Bill and bill payments

Definition 1

Payments through bills of exchange are one of the non-monetary forms of payment. This form of payment is called bill of exchange .

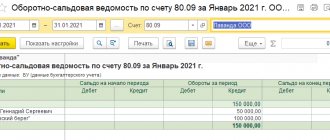

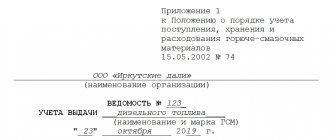

Picture 1.

Figure 2.

Bill payments in Russia are regulated by bill legislation and civil law.

Definition 2

A bill of exchange is a security, which is a debt document that certifies an unconditional right to demand that the holder of the bill pay a specified amount of money from the drawer upon the maturity date. The bill of exchange is drawn up in the prescribed form and contains mandatory details. The subject of a promissory note is only money. A bill certifies unconditional monetary obligations. The bill of exchange form of payment involves the use of simple, transferable, commodity, and financial bills.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Figure 3.

The payment period for the bill of exchange is established:

- upon presentation;

- after presentation after a certain time;

- after compilation after a certain time;

- on the specified day.

Accounting for bills of exchange used by companies when paying for goods, works or services delivered is regulated by order of the Ministry of Finance.

We paid you with a bill of exchange: accounting

Introductory information

At its core, a bill of exchange is a debt security. In practice, it is common to use this security as a means of payment, when the buyer, in payment for goods (work, services) received, transfers a bill of exchange to the buyer. So, you received a bill of exchange from your buyer in payment for the cost of goods, work or services sold to him. Let’s make a reservation right away that what kind of bill you received is of great importance. A distinction is made between the buyer's own bill and a third party bill. The difference between them is that the buyer’s own bill of exchange is issued by the buyer himself, that is, it is the buyer who acts as the drawer of the bill. He, as a rule, repays it, that is, makes payment on it (promissory note). But he can also indicate another person as the payer of the bill of exchange (bill of exchange). Whereas the buyer himself previously received a bill of exchange from a third party from another organization or bank. He can present this bill for redemption and receive money on it, sell it or transfer it as a means of payment under endorsement to his supplier.

Accounting for third party bills

Let's say you receive a third party promissory note from a buyer. Such a bill refers to the organization’s financial investments, which clearly follows from PBU 19/02 “Accounting for financial investments.” Accordingly, to reflect it in accounting, account 58 “Financial investments” is used. The question immediately arises: at what value should a bill of exchange be reflected that was not purchased for money, but was received from the buyer to repay the debt?

The answer to this question is contained in paragraph 14 of PBU 19/02. It says that the initial cost of financial investments acquired under agreements providing for the fulfillment of obligations (payment) in non-monetary means is recognized as the value of assets transferred or to be transferred by the organization. In this case, the value of assets transferred or to be transferred by the organization is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets. Thus, the initial cost of the bill will be the cost of goods sold, including VAT, and not the nominal value of the bill.

Example Stroymash LLC in October 2009 sold products to New Technologies OJSC for the amount of 177,000 rubles. (including VAT - 27,000 rubles). By agreement of the parties, in payment for these products, New Technologies OJSC transferred to the supplier an interest-free promissory note from a third party with a nominal value of 200,000 rubles, with a maturity date of November 20, 2010. This promissory note was received by the supplier in the same month when the sale took place, and more precisely, October 16, 2009. In the accounting records of Stroymash LLC in October 2009, the following entries were made: Debit 62 Credit 90 - 177,000 rubles. — the shipment of products is reflected; Debit 90 Credit 68 - 27,000 rub. — VAT is charged on product sales; Debit 58 Credit 76 - 177,000 rub. — the receipt of a third party’s bill of exchange for payment for products is reflected; Debit 76 Credit 62 - 177,000 rub. — reflects the “closing” of accounts receivable.

