The essence of the WIP write-off operation

Work in progress is a set of expenses that have already been sent to the production process, but the result of the process, for example, finished products, has not yet been received (clause 63 of the order of the Ministry of Finance of Russia “On approval of the Regulations on accounting…” dated July 29, 1998 No. 34n ).

In the normal course of the process, the work in progress recorded at the end of the reporting period then, in the usual manner, forms the cost of products manufactured with its participation. However, in this process, deviations from its usual course may arise, and then the accountant is faced with the question of what to do with the “stuck” WIP?

Write-off of work in progress that did not produce products

In commercial practice, there are quite often cases when an enterprise decides to terminate a production project, for example, to stop producing some type of product if it is not in demand by the market and the production is assessed as unprofitable.

The specifics of the production cycle may be such that at the time of implementation of the decision to discontinue production, work in progress is available. This situation will have its own nuances for accounting and tax accounting purposes:

- Accounting. The fundamental aspect will be the provisions of PBU 10/99. It is obvious that the costs of discontinuing the production of a product and writing off work in progress for it will not bring clear economic benefits to the enterprise in the future. Therefore, they should be included in other expenses for accounting purposes. That is, the write-off of work in progress in this case will be done by posting Dt 91.2 “Other expenses” Kt 20 (23, 25, 26).

IMPORTANT! If the release of a discontinued product can be separated into a separate segment (operational or functional), then to reflect the information in the financial statements, the provisions of PBU 16/02 “On Discontinued Operations” should be applied, including with regard to the write-off of work in progress.

- Tax accounting.

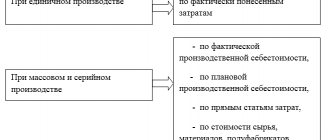

- For the purposes of calculating income tax, work in progress that does not produce production is written off as non-operating expenses in the amount of direct costs (Clause 11, Article 265 of the Tax Code of the Russian Federation). At the same time, indirect costs are not distributed to the share of such work in progress, but are included in full in the expenses of the current period (clause 2 of Article 318 of the Tax Code of the Russian Federation). This is the difference between the accounting and tax accounting procedures, since in accounting it is possible to write off all expenses associated with work in progress immediately to the expense side.

To learn how to distribute expenses, read the material “How to divide income tax expenses into direct and indirect?”

- There is a controversial point regarding VAT accepted for deduction on expenses incurred on work in progress that did not produce products. According to the Ministry of Finance, set out in letter No. 03-03-06/1/163 dated March 29, 2012, input VAT on work in progress that did not produce products should be restored in tax accounting. At the same time, paragraph 3 of Art. 170 of the Tax Code of the Russian Federation contains a closed list of situations requiring the restoration of input VAT, and the case of writing off work in progress is not mentioned there. On this basis, there are judicial precedents with the conclusion that it is not necessary to restore input VAT when writing off work in progress as non-operating expenses. If, however, input VAT is restored, then the restored amounts are included in other expenses.

Find out more about VAT restoration in the material “The nuances of VAT restoration and what transactions are used.”

IMPORTANT! As a result of the fact that in accounting, indirect costs are included in the written-off work in progress that did not produce products, and in tax accounting, indirect costs are included in the expenses of the current period, deferred tax liabilities (DTL) can be formed.

real advice on accounting

Library of the Online School “Become a Chief Accountant”!

03/31/2020

Question: How to write off the costs of unclaimed unfinished construction (design and survey work). Taxes and accounting.

Answer: In accordance with the Concept of Accounting in a Market Economy of Russia When generating information in accounting, one should adhere to a certain prudence in judgments and estimates that take place under conditions of uncertainty, so that assets and income are not overstated , and liabilities and expenses are not underestimated. At the same time, the creation of hidden reserves, deliberate understatement of assets or income and deliberate overstatement of liabilities or expenses are not allowed (clause 6.3.4).

The elements of information generated in accounting about the financial position of an organization , which are reflected in the balance sheet, are assets , liabilities and capital (7.1).

Assets are considered to be business assets

- control over which the organization has acquired as a result of fait accompli of its economic activities and

- which should bring it economic benefits in the future (clause 7.2.).

