Auxiliary production is created at large enterprises in addition to the main production lines. The costs of auxiliary workshops are taken into account in calculating the cost of manufactured products. The objectivity of the organization’s pricing policy depends on the reliability of accounting for the costs of different production groups and the literacy of the distribution of invested resources. The procedure for planning and accounting for production expenses is regulated by the norms of Order of the Ministry of Industry and Science of January 4, 2003 No. 2.

How to calculate the cost of production ?

Purpose of auxiliary production

At large enterprises, the organizational structure may include auxiliary units that service the main production and, as a rule, do not produce products.

For example, auxiliary industries include:

- energy workshops for electricity, gas, steam and other various types of energy;

- transport services for transport services;

- OS repair shops;

- workshops for the production of building parts, tools, spare parts or enrichment of building materials in construction organizations;

- auxiliary units for the construction of non-title structures;

- mining of stone, gravel, sand, including other non-metallic materials;

- logging and sawmilling;

- salting, drying, canning agricultural products, etc.

However, ancillary industries may also provide services to third party customers.

The costs of auxiliary production can be direct, that is, for direct activities, and partially indirect for management and maintenance.

The nuances of accounting for seasonal production

Due to climatic conditions, the activities of most agricultural enterprises are seasonal. This leads to the fact that the enterprise has periods of activity and downtime. And if everything is more or less clear with the lack of income during the off-season, then what about expenses?

During the downtime period, it is important to correctly classify expense items for accounting purposes:

- on assets;

- expenses related to future periods;

- current expenses.

As can be seen from this classification, it is assumed that during the idle period the agricultural enterprise has no direct costs associated with the sale of products, since there is no sales. Note that direct costs in agriculture include:

- direct material costs for the production process;

- expenses for remuneration of employees employed in the main production (including contributions for their compulsory insurance);

- depreciation of fixed assets used in the main production.

Thus, all expenses incurred during the shutdown period to support operations in the next season are accounted for either as assets or as expenses incurred in the current period but related to future ones.

The exception is permanent indirect costs, such as administration salaries. They are expensed monthly.

Example 1

Kombikorm LLC, operating in central Russia, incurred the following expenses in February 2022:

- purchased a new combine;

- repaired 2 existing combines using our own resources;

- purchased seeds of a new variety of fodder corn;

- paid salaries to the manager and accountant.

The following entries were made in the LLC accounting:

- Dt 08 Kt 60 - the purchase of a new combine is reflected;

- Dt 97 Kt 60 - spare parts and materials were purchased for the repair of 2 old combines;

- Dt 97 Kt 70 - salaries were accrued to the technicians who carried out the repairs;

- Dt 97 Kt 69 - insurance premiums are charged on amounts related to equipment repair;

- Dt 10 Kt 60 - planting material (seeds) has been capitalized;

- Dt 26 Kt 70, 69 - administration salaries and insurance premiums are accrued.

Regarding wages, it should be borne in mind that labor relations with seasonal workers also have their own specifics. In our article we will not dwell in detail on seasonal workers.

You can read more in the article “Art. 59 of the Labor Code of the Russian Federation: questions and answers.”

To conclude the topic of seasonality, we cannot help but touch upon the calculation of depreciation in agriculture.

For accounting purposes, depreciation of fixed assets used seasonally must be accrued during the season. That is, the annual norm must be invested in the season (clause 19 of PBU 6/01, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n). For example, if the activity is carried out for 5 months a year, then for each month of the season you need to write off 1/5 of the annual depreciation rate.

IMPORTANT! For tax accounting purposes, the situation with depreciation of fixed assets is different. Clause 3 Art. 256 of the Tax Code of the Russian Federation does not provide for the exclusion of fixed assets from depreciable property due to their seasonal use. Just as the Tax Code of the Russian Federation does not provide for seasonal depreciation using the method used in accounting. For tax purposes, depreciation in agriculture is calculated in accordance with the Tax Code of the Russian Federation, which leads to the formation of temporary tax differences during seasonal work.

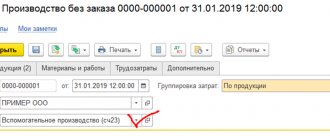

Account 23 in accounting

To account for the costs of auxiliary production in accounting, calculation account 23 is used:

- the debit of the account records the costs of auxiliary production;

- the loan reflects the actual cost of auxiliary production services provided to the main production or third-party customers;

- The account balance at the end of the month shows the value of work in progress:

Analytical accounting for accounting account 23 is carried out by type of production.

