Payments to volunteers: what amounts are not subject to contributions under Art. 420 Tax Code of the Russian Federation

Cases when the object subject to insurance premiums does not appear are described in Part 2 of Art. 420 of the Tax Code of the Russian Federation (paragraphs 4–7). The following payments are not subject to insurance premiums:

- produced by firms and individual entrepreneurs for the benefit of foreigners and stateless persons working in separate divisions of Russian companies located abroad;

- volunteers as part of the execution of contracts concluded in accordance with Art. 7.1 of the Law of August 11, 1995 No. 135-FZ on charitable activities;

- produced by the organizing committee "Russia-2018" and FIFA (as well as their subsidiaries) in favor of foreign citizens, stateless persons and volunteers (in situations listed in paragraph 7 of Article 420 of the Tax Code of the Russian Federation).

Some benefits may soon be reduced if the State Duma approves draft law No. 204728-7 (on the adjustment of Article 420 of the Tax Code of the Russian Federation). It is proposed to reduce the list of non-contributory amounts by excluding from it payments to foreign citizens and stateless persons under employment contracts and civil service agreements concluded:

- with FIFA subsidiaries;

- organizing committee "Russia-2018" or its subsidiaries.

Find out in a timely manner about important and useful news from the materials and messages of our website:

- “Changes in currency legislation since 2017”;

- “A new fiscal data operator has been registered”;

- “The list of preferential regions for individual entrepreneurs on the simplified tax system and PSN has been updated.”

We will consider further what other payments are not subject to insurance premiums.

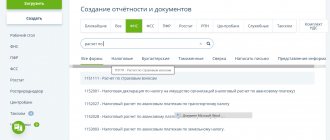

Calculation of insurance premiums: we submit without errors

The time has come to prepare reports for the first quarter of 2022. Let us remind you about the procedure for filling out the calculation of insurance premiums, and also draw your attention to the most common mistakes that organizations that pay insurance premiums make when completing this calculation. In addition, we will tell you about the changes that came into force on January 1, 2018, which directly relate to insurance premiums.

At the beginning, let us remind you that the calculation of insurance premiums is submitted no later than the 30th day of the month following the reporting period ( clause 7 of Article 431 of the Tax Code of the Russian Federation

).

In this case, reporting periods are recognized as the first quarter, half a year, nine months of the calendar year ( clause 2 of article 423 of the Tax Code of the Russian Federation

). Thus, organizations are required to submit calculations for insurance premiums within the following deadlines:

– for the first quarter of 2022 – no later than 05/03/2018, since April 30 is a day off;

For your information:

If the date of submission of the calculation falls on a weekend, the end of the deadline for its submission is postponed to the next working day (

clause 7 of Article 6.1 of the Tax Code of the Russian Federation

).

– for the first half of 2022 – no later than July 30, 2018; – for nine months of 2022 – no later than October 30, 2018; – for 2022 – no later than 01/30/2019.

Main changes from 01/01/2018

A number of amendments have been made to the Tax Code regarding insurance premiums. Let's look at the main changes.

Article 420 “Object of taxation of insurance premiums”.

Innovations in this article were introduced

by Federal Law No. 335-FZ

.

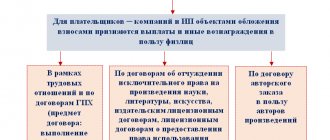

From 01/01/2018, the object of taxation of insurance premiums for organizations is payments and other remuneration in favor of individuals subject to compulsory social insurance (with the exception of remunerations paid to persons specified in paragraph 2 of paragraph 1 of Article 419 of the Tax Code of the Russian Federation

):

– within the framework of labor relations and under civil law contracts, the subject of which is the performance of work and the provision of services; – under copyright contracts in favor of the authors of works; – under agreements on the alienation of the exclusive right to the results of intellectual activity, which are specified in paragraphs. 1 – 12 p. 1 tbsp. 1225 Civil Code of the Russian Federation

, publishing license agreements, license agreements for granting the right to use the results of intellectual activity, which are named in these subparagraphs (including remunerations accrued by rights management organizations on a collective basis in favor of the authors of works under agreements concluded with users).

Thus, now, for the purposes of recognizing the object of taxation by insurance premiums, agreements on the transfer of rights to almost all results of intellectual activity, and not just works of science, literature and art, are taken into account.

