Controllers reason as follows. Accountable amounts for which the employee has not reported are his debt to the company. The organization has the right to withhold the debt from the debtor's salary no later than one month from the day when the deadline for submitting the advance report has expired (Article 137 of the Labor Code of the Russian Federation). If the employer does not withhold money, the tax authorities have the right to recognize this amount as a payment in favor of the employee within the framework of labor relations and impose insurance contributions (subclause 1, clause 1, article 420 of the Tax Code of the Russian Federation, clause 5 of the appendix to the letter of the Federal Tax Service of Russia dated April 14, 2015 No. 02-09-11/06–5250). In addition to additional assessments, tax authorities will also fine the company for non-payment and for distortion of personalized accounting information. If the employee later reports for the accountable amounts, the organization has the right to recalculate contributions. However, all this can be avoided if you follow the rules.

The lack of economic benefit will be proven by the company’s attempts to return the money

If the tax authorities make a claim, it would be advisable for the company to try to return the money during the audit. For example, if the amount of accountable funds is significant, enter into a written agreement with the employee that he will return the money in installments over a long period of time. The lack of income will be proven by the very fact of such an agreement and the first returns. The fact that an employee has violated the deadline for submitting an advance report is not a reason to charge additional personal income tax.

In one case, the director of the company did not report on accountable funds for more than a year. During this time, the debt grew to 88 million rubles. Tax officials did not miss the chance to get additional funds into the budget and offered the company to withhold personal income tax from this amount, imposed a fine and accrued additional penalties. The organization managed to win the dispute - the accountant and the company converted part of the amount into a loan, the director returned part of the amount to the company's cash desk, and the company returned part of it in court. The company decided to withhold the remainder from the salary in the amount of 50 percent.

The inspectors tried to challenge such re-registrations and returns, since they occurred after the inspection. But the court sided with the company. By default, accountable amounts are issued with the condition of reporting or return. Inspections must prove otherwise. They did not provide evidence that the employee received an economic benefit. All their arguments in favor of additional charges were based only on the violation of the deadline for submitting the advance report. The company tried to repay the debt, even after a tax audit. Consequently, in fact, the employee did not receive income, therefore fines and penalties are unlawful (Resolution of the Central District Administrative District dated July 19, 2016 No. F10-2385/2016).

The AC of the Central District agreed with this decision in its resolution dated November 2, 2016 No. F10-3997/2016. During the trial, the director will present documents regarding some of the funds issued. He returned the other part to the cashier. The court overturned the decision on additional assessment.

Return of the accountable amount to the cashier

The accountable person is obliged to return the cash to the cash desk if, at the end of a business trip or after a business transaction, the employee has a balance of unused funds, as well as in a situation where the production operation was canceled for one reason or another. We will describe in more detail below the procedure for recording and processing the return of the imputed amount to the cash desk.

General procedure

In most cases, the return of accountable amounts to the enterprise's cash desk is carried out due to the fact that the amount of the advance issued against the account exceeded the actual expenses of the employee, and, as a result, a balance of unused funds has formed that must be returned.

According to current legislation, a citizen is obliged to return the accountable amount no later than the end of the third working day following:

- the day the business trip ends (including days of return home);

- on the day of a business transaction (purchase of materials, payment for goods/services).

The return operation is reflected in the following accounting entry:

| Dt | CT | Description |

| 50 | 71 | The balance of unused funds issued as a report for a business trip or economic needs was returned to the company's cash desk. |

The basis for returning the unused amount is an advance report and documents confirming expenses (travel tickets, receipts for payment of accommodation, checks for payment of household expenses, etc.).

Let's look at an example . On 08/01/2022, an order was issued to send the sales manager of Factor LLC Vasyukov on a business trip to Tula for 4 days (08/06/2022 – 08/09/2022).

On 08/02/2022, Vasyukov filled out an application for the issuance of funds on account as an advance for an upcoming business trip in the amount of 6,300 rubles, including:

- daily allowance for 4 days – 2,800 rubles. (700 rub. * 4);

- travel to Tula and back by bus – 1,200 rubles;

- accommodation in Tula (2 days) – 2,300 rubles.