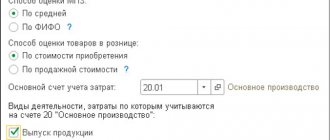

Cost/Expense Accounting

The accounting of a manufacturing enterprise reflects direct and indirect costs. The composition of both must be fixed in the company's accounting policies. Most often in the manufacturing sector, direct costs include:

- cost of materials (basic, auxiliary);

- salary, mandatory insurance contributions;

- depreciation of production equipment and machinery.

Costs that are not included in the specified list are recognized as indirect.

The cost of finished products in tax accounting is estimated at the cost of direct expenses. The latter are not entirely related to production. Work in progress must be taken into account.

Postings to account 23 “Auxiliary production”

Correspondence and main entries for the “Auxiliary Production” account are presented in the table below:

| Dt | CT | Wiring Description | A document base |

| 08.03/01 | 23/08.03 | Capitalization of OS from your repair shop | OS-1, 301-APK |

| 10 | 23 | Cost of services for delivery of materials from suppliers | 134-APK, 4-P, 4-S, 301-APK |

| 15 | 23 | Reflection of auxiliary production services when procuring materials | Calculation of distribution of services, 301-APK |

| 20.03 | 23.01 | Reflection of the repair of equipment/mechanisms of industrial (auxiliary) production in your repair shop | 302-APK |

| 21 | 23.01 | Own semi-finished products taken into account | 264-APK, Report on distribution of services |

| 23 | 23 | Counter services of auxiliary productions | 301-APK, Accounting certificate |

| 28 | 23 | Attribution of the cost of rejected products (works/services) of auxiliary production | Product defect report, Accounting certificate |

| 29 | 23 | Attribution of the cost of work/services of auxiliary production for servicing production facilities/farms | 301-APK, TTN, etc. |

| 41 | 23 | Capitalization of auxiliary production products | Accounting certificate, Acceptance note |

| 23 | 68 | Calculation of payments to road funds | Accounting information |

| 23 | 69 | Calculation of the unified social tax to the Social Insurance Fund, Pension Fund, etc. | T-49, Calculation of determining the share of the single tax, Accounting certificate |

| 23 | 70 | Calculation of wages to employees | T-49,136-APK, 137-APK, etc. |

| 23 | 71 | Payment of various expenses through accountable persons | AO-1 + documents for the purchase of MPZ |

| 23 | 73.03 | Write-off as expenses compensation for the use of personal cars of personnel for production needs | Agreement for the use of personal transport, Accounting certificate |

| 23 | 76.08 | Reflection by the tenant of the rental amount (on the balance sheet) | Lease agreement, Calculation of payments under the agreement, Accounting certificate |

| 23 | 91.01 | Reflection of surplus work in progress | INV-19, Manager's Order |

| 23 | 94 | Inclusion in costs of the cost of missing MC/losses | INV-3, INV-19, Manager's order |

| 23 | 96 | Inclusion in costs of deductions to the reserve for future expenses/payments of auxiliary production | Accounting certificate, Calculations of reserves |

Land as the main means of production in agriculture

Land holds a special place in agriculture. This is the main object of fixed assets and the main subject of labor application. At the same time, land has significant differences from other means of production:

- does not wear out or depreciate;

- when used correctly, it can improve its properties (for example, in terms of increasing fertility);

- is not a human-made object;

- the land plot cannot be manufactured, replaced, or moved.

All this leads to the peculiarities of land accounting:

- Land plots can be used by an enterprise on the right of ownership, use or lease. Accordingly, accounting should be conducted in such a way that analytics on this aspect are provided both on the balance sheet and on off-balance sheet accounts.

- When registering the land, it is valued:

- by purchase costs;

- the value of the property exchanged for the land plot (in case of exchange);

- market value on the date of capitalization (if received free of charge);

- agreement of the parties (with a contribution to the management company).

If none of the above methods are suitable, the land is valued at the standard price.

IMPORTANT! The definition of the standard price of land is given in Art. 25 of the Law of the Russian Federation “On Payment for Land” dated October 11, 1991 No. 1738-I. The standard price is a value that is determined based on the potential income from a specific land plot over the estimated payback period.

- Land analytics is provided in terms of at least:

- existing agricultural land (they, in turn, are divided by use: arable land, perennial crops (orchards, vineyards), pastures, hayfields, etc.);

- fallow lands (resting to restore fertility);

- areas of forests and tree and shrub plantings (protective strips for other land use objects);

- lands under water and at the stage of reclamation;

- lands under roads, runs and clearings;

- lands for public buildings;

- other lands depending on their purpose and use.

- Accounting is carried out using standard accounts and postings for non-current assets. For example, the acquisition of a plot of land into ownership is reflected as follows:

- Dt 08 Kt 60, 76, 75, 98 - ownership of land acquired;

- Dt 01 Kt 08 - the land was accepted for balance according to the act.

