Formation of exchange rate differences and their types

Exchange rate difference refers to the difference formed due to fluctuations in exchange rates over different periods of time.

It appears when recalculating the value of the fixed capital or liabilities of an enterprise, taking into account changes in quotations officially established by the Central Bank. Exchange rate differences are relevant not only for those companies whose activities are directly related to export or import operations. Its appearance is inevitable when: (click to expand)

- the entrepreneur uses credit and borrowed resources in foreign currency;

- employees are expected to travel to foreign countries, which means foreign currency is needed to cover their costs;

- contracts are concluded between Russian counterparties in conventional units, which are then converted into rubles on the payment date. The reason is insurance against financial losses, the likelihood of which is significant due to the instability of domestic money.

Depending on how the foreign currency quote fluctuates, the exchange rate difference may be:

- Positive if there is an increase in the exchange rate.

- Negative – when the quote decreases.

The reason for exchange rate differences

Currency rates can fluctuate in any direction – both increase and decrease. Events may develop unpredictably, so the company may receive less or more income than expected if the price in the contract is not specified in rubles. A change in the official value of the currency will affect the amount of income of the organization.

The growth of the exchange rate increases:

- expenses for the purchase of goods, equipment, materials, payment for services;

- volume of sales revenue.

Conversely, a depreciation of the exchange rate can reduce the cost of paying obligations in foreign currency or income from sales of goods, works, services, the price of which was indicated in the monetary units of another state.

Exchange rate differences can be either positive or negative. If the exchange rate has not changed, there will be no difference.

Exchange differences under different taxation systems (USN, OSNO, Unified Agricultural Tax)

Companies and organizations using the simplified tax system do not recalculate the value of foreign currency assets. They do not have the need to calculate exchange rate differences during such a transaction and include the corresponding amounts in the tax base.

The same procedure is provided when obligations are expressed in foreign currency, and payment is made in domestic currency. It turns out that the change of course by the Central Bank does not have any impact on:

- Balance of money in a foreign currency account.

- The amount of foreign currency debt of counterparties-buyers to whom the goods have already been shipped.

There are no such concessions for enterprises operating on OSNO. Exchange rate differences must be recalculated for different periods of time: (click to expand)

- on the reporting date, which corresponds to the last day of the quarter;

- when there is a significant fluctuation in foreign currency quotes;

- on the day of transfer of cu. counterparties or crediting money received from them.

Companies using the unified agricultural tax system should include positive exchange rate differences in non-operating income, as with the simplified tax system, but at the end of the quarter. But they cannot reduce the tax base if there are differences with a minus sign on advance payments. This also applies to others working under simplified conditions.

Exchange differences under the simplified tax system “income” and “income minus expenses”

The value of assets or liabilities is accepted for accounting in rubles. In accounting, income and expenses are recalculated at the Central Bank exchange rate at the time of payment, since the cash method is used. That is, “simplified” people do not need to re-evaluate liabilities as of reporting dates and take into account the resulting exchange rate differences in income or expenses (Clause 1, Article 346.17 of the Tax Code of the Russian Federation).

In other words, the organization includes funds in the tax base on the day it receives an advance or payment from the buyer, customer:

- if the payment was made in foreign currency - at the official exchange rate of the Central Bank on the day of receipt of funds (credited to the current account or deposited in the organization's cash desk) (clause 3 of Article 346.18 of the Tax Code of the Russian Federation);

- for ruble receipts - the entire amount is included in income without any recalculation.

In KUDiR, transactions are also reflected in Russian rubles.

In accounting, the receipt is reflected by posting using account 52 “Currency account”:

Debit 52 / Credit 62.

The date of shipment does not in any way affect the tax obligations of the simplified product; income is taken into account only once - at the time of its receipt. That is, in this case, exchange rate differences do not arise under the simplified tax system in 2020.

