One of the types of non-production payments to employees is financial assistance paid to employees in need of funds upon their application. The list of reasons for payment is not limited; financial assistance can be paid: for an employee’s vacation, for treatment, in connection with a marriage, the birth of a child, etc. The employer himself makes the decision on payment, focusing on the financial capabilities of the company. Is financial assistance included in the calculation of vacation pay and average salary? Can it be considered as income for working employees? The answers are in our material.

What is financial assistance for vacation?

In order to answer the question of whether financial assistance is included in the calculation of vacation pay, you should decide what is meant by financial assistance in the context of vacation payments.

The Presidium of the Supreme Arbitration Court of the Russian Federation, in its resolution dated November 30, 2010 No. VAS-4350/10, states that financial assistance should include employer payments that are not related to the employee’s performance of a labor function and aimed at meeting the social needs of a citizen in a difficult situation. This could be, for example, damage to property and/or health due to an emergency, serious illness, death of a close relative, birth (adoption) of a child, etc.

According to the logic of this resolution, financial assistance—including vacation—should also include payments that:

- are not included in the wage system;

- are not paid on a regular basis;

- not related to labor productivity;

- are not stimulating.

And if this or that payment (it does not matter whether it is one-time or multiple) meets the specified 4 criteria, then it may well be classified as financial assistance.

In order to prove to the inspectors that such payments are precisely material assistance - for vacation or not, it does not matter - the employer company can provide a clear definition of material assistance, as well as the criteria for its provision, in the collective labor agreement or in the regulations on financial assistance. We can take the theses of the Supreme Arbitration Court of the Russian Federation that we have considered as a basis.

See the material “Regulations on the provision of financial assistance to employees” for more details.

Example of vacation pay calculation

Below are two examples of calculating payment for vacation, when financial assistance was paid to a civil servant and a non-state employee.

For employees of non-government structures

Initial data:

During the billing period, the employee received a salary in the amount of 350,000 rubles.

He applied for leave in July for 28 days.

In June he fell ill and was given sick leave for 7 days. Number of days worked this month: 30-7=23 days. Total number of days in a partially worked month: 29.3/30*23=22.46.

In May, in connection with the birth of a child, he was given financial assistance in the amount of 8,000 rubles.

Vacation pay calculation:

In this example, financial assistance assigned and paid in May is not included in the calculation of average daily earnings.

Average earnings = 350,000 / (11 * 29.3 + 22.46) = 1015.20 rubles.

Vacation pay = 28 * 1015.2 = 28425.6 rubles.

For civil servants

Initial data:

The vacation was issued from October 1, 2019 for 14 days. Monthly salary (in rubles):

- 7900 - salary;

- 1690 - additional payment for rank;

- 790 - for length of service;

- 9480 - for special conditions;

- 700 - 1/12 of financial assistance for the previous year;

- 800 - 1/12 of all bonuses for the year before the vacation.

Calculation:

The above types of surcharges are fully included in the calculation.

Amount of vacation pay = (7900+1690+790+9480+700+800) / 29.3 * 14 = 10206.14 rubles.

From this amount, personal income tax should be withheld at 13% and insurance premiums payable at a general rate of 30%.

What is the significance of the fact that payments are classified as financial assistance?

The criteria for classifying certain payments as financial assistance for an employer may play a role:

1. When maintaining tax records.

The fact is that material assistance cannot be included in expenses when calculating the taxable base for income tax (clause 23 of Article 270 of the Tax Code of the Russian Federation). In turn, payments to employees that are not recognized as financial assistance are included in expenses.

Find out how financial assistance affects the amount of income tax in the Ready-made solution from ConsultantPlus by receiving a free trial access.

How financial assistance is subject to insurance premiums, read this article.

See also:

- “Is financial assistance to an employee subject to personal income tax?”;

- “We reflect financial assistance under the simplified tax system “income minus expenses”.

2. When calculating vacation pay.

Financial assistance can be either completely excluded from the formula for calculating vacation pay (clause 3 of the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of Russia dated December 24, 2007 No. 922), or in a number of cases and with certain restrictions included in it (clause 6 Rules for calculating the salary of federal civil servants, approved by Decree of the Government of the Russian Federation dated September 6, 2007 No. 562, hereinafter referred to as the Rules).

