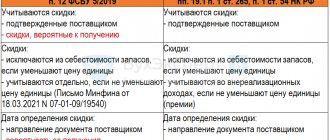

Types of incentives

To increase sales and attract new customers, suppliers often use various reward systems.

For example, they provide customers with discounts, bonuses, bonuses, and gifts. The concepts of “discount”, “premium”, “bonus” are not defined in the legislation. However, taking into account current practice and economic meaning, they can be understood as follows.

A discount is usually a reduction in the contract price of a product, work or service for fulfilling certain conditions. One of the forms of discounts can be a reduction in the amount of debt the buyer owes for goods supplied, work performed or services rendered.

Premium is money paid to the buyer for fulfilling certain terms of the contract. For example, a bonus may be given for the volume of purchased goods, works, or services. At the same time, a premium associated with the delivery of goods can also be a form of discounts when this occurs to reduce the cost of delivery (letter of the Ministry of Finance of Russia dated September 7, 2012 No. 03-07-11/364).

Bonus is an incentive in the form of supplying the buyer with an additional batch of goods, performing a scope of work and providing services beyond what was initially agreed upon without payment. In fact, the bonus consists of two interrelated business transactions:

- providing a discount to reduce the price specified in the contract;

- sale of goods, works or services at the expense of the resulting accounts payable to the buyer. In this case, the amount of debt should be considered as an advance received (letter of the Ministry of Finance of Russia dated August 31, 2012 No. 03-07-15/118).

As a rule, bonuses are provided as part of promotions. For example, when buyers of a specific product are given a gift. This way you can promote new products or sell those that are not in demand. Document the action being carried out by order of the manager.

A gift is another type of incentive for fulfilling the terms of the contract. Like the bonus, it combines several concepts. In this case, one should take into account its economic essence and the mechanism of action of such incentives. For example, a seller may provide a gift if:

- acquisition by the buyer of a set of goods, works, services. For example, when you purchase two units of a product, the third is provided free of charge. This can be regarded as a bonus in kind;

- the buyer achieves the established volume of purchases. This can be seen as a bonus. That is, the buyer is first given a discount on the cost of the gift and it is provided against the resulting accounts payable;

- carrying out an advertising campaign. For example, all clients receive a gift on a holiday. And this is already a gratuitous transfer (clause 2 of article 423, article 572 of the Civil Code of the Russian Federation). This is explained by the fact that the relationship associated with the provision of this kind of gifts is stimulating and not encouraging in nature within the framework of the concluded agreement;

- other promotions and events.

The condition for providing incentives can be provided both directly in the contract with the counterparty, and in a separate agreement that is an integral part of it (clause 2 of Article 424 of the Civil Code of the Russian Federation).

The seller determines the type and amount of the incentive independently and coordinates it with the counterparty, for example, by sending the buyer a notice - a credit note (clause 2 of article 1 and clause 4 of article 421 of the Civil Code of the Russian Federation).

Situation: is it possible to provide a buyer-organization with gifts worth more than 3,000 rubles? The provision of a gift is subject to the buyer's fulfillment of certain terms of the contract.

Yes, you can.

After all, the limit is 3000 rubles. valid only for gift agreements between organizations, when one party transfers or undertakes to transfer ownership of an item free of charge to the other party. This follows from paragraph 1 of Article 572 and paragraph 1 of Article 575 of the Civil Code of the Russian Federation.

But in the situation under consideration, we are not talking about gratuitous transfer. The seller rewards the buyer for fulfilling certain conditions and counter-obligations. This means that the cost of the gift given does not matter.

The courts adhere to a similar point of view (clause 3 of the information letter of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 104).

Limitations and risks:

Documentation

Any discounts and bonuses must be documented, for example, by a concluded agreement, which stipulates the conditions for the provision of discounts or bonuses; drawn up in writing with a calculation of the discounts provided; documents confirming fulfillment of the terms of the contract.

Amount of discount

The discount should not be provided for more than 20% of the established cost of the product, work or service. However, if the discount exceeds 20%, tax officials may conduct an audit to determine the basis for its provision. An individual entrepreneur who has provided a discount of more than 20% can motivate the use of discounts by seasonal fluctuations in consumer demand for certain goods, and the loss of consumer qualities of goods sold at a discount, for example, the approaching expiration date of products. It is possible to justify the provision of such a high discount by the marketing policy pursued by the company when promoting new goods or services that have no analogues to the market; implementation of experimental models and samples of goods to familiarize consumers with them.

Accounting: discounts

Discounts are provided by:

- at the time of sale or thereafter in respect of future sales;

- after the sale - in relation to goods sold, work performed or services provided. These are so-called retro discounts.

If a discount is provided at the time of sale or after it for future deliveries, then for accounting purposes this can be considered a sale at the price agreed upon by the parties. In this case, the established price may be less than what the seller declares under normal conditions. There is no need to reflect such a discount in accounting. You just need to reflect the implementation using standard postings.

Record the fact of implementation with the following entry:

Debit 62 (50) Credit 90-1

– sales revenue is reflected taking into account the discount.

If you pay VAT and it is levied on goods (works, services), then simultaneously with the sale, reflect its accrual as follows:

Debit 90-3 Credit 68 subaccount “VAT calculations”

– VAT is charged on the actual sales amount;

Well, when you receive payment into your bank account, make the following entry:

Debit 51 Credit 62

– payment has been received from the buyer taking into account the discount.

This procedure follows from the Instructions for the chart of accounts (accounts 50, 51, 62, 68 and 90), paragraph 6 of PBU 9/99 and is explained in the letter of the Ministry of Finance of Russia dated February 6, 2015 No. 07-04-06/5027.

If a discount is provided on a product, work or service that has already been sold, then reflect it in accounting depending on when the buyer was rewarded:

- before the end of the year in which the implementation took place;

- after the end of the year in which the implementation took place.

The discount was provided in the same year in which the sale took place. Adjust sales revenue for the period by the amount of the incentive at the time it was granted. In accounting, reflect such transactions as follows.

At the time of sale, before the discount is granted, complete the usual transactions:

Debit 62 Credit 90-1

– revenue from sales is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations”

– VAT has been charged (only post if you pay tax and sales are subject to it).

At the time of discount:

Debit 62 Credit 90-1

– revenue from previously shipped goods, works, and services is reversed in the amount of the discount provided.

After issuing an adjustment invoice to the buyer:

Debit 90-3 Credit 68 subaccount “VAT calculations”

– VAT is reversed from the amount of the discount provided.

This procedure is established by paragraphs 6, 6.5 of PBU 9/99.

The discount is provided in periods following the year in which the sale took place. Reflect it as part of other expenses in the current period as of the date of provision (clause 11 of PBU 10/99).

When identifying expenses from previous years in accounting, make the following entry:

Debit 91-2 Credit 62

– losses from previous years associated with the provision of a discount to the buyer (excluding VAT) were identified.