Based on a statement signed by the director of Factor LLC, an order was issued to issue funds to Vasyukov in cash through the cash register. Accountable funds were issued to Vasyukov on 08/02/2022, an expense cash order was issued, the accounting reflected the following entries:

Dt 71 Kt 50.

On 08/09/2022, Vasyukov returned from a business trip, and on 08/10/2022 he provided an advance report to the Factor accounting department indicating actual expenses in the amount of rubles, including 6,045 rubles:

- daily allowance for 4 days – 2,800 rubles. (700 rub. * 4);

- travel to Tula and back by bus – 1,140 rubles;

- accommodation in Tula (2 days) – 2,105 rubles.

The balance of unused funds is 255 rubles. (6,300 rubles – 6,045 rubles) Vasyukov returned to the cashier on 08/11/2022. The cashier issued a cash receipt order for accepting the money. The accounting reflects the following posting:

Dt 50 Kt 71.

Refund upon trip cancellation

The need to return the accountable amount may arise when a business trip is canceled in the event that funds in the form of an advance have already been issued to the accountable person.

The return of the accountable amount to the cash desk in such situations is processed in the following order:

- The HR department employee issues an order to cancel the business trip. The order is signed by the head of the organization, after which the document is handed over for notification to the employee who was previously given an advance for the business trip.

- Based on the order to cancel the business trip, the employee returns to the cash desk the entire accountable amount received previously.

The deadline for refunding funds when a business trip is canceled is no later than the day following the day the corresponding order is issued.

Refunds upon cancellation of a business trip are not accompanied by an advance report. The basis for the return of the accountable amount is an order to cancel the trip. It is the number and date of the order that the cashier indicates in the receipt order as the basis for the return of funds, and the accountant - when reflecting transactions in accounting.

It is better to issue money for a long term. It's safer

The company has the right to set a separate deadline for each accountable amount. This needs to be fixed in an order or memo. You can prescribe a single reporting deadline for everyone or fix different deadlines depending on the level of the position or the purpose of the money. For example, an accountant has three months to buy rare parts and report on these expenses. The deadline for the report on the purchase of household needs is three working days.

However, the above orders must be created in advance. In one of the cases, the company set a period of 24 months for reporting on funds. But she lost the trial because she presented an order for such a long term during the trial. During the audit of the company, the tax authorities did not see him. The judges considered the company’s actions to be an evasion of additional charges, and therefore did not take the order into account (resolution of the Third AAS dated September 28, 2015 No. 03AP-4126/2015).

Issuance of accountable amounts

Most often, cash is issued for reporting:

- as an advance on travel expenses;

- for household needs (for the purchase of office and household goods, gasoline at gas stations, for paying for minor repairs, etc.).

When issuing money on account, remember that you cannot give accountable amounts to an employee who has not accounted for previously received money (clause 6.3 of the Instruction on the conduct of cash transactions, approved by the Bank of Russia dated March 11, 2014 No. 3210-U).

If you gave an employee money from the cash register on account, make an entry to the debit of account 71:

DEBIT 71 CREDIT 50

– the employee was given an accountable amount from the cash register.

If you miss the statute of limitations, you will have to pay personal income tax

If more than three years have passed since the date on which the employee was supposed to account for the accountable amounts or return them, the statute of limitations is considered to have expired. The company will not be able to repay the overdue debt even through court. In such cases, judges recognize that the employee received an economic benefit, which is subject to personal income tax (Resolutions of the North-Western District No. F07-5021/2016 dated 07/14/16, Central District No. F10-3997/2016 dated 11/02/16). If the statute of limitations has not expired, the accountable money is the employee’s debt (Resolution of the Fourth AAS dated March 25, 2015 No. 04AP-726/2015).

To protect themselves, organizations sign agreements with employees to repay the debt in installments, acts of reconciliation, or receive letters from them acknowledging the debt. In these ways, companies trigger the limitation period in a new circle (Article 203 of the Civil Code of the Russian Federation, paragraph 20 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated September 29, 2015 No. 43). But the reconciliation report or other documents must be signed before the expiration of the statute of limitations, otherwise they will not save you from the claims of the tax authorities (Resolution of the AS of the North-Western District dated July 14, 2016 No. F07-5021/2016).