Article 426 “Insurance premium rates”.

Amendments to this article were made by

Federal Law No. 361-FZ

.

Please note that the rates of insurance premiums that came into force in 2022 for the main category of legal entities do not change and are valid until 2022. So, according to Art.

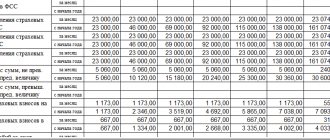

426 of the Tax Code of the Russian Federation in 2022 - 2022, the following insurance premium rates are applied to payers (except for payers for whom reduced rates are determined):

1) for compulsory pension insurance:

– within the established maximum value of the base for calculating insurance premiums – 22%; – above this value – 10%;

2) for compulsory social insurance:

– in case of temporary disability and in connection with maternity, within the established maximum value of the base for calculating insurance premiums for this type of insurance – 2.9%; – in case of temporary disability in relation to payments and other remuneration in favor of foreign citizens and stateless persons temporarily staying in the Russian Federation (with the exception of highly qualified specialists in accordance with Federal Law No. 115-FZ

), within the established maximum base for calculating insurance premiums for this type of insurance - 1.8%;

3) for compulsory health insurance – 5.1%.

Article 421 “Base for calculating insurance premiums for payers making payments and other remuneration to individuals.”

According to

paragraph 6

of this article, the size of the corresponding maximum base for calculating insurance premiums is established annually by the Government of the Russian Federation.

Let us remind you that from 01/01/2018 the Decree of the Government of the Russian Federation of 11/15/2017 No. 1378

, on the basis of which:

– the maximum base for calculating insurance premiums paid to the Social Insurance Fund for 2022 is 815,000 rubles; – the maximum value of the base for calculating insurance premiums paid to the Pension Fund for 2022 is equal to 1,021,000 rubles.

For your information:

Insurance premiums to the Federal Compulsory Medical Insurance Fund are charged for the entire amount of payments and remunerations in favor of individuals without taking into account the maximum value of the base for calculating insurance premiums.

Article 431 “The procedure for calculating and paying insurance premiums paid by payers making payments and other remuneration to individuals, and the procedure for reimbursing the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity.” Clause 7

This article establishes the procedure for submitting calculations for insurance premiums.

From 01.01.2018, the provisions of this paragraph must be applied taking into account the amendments made by Federal Law No. 335-FZ

. So, starting from January 1, 2022, the calculation is considered not submitted if in the calculation (updated calculation) the information for each individual for the billing (reporting) period and (or) for each of the last three months of the billing (reporting) period contains errors:

– in the amount of payments and other remuneration in favor of individuals; – in the base for calculating insurance contributions for compulsory pension insurance within the established limit; – in the amount of insurance contributions for compulsory pension insurance; – in the amount of insurance contributions for compulsory pension insurance, calculated on the basis of the base for their calculation, not exceeding the maximum value; – in the database for calculating insurance premiums for compulsory pension insurance at an additional rate; – in the amount of insurance contributions for compulsory pension insurance at an additional rate.

In addition, the calculation is considered not submitted if in the calculation submitted by the payer the sums of the same indicators for all individuals do not correspond to the same indicators as a whole for the payer of insurance premiums and (or) the calculation contains unreliable personal data identifying the insured individuals.

About the above errors, the payer is sent a corresponding notification no later than the day following the day of receipt of the calculation (updated calculation) in electronic form (10 days following the day of receipt of the calculation on paper).

Note:

according to

paragraph 7 of Art.

431 of the Tax Code of the Russian Federation, the presence of errors in the calculation submitted by the payer when calculating insurance premiums for compulsory health insurance is not a basis for refusing to accept the calculation.

However, when conducting a desk tax audit and identifying errors in calculations, the tax authority, on the basis of Art.

88 of the Tax Code of the Russian Federation informs the payer about this with the requirement to provide the necessary explanations within five days or submit an updated calculation to the tax authority.

This is stated in the Letter of the Federal Tax Service of the Russian Federation dated February 19, 2018 No. GD-4-11/

[email protected] .

The most common mistakes in calculating insurance premiums

The organization incorrectly indicates the personal data of employees

when filling out section.