After issuing an adjustment invoice to the buyer:

Debit 68 subaccount “VAT calculations” Credit 62

– VAT is accepted for deduction from the amount of the discount provided.

This procedure is established by paragraph 39 of the Regulations on accounting and reporting, the Instructions for the chart of accounts (account 91), paragraphs 6 and 6.4 of PBU 9/99 and is explained in the letter of the Ministry of Finance of Russia dated February 6, 2015 No. 07-04-06/5027 .

Providing a discount (including in cash), which does not change the price of the goods under the terms of the contract, should be considered as a sale of property.

In accounting, reflect the provision of such a discount in the form of an additional batch of goods with the following entries:

Debit 62 Credit 90-1

– revenue from the sale of a consignment of goods within the discount is reflected (in the amount of the discount);

Debit 90-3 Credit 68 subaccount “VAT calculations”

– VAT has been charged (only post if you pay tax and sales are subject to it);

Debit 90-2 Credit 62

– the amount of the discount provided to the buyer is included in the cost price (excluding VAT).

This order follows from the Instructions for the chart of accounts (accounts 41, 62, 68, 90).

If you provide a discount in cash, then make the following entries in your accounting:

Debit 90-2 (44) Credit 62

– a cash bonus has been awarded to the buyer;

Debit 62 Credit 51

– premium paid to the buyer.

This order follows from the Instructions for the chart of accounts (accounts 51, 62, 68, 90).

The discount is issued on the date of purchase of the product

The discount can be issued without any delay. This happens when the client purchases a product in the required volume or for the required amount. In such a situation, there is no need to record the discount in accounting. It is enough to simply reflect the sale at cost already taking into account the discount.

The fact of a discount is recorded in accounting only when the sold products appear in accounting at their sales value. The reversal method is used for accounting. You need an entry DT41 KT42. The following records are needed to record the sale of products based on the cost of actual sales.

The need to use a reversal is due to the fact that the method of accounting for products at sales value assumes that the price of the product recorded in account 41 is identical to the real value upon sale. If no adjustments are made when the discount is actually provided, the markup amount will be inflated.

IMPORTANT! If the company keeps records at the purchase price, account 42 is not used, the discount given at the time of purchase is not recorded in accounting.

Wiring used

This set of wiring is used:

- DT41 KT60. Receipt of products from the supplier.

- DT19 KT60. Accounting for VAT on purchased products.

- DT41 KT42. Calculation of markup on purchased goods.

- DT60 KT51. Transfer of payment to the supplier.

- DT68 KT19. Acceptance of VAT deduction after transfer of money to the supplier.

- DT50 KT46. Fixation of revenue from product sales taking into account discounts.

- DT46 KT68. Accrual of VAT on turnover on products sold.

- DT46 KT42. The discount amount recorded using the red reversal method.

- DT46 KT42. Fixation of markup.

- DT46 KT80. Establishment of financial results from the sale of products with benefits.

FOR YOUR INFORMATION! Large trading entities often implement a barcoding system in their activities. They take into account every unit of product sold. Accounting is carried out at purchase prices. The discount in the presence of these circumstances is not fixed.

Accounting: bonus

Having provided a bonus, two business transactions must be reflected in accounting:

- discount on previously shipped goods, work performed or services provided;

- sale of goods, works or services against the resulting accounts payable to the buyer.

Reflect the first business transaction in the manner prescribed for reflecting the discount.

On the debt incurred, charge VAT on the advance payment. After all, money that was received earlier cannot be considered payment for goods that have already been shipped. In essence, this is an advance payment (letter of the Ministry of Finance of Russia dated August 31, 2012 No. 03-07-15/118).

In accounting, reflect the recognition of recovered accounts payable in advance and the sale of goods against this advance with the following entries:

Debit 62 subaccount “Settlements for shipped products” Credit 62 subaccount “Settlements for advances received”

– the amount of the restored debt is recognized as an advance received against a future bonus delivery;

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT”

– VAT is charged on the prepayment amount, that is, the recovered debt.

After shipping a bonus shipment of goods, performing an additional amount of work or services, make the following entries:

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT on advances received”

– VAT accrued on prepayment is accepted for deduction;

Debit 62 subaccount “Settlements for shipped goods” Credit 90-1

– revenue from the sale of bonus goods (works, services) is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations”

– VAT is charged on proceeds from the sale of bonus goods (works, services);

Debit 90-2 Credit 41 (20)

– the cost of sold bonus goods (work, services) is written off;

Debit 62 subaccount “Settlements for advances received” Credit 62 subaccount “Settlements for shipped goods”

- prepayment has been credited.

Insurance premiums and personal income tax

If an organization has provided a discount, a bonus, paid a bonus, or reduced the debt of a citizen buyer, then the amount of such incentives does not need to be accrued:

- contributions for compulsory pension, social or health insurance (part 1 of article 1, part 1 of article 7 of the Law of July 24, 2009 No. 212-FZ);

- contributions for insurance against accidents and occupational diseases (clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

This is due to the fact that the income received by the buyer when providing incentives is not his remuneration within the framework of labor relations or civil contracts.

If an organization has reduced the debt of a citizen-buyer free of charge, that is, without fulfilling any condition, then such an operation is a regular debt forgiveness. Therefore, a person has an income in the amount of incentives. Personal income tax must be withheld from such income. True, under certain conditions this is impossible to do. Then report this to the tax office. All this follows from Article 41, paragraph 1 of Article 210, paragraphs 1 and 3 of Article 224, paragraph 1 of Article 226 of the Tax Code of the Russian Federation, Article 415 of the Civil Code of the Russian Federation. The same conclusion is expressed in the letter of the Federal Tax Service of Russia dated October 11, 2012 No. ED-4-3/17276.

Promotion does not change the price

If the incentive does not change the price, then the income tax basis does not need to be adjusted. Incentives of this kind must be taken into account as part of non-operating expenses in relation to:

- goods - on the basis of subclause 19.1 of clause 1 of Article 265 of the Tax Code of the Russian Federation;

- works, services - on the basis of subparagraph 20 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation.

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated July 23, 2013 No. 03-03-06/1/28984, dated December 19, 2012 No. 03-03-06/1/668, dated September 27, 2012 No. 03 -03-06/1/506, dated April 3, 2012 No. 03-03-06/1/175.

When using the accrual method, expenses in the form of incentives provided to the buyer are taken into account when calculating income tax in the reporting (tax) period to which they relate. This is established in Article 272 of the Tax Code of the Russian Federation.

When using the cash method, expenses in the form of incentives provided to the buyer are taken into account when calculating income tax in the reporting (tax) period in which:

- paid the buyer a premium;

- transferred goods provided as a bonus or gift, but only if it was paid to your supplier;

- at the time of debt forgiveness, if a discount is provided that does not reduce the price. All other discounts reduce the price.