Future economic benefits are the potential of assets to directly or indirectly contribute to the flow of cash into the organization . An asset is considered to provide future economic benefits to the entity when it can be:

a) used separately or in combination with another asset in the process of production of products, works, services intended for sale; b) exchanged for another asset; c) used to pay off an obligation; d) distributed among the owners of the organization (clause 7.2.1.).

When accepting property for accounting as an asset of a certain type, one should be guided by the criteria (conditions) established by the relevant regulatory legal acts on accounting (Letter of the Ministry of Finance of the Russian Federation dated November 2, 2011 N 07-02-10/98).

From the Organization’s question it follows that the cost of an uncertified construction project consists of the costs of design and survey work, which will never be used in the interests of the Organization.

Consequently, the specified construction in progress does not correspond to the concept of an asset in accounting. Because it will not bring future economic benefits to the Organization.

The specified object is subject to write-off from the balance sheet of the Organization.

In accordance with clause 11 of the Accounting Regulations “Expenses of the organization” PBU 10/99, approved. By order of the Ministry of Finance of the Russian Federation dated May 6, 1999. No. 33n other expenses are expenses associated with the sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, and products.

Thus, the cost of an unfinished construction project accounted for as an investment in non-current assets is included in other expenses

Based on paragraphs 2, 16, 18 of PBU 10/99, the cost of a liquidated object of unfinished construction is recognized as an expense on the date of its disposal - the date of drawing up the act of writing off this object .

In accounting, the following entries are made:

Dt. 91.02 – Kt. 08 . – the cost of an unfinished construction project is written off.

The Organization does not generate income from this business transaction.

Documentation of write-off of an unfinished construction project.

To write off an unfinished construction project, an order from the manager must be drawn up, in which it is necessary

- indicate the reason for making such a decision;

- appoint a commission to complete the documentation.

The commission must issue an act on the write-off of an unfinished construction project. The act is drawn up in any form, taking into account the requirements for primary documents (Article 9 of Federal Law No. 402-FZ “On Accounting”. We note that the form of the act must be approved by order of the manager as part of the appendices to the accounting policy.

VAT

We note the ambiguity of the issue of the need to restore VAT when writing off an unfinished construction project.

According to the opinion of the Ministry of Finance of Russia, set out in the Letter dated 02/07/2008. No. 03-03-06/1/86, the liquidated object of unfinished construction is not used in activities subject to VAT. In this regard , VAT accepted for deduction upon the acquisition of an unfinished construction project must be restored in the tax period when the liquidation takes place.

However, the courts do not share this position , believing that the list of grounds for VAT restoration specified in paragraph 3 of Art. 170 of the Tax Code of the Russian Federation is closed and does not contain such a basis as the liquidation of an unfinished construction project. (Resolution of the Nineteenth Arbitration Court of Appeal dated February 12, 2018 No. 19AP-7783/2017 in case No. A14-2518/2017, resolution of the Federal Antimonopoly Service of the Moscow Region dated April 1, 2014 No. F05-2300/2014, North Caucasus District dated April 23, 2013. in case No. A32-7901/2012). At the same time, we draw the Organization’s attention to the presence of contrary judicial practice (Resolution of the Fourth Arbitration Court of Appeal dated February 1, 2017 in case No. A10-3305/2016).

Thus, the situation with the restoration of VAT is controversial and depends on the specific circumstances of the case.

Tax risks can be significant.

You can read more about VAT restoration in our article: Liquidation of an unfinished construction project. Is VAT reinstated?

Income tax

In accordance with Art. 252 of the Tax Code of the Russian Federation, expenses are recognized as justified and documented expenses incurred (incurred) by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were incurred, and (or) documents indirectly confirming the expenses incurred. expenses (including customs declaration, business trip order, travel documents, report on work performed in accordance with the contract). Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

In accordance with paragraphs. 8 clause 1 art. 265 of the Tax Code of the Russian Federation, non-operating expenses include expenses for the liquidation of fixed assets being decommissioned, as well as expenses for the liquidation of unfinished construction projects and other property whose installation has not been completed (expenses for dismantling, disassembling, removal of disassembled property).

