In general terms, operating expenses are the costs of an enterprise that are not directly related to its core activities. The current edition of PBU 10/99 does not contain a precise definition of the terms operating income and expenses due to the change in classification according to Order No. 116n dated September 18, 2006. The legislation now proposes a simplified gradation for other expenses/income, as well as expenses/income for ordinary activities . How to determine what costs belong to what, how to calculate net operating income - we will explain in detail below.

What do operating expenses include?

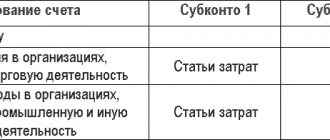

All indirect expenses of the enterprise are recognized as operating expenses. Previously, there was a classification of costs into non-operating, operating and emergency. With the entry into force of Order 116n, such division was abolished, but it is possible if necessary at the request of the enterprise. A complete list of the main operating expenses is contained in paragraph 11 of Chapter III of PBU 10/99.

Operating expenses include the following costs:

- Representation of assets, including property, enterprises for temporary paid use or ownership.

- Submission for paid use of patent rights to intellectual property for various purposes.

- Participation in the authorized capital of other companies.

- Payment of cash settlements to credit institutions.

- Payment of interest on borrowed obligations of various types.

- Costs of disposal, sale, or other write-off of assets, property, goods, finished products of an enterprise, with the exception of Russian funds.

- Creation of valuation reserves by the enterprise, including for doubtful debts, for depreciation of securities, etc.

The listed types of costs are included in operating expenses if they do not relate to the main activities of the enterprise. Otherwise, such costs are subject to inclusion in ordinary expenses.

General overview

In accordance with the concept adopted within the framework of scientific doctrine, OCF (or OCF - operating cash flow) is a set of money received by an organization as a result of its core functionality. The methods used to analyze the current economic situation and overall liquidity of the enterprise are relevant both when considering potential projects and for operational management. A high level of value reflecting cash flow from operating activities indicates opportunities for business diversification, investing in the development of new products, reducing debt obligations, and paying dividends to owners and shareholders. On the contrary, a low, permanently negative indicator indicates that the company needs to constantly attract borrowed resources to allow it to stay afloat.

In accordance with the established classification used by experts and analysts, it is customary to distinguish three streaming categories:

- Investment funds aimed at developing the enterprise.

- Cash flow from core operating activities.

- Financial activity, including the formation and repayment of loans and debt obligations, issue of securities, etc.

Their combination creates a pure analytical value, the so-called NCF (Net Cash Flow). ECT, in turn, is considered as the ratio of income and expenses directly related to the operation of the company, and used, among other things, to pay off most of the debts.

We can say that this indicator reflects the profitability of the enterprise more accurately than the conditional rate of profit, and is suitable for assessing not only the quantity, but also the quality of income items. It is no secret that for some organizations the practice of “aggressive accounting” is common, when, despite the formally high turnover, there is constantly not enough money in current accounts. Potential investment risks should be assessed in advance to avoid unpleasant consequences. By conducting an OCF analysis, you can understand whether the external image of a successful business really corresponds to reality, or whether management is simply trying to put on a good face on a bad game.

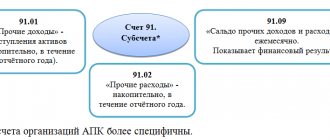

What does operating income include?

Similar to expenses, operating income is classified as such if it is not related to the main work of the enterprise. Otherwise, they must be reflected in account 90 and accounted for as revenue from ordinary activities. A complete list of types of income from other operations is contained in paragraph 7 of PBU 9/99.

Operating income consists of income:

- From paid representation to time-limited use of enterprise assets.

- From paid representation of patent rights to various types of intellectual property.

- In connection with participation in the authorized capitals of other companies, including interest and income from investments in bonds and securities.

- From participation in simple partnership agreements.

- From the sale of property, assets of the organization, goods or manufactured products.

- Interest received on loans and borrowings.

- Accrued penalties for violation of contractual terms.

- From assets received free of charge.

- Profit of previous periods.

- Compensation for losses caused to the enterprise.

- Amounts of accrued exchange rate differences.

- Amounts of accounts payable that have already expired.

- Amounts of recognized income from revaluation of assets.

- Other types.

What company expenses can be classified as operating expenses?

For a better understanding, it is necessary to clarify what can be classified as operating costs. These are the tools used for:

- payment of interest on the loan and bank commissions (for example, for transferring money);

- creating reserve capital;

- investments in the authorized capital of other companies;

- royalties for the use of objects protected by copyright;

- disposal/write-off of goods, fixed assets and finished products.

- payment for advertising and marketing, legal, utilities, licenses, office supplies and other consumables;

- payment of fines, penalties and other compensation to individuals, organizations and government bodies;

- assistance through charity;

- covering other losses associated with emergency situations, etc.