But when should financial assistance for vacation (or provided before it) be included in the calculation of vacation pay?

The answer to this question depends on the legal status of the employer's company. The fact is that the legislation of the Russian Federation establishes separate rules for calculating vacation for:

- federal civil servants;

- other employees (including employees of regional and municipal departments).

How to take into account financial assistance for vacation in accounting, as well as correctly calculate personal income tax and insurance premiums, ConsultantPlus experts explained. Get trial access to the system and study the issue in more detail.

Financial assistance in accounting for average earnings

Financial assistance does not apply to payments for the performance of an employee’s work duties. Also, this payment is not regulated by labor legislation. Let's consider the main legal aspects and transactions for financial assistance to employees of the organization.

Postings for calculating financial assistance

To avoid disputes with inspection authorities, it is recommended to establish internal regulations the types of payments equivalent to financial assistance, their amount and the documents that employees must provide in order to receive it.

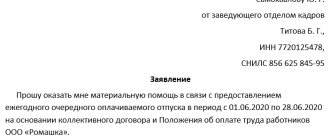

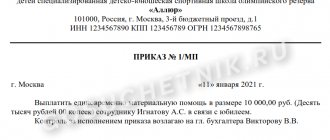

Mat. assistance will be assigned to the employee upon his written request, based on the order of the manager.

The accrual of this payment to employees of the organization should be reflected by posting: Debit 91.2 Credit 73 .

If payment is made to persons who are not employees of the organization, then the posting looks like this: Debit 91.2 Credit 76 .

The company can make the payment from retained earnings. To do this, it is necessary to hold a meeting of the founders and draw up a decision in accordance with which the money will be paid. To reflect the accrual for this situation, you need to make an entry Debit 84 Credit 73 (76).

The process of transferring funds is reflected by posting: Debit 73 (76) Credit 50 (51).

Taxation and insurance contributions for financial assistance

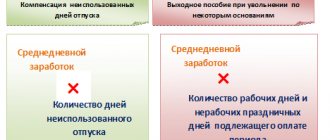

Financial assistance is not subject to personal income tax and insurance contributions:

- If its size does not exceed 4000 rubles.

- Assistance paid in case of personal injury due to a natural disaster

- Assistance paid for damage caused by a terrorist attack

- Assistance was paid due to the death of a close relative or the employee himself

- Assistance in the amount of up to 50,000 rubles. in connection with the birth of a child (this amount is total for both parents, each receiving payment at their place of work)

Amounts of paid financial assistance do not reduce income tax, i.e. They cannot be taken into account in expenses.

One of the most common types of financial assistance is payment in connection with vacation. It is equivalent to payment for time worked, therefore it is subject to personal income tax and contributions in full.

With a simplified taxation system, if mat. assistance is established by the regulations of the organization, it is equivalent to the payment of wages. Therefore, it can be included in expenses (tax object “Income minus expenses”). For payments under the simplified regime, the same rules apply as for the general regime, i.e. cases when swearing assistance is not subject to contributions and personal income tax is the same.

Example of postings for payment of financial assistance to an employee

The organization, at the request of the employee, with the attached documents, made a payment to him in connection with the birth of a child in the amount of 30,000 rubles. The attached documents contain a 2-NDFL certificate from the place of work of the employee’s wife, from which it follows that she received the same assistance in the amount of 40,000 rubles.

Financial assistance is included in average earnings for calculating benefits if it depends on length of service

The company, on the basis of a collective agreement and the procedure for providing financial assistance, paid employees financial assistance before their annual paid vacations.

The amount of financial assistance was determined depending on the length of continuous work in the company. Assistance was not paid if there was a disciplinary sanction at the time of going on leave.

At the same time, contributions were assessed for financial assistance, and it was included in the calculation of average earnings for the calculation of temporary disability benefits.

Based on the results of the on-site inspection, the FSS partially refused to accept for offset the costs of paying benefits in the amount of 2.6 thousand rubles, excluding financial assistance up to 4 thousand rubles per person from the calculation of average earnings. The Fund believes that the legislation provides for the exclusion of such amounts of financial assistance from the base for calculating contributions; therefore, these amounts should not be included in the average earnings for calculating benefits.

