Participants, including founders or shareholders, can provide financial assistance to their organization. When necessary, replenish working capital to prevent bankruptcy and cover losses. There are several ways, usually this is:

- loan;

- gratuitous transfer of property, including money, into the ownership of the organization;

- transfer of property for free use, that is, a loan.

If we are talking about an LLC, then its participant can provide assistance in the form of a contribution to property or an additional contribution to the authorized capital.

To quickly understand each registration option, understand the accounting features and restrictions associated with each type of financial assistance, take a look at the table.

Help in kind

The participant can provide financial assistance in non-monetary form. That is, transfer fixed assets, materials, goods, and intangible assets to the organization. The accounting procedure in this case depends on the type of property. For more information, see:

- How to register and record the receipt of fixed assets free of charge;

- How to record the receipt of materials in accounting;

- How to reflect the purchase of goods in accounting;

- How to reflect the acquisition (creation) of a trademark in accounting.

Financial assistance from the founder in 2022

> authorized capital > Financial assistance from the founder in 2019

The founders of a limited liability company can provide financial assistance to the enterprise at any time. This is often very convenient in case of financial difficulties of the organization. It is easier to get help from a founder than to get a loan from a bank. How can financial assistance be provided from the founder, how to reflect it in accounting, what entries should be made?

Financial assistance can be either monetary or material (in the form of property).

How can a founder provide financial assistance to an organization:

- Interest-free loan;

- Loan with interest;

- Transfer of property or finances free of charge;

Let's take a closer look at each of these cases, what their features are, and what entries the accountant should make.

Financial assistance in the form of a cash loan

A loan in the form of cash is repayable financial assistance from the founder, which involves the return of funds transferred to the organization to the founder after a certain period of time.

In this case, funds are transferred from the founder to the enterprise on the basis of a loan agreement, the drafting of which must comply with the norms of the Civil Code of the Russian Federation.

The loan can be interest-bearing or interest-free.

In the first case, the interest rate must be specified in the loan agreement, but if its amount is not specified in the agreement, then it is assumed to be equal to the refinancing rate in effect on the current date. In this case, every month to reflect the interest accrual transactions, you need to clarify the current rate at the moment.

If the loan is interest-free, then this should also be indicated in the text of the agreement. In this case, the received loan amount is not included in the organization’s income and is not subject to income tax. Material benefits arising from savings on interest are also not subject to income tax. As a rule, this is the method of providing financial assistance that the founders choose.

In addition to specifying the amount and interest rates, the loan agreement may also include information about what the money should be spent on, what the term and procedure for repayment are.

Postings:

In accounting, for accounting for loans, either account 66 (for short-term, for a period of less than 1 year) or account 67 (for long-term, for a period of more than 1 year) is used. These two accounts were discussed in detail in this article.

Depending on the type of incoming funds, accounts 66 and 67 correspond with cash accounts (50, 51, 52).

Postings for receiving a loan from the founder:

- Debit 51 (50, 52) Credit 66 – short-term loan received.

- Debit 51 (50, 52) Credit 67 – long-term loan received.

Postings for the return of funds to the founder:

- D 66 (67) K51 (50, 52) – return of financial assistance to the founder.

Free assistance from the founder

This method of providing assistance to an organization is very often used. This is due to its convenience. The money is transferred to the organization free of charge, no return is expected. These funds do not affect the size of the authorized capital in any way, and the founder’s share is not increased. Increasing the authorized capital is a rather complicated procedure; this is described in detail here.

If a decision is made to provide gratuitous financial assistance, this must be formalized using the appropriate documents.

In this case, it is necessary to take into account the Tax Code of the Russian Federation, which states that if the founder’s share in the authorized capital exceeds 50%, then the gratuitous funds received by the organization are not included in income and are not subject to income tax.

If the share is less than 50%, then the amount received is included in non-operating income.

A decision on the provision of gratuitous assistance must be drawn up in writing, which must indicate the purposes for which the transferred funds can be spent.

Postings for accounting for gratuitous assistance:

To account for gratuitously received assets, account 98 “Deferred income” is used, on which subaccount 2 “Gratuitous receipts” is opened.

Posting for receiving financial assistance: D51 K98.2.

Further, according to PBU 9/99 clause 8, these funds must be taken into account as part of other income: entry D98.2 K91.1.

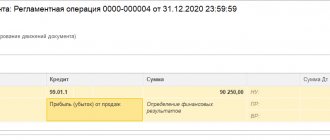

Despite the fact that the funds received are taken into account in other income, they do not participate in the calculation of income tax, so a discrepancy arises between accounting and tax accounting. The resulting difference forms a permanent tax asset, which is reflected in accounting using entry D68 K99 in an amount equal to 20% of the amount of gratuitous assistance received.

Rate the quality of the article. We want to be better for you:

Source: https://buhland.ru/finansovaya-pomoshh-ot-uchreditelya/

Help with money

If financial assistance from a participant is received in cash, then the accounting procedure depends on the period in which it was received:

- during the reporting year - for any purpose;

- at the end of the reporting year - to cover the loss generated in account 84 “Retained earnings (uncovered loss)”.

Include the money received from the participant during the year as other income. Make a note in your accounting:

Debit 50 (51) Credit 91-1

– reflects the gratuitous receipt of money from the participant.

Do not use Account 98-2 “Gratuitous receipts” when receiving money. It is intended to account for income from gratuitous receipts of non-monetary assets only. This conclusion can be made in the Instructions for the chart of accounts.