This follows from the provisions of paragraph 3 of Article 273 of the Tax Code of the Russian Federation.

Document the provision of incentives to the buyer in a deed.

Incentives for the purchase of food products

Situation: is it possible for a trade organization to take into account when calculating income tax the incentive to the buyer provided for in the contract for the supply of food products, which does not change their price?

Yes, it is possible if the incentive meets the requirements of the Law of December 28, 2009 No. 381-FZ.

This law sets out the rules for trading activities on the territory of Russia. They are effective from February 1, 2010.

According to these rules, an agreement for the supply of food products can only provide for one type of remuneration that is not related to a change in the price of the product. This is a reward to the buyer for purchasing a certain volume of goods. It does not matter how this remuneration is named in the supply agreement: discount, premium, bonus or gift (letter of the Ministry of Finance of Russia dated October 11, 2010 No. 03-03-06/1/643). The main thing is that the following conditions are met:

- the amount of the incentive cannot exceed 10 percent of the cost of the goods purchased by the buyer;

- incentives can be provided only for the supply of products that are not mentioned in the list of socially significant food products approved by Decree of the Government of the Russian Federation of July 15, 2010 No. 530.

This procedure is established by parts 4–6 of Article 9 of the Law of December 28, 2009 No. 381-FZ.

If all the specified conditions are met, then take into account the incentive for the purchase of a certain volume of goods when calculating income tax as part of non-operating expenses (subclause 19.1, clause 1, article 265 of the Tax Code of the Russian Federation).

Otherwise, do not take into account the incentive, since its provision does not meet the requirements of Part 4 of Article 9 of the Law of December 28, 2009 No. 381-FZ. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated April 10, 2015 No. 03-07-11/20448.

Incentives for purchases: discounts, bonuses, benefits

The procedure for concluding a purchase and sale agreement and the definition of the main concepts used when signing it are regulated by Chapter 30 of the Civil Code of the Russian Federation. However, the code does not contain the concept of a discount (premium, bonus). There is also no clear definition of them in the Tax Code. Based on the established practice in civil circulation, the following definitions can be derived:

- discount is a reduction by the seller of the price of a product compared to the prices he usually applies;

- A premium, or bonus, is the free provision by the seller of an additional volume of goods or the payment to the buyer of a certain amount of money.

The choice of a particular of these methods of stimulating the buyer to purchase depends on the seller and is determined by his marketing policy. Discounts (bonuses) conditionally provided to customers can be divided into the following types:

- Discounts and bonuses, divided depending on the conditions for which they are provided:

- provided for completing a certain volume of purchases;

- provided for compliance with certain payment conditions (for example, a discount for full or partial prepayment, a discount for early payment);

- for the acquisition of new types of goods;

- for the purchase of seasonal goods during the “off-season” time, etc.

- Discounts and bonuses depending on the time of their provision:

- provided at the time of shipment of the goods to the buyer;

- provided a certain time after shipment, usually based on an analysis of the buyer’s purchasing and payment discipline.

Since according to sub. 19.1 clause 1 art. 265 of the Tax Code of the Russian Federation, expenses in the form of a premium (discount) paid (provided) by the seller to the buyer as a result of fulfilling certain terms of the contract are classified as non-operating expenses of the seller, which reduce its taxable profit, such expenses must meet the general characteristics provided for in paragraph 1 of Art. 252 of the Tax Code. Namely, they should be:

- economically justified;

- documented.

The economic justification for such expenses will be their focus on generating income from the activities in connection with which such expenses were incurred. As a rule, confirmation of this focus will be a document on the seller’s marketing policy, which establishes:

Firstly,

the main goals of providing discounts to customers (increasing sales volumes, if discounts increase depending on the growth of purchases, or reducing payment terms, if the largest discount is provided with a minimum deferred payment or prepayment);

Secondly,

conditions for their provision, for example, what volume of goods and for what period must be purchased to receive a discount in a certain amount, an indication of the possibility of providing discounts if the buyer violates contractual terms, the possibility of summing up discounts, etc.;

Thirdly,

the procedure for their provision - the specific type of incentive for buyers and the timing of their provision.

thirdly, the procedure for their provision - the specific type of incentive for buyers and the timing of their provision.

At the same time, such recording will also serve as documentary evidence of expenses incurred when providing discounts (bonuses), but only if the general conditions for providing incentives related to a given buyer are reflected in the agreement with him. That is, the contract must contain clear instructions on all of the above points, and also additionally define:

1. Moments (dates) at which the buyer is considered to have fulfilled the conditions for receiving discounts (bonuses).

So, if discounts are provided for the purchase of a certain volume of purchases in a certain period (for example, a quarter), such points may be:

- signing by the parties of the next specification;

- shipment of products from the seller’s warehouse according to the dates on the bill of lading or bill of lading;

- date of actual arrival of the products at the buyer's address.

In the absence of such instructions, questions may arise between the parties (as well as from the tax authorities). For example, products were removed from the seller’s warehouse on March 30 (1st quarter of the year), and arrived at the buyer’s warehouse on April 4 (2nd quarter). Does the buyer have the right to demand a discount for having fulfilled the condition of purchasing a certain volume? And does the seller have the right to provide him with such a discount and take it into account as part of his expenses? The answer to these questions should be contained in the terms of the contract.

If a discount is provided for compliance with payment terms, the contract must clearly indicate which date is the payment date. This can be either the date the funds are written off from the buyer’s current account, or the date they are credited to the seller’s account, since money is not always written off and credited on the same day.

2. On the basis of what documents will the buyer’s compliance with the conditions for using discounts (bonuses) be established?

It seems the simplest to use as confirmatory:

- to confirm the volume of purchases - specifications, or primary accounting documents, namely: a bill of lading (with a buyer’s note on receipt of the cargo specified in it), a bill of lading.

- to confirm payment discipline - statements from the selling bank or buying bank confirming the debiting of money from the account or its receipt.

Specific documents confirming the right to receive discounts will be determined by the parties depending on how they determined the moment the buyer fulfills his obligations under the contract.

In addition to the specified documents, the parties can also draw up a bilateral act (in any form) stating that for a certain period the buyer has fulfilled the terms of the contract, which is confirmed by the following documents, and list all the above documents.

3. When providing incentives for the purchase of agreed volumes of products, especially if such a volume is expressed in the purchase of products for a certain amount, it is also advisable to determine:

- whether this amount includes the amount of VAT charged to the buyer or not;

- Will there be an increase in this volume if the seller increases the price per unit of product (for example, when signing the contract, a unit of product cost 10 rubles and the buyer undertook to purchase 1,000 rubles worth of products during the quarter. But after signing the contract, the seller unilaterally, when the contract allows similar actions, increased the price of a unit of production to 20 rubles, and the buyer, in order to comply with the condition on the volume of purchases, only needs to purchase a smaller quantity of products).