Example

Osen LLC, which uses the simplified tax system for income, entered into an agreement on March 2, 2022 with a foreign company for the supply of spare parts in the amount of 8,300 euros. The shipment took place on March 21. Full prepayment from the buyer was received in the company's foreign currency account on March 20, 2022. The euro exchange rate on the day the contract was concluded was 73.7235 rubles, on the day the funds were credited to the bank account - 87.2669 rubles, on the date of shipment - 84.1552 rubles.

On March 20, 2020, Osen LLC included in its income the amount of the prepayment, recalculating it at the exchange rate on the date of receipt of the money:

8300 x 87.2669 = 724315.27 rubles.

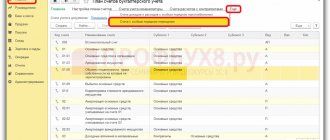

In accounting, the transaction was reflected as follows:

D52 /K62.2 - 724,315.27 rubles.

On the day of shipment, the company will write off the resulting accounts payable:

D62.1 / K90 – 724,315.27 rubles, the shipment of spare parts is reflected;

D62.2 / K62.1 – RUB 724,315.27, prepayment received from the buyer is included.

The income will be reflected in KUDiR on March 20, 2020 in the amount of RUB 724,315.27.

We will separately consider the issue of currency purchase or sale operations.

Accounting for exchange rate differences in UTII

Organizations used by UTII keep full accounting records and submit appropriate reports. When the tax base is formed, exchange rate differences are not taken into account. For firms on UTII, the object of taxation is imputed income, the amount of which is determined by multiplying the basic profitability and the physical indicator characteristic of a specific activity. Thus, any transaction with foreign currency does not have any impact on the calculation of UTII.

If this type of taxation is applied simultaneously with OSNO, then the organization must keep records of both income and costs separately. It happens that it is practically impossible to do this. Then the total amount is distributed in proportion to the share of income received from work for each type of taxation. In the case where exchange rate differences relate to those component activities of the organization that are not subject to UTII, taxes are paid to the treasury according to OSNO.

Features of accounting under the simplified tax system

For companies using the simplified tax system, exchange rate differences from transactions related to the purchase and sale of foreign currency are subject to accounting. But only on condition that it is positive.

The basis for such accounting is the explanation of the Ministry of Finance that transactions in the non-banking sector for foreign currency exchange are not the sale of goods. They become such only for banking institutions. For them, foreign currency is property for sale, and therefore a commodity.

For companies using the simplified tax system, the purchase of foreign currency and its sale for domestic currency are operations that:

- related to foreign currency circulation;

- do not apply to its sale.

Exchange differences with plus or minus arising from foreign currency purchase and sale transactions should be taken into account in non-operating income. When the foreign currency was sold above the official quotation, a positive exchange rate difference appears. It is this that should be included in non-operating income.

Sale of currency under the simplified tax system. Example and wiring

Example 2. On April 8, payment for goods under a previously concluded contract was credited to the foreign exchange account of company N. The amount is €1200.

The currency was sold a day later to a commercial bank at the rate of 75.3254 RUB/€.

The Central Bank quote was 74.2387 RUB/€, which allowed the company to create a positive exchange rate difference:

1200·(75.3254-74.2387) = 1,304.04 rubles.

In KUDiR, income is reflected in this way:

| Operation description | Amount, rub. |

| Amount of payment under the concluded contract | 89 086,44 (1200·7,2387) |

| Exchange rate difference (plus) from the sale of foreign currency | 1304,04 |

When a “simplified” person keeps accounting in full, the transaction will be reflected in the following entries:

| Debit | Credit | A comment | €, RUB |

| 57 | 52 | Currency transferred to the bank for sale | €1200 |

| 51 | 57 | Revenue in rub. from the sale of euros was credited to the account (according to the Central Bank quote) | 89 086,44 |

| 57 | 91.1 | exchange rate difference determined, rub. | 1 304,04 |

When the commercial bank rate was lower than the official quote, for example, 73.9856, the difference would be with a minus sign:

1200·(73.9856-74.2387) = -303.72 rub.

Important! Exchange rate differences with a minus sign are not included in the costs of the simplified tax system and are not recorded in KUDiR.