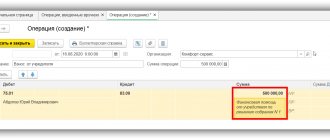

An example of how financial assistance provided by the founder in cash is reflected in accounting

In March of this year, the founder of Alpha LLC A.V. Lvov provided financial assistance to the organization in cash. The purpose of financial assistance is to replenish the organization’s working capital, amount – 500,000 rubles. The money arrived in the organization’s bank account on March 15.

An entry was made in Alpha's accounting records.

March 15th:

Debit 51 Credit 91-1 – 500,000 rub. – financial assistance was received from the founder.

Financial assistance from the founder of the transaction

5 If you decide to get your money back, reflect it as a loan received. To do this, be sure to enter into a loan agreement. 6 In accounting, reflect this as follows: - D51 or 50 K66 or 67 - reflects the receipt of a loan from the founder; - D66 or 67 K51 or 50 - reflects the return of the loan to the founder.

Here, enter the purpose of the financial assistance, its amount and form of payment (for example, to a current account). 2 Consider financial assistance as part of other income. It should be noted that this amount does not increase the tax base when calculating income tax, therefore a permanent difference appears in accounting, which entails the formation of a permanent tax asset. This is specified in the Tax Code (Article 251) and in PBU 18/02.

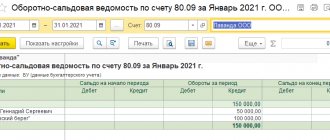

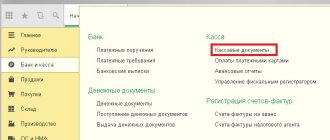

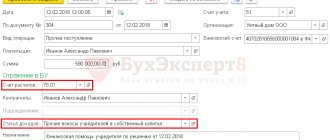

11/27/2014 14:36 How to reflect the financial assistance received from the founder in the 1C: Accounting 8 program.

In the Directory of Business Operations. 1C: Accounting 8 added a practical article “Receiving gratuitous financial assistance from the founder (share more than 50%)”, which considers the receipt of gratuitous financial assistance from the founder of the organization, whose share in the authorized capital of the company is 77%. The founder of this organization - an individual (resident of the Russian Federation) - is not an employee. The intended purpose of financial assistance is to replenish current assets.

The main purpose of creating a commercial organization is to make a profit (clause

Loss Coverage

If money is received from a participant to repay a loss generated at the end of the reporting year, do not use account 91.

As a rule, the decision of participants, including founders or shareholders, to provide financial assistance to cover losses is made after the end of the reporting year, but before the approval of the annual financial statements. Such a decision is recognized as an event after the reporting date. Financial assistance is immediately charged to account 84 “Retained earnings (uncovered loss).” In this case, no entries are made in the accounting records of the reporting period. This follows from paragraphs 3 and 10 of PBU 7/98.

To account for incoming funds, use account 75 “Settlements with founders”. It is worth opening a subaccount for it “Funds of participants aimed at repaying losses.”

The receipt of financial assistance to cover the loss generated at the end of the reporting year should be reflected in accounting entries.

1. On the date when the decision on financial assistance is documented by the minutes of the general meeting of participants, including shareholders, or by the decision of the sole founder:

Debit 75 subaccount “Funds of participants aimed at repaying losses” Credit 84

– a decision was made to repay the loss at the expense of the participants’ funds.

2. On the date of receipt of money:

Debit 50 (51) Credit 75 subaccount “Funds of participants aimed at repaying losses”

– funds were received from participants to cover losses generated at the end of the reporting year.

This procedure follows from the Instructions for the chart of accounts (account 75).

Replenishment of the reserve fund

Situation: how to reflect in accounting the receipt of gratuitous monetary assistance from a participant (founder, shareholder) to replenish the reserve fund (capital)?

The reserve fund can only be replenished from retained earnings. Therefore, first reflect financial assistance as part of other income. At the end of the year, after summing up financial activities, include these amounts in the reserve fund.

There is no other way to form a reserve fund using financial assistance. Therefore, first reflect the funds received from participants in account 91-1 as part of other income.

Turnovers in the debit of account 91-1 “Other income” will increase the organization’s net profit generated on account 99 “Profits and losses”.

At the end of the year, after summing up the results for account 84 “Retained earnings”, form a reserve fund from retained earnings.

In accounting, reflect all this with the following entries:

Debit 50 (51) Credit 91-1

– reflects the gratuitous receipt of money from the participant (founder, shareholder);

Debit 91-1 Credit 99

– profit is reflected at the end of the year;

Debit 99 Credit 84

– reflects net profit at the end of the year;

Debit 84 Credit 82

– contributions have been made to the reserve fund (capital) according to the standards approved by the charter.

This conclusion follows from the Instructions for the chart of accounts (accounts 84, 82).

If, after increasing the reserve capital (fund), its value exceeds the restrictions established in the organization’s charter, amend the charter.

All this follows from paragraph 7 of PBU 9/99, paragraph 1 of Article 35 and Article 12 of the Law of December 26, 1995 No. 208-FZ, paragraph 1 of Article 30, paragraph 4 of Article 12 of the Law of February 8, 1998 No. 14-FZ , Instructions for the chart of accounts (accounts 84, 99) and is confirmed in the letter of the Ministry of Finance of Russia dated August 23, 2002 No. 04-02-06/3/60.

Free assistance from the founder: postings

Free assistance from the founder is a common way to help the company. It is formalized in a written decision, which indicates the purposes for which the transferred assets should be directed. Money is credited from the founder using the other income/expenses account – 91.