3 “Personalized information about the insured persons” of the calculation. An error is the incorrect indication of the full name, SNILS and TIN of the insured persons.

By virtue of clause 7 of Art.

431 of the Tax Code of the Russian Federation, a calculation with such an error is considered not presented. At the same time, when filling out the calculation for the billing (reporting) period in section. 3 you should indicate current personalized information about the insured persons as of the date of reporting. Personal data filled out in strict accordance with the identity document of the individual - the recipient of the income, as of the date of submission of information (including updated information) to the tax authority is relevant.

Consequently, if an individual’s personal data has changed after the organization has submitted a calculation of insurance premiums to the tax authority, an updated calculation is not submitted. Such clarifications are given in the Letter of the Federal Tax Service of the Russian Federation dated December 29, 2017 No. GD-4-11/ [email protected]

.

Note:

in detail about the procedure for filling out the relevant details contained in section.

3 “Personalized information about insured persons” for the calculation of insurance premiums, as stated in the Letter of the Federal Tax Service of the Russian Federation dated December 21, 2017 No. GD-4-11 /

[email protected] .

The organization does not reflect payments not subject to insurance premiums.

The list of amounts not subject to insurance premiums is established

by Art.

422 Tax Code of the Russian Federation .

According to clauses 1

,

2 of Art.

420 of the Tax Code of the Russian Federation, the object of taxation of insurance premiums for payers-employers (hereinafter referred to as payers) are payments and other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance.

At the same time, due to the Procedure for filling out the calculation of insurance premiums

, approved by

Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/

[email protected] (hereinafter referred to as

the Procedure)

, when calculating the amounts of insurance premiums, payers in the corresponding lines and columns of Appendix 1 and appendices 2 to section.

1 of the calculation reflects the amounts of payments and other remunerations that are named in clauses 1

and

2 of Art.

420 Tax Code of the Russian Federation . If the payer did not show non-contributory payments in previously submitted calculations, it is necessary to submit updated calculations.

The organization does not indicate the daily allowance paid in the report.

Amounts of payments and other remuneration that are not subject to insurance premiums in accordance with

Art.

422 of the Tax Code of the Russian Federation , in particular, daily allowances within the amounts established by the Tax Code are also subject to reflection in the calculation based on

the Procedure

.

Payers show in the calculation the basis for calculating insurance premiums, calculated according to the rules of Art.

421 of the Tax Code of the Russian Federation as the difference between the accrued amounts of payments and other remunerations that are included in the object of taxation of insurance premiums in accordance with

clauses 1

and

2 of Art.

420 of the Tax Code of the Russian Federation , and amounts not subject to insurance premiums in accordance with

Art.

422 Tax Code of the Russian Federation .

Such clarifications are given in the Letter of the Federal Tax Service of the Russian Federation dated November 24, 2017 No. GD-4-11/

[email protected] .

The organization does not include

travel expenses and compensation for the use of personal vehicles for business purposes in the calculation.

According to

Art.

422 of the Tax Code of the Russian Federation are not subject to insurance premiums for payment by an organization of expenses for an employee’s business trip (daily allowances provided for in

paragraph 3 of Article 217 of the Tax Code of the Russian Federation

, and actually incurred and documented targeted expenses for travel to the destination and back, expenses for renting residential premises, etc. .), as well as established

by Art.

188 of the Labor Code of the Russian Federation , compensation paid by an organization to an employee for the use of personal vehicles for business purposes, in the amount determined by an agreement between the organization and such employee.

The base for calculating insurance premiums is determined as the sum of all payments and other remuneration in favor of the employee minus the amounts listed in Art.

422 of the Tax Code of the Russian Federation , including daily allowances provided for in

paragraph 3 of Art.

217 of the Tax Code of the Russian Federation , and actually incurred and documented travel expenses, as well as the above-mentioned compensation payments in the amount established by the agreement.

Thus, taking into account the provisions of paragraph 1 of Art.

421 of the Tax Code of the Russian Federation provided for in

paragraphs.

1 clause 1 art. 420 of the Tax Code of the Russian Federation , payments calculated in favor of employees, including payment of travel expenses and the mentioned compensation payments, will be reflected:

– according to lines 030 subsection. 1.1 (for insurance contributions for compulsory pension insurance) and subsection. 1.2 (for insurance premiums for compulsory health insurance) of Appendix 1 to Section. 1 calculation; – on line 020 of Appendix 2 (for insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity) to section. 1 calculation; – according to line 210 of subsection. 3.2.1 section 3 calculations.