In addition, if the seller, in addition to the discounts provided for in the contract, conducts various promotions that also provide benefits for buyers in order to stimulate them to purchase, it should be established whether the volume of goods purchased as part of such promotions is included in the total volume required to provide contractual discounts.

For example, the section on discounts (or an appendix to the contract) may look like this:

The Seller provides the Buyer with a discount on the purchased products in relation to the wholesale price applicable to the Seller according to its price list.

At the time of signing this agreement, the amount of the discount provided to the buyer is ____%.

The discount provided in accordance with clause 2 of this agreement can be unilaterally changed by the seller at the end of each calendar quarter, depending on the buyer’s compliance with the following conditions:

Promotion changes price

Accounting for the calculation of income tax using the accrual method depends on when the incentive that changes the price was provided - in the same reporting (tax) period in which the sale took place, or in subsequent ones.

So, if the incentive was provided in the same period, then adjust the basis for calculating income tax in the current reporting (clause 7 of Article 274 of the Tax Code of the Russian Federation).

If a decrease in the price of goods affects the seller’s tax obligations for income tax in past reporting (tax) periods, then you can do one of the following:

- submit updated income tax returns for previous reporting (tax) periods;

- do not submit updated returns, but recalculate the tax base and the amount of tax for the period in which the incentive was provided, and reflect this in the tax return for the same period;

- do not take any measures to adjust the tax base (for example, if the amount of overpayment is insignificant).

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated May 22, 2015 No. 03-03-06/1/29540.

For more information about this, see In what cases you need to file an updated tax return.

As for the cash method, sales income is recognized on it on the date of receipt of money from customers. Accordingly, there will be no need to adjust revenue after the incentive is provided. Even if it is a retro discount, that is, when the price of an already sold product changes. Indeed, in this case, the money received earlier must be reclassified as an advance, and under the cash method it is also taken into account in income. This means that the tax base will not change in any way. This follows from paragraph 2 of Article 273 of the Tax Code of the Russian Federation and is confirmed in the letter of the Federal Tax Service of Russia for the Moscow Region dated October 5, 2006 No. 22-22-I/0460.

The costs associated with providing a premium, bonus or gift to offset price changes should be taken into account in the same way as in a situation where prices do not change.

Income tax and retro discount

After the seller and buyer sign a document granting a discount on the product, tax accounting will have to be adjusted by both the seller and the buyer.

Reduction in seller's revenue

The seller needs to adjust the previously recorded revenue. If the goods are shipped and the discount is provided in the same quarter, then there are no difficulties. The proceeds will be included in the income tax return taking into account the discount provided. If the discount was provided in another quarter, and after submitting the declaration, you need to decide whether it is necessary to submit updated income tax declarations for the period of shipment of the goods. Look: in the quarter of shipment the seller did not make any mistakes - he drew up a declaration taking into account the data that was available at that time. A subsequent change in the price of a product is a new circumstance. So it is quite logical to take it into account only in the period when the agreement on providing a retro discount is signed. Well, as always, our task is not to underestimate the tax base. If this condition is met, then the inspectors will have no complaints. Therefore, if the discount is provided in the same calendar year in which the goods are shipped, then the easiest way is to reduce the revenue in the current income tax return (calculation). Well, what if the product was shipped in one year, and a discount was provided for it in the next? There are two possible accounting methods. Method 1. Submit an updated declaration (calculation) for the period in which the goods were shipped (Article 81 of the Tax Code of the Russian Federation). In this clarification, you must indicate the revenue taking into account the discount provided (of course, excluding VAT). Since as a result of the clarification the amount of tax on the declaration will be less, you do not need to pay anything extra (there are no penalties or arrears). (-) The disadvantage of this method is that it is labor intensive. And also that such “minus” clarifications often attract unwanted attention from tax authorities. (+) The advantage of this method is that you get an overpayment for the previous period or the underpayment is reduced (which should reduce penalties if you did not pay income tax on time on any return). Method 2. During the period of provision of the retro discount, we reflect it as part of non-operating expenses as a loss of past periods identified in the current reporting (tax) period (Article 54 of the Tax Code of the Russian Federation). (+) The advantages of this method mirror the disadvantages of the first method: less labor costs, less unnecessary attention from inspectors. In addition, the Ministry of Finance does not object to this method of accounting for retrodiscounts.

Note The Ministry of Finance generally proposes to consider the reflection of the retro discount provided by the seller as an adjustment to past periods, similar to the correction of errors in tax accounting (Letters of the Ministry of Finance of Russia dated 06.29.2010 N 03-07-03/110, dated 06.23.2010 N 03-07-11/267 ). One can argue with this, but why? After all, the Ministry of Finance gives us additional opportunities. And everyone can choose the method that they like best.

(-) The disadvantage of the second method is that all changes will reduce the tax base only for the current year.

Conclusion It is easier to reflect the retro discount provided by the buyer for last year's shipments using the second method - as expenses of the current period.

Adjustment of the cost of goods from the buyer

When choosing a method for reflecting the received retro discount, it is also better for the buyer to ensure that the income tax base is not underestimated. After receiving the retro discount, he needs to change the purchase price of the goods in tax accounting. As a result, it will be necessary to recalculate the cost of goods sold. But when to do this depends on the situation. Situation 1. Products for which a discount has been received have not yet been sold. In this case, the buyer does not have any difficulties. You just need to reduce the cost of their acquisition by the amount of the discount received (Letters of the Ministry of Finance of Russia dated 03/20/2012 N 03-03-06/1/137, dated 01/16/2012 N 03-03-06/1/13). Situation 2. Products for which a discount was received were sold in the same quarter in which the discount was received. This is also a simple situation. The easiest way to reduce direct expenses on your income tax return is the cost of purchasing purchased goods. Some accountants, even in this situation, prefer to register the retro discount as non-operating income, but this will not change the size of the profit base. Situation 3. “Discount” goods were sold in the past quarter (or even in the past year). In this situation, you need to think carefully about how to reflect the retro discount. Method 1. Submit an updated declaration for the period of sale of goods for which a discount was subsequently received . This method is recommended in some of their letters by Moscow tax officials (Letter of the Federal Tax Service of Russia for Moscow dated July 30, 2006 N 19-11/58920). Of course, when submitting an update, they will require payment of both arrears of income tax and penalties (if the update is submitted after the deadline for paying the tax on the primary declaration) (Article 75 of the Tax Code of the Russian Federation). Method 2. Reflect the discount received as income for the current period . Indeed, according to the rules of the Tax Code, method 1 should be applied only when the buyer distorted the data of the previous period (Article 81 of the Tax Code of the Russian Federation). And in our case, the buyer has not yet received the right to a discount during the period of receipt and sale of goods. Consequently, he did not distort the data on the profits of previous periods. This approach was also supported by a specialist from the Ministry of Finance.