The courts of three instances (case No. A14-13250/2021) overturned the fund’s decision, explaining that wages include all amounts paid as remuneration and incentives for work.

According to Article 191 of the Labor Code, the employer has the right to encourage employees who conscientiously perform their job duties - he can express gratitude, give a bonus, award a valuable gift, a certificate of honor, or present him for a title.

Moreover, if the amount of payment in favor of the employee depends on labor success (work experience, position, production results, absence of disciplinary sanctions are taken into account), then these payments are recognized as elements of remuneration.

In the cassation decision (F10-1187/2021 dated April 28.

2021) states: “amounts of financial assistance for vacation, the procedure for providing which depends on the criteria that allow it to be classified as elements of remuneration, are subject to insurance contributions to extra-budgetary funds and, accordingly, are included in the average earnings, on the basis of which benefits for temporary disability are calculated , maternity benefits, monthly child care allowance in full.”

Does the calculation of average earnings for vacation pay include financial assistance, the payment of which is provided for by an employment (collective) agreement or local regulations?

Material assistance of a social nature should not be taken into account when calculating average earnings when calculating vacation pay. Financial assistance, which is part of the wage system, may be included in the calculation of average earnings.

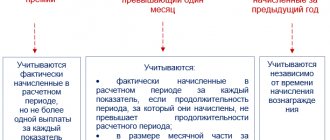

To calculate the average salary, all types of payments provided for by the remuneration system are taken into account, applied by the relevant employer, regardless of the sources of these payments (Part 2 of Article 139 of the Labor Code of the Russian Federation, paragraph 2 of the Regulations on the specifics of the procedure for calculating the average salary, approved by the Decree of the Government of the Russian Federation dated 12/24/2007 No. 922 (hereinafter referred to as Regulation No. 922)).

Payments that are taken into account when calculating average earnings include, in particular (clause 2 of Regulation No. 922):

— allowances and additional payments;

— payments related to working conditions;

— bonuses and rewards provided for by the remuneration system;

- other wage payments provided for by the wage system.

As you can see, the calculation of average earnings includes payments that are remuneration for labor.

Social payments and other payments that do not relate to wages, including financial assistance, are not taken into account when calculating average earnings (clause 3 of Regulation No. 922).

If material assistance is of an incentive nature, is part of the wage system, is included in the wage fund, then it can be taken into account when calculating average earnings (Decision of the Supreme Court of the Russian Federation dated May 10, 2021 No. 307-KG18-918 in case No. A66-13705/ 2021).

Material assistance and calculation of average earnings

The Arbitration Court of the Central District, in a ruling dated December 6, 2021 in case No. A14-22041/2021, figured out which payments to employees should be taken into account when calculating average earnings for maternity benefits, and which should not.

Financial assistance (one-time payments) when calculating leave for federal employees: nuances

Federal civil servants include employees of departments who receive salaries from the federal budget without attracting other budgetary sources of funding (Clause 1, Article 10 of the Law “On the Public Service System” dated May 27, 2003 No. 58-FZ).

Financial assistance is a type of additional payments for a federal civil servant (clause 2 of the Rules). It is isolated from various allowances and incentives and therefore can be considered as unrelated to the remuneration system.

At the same time, in accordance with clause 6 of the Rules, financial assistance is included in the calculation of vacation pay for employees of federal departments. But not completely, but limitedly - like 1/12 of each accrued payment for the billing period before the vacation (12 months).

In this case, only actual payments are taken into account, and not regulatory ones, if any are provided for (letter of the Federal Tax Service of Russia dated November 23, 2007 No. BE-6-16/906). The formula for calculating vacation pay can take into account several payments of financial assistance - before or before the vacation (letter of the Ministry of Health and Social Development of the Russian Federation dated November 15, 2007 No. 3495-17).

The jurisdiction of the Rules introduced by Resolution 562 applies to all positions in federal departments, except for those for which the amount of remuneration is determined based on performance indicators (in the manner established by paragraph 14 of Article 50 of the Law “On the State Civil Service” dated July 27. 2004 No. 79-FZ).

Is financial assistance included in average earnings?

provisions, municipal employees are entitled to a one-time payment for vacation during a calendar year in the amount of two salaries.

The rationale for this position is given below in the materials of the Personnel System.