Account 98/2 of gratuitous receipts is not used for transactions with funds, since it is intended to account for income from the receipt of property. Basic transactions with the gratuitous assistance of the founder:

| Operations | D/t | K/t |

| Non-refundable financial assistance from the founder to the bank account | 51 | 91/1 |

| Arrival of OS | ||

| An OS object was transferred as a gratuitous receipt | 08 | 98/2 |

| Transferring the OS into operation | 01 | 08 |

| Accrual of depreciation on the OS | 20 | 02 |

| The cost of fixed assets is reflected as part of other income | 98/2 | 91/1 |

| Transfer of materials | ||

| Inventory and materials transferred from the founder | 10 | 98/2 |

| Materials written off for production | 20 | 10 |

| The cost of inventory items is reflected in other income | 98/2 | 91/1 |

| Help to pay off losses | ||

| A decision was made to pay off the loss | 75 | 84 |

| Crediting funds to cover the loss | 51 | 75 |

| Contribution of money by the founder to the authorized capital | ||

| Funds contributed to the management company | 75,50,51 | 80 |

| Contribution made: | ||

| - cash to the cash desk | 50 | 75 |

| - goods | 41 | 75 |

| — Inventory | 10 | 75 |

| - OS | 08 | 75 |

| Transfer by the founder of OS to increase net assets | 08 | 83 |

| Replenishment of the reserve fund | ||

| Funds contributed by the founder to add reserve capital | 50,51 | 91/1 |

| The company's income for the year was determined | 91/1 | 99 |

| Net annual income calculated | 99 | 84 |

| Deductions were made to the reserve fund in accordance with the charter | 84 | 82 |

When financial assistance is not taken into account when calculating income tax

In some cases, financial assistance does not need to be taken into account as income when calculating income tax. Such situations are named in the table below.

| Type of assistance received | Conditions under which you do not have to reflect income in tax accounting | Restrictions | Reasons |

| Property, including money. In addition to property and non-property rights | The participant, founder or shareholder who provides financial assistance owns more than 50 percent of the authorized capital of the recipient organization | The property or part thereof cannot be transferred to third parties during the year. Otherwise, its cost will have to be taken into account in income. The restriction does not apply to money | Clause 2 of Article 38, clause 8 of Article 250, subclause 11 of clause 1 of Article 251 of the Tax Code of the Russian Federation |

| The organization receiving financial assistance owns more than 50 percent of the authorized capital of the transferring organization. Moreover, on the date of transfer of property, the receiving organization must own this contribution by right of ownership | If the transferor is a foreign company included in the list of states and territories that provide preferential tax treatment, the value of the property received from it must be included in income regardless of the size of the share | ||

| Property and non-property rights, property itself, including money | Financial assistance was provided to increase the net assets of the recipient organization. The size of the shares in the authorized capital does not matter. Including when this is done with a simultaneous reduction or termination of the debt of the recipient organization to the participant, founder or shareholder | The purpose of financial assistance is directly indicated in the decision or provided for in the constituent documents of the recipient organization | Subclause 3.4 of clause 1 of Article 251 of the Tax Code of the Russian Federation |

If financial assistance received from a participant, including a founder or shareholder, does not increase the base for calculating income tax, a permanent difference arises in accounting, with which a permanent tax asset must be calculated (clause 7 of PBU 18/02).

Financial assistance to increase net assets is not taken into account in income. This rule also applies to situations where, at the request of participants, founders or shareholders, the company’s debt to them is reduced or terminated. For example, if a company has not fulfilled its obligations to a participant under a loan agreement, he can transfer the loan to increase net assets. Thus, he terminates the company’s obligations under the agreement (letter of the Federal Tax Service of Russia dated July 20, 2011 No. ED-4-3/11698).

At the same time, interest accrued on such a loan and written off through debt forgiveness is not recognized as property received free of charge in order to increase net assets. In fact, these funds are not transferred to the public. Therefore, the debtor includes them in non-operating income on the basis of paragraph 18 of Article 250 of the Tax Code of the Russian Federation. Such clarifications are given in the letter of the Federal Tax Service of Russia dated May 2, 2012 No. ED-3-3/1581.

An example of reflection in accounting and taxation of fixed assets received free of charge from the founders to increase net assets. The organization applies a general taxation system

Based on the results of 2015, Torgovaya LLC revealed that the amount of net assets is less than the authorized capital.

In March 2016, one of the participants, A.S. Glebova - decided to make a property contribution to the society in order to increase net assets - a Sony VAIO VPC-L22Z1R/B computer worth 78,000 rubles. In the same month, at the general meeting of participants, this decision was approved and enshrined in the minutes. The computer was handed over to Glebova to the company and put into operation the same month.

In March, the following entries were made in the accounting records of Hermes:

Debit 08 Credit 83 subaccount “Glebova’s contribution to increasing net assets” – 78,000 rubles. – fixed assets received from Glebova to increase net assets were taken into account;

Debit 01 subaccount “Fixed asset in operation” Credit 08 – 78,000 rub. – the fixed asset was accepted for accounting and put into operation.

When calculating income tax, the cost of a computer received free of charge is not taken into account (subclause 3.4, clause 1, article 251 of the Tax Code of the Russian Federation).

Situation: is it possible to take into account expenses paid with financial assistance from the founder when calculating income tax? The founder's share in the authorized capital exceeds 50 percent.

Yes, you can.

After the money received free of charge from the founder is capitalized, it becomes the property of the organization. Therefore, they spend them as their own funds. Consequently, costs paid with these funds can be taken into account when calculating income tax. Provided, of course, that the costs are economically justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation).

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated March 20, 2012 No. 03-03-06/1/142, dated June 29, 2009 No. 03-03-06/1/431, dated January 21, 2009 No. 03 -03-06/1/27 and confirmed by arbitration practice (see, for example, decisions of the FAS of the North-Western District dated April 12, 2007 No. A56-13199/2006, Volga-Vyatka District dated August 28, 2006 No. A29- 13543/2005a).