Further, the amounts of payment for travel expenses and compensation payments not subject to insurance contributions must be shown:

– according to lines 040 subsection. 1.1 and subsection. 1.2 appendix 1 to section. 1 calculation; – according to line 030 of appendix 2 to section. 1 calculation.

According to line 220 of subsection. 3.2.1 section 3 of the calculation will reflect the base for calculating insurance contributions for compulsory pension insurance for the employee, minus the mentioned payments for travel expenses and compensation payments. Such clarifications were provided by the Ministry of Finance in Letter dated October 23, 2017 No. 03-15-06/69146

.

The organization incorrectly reflects payments to foreign employees in its calculations.

Let us recall that, according to

Federal Law No. 379-FZ,

foreign citizens or stateless persons (with the exception of highly qualified specialists in accordance with

Federal Law No. 115-FZ

) temporarily staying in the territory of the Russian Federation and having entered into employment contracts for an indefinite period are recognized as insured under compulsory pension insurance. or fixed-term employment contracts for a period of at least six months.

Furthermore, in accordance with Art. 420 Tax Code of the Russian Federation

The object of taxation of insurance premiums for payer organizations is payments and other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance.

Currently, the Treaty on the Eurasian Economic Union dated May 29, 2014

(hereinafter referred to as

the Treaty

) is in force.

The parties to this agreement are the Russian Federation, the Republic of Belarus, the Republic of Kazakhstan, the Republic of Armenia and the Kyrgyz Republic. Based on the provisions of paragraph 3 of Art.

98 of the Treaty, social security (social insurance) (except for pensions) for workers of the EAEU member states and members of their families is carried out on the same conditions and in the same manner as providing for citizens of the state of employment.

At the same time, according to clause 5 of Art.

96 of the Treaty , social security (social insurance), in particular, includes compulsory health insurance.

Thus, citizens of the Republic of Belarus, the Republic of Kazakhstan, the Republic of Armenia and the Kyrgyz Republic, regardless of their status, are insured persons in the compulsory health insurance system on an equal basis with citizens of the Russian Federation; accordingly, payers must pay insurance premiums for compulsory health insurance from payments in favor of these persons . Employees of the regulatory agency recalled this in Letter of the Federal Tax Service of the Russian Federation dated February 14, 2017 No. BS-4-11/2686

.

As for filling out the calculation regarding the indication of personalized information about the insured persons - foreign workers, citizens of an EAEU member state temporarily staying in the territory of the Russian Federation, you should be guided by the Procedure

.

In particular, when specifying the category code of the insured person, Appendix 8 to this procedure is applied. Moreover, since in accordance with paragraph 1 of Art.

7 of Federal Law No. 167-FZ , foreign citizens temporarily staying in the territory of the Russian Federation, who are highly qualified specialists on the basis of

Federal Law No. 115-FZ

, are not recognized as insured persons in the compulsory pension insurance system, and insurance premiums for compulsory pension insurance are not paid from payments in their favor are also paid in section.

3 calculations, the specified information about such employees is not entered. This is stated in the Letter of the Ministry of Finance of the Russian Federation dated July 12, 2017 No. 03-15-06/44430

.

The organization reflects in the report payments made to individuals - its employees under lease agreements. Clause 4 of Art. 420 Tax Code of the Russian Federation

It has been established that payments and other remuneration within the framework of civil contracts, the subject of which is the transfer of ownership or other real rights to property (property rights), and contracts related to the transfer of property (property rights) for use, are not recognized as an object of taxation with insurance premiums. .

Article 606 of the Civil Code of the Russian Federation

provides that under a lease agreement (property lease), the lessor (lessor) undertakes to provide the lessee (tenant) with property for a fee for temporary possession and use or for temporary use.

Thus, taking into account the provisions of paragraph 4 of Art.

420 of the Tax Code of the Russian Federation , payments under lease agreements concluded with the above-mentioned individuals are not reflected in the calculation of insurance premiums.

These clarifications were provided by the Ministry of Finance in Letter dated November 1, 2017 No. 03-15-06/71986

.