From authoritative sources Alexandra Sergeevna Bakhvalova, consultant of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia “Revenues are recognized in the reporting period in which they occurred (Clause 1 of Article 271 of the Tax Code of the Russian Federation). Therefore, if an organization, for example, received a discount in the third quarter on goods purchased in the first quarter and sold in the second quarter, then it has the right to take this amount into account as part of non-operating income in its income tax reporting for 9 months. Moreover, even if, by agreement with the supplier, the discount changes the price of the goods supplied.”

Of course, reflecting the discount received from the seller as income in the current period is both easier and more profitable - you do not have to file updated declarations, nor pay additional taxes and penalties. However, there is no guarantee that inspectors will support this method of accounting during inspection. By the way, in some of its letters, the Ministry of Finance explains that a discount should be taken into account as an independent income only if it does not change the cost of the purchased goods (Subclause 19.1, paragraph 1, Article 265 of the Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated January 16, 2012 N 03-03-06 /1/13). So it is safer to submit clarifications and adjust the cost of the goods from the date of its receipt in your organization. But here it’s up to you to decide exactly what to do.

VAT

In an agreement for the supply of non-food products, the parties can establish a condition: the incentive - a discount, bonus, premium or gift - affects the price of the product or not.

If the incentive does not change the price of goods , then the VAT tax base does not need to be adjusted (clause 2.1 of Article 154 of the Tax Code of the Russian Federation).

When an incentive changes the price of an item , adjust the basis for calculating VAT. To do this, issue an adjustment invoice (subclause 4, clause 3, article 170, clause 13, article 171, clause 10, article 172 of the Tax Code of the Russian Federation).

The amount of VAT on the difference resulting from a decrease in the value of the goods can be deducted (paragraph 3, paragraph 3, Article 168, paragraph 3, paragraph 1 and paragraph 2, Article 169, paragraph 13, Article 171, paragraph 10, Article 172 of the Tax Code of the Russian Federation).

Has the price changed for goods listed on multiple primary invoices? Then you can issue a single adjustment invoice to the same buyer (paragraph 2, subclause 13, clause 5.2, article 169 of the Tax Code of the Russian Federation).

For more information, see:

- How to create and register an adjustment invoice;

- Procedure for issuing an adjustment invoice due to a price change;

- Under what conditions can input VAT be deducted?

In a similar manner, take into account the receipt of incentives for work (services) when calculating VAT.

An example of how to reflect in accounting and taxation the payment of a bonus to the buyer for achieving the volume of purchases established by the contract. According to the terms of the contract, the premium does not change the cost of goods

LLC "Torgovaya" sells goods wholesale. The organization uses the accrual method. Income tax is paid monthly.

On October 5, Hermes entered into a purchase and sale agreement with Alpha LLC for the purchase of a consignment of goods. According to the agreement, if Alpha purchases goods from Hermes in the amount of 1,100,000 rubles. (including VAT - 100,000 rubles), Hermes pays Alpha a bonus in the amount of 30,000 rubles.

On October 15, Alpha purchased a batch of goods from Hermes in the amount of 1,100,000 rubles. (including VAT – 100,000 rubles).

The cost of goods sold by Hermes was 500,000 rubles. In pursuance of the terms of the purchase and sale agreement, on October 22, Hermes transferred a cash bonus in the amount of 30,000 rubles to Alpha.

The accountant made the following entries in the Hermes accounting.

October 15:

Debit 62 Credit 90-1 – 1,100,000 rub. – revenue from the sale of goods is reflected;

Debit 90-2 Credit 41 – 500,000 rub. – the cost of goods sold is written off;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 100,000 rubles. – VAT is charged on sales proceeds.

22 of October:

Debit 90 (44) Credit 62 – 30,000 rub. – a cash premium has been awarded to the buyer.

Since the incentive in the form of a bonus did not lead to a decrease in the price of the product, the VAT tax base is not adjusted.

Debit 62 Credit 51 – 30,000 rub. – premium paid to the buyer.

Providing a bonus does not change the price of the goods, so the Hermes accountant applied the provisions of subclause 19.1 of clause 1 of Article 265 of the Tax Code of the Russian Federation and took into account the bonus in the amount of 30,000 rubles. as part of non-operating expenses.

In October, when calculating income tax, the accountant included:

- included in income – 1,000,000 rubles;

- included in expenses - 530,000 rubles. (RUB 30,000 + RUB 500,000).

An example of how to reflect in accounting and taxation the payment of a bonus to the buyer for achieving the volume of purchases established by the contract. Under the terms of the contract, the premium changes the value of the goods. The bonus is provided after the sale of goods

LLC "Torgovaya" sells goods wholesale. The organization uses the accrual method. Income tax is paid monthly.

On October 5, Hermes entered into a purchase and sale agreement with Alpha LLC for the purchase of a consignment of goods. According to the agreement, if Alpha purchases goods from Hermes in the amount of 1,100,000 rubles. (including VAT - 100,000 rubles), Hermes reduces their cost by 10 percent.

On October 15, Alpha purchased a batch of goods from Hermes in the amount of 1,100,000 rubles. (including VAT – 100,000 rubles).

The cost of goods sold by Hermes was 500,000 rubles. In pursuance of the terms of the purchase and sale agreement, on October 22, Hermes provided Alpha with a discount of 10 percent of the cost of the goods.

The accountant made the following entries in the Hermes accounting.

October 15:

Debit 62 Credit 90-1 – 1,100,000 rub. – revenue from the sale of goods is reflected;

Debit 90-2 Credit 41 – 500,000 rub. – the cost of goods sold is written off;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 100,000 rubles. – VAT is charged on sales proceeds.

22 of October:

Debit 62 Credit 90-1 – 110,000 rub. – revenue from previously shipped goods is reversed (by the amount of the discount provided);

Debit 90-3 Credit 68 subaccount “VAT calculations” – 10,000 rubles. – VAT is reversed from the amount of the discount provided (based on the adjustment invoice).

Since the incentive in the form of a bonus led to a decrease in the price of the product, the tax base for income tax is adjusted in the current reporting period by the amount of the incentive.

In October, when calculating income tax, the accountant included:

- included in income – 900,000 rubles;

- included in expenses - 500,000 rubles.

When supplying food products, the contract may contain a provision for remuneration (bonus) for achieving a certain volume of purchases. The amount of such remuneration should not exceed 10 percent of the price of the purchased goods. This type of incentive does not change the price of goods, regardless of the terms of the contract. This procedure follows from the provisions of paragraph 4 of Article 9 of the Law of December 28, 2009 No. 381-FZ. Having provided remuneration for the volume of purchase, the VAT tax base does not need to be adjusted. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated September 18, 2013 No. 03-07-09/38617.