An example of how expenses paid from financial financial assistance from the founder are reflected in accounting and taxation. The founder's share in the authorized capital of the organization is 55 percent

In February, the founder of Torgovaya LLC A.V. Lvov provided the organization with free financial assistance in cash. The money was provided to replenish our own working capital. The amount of assistance is 150,000 rubles. In the same month, the money received was used to purchase materials. The cost of purchased materials is 150,000 rubles. (including VAT – RUB 22,881). In March, the materials were released into production.

The organization uses the accrual method. Income tax is paid monthly.

Postings have been made in the organization's accounting.

In February:

Debit 51 Credit 91-1 – 150,000 rubles. – received funds from the founder;

Debit 68 subaccount “Calculations for income tax” Credit 99 – 30,000 rubles. (RUB 150,000 × 20%) – a permanent tax asset is reflected;

Debit 60 Credit 51 – 150,000 rub. – funds were transferred to the materials supplier;

Debit 10 Credit 60 – 127,119 rub. – materials are capitalized;

Debit 19 Credit 60 – 22,881 rub. – input VAT is reflected;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 22,881 rub. – accepted for deduction of input VAT.

In March:

Debit 20 Credit 10 – 127,119 rub. – materials are written off for production.

When calculating income tax in February, the Hermes accountant did not include funds received from the founder as income. When calculating income tax in March, the cost of materials written off for production was taken into account as expenses.

Use of gratuitously received funds in economic activities

The conditions of paragraphs do not apply to funds. 11 clause 1 art. 251 of the Tax Code of the Russian Federation on the impossibility of transferring property received free of charge to third parties within one year.

For profit tax purposes, the gratuitous receipt by a business company of funds from the founder, who owns more than 50% of the share in the authorized capital of the company, and the further expenditure of funds on the acquisition of any assets are considered as two different business transactions.

After being accepted for accounting, funds received free of charge acquire the status of own funds from the recipient organization.

Consequently, their expenditure qualifies as expenditure of the taxpayer’s own funds and must comply with the requirements of Art. 252 of the Tax Code of the Russian Federation (Letters of the Ministry of Finance of Russia dated January 23, 2008 N 03-03-05/2, Federal Tax Service of Russia for Moscow dated February 18, 2008 N 20-12/015203).

Therefore, in practice, many enterprises act as follows: a participant (shareholder) who owns a share in the authorized capital of more than 50% transfers funds to the enterprise free of charge, which are not subject to income tax on the basis of paragraphs. 11 clause 1 art. 251 Tax Code of the Russian Federation. Then the company pays expenses, buys fixed assets, goods, and materials with this money. As a result, the expenses were paid, the property was not received free of charge, but was paid for with its own funds, therefore the organization takes into account income tax expenses in accordance with the generally established procedure.

The main thing is that the provisions of Art. 252 Tax Code of the Russian Federation:

expenses were incurred to carry out activities aimed at generating income;

expenses are economically justified and documented.

When and how financial assistance should be included in income when calculating income tax

When none of the conditions for exemption from taxation of the received financial assistance are met, take it into account as part of non-operating income (clause 8 of Article 250 of the Tax Code of the Russian Federation).

Recognize income:

- on the day the money is received in the current account or at the cash desk;

- on the date of receipt of the property (for example, execution of the transfer and acceptance certificate).

These rules apply both to the accrual method and to the cash method (subclauses 1 and 2, clause 4, article 271, clause 2, article 273 of the Tax Code of the Russian Federation).

If financial assistance received from a participant (founder, shareholder) increases the base for calculating income tax, but is not reflected in the income in accounting, a permanent difference is formed, with which a permanent tax liability must be calculated. This follows from the provisions of paragraphs 4 and 7 of PBU 18/02. For example, such a situation may arise when receiving money to pay off a loss formed at the end of the reporting year, or when receiving property for free use.

An example of reflection in accounting and taxation of funds received free of charge from the founders to pay off losses at the end of the reporting year. The organization applies a general taxation system

Based on the results of 2015, Torgovaya LLC received a loss of 1,000,000 rubles. The founders of Hermes are A.V. Lvov (share in the authorized capital of Hermes is 51%) and A.S. Glebova (share – 49%).

In March 2016 (before the annual financial statements were approved), the founders decided to cover the resulting loss from their own funds in the following proportions:

- Lviv - in the amount of 510,000 rubles;

- Glebova - in the amount of 490,000 rubles.

In the same month, money from the founders arrived in the Hermes bank account.

In March 2016, the following entries were made in the accounting records of Hermes:

Debit 75 subaccount “Funds from Lvov aimed at repaying the loss” Credit 84 – 510,000 rubles. – a decision was made to repay part of the loss to Lvov;

Debit 75 subaccount “Glebova’s funds aimed at repaying the loss” Credit 84 – 490,000 rubles. – a decision was made to repay part of Glebova’s loss;

Debit 51 Credit 75 subaccount “Funds from Lvov aimed at repaying the loss” – 510,000 rubles. – money was received from Lvov to repay the loss;

Debit 51 Credit 75 subaccount “Glebova’s funds aimed at repaying the loss” - 490,000 rubles. - money was received from Glebova to repay the loss.

In accounting, when receiving funds from the founders to repay a loss, income does not arise. When calculating income tax, income includes funds received from Glebova (since the founder’s share is less than 50%). The result is a permanent difference and a permanent tax liability:

Debit 99 subaccount “Continuous tax liabilities” Credit 68 subaccount “Calculations for income tax” - 98,000 rubles. (RUB 490,000 × 20%) – a permanent tax liability is reflected.