The organization includes in Sec. 3 calculation of excess workers or does not include certain workers.

One such example is the situation when in Sect.

3 calculations for insurance premiums do not reflect employees on maternity or child care leave. Let us remind you that insured persons for the purposes of compulsory pension, medical and social insurance are persons working under employment contracts ( clause 1, article 7 of Federal Law No. 167-FZ

,

clause 1, article 10 of Federal Law No. 326-FZ

,

clause 1 Article 2 of Federal Law No. 255-FZ

). Thus, these persons must be included in Sec. 3 calculations for insurance premiums. This error must be corrected as follows:

– if any insured individuals are not included in the initial calculation, Section. 3, containing information regarding these individuals, and at the same time the indicators of section. 1 calculation; – in case of erroneous presentation of information about the insured persons in the initial calculation, Section. 3, containing information regarding such individuals, in which in lines 190 - 300 subsection. 3.2, the value “0” is indicated in all familiar places, and at the same time the indicators in section are adjusted. 1 calculation; – if it is necessary to change the indicators reflected in subsection for individual insured persons. 3.2 of the calculation, section should be included in the updated calculation. 3, containing information regarding such individuals with correct indicators in subsection. 3.2, and if necessary (in case of a change in the total amount of calculated insurance premiums), the indicators of section. 1 calculation.

Such clarifications are given in letters of the Federal Tax Service of the Russian Federation dated June 28, 2017 No. BS-4-11/ [email protected]

(

clause 2.2

),

dated July 18, 2017 No. BS-4-11/

[email protected] .

The organization reflects the amounts of expenses reimbursed by the territorial bodies of the Social Insurance Fund in the wrong period.

According to

clause 11.14 of the Procedure

on line 080 of Appendix 2 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity” to section.

1 of the calculation, the corresponding columns indicate the amounts of the payer’s expenses reimbursed by the territorial bodies of the Social Insurance Fund for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity from the beginning of the billing period, for the last three months of the billing (reporting) period, as well as for the first, the second and third months of the last three months of the billing (reporting) period. Thus, if reimbursement of the payer’s expenses is carried out in one reporting period for expenses incurred in another reporting period, these amounts must be reflected in the calculation for the reporting period in relation to the month in which the territorial bodies of the Social Insurance Fund provided the specified reimbursement. These clarifications were provided by the Federal Tax Service in Letter No. BS-4-11 dated July 3, 2017/

[email protected] .

* * *

In conclusion, we note once again that:

– calculation of insurance premiums for the first quarter of 2022 must be submitted no later than 05/03/2018; – payers reflect in the calculation the base for calculating insurance premiums, calculated in accordance with Art. 421 Tax Code of the Russian Federation

as the difference between the accrued amounts of payments and other remunerations that are included in the object of taxation of insurance premiums by virtue of

clauses 1

and

2 of Art.

420 of the Tax Code of the Russian Federation , and amounts not subject to insurance premiums in accordance with

Art.

422 Tax Code of the Russian Federation .

This means that the object of taxation of insurance premiums includes all amounts of remuneration that were paid to the insured persons within the framework of the employment relationship; – tax legislation provides that for failure to submit a tax return (calculation of insurance premiums) to the tax authority at the place of registration within the deadline established by the legislation on taxes and fees, a fine is applied in the amount of 5% of the amount of tax (insurance contributions) not paid within the deadline established by the legislation on taxes and fees contributions) subject to payment (additional payment) on the basis of this declaration (calculation), for each full or partial month from the day established for its submission, but not more than 30% of the specified amount and not less than 1,000 rubles. ( clause 1 of article 119 of the Tax Code of the Russian Federation

).

Tarasov V. D., expert of the information and reference system “Ayudar Info”

Non-taxable payments under Article 422 of the Tax Code of the Russian Federation

Amounts not subject to insurance premiums are listed not only in Art. 420 of the Tax Code of the Russian Federation, but also in Art. 422. These are payments:

- not within the framework of labor relations and civil process agreements (for example, financial assistance to relatives of a deceased employee, etc.);

- citizens under contracts related to the sale or transfer of property for temporary use (under lease agreements, transfer of money in debt, etc.);

- in the form of compensation provided for by federal and local legislation (for payment for special clothing, training, etc.)