Based on this norm, the Ministry of Finance of the Russian Federation believes that the cost of directly unfinished construction during its liquidation is not taken into account when forming the tax base for corporate income tax. (Letter of the Ministry of Finance of Russia dated March 14, 2019 N 03-03-06/2/16615).

We note that judicial practice on this issue is ambiguous .

From the Determination of the Supreme Arbitration Court of the Russian Federation dated January 10, 2012. No. VAS-16900/11 in case No. A56-60650/2010 it follows that the Supreme Arbitration Court of the Russian Federation supported the tax authority, which excluded from the calculation of the tax base for income tax the costs of creating a liquidated object of unfinished capital construction.

In the Resolution dated September 17, 2018. No. 13AP-21389/2018 in case No. A56-9767/2018 The Thirteenth Arbitration Court of Appeal, referring to the said Determination of the Supreme Arbitration Court of the Russian Federation, also recognized the position of the tax authority as justified.

However, the Arbitration Court of the North-Western District, by Resolution dated January 22, 2019. No. F07-16106/2018 in case No. A56-9767/2018 canceled the said judicial act. And by Decision No. 307-ES19-5807 dated May 16, 2019, the Supreme Court of the Russian Federation supported it.

From the above it follows that the cost of unfinished construction projects, for which there are documents confirming the costs incurred for their construction, can reduce the tax base for income tax, but with the presence of a tax risk.

In a tax dispute, the outcome of the case will depend on the quality of the documents confirming the costs, as well as on the court’s position on this issue.

You can read more about recognizing the value of unfinished construction when calculating the tax base for income tax in our article: Liquidation of an unfinished construction project. Income tax risks.

- If you have any questions, write to our address: This email address is being protected from spambots. Javascript must be enabled in your browser to view the address.

- Thank you for your cooperation!

- We will be grateful for your recommendation to your colleagues of our Online School “Become a Chief Accountant!”

- Our mission is mentoring aspiring accountants.

Writing off internal defects

An internal defect is recognized as one identified within the enterprise before the sale of defective products. Most of such defects are detected at the time of exit from production (since there is usually quality control), i.e. at the time of the usual write-off of work in progress for the cost of finished products.

Marriage can be:

- correctable - then the costs of correcting it can be calculated on cost accounts (for example, according to Dt 20) and then directed to the cost of finished products (Dt 40 (43) Kt 20);

- irreparable - then losses from defects are calculated on account 28 “Defects in production” and the main point in the calculation is the write-off of work in progress for defects: Dt 28 Kt 20 (23) - the costs of creating products (semi-finished products) recognized as irreparable defects are written off.

It is noteworthy to write off the final calculation result from account 28 (the account should not have a balance at the end of the period).

The process of calculating the result of a defect is as follows (schematically, excluding VAT):

- Dt 10 Kt 28 - returnable materials from defective products are capitalized.

- Dt 76 Kt 28 - reflects the debt of those responsible for the marriage (persons can be both individuals (employees) and legal entities (suppliers of low-quality raw materials, for example)).

As a result, at the end of the period there remains a balance (usually a debit) on account 28, showing the actual loss from the defect. And this balance is subject to write-off Dt 20 (23) Kt 28, i.e. WIP increases again, and then the cost of finished products.

Accounting for unfinished construction projects

Unfinished construction is a construction project that has not been put into operation and for some reason has been “frozen” for some period of time.

Unfinished construction leads to serious economic losses, because the invested resources do not provide a return, equipment becomes physically and morally old, and technology also becomes obsolete. In addition, unfinished construction requires large costs for its maintenance and is determined by the volume of capital investments that are spent for a certain period of time, and the amount is usually considerable. Therefore, from an economic point of view, it is advisable to promptly liquidate the so-called “unfinished buildings”, or, even better, to sell them.

At the same time, a completely reasonable desire arises - to write off the funds invested in the construction of the facility as expenses, thereby saving on a single tax for a “simplified” person with the tax regime “income minus expenses” can be very significant. However, at first glance, clause 1 of Art. 346.16 of the Tax Code of the Russian Federation will not allow this, and the tax authorities quite often take a position on this issue that is not in favor of taxpayers who apply the simplified tax system with the object of taxation “income minus expenses”.