Situation: is it necessary to include gratuitous assistance received from the founding commercial organization in the calculation of income tax? The amount of assistance provided exceeds RUB 3,000.

Yes need. But only if the conditions are not met that allow financial assistance not to be taken into account in income.

The fact is that, regardless of the amount of gratuitous assistance received from the founder, it does not need to be taken into account in income only in strictly defined situations. This follows from the provisions of paragraph 8 of Article 250, subparagraphs 11 and 3.4 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

In relation to gratuitous assistance, the amount of which exceeds 3,000 rubles, the possibility of applying this procedure is confirmed by arbitration practice (see, for example, decisions of the Federal Antimonopoly Service of the North-Western District dated December 23, 2005 No. A56-4986/2005, Volga District dated December 6, 2007 No. A65-5602/2007-SA1-7).

Attention: in a situation where gratuitous assistance is provided by the founding organization in the amount of more than 3,000 rubles, there is a risk that the recipient may be forced to take the assistance into account in income when calculating income tax.

Thus, according to Article 575 of the Civil Code of the Russian Federation, a gift between commercial organizations in the amount of more than 3,000 rubles. forbidden. And based on the provisions of the Tax Code, it follows that such transactions are allowed. The concept of property transferred or received free of charge for the purposes of calculating income tax is defined in paragraph 2 of Article 248 of the Tax Code of the Russian Federation. However, no cost restrictions have been established in relation to this property.

In a number of cases, it was proven in the courts that when calculating income tax, amounts over 3,000 rubles. still needs to be taken into account in income. Since assistance from one organization to another, in order to be exempt from taxation, must fulfill not only the conditions defined in the Tax Code, but also those provided for in Article 575 of the Civil Code of the Russian Federation. For example, resolutions of the Federal Antimonopoly Service of the Moscow District dated December 5, 2005 No. KA-A40/11321-05, dated June 30, 2005 No. KA-A40/3222-05.

Therefore, it is safer to formalize the funding received from the founder as an interest-free loan agreement or (if we are talking about an LLC) as a contribution to property.

Help received from a legal entity

Giving money in the form of financial assistance is essentially a gift. According to Art. 575 of the Civil Code of the Russian Federation, donations between commercial organizations are not allowed. The exception is ordinary gifts, the cost of which does not exceed 3 thousand rubles.

Thus, a gift transaction between commercial organizations is contrary to civil law and, as a consequence, on the basis of Art. 168 of the Civil Code of the Russian Federation, such a transaction will be invalid and void.

It should be taken into account that, in accordance with the Civil Code of the Russian Federation, any interested person (including the participant who transferred the money) during the limitation period may submit a claim to the court to apply the consequences of the invalidity of the donation, and the organization will be forced to return the money received. The limitation period for a claim to apply the consequences of the invalidity of a void transaction is three years.

The question arises to what extent the application of paragraphs is justified. 11 clause 1 art. 251 of the Tax Code of the Russian Federation, if the transfer of property violates the provisions of the Civil Code of the Russian Federation on the prohibition of donations.

On the one hand, the Tax Code of the Russian Federation allows for the gratuitous transfer of property (essentially, donation) between commercial organizations. The Resolution of the Federal Antimonopoly Service of the North-Western District dated December 23, 2005 N A56-4986/2005 notes that the rules of Art. 575 of the Civil Code of the Russian Federation, which prohibits donations, do not apply if the conditions of paragraphs are met. 11 clause 1 art. 251 Tax Code of the Russian Federation. The Resolution states that the Tax Code of the Russian Federation allows a Russian organization to receive property from the organization free of charge if the authorized capital of the receiving party consists of more than 50% of the contribution (share) of the transferring party, therefore Art. 575 of the Civil Code of the Russian Federation in this case is not applicable.

At the same time, there is an example of a court decision according to which the gratuitous transfer of property (donation) between commercial organizations is not allowed. Thus, in the Resolution of the Federal Antimonopoly Service of the Moscow District dated December 5, 2005 N KA-A40/11321-05, it was concluded that the application of the provisions of paragraphs. 11 clause 1 art. 251 of the Tax Code of the Russian Federation is possible subject to the transfer of property free of charge in compliance with the norms of current legislation, in particular the requirements of Art. 575 of the Civil Code of the Russian Federation.

VAT

When calculating VAT, do not take into account funds received from a participant, including a founder or shareholder, as gratuitous assistance. This is explained by the fact that the receipt of money is subject to VAT only if it is associated with payments for goods, works or services sold (subclause 2, clause 1, article 162 of the Tax Code of the Russian Federation).

Providing gratuitous financial assistance in cash is not considered a sale. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated June 9, 2009 No. 03-03-06/1/380.

Situation: is it possible to deduct VAT on goods, works or services that were purchased using funds received free of charge from a participant (founder, shareholder)?

Yes, you can.

The conditions under which an organization has the right to deduct input VAT are defined in Articles 171 and 172 of the Tax Code of the Russian Federation. The buyer’s right to deduct VAT does not depend on the sources from which goods, works or services were purchased. Therefore, in the situation under consideration, input VAT can be deducted on a general basis.

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated June 29, 2009 No. 03-03-06/1/431, dated June 6, 2007 No. 03-07-11/152 and confirmed by arbitration practice (see, for example, resolutions FAS Volga-Vyatka District dated August 28, 2006 No. A29-13543/2005a, dated November 17, 2005 No. A29-933/2005a, Moscow District dated March 12, 2008 No. KA-A40/1240-08).