Purchasing foreign currency under the simplified tax system: transactions

In the case when foreign currency is purchased to pay off a loan or compensate for the costs of employees on foreign business trips, the following is recorded in accounting:

| Debit | Credit | A comment |

| 57 | 51 | Transferring money to purchase foreign currency |

| 52 (1, 2, 3) | 57 | Crediting funds to a transit account |

| 91.2 | 51 | Commission paid to the bank |

Non-operating income is obtained when the Central Bank quote is higher than the purchase rate. The wiring looks like this:

DT 57 KT 91.1

The company's income increases.

Example 3 . has a foreign currency loan. To repay it, you need to buy currency for €5,500. At a commercial bank, the exchange rate for € is 73.6987, at the Central Bank – 74.2256 RUB/€.

The Central Bank quote is higher, which means that when purchasing you will get a positive exchange rate difference:

5,500·(74.2256-73.6987) = 2,897.95 rubles.

This amount will be reflected in KUDiR as income.

Procedure for accounting for income in foreign currency

According to paragraph 3 of Art. 346.18 of the Tax Code of the Russian Federation, income and expenses expressed in foreign currency are taken into account in conjunction with income and expenses expressed in rubles. In this case, income and expenses expressed in foreign currency are recalculated into rubles at the official exchange rate of the Central Bank of the Russian Federation, established respectively on the date of receipt of income and (or) the date of expenditure.

In accordance with Art. 346.15 of the Tax Code of the Russian Federation, taxpayers using the simplified tax system, when determining the object of taxation, take into account income from sales determined on the basis of Art. 249 of the Tax Code of the Russian Federation, and non-operating income determined on the basis of Art. 250 Tax Code of the Russian Federation.

When determining the object of taxation, income provided for in Art. 251 Tax Code of the Russian Federation; income received in the form of dividends and income from transactions with certain types of debt obligations; as well as income of individual entrepreneurs, subject to personal income tax at tax rates of 35% and 9%.

According to paragraphs 1 and 2 of Art. 249 of the Tax Code of the Russian Federation, income from sales is recognized as proceeds from the sale of goods (works, services) both of one’s own production and those previously acquired, and proceeds from the sale of property rights. Sales proceeds are determined based on all receipts associated with payments for goods (work, services) sold or property rights expressed in cash and (or) in kind.

In accordance with paragraph 1 of Art. 346.17 of the Tax Code of the Russian Federation, the date of receipt of income is recognized as the day of receipt of funds to bank accounts and (or) to the cash desk, receipt of other property (work, services) and (or) property rights, as well as repayment of debt (payment) to the taxpayer in another way (cash method ).

Thus, income in the form of foreign currency, including revenue from the sale of goods, is taken into account for tax purposes by the tax paid in connection with the application of the simplified tax system when the specified funds are received into the taxpayer’s transit currency account.

It is on this date that the income received must be reflected in UAH. Section 4 I “Books of accounting of income and expenses of organizations and individual entrepreneurs using a simplified tax system”, approved by order of the Ministry of Finance of the Russian Federation dated October 22, 2012 N 135n.

Features of tax accounting for exchange rate differences

- The first feature is that in tax accounting, exchange rate differences arise only if the obligation is expressed in foreign currency, and it should be paid in it. The date the difference appears is the period of time when the operation is performed.

- Second feature. Tax accounting classifies differences with a plus as non-operating income. This means that they do not appear in the calculation of VAT, but affect the amount of income tax.

- Third feature. As in accounting, there is no need to recalculate advances and prepayments in foreign currency.

Important! When making payments in foreign currency, there should be no differences between tax and accounting. Income and costs are reflected in the same amounts.

What has changed due to the adoption of Decree No. 159?

Decree No. 159 gave commercial organizations the right to:

1) attribute the amounts of differences arising from January 1, 2022 to December 31, 2022 when recalculating the value of assets and liabilities expressed in foreign currency into the official monetary unit of the Republic of Belarus to income (expenses) of future periods;

2) subsequently write them off as income (expenses) for financial activities in the manner and within the time limits established by the head of the organization, but no later than December 31, 2022 (clause 1 of Decree No. 159).