In addition, the expenses associated with the dismantling of such an object cannot be included in the expenses of the “simplified” ones, even if the dismantling work is economically feasible, because the list of expenses named in paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation is of a closed nature and payment for the dismantling of such an object is not indicated in this list. But the cost of materials received during the liquidation of an unfinished construction project is taken into account as part of non-operating income, including when applying the simplified tax system with the object of taxation “income minus expenses”. This position is confirmed in the letter of the Ministry of Finance of Russia dated April 19, 2010 No. 03-03-06/1/277.

As for accounting, in accordance with clause 11 of PBU 10/99, expenses associated with the liquidation of an unfinished construction project, including the cost of dismantling work, are taken into account as part of other expenses.

IMPORTANT IN WORK

Ownership of a real estate property that has not been completed by construction is subject to registration only if it is not the subject of a valid construction contract, and, if necessary, the owner can make a transaction with this property.

Accounting for an unfinished construction project

Thus, based on the instructions for using the Chart of Accounts, capital construction costs are taken into account on balance sheet account 08 “Investments in non-current assets”, subaccount “Construction of fixed assets”. Expenses in the form of the book value of an asset when it is written off in the event of liquidation or sale are reflected in the debit of account 91 “Other income and expenses”, subaccount “Other expenses” in correspondence with account 08, subaccount “Construction of fixed assets”. Expenses in the form of the cost of dismantling work are also reflected in the debit of account 91 “Other expenses” in correspondence with account 60 “Settlements with suppliers and contractors” if the dismantling work was performed by a third party; if these works were performed on their own, accounts 70 “Calculations with personnel for wages”, 69 “Calculations for social insurance and security” correspond with the corresponding sub-accounts for types of taxes and fees. If, after the dismantling of the NZS facility, the organization has capitalized materials for their subsequent sale, then in accordance with paragraphs. 2, 5 and 9 PBU 5/01, as well as in accordance with clause 7 of PBU 9/99, such materials at the current market value determined on the date of their acceptance for accounting are reflected in the debit of account 10 “Materials” in correspondence with the credit of account 91 , subaccount “Other income”.

GOOD TO KNOW

Costs for the construction of fixed assets and costs for the acquisition and completion of unfinished construction projects are included in expenses that reduce the tax base for the simplified tax.

Example 1.

LLC “Standard” applies the simplified tax system with the object of taxation “income minus expenses”. The organization carries out wholesale trade in industrial goods and plans to open retail trade as well. For this purpose, in February 2010, an agreement was concluded with the construction organization Vostok LLC for the construction of a building for a store.

Due to a lack of working capital, the management of Standard LLC made a decision in January 2015 to mothball the facility. About this, the management of the organization issued a corresponding order, which determined the deadlines for preparing documentation for the transfer of the NZS facility to conservation and, in connection with this, conducting an inventory of the unfinished facility.

As of December 31, 2014, the carrying amount of construction in progress was RUB 24,720,000.

To determine the condition of the construction site, a commission was created, which included both representatives of the customer and representatives of the contractor. Within a month from the date of the decision, the customer and the contractor signed an act of suspension of construction. To prepare this document, the unified form No. KS-17 was used, but it was possible to develop your own form based on it.

Next, Standard LLC determined a list of works and costs, on the basis of which an estimate for the conservation and protection of the construction site was drawn up. In particular, the corresponding expenses were identified and then paid and certain actions were performed.

Firstly , Standard LLC entered into an agreement with the design organization Vityaz LLC for the preparation of documentation necessary for the conservation of an unfinished construction project. For the services provided by this organization, 35,400 rubles were paid, including VAT - 5,400 rubles.

Secondly , an additional agreement was concluded with the construction contractor, according to which this organization carried out work on the conservation of the store’s ground construction. The contractor's costs for these works amounted to 302,080 rubles, including VAT - 46,080 rubles. In addition, the contractor was paid RUB 200,000. as a penalty for violating the terms of a construction contract.