NOTE! For operations with land, there are separate forms of primary registration, approved by order of the Ministry of Agriculture of the Russian Federation dated May 16, 2003 No. 750. For example, for the capitalization of agricultural land (land), form 401-APK is used.

Examples of transactions and postings on account 23

Example 1. Carrying out work for the needs of a third party

Let's say the repair organization Vesna LLC has auxiliary production. Based on the results of the work for Leto LLC, the revenue of the auxiliary workshop amounted to 59,000 rubles, incl. VAT – 9,000 rubles, expenses for performing work – 29,000 rubles.

In Vesna LLC, the performance of work for the needs of a third-party organization is reflected in the following entries in account 23:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 23 | 10/70/69 | 29 000 | Costs for work performed are taken into account | 261-APK, 264-APK, 267-APK, 265-APK, 136-APK, 137-APK, T-49, Accounting certificate |

| 62 | 90.01 | 59 000 | Sales revenue taken into account | Repair work acceptance certificate |

| 90.02 | 23 | 29 000 | Expenses written off | Report on the distribution of auxiliary production services, 301-APK |

| 90.03 | 68 VAT | 9 000 | VAT charged | Repair work acceptance certificate |

| 90.09 | 99 | 21 000 | Reflection of the financial result (profit) from sales at the end of the month | Repair Work Acceptance Certificate, Accounting Certificate |

Separation by production cycles

Another feature of agriculture is that the production cycle often does not coincide with the reporting year. An example is the cultivation of winter crops, which are sown in the fall of one year and harvested in the spring or summer of the next.

As a result, in the accounting of agricultural organizations, it is accepted to differentiate production costs by periods (years):

- costs of past periods (years) for the current harvest;

- expenses of the current period for the future harvest;

- expenses of the current period for the harvest in it.

To organize the distribution of direct costs, analytical subaccounts are opened on account 20. For example, 20/production of the reporting year and 20/production of the next year.

An additional nuance exists for distributed expenses. They are independent intermediate objects of cost accounting (see paragraph 44 of the methodological recommendations of the Ministry of Agriculture of Russia, approved by Order of the Ministry of Agriculture dated 06.06.2003 No. 792). That is, during the year, these expenses are taken into account in separate analytical accounts, and at the end they are distributed to cost analytics by year - for the harvest of the current year and the future.

Another nuance of cost formation, arising from the biological characteristics of agriculture, is the use of planned and actual costs.

A shifted production cycle is characterized by cost accounting at planned costs during the calendar year. The actual cost is determined once on the last day of the year through a special calculation. Identified deviations between fact and plan include:

- for products already sold in the reporting year - to the account of 90;

- the balance of finished products in warehouses - to account 43.

Example 2

Agronom LLC decided to sow winter wheat in 2022. In addition, the LLC also sows other grain crops. In 2022, it was discovered that frosts had killed about 20% of the winter crop.

In September 2022, the LLC made the following entries: Dt 20 (harvest 2016) Kt 10, 70, 69 - for the amount of direct actual costs for sowing winter crops - 1,000,000 rubles.

In December 2022, the LLC calculated the actual cost for 2022:

- Dt 20 (harvest 2017) Kt 20 (depreciation of fixed assets) - 200,000 rubles. (depreciation of used fixed assets distributed among types of crops for the current year’s harvest is written off);

- Dt 20 (harvest 2018) Kt 20 (depreciation of fixed assets) - 100,000 rubles. (distributed depreciation is written off for next year’s harvest);

- Dt 43 Kt 20 (harvest 2017) - 200,000 rubles. (deviations of the fact from the plan are written off to the account of finished products of the current year).

In May 2022:

- Dt 20 (harvest 2018) Kt 10, 60, 70, 69 - 400,000 rub. (the costs of harvesting winter crops are taken into account at the planned cost);

- Dt 43 Kt 20 (harvest 2016) - 1,500,000 (1,000,000 + 100,000 + 400,000) rub. (the current cost of the winter crop harvest in 2018 has been formed);

- Dt 91 Kt 20 (crop loss - 2018) - RUB 300,000. (the loss from the destruction of crops is reflected in the accounting);

- Dt 90 Kt 43 - 1,500,000 rub. (the cost of sold winter crops has been written off).

In December 2022, the LLC will need to complete calculations for the winter crop harvest - 2022:

- Dt 20 (harvest 2018) Kt 20 (depreciation of fixed assets) - 100,000 rubles. (distributed depreciation of fixed assets for the 2022 season was written off);

- Dt 90 Kt 20 (destruction of crops) - 300,000 rubles. (the cost of the sold crop was reversed for the amount of loss from the loss of crops);

- Dt 90 Kt 20 (harvest 2018) - 100,000 rub. (the cost of the sold crop was adjusted by the amount of distributed expenses).