Free financial assistance to the founder (under the simplified tax system, postings) in 2022

1 tbsp. 50 Civil Code of the Russian Federation).

The founders (participants, shareholders) of companies of various forms of ownership can be both individuals (residents and non-residents of the Russian Federation, including employees of organizations) and legal entities (Russian and foreign organizations).

The founders have the right to provide financial assistance to the company by gratuitously transferring funds, securities or other property. The purposes of gratuitous assistance may be: conducting statutory activities; payroll calculations; transfer of taxes; payments for rent, communications and office maintenance; payment of travel expenses; repayment of loan obligations, etc.

The document on the basis of which free financial assistance can be received is, as a rule, an agreement on the provision of financial assistance.

In accounting, funds received by a Russian organization from the founder free of charge are other income and are recognized on the date of their receipt (clause 7 of PBU 9/99 “Income of the organization,” approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n).

In tax accounting in accordance with paragraphs. 11 clause 1 art. 251 of the Tax Code of the Russian Federation, property received free of charge (work, services, property rights) is not considered income for the purpose of calculating income tax.

Funds transferred free of charge by the founder of a Russian organization that are not related to the payment of goods (work, services) subject to value added tax are not included in the VAT tax base of the receiving party (clause 1, clause 1, article 146, clause 2 Clause 1 of Article 162 of the Tax Code of the Russian Federation).

In addition, in connection with the release of new releases in the “Directory of Business Operations. 1C:Accounting 8" the following articles have been updated:

Please note that starting with release 3.0.33 of the 1C: Accounting 8 program, a new Taxi interface is used. Read more here.

Along with the “Taxi” interface, the previous “1C:Enterprise 8” interface is also retained. The user can select the interface type in the program settings (see here).

For other directory news, see here.

<<< Back

, registration date – October 7, 2010, registrar – Interdistrict Inspectorate of the Federal Tax Service No. 46 for MOSCOW. One of the founders is Zayashnikov Stanislav Yurievich. The full official name is LIMITED LIABILITY COMPANY “FIRST FINANCIAL AID”. Legal address: 125009, MOSCOW, st. BOLSHAYA DMITROVKA, 5/6, bldg.

simplified tax system

When determining simplified income, the same income is not taken into account as when calculating income tax. This means that financial assistance received from a dependent founder or someone who owns more than 50 percent of the authorized capital of the recipient is also not taken into account when calculating the single tax. As well as assistance to increase net assets. This procedure is established by Article 346.15, paragraph 8 of Article 250, subparagraphs 3.4 and 11 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation and letters of the Ministry of Finance of Russia dated April 18, 2011 No. 03-03-06/1/243, dated June 9, 2009 No. 03-03-06/1/380. Although the above letters are devoted to the procedure for accounting for financial assistance when calculating income tax, their provisions can also be extended to the calculation of a single tax under simplification.

If the specified conditions are not met, then assistance from a participant, including a founder or shareholder, should be taken into account as part of non-operating income (Article 346.15 and Clause 8 of Article 250 of the Tax Code of the Russian Federation).

Recognize income:

- on the day the money is received in the current account or at the cash desk;

- on the date of receipt of the property (for example, execution of the transfer and acceptance certificate).

This follows from the provisions of paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation.

Reflection of gratuitous financial assistance for tax accounting purposes

The Tax Code of the Russian Federation provides for two options for accounting for gratuitous financial assistance. In the first case, income in the form of property received free of charge, regardless of whether it was transferred by a legal entity or an individual in accordance with clause 8 of Art. 250 of the Tax Code of the Russian Federation, except for the cases specified in Art. 251 of the Tax Code of the Russian Federation, relate to non-operating income that forms the tax base for calculating income tax.

Based on paragraphs. 11 clause 1 art. 251 of the Tax Code of the Russian Federation, when determining the tax base for corporate income tax, income in the form of property received by a Russian organization free of charge is not taken into account:

from an organization, if the authorized (share) capital (fund) of the receiving party consists of more than 50% of the contribution (share) of the transferring organization;

from an organization, if the authorized (share) capital (fund) of the transferring party consists of more than 50% of the contribution (share) of the receiving organization;

from an individual, if the authorized (share) capital (fund) of the receiving party consists of more than 50% of the contribution (share) of this individual.

In this case, the received property is not recognized as income for profit tax purposes only when, within one year from the date of its receipt, the specified property (except for cash) is not transferred to third parties.

Thus, the reflection of this transaction in tax accounting depends on the source of assistance.

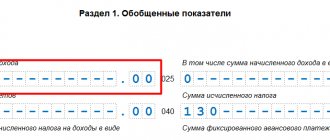

In the first case, in the income tax return, gratuitous financial assistance must be reflected as follows: line 100 indicates the total amount of non-operating income of the enterprise. Line 103 shows the value of property, work, services or property rights received free of charge, with the exception of those specified in Art. 251 Tax Code of the Russian Federation.

The procedure for reflecting gratuitous financial assistance for tax accounting purposes in the second case is explained in Letter of the Ministry of Finance of Russia dated 04/02/2008 N 03-03-06/1/252.

The Letter states that funds received free of charge by the company from a shareholder with a stake in the authorized capital of more than 50% are not taken into account when determining the tax base for corporate income tax.

As for the income tax return, gratuitous financial assistance received from a participant (shareholder) owning a stake in the authorized capital of more than 50% is reflected in line 200 “Amount of income not taken into account when determining the tax base.”

OSNO and UTII

If financial assistance is received and the conditions for its exemption from taxation are not met, then when calculating income tax, it must be taken into account in non-operating income.