- other specified in Art. 422 of the Tax Code of the Russian Federation.

Certain types of payments are not subject to insurance premiums if certain requirements are met and only for limited periods of time - we will discuss this in the following sections.

Find out what to do with contributions if an employee dies here.

See also: “ERSV: how to show payments that are not included in the contribution object or not subject to them” and “ERSV line by line: reflecting payments that are not subject to contributions.”

Taxable amounts

According to the rules for filling out the calculation of contributions, their object for employers is payments and other remuneration to individuals who are subject to mandatory social insurance by virtue of the instructions of federal laws. Namely (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation):

| 1 | Within the framework of: • labor relations; • civil contracts for the performance of work and provision of services. |

| 2 | Under agreements addressed to the authors of works |

| 3 | Under agreements: • on the alienation of the exclusive right to works of science/literature/art; • publishing license; • license to grant the right to use a work of science/literature/art. Also, rewards that accrue when managing rights on a collective basis in favor of the authors of works under agreements with users. |

Also see “Procedure for filling out the calculation of insurance premiums for 2022.”

Private lessons and cleaning services: when fees are not paid

Law No. 401-FZ dated November 30, 2016 added clause 3 of Art. 422 of the Tax Code of the Russian Federation, a subparagraph that specifies payments that are not subject to insurance contributions.

This rule applies only to payments received by individuals in 2017–2018 and meeting the following conditions:

- income was received as a result of settlements between individuals (not individual entrepreneurs) for the provision of services for personal needs;

- the recipient of the income notified the tax authorities (the notification scheme is described in clause 7.3 of Article 83 of the Tax Code of the Russian Federation);

- the individual completed the work independently (without hiring hired labor).

The list of services for personal needs includes:

- cleaning of residential premises;

- housekeeping;

- tutoring;

- supervision of persons in need of constant outside care (children, elderly people, the sick - according to the conclusion of the medical institution).

This list may be expanded if regional authorities consider it necessary to include additional services of this kind (for personal, household and other needs) and adopt a corresponding law.

How regional legislation can influence the tax burden and the possibility of not using online cash registers is stated in the articles:

- “List of settlements exempt from online cash registers”;

- “List of property taxed at cadastral value”.

Income tax

| ESSENCE OF THE CHANGE | EXPLANATION | STANDARD OF THE TC RF/ACT OF TAX LEGISLATION |

| Changed the income tax return form | The new form will be used for reporting for 2022. Changes in the corporate income tax return form from 2022 are insignificant and concern mainly specific payers. See ““ for more details. | Order of the Federal Tax Service dated October 5, 2021 No. ED-7-3/869 |

| Allowed to take into account more costs for spa treatment | From January 1, 2022, expenses for sanatorium and resort treatment can be included in income tax expenses even if:

| New ed. clause 24.2 part 1 art. 255 Tax Code of the Russian Federation |

| Extended the restriction on carrying forward losses from previous years | Until the end of 2024, the income tax base can be reduced by the amount of losses from previous years, but not by more than 50%. Previously, this restriction was valid until December 31, 2021. | New ed. clause 2.1 art. 283 Tax Code of the Russian Federation |

| The composition of accounted income from coronavirus subsidies has been clarified | They added that income does not need to take into account any subsidies received in connection with the coronavirus, except for funds to compensate interest rates on loans. Until 2022 there were certain restrictions. The new rule has been extended to 2022. | New ed. subp. 60 clause 1 art. 251 Tax Code of the Russian Federation |

| New rules have been introduced for the initial and residual value of fixed assets, as well as the useful life and the corresponding depreciation rate | From 01/01/2022, during completion, retrofitting, reconstruction, modernization, technical re-equipment, partial liquidation of facilities and for other similar reasons, the initial cost of fixed assets changes regardless of the size of their residual value. From 01/01/2022, a depreciation procedure is provided for the case when, as a result of reconstruction, modernization or technical re-equipment, the useful life has not increased. It is necessary to apply the depreciation rate determined based on the useful life originally established for this object. | New ed. para. 1 item 2 art. 257 and para. 3 p. 1 art. 258 Tax Code of the Russian Federation |