Decree No. 159 applies to relations that arose from January 1, 2022 (clause 2 of Decree No. 159).

Before the adoption of Decree No. 159, the amount of exchange rate differences arising in organizations (including when returning advances and repaying accounts payable in the form of a letter of credit), except for the cases specified in paragraphs. 5, 6 NAS No. 69 [3] , should have been reflected in the debit (credit) of accounts for cash, settlements and other accounts and the credit (debit) of account 91 “Other income and expenses”, unless otherwise established by law (clause 7 of NAS No. 69).

Thus, in the vast majority of cases in 2022, exchange rate differences should have been reflected in account 91 as part of income and expenses for financial activities, which, taking into account the increase in foreign exchange rates, led to a deterioration in the financial results of many organizations (decrease in profits, increase in losses) .

Exchange differences under contracts in equivalent

Decree No. 159 does not change the procedure for reflecting in accounting exchange rate differences that arise when recalculating the value of assets and liabilities expressed in the official monetary unit of the Republic of Belarus in an amount equivalent to a certain amount in foreign currency. In relation to such exchange rate differences, the following options for reflection in accounting and when taxing profits in 2022 can be applied (see Tables 1 and 2).

Table 1

Option 1

In this case, the procedure for reflecting exchange rate differences in income and expenses in accounting and tax accounting will be the same.

table 2

Option 2

In this case, the procedure for reflecting exchange rate differences in income and expenses in accounting and tax accounting will not be the same. The consequence of this will be the emergence of deferred tax assets and (or) deferred tax liabilities (Instruction No. 113 [7] ).

Exchange differences under contracts in foreign currency

Let us remind you that exchange rate differences |*| under contracts in foreign currency arising during a calendar year, organizations (except for banks) have the right to include in non-operating income and (or) expenses when determining the tax base for income tax:

* Transfer of reflection of exchange rate differences in the composition of income (expenses) for financial activities

– or on the dates determined in accordance with Art. 174 and 175 of the Tax Code, during the tax period;

– or in the last reporting period of the corresponding calendar year.

The procedure chosen by the organization for tax accounting of exchange rate differences is reflected in its accounting policy and is not subject to change during the current tax period (subclause 1.1, clause 1 of Decree No. 504).

Subsequently, organizations received the right to change the procedure for tax accounting of exchange rate differences, chosen in accordance with Decree No. 504, once during 2022 by amending the accounting policy (subclause 2.6, clause 2 of Decree No. 143 [8]).

How do Decree No. 159 and Decree No. 504 work?

Decree No. 159 regulates issues of accounting for exchange rate differences, and Decree No. 504 regulates issues of taxation of exchange rate differences.

With the adoption of Decree No. 159, the option of reflecting exchange rate differences in accounting for assets and liabilities denominated in foreign currency appeared. Organizations should formalize their choice in their accounting policies.

The Letter of the Ministry of Taxes and Taxes explains that for profit tax purposes , commercial organizations that have changed the procedure for reflecting exchange rate differences in accordance with Decree No. 159 in accounting are guided by the provisions of sub-clause. 3.20 clause 3 art. 174 and sub. 3.26 clause 3 art. 175 of the Tax Code and include in non-operating income (expenses) the resulting exchange differences at each reporting date, i.e. without applying the provisions of Decree No. 159.

The period chosen by the organization for including exchange rate differences in the tax base for income tax must be fixed in the accounting policy. Organizations do not have the right to establish in their accounting policies different accounting procedures for exchange rate differences to be included in non-operating expenses and for exchange rate differences to be included in non-operating income.

If the procedure for tax accounting of exchange rate differences is not defined in the organization's accounting policy, exchange rate differences are subject to accounting when calculating income tax on the basis of the provisions of Art. 173–175 NK.

How can exchange rate differences be taken into account?

