Officially working citizens have the right to various labor benefits according to legal requirements. These include annual leave and the possibility of obtaining a sick leave certificate. Based on this document, a temporary disability benefit is assigned, the amount of which depends on the duration of absence from work and the average amount of earnings.

Since the employer pays contributions to state funds and taxes from the salaries of his hired specialists, the question arises whether these payments are transferred from sick leave benefits.

Are sick leave insurance premiums covered by the employer?

According to Art. 183 of the Labor Code, all citizens who are sick and issue a certificate of incapacity for work receive benefits for all days of absence from work. According to the general rules, this payment is not subject to insurance premiums, which is confirmed by the provisions of Art. 422 NK. Therefore, hospital payments do not transfer funds to social, pension or health insurance.

Reference! Such rules apply not only to funds paid by employers, but also to money transferred from the Social Insurance Fund.

The benefit is assigned exclusively to persons who are officially employed citizens, therefore, for them, the employer makes monthly contributions to the Social Insurance Fund. The current rate is 2.9% of earnings.

Therefore, these funds are withdrawn from a citizen’s salary so that in the future, when going on sick leave, the person can receive the optimal amount. The first three days are paid for by the employer, after which Social Insurance Fund funds are used. The benefit received on sick leave is not considered a salary, but is represented by a social payment on which insurance contributions are not charged.

Calculation of benefits for sick leave

Payment of sick leave benefits is made to insured persons (clause 1, part 1, article 2 of Federal Law No. 255-FZ of December 29, 2006, hereinafter referred to as Law No. 255-FZ):

- employees with whom the organization has concluded employment contracts: for temporarily staying foreign citizens and stateless persons, benefits are paid only if the employer paid insurance premiums for them at least 6 months before the month of the occurrence of the insured event (Part 4.1 of Article 2 of Law No. 255 -FZ);

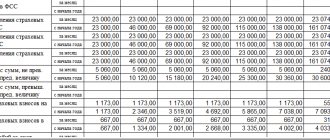

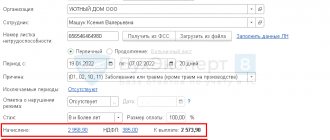

Calculation of benefits for temporary disability is made based on average earnings, the number of days of incapacity and depends on the length of the employee’s insurance period:

Average daily earnings are calculated using the formula (Part 3, Article 14 of Law No. 255-FZ):

The billing period is 2 calendar years preceding the year of the insured event (Part 1, Article 14 of Law No. 255-FZ).

The amount of earnings for the billing period includes all payments subject to insurance contributions (Part 2, Article 14 of Law No. 255-FZ).

Average earnings are limited by maximum and minimum values.

The maximum base for calculating contributions was:

- in 2022 - 815,000 rubles.

- in 2022 - 865,000 rubles.

Maximum in 2022 - (755,000 + 815,000) / 730 = 2,150.68 rubles.

The minimum wage is:

- from 01/01/2019 – 11,280 rub.

Minimum - (11,280*24) / 730 = 370.85 rub.

Percentage of experience:

- 60% - if the employee’s insurance coverage is up to 5 years;

- 80% - with insurance experience from 5 to 8 years;

- 100% - with insurance experience of more than 8 years;

- if the length of service is less than 6 months: in an amount not exceeding the minimum wage for a full calendar month, incl. taking into account regional coefficients, if they are applied;

- from the date of violation - in an amount not exceeding the minimum wage for a full calendar month.

For a dismissed employee:

- 60%, if no more than 30 calendar days have passed since the date of dismissal.

Caring for a sick child:

- for outpatient care: the first 10 days - depending on the employee’s length of service;

- subsequent days - in the amount of 50% of his average earnings;

When caring for a sick family member (not a child):

- in an outpatient setting - depending on the employee’s length of service.

The benefit is calculated for calendar days and all sick days indicated on the certificate of incapacity for work are paid (Article 6 of Law No. 255-FZ).

The benefit is not assigned during the periods (Article 9 of Law No. 255-FZ):

- release from work for any reason - with or without pay, with the exception of the period of annual leave;

- suspension from work in accordance with the law;

- downtime, except in the case where the disability began before the start of the downtime and continues during its period;

- forensic medical examination, arrest, detention.