Some experts also consider the purchase of raw materials and wages to be operating expenses, while others are sure that these are production costs and do not belong to operating expenses. We will not interpret the concept too broadly and will focus on the above points.

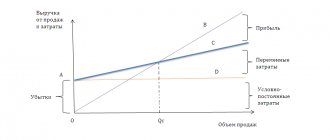

Net Operating Income - Formula

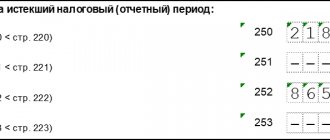

As can be seen from the contents of the lists, income and expenses practically coincide in their economic purpose. In this regard, the ratio of operating expenses to operating income is used when calculating profit for other facts of business activity. Separate accounting allows you to determine net operating income:

Net operating income is: The amount of VA (the actual amount of gross income) – the amount of OP (operating expenses excluding depreciation).

The indicator characterizes the amount of net profit from the use of property, contributions to the authorized capital, investments in securities, and other types of income. It is economically important to calculate the NIR for the current period. But a one-time positive result is not a guarantee of profit in future periods.

The ratio of operating expenses to the company's sales revenue will help to calculate the operating expense ratio, which characterizes the dynamics of the profitability of overall activities. The lower the value obtained, the more profit the company has for the reporting period. The higher the coefficient, the more significant the business costs to maintain its livelihoods.

KOR (OER) = OR / Total income

An enterprise can establish formulas for calculating operating income and operating expenses independently, adhering to the legislative norms of PBU 9/99 and 10/99. It is recommended to measure performance indicators on the basis of financial (accounting) reporting data. Calculations are made for a period - month/quarter or for the reporting year.

Net operating profit

By its nature, operating profit represents profit before tax (before income taxes).

A more visual indicator for an investor is net operating profit , the purpose of which is to show how much of the proceeds from the organization’s core activities will remain at its disposal after paying income tax.

The calculation formula is as follows:

CHOP = OP – NNP,

Where:

NOP - net operating profit ;

NNP - income tax.

The net operating profit becomes of key importance for an investor, for example, when choosing from several alternative investment projects related to regions (countries) with different tax burdens.

For information on how to correctly calculate the tax burden in the Russian Federation, see the material “Calculation of the tax burden in 2015 (formula).”

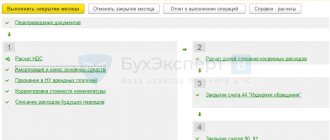

Calculation methods

To determine numerical indicators, various methods can be used, but the most common among them are direct and indirect methods. They differ from each other in several parameters, including the specifics of the source data reflecting the movement between current accounts. It is worth noting that in this case, criteria not taken into account in the process of determining profit are also taken into account, such as depreciation, amortization, tax deductions, capital expenditures, as well as debt and penalty obligations.

Direct method

To get the desired result, the company needs to register all cash transactions associated with receipts and deduct from the resulting amount of revenue the costs that arose in the process of supporting core activities. Expense items include cost of goods sold, payroll, rent and utilities, and interest payments. In turn, total income may also include money received as a result of third-party activities: both investment and financial in nature.

OCF is operating cash flow, the formula for which is straightforward to calculate. As an example, we can take a conditional organization, the work of which in the reporting period is characterized by the following indicators:

Income:

- revenue - 700 thousand rubles;

- sale of bonds - 50,000.

Expenses:

- rent - 45 thousand.

- Payroll - 120,000.

- social contributions - 40,000.

- purchase of products - 330 tr.

Thus, the gross cash flow will be 215 thousand rubles. (700+50-45-120-40-330).

Indirect method

In this case, the basis of the methodology is the calculation of the net profit value, and the calculation is carried out in the reverse order, allowing one to determine the value of the monetary base. Sales revenues are taken into account as they are received, but are not always associated with actual crediting to current accounts. This is a more complex method, but it allows you to get a clear understanding of the specifics and effectiveness of the business, even in cases where the organization is one of the most complexly structured. In particular, the indirect method is used by public companies in the process of forming ODDS.

To “clean” profitable indicators, not only expense items are subtracted from the amount, but also other income, including those related to the enterprise’s third-party activity in the investment market. In addition, the costs include related expenses that are not related to the monetary category - depreciation of fixed assets, depreciation, accrued taxes. The growth or reduction in the volume of inventory, accounts payable and receivable, calculated in relation to the previous period, are also subject to accounting.

Let's consider an example of an indirect assessment of OCF for an organization that did not receive income from investments, whose profit for the reporting period amounted to 200,000 rubles. The applied adjustments are as follows:

- +35,000 - depreciation and amortization of assets;

- +20,000 — deferred tax payments;

- -30,000 — increase in accounts receivable;

- +10,000 - reduction of debt obligations on the loan.

Thus, the total amount of edits is +35,000 added to the original value. The final CCT figure will be 235,000 in net terms, which suggests effective business management in terms of revenue generation.