When calculating vacation pay to employees, situations arise that require recalculation. The reason for the recalculation may be an accountant's error when recalling an employee from vacation or, conversely, an extension of vacation days, including due to sick leave while there.

The 1C: ZUP 3.1 program, of course, provides the opportunity to recalculate vacation pay. The procedure for this depends on whether the recalculation is made in the current month or in the next billing period.

When is it possible (necessary) to recalculate wages?

Since the terms of remuneration are mandatory information for inclusion in an employment contract, any changes to the salary must have a basis.

The basis for recalculating wages upward is:

- carrying out indexation in the organization;

- underpayment of the due amount due to a calculation error;

- increasing the employee's salary by agreement of the parties.

https://www.youtube.com/watch{q}v=413kbQ2Yi-c

The salary is recalculated downward if the employee has a debt to the company. In this case, deductions are made in accordance with Art. 137 of the Labor Code of the Russian Federation.

Another reason for reducing wages may be a change in organizational working conditions (Article 74 of the Labor Code of the Russian Federation) or a direct indication in the law (for example, for federal civil servants).

Video about the registration procedure

Paid leave is issued annually, based on the schedule adopted by the company. All employees have the right to use all vacation at once or divide it into parts (Article 125 of the Labor Code of the Russian Federation).

The law determines that one part cannot be less than fourteen days.

As for additional leave issued for hazardous work or living in unfavorable areas, it can be used either in the current year or added to the next leave.

However, it is legally allowed to combine vacations only for two years. If the employee has not used additional days during this period, they are automatically written off and he will no longer be able to use them.

In order to receive vacation pay, the employee only needs to write an application; the employer has no right to demand other documents from him, since he himself has access to them (work book, employment contract, employee vacation schedule).

Based on the application, the responsible persons must draw up an order for a specific employee to go on vacation, which will be transferred to the accounting department for calculating vacation benefits.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

How will recalculation of vacation pay affect personal income tax?

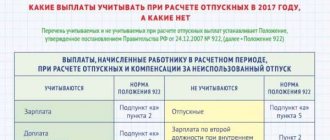

Additional payment for vacation pay is subject to personal income tax in accordance with the general procedure. The tax is charged on the difference between the previously accrued amount and the recalculated amount.

Example

From May 12 to May 31, 2022, the company has extended paid non-working days for all employees, because... In the region of operation, the self-isolation regime was extended until the end of May. According to the vacation schedule, engineer Mikhailov’s annual vacation begins on June 1, 2022. Vacation pay was accrued to him in advance in the amount of 25,260 rubles. When transferring, personal income tax was withheld at 13% - 3284 rubles. Mikhailov received 21,976 rubles in his hands.

Based on clarifications from the Ministry of Labor, the company recalculated vacation pay for June 2022, excluding the paid non-working period. As a result, the amount of the engineer’s vacation pay increased and amounted to 26,120 rubles.

Amount to be paid additionally: 26,120 – 25,260 = 860 rubles. It was decided to transfer it to the employee’s card. When paying, the company withheld personal income tax of 13%, taking into account the previously withheld tax:

26,120 x 13% - 3284 = 112 rubles.

As a result of the recalculation of vacation pay for June, Mikhailov received an additional 748 rubles. (860 -112). The company transferred the tax on May 29, 2020 in the total amount: 3284 + 112 = 3396 rubles.

The deadline for transferring personal income tax on vacation pay is the last day of the month in which they are paid to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation). Therefore, when transferring tax, the payment document indicates the month when the company pays the surcharge. For example, if, when recalculating vacation pay for May, the company paid the difference to an employee in June, the tax on this difference must be transferred by the end of June.

It is more difficult to reduce the amount of vacation pay. In this case, an overpayment occurs - both for vacation pay and personal income tax. It can be taken into account when withholding overpaid funds from the employee, which can only be done with the written consent (application) of the employee. Overpayment of personal income tax can either be returned to the employee upon his application, or offset against future periods.

Recalculation of wages for the previous period upward

In practice, recalculation upward is most often done in connection with indexation in the organization and the acquisition by an employee of a certain status / length of service, for which an incentive bonus is awarded.

For example, according to paragraph 5 of Art. 50 of the Law “On State...” of July 27, 2004 No. 79-FZ, for civil service experience of up to 5 years, the bonus is 10%, from 5 to 10 years - 15%, etc.

In the HR and accounting departments of enterprises, they may not immediately notice that an employee’s work experience has exceeded 5 years, and award him a salary that is less than it should be. Then the employee has the right to write an application for recalculation, and based on it (the application), additional accrual will occur in the next billing period.

Let's get back to indexing.

Despite the uncertainty of the provision on salary indexation by employers representing private capital (Article 134 of the Labor Code of the Russian Federation), its implementation is an obligation (definition of the Constitutional Court of the Russian Federation dated November 19, 2015 No. 2618-O, letter of Rostrud dated April 19, 2010 No. 1073-6-1) .

We invite you to familiarize yourself with: Sample agreement with payment of success fees

The procedure for salary indexation is specified in the local act; it includes the frequency and size of the increase.

The employer can focus on changes in the cost of living, the consumer price index, inflation and other values.

Recalculation of wages for the previous period will be carried out if the employer is overdue for indexation.

Additional accrual