Data source - account 71

The balance sheet includes the debt of employees and the employer for accountable amounts from accounting. All necessary information is accumulated on account 71 “Settlements with accountable persons.

The debit of account 71 reflects the amounts issued to employees:

- for various administrative and economic needs: purchase of stationery, payment for repair services for office equipment, purchase of household chemicals and cleaning products for office cleaning, etc.;

- to pay for travel expenses: purchasing tickets, paying for rented accommodation on a business trip, hotel services, etc.;

- for entertainment and other similar expenses.

Entries on the debit of account 71 are made on the basis of supporting documents: cash receipts orders or bank statements, depending on the source of payment: from the cash register in cash or in non-cash form through a bank account to the accountant’s card.

If an employee spent more than was given to him, the debit of account 71 reflects the amount of repayment by the employer of the overexpenditure to the employee.

The credit of account 71 reflects documented expenses of accountable persons. The basis for accounting records is advance reports with attached supporting documents after approval by the manager.

On the credit side, accounts 71 also reflect employee returns of accountable amounts if expenses have not been incurred or are not documented.

Who can be an accountable person

Employees of the organization, when carrying out business transactions and for going on business trips, receive funds in advance from the accounting department for the implementation of these goals. They are the accountable persons for the institution. Such a person must have a number of qualities:

- This must be an individual.

- Such a citizen must officially be in an employment relationship either with an enterprise (legal entity) or with an individual who has the status of an entrepreneur.

- An employment contract in any form must be concluded between such a person and the organization, i.e. the employee can be hired for permanent or temporary work.

Accountable persons are given an advance for future expenses

The list of persons who can be allocated sums of money to carry out their activities must be endorsed by the head of the enterprise. To regulate this process, accountants use the Rules for Conducting Cash Transactions. For example, before receiving a new advance, each responsible person must fulfill the obligation to provide a report on previously issued amounts.

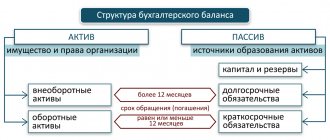

Filling out the balance: two general rules

If on the date of drawing up the balance sheet for account 71 you have non-zero debit and/or credit balances, the “accountable” debt must be reflected in it. In this case, two important rules should be observed:

This means that the debt of reporting entities is reflected in the balance sheet in expanded form: separately for debit and credit - if the relevant data is available in the records.

The second rule for reflecting settlements with accountables in the balance sheet is related to the period of circulation (repayment) of accountable amounts:

Typically, settlements with accountable persons occur multiple times within a calendar year, that is, they are short-term in nature. Therefore, they are reflected in the assets of the balance sheet in section II “Current assets”, and in the liabilities in section V “Current liabilities”.

If, based on the specifics of the company’s work and the specifics of relationships with accountable persons, certain amounts are repaid within a period exceeding 12 months after the reporting date, these amounts should be shown in the balance sheet based on the general rules - as part of long-term assets.

Accounts receivable from persons

All amounts of money that the company operates must be taken into account in accounting. Each line of the balance sheet must be completed by an accountant. If this is not done, then the inspection authorities may count the amounts provided to the accountable person as income of the organization or a targeted loan. And since this is profit, then tax must be paid on it, but since for obvious reasons this has not been done, tax officials have the right to impose penalties on the organization.

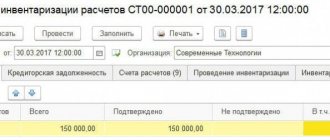

When a receivable is formed in the reporting, a separate document is created to reflect it. If any part of the funds remains unspent, then it must be returned to the enterprise's cash desk. In cases where this does not happen for some reason, the entire amount is deducted from the salary of the reporting person.

No matter how the money is returned to the cash desk, it must be reflected in the enterprise’s balance sheet with a special entry, based on the norms of current legislation.

Accounts receivable in accounting are reflected in the assets section of the enterprise. Despite the fact that this part of the property is in other hands, it is legally the property of the organization. When a report is drawn up, receivables should be arranged according to the dates of their formation. It is posted to account 62 “Settlements with customers”.

Next, you should find out how to reflect the debt on the forwarder's accountable amounts in the balance sheet: as an asset or as a liability. Here it should be understood that an asset is the finances and property that the organization owes, and a liability is what the organization owes. For example, money to pay for vacation is a liability. And the forwarder's debt for accountable amounts is an asset.

