Business entities are required to maintain control over assets listed on their balance sheet. There are various forms of property of organizations and enterprises - in particular, the classification provides for the placement into a separate category of objects of labor involved in production processes without loss of their natural form. Such objects have a certain service life, the duration of which is determined by gradual wear and tear, which reduces their actual material value. When a condition occurs that precludes further use, fixed assets are written off or disposed of - accounting entries are made in accordance with the requirements of the Tax Code and are the basis for exclusion from the current balance sheet.

General rules

The limited operational resource, characteristic of assets in the category under consideration, determines the onset of a moment at which the original functionality cannot actually be implemented, either partially or completely. Keeping fixed assets on the balance sheet in such a situation is impractical and unprofitable, and also contradicts legal requirements, therefore, in the case of an inventory, penalties may be applied to the responsible entities.

To put it briefly, accounting for the disposal of fixed assets is the documentation of a write-off indicating the reason, which may include:

- Wear and tear of the property fund (both physical and moral).

- Destruction resulting from extraordinary circumstances.

- Damage to property - both intentional and accidental.

- Theft or shortage identified during the audit.

- Sale for the purpose of generating income, as well as transfer as part of an exchange or gift.

- Execution of an act of transfer to a deposit forming the authorized capital of another organization.

- Expiration of the period allotted for the redemption of the leased object.

This list is not exhaustive, so examples of reasons for disposal of fixed assets for accounting may differ. The key reason is the lack of possibility of further operation, confirmed by the result of the next inventory or a separate document. It is worth noting that local movement between divisions of one enterprise does not qualify for the status in question and does not require the preparation of documents of this kind.

Based on the provisions established within the Chart of Accounts, as well as in the accompanying Instructions for Use, opening a subaccount to account 01 is permitted regardless of the factor that is the root cause. This recommendation is based on Order No. 94n of 2000 of the Ministry of Finance of the Russian Federation.

Expenses associated with the disposal of fixed assets from the organization are taken into account and reflected in the following accounting entries. As part of the review, let us consider, as an example, subaccount 01/B, to which the primary cost of fixed assets, previously listed in relation to the object in account 01, is written off. Thus, posting D 01/B - K 01 is generated.

The next stage is the write-off of the depreciation accumulated over the period of operation, the value of which is determined at the time the asset is excluded. The standard formulation is used here: Debit 02 - Credit 01/B, while the result of reflection is the resulting residual value. The value determined on the main or subaccount is subject to further liquidation from the balance sheet through a procedure during which the entire amount is written off.

How is the disposal of fixed assets carried out in accounting?

The procedure governing the disposal of fixed assets is reflected in Part 5 of PBU 6/01. In accordance with this norm, disposal may be due to the following reasons:

- implementation;

- wear and tear: moral or physical;

- liquidation: due to an accident, natural disaster, etc.;

- other reasons given in clause 29 of PBU 6/01.

Any disposal of fixed assets must be supported by the following documents:

- OS-4 (excluding cars);

- OS-4a (for cars);

- OS-4b (for the OS group, excluding motor transport).

In accordance with the order of the Ministry of Finance of the Russian Federation “On approval of the Chart of Accounts and Instructions for its application” dated October 31, 2000 No. 94n, a sub-account “Disposal of fixed assets” is opened to reflect operations on the disposal of fixed assets to account 01 “Fixed Assets”. This allows you to form the residual value of the disposed fixed asset in a separate subaccount, and then reflect it in expenses on account 91 “Other income and expenses.”

For documents that need to be used to justify the disposal of fixed assets, see the material “Documentation of write-off of fixed assets”.

Regardless of the reason for disposal of fixed assets, the postings (entries for writing off the original cost and depreciation) will be similar:

- Dt 01 “Disposal” Kt 01 “OS” - the initial cost of fixed assets was transferred to the disposal account.

- Dt 02 Kt 01 “Disposal” - depreciation is written off.