Situation: Is it possible to provide vacation in advance for the next working year?

“It is possible only if the employer himself does not object. The employer has no obligation to provide such leave.

The employer is obliged to provide employees with leave annually: for each working year (Article 122 of the Labor Code of the Russian Federation). Providing leave earlier than the beginning of the working year for which it is provided is not provided for by labor legislation. The courts also point to this, see, for example, the ruling of the St. Petersburg City Court No. 33-16777/2012.

This rule applies even to those employees who have the right to leave at any convenient time, for example, for employees before maternity leave or after parental leave. They do have the right to claim vacation, but it only applies to unused vacation for the current and earlier years.

Advice: it is not recommended to provide full leave for the next working year.

First reason. If an employee decides to resign without working out the vacation used, the employer will not always have the opportunity to withhold the amount of unused vacation pay.

The second reason. The employer is generally obliged to provide leave annually (Article 122 of the Labor Code of the Russian Federation). By providing full leave in advance, the employer himself finds himself in a situation where he formally cannot fulfill the legal requirement for annual provision, so that the employee actually has the opportunity to rest during the year, or he will have to provide leave in advance again.” *

A professional help system for lawyers in which you will find the answer to any, even the most complex, question. Try it for free

A one-time payment for vacation is a common way to reward company employees for productive work.

This payment is prescribed in the wage regulations along with financial assistance accrued with vacation pay.

In the article we will look at how to receive a lump sum payment for vacation in 2022, how to apply for it (including by resigning employees), its size and recipients.

How is a lump sum payment for vacation taxed?

A one-time payment for vacation is not recognized by law as financial assistance, despite the regularity of its appointment. This is encouragement and stimulation of the employee.

The payment is made together with the calculation of vacation accruals and is subject to personal income tax.

In this regard, employers, as tax agents of their employees, are obliged to withhold the required amount from accruals and pay personal income tax to the budget.

A one-time payment for vacation will not be subject to personal income tax if its amount is less than 4 thousand rubles per employee.

In order to economically justify the need to make a payment, the wage provision must contain complete information about the nature of the accrual:

- its value as a percentage of the salary or in a fixed amount;

- the required length of service to qualify for payment;

- loss of the right to an incentive payment in the event of detection of cases of violation of labor discipline.

A one-time payment for vacation is subject to inclusion in the cost of paying employees and is subject to taxation:

- Personal income tax at a rate of 13%;

- insurance contributions to the Social Insurance Fund, Compulsory Medical Insurance Fund, Pension Fund (from 2022 - to the Federal Tax Service) at a rate of 22%.

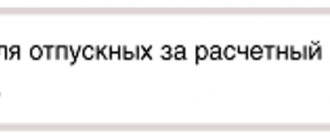

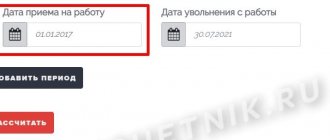

How is a lump sum payment calculated for vacation upon subsequent dismissal?

An employee who has announced his resignation from the company does not lose the right to annual paid leave. He can exercise his right in two ways:

- Rest for the prescribed amount of time and then quit.

- Receive compensation for the vacation that he did not have time to take, and quit his job.

The employer can provide the employee with partial leave and compensate the rest in cash. The conditions for obtaining the right to leave before dismissal are:

- concluding an employment contract when applying for a job;

- termination of an employment contract on personal initiative or in agreement with the employer;

- the end of a fixed-term employment contract when the employer does not want to renew it;

- the employee’s desire to leave work when it is his turn for annual paid leave;

- absence of violations of labor discipline that led to dismissal;

- submitting a resignation letter within the prescribed period.

All money due to the employee, including vacation pay, must be paid within three calendar days before the start of the vacation, and the final payment is made on the last working day before the vacation.

When dismissal is agreed with the employer, the application must be drawn up separately, and the process of dismissal and obtaining the right to rest is agreed with management. In other situations, vacation can be combined with the dismissal procedure. Upon leaving work, the employee will receive:

- vacation pay;

- wage debt for past working periods;

- settlement money for the previous month of performance of official duties;

- compensation amount for vacations that the employee did not take.

Source: https://rebuko.ru/vhodit-li-materialnaya-pomoshh-v-srednij-zarabotok/

Is financial assistance taken into account when calculating vacation in a private company?