The unreturned portion of the money given to the accountable person may be deducted from his salary

Lines in the balance sheet for imprest amounts

Now let's move on to the details - in which balance sheet lines should we reflect the employer's debt to its accountables and the debt of its accountable persons to the company? The following two rules are formulated on the assumption that all settlements with accountable persons in the company are short-term:

How debt is written off

The mechanism for writing off each debt is very specific. All existing cases may differ radically from each other. To write off the balances of accountable amounts, you should do the following manipulations:

- Set the start date for the limitation period. If a person was obliged to return the money and report on July 7, 2015, then July 8 is considered such a date.

- Then count three years from this date. In this case, it is July 8, 2022.

- After which the amount of money is considered uncollectible and is written off in accounting against the reserve for doubtful debts.

Please note that a write-off is not a cancellation. For five years, the debt should be reflected in the balance on account 007.

Reflecting receivables and payables, even for an experienced accountant, sometimes poses a problem. All money in the organization’s circulation must be recorded when preparing accounting records. Therefore, you need to monitor periodically changing reporting rules.

You can learn about settlements with accountable persons from the video:

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

Free consultation with a lawyer Request a call back Still have questions? Call the number and our lawyer will answer all your questions for FREE

Reportable debts in a simplified balance sheet

Debt on accountable amounts must also be reflected in the simplified balance sheet. The same rules and approaches apply as described above for a regular balance.

The only clarification is that in the simplified balance sheet, the lines where accountable debt falls are called slightly differently:

Let us remind you that clause 4 of Art. 6 of the Law of December 6, 2011 No. 402-FZ “On Accounting”. Small enterprises, non-profit organizations, and participants in the Skolkovo project have the right to draw up a simplified balance sheet using the form from Appendix 5 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Debt of accountable entities in the balance sheet - asset or liability

It is possible to issue money on account as before only on the condition that the accountable person has fully repaid the debt on the previous amounts. The employee is also reimbursed for the costs of paying for additional services provided in hotels and included in the bill for... Order - who is the accountable person. how long is it issued?

Info Statement is not required. This is a controversial issue; no consensus has yet been reached. but it’s better to write. In the right corner write to Kompashka LLC and instead of the wording “I ask you to issue” write “it is necessary to issue” Signature of the manager. Help me make accounting entries! 1. a) Db 50 Kt 51 b) Db 26 Kt 512. Db 70 Kt 503. Db 10 Kt 604. ?5. ?6. ?7. Db 51 Kt 908. ?9. Db 10-1 Kt 7110. Db 76 Kt 51 Db 68 Kt 7011. After funds are issued to accountable persons, a debt is formed to employees. The tabular parts Goods, Payment and Other are provided for recording the expenses of the accountable person. Did you take out insurance? Who knows the balance sheet??? Help!!! Please help 131563 121003660. Funds have been debited from the institution's personal account to be received at the cash desk to repay the debt to the accountable person for payment of transportation expenses. 1)D_t 71 Kt 50-460002)Dt 71 Kt 50-156723)Dt 10 Kt 71-210004)Dt 50 Kt 71-109debit turnover=46000+15672= 61672 Loan turnover = 21109 balance = 49000 + 21109-61672 = 8437 credit Please, help with the documents) List of basic regulatory documents regulating the procedure for maintaining accounting records in trade: 1. Federal Law On Accounting dated December 6, 2011 No. 402-FZ, 2. Civil Code of the Russian Federation. AttentionThe division of assets between the founders will be as follows:

- the first one owns 15 million;

- the second - 45 million;

- the third - 90 million.

What does it mean when the size of the contribution and the nominal value of the share are not equal, the video below will tell you: The role of intangible and non-current assets Intangible assets are those long-term investments that do not have a material form, but they work for the company for a long period. Such assets include:

- objects of intellectual property;

- computer programs;

- rationalization ideas;

- business reputation.

Such assets do not play a significant role in the company's capital.

Penalty for errors in reporting

If you show the final balance of payments in the balance sheet (the difference between accounts receivable and accounts payable on account 71), the indicators on line 1230 “Accounts receivable” of the asset and line 1520 “Accounts payable” on the liability side of the balance sheet will be unreliable. And this is fraught with negative consequences: a distortion of any balance sheet indicator by 10% or more is considered a gross violation of accounting rules.