It is necessary to indicate the basis for issuing accountable funds

Money issued on account cannot be considered a labor payment to an employee, as recognized by the Volga Region Autonomous District, Resolution No. F06-3232/2015 dated 12/09/15. The company issues funds so that the employee purchases goods or work for its needs. Money and goods do not become the property of the accountable. The absence of supporting documents does not prove that the employee received an economic benefit. The AS of the West Siberian District came to the same conclusion in its resolution dated September 30, 2014 No. A27-16522/2013.

Accountable funds cannot be considered payments under an employment contract, which means that insurance premiums do not need to be charged on them (Resolution of the Moscow District AS of December 23, 2016 No. F05-12835/2016).

A similar conclusion is contained in the resolution of the Volga District Court of December 25, 2015 No. F06-4463/2015 (upheld by the decision of the RF Armed Forces dated April 21, 2016 No. 306-KG16-3205).

However, if the organization systematically issues accountable funds to the director and does not indicate their purpose, the inspectors will file claims (Resolution of the Central District AS dated November 2, 2016 No. F10-3997/2016). Which side the court takes will depend on the circumstances of the case.

To avoid litigation, it is worth indicating the reasons for issuing money in official notes or orders: for the purchase of goods, for business needs, etc. But the purpose of accountable funds must correspond to the employee’s position. For example, the director can be given money for entertainment expenses.

In one case, the company gave money to an employee. The basis for issuing funds was the issuance of an interest-free loan to another company. The employee attached the borrower's receipt orders to the advance report. Inspectors suspected fraud and included accountable amounts in the employee’s income. The court removed the additional charges (resolution of the Arbitration Court of the North-Western District dated January 27, 2015 No. A42-3672/2012).

Regulatory regulation

The employee must return the unused amount within the period established by the employer’s local regulations (clause 6.3 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 N 3210-U). If the employee returns the unspent advance before the expiration of this period, no debt arises , so in this case we are not talking about “forced” withholding described in Art. 137-138 of the Labor Code of the Russian Federation, but about the execution by the employer of the employee’s will.

The employee has the right to dispose of his wages at his own discretion by submitting a corresponding application to the employer. At the same time, Art. 138 of the Labor Code of the Russian Federation on limiting the amount of deductions when collecting a debt does not apply in this case (Letter of the Rostrud of the Russian Federation 09/26/2012 N PG/7156-6-1). In other words, the employee can indicate in the application any amount that he would like to deduct from his salary to reimburse the subaccount.

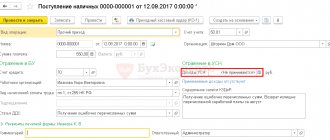

BOO. Repayment by an employee of the amount of an unspent advance from his salary, if the period for returning the funds has not expired , is reflected by posting (Instructions for using the chart of accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n, hereinafter - Instructions for using the chart of accounts N 94n, Chart of Accounts 1C ):

- Dt “Settlements with personnel for wages” Kt 71.01 “Settlements with accountable persons.”

But!

The amount of unreturned accountable funds is reflected in the account “Shortages and losses from damage to valuables” (Instructions for using the chart of accounts N 94n), if:

- the employee did not report on time;

- the expense report is not approved by the manager (costs are not approved);

- The refund deadline set by the organization has been violated.

Then the wiring looks like:

Dt “Shortages and losses from damage to valuables” Kt 71.01 “Settlements with accountable persons.”

WELL. When reporting amounts are withheld in tax accounting, no income arises (Clause 1, Article 41 of the Tax Code of the Russian Federation).

Personal income tax and insurance premiums . The amounts withheld do not affect the calculation of personal income tax and insurance premiums.

Supporting documents must be attached to the costs.

If the employee still has a debt, then the organization’s main counterargument is the ability to collect it. But if a company has already accepted an unconfirmed advance report from an employee and written off his debt, it should operate with the reality of costs. For example, the results of work, services or purchased goods. If the company paid the debt to the counterparty through an accountant, it is necessary to present acts of reconciliation with this counterparty.

In one of the legal proceedings, the organization accepted goods without documents for accounting. The employees attached to the advance reports acts of the working commission, certificates and reports, as well as orders from the director of the company for each of the accountable persons. The company considered that the individual accounted for the money. But the tax authorities did not agree with this, included these amounts in the income of employees and imposed contributions on it. The court sided with the company. He pointed out that the tax authorities did not provide evidence that the society received materials, goods, works and services free of charge. Consequently, the company paid for them, and the accountable money cannot be considered income of individuals (Resolution of the Autonomous District of the Ural District dated November 11, 2015 No. F09-7999/15). However, so far this is only one case in favor of the company, so it is not a fact that the tax authorities will also lose next time.