In this example, the nominal value of the bill was 200,000 rubles. This means that when the organization presents the bill for redemption, it will generate income (discount) in the amount of 23,000 rubles. (200,000 – 177,000). This discount can be reflected in accounting in two ways. The first method is that the organization attributes the difference between the initial and nominal value of a security to financial results during the circulation period of the security evenly, as income is due on it in accordance with the terms of issue (clause 22 of PBU 19/02). In this case, the corresponding account should be indicated as account 58, as this follows from the Instructions for using the Chart of Accounts. As a result, at the end of the bill’s circulation period, its original value will be brought to its nominal value. The second method is to show income on a bill at the time of actual receipt, that is, at the time the bill is presented for redemption. The chosen method must be fixed in the order on the company’s accounting policy.

Accounting for the counterparty's own bill of exchange

If you received his own bill of exchange from the buyer as payment, keep in mind: account 58 “Financial investments” cannot be used to account for such a bill of exchange. We make this conclusion based on paragraph 3 of PBU 19/02 “Financial investments” (approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n). It says that financial investments do not include “bills issued by the organization-issuer of the bill to the organization-seller when paying for goods sold, products, work performed, services rendered.” If the seller cannot account for the buyer’s own bill of exchange in account 58, the question arises: in which account should the recipient of the bill reflect this security? None of the current Accounting Regulations contain an answer to this question. However, from the Instructions to the Chart of Accounts, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n (in the comments to account 62), we can conclude that for these purposes a sub-account “Bills received” is opened for account 62.

In addition, there is a letter from the Ministry of Finance of Russia dated October 31, 1994 No. 142. It says that upon receipt of a bill of exchange for goods supplied (products), work performed and services rendered, the organization receiving the money on the bill (the holder of the bill) reflects the value of the bill in the debit of account 62 “Settlements with buyers and customers”, sub-account “Bills received” in correspondence with the account in which revenue is reflected. Later, the Ministry of Finance of Russia, by letter dated January 20, 2003 No. 16-00-12/2, confirmed the possibility of using the “old” letter in the future.

Judging by the explanations contained in these letters, the organization must immediately make an entry for the cost of shipment (which is equal to the amount of the bill of exchange): Debit 62 subaccount “Bills received” Credit 90. However, in practice, many organizations split this posting into two entries: 1. Debit 62 subaccount “Debt for goods (work, services)” Credit 90 2. Debit 62 subaccount “Bills received” Credit 62 subaccount “Debt for goods (work, services)”. In our opinion, both the first and second options are correct, therefore the organization, at its own discretion, can use any of them.

Accounting for settlements using bills of exchange

Settlements on bills of exchange arise from the moment when the buyer issues a bill of exchange in the name of the supplier as security for the debt for the goods supplied to him. Thus, the supplier provides a deferred payment to the buyer, a kind of commercial loan.

The company that issued the bill of exchange records the debt on it in the $60$ account “Settlements with suppliers and contractors” in the subaccount $3$ “Bills issued”. The drawer reflects the amount specified in the bill as a reduction in the debt to the supplier for the goods received and at the same time takes it into account in the form of accounts payable to the supplier under the executed bill. In this case, the following entry is made in accounting:

Features of settlements using bills of exchange

These features include the following:

- the drawer and holder of the bill can be either a citizen or a legal entity (Article 2 of Law No. 48-FZ), including in cases established by law - an administrative-territorial unit;

- only a monetary obligation can be transferred under a bill of exchange;

- the bill of exchange can be executed exclusively on paper (Article 4 of Law No. 48-FZ, Clause 2 of Resolution No. 33/14);

- a bill of exchange can be simple (under which the drawer undertakes to pay the corresponding amount to the holder of the bill) or transferable (under which the drawer issues the bill to the holder of the bill, and payment for it is made by a third party who has assumed such an obligation by acceptance);

- the list of mandatory details of a promissory note is enshrined in clause 75 of regulation No. 104/1341, the details of a bill of exchange - in clause 1 of the said regulation.

