Postings

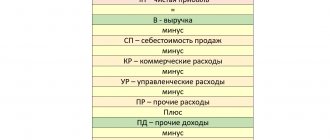

Net profit remains at the disposal of the organization after paying all taxes and payments to the budget

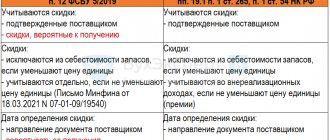

The terms “retro bonus” or “retro discount” appeared in the business lexicon relatively recently. Who and when

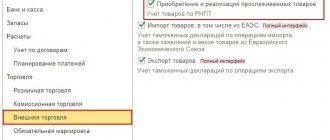

When can you use currency? Transactions in currency between Russian organizations are prohibited and are carried out only

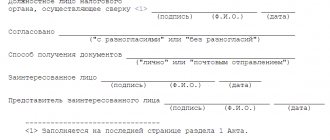

Why does an overpayment occur and how to find out about it An overpayment may occur due to a taxpayer error,

Documents confirming the acquisition of goods and materials by the accountable person Accountable person - an employee who received money for business,

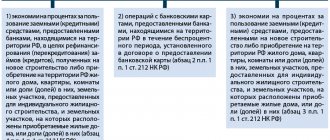

Almost every company (IP) at certain stages of its activities needs additional cash injections.

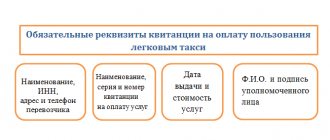

Taxi travel expenses for a posted employee An employee sent on a business trip can use the service

What is this? An invoice can be issued or presented by the seller (as well as by entities such as

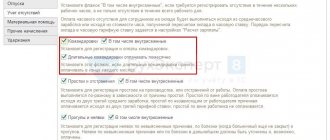

Accounting for business trips has a number of nuances: designation in the time sheet, payment procedure for the time spent in

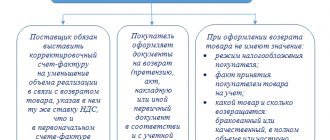

When can you return an item? The relationship between buyer and seller does not always develop without problems.