Accounting of settlements with accountable persons.

Accounting for settlements with accountable persons is kept on account 71 “Settlements with accountable persons” (A-P). Analytical accounting of the account is maintained for each accountable person. After issuing the money to the employee, the accountant will make the following entry:

Debit 71 – money issued on account

Credit 50 (51)

Write-off of spent accountable amounts is carried out on the basis of the approved advance report and is reflected in the credit of account 71.

WRITTEN OFF BUSINESS EXPENSES

| Type of consumption | Wiring |

| − property acquired | D 10 (08, 41) – materials were capitalized (fixed assets, K 71 goods) purchased by an accountable person When purchasing valuables in retail trade, the employee must submit a sales receipt or invoice and cash register receipt to |

| − expenses related to the needs of the main, auxiliary or service industries | D 20 (23, 29) – the expenses of the accountable person are written off as expenses K 71 main (auxiliary, servicing) production |

| − expenses related to management activities | D 25 (26) – general production expenses K 71 (general business) expenses were paid by accountable persons. |

| − expenses related to the sale of finished products or goods | D 44 – expenses of accountable persons are taken into account in selling expenses K 71 |

| − expenses for non-production activities (for example, expenses for sporting events, recreation, entertainment, etc.): | of the person reporting to K 71 are taken into account as part of other expenses |

WRITTEN OFF TRAVEL EXPENSES

| Purpose of the trip | Wiring |

| − purchase, delivery of fixed assets (equipment, cars, etc.) | D 08 – business trip costs associated with the purchase, K 71 delivery of fixed assets |

| − purchase, delivery of materials | D 10 – business trip costs associated with the purchase, K 71 delivery of materials |

| − purchase, delivery of goods | D 41 – business trip costs associated with the purchase, K 71 delivery of goods |

| − concluding agreements on the sale of products, studying sales markets in other regions, participating in exhibitions | D 44 – expenses for a business trip related to sales of K 71 |

| − participation in training seminars, shareholder meetings, other goals related to production activities | D 26 - written off the costs of a business trip necessary for K 71 management needs of the organization |

| − warranty repairs of previously sold products (if a reserve for warranty repairs has been created) | D 96 – expenses for a business trip associated with the return, K 71, transportation of defective products were written |

| − business trip of a non-production nature (for example, checking a summer camp owned by an enterprise) | D 29 (91) – business trip expenses are written off, not directly To 71 related to production activities pre- acceptance |

| − elimination of consequences of emergency situations | D 91 – the costs of a business trip related to K 71 eliminating the consequences of an emergency situation |

If the employee has an unspent balance of the advance payment , then within 3 days allotted for drawing up the advance report, it must be returned to the cash desk using a cash receipt order. In accounting, such an operation is formalized by posting:

D 50 – the balance of the advance from the accountable person is returned to the cashier

K 71

If an employee has reasonably spent money in an amount greater than the advance payment issued, then the amount of overspending is reimbursed to him from the organization’s cash desk on the basis of an approved advance report. This operation is formalized by posting:

D 71 – the employee is reimbursed for expenses exceeding the amount of the advance payment issued

K 50

If the employee does not return the accountable amount within the prescribed period, then within a month (the statute of limitations) by order of the head of the enterprise, it must be withheld from the employee’s salary. This operation is executed by transactions:

D 94 – the accountable amount not returned on time is reflected

K 71

D 70 – unreturned accountable amount was withheld from the employee’s salary

K 94

As long as the amount not paid on time is registered with the employee, it is regarded as a loan provided to him. In this case, the material benefit from the use of borrowed funds must be calculated. If the debt is written off at the expense of the organization, then this amount must be included in the employee’s total income and personal income tax must be withheld from it.

Accounting for settlements with personnel for other operations.

is maintained on account 73 “Settlements with personnel for other operations” (A - P). Sub-accounts can be opened for the account: 73-1 “Settlements for loans provided”;

73-2 “Calculations for compensation for material damage”;

73-3 “Payments for goods provided on credit”;

73-4 “Insurance calculations”, etc.

