixed asset item. A record is made - D 01 K 08.

The accounting unit for fixed assets is an inventory item. An inventory item of fixed assets is recognized as:

- an object with all fixtures and accessories,

- a separate structurally isolated object intended to perform certain independent functions,

- a separate complex of structurally articulated objects that constitute a single whole and are intended to perform a specific job. A complex of structurally articulated objects is one or more objects of the same or different purposes, having common devices and accessories, common control, mounted on the same foundation, as a result of which each object included in the complex can perform its functions only as part of the complex, and not independently.

If one object has several parts, the useful lives of which differ significantly, each such part is accounted for as an independent inventory item. (Accounting policy element)

For accounting purposes, there are three types of valuation:

1. initial cost.

2. replacement cost.

3. residual value.

Table 1.

Types of valuation of fixed assets for accounting and reporting.

| Type of assessment | Definition of assessment |

| Initial cost | Determined at the time the object is accepted for accounting, depending on the source of receipt of fixed assets |

| Replacement cost | Determined as a result of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets |

| Residual value | Determined at the reporting date as the difference between the original (replacement) cost and the amount of depreciation |

Fixed assets are accepted for accounting at their original cost.

Table 2.

Rules for the formation of the initial cost depending on the direction of acquisition of fixed assets.

| No. | Type of assessment | Rules for the formation of initial cost | Normative base |

| Purchase for a fee | The amount of actual expenses of the organization for acquisition, construction and production, excluding value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation). The actual costs for the acquisition, construction and production of fixed assets are: - amounts paid in accordance with the contract to the supplier (seller), - amounts paid for delivering the object and bringing it into a condition suitable for use; — amounts paid to organizations for carrying out work under a construction contract and other contracts; — amounts paid to organizations for information and consulting services related to the acquisition of fixed assets; — customs duties and customs fees; - non-refundable taxes, - state duty paid in connection with the acquisition of fixed assets; — remunerations paid to the intermediary organization through which the fixed asset was acquired; — other costs directly related to the acquisition, construction and production of fixed assets. General and other similar expenses are not included in the actual costs of acquisition, construction or production of fixed assets, except when they are directly related to the acquisition, construction or production of fixed assets. | clause 8 of PBU No. 6/01 | |

| making a contribution to the authorized (share) capital | The initial cost of fixed assets is their monetary value, agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation. | clause 9 of PBU No. 6/01 | |

| fixed assets received by an organization under a gift agreement (free of charge) | The initial cost of fixed assets is their current market value on the date of acceptance for accounting as investments in non-current assets. The current market value is understood as the amount of cash that can be received as a result of the sale of the specified asset on the date of acceptance for accounting. When determining the current market value, data on prices for similar fixed assets received in writing from manufacturing organizations can be used; information on the price level available from state statistics bodies, trade inspectorates, as well as in the media and specialized literature; expert opinions (for example, appraisers) on the value of individual fixed assets. | clause 10 of PBU No. 6/01 clause 29 of the Guidelines | |

| fixed assets received under contracts providing for the fulfillment of obligations (payment) in non-cash | The initial cost is the value of assets transferred or to be transferred by the organization. The value of assets transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets. If it is impossible to determine the value of assets transferred or to be transferred by the organization, the value of fixed assets received by the organization under contracts providing for the fulfillment of obligations (payment) in non-monetary means is determined based on the cost at which similar fixed assets are acquired in comparable circumstances. | clause 11 of PBU No. 6/01 | |

| when they are produced by the organization itself | The initial cost is determined based on the actual costs associated with the production of these fixed assets. Accounting and formation of costs for the production of fixed assets is carried out by the organization in the manner established for accounting for the costs of the corresponding types of products manufactured by this organization. | Clause 26 of the Guidelines | |

| Fixed assets identified during the inventory | Accepted for accounting at current market value | Clause 36 of the Guidelines |

The initial cost of fixed assets accepted for accounting in accordance with paragraphs 2, 3, 4, 5 is determined in relation to the procedure given in paragraph 1 of Table 2.

Costs for completion, additional equipment, reconstruction, modernization of fixed assets are taken into account in the account for investments in non-current assets.

Upon completion of the completion of construction, additional equipment, reconstruction, modernization of a fixed asset item, the costs recorded in the account for investments in non-current assets increase the initial cost of this fixed asset item. A record is made - D 01 K 08.