Conclusion

A bill of exchange is a security that confirms an unconditional debt obligation. You can collect a debt on a bill of exchange in a simplified form, using a court order.

Therefore, it is convenient to use a bill of exchange in settlements with deferred payment, as a guarantee of payment. In this case, accounting must be carried out on separate “bill” sub-accounts opened to standard accounts for accounting payments.

Discount or interest on a bill associated with deferred payment should be charged to other income of the supplier and other expenses of the buyer.

Accounting

In accounting, reflect the transfer of your own bill of exchange in payment for goods (work, services) in separate subaccounts to the settlement accounts. For example, this may be account 60 “Settlements with suppliers and contractors” subaccount “Settlements on bills issued” or account 76 “Settlements with various debtors and creditors” subaccount “Settlements on bills issued”.

This is due to the fact that an organization that pays a counterparty with its own bill of exchange does not recognize the bill itself as property (goods). Being in the ownership of the drawer, he does not certify any rights and obligations, and upon transfer only secures the debt, guaranteeing payment on it with a deferred payment. That is, for the drawer, his own bill of exchange is not a security, and there is no need to reflect it using account 58-2 “Debt securities”. This follows from articles 815, 823 and paragraph 1 of article 142 of the Civil Code of the Russian Federation, articles 1 and 75 of the Regulations approved by the resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341, and paragraph 3 of PBU 19/02.

Debt to the counterparty for goods (works, services), secured by your own bill of exchange, should be taken into account at the cost of goods (works, services). This follows from the systematic interpretation of the provisions of paragraphs 1 and 2 of PBU 15/2008 and paragraphs 6.2 and 6.3 of PBU 10/99.

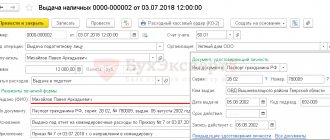

When transferring your own bill of exchange when paying for goods (work, services), make the following entry in accounting:

Debit 60 (76) subaccount “Settlements for purchased goods (works, services)” Credit 60 (76) subaccount “Settlements for bills issued” - your own bill was issued to ensure payment for goods (works, services).

When repaying (paying) your own bill of exchange, make the following entry in accounting:

Debit 60 (76) subaccount “Settlements on bills issued” Credit 51 (50) – the presented bill is repaid (paid).

This scheme of accounting entries follows from the Instructions for the chart of accounts (accounts 60, 76) and paragraph 2 of the letter of the Ministry of Finance of Russia dated October 31, 1994 No. 142. It is this letter that explains the procedure for reflecting in accounting transactions with the organization’s own bills of exchange (clause 13 of the Government Resolution RF dated September 26, 1994 No. 1094). Although this document was adopted in pursuance of the old accounting legislation, its provisions can still be applied now with amendments to the new Chart of Accounts.

Situation: is it necessary to keep records of issued own bills of exchange on off-balance sheet account 009?

Yes need.

The issued own bill is security and confirmation of the obligation, which gives the organization the right to defer payment. This follows from Article 815 of the Civil Code of the Russian Federation, Articles 1 and 75 of the Regulations approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

The instructions for the chart of accounts to reflect the security issued by the organization provide for account 009 “Securities for obligations and payments issued.”

In addition, the need for such an accounting entry is confirmed by paragraph 8 of the letter of the Ministry of Finance of Russia dated October 31, 1994 No. 142. It is this letter that explains the procedure for reflecting in accounting transactions with the organization’s own bills of exchange (clause 13 of the Decree of the Government of the Russian Federation dated September 26, 1994 No. 1094 ). Although this document was adopted in pursuance of the old accounting legislation, its provisions can still be applied now with amendments to the new Chart of Accounts.

When using an off-balance sheet account in accounting, make the following entries.

– When issuing security:

Debit 009 – reflects the amount of collateral issued.

– When paying off debt:

Loan 009 – the amount (part of the amount) of the issued collateral is written off.