Situation: should the seller adjust the VAT base if he paid remuneration to a citizen who purchased the goods at retail?

Yes, I should.

In this case, the remuneration paid changes the price of goods sold at retail, even if the contract contains a condition to the contrary.

The fact is that when an organization provides citizens with discounts, bonuses, bonuses, gifts, trading at retail, the provisions of paragraph 2.1 of Article 154 of the Tax Code of the Russian Federation do not apply. This rule should be applied only to wholesale trade, when a contract for the supply of goods is concluded with buyers. Similar clarifications are in the letter of the Ministry of Finance of Russia dated July 11, 2013 No. 03-07-11/26921.

Moreover, according to the logic of the Ministry of Finance of Russia, in the retail trade of food products, the norm of paragraph 4 of Article 9 of Law No. 381-FZ of December 28, 2009 also does not apply. After all, it regulates wholesale supplies.

Consequently, the incentive provided to a citizen changes the price of goods sold to him at retail, regardless of whether these goods are food or non-food. These conclusions are contained in the resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 7, 2012 No. 11637/11 and dated December 22, 2009 No. 11175/09.

That is, in any case, in a situation where an organization pays a remuneration to a citizen-buyer, the initial price of the product changes. Therefore, the VAT tax base will have to be adjusted for the amount of such incentive by drawing up an adjustment invoice. Draw up such a document in one copy, for yourself. After all, citizens who are not engaged in entrepreneurial activities do not pay VAT and therefore simply will not be able to take advantage of the right to deduction. The amount of VAT on the difference resulting from a decrease in the value of the goods can be deducted. All this follows from paragraph 1 of Article 143, paragraph 3 of paragraph 3 of Article 168, paragraph 3 of paragraph 1 and paragraph 2 of Article 169, subparagraph 4 of paragraph 3 of Article 170, paragraph 13 of Article 171, paragraph 10 of Article 172 of the Tax Code of the Russian Federation.

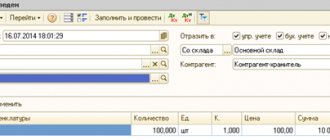

Receiving a bonus from a supplier (accounting with the buyer) in 1C: Enterprise Accounting ed. 3.0

Published 07/21/2021 08:43 Author: Administrator Let's continue the conversation about bonuses to counterparties. In the previous article, we looked at how the buyer's premium is reflected in the seller's accounting. It's time to talk about how to reflect the premium received from the supplier in the buyer's accounting. And again we will consider two options for the development of events in 1C: Enterprise Accounting ed. 3.0: receiving a bonus from the supplier for the volume of purchases and crediting such a bonus against payment for future goods.

In accounting, this premium received by the buyer for fulfilling certain conditions of the supply agreement is reflected as other income, and in tax accounting as non-operating income.

Let's consider a conditional example: the agreement between the supplier Ponchik LLC and the buyer Buttercup LLC stipulates that when purchasing goods over 200 thousand rubles. per month, the buyer is paid a bonus of 3% of the purchase price for that month. In July 2022, the Buyer LLC Buttercup purchased goods from the Supplier LLC Donut in the amount of 250 thousand rubles. The amount of the premium to the buyer was 7,500 rubles. (RUB 250,000 * 3%). The bonus does not affect the cost of goods shipped to the buyer and is transferred to the bank account within 7 calendar days.

Providing a bonus from the supplier for the volume of purchases

Based on an agreement with the supplier, notice or notice, the buyer's premium is reflected as part of other income by the accounting entry: Dt 76.05 Kt 91.01.

When the premium is credited to the current account, the following entry is made: Dt 51Kt 76.05.

Let's consider step by step the reflection of operations to provide a bonus to the buyer for the volume of purchases in the accounting of the buyer LLC "Lutik" in 1C: Enterprise Accounting.

Step 1. Go to the “Operations” - “Operations entered manually” section. Click New and select the Operation command.

Step 2: Add an accounting entry:

By debit - account 76.05, indicating the supplier who issued the bonus for sales volume and the contract. In our example, the supplier is Lyutik LLC.

For the loan – account 91.01. As the first subaccount, add a new item of other income and expenses using the “Create” button in the article directory of the same name.

Step 3. In the title of the article, indicate “Receiving a bonus from a supplier for volumes of purchases.”

Type of item – “Other non-operating income (expenses)”.

Step 4. Specify the content of the transaction and posting - “Calculation of bonuses from the supplier for sales volumes.” Set the bonus amount to RUB 7,500.

Step 5. Create a “Turnover balance sheet for account 76.05”.

The debit turnover reflects the amount of the supplier's bonus for the volume of goods purchased.

Receipt of the premium is reflected in the bank account statement.

Step 6. Create a “Receipt to the current account” in the “Bank and cash desk” section or download bank statements with the type of transaction “Other receipt”. Settlement account select 76.05 “Settlements with other suppliers and contractors”.

Post a document confirming receipt of the supplier's premium to the bank account.

After posting the document, the turnover on account 76.05 will be closed.

Supplier's bonus in the accounting of the buyer of Buttercup LLC in the amount of 7,500 rubles. accrued and received the current account.

Let's consider the second example, when the buyer of Buttercup LLC offsets the supplier's premium against payment for goods.

Crediting the received premium against payment for goods

Let's move straight to an example: in July 2022, Buttercup LLC purchased goods from the supplier Ponchik LLC in the amount of 200,000 rubles. and wants to count the bonus received in June towards payment for the delivery.

To offset the premium received by the buyer of Buttercup LLC from the supplier Ponchik LLC, create a “Debt Adjustment” document from the “Purchases” or “Sales” section.

Step 1: Click Create.

Step 2. Fill out the header of the document:

Type of operation – “Other adjustments”.

“Debtor” and “Creditor” select the supplier from the directory - Donut LLC.

Click “Fill” - “Fill with mutual settlement balances” or the “Fill” button at the top of the document.

The tabular part will be automatically filled with data on settlements with the supplier.

You can credit the amount in two ways:

Option 1:

The “Accounts Payable” tab will display the amount owed to the supplier. In our example, 200,000 rubles.

Step 3. Change the amount to the amount to be offset on the Accounts Payable tab and post the document.

Option 2:

Step 4. Clear the table on the “Accounts Payable” tab, leaving only the offset amount on the “Accounts Receivable” tab on the account 76.05 - 7500 rubles.

Step 5. Go to the “Accounts” tab and indicate the accounts receivable write-off account – 60.01 “Settlements with suppliers and contractors”.

Select a supplier and enter a contract.

In the “Documents of settlements with the counterparty” field, indicate the document against which payment is offset. In our example, this is the receipt of goods for 200,000 rubles. from LLC "Donut" 07/18/2001

Step 6. Post the document by clicking the button of the same name and look at the postings.