Taking into account the norms of Decree No. 159, Decree No. 504, Decree No. 143 |*| and Letters of the Ministry of Taxation, the following options can be distinguished for accounting for exchange rate differences in relation to assets and liabilities denominated in foreign currency for accounting and profit tax purposes, which may occur in accordance with the accounting policy (see Tables 3–7).

* Changes in the reflection of exchange rate differences in tax accounting in 2022.

Table 3

Option 1

In this case, the procedure for reflecting exchange rate differences in expenses will be the same in accounting and tax accounting.

Table 4

Option 2

In this case, the procedure for reflecting exchange rate differences in expenses may not coincide in accounting and tax accounting, and deferred tax assets and (or) deferred tax liabilities may arise in accordance with Instruction No. 113.

Table 5

Option 3

In this case, the procedure for reflecting exchange rate differences in expenses will be the same in accounting and tax accounting.

Table 6

Option 4

In this case, the procedure for reflecting exchange rate differences in expenses will not be the same in accounting and tax accounting |*| and deferred tax assets and (or) deferred tax liabilities will arise in accordance with Instruction No. 113.

* How accounting and tax accounting of exchange rate differences will interact

Table 7

Option 5

In this case, the procedure for reflecting exchange rate differences in expenses may not coincide in accounting and tax accounting, and deferred tax assets and (or) deferred tax liabilities may arise in accordance with Instruction No. 113.

Have all the questions been resolved?

Organizations have the most questions about the correct application of option 2 for profit tax purposes. Let's take a closer look at it.

For accounting purposes, the organization will provide for the attribution of exchange rate differences under contracts in foreign currency to income (expenses) of future periods and write off to income (expenses) from financial activities in the manner and within the time frame established by the head of the organization, but no later than December 31, 2022 (p 1 of Decree No. 159).

For profit tax purposes, such exchange rate differences are reflected on the dates determined in accordance with Art. 174 and 175 of the Tax Code (paragraph 2, subparagraph 1.1, paragraph 1 of Decree No. 504).

Let's turn to the norm sub. 3.20 clause 3 art. 174 Tax Code: the date of reflection of non-operating income in the form of exchange rate differences is determined by the payer on the date of recognition of income in accounting (clause 2, subclause 3.20, clause 3, article 174 of the Tax Code). In sub. 3.26 clause 3 art. 175 of the Tax Code also states that the date of reflection of non-operating expenses is determined by the payer on the date of recognition of expenses in accounting (clause 2, subclause 3.26, clause 3 of Article 175 of the Tax Code).

According to the author, when choosing this option for accounting for exchange rate differences, based on the above Tax Code norms, the recognition of non-operating income and expenses during the tax period should occur as in accounting.

However, the Letter of the Ministry of Taxes and Taxes explains that for profit tax purposes , commercial organizations that have changed the procedure for reflecting exchange rate differences in accordance with Decree No. 159 in accounting include the resulting exchange rate differences in non-operating income (expenses) |*| at each reporting date, i.e. without applying the provisions of Decree No. 159.

* The procedure for accounting for exchange rate differences when determining income tax can be changed once

There is no practice of inspections of this area of accounting by tax authorities and the State Control Committee. Accordingly, there is also no judicial practice.

If an organization decides to use option 2, it would be advisable for it to have a targeted response from the tax authorities.

Let us remind you that payers are guaranteed administrative and judicial protection of their rights and legitimate interests in the manner determined by the Tax Code and other acts of legislation (part one, clause 3, article 21 of the Tax Code).

Part one, clause 3, art. 21 of the Tax Code also applies to payers when calculating and paying taxes, fees (duties) on the basis of clarifications on the application of tax legislation received by them from tax authorities in written or electronic form (part two of clause 3 of Article 21 of the Tax Code).

From the editor

The procedure for reflecting exchange rate differences in tax accounting is also explained in the letter of the Ministry of Taxes of the Republic of Belarus dated 06/03/2020 No. 2-2-10/01179 (see p. 41 of this issue of the magazine). The questions raised by the author of the article are heard in the “Question of the Week” (see p. 7 of this issue of the magazine).