| Restricted the transfer of property to socially oriented NPOs for recognition in non-operating expenses | Since 2022, one category of non-profit organizations has been established as recipients of property - these are NPOs included in the Register of socially oriented non-profit organizations. | New ed. para. 2 subp. 19.6 clause 1 art. 265 Tax Code of the Russian Federation |

| Changed the rules for accounting for leased assets | From 01/01/2022, the leased asset is taken into account by the lessor as part of its depreciable property and depreciates it in the general manner. The lessee takes into account lease payments when calculating tax. The Tax Code norm, which allowed the leased asset to be transferred under an agreement for registration to the lessee, no longer exists. These rules apply to leasing agreements concluded from January 1, 2022. Accounting for “old” contracts is carried out in the same manner until the end of their validity period. They indicated that if the lease payments include the redemption value of the property, then they are taken into account in the expenses of the lessee minus the redemption value. | Clause 10 of Art. was declared invalid. 258 and clause 8.1 of Art. 272 Tax Code of the Russian Federation New edition para. 1 sub. 1 item 2 art. 259.3 and sub. 10 p. 1 art. 264 Tax Code of the Russian Federation |

How to fulfill the obligation to notify tax authorities in order not to pay contributions

To obtain an exemption from paying insurance premiums, an individual performing services (clause 7.3 of Article 83 of the Tax Code of the Russian Federation):

- fills out the notification in the form specified in Appendix No. 1 to the order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-14/ [email protected] ;

- transfers it to the tax authorities before the start of the specified types of services and after the termination of such activities.

The notification is submitted to any tax office - the tax authorities will register the individual at his place of residence (place of stay in the Russian Federation).

Appendix No. 3 to Order No. MMV-7-14/ [email protected] describes the procedure for filling out the notification. With its help, an individual informs tax authorities:

- information about yourself (full name, tax identification number, telephone number, gender, details of an identity document, etc.);

- coded sign of the beginning (“1”) or end (“2”) of the activity;

- type of activity from the proposed options.

If an individual provides other services, the type of which is prescribed by regional authorities, the last sheet of the notification is additionally filled out, which reflects:

- details of the law and code of the region that installed the service;

- Name of service.

The following materials will tell you about the powers of regional authorities in tax rulemaking:

- “What is the procedure for calculating corporate property tax?”;

- “Basic profitability under the patent tax system in 2017”.

Property tax

| ESSENCE OF THE CHANGE | EXPLANATION | STANDARD OF THE TC RF/ACT OF TAX LEGISLATION |

| Regions were prohibited from setting tax payment deadlines and introduced uniform deadlines for tax payment and advance payments | Regional authorities no longer have the right to set deadlines for paying property taxes for organizations. They can only determine tax rates and the manner in which taxes are paid - with or without advance payments. From 2022, payment deadlines for all regions have been established:

| New ed. Art. 383 Tax Code of the Russian Federation |

| Regional authorities are required to post changes to special lists of retail and office real estate on the Internet | From January 1, 2022, regional authorities, within 5 working days, are required to post changes to special lists of retail and office real estate, the tax base for which is cadastral value, on their official website or on the regional website. During the same period, regional authorities send electronic information about changes to the Federal Tax Service for the constituent entity of the Russian Federation. | New clause 7.1 of Art. 378.2 Tax Code of the Russian Federation |

| The procedure for calculating tax in relation to real estate that is in common shared ownership is regulated | The amount of tax or advance payment on it in relation to real estate, the tax base for which is the cadastral value, is calculated for each of the participants in shared ownership in proportion to his share in such real estate. If during the year the size of the share in the right of common ownership changes, the amount of tax or advance payment is calculated taking into account the coefficient determined in accordance with clause 5 of Art. 382 of the Tax Code of the Russian Federation. | New sub. 4 clause 12 art. 378.2 Tax Code of the Russian Federation |

| It was established that destroyed real estate is excluded from the list of objects of taxation | From January 1, 2022, tax calculation stops on the 1st day of the month of death or destruction of a taxable property. The basis is an application to the Federal Tax Service. The Federal Tax Service has approved the form, format and procedure for filling out the application. For more details, see “How to report to the tax office the loss or destruction of an object under property tax from 2022.” | New clauses 4.1 and , new ed. clause 5 art. 382 Tax Code of the Russian Federation |