Thirdly , Standard LLC spends 50,000 rubles monthly on the maintenance of the mothballed facility, and 35,000 rubles were spent monthly on lighting and other utilities provided by Omega LLC, including VAT - 5339 rub. The conservation period for the store's NZS was 6 months (January – June 2015).

Let us note at the same time that the organization’s accounting department took into account the costs of preserving the NZS store separately. In connection with this working chart of accounts of Standard LLC, the following sub-accounts have been established, opened to account 08 “Investments in non-current assets”:

- 08.3 – “Construction of a fixed asset”;

- 08.8 – “Costs for conservation of the store’s NZS.”

Thus, expenses generated during the period of store construction (February 2010 - December 2014) were recorded as the debit of account 08.3 in correspondence with cost accounts 60 “Settlements with suppliers and contractors”, 70 “Settlements with personnel for wages", 69 "Calculations for social insurance and security", etc.

As a result, as of December 31, 2014, the cost of the store’s original equipment in the estimate of actual costs amounted to RUB 24,720,000, which was reflected in the debit point. accounts 08.3.

All expenses for the unfinished construction of the store were promptly paid by Standard LLC.

In January 2015, after the organization made a decision to transfer the store's equipment to conservation, the following accounting entries were made:

| Debit | Credit | Sum | Operation |

| 08.8 | 60 | 35 400 | For the preparation of documentation for the conservation of the facility, carried out by Vityaz LLC |

| 08.8 | 60 | 302 080 | For the work carried out on the preservation of the store's NZS, performed by Vostok LLC |

| 08.8 | 60 | 200 000 | Penalty for violation of the terms of the contract with Vostok LLC |

| 08.8 | 70, 69 | 300 000 | Salaries of guards accrued for the entire period of conservation, taking into account the unified social tax (insurance contributions) |

| 08.8 | 60 | 210 000 | For lighting and other utilities accrued by Omega LLC for the entire period of conservation of the facility |

| 60 | 51 | 35 400 | Paid |

| 60 | 51 | 302 080 | Paid for the work of Vostok LLC |

| 60 | 51 | 200 000 | Penalty paid to Vostok LLC |

| 70, 68, 69 | 50, 57 | 300 000 | The guards' wages were paid and personal income tax and unified social tax (insurance contributions) were paid in accordance with accrued and paid wages |

| 60 | 51 | 210 000 | Utilities provided have been paid for |

As a result, the total amount of expenses related to the conservation of the facility, paid for 6 months of 2015, amounted to 1,047,480 rubles.

GOOD TO KNOW

VAT received from performing organizations is taken into account as part of the cost of work performed, without allocating it to account 19 “VAT on acquired values”, since Standard LLC is not a VAT payer, and therefore cannot claim it for deduction .

In accounting, conservation expenses were included in the financial results by writing them off to balance sheet account 91.2 “Other expenses” and the following entry was given:

Debit 91.2 Credit 08.8 – 1,047,480 rub. according to the working chart of accounts used in Standard LLC.

After six months of the NZS facility being mothballed, the organization’s management decided to liquidate or sell this facility, because the monthly costs of maintaining the unfinished facility alone amounted to 510,000 rubles. (300,000 rubles + 210,000 rubles) is not economically feasible to continue to have.

However, the completion of the conservation of the NZS facility was preceded by its re-preservation, for which the corresponding orders were issued by the head of the organization, and a commission was created for the re-conservation of the designated facility. These documents indicated the grounds for reactivation, the list and characteristics of the property to be reactivated, the beginning and end of the reactivation period.

The commission included representatives of the customer - Standard LLC, the contractor - Vostok LLC, the design organization - Omega LLC and other interested parties. The condition of the reactivated object was assessed taking into account the data recorded earlier in the act drawn up according to f. No. KS-17. It was decided not to involve third-party organizations to carry out the re-opening work.

Next, the management of Standard LLC considered two options, namely: liquidation and sale of the NZS facility. At the same time, it was decided to make the appropriate calculations to select one of them, acceptable for the organization - the owner of the NZS.