The punishment for this violation is a fine on company officials from 5,000 to 10,000 rubles. (Article 15.11 of the Code of Administrative Offenses of the Russian Federation). If the violation is committed and detected again, the fine will double. And the top officials of the company may be disqualified for a period of 1 to 2 years.

Is a calculator an asset or a liability?

Reserves in the enterprise The reserve for doubtful debts refers to the liabilities of the enterprise. Now let's define the nuances, the reserve for doubtful debts is an asset or a liability in accounting. In this situation, it is appropriate to consider the basic terms. Note that the company's financial assets relate to its own part of the company's liabilities.

Accordingly, accountants reflect material and monetary funds formed to stabilize the liquidity of the enterprise in the passive part of the balance sheet. The formation of a reserve for doubtful debts is determined by special nuances. This amount, by law, is a maximum of 10% of the organization’s revenue. For this reason, specific figures here are calculated based on the determination of profit in the tax or reporting period. Moreover, here in accounting this position is reflected in credit account 63 with correspondence on the account. 91.02 “Other expenses”.

Help distribute household items. transactions on Debit and Credit accounts. I've already done the beginning, but it doesn't work any further. I can only use RAS, but I don’t know your work plan. Reflection in the accounting of expenses for payment of utilities during the period of work on the completion of the facility. Funds are issued to accountable persons in amounts and for periods determined by the head of the institution. Where do such accounts finally come from?))) This is Russia. Nobody knows the Ukrainian chart of accounts. Please help me understand the log of business transactions 1. How did you calculate the VAT on the received fixed assets? The VAT should be equal to 126,000 x 18% = 22,680, provided that the figure 18,000 is not given in your problem statement. Dina explained the rest of the errors to you.

Reflection of taxes and fees

Thus, the credit balance determines the financial obligations of the enterprise, and the debit balance determines advance payments with overpayments

The next problem faced by employees of the economic department is debt to the budget.

An accounting asset or liability is filled in in this situation, we will look into it below.

According to financiers, the same rule applies here as in the case above.

Accordingly, accounts become transferred from the active part to the passive section . Please note that such nuances apply to all settlement transactions of the enterprise.

Transactions for the transfer of budget payments are carried out on account 68 . The loan in this situation reflects the amounts of arrears and actual accruals.

Accordingly, income tax is entered into the accounting department in the form of an entry: D-99, K-68. The personal income tax reflection looks like this: D-70, K-68. But the receipt of money into budget accounts requires a debit entry.

Thus, the credit balance determines the financial obligations of the enterprise, and the debit balance determines advance payments with overpayments.

Correct distribution of balance sheet items among budget payments is the key task of an accountant

Note that particular difficulties arise here when determining VAT accounting. This fee is paid when selling services or products of the enterprise. In addition, value added tax is also reflected in purchase and sale transactions of company property.

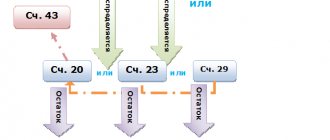

For these reasons, when making an accounting entry, associate account 68 with positions 90–91 . In situations where this contribution is deductible, it is appropriate to refer to accounts 19–20, 23 and 29.

As you can see, knowledge of the nuances of accounting guarantees the absence of misunderstandings with the tax service. Remember, correctly reflected positions on the payment of budget fees here become a key point for the smooth functioning of the company.

Please note that in order to correctly reflect financial income and losses, the purpose of the payment and the balance of the amount in the counterparty’s accounts are important.

The procedure for withholding accountable amounts in the event of their non-return by an employee

Return of unspent advance accountable amounts can be carried out using one of the following methods:

- The employee submits a completed advance report and, based on it, deposits the required amount into the cash desk.

- The employee does not have the opportunity to return the money within the established time frame; he turns to the employer with a written request to make deductions from wages.

- The head of the company issues an order or order to withhold the amount of debt from the salary (provided that the employee has no objections).

- If there are disagreements between the accountable person and the management of the company, the issue is resolved in court.

- The director of the company decided to forgive the debt and recognize it as the employee’s income.

unreturned accountable amounts from your salary ?