In this case, the residual value formed on account 01 “Disposal” will be written off to the debit of accounts corresponding to the nature of the transactions performed, for example:

- sales, liquidation, depreciation: Dt 91.2 Kt 01 “Disposal”;

- contribution to the capital: Dt 76 Kt 01 “Disposal”;

- disposal of an asset due to a shortage: Dt 94 Kt 01 “Disposal”.

Example 1

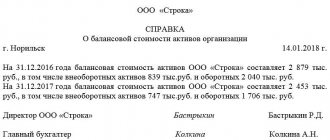

Auto-park LLC sold the car in August. The cost of sales in accordance with the agreement amounted to 472,000 rubles. (including VAT RUB 72,000). The initial cost of the car is 700,000 rubles, the amount of accrued depreciation over the period of operation is 130,000 rubles. The organization records incoming fixed assets on account 01.01; for retired fixed assets, subaccount 01.02 is used.

In August, Auto-park LLC will reflect in its accounting records:

Dt 62 Kt 91.01 - 472,000 rub. - sale of a car.

Dt 91.02 Kt 68.02 — 72,000 rub. — VAT is charged on sales.

Dt 01.02 Kt 01.01 — 700,000 rub. — write-off of the original cost.

Dt 02 Kt 01.02 - 130,000 rub. — write-off of depreciation.

Dt 91.02 Kt 01.02 — 570,000 rub. — the residual value is included in expenses.

For more information about postings reflecting fixed assets accounting, see the article “Postings Dt 01 and Kt 01, 08 (nuances)”.

As can be seen from the example, income and expenses associated with the disposal of fixed assets are taken into account during the period of implementation of these actions (clause 31 of PBU 6/01), which cannot be said about the tax accounting of such transactions.

What documents are used to document the disposal of fixed assets upon sale?

One of the options for getting rid of unnecessary assets, relevant in situations where their condition still allows for use for their intended purpose, is sale. As a result, other income is formed, the basis for which is the conclusion of a purchase and sale transaction, as well as expenses, including both the residual value and the costs associated with the transaction. This approach is supported by a number of provisions of the Accounting Plan (clauses 31-6/01, 7-9/99, 11-10/99), and the previously mentioned ministerial order.

Based on this, documentation of accounting entries upon disposal of fixed assets at an enterprise includes:

| Action | Debit | Credit |

| Reflection of sales income | 62, “Settlements with buyers and customers” | 91, "Other" |

| Tax accrual according to VAT subaccounts (under the general taxation system) | 91 | 68, “Tax calculations” |

| Write-off of the residual cost of sold operating systems | 91, s/s “Other” | 01/B |

| Registration of sales expenses | Same | 10 “Materials”, 60 “Mutual settlements”, etc. |

What are the features of tax accounting for the disposal of fixed assets?

You should pay attention to the accounting procedure for implemented operating systems established by Chapter. 25 Tax Code of the Russian Federation. So, in accordance with paragraph 3 of Art. 268 of the Tax Code of the Russian Federation, a loss arising when the residual value of fixed assets exceeds the amount of proceeds from the sale of fixed assets should be accepted for the purpose of calculating income tax in equal shares over the entire remaining useful life. This feature of accounting for losses for income tax purposes creates temporary differences, which are reflected by applying PBU 18/02.

Find out how to apply PBU 18/02 when temporary differences arise in the ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Example 2

The initial conditions are from example 1. At the same time, the remaining useful life of the OS is 37 months.

Let's determine the amount of loss 570,000 - (472,000 - 72,000) = 170,000 rubles.

The loss that Auto-park LLC can evenly take into account monthly for the purpose of calculating income tax is 170,000 / 37 = 4,594.59 rubles. Starting from 2022, Auto-park LLC will reflect this amount as part of other expenses.

Thus, a temporary difference will arise in the accounting of the LLC - a deferred tax asset, reflected in August by posting Dt 09 Kt 68 - 170,000 rubles. In September, this amount will be reduced Dt 68 Kt 09 - 4,594.59 rubles.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Transfer free of charge (for free)

Another option for disposing of assets is to place them at the disposal of a third party without making a profit. In such situations, the procedure and methods for accounting for the disposal of fixed assets remain unchanged - the only difference from the previous algorithm will be the absence of a record of income recognition, since in this case it is actually absent. In this case, for calculating value added tax, in accordance with the provisions of the second paragraph of Article 154 of the Tax Code, the market price of the object is taken as the basis.

