Postings

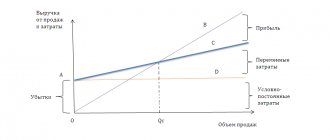

The expenses of an enterprise spent on the production of products and their subsequent sale are called costs. They can

The cost of transporting goods is calculated taking into account the provisions stated in the instructions for composition, accounting and

RKO: in Excel You can also RKO in excel. It contains the same graphs

If the court battle is lost, the losing party must reimburse the winner for legal costs. Significant value

The dangers of incorrect entries Incorrect invoices and incorrect entries in purchase books and

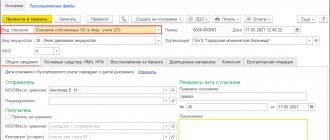

Features of depreciation of office equipment One of the key issues that an accountant needs to solve when setting up

Conditions for classifying a tool as a fixed asset Tool, inventory can be taken into account as

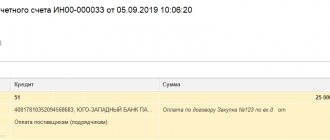

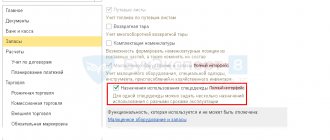

Tutorial 1C: Accounting 8 In the last lesson, you and I learned how to receive goods and materials, additional. expenses

The procedure for executing a court decision to write off a debt A court decision to collect a debt from

What is investment in fixed capital? Investment in fixed capital means (Section II