The current tax legislation does not contain a mechanism for distributing non-operating income between different types of activities. If you cannot determine whether non-operating income belongs to a particular type of activity, then its entire amount should be included in the tax base for income tax and tax should be charged at a rate of 20 percent. This position is adhered to by the Russian Ministry of Finance in letter dated March 15, 2005 No. 03-03-01-04/1/116.

What to consider when providing charitable assistance

Today, the issue of charitable assistance is more relevant than ever. A huge number of businessmen provide free assistance to citizens, charitable organizations and medical institutions: they make monetary donations, provide premises, cars, free lunches, food, medical products, medicines, personal protective equipment.

Of course, the life and health of people are the determining factors, and few people think about what tax consequences arise for the benefactor. And they may turn out to be an unpleasant surprise if you do not take into account some of the nuances of tax legislation, the official position of controllers and judicial practice.

Thus, if assistance is provided in the form of a transfer of funds, the issue of charging VAT on such transfer does not arise; this is not recognized as the sale of goods (work, services) for the purposes of imposing this tax (subclause 1, clause 3, article 39, subclause 1 Clause 2 of Article 146 of the Tax Code of the Russian Federation). There will be no issues with VAT calculation even when the benefactor uses a special tax regime or is exempt from paying this tax.

If goods are transferred (work is performed, services are provided), it is necessary to pay attention to the documentation of this assistance. In particular, the norm sub. 12 clause 3 art. 149 of the Tax Code of the Russian Federation provides for exemption from VAT if goods (work, services) are transferred as part of charitable activities.

At the same time, VAT exemption is not applicable when it comes to the transfer of excisable goods (for example, the transfer of disinfectants). The exemption does not apply in the case of a sponsorship contribution: it is not a charitable donation, is of a targeted nature and involves reciprocal obligations of the parties to provide advertising services1.

At the same time, both the Ministry of Finance of Russia and the Federal Tax Service for Moscow insist that in order to confirm the right to exemption from VAT, the following documents must be submitted2:

- agreement on the gratuitous transfer of goods (work, services), property rights;

- act of acceptance and transfer of goods (work, services), property rights or other document confirming the transfer;

- documents proving the intended use of the received.

In the absence of supporting documents, there is a high risk that the benefactor will not be able to confirm the right to VAT exemption.

In fairness, I note that the norms of Ch. 21 of the Tax Code of the Russian Federation does not provide a list of such documents. In accordance with the norms of civil law, a donation is a unilateral transaction and does not require anyone’s consent to accept it (clause 2 of Article 582 of the Civil Code of the Russian Federation). This means that additional bilateral documents are not required.

Judicial practice, in turn, is also ambiguous. Some courts proceed from the fact that the receipt of funds as part of charitable assistance is confirmed by a letter from the recipient with a request to transfer money for certain purposes and a payment order for the transfer of funds by the benefactor3.

Others believe4 that unilateral donations (without concluding an agreement) are consistent with the provisions of the Federal Law “On Charitable Activities and Volunteering (Volunteering)”: the transfer of goods (services) is carried out on the basis of relevant orders and letters.

Considering the contradictory positions of official bodies and courts, it is still advisable to create a package of documents confirming the transfer of goods (work, services) for charitable purposes. This will help reduce risks and confirm the meaning of the business transaction5. Of course, this issue must be approached from the standpoint of economic feasibility.

Another important point: if goods (property) were specifically purchased for the purposes of charity, then the VAT paid upon their acquisition is not deductible, but is included in the cost of these goods (property) (subclause 1, clause 2, article 170 of the Tax Code RF). If such goods (property) were purchased for transactions subject to VAT earlier and VAT on them was accepted for deduction, it will have to be restored in the tax period when the goods (property) were transferred for charitable purposes (clause 3 of Article 170 of the Tax Code of the Russian Federation ). However, since the restored VAT is related to charitable activities (and will not meet the requirements of Article 252 of the Tax Code of the Russian Federation for accounting for expenses), it should be taken into account as part of other expenses (as provided in general cases according to the rules of subparagraph 2, paragraph 3, Article 170 of the Tax Code of the Russian Federation ) is extremely risky. It can be predicted with a high degree of probability that such an expense will be refused to be taken into account for income tax purposes.

Also, if the share of expenses for non-taxable transactions exceeds 5% of the total amount of expenses (paragraph 7, paragraph 4, article 170 of the Tax Code of the Russian Federation), an obligation arises to keep separate records of taxable and non-taxable transactions and amounts of “input” VAT (paragraph 4, article 149 , clause 4 of article 170 of the Tax Code of the Russian Federation). This requirement is also relevant when carrying out charitable activities6.

In addition, you can refuse to apply this exemption for a period of at least a year by submitting a corresponding application to the tax authority at the place of registration no later than the first day of the tax period from which you intend to refuse the exemption or suspend its use (clause 5 of Article 149 of the Tax Code of the Russian Federation ).

As for income tax, expenses in the form of the cost of gratuitously transferred property (work, services, property rights) and expenses associated with such transfer are not taken into account as expenses, since they do not meet the requirements of Art. 252 of the Tax Code of the Russian Federation (clause 16 of Article 270 of the Code)7. Exceptions to charitable assistance norms of Ch. 25 do not contain NC.

The amount of targeted contributions made for the maintenance of non-profit organizations (clause 34 of Article 270 of the Tax Code of the Russian Federation), as well as funds and other property, property rights transferred for the maintenance of non-profit organizations, including charitable activities, cannot be taken into account as part of expenses. 2 Article 251 of the Code).