As an example, consider the following situation. The company decided to transfer to an individual free of charge a vehicle originally purchased for 950,000 rubles. At the time of registration of the act, the depreciation rate was 635,000, the market valuation was 450 thousand, including VAT equal to 75,000 rubles. Thus, the account for accounting will look like this:

| Action | D | TO | Sum, thousand rubles |

| Write-off of original cost | 01/B | 01 | 950 |

| Depreciation at the time of transfer | 02 | 01/B | 635 |

| Carrying out residual work | 91, s/s “Other” | 01/B | 315 (950-645) |

| Tax accrual based on market price for VAT subaccounts | 91 | 68 | 75 |

Let's understand the basics

A fixed asset is a non-current asset that meets the following conditions:

- period of use - at least 12 calendar months (at least a year);

- used in the economic activities of the organization;

- transfer, resale or donation is not planned;

- can generate income for the institution.

The procedure for receipt and disposal of fixed assets is presented in PBU 6/01.

Please note that state employees must work according to different rules. For public sector institutions, the provisions of Instruction No. 157n, new FSBUs, as well as local standards apply. Keep in mind that state employees cannot dispose of all property. For example, a government-type organization does not have the right to write off its fixed assets from the register without the permission of the founder. Budgetary organizations manage only movable property purchased at the expense of their own capital. Autonomous institutions have the right to independently dispose of movable and immovable property acquired at the expense of their finances.

The disposal of particularly valuable property transferred to the disposal of the founder or acquired through budget subsidies is not permitted, regardless of the type of public sector institution. The composition of especially valuable property is determined by the founder and secured in a separate local order. To write off such an asset, the owner's permission is required.

Termination of use due to critical wear and tear

Another factor that serves as a basis for refusing further exploitation is the moral or physical wear and tear of assets, making them unsuitable from the point of view of solving basic functional tasks. In this case, to account for and reflect the disposal of fixed assets at their residual value, an entry is used that qualifies the organization's emerging expenses: D 91, s/s “Other” - K 01/B.

Methods

Methods for disposal of assets depend on the reasons for deregistration of fixed assets.

OS objects leave the organization for the following reasons:

- physical wear and tear – the object is no longer able to work as efficiently as before;

- obsolescence - the asset does not correspond to modern realities and requires updating;

- complete depreciation - the end of the useful life established for a specific fixed asset when it was accepted onto the balance sheet of the enterprise;

- breakdown, damage – loss of previous performance qualities;

- the object is no longer needed by the organization;

- other reasons.

In accordance with these reasons, the following methods of disposal of fixed assets from the organization are possible:

- Write-off due to wear and tear.

- Sale to another person – transfer for a fee.

- A gift to another person is a gratuitous transfer.

- Contribution to the authorized capital of another organization.

These methods are the main directions for disposal of fixed assets from the company.

Documenting

The disposal process requires mandatory documentation. Any operation must be supported by a document.

Any posting should only be carried out with paper confirmation.

The disposal procedure is usually accompanied by the preparation of the following documents:

- Order - based on the order, a commission is formed that makes a decision on the need to dispose of the fixed asset and the reasons for this.

- The inspection report of a fixed asset is a document drawn up by members of the commission during the assessment of the condition of the asset.

- Defective statement - if the equipment is damaged.

- Write-off act (OS-4, OS-4a or OS-4b) – if the object is subject to deregistration and further dismantling, disposal or destruction.

- Act of acceptance and transfer (OS-1, OS-1a or OS-1b) – if the object is transferred to another person as a gift, sale or contribution to the authorized capital of another company.

- Contract of sale or gift.

- Inventory card (OS-6, OS-6a or OS-6b) – information about the withdrawal of fixed assets from the balance sheet of the enterprise is entered.