At the same time, the organization must reflect reliable information on the movement of bills of exchange in the context of analytical accounting according to balance sheet accounts (for example, 60, 76). In this case, there is no need to reflect transactions on the issuance and repayment of own bills of exchange on the balance sheet (on account 009) (clause 3 of Article 10 of the Law of December 6, 2011 No. 402-FZ).

Confirm the fact of transfer of the bill of exchange with a primary document drawn up in any form; there is no unified form for this. For example, this could be an act of acceptance and transfer of own bills. Compile it taking into account the requirements for primary documents.

Situation: how to reflect in accounting the transaction of transferring one’s own bill for goods (work, services), if it is formalized by a novation agreement? The debt to pay for goods (works, services) has been converted into a loan obligation.

Reflect as security for the obligation under the loan agreement.

Article 818 of the Civil Code of the Russian Federation stipulates that by agreement of the parties, a debt can be replaced by a loan obligation. Such a replacement is recognized as a novation and is formalized as a loan agreement (Articles 414 and 808 of the Civil Code of the Russian Federation). From the moment an agreement is concluded on the novation of the debt to pay for goods into a loan obligation, the organization’s debt to pay for goods ceases and the organization’s obligation arises for a loan secured by a bill of exchange (clause 1 of Article 414 of the Civil Code of the Russian Federation).

Depending on the circulation period of your own bill of exchange, transactions with it are reflected in a separate sub-account (for example, “Settlements on bills of exchange issued”) to the account:

- 66 “Settlements for short-term loans and borrowings”, if the bill is issued for a period of less than one year;

- 67 “Calculations for long-term loans and borrowings”, if the loan (credit) is issued for a period of more than one year.

Make the following entries in your accounting:

Debit 60 (76) Credit 66 (67) subaccount “Settlements on bills issued” - the debt for payment for goods (works, services) has been converted into a loan obligation secured by its own bill.

This follows from paragraphs 1 and 2 of PBU 15/2008 and the Instructions for the chart of accounts (accounts 66, 67, 009).

For more information about recording borrowed obligations in accounting, see How to reflect transactions for obtaining a loan (credit) in accounting.

An example of reflecting in accounting transactions for the transfer and repayment of an organization’s own bill of exchange transferred as security for purchased goods

In February, Alpha LLC entered into a purchase and sale agreement for goods with Torgovaya LLC for the amount of RUB 3,540,000. (including VAT – 540,000 rubles). According to the terms of the agreement, to secure the obligation to pay for the goods, Alpha transfers its own promissory note with a nominal value of RUB 3,540,000. with a maturity date no earlier than March 18 of the current year.

In the same month, Hermes shipped goods to Alpha, and Alpha transferred the bill of exchange to Hermes under the transfer and acceptance certificate.

To reflect the transaction of transfer and repayment of his own bill of exchange transferred as security for purchased goods, the accountant opened a subaccount for account 60 “Settlements with suppliers and contractors” - “Settlements for purchased goods (work, .

In February, the following entries were made in the organization’s accounting records:

Debit 41 Credit 60 subaccount “Settlements for purchased goods (works, services)” – 3,000,000 rubles. (RUB 3,540,000 – RUB 540,000) – purchased goods are capitalized;

Debit 19 Credit 60 subaccount “Settlements for purchased goods (works, services)” – 540,000 rubles. – input VAT on purchased goods is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 540,000 rubles. – accepted for deduction of VAT on purchased goods;

Debit 60 subaccount “Settlements for purchased goods (works, services)” Credit 60 subaccount “Settlements for bills issued” – RUB 3,540,000. – own bill of exchange was issued to secure debt on purchased goods.

In March, Hermes presented Alpha's bill of exchange for payment. Alpha paid the debt in full.

Alpha's accountant reflected this operation as follows:

Debit 60 subaccount “Settlements on bills issued” Credit 51 – RUB 3,540,000. – the debt on purchased goods, secured by its own bill of exchange, was repaid.