Temporary disability benefit:

- appointed: no later than 10 calendar days from the date of the employee’s application;

- for the first 3 days of illness - at the expense of the policyholder (employer);

- together with the next salary (Part 1, Article 15 of Law No. 255-FZ).

For the first three days of illness (at the expense of the employer):

- in accounting: labor costs;

- Dt of the cost account, according to which the salary is calculated Kt.

- as part of other expenses, such as labor costs (clause 48.1, clause 1, article 264 of the Tax Code of the Russian Federation);

Benefits at the expense of the employer are subject to personal income tax (clause 1 of Article 217 of the Tax Code of the Russian Federation) and are not subject to insurance contributions (clause 1 of clause 1 of Article 422 of the Tax Code of the Russian Federation).

For the following days - at the expense of the Social Insurance Fund:

- in BU: Dt 69.01 Kt;

- not included in expenses.

Benefits at the expense of the Social Insurance Fund are subject to personal income tax (clause 1 of Article 217 of the Tax Code of the Russian Federation) and are not subject to insurance contributions (clause 1 of clause 1 of Article 422 of the Tax Code of the Russian Federation)

The expenses of the simplified tax system reflect only sick leave at the expense of the employer, i.e. for the first three days (clause 1, clause 2, article 3 of the Federal Law of December 29, 2006 N 255-FZ, clause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Sick leave at the expense of the Social Insurance Fund, incl. Personal income tax from it is not recognized as expenses of the simplified tax system.

If an advance was previously given to an employee, then at the time sick leave is accrued, only the amount payable at the employer’s expense can be taken into account in expenses, i.e. excluding personal income tax.

Personal income tax on sick leave at the expense of the employer is accepted as expenses at the time of payment.

Deadline for paying personal income tax on income in the form of temporary disability benefits:

- the last day of the month in which their payment was made (paragraph 2, paragraph 6, article 226 of the Tax Code of the Russian Federation).

See also:

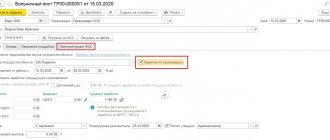

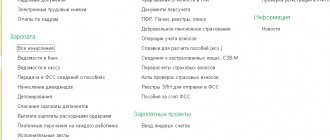

- Accrual of sick leave in 1C 8.3 Accounting step by step

- How to extend vacation due to sick leave in 1C

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Calculation of sick leave benefits...

- Calculation of sick leave benefits...

- How to reflect in 6-NDFL the situation when the deduction “ate up” the amount of sick leave? (from the recording of the broadcast on July 11, 2019) You do not have access to view To gain access: Complete a commercial…

- Inclusion in the calculation base of the amount of benefits at the expense of the Social Insurance Fund (ZUP 3.1.18) Some employers pay an additional amount before the salary to the temporary benefit…

When are insurance premiums transferred from benefits?

Contributions are levied on temporary disability benefits if the benefit amount is above the established maximum. Under such conditions, for the first three days the employer is not only obliged to pay sick leave funds, but also pay a certain amount to the Social Insurance Fund. The current maximum value is 865 thousand rubles.

For example, an accountant receives a salary of 55 thousand rubles. per month. For 2 years of work, the average salary is 1 million 320 thousand rubles.

The calculation is carried out in the following steps:

- average earnings for 3 days is: 1320000/731*3=5417 rubles;

- based on the maximum payment, average earnings should not exceed 6894 rubles;

- therefore, insurance payments are transferred from the difference between these indicators: 6894-5417 = 1477 rubles.

If a hired specialist is a member of a trade union organization, then he is obliged to make monthly appropriate payments. But if a person receives sick leave benefits, then he does not have to worry about reducing this amount.

Trade union dues are levied exclusively on income, and benefits are represented by social payments, so funds are not deducted from them to the Pension Fund or Social Insurance Fund. But on benefits assigned in connection with temporary disability, you have to pay income tax, amounting to 13% of the payment. This fee is the only payment from social benefits, which is of an average size.