The “Debt Adjustment” document repaid part of the amount payable to the supplier Ponchik LLC with the amount of the supplier’s premium reflected in account 76.05 “Settlements with other debtors and creditors”, creating the following entry:

Dt 60.01 Kt 76.05 with the content of the posting - “Assignment of debt”.

Step 7. Create a “Turnover balance sheet for account 76.05.”

Turnovers are closed, there is no balance. Supplier bonus to Ponchik LLC in the amount of RUB 7,500. for the purchase of certain volumes of goods is offset against the payment of debt.

Step 8. Create a “Turnover balance sheet for account 60.01”. The amount payable to the supplier was reduced by 7,500 rubles. due to the supplier's premium.

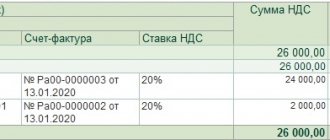

Reflection of the supplier's premium in the buyer's reporting

In the “Reporting” - “Regulated Reports” section, create an “Income Tax Declaration”.

Step 1. Click “Create” and select a report form from the list.

Step 2. Click “Fill out” and open the section of Appendix No. 1 to Sheet 02. The bonus for the volume of purchases without changing the price of goods in the amount of 7,500 rubles is reflected in the report on line 100 “Non-operating income”.

Step 3. Select the cell and click “Decrypt” (the button at the top of the report or by right-clicking) and see the details.

The bonus amount was included in the report as turnover in the debit of account 91.01 “Other income and expenses.”

By double-clicking on a cell, the “Turnover Balance Sheet” will open, where the user can analyze all the amounts by line.

Author of the article: Olga Kruglova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Zotsenko 02/18/2022 12:55 Thank you! Everything is very detailed and clear. The only thing I would like to know is about VAT in this situation. Do I need to write out a s/f?

Quote

0 Irina Plotnikova 11/27/2021 07:52 I quote Olga:

Hello, can the buyer hold the premium for August on October 1, and not on September 15 (the settlement report is dated September 15 and the money was received on the account on October 15)???

Olga, hello.

The supplier establishes the procedure and conditions for paying bonuses to the buyer in the supply agreement or additional agreement. agreement to it. This is stated in the Letter of the Ministry of Finance of the Russian Federation dated 09/07/2012 No. 03-07-11/364. If your organization is on OSNO, then expenses in the form of discounts provided to the buyer are taken into account when calculating income tax on the date of calculation in accordance with the terms of the concluded agreements (clause 3, clause 7, article 272 of the Tax Code of the Russian Federation). Quote 0 Olga 11/25/2021 03:59 Hello, can the buyer hold the premium for August on 10/01, and not on 09/15 (the settlement report is dated 09/15 and the money was received on the account on 10/15)???

Quote

0 Irina Plotnikova 07/26/2021 07:41 I quote Natalya:

Good afternoon!!! The supplier provided a bonus according to the contract for achieving the volume of purchases. The bonus is provided by reducing accounts receivable. Is the simplified tax system paid on this financial premium? LLC ON USN 15% retail.

Natalya, hello.

Yes, tax is paid. The amount of the premium (bonus) for the organization’s fulfillment of the terms of the agreement on the volume of purchases is included in non-operating income on the date of its receipt from the supplier (clause 1 of article 346.15, clause 1 of article 346.17, article 250 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated 09/30/2013 N 03-11-06/2/4031 9). Quote 0 Natalya 07.23.2021 15:36 Good afternoon!!! The supplier provided a bonus according to the contract for achieving the volume of purchases. The bonus is provided by reducing accounts receivable. Is the simplified tax system paid on this financial premium? LLC ON USN 15% retail.

Quote

Update list of comments

JComments

simplified tax system

Organizations that pay a single tax on income do not take into account expenses, including incentives provided to customers, when calculating it (Clause 1, Article 346.18 of the Tax Code of the Russian Federation).

For organizations that have chosen such an object of taxation as income reduced by the amount of expenses, the list of expenses taken into account when calculating the tax base is limited by Article 346.16 of the Tax Code of the Russian Federation. The costs of paying or providing customers with appropriate incentives - discounts, bonuses, bonuses or gifts - are not included in this list.

When selling goods at discounts, include in income the amounts actually received from customers, that is, minus the discounts provided. This follows from paragraph 1 of Article 346.15, paragraph 1 of Article 249 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated March 11, 2013 No. 03-11-06/2/7121.

Documentation

I APPROVED

Director of Projectnaya Sreda LLC

Visnevskaya M.A.

"01" January 2022

REGULATIONS ON PROVIDING DISCOUNTS TO CUSTOMERS

1. General Provisions

1.1. This Regulation on the provision of discounts to customers of the Limited Liability Company "Proektnaya Sreda" (hereinafter referred to as the "Regulation" and the "Organization" respectively) was developed in accordance with the current legislation of the Russian Federation and determines the procedure for providing discounts to customers of services, including educational services, of the Organization .

For the purposes of the Regulations, customers mean:

· legal entities – organizations that have paid for services for training, information and development of their employees;

· individuals – persons who paid for services and personally received the results of the services provided.

1.2. The economic justification for providing discounts to customers is approved by the Head of the Organization.

1.3. These Regulations are mandatory for execution by all employees of the Organization, whose job responsibilities include conducting negotiations and concluding agreements for the sale of the Organization’s services.

2. Goals and objectives of developing the Regulations

2.1. These Regulations have been developed for the purposes of: accelerating the turnover of working capital; increasing sales volume; expansion of the sales market; increasing customer loyalty.

2.2. Objectives of the Regulations: determination of the terms of contracts with customers of the Organization's services, containing conditions for the provision of discounts, bonus points, as well as the inclusion in them of legally established requirements and the exclusion of conditions that contradict the law, as well as the exclusion of incomplete, ambiguous and contradictory requirements; conclusion of a contract on terms that can be properly fulfilled by the Organization and the customer.

3. General provisions on bonuses and discounts

3.1. Customers - legal entities are provided with discounts and bonuses (Section 4, 6 of these Regulations). Individuals are provided only with bonuses (Section 5, 6 of these Regulations).

3.2. Bonuses are provided for both legal entities and individuals. The purpose of bonuses is to support Customers’ actions aimed at promoting the Organization’s services.

3.2. Bonuses are provided (accrued and used) in Russian rubles.

3.3. The customer has the right to pay with bonuses for any service of the Organization, but not more than 60% of its total cost.

3.4. Bonuses are credited to the customer’s virtual account upon the accrual condition. The Organization informs the Customer about the accrual of bonuses via email, SMS, or through the Customer’s personal account on the Organization’s website.

3.5. Bonuses are valid for 1 (one) year from the date of bonus accrual. After 1 (one) calendar year from the date the bonus was accrued, if it has not been used by the customer, the bonus is canceled.