It is possible to prepare additional documents depending on the reasons and method of disposal of the fixed assets item.

Write-off of assets retired due to an emergency or identified shortage

Just as in the previous case, the removal from the balance sheet of actually missing property of an enterprise, lost due to emergency events or as a result of unknown circumstances, is recorded by the accounting department as an expense item. At the same time, it is worth noting that a prerequisite is the organization of an unscheduled inventory, based on the results of which an act is formed confirming the fact of absence.

Recommendations based on the provisions of the orders of the Ministry of Finance boil down to accounting for losses from the disposal of fixed assets in account 94 (“Shortage or damage to property assets”, D94 - K01/B), and then, due to the absence of culprits and responsible entities, to reclassification as “ Other expenses" (D91 - K94). The same algorithm is also used in situations where the loss of one of the operating systems is a consequence of the influence of unidentified factors, and is discovered already in the process of a planned audit.

Mobile solutions offered by . allow you to simplify and automate accounting. Specialized software guarantees operational control over balances and helps track the entire product distribution cycle.

Reflection in the tax accounting amount of the loss from the sale of fixed assets

If the residual value of an asset, taking into account the costs associated with its sale, exceeds the proceeds from its sale, then the difference between these values is recognized as a loss.

The loss from the sale of fixed assets under NU cannot be fully taken into account at the time of sale of the fixed assets. It is included in indirect (other) expenses in equal shares over the remaining useful life of the asset, defined as the difference between the established useful life of the asset and the actual life of its operation until the moment of sale (clause 3 of Article 268 of the Tax Code of the Russian Federation).

The loss under the accounting system is fully taken into account at the time of sale (clause 31 of PBU 6/01).

Determining the amount of loss

The amount of loss subject to equal write-off in tax accounting can be determined using the report Register of information on financial results from the sale of fixed assets and intangible assets in the section Reports - Income tax - Tax accounting registers - Register of reporting data generation - Financial results from the sale of fixed assets and intangible assets.

Reflection in the tax accounting amount of the loss from the sale of fixed assets

There is no standard document for reflecting in NU the operation of accounting for the amount of loss from the sale of fixed assets in 1C.

Therefore, we propose to reflect the loss from the sale of fixed assets according to NU by posting Dt 97.21 Kt 91.09:

- in the debit of account 97.21 - the transfer of losses to the future is reflected to automatically include the loss in other expenses in equal shares over the remaining useful life of the fixed assets;

- on the credit of account 91.09 - the loss is excluded from the expenses of the current period in NU.

This operation is reflected using the document Transaction entered manually, the operation type Operation in the section Operations – Accounting – Transactions entered manually.

The document states:

- Date - date of implementation of the OS;

- The amount is not indicated, because in accounting, the loss was recognized at a time when the document Transfer of Assets .

The reference book Deferred Expenses specifies the parameters for recognizing losses from the sale of fixed assets in the National Institution:

- Type for NU - Losses from the sale of depreciable property ;

- Amount - 108,000 , i.e. amount of loss according to NU;

The amount in the Deferred Expenses is indicated for reference only. To calculate the monthly loss amount, the amount indicated in account 97.21 is used, i.e. Amount NU Dt document Transaction entered manually .

- Recognition of expenses - By month ;

- The write-off period from to is the period during which the loss will be taken into account in other expenses for NL. Set starting from the month following the implementation, ending with the last month of the OS SPI.

Control

Transfer as a contribution to the authorized capital

This option for disposing of assets involves the use of the corresponding account 58 - “Financial investments”. Taking into account the fact that when making a share expressed not in monetary form, an independent expert is required to evaluate the object, and at the same time, the interested parties to the transaction themselves do not have the right to insist on a higher value - there is a possibility of a difference between residual and estimated value recorded on account 91.

It is also worth noting that resident enterprises that pay VAT are required to restore the tax applied to the object. The amount is entered by the transferring entity into the accompanying documentation, and after completion of the procedure it can be deducted from the recipient party, while for the investor it is determined in the structure of financial investments. The algorithm established for its calculation, enshrined in Article 170 of the Tax Code, provides for the use of a proportion relative to the residual value of retired fixed assets.