GOOD TO KNOW

Expenses for the liquidation of unfinished construction projects and other property, the installation of which has not been completed (costs for dismantling, dismantling, removal of disassembled property), protection of subsoil and other similar work are taken into account on the date of presentation to the taxpayer of documents on the completion of dismantling work (clause 3, clause 7, art. 265 of the Tax Code of the Russian Federation), unless, of course, dismantling is carried out by third-party contractors.

Option 1. Liquidation of the NZS facility.

In this case, dismantling work is required, which can be performed by the contracting construction organization Vostok LLC. The cost of such work under the terms of the contract with this organization can be 950,000 rubles, including VAT - 144,915 rubles. In accounting, these expenses can be debited from account 91.2 “Other expenses” in correspondence with account 60 “Settlements with suppliers and contractors”, according to the acceptance certificate for work performed.

The cost of construction work recorded on account 08.3 in accounting if option 1 (liquidation) is selected can also be written off:

Debit 91.2 Credit 08.3 – 24,720,000 rub. in accordance with the act of liquidation of an unfinished construction site.

In addition, in the event of liquidation of the NZS object during its dismantling, materials will be received for a total amount of 2,800,000 rubles, which will be capitalized according to the receipt order and reflected on balance sheet account 10 “Materials” in correspondence with account 91.1 “Other income” according to the current market value determined on the date of their acceptance for accounting in accordance with paragraphs. 2, 5, 9 PBU 5/01, instructions for using the Chart of Accounts. In this case, in accounting we will see an increase in profit.

And now regarding the tax accounting of Standard LLC in the event that the choice is made according to option 1 (liquidation of the NZS facility). Due to the fact that the organization applies the simplified tax system “income minus expenses”, both during conservation and during liquidation of a given object, the picture is completely different than in accounting. This is due to the fact that all organizations using the simplified tax system reduce the income received for expenses strictly specified in paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation, which does not specify not only the costs of conservation and dismantling, but also the costs in the form of the cost of a liquidated construction project.

Consequently, the indicated expenses cannot be taken into account for taxation purposes under the simplified tax system.

NZS can be taken into account as part of non-operating income at market value in accordance with clause 1 of Art. 346.15, paragraph 13 of Art. 250, paragraph 4, art. 346.18 Tax Code of the Russian Federation.

As we can see, the option of liquidating the construction work with the posting of materials obtained as a result of dismantling is not at all attractive to Standard LLC.

As a result, the management of Standard LLC in July 2015 finally made the final decision - to sell the NZS store facility, because by this time the organization had completely lost the ability to finance this construction, and at the same time the desire to open a retail trade had sunk into oblivion .

GOOD TO KNOW

Investment assets include, in particular, objects of unfinished construction, which will subsequently be accepted for accounting by the borrower and (or) customer (investor, buyer) as fixed assets.

Option 2. Sale of the NZS facility.

In connection with the decision to sell the property, Standard LLC officially registered ownership of the property being sold in the same month and paid a state fee of 22,000 rubles. (Clause 22, Clause 1, Article 333.33 of the Tax Code of the Russian Federation), because such an object can be the subject of a purchase and sale agreement only after state registration of ownership of it with the owner of this object. This rule follows from Art. 219, paragraph 2 of Art. 218, paragraph 1, art. 549 of the Civil Code of the Russian Federation. To register the right, the following documents were submitted to the justice department: certificate of ownership of the land plot allocated for construction; permission to construct a separate building; project documentation and documents containing a description of the unfinished construction project (clauses 2, 3, 4 of Article 25 of the Federal Law of July 21, 1997 No. 122-FZ “On state registration of rights to real estate and transactions with it”). And then, after the transfer of ownership to the new owner on the basis of a purchase and sale agreement, the ownership of this object by the new owner must be legalized through state registration. In this case, the state duty is paid by the buyer (letter of the Ministry of Finance of Russia dated October 17, 2011 No. 03-05-05-03/35).

GOOD TO KNOW

The specifics of registering ownership of an unfinished construction project are established by the Methodological Recommendations on the procedure for state registration of rights to created, created, reconstructed real estate objects, approved by Order of the Federal Registration Service dated 06/08/2007 No. 113.