Attention! If sick leave is issued for pregnancy and childbirth, then not only insurance payments, but also personal income tax are not collected from them.

Insurance premiums are charged in the following situations:

- Calculation of benefits in the amount of 100% for an employee who does not have the required length of service. Such an initiative on the part of the employer acts as an accrual of additional income. Therefore, all required government payments are collected from the excess. For example, if a citizen’s work experience is less than 5 years, then the benefit amount is 60% of earnings. But the head of the company can, on his own initiative, increase the payment to 100%. But if you exceed the amount, you have to pay insurance premiums equal to 2.9%. From the 4th day, funds are transferred from the Social Insurance Fund. Typically, such a decision to increase benefits is made by the employer for valuable employees who have little experience but bring high profits to the company. The state does not provide for additional payments, therefore, for such a decision, company managers are required to pay insurance premiums.

- The Social Insurance Fund denies the employee benefits. This decision often arises due to illiterate documentation on the part of the employer. Sometimes there are problems coordinating payments with government agency representatives. The heads of organizations that care about the health of their hired specialists decide to assign them a payment at their own expense. But such transfers do not act as social benefits and are therefore recognized as income. They have to contribute funds to various state funds and the Federal Tax Service.

An employer obliged to transfer insurance premiums from sick pay must take into account the deadlines established by law, otherwise the director of the company will be held administratively liable. Therefore, money is paid before the 15th of the next month. At the same time, the payment order is retained, which serves as evidence of the fulfillment of obligations by the employer.

Income not subject to contributions

3. Amounts of employer contributions paid by the employer in favor of the employee for a funded pension. The limit is no more than 12,000 rubles per year per employee.

4. Amounts of employer contributions paid in accordance with the legislation of the Russian Federation on additional social security (giving the right to a monthly supplement to pension) for certain categories of employees:

- in the coal industry (directly employed full-time in underground and open-pit mining operations for the extraction of coal and shale and in the construction of mines, longwall miners, miners, jackhammer operators, mining machine operators) - for organizations specified in the decree of the Government of the Russian Federation dated October 11, 2010 No. 798;

- members of flight crews of civil aviation aircraft (the list of positions was approved by Decree of the Government of the Russian Federation of March 14, 2003 No. 155).

5. Amounts paid to individuals by election commissions, referendum commissions, as well as from the election funds of candidates for elective public positions.

6. The cost of uniforms and uniforms issued to employees in accordance with the legislation of the Russian Federation, if it is issued to them for temporary use, its value is listed on the organization’s balance sheet, is issued for use only at work when performing labor functions and is handed over by employees upon dismissal (that is, the right ownership of the clothing remains with the company).

7. The cost of travel benefits provided by the legislation of the Russian Federation to certain categories of workers: judges - payment of the cost of travel to the place of rest and back; students studying by correspondence at state accredited universities - payment of travel once per academic year to the place of performing laboratory work, taking tests and exams, preparing and defending a diploma project (work).

8. The amount of financial assistance provided by employers to their employees is no more than 4,000 rubles per employee per billing period.

9. Amounts of tuition fees for basic and additional professional educational programs, including for vocational training and retraining of workers (as a rule, at the initiative of the employer).

10. Amounts paid to employees to reimburse the costs of paying interest on borrowed funds received by them for the purchase and (or) construction of residential premises (without restrictions on the amount).

11. Amounts of monetary allowance and other payments received in accordance with the legislation of the Russian Federation:

- military personnel;

- members of the rank and file of the internal affairs bodies of the Russian Federation, the federal fire service;

- persons in command of the federal courier communications;

- employees of the penal system, customs authorities and authorities for control over the circulation of narcotic drugs and psychotropic substances.

12. Payments to prosecutors, investigators, judges of federal courts and justices of the peace in terms of contributions payable to the Pension Fund.

13. Payments in favor of full-time students in educational institutions of secondary vocational and higher vocational education for activities carried out in a student group under labor or civil contracts, in terms of mandatory pension contributions.

Will the insurance payment change when benefits are transferred?

Company managers save if the payment amount does not exceed the established limit. If the amount exceeds this figure, then you will have to transfer insurance premiums from the excess.

According to Art. 430 of the Tax Code of the Social Insurance Fund compensates the heads of enterprises for the amounts spent on transferring money to employees on sick leave.

But there are exceptions in which it is impossible to reduce insurance transfers by the employer.

These include situations:

- a certificate of incapacity for work is issued on the basis of an injury received by a citizen during the performance of work duties;

- the benefit is paid on the basis of an illness acquired while working in dangerous or harmful conditions;

- the company operates using OSNO, and the employee works in two directions, and in one such direction it is required to pay tax according to UTII.

Therefore, when receiving compensation, the chosen tax regime and the reasons for the employee’s illness are taken into account.

Sources of payment of temporary disability benefits

The employee's illness period can be paid from two sources - from the employer's funds or from the social insurance fund.

| Type of benefit | At the expense of the employer | At the expense of the Social Insurance Fund |

| Employee illness | First 3 days | The rest of the illness |

| Caring for a sick child | The entire period of the child’s recovery | |

| Maternity benefit | In full at the expense of the Social Insurance Fund |

To accept sick leave for credit, it is necessary that at the time of the onset of illness an employment contract was concluded between the employee and the employer. Periods of absence from work due to injury resulting from unlawful acts are not paid.

| ★ Best-selling book “Calculating sick leave and insurance premiums in 2018” for dummies (understand how to calculate insurance premiums in 72 hours) 3000+ books purchased |

Imposition of insurance premiums on maternity benefits

If an employee becomes pregnant, then before the birth of the baby she has the right to go on maternity leave, receiving sick leave payments. Insurance premiums and personal income tax are not charged from this amount. This is provided for by the provisions of Art. 217 NK.

No other taxes or contributions are charged on the B&R benefit. Therefore, if for some reason the employer takes extraneous funds from the payment, the employee can contact the labor inspectorate to bring the violator to justice.

Benefit amount

Disability benefits or simply sick leave are paid to employees as follows:

- the first 3 days of illness are paid from the employer’s funds;

- the subsequent period of incapacity for work - from the Social Fund.

The amount of sick leave is calculated using the formula:

Benefit amount = Average daily earnings x % of payment x Duration of sick leave in days

What is payment percentage? This is a value that depends on length of service. The longer the employee’s experience, the greater the percentage of average earnings he receives during sick leave. If the experience is less than 6 months, then the minimum wage is used instead of the average salary; if the experience is more than 8 years, 100% of the average daily earnings are paid.

To calculate the average daily earnings, the amount of the employee’s income is taken 2 years before the start of the year in which he was accrued sick leave. In other words, this year you need to take information about the employee’s income for 2016-2017. The following formula is applied:

Average daily earnings = Base / 730,

- where the base is the amount of payments to the employee made over the two previous years from which insurance premiums were calculated;

- 730 — number of days in the billing period.

In this case, the base cannot exceed a certain limit value , which is established for the year for calculating the amount of insurance contributions to the Social Insurance Fund. The limit values are:

- for 2016 - 755,000 rubles;

- for 2022 - 718,000 rubles;

- for 2022 - 815,000 rubles.

We recommend reading the article “Note for an Accountant: How to Calculate Sick Leave,” which explains in what cases disability benefits are accrued, and also provides an algorithm and example for calculating sick leave benefits.

Are disability benefits subject to insurance premiums? In general, no. This applies to both the part of the sick leave that is paid at the expense of the employer and the part that comes from the Social Insurance Fund.

But in some cases, insurance premiums must be calculated from the amount of sick leave. We'll talk about this in more detail below.

Please note that by the amount received from the Social Fund, the employer has the right to reduce the amount of social insurance contributions due to illness and maternity.

Common Mistakes

If the head of a company or accountant makes mistakes when filling out a sick leave certificate, this leads to an incorrect calculation of the payment. They arise due to various factors, for example, an accountant may make an arithmetic error, and software failures often occur.

If such errors are detected, recalculation must be carried out. This leads to underpayment or overpayment. If the employee did not receive a certain amount, then he is paid the due funds. In this case, the amount is divided into two parts, since one is appointed by the employer, and the second is issued by representatives of the Social Insurance Fund. After recalculation, the money is paid on the day you receive your salary.

Important! Attention! company, so he additionally transfers compensation to the employee for each day of delay.

If it turns out that the employee received more funds than he was entitled to, he will have to return the excess. But if the error occurred due to the fault of the employer, then the citizen may refuse to return the money. If he agrees with the manager’s demand, then he draws up a written permission to withhold a specific amount from the salary.

Registration

Payments for business trips both within and outside the territory of Russia are not subject to insurance contributions:

- daily allowance within the limits established by clause 3 of Art. Art. 217 of the Tax Code of the Russian Federation, - 750 rubles. for business trips in Russia and 2500 rubles. — for foreign business trips (until January 1, 2022, daily allowances were not subject to insurance contributions in the amount established in the collective agreement);

- actually incurred and documented travel expenses to and from the destination;

- fees for airport services (except for VIP lounge services);

- commission fees;

- expenses for travel to the airport or train station at places of departure, destination, transfers;

- baggage costs;

- living expenses. Expenses for renting accommodation during a business trip are subject to insurance premiums if the employee does not provide documents confirming payment for accommodation;

- expenses for payment of communication services;

- fees for processing and registering a service passport;

- visa fees;

- expenses for exchange transactions with cash foreign currency.

The amount of payment for a visa and medical insurance, the availability of which is a prerequisite for obtaining a visa when sending an employee on a business trip to the territory of foreign countries, is not subject to insurance premiums. Even if such a business trip abroad is canceled (that is, the trip did not take place), the amounts paid by the employer for a visa and compulsory medical insurance for the employee are still not subject to insurance premiums, since the qualifications of this type of payment do not change (attachment to the letter of the Federal Social Insurance Fund of Russia dated April 14, 2015. No. 02-09-11/06-5250).

The amount of reimbursement for expenses associated with an employee's trip on a one-day business trip (payments in lieu of daily allowance) is not subject to insurance premiums only if there are documents confirming the expenses incurred. These are checks, receipts, invoices for the provision of services and work. Without confirmation, such payments should be included in the base for calculating contributions, including contributions for injuries (letter of the Ministry of Labor of Russia dated April 1, 2015 No. 17-3/B-156).

Employees whose permanent work is carried out on the road or has a traveling nature are reimbursed for travel expenses, rental housing, daily allowance or field allowance (Article 168.1 of the Labor Code of the Russian Federation). The procedure for reimbursement of expenses associated with business trips of certain categories of employees and the amount of compensation are established by a labor agreement, collective agreement or other local regulation.

However, based on the provisions of Articles 164 and 168.1 of the Labor Code, compensation should be aimed specifically at reimbursing employees for expenses incurred, including those related to living outside their place of permanent residence (per diems). This means that the corresponding costs of “traveling” workers must be documented. It is also necessary to confirm that the work of individuals in their positions who receive compensation is of a traveling nature. Only under such conditions, compensation, including daily allowances, are exempt from insurance premiums (letter of the Ministry of Labor of Russia dated December 28, 2015 No. 17-3/B-641).

The Supreme Court has a similar position in its Determination of August 11, 2022 No. 310-KG17-10343. Let's take a closer look.

The company’s local regulations establish that when an employee is sent on a one-day business trip, he is paid a daily allowance in the amount of 500 rubles per day. And if an employee who returned from a one-day business trip went on a new one-day business trip on the same day, then for that day he received double the daily allowance (i.e. 1000 rubles). FSS inspectors stated that daily allowances for one-day business trips are not provided for by law, so insurance premiums must be charged on these payments.

The Supreme Court sided with the company, pointing out the following. Based on the social orientation and economic content of these payments, they can be recognized as compensation aimed at reimbursing the expenses of employees whose work is of a traveling nature. And such payments are not subject to insurance premiums, since they cannot be qualified as remuneration for the employee’s performance of labor functions. In addition, an employee’s economic benefit may arise when, as an exception to the established rules, he is paid an amount greater than that provided for in a collective agreement or local regulation. In this case, employees received “daily allowances” in the amount established by the order of the company.