To make it clearer, consider a clear example of such a situation. Let's say an enterprise uses OS as a contribution, transferring assets worth 560,000 rubles into the authorized capital (let's denote it StOS). Depreciation charges (AmOC) recorded at the time of transfer amounted to 139,000 rubles. The value stated by an independent valuation expert, and determined excluding VAT, is equal to 480 thousand, which was confirmed by the corresponding decision of all participants in the organization.

The amount of value added tax (VAT), previously adopted for the object in question, is equal to 112,000 rubles, which allows us to calculate the amount to be restored. As a result of simple calculations, the desired value will be 84,200 rubles:

NDSV = NDSP * ((StOS - AmOS) / StOS)

To reflect retired fixed assets in the balance sheet of an enterprise, it will be sufficient to complete the following entries:

| Action | D | TO | Sum, thousand rubles |

| Write-off of original cost | 01/B | 01 | 560 |

| Depreciation at the time of transfer | 02 | 01/B | 139 |

| Reflection based on the approved results of an independent expert assessment | 58, “Financial investments”, s/s “Units and shares” | 76, “Mutual settlements” | 480 |

| Write-off of residual item | 76 | 01/B | 421 (560-139) |

| VAT recovery | 19, “VAT on acquisitions” | 58, s/s “Units and shares” | 84,2 |

| Inclusion of tax collection in the investment structure | 58, s/s - the same | 19 | 84,2 |

| Reflecting the positive difference | 76 | 91, s/s “Other” | 59 (480-421) |

In situations where the result of comparing the estimate and the current value turns out to be negative, other expenses actually arise, reflected in the entry D91 - K76.

OS implementation

Regulatory regulation

Sales are recognized as the transfer of ownership of goods (including fixed assets) on a reimbursable basis (Article 39 of the Tax Code of the Russian Federation). At the same time, organizations must take into account the income and expenses associated with acquisitions and sales.

Income:

- In the accounting system, revenue from the sale of fixed assets is classified as other income and is reflected in the credit of account 91.01 “Other income” (clause 31 of PBU 6/01, clause 7 of PBU 9/99, chart of accounts 1C). Income is recognized at the moment of transfer of ownership of the fixed asset (clause 12 of PBU 9/99).

- In NU, income is the proceeds from the sale of fixed assets without VAT (clause 1 of Article 248 of the Tax Code of the Russian Federation). The date of receipt of income using the accrual method is the date of transfer of ownership of the asset (clause 1, article 39 of the Tax Code of the Russian Federation, clause 3 of article 271 of the Tax Code of the Russian Federation).

Expenses:

- In accounting, this is the residual value of the fixed asset and the costs associated with its implementation (dismantling, transportation, evaluation, etc.) (clause 5, clause 9 of PBU 10/99). Expenses in the accounting system are reflected in the debit of account 91.02 “Other expenses” (clause 31 of PBU 6/01, clause 11 of PBU 10/99, chart of accounts 1C).

- In NU, the amount of expenses that reduce sales income, just as in accounting accounting, includes the residual value of the fixed asset and expenses associated with its sale (Article 249 of the Tax Code of the Russian Federation, paragraph 1, clause 1, Article 268 of the Tax Code of the Russian Federation).

If the sale of fixed assets is carried out, in respect of which a depreciation bonus was previously applied, then the bonus must be restored if:

- the object is sold to a person who is interdependent with the taxpayer earlier than after 5 years from the date of commissioning.

VAT

Sales of fixed assets are subject to value added tax on the date of shipment (transfer) of fixed assets (clause 3 of article 38 of the Tax Code of the Russian Federation, clause 1 of article 39 of the Tax Code of the Russian Federation, subclause 1 of clause 1 of article 146 of the Tax Code of the Russian Federation, article 147 of the Tax Code RF).