An advance not returned on time can be deducted from the employee’s monthly earnings. This procedure is carried out in accordance with the provisions of Art. 137 Labor Code of the Russian Federation. In order for the accounting department to have the authority to withhold funds from the income of an accountable person that have not been returned to them:

- the head of the company, within a month from the end of the deadline for submitting the report and depositing money into the cash register, issues an order on deductions;

- The debtor signs in the order or on a separate form and agrees to make deductions.

If these requirements are not met, a refund is possible only in court.

NOTE! For debts arising due to non-repayment of accountable funds, the usual limitation period applies (3 years), during which the employer can go to court to forcefully collect the employee’s debt to the company.

If the company's management does not initiate the return of funds through deduction from wages or forced return by court decision, then for the debtor the unreturned accountable funds become income. In this situation, the employer acts as a tax agent: he has an obligation to accrue and withhold personal income tax on the total amount of unused and returnable accountable funds. If it is not possible to withhold income tax, the employer notifies the tax authorities in writing. This sequence of actions is specified in the Letter of the Ministry of Finance dated September 24, 2009 No. 03-03-06/1/610.

IMPORTANT! If there is an application from an accountable person to withhold from his earnings the debt on the advance report, it is allowed to send the entire amount of the debt for reimbursement at once.

Rostrud, in a Letter dated September 26, 2012 under No. PG/7156-6-1, indicated that the employer can make a one-time deduction of debt on accountable funds if this action is agreed upon with the employee. The employee is given the right to indicate in the application the percentage of deductions or a fixed monthly amount within which the debt can be repaid from the salary.

IMPORTANT! A sample order for the deduction of unspent accountable amounts from wages from ConsultantPlus is available at the link

When deducting debt from an employee’s monthly income based on the manager’s order, it is necessary to be guided by the maximum restrictions from Art. 138 Labor Code of the Russian Federation.

The total amount of all types of deductions from accrued wages cannot exceed 20% of income; in some situations, the limit may be increased to 50 or 70%.

When initiating legal proceedings between the accountable person and the employer, the algorithm of actions is as follows:

- before the expiration of the limitation period, the company files a claim with the judicial authorities;

- at the end of the one-month period allotted for resolving the issue through voluntary fulfillment of obligations or issuing a management order on deductions, the accounting department must show in the accounts the additional accrual of insurance premiums for the amount of debt on accountable funds;

- upon entry into force of a court decision in favor of the employer, income tax is withheld from the amount of debt.

NOTE! Debt forgiveness is formalized by order of the enterprise.

To forgive debt on accountable funds, the head of the company issues an order. An alternative option: the debtor makes a request to cancel the debt in the form of an application addressed to the director of the enterprise, the director, with his resolution on the application, records the decision to forgive the debt. The date of writing off the debtor's obligations will coincide with the date of the resolution or the day of registration of the order. Personal income tax accruals must be made on this date; the tax is transferred to the budget on the day the amounts are actually withheld or on the next day.

If there is a debt on accountable funds for a dismissed employee after the end of the limitation period, the organization has the right to transfer the amount of the debt to the category of bad debts. After this, you can write off the costs according to the rules of clause 14.3 of PBU 10/99.

Account 60 active or passive Payments to suppliers and contractors

60 accounting account is used to reflect data on amounts due and paid to suppliers or contractors.

This is a universal and necessary account, regardless of the type of activity the enterprise carries out. One way or another, any legal entity has financial relations with suppliers or contractors.

Let's consider the procedure for accounting for calculations of this type, and also find out: is account 60 active or passive?

Who are the suppliers and contractors?

As already mentioned, no company can exist without interaction with other economic entities. Who are called suppliers? These are those enterprises that supply goods and materials and provide various services (including housing and communal services).

Contractors include only companies providing repair and construction services. In both cases, these are legal entities (sometimes also individuals) who supply the enterprise. In this connection, commodity-money relations arise. One organization becomes a debtor to another.

To record settlements with suppliers, use the Accounts with Suppliers and Contractors account.

Account 60 in accounting: purpose

This account is used by everyone and everything: almost every accountant has come across it in one way or another. There are usually no difficulties in preparing transactions for settlements with suppliers and contractors. To determine the amounts in the correct part of the account (debit or credit), you need to know exactly: is account 60 active or passive? A decision should be made after consistent reflection.