| The procedure for providing tax benefits for cadastral real estate has been regulated | From January 1, 2022, Russian organizations in relation to real estate, the tax base for which is the cadastral value, received the right to submit an application to the Federal Tax Service for tax benefits. | New clauses 4.1 and , new ed. clause 5 art. 382 Tax Code of the Russian Federation |

| Updated the form and format of the property tax declaration | It is submitted using a new form starting with reporting for 2022. The changes are of a technical nature. | Order of the Federal Tax Service dated June 18, 2021 No. ED-7-21/574 |

| New rules have been introduced for organizations to pay property tax when renting | From January 1, 2022, the rules for taxation of property of organizations leased, including leasing, have been changed. Now the transferred property is subject to taxation exclusively by the lessor (lessor). | New name and new clause 3 of Art. 378 Tax Code of the Russian Federation |

| The application form for tax relief on corporate property tax has been approved | It will be applied from the 2022 tax period. Organizations submit an application only in relation to property objects, the tax base for which is their cadastral value (we remind you that from the report for 2022 on such objects it is not necessary to submit a declaration). The application can be submitted to any tax authority. You can (i.e., not necessarily) attach supporting documents to it. The application and documents can be submitted to the tax authority and through the MFC. For more information, see “How an organization can apply for a property tax benefit: form from 01/01/2022“. | Order of the Federal Tax Service dated 07/09/2021 No. ED-7-21/646 |

Saving on fees for an entrepreneur using a simplified approach

A simplified individual entrepreneur who pays mandatory pension contributions for himself determines his expenses for paying contributions according to the algorithm (subclause 1, clause 1, article 430 of the Tax Code of the Russian Federation):

if D ≤ 300,000 rub. → ∑SV = 12 × minimum wage × TSV.

if D > 300,000 rub. → ∑SV = 12 × minimum wage × TSV + 1% × (D – 300,000 rub.),

Where:

D - income for the billing period;

∑СВ — the amount of insurance contributions for compulsory pension insurance;

Minimum wage - the minimum wage established by federal law at the beginning of the year for which insurance premiums are paid;

TSV - the tariff of insurance premiums established by clause 2 of Art. 425 Tax Code of the Russian Federation.

After calculating the amount of insurance premiums in a situation where the income exceeds the border of 300,000 rubles, it is necessary to check whether the conditions are met:

If ∑SV > 8 × 12 × minimum wage × TSV → ∑SV = 8 × 12 × minimum wage × TSV

Thus, the amount of insurance premiums cannot exceed the product of 8 times the minimum wage (increased by 12 times) and the insurance premium rate.

Wherein:

- The income of an individual entrepreneur is determined according to the rules of Art. 346.15 Tax Code of the Russian Federation;

- expenses under Art. 346.16 of the Tax Code of the Russian Federation are not taken into account.

For the nuances of calculating simplified income, see the article “The procedure for calculating tax under the simplified tax system “income” in 2016–2017 (6%) .

This calculation algorithm is described in the letter of the Ministry of Finance of Russia dated 06/09/2017 No. 03-15-05/36277.

WHO IS RESPONSIBLE TO PAY INSURANCE PREMIUMS

The calculation and payment of insurance premiums is regulated by the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation).

Insurance premiums are understood as mandatory payments for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, collected from organizations and individuals for the purpose of financial security for the implementation of the rights of insured persons to receive insurance coverage for the corresponding type compulsory social insurance (Article 8 of the Tax Code of the Russian Federation).

Payers of insurance premiums are (clause 1 of Article 419 of the Tax Code of the Russian Federation):

• persons making payments and other remuneration to individuals:

– organizations;

- individual entrepreneurs;

– individuals who are not individual entrepreneurs;

- individual entrepreneurs, lawyers, mediators, notaries engaged in private practice, arbitration managers, appraisers, patent attorneys and other persons engaged in private practice in accordance with the legislation of the Russian Federation.

If the payer simultaneously belongs to several categories indicated above, he calculates and pays insurance premiums separately for each basis.

Results

The Tax Code provides for the payment of insurance premiums on a significant portion of the income received by citizens.

The payments listed in Art. 410 and 422 of the Tax Code of the Russian Federation. These are amounts not related to the performance of labor duties, compensation provided for by law, payment for services performed by individuals for the personal needs of citizens, etc. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.