3.6. If a bonus is used to pay for the Organization's services, the amount of the bonus used is debited from the customer's virtual account upon written request by email. Bonuses are debited when the Organizer receives the entire payment for the service (minus the amount of the bonus used).

3.6. Bonuses cannot be exchanged for money or other material assets.

3.7. Bonuses for individuals can be combined with promotional prices announced on the website or in another source. In this case, the total discount from the base cost of the event cannot exceed 60%.

3.8. Upon entry into force of this Regulation, bonuses due to individuals and legal entities for the period that has passed since 01/01/2018 are automatically accrued on the date of this regulation.

4. Discounts for Customers - legal entities and the procedure for calculating them:

4.1 Customers – legal entities are provided with a cumulative discount on payment for the Organization’s services, as well as bonuses (Section 4, 6 of these Regulations). The discount is set as a percentage of the cost of the service established in the price list. The amount of the discount is set depending on the total cost of the Organization’s previously paid services for the last 2 years from the current date, hereinafter referred to as the “accumulation amount”:

- 8% of the cost of the service - for savings amounts from 250,000 to 499,999 rubles;

- 12% of the cost of the service – for savings amounts from 500,000 to 999,999 rubles;

- 18% of the cost of the service - for savings amounts of 1,000,000 rubles and above.

4.3. The discount amount is recalculated upon completion of paid training or provision of information and consulting services. The fact of completion of training (provision of services) is confirmed by signing the Certificate of acceptance of work performed / services provided).

4.4. Discounts for legal entities and bonuses for individuals cannot be combined with each other.

4.5. Discounts and bonuses of one legal entity can be used together. At the same time, discounts for legal entities cannot be combined with promotional prices announced on the website or in another source.

4.6. In non-standard situations, only the Head of the Organization decides to provide discounts and approves the amount of individual discounts.

5. Types of bonuses for individuals and the procedure for their accrual:

The following bonuses have been established for individuals:

· Bonus for participation (clause 5.1)

· Bonus for review (clause 5.2.)

· Bonus for recommendation (clause 5.3.)

5.1. Bonuses for participation are determined and awarded by the Organization to an individual who has completed training since 01/01/2018 in the amount of 5 (five)% of the amount of paid services, in rubles. The percentage is calculated based on the amount of actual payment. Such a bonus is credited to the Customer’s personal account (in the Organization’s accounting system) the next day after the end of the paid training.

5.2. Bonuses for reviews left about the service received (accepted):

5.2.1. For a written review of at least 1,500 characters with spaces, a bonus of 2% of the cost of the service is awarded (in the amount of the declared base cost of the service, according to the price list);

5.2.2. For a video review of at least 40 seconds, a bonus of 3.5% of the cost of the service is awarded;

5.2.3. The review must contain the full name, position and company name of the Customer, as well as the service received and its result for the Customer;

5.2.4. The review must be sent by email or the text of the review must be posted in your personal account on the Organization’s website;

5.2.5. For each service (for which a review is left) only one bonus can be awarded.

5.2.6. Reviews are accepted for services provided no earlier than 06/01/2019;

5.2.7. Bonuses are awarded the next day after receiving the review materials;

5.2.8. Providing feedback by the customer means his agreement that the Organization reserves the right to post the received reviews on its company’s websites and use them in other sources and media, indicating the name of the author of the review, position and name of the Company.

5.3. Bonuses for recommending the Organization’s services: The Customer is awarded a bonus in the amount of 2,000 rubles for providing a recommendation to the “Second Customer” under the following conditions:

5.3.1. The bonus is awarded to an individual (customer) who has previously received any service from the Organization and who has recommended any service to another individual or legal entity (Second Customer) who has not previously received services from the Organization.

5.3.2. The bonus is awarded for recommending a service whose full (or declared) cost was more than 3,000 rubles.

5.3.3. The bonus is credited to the customer the next day after completion of training (receipt.

5.3.4. The bonus is accrued in case of payment, or in case of payment by the employer of the Second customer for the first time. If the employer of the Second Customer pays for the Organization’s services not for the first time (repeatedly), the bonus is not accrued.

5.3.5. The condition for providing a bonus for a recommendation is Information about the customer as the person who recommended it, recorded by the Second customer in the questionnaire when receiving the service.

5.3.6. The Customer receives a Recommendation Bonus once for each “Second Customer” attracted, in accordance with the specified rules.

5.3.7. Bonuses are awarded for recommendations to attend the Organizer’s events starting from 01/01/2020.

6. Types of bonuses for legal entities and the procedure for their accrual

6.1. A legal entity is awarded bonuses for leaving feedback on the services received by its employees:

6.1.1. For a written review of at least 2,500 characters with spaces, a bonus of 3,000 rubles is awarded;

6.1.2. For a video review of at least 40 seconds in length, a bonus of 6,000 rubles is awarded;

6.2. Feedback from a legal entity is accepted according to the brief provided by the Organization at the request of the customer in advance;

6.3 Feedback is accepted on behalf of the Head of the Company, HR Director, Department Director, Division Head or other similar position;

6.4. The bonus is accrued if a legal entity pays for the Organization’s services in a total amount of more than 30,000 rubles for the period from 01/01/2018;

6.5. To receive a bonus, the customer must send a review by email;

6.7. Reviews are accepted for services provided no earlier than 06/01/2019;

6.8. Bonuses are awarded the next day after the Organization receives feedback materials from the Customer;

6.9. Providing feedback means the Customer agrees that the Organization reserves the right to post reviews on its website and use them in other sources and media, indicating the name of the author of the review, position and name of the Company.

6.10. The conditions for discounts in accordance with these Regulations do not apply to the Organization’s services, including educational ones, which are provided exclusively to one legal entity in the format of individual (closed) corporate training, without announcing an open enrollment of participants.

6.11. The Organization reserves the right to award additional bonuses (not described in this document) as part of any promotions, the terms of which are separately published on the Organization’s website, in mailings and in other open sources of information.

7. Final provisions

7.1. This Regulation is approved by the Order of the Head of the Organization and comes into force from the moment of its approval.

7.2. The decision to make changes or additions to these Regulations is made by the Head of the Organization.

OSNO and UTII

As a rule, it is always possible to determine what type of activity the incentives provided to customers relate to. Therefore, if an organization applies a general taxation system and pays UTII, incentives provided to customers within the framework of activities transferred to UTII and activities on the general taxation system must be taken into account separately for the purpose of calculating income tax and VAT (clause 9 of Article 274, clause 7 of article 346.26 and clauses 4, 4.1 of article 170 of the Tax Code of the Russian Federation).

Incentives - discounts, bonuses, premiums or gifts that an organization provides to customers as part of its activities under the general taxation system - subject to the conditions for their recognition in the tax base, can increase expenses.

Do not take into account incentives that are provided to the buyer as part of activities transferred to UTII for tax purposes (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).