Since expenses for goods (work, services) donated in the form of charitable assistance are not related to the receipt of income, take advantage of the provisions of sub-clause. 20 clause 1 art. 265 of the Tax Code of the Russian Federation (regarding the possibility of taking into account other justified non-operating expenses) will not work.

It should be borne in mind that not only the costs of purchasing goods (work, services) donated for charitable purposes cannot be accepted, but also depreciation on fixed assets for the period of their transfer for free use, as well as labor costs (and insurance premiums) of personnel involved in the production of goods (works, services) donated to charity, and other similar expenses.

When calculating the single tax under the simplified tax system (the “income minus expenses” base), a similar rule applies: the expenses specified in Art. 270 of the Tax Code of the Russian Federation, not accepted8.

The laws of constituent entities of the Russian Federation may establish the right to reduce the amount of tax (advance payment) subject to credit to the revenue side of the budgets of these constituent entities - the use of an investment tax deduction when calculating income tax (clause 1 of Article 286.1 of the Tax Code of the Russian Federation). Please note that:

- this right must be provided for by the law of the subject of the Federation (but not everywhere such laws have been adopted);

- donations must be transferred to state and municipal institutions operating in the field of culture, as well as non-profit organizations (funds) for the formation of endowment capital in order to support these institutions. That is, if assistance is provided, for example, directly to citizens, it will be impossible to apply a deduction;

- The right to deduction does not apply to all organizations (this applies, for example, to residents of special economic zones, participants in regional investment projects, free economic zones, territories of rapid socio-economic development. The list of such organizations is established by clause 11 of Article 286.1 of the Tax Code of the Russian Federation).

For charitable organizations, the laws of the constituent entities of the Federation may also provide for reduced tax rates to be credited to local budgets (clause 1 of Article 284 of the Tax Code of the Russian Federation). To do this, it is necessary that the subject of the Russian Federation adopts the appropriate law and meets the conditions for applying the reduced rate provided for by this law (such laws have not been adopted everywhere).

If the benefactor is an individual (including an individual entrepreneur), he has the right to receive a social tax deduction (clause 3 of Article 210, subclause 1 of clause 1 of Article 219 of the Tax Code of the Russian Federation). This right can be exercised subject to the following conditions:

- The deduction applies only to income taxed at a rate of 13%. That is, for example, individual entrepreneurs using the simplified tax system, UTII and patent will not be able to take advantage of the deduction;

- the deduction is provided in the amount sent by an individual during the year for charitable purposes in the form of monetary assistance to certain categories of recipients (charitable and religious organizations, NPOs. The list and some conditions are given in paragraph 1 of Article 219 of the Tax Code of the Russian Federation). If assistance was provided to citizens, the right to deduction does not arise;

- You cannot claim a deduction even if the assistance was provided in kind. True, there are examples when the courts did not agree with such an interpretation10. In these cases, there is a risk of a dispute with the tax authority;

- the deduction cannot exceed 25% of the income received by an individual for the year.

In addition, the balance of the deduction not used in the tax period is not carried over to the following tax periods.

The law of a subject of the Federation may increase the maximum deduction amount (but not more than 30% of the amount of an individual’s income) and establish categories of state and municipal institutions operating in the field of culture, and non-profit organizations (foundations), donations to which can be accepted for deduction in the increased maximum size.

To summarize, I would like to express the hope that in the current difficult economic conditions, one of the support measures will be the actions of the authorities, which, by reducing the tax burden, will support those who, in very difficult conditions, have shown civic responsibility by providing much-needed assistance now.

In addition, at a meeting with volunteers held on April 30, Russian President Vladimir Putin announced the need to support charitable organizations.

1 Letter of the Ministry of Finance dated September 1, 2009 No. 03-03-06/4/72.

2 Letter of the Ministry of Finance dated October 26, 2011 No. 03-07-07/66, letters of the Federal Tax Service of Russia for Moscow dated December 2, 2009 No. 16-15/126825, dated March 5, 2009 No. 16-15/019593.1 , dated August 2, 2005 No. 19-11/55153.

3 Resolutions of the Federal Antimonopoly Service of the Moscow District dated January 26, 2009 No. KA-A40/13294-08 in case No. A40-3912/08-129-16, dated January 9, 2008 No. KA-A40/13490-07-2 in case No. A40-74705/06-126-466, FAS North-Western District dated November 17, 2005 in case No. A56-11300/2005.

4 See, for example, Resolution of the Federal Antimonopoly Service of the East Siberian District dated August 18, 2005 No. A58-5044/04-F02-3966/05-S1.

5 Resolutions of the FAS Volga District dated November 10, 2005 in case No. A55-2057/2005-29, FAS North Caucasus District dated August 21, 2013 in case No. A32-26727/2012.

6 Resolution of the Federal Antimonopoly Service of the Moscow District dated October 11, 2011 in case No. A40-138316/10-90-799.

7 See also letters of the Ministry of Finance of Russia dated April 16, 2010 No. 03-03-06/4/42, dated April 4, 2007 No. 03-03-06/4/40.

8 Clause 2 art. 346.16 Tax Code of the Russian Federation. See also Resolution of the Federal Antimonopoly Service of the Ural District dated June 26, 2012 No. F09-4813/12 in case No. A50-19121/2011, Letter of the Ministry of Finance of Russia dated April 15, 2005 No. 03-04-14/06.

9 Letter of the Ministry of Finance of Russia dated March 2, 2010 No. 03-04-05/8-78.

10 Resolutions of the Federal Antimonopoly Service of the Ural District of December 8, 2008 No. F09-9086/08-C2 in case No. A50-6933/08, of the Volga District of June 28, 2006 in case No. A12-29703/05-C51.