The date of shipment of the OS is recognized (clause 1, clause 1, clause 16, article 167 of the Tax Code of the Russian Federation):

- date of drawing up the transfer and acceptance certificate (for example, OS-1) - for movable property;

- the date of transfer to the buyer according to the transfer and acceptance certificate, regardless of the date of state registration of the transfer of ownership - for real estate.

Features of calculating the tax base and the applied VAT rate depend on how input VAT was taken into account when purchasing fixed assets:

- VAT was not included in the cost of fixed assets (clause 1 of Article 154 of the Tax Code of the Russian Federation): tax base - the contractual cost of the sold fixed assets;

- VAT rate is 20%.

- tax base - profit from the sale of fixed assets, representing the difference between the contractual value of the sold fixed assets and its residual value;

When selling fixed assets, it is not necessary to restore the VAT accepted for deduction upon purchase, even if the fixed assets were sold at a loss (clause 3 of Article 170 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated January 15, 2015 N 03-07-11/422).

The amount of accrued VAT is reflected in Dt 91.02 “Other expenses” in correspondence with Kt 68.02 “Value added tax”.

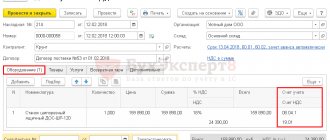

Accounting in 1C

The sale of fixed assets is documented in the document Transfer of fixed assets in the section fixed assets and intangible assets - Disposal of fixed assets - Transfer of fixed assets.

The header of the document states:

- OS event - description of the OS transfer event. In our example - Sale , which has an OS event type - Transfer ;

- Agreement - a document according to which settlements are made with the buyer, Type of agreement - With the buyer .

In our example, settlements under the agreement are carried out in rubles PDF. As a result of selecting such an agreement, the following subaccounts for settlements with the buyer are automatically established the Transfer of Assets

- Settlement account - 62.01 “Settlements with buyers and customers”;

- Advances account - 62.02 “Calculations for advances received.”

If necessary, accounts for settlements with the buyer can be corrected in the document manually or configured for the automatic insertion of other accounts for settlements with the counterparty.

On the Fixed Assets , the following is indicated:

- Fixed asset - implemented by the OS, selected from the Fixed Assets directory;

- Income account - 91.01 “Other income”;

- Subconto - an analytical item for accounting for other income and expenses, selected from the directory Other income and expenses, Type of article - Sales of fixed assets ;

- VAT account - 91.02 “Other expenses”;

- Expense account - 91.02 “Other expenses”. For analytical accounting, the same Subconto as for other income.

Postings according to the document

The document generates transactions:

- Dt 62.01 Kt 91.01 - revenue from the sale of fixed assets;

- Dt 91.02 Kt 01.09 - write-off of residual value;

- Dt 91.02 Kt 68.02 - accrual of VAT on the sale of fixed assets;

- Dt Kt 02.01 - depreciation calculation for the month of disposal of fixed assets;

- Dt 02.01 Kt 01.09 - write-off of accumulated depreciation to determine the residual value;

- Dt 01.09 Kt 01.01 - write-off of the original cost to determine the residual value;

Control

Calculation of monthly depreciation amount:

Calculation of financial results:

Documenting

The organization must approve the forms of primary documents, incl. OS implementation document and an inventory card form for OS accounting. In 1C, the OS Acceptance and Transfer Certificate (OS-1) and the OS Inventory Card (OS-6) are used.

The form can be printed by clicking the Print button - Certificate of acceptance of the transfer of OS (OS-1) of the document Transfer of OS . PDF

Based on this act, a record of disposal is made in the inventory card of the sold fixed assets, which is attached to the act of acceptance and transfer of fixed assets (clause 81 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n).

the OS Inventory Card (OS-6) button in Fixed Assets directory . PDF

Income tax return

Starting from the half-year declaration, the loss from the sale of fixed assets will be reflected in Appendix 3 to Sheet 02: PDF

- line 010 - number of retired fixed assets;

- line 020 - number of retired fixed assets with a loss;

- line 030 - revenue from the sale of fixed assets;

- line 040 - residual value of fixed assets;

- line 060 - loss from the sale of fixed assets.