In private firms and all those business entities that do not belong to the system of federal departments, material assistance is not taken into account when calculating the amount of vacation pay - like other social payments. This rule applies, in particular, to municipal employees (decision of the Kovylkinsky District Court of the Republic of Mordovia dated March 25, 2015 No. 2-116/2015).

It should be noted that the very fact of using the concept of “material assistance” in local and industry-wide departmental (at levels below federal) standards will mean nothing if the payments associated with this concept do not actually meet the criteria for material assistance. Payments called material assistance in the local act, but not corresponding to them in essence, will be considered labor payments (letter of the Ministry of Finance dated June 26, 2012 No. ED-4-3 / [email protected] ). They will need to be taken into account when calculating vacation.

If in the regulations governing the work of specifically federal departments, the concept of “material assistance” is directly associated with the wage system (and does not fall under clause 3 of the Regulations under Resolution 922), then, nevertheless, such assistance should be taken into account when calculating vacation pay for federal employees necessary according to the Rules approved by Resolution 562.

Thus, paragraph 32 of the Regulations, introduced by order of Rosobrnadzor dated July 17, 2015 No. 1247, establishes that employees of the Federal Service for Supervision in Education and Science are entitled to a one-time provision of financial assistance in the amount of one salary. The connection between financial assistance and labor function is obvious, but its amount is not included in the calculation of vacation pay in full, but only in 1/12 of the part - as prescribed by a higher departmental regulation.

See also “Financial assistance upon dismissal of one’s own free will.”

Is financial assistance income?

Let's consider whether material assistance is income from a tax point of view. In Art. 210 of the Tax Code of the Russian Federation states that when calculating personal income tax, all income received by an individual in a specific tax period is taken into account. But in clauses 8, 8.3 and 8.4 of Art. 217 of the Tax Code of the Russian Federation provides a list of payments that are completely or partially not subject to taxation, among which are some types of one-time financial assistance:

- in connection with the death of an employee or a member of his family;

- victims of a natural disaster or terrorist attack;

- at the birth (or adoption) of a child (within 50 thousand rubles).

For all other types of financial assistance, the non-taxable limit is 4,000 rubles. per year - an amount exceeding this limit is subject to taxation (clause 28 of article 217 of the Tax Code of the Russian Federation).

Is there a regional coefficient for financial assistance? When paying for labor, these coefficients are widely used in the Far North and some other areas. But the coefficients do not apply to financial assistance, since it is not included in wages (Article 129 of the Labor Code of the Russian Federation). This position is adhered to by the courts and some government departments (for example, letter of the Ministry of Labor of the Russian Federation dated July 22, 1999 N 716-7). The amount of financial assistance is determined by local acts and collective agreements.

Results

Financial assistance for vacation is included in the calculation of vacation pay by an employer in the status of a federal department, but not in full, but in the amount of 1/12 of the actual payments. For other employers - it is included only on the condition that the payments, which are called financial assistance by local standards, are actually labor payments (incentives, incentives). Payments in the form of financial assistance that are not related to the labor function in private firms and budgetary organizations that are not related to federal departments are not taken into account when calculating vacation pay.

As a rule, the frequency of payments is not a criterion for classifying them as financial assistance or labor incentives.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

- Law “On State Civil Service” dated July 27, 2004 No. 79-FZ

- Decree of the Government of Russia dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is financial assistance included in the calculation of vacation pay?

Labor lawVacationAnnualVacation pay

When financial assistance is included in the calculation of vacation pay, and when not - important subtleties and examples of accounting for payments

When financial assistance is included in the calculation of vacation pay, and when not - important subtleties and examples of accounting for payments

The time spent on vacation is paid by the employer, and average daily earnings are calculated for each day of rest. The procedure for its calculation is specified in Article 139 of the Labor Code of the Russian Federation and Resolution No. 922.

To correctly calculate the amount of vacation pay, it is necessary to determine the average daily salary, which is calculated based on the amount of income received for the billing period. Should financial assistance be included in total earnings?

Part-time job

The part-time worker has the right to leave. Weekends at additional work are provided in parallel with the rest period at the main place.

Vacation pay is calculated according to the same rules.