Don’t know how to solve or complete a coursework or dissertation? Order a solution

Errors in advance reports may result in additional charges

In one of the cases, the court found that the tax authorities were right, since the primary documents that the company attached to the expense report did not contain the position, surname, first name and patronymic of the person who signed them. The sales receipts did not contain the names of the goods, but only general phrases: “household expenses” or “office supplies.” There were also no dates for drawing up the documents, the columns “quantity” and “price of goods” were not filled in, there was no seller’s signature. In this case, the accountable amounts can be considered the employee’s income. This is what the Supreme Court of the Russian Federation considered in its ruling dated 03/09/16 No. 302-KG16-450. The AC of the North Caucasus District came to the same conclusion in its resolution dated May 23, 2016 No. F08-2743/2016.

In another case, the director of the company received 4.7 million rubles on account, and confirmed the expenses with contracts with individuals. They were interrogated, it turned out that the individuals had never sold materials to the company and did not receive any money from it other than salaries. In addition, the goods that were specified in the sales contracts were neither written off nor leftover materials. The court sided with the tax authorities and supported additional assessments (resolution of the Federal Antimonopoly Service of the East Siberian District dated January 24, 2014 No. A19-2278/2013).

Another example is that employees attached checks from organizations that did not have registered cash registers to the advance report. As a result, controllers included the accountable money in the income of individuals. The court supported them (resolution of the Administrative Court of the North Caucasus District dated July 7, 2015 No. F08-3967/2015).

How to reflect an unreturned report in accounting

The accountant must return the unspent money within the period for which it was issued to him. If he did not do this, he will have to recognize them as unreturned.

Such means include:

- money for which an advance report has not been submitted or has been submitted but not reasonably accepted by the manager;

- the balance of funds has not been deposited at the cash desk, despite the fact that the advance report has been submitted.

We reflect these amounts in accounting based on the accounting certificate by posting Dt 94 Kt 71 .

Useful information from ConsultantPlus

So that the inspectors have no doubt that the money was taken on account and not misappropriated by the employee, we recommend establishing rules in the organization with clear deadlines for submitting a report on the amounts spent. Moreover, such reports must be accompanied by supporting primary documents (read more...).

The regularity of payments will prove their salary nature

If employees have not yet reported on the previous amounts, the procedure for maintaining the cash register prohibits issuing new amounts to them for reporting. But many companies do not pay attention to this ban. In one of the cases, an individual entrepreneur transferred money monthly to the cards of his employees for several years. The purpose of payment indicated “for economic needs.” However, the employees did not report, did not return the balance, and the individual entrepreneur did not try to get his money back. When the tax authorities checked the individual entrepreneur, the statute of limitations for payments for 2010 and the first half of 2011 had already passed. As a result, the court sided with the inspectors and recognized all such amounts as income for individuals, regardless of whether the statute of limitations had passed or not (Resolution of the Administrative Court of the North-Western District dated April 21, 2016 No. F07-957/2016).

If payments of accountable amounts are made regularly, it will be similar to a salary. Especially if these amounts correspond to the level of wages. Sometimes an organization pays an employee a low salary, and gives the difference in the form of accountable funds. In this case, fiscal officials can draw a conclusion about the salary nature of the payments.

Collection of accountable amounts from an employee

So, the employee did not provide an advance report or did not provide proper documents on the expenditure of the issued amounts for the appropriate purposes; The employee does not agree to withhold the corresponding amounts of wages.

What to do?

In this case, the employer can file a lawsuit to collect accountable funds from the employee.

Statement of claim for recovery of accountable funds

A statement of claim for the recovery of accountable funds is a procedural document that requires compliance with the rules for its preparation in accordance with the requirements of procedural law.

Since the employee was given funds for specific purposes, and the employee did not report on their intended use, we can therefore say that the employer suffered damage by the employee, and unjust enrichment occurred on the employee’s side.

As stated above, it is important that the deadline by which imputed amounts are issued is specified.

PAY ATTENTION to the statute of limitations ; the employer can file a claim in court within one year after the damage was discovered. Since the relevant dispute arises from labor relations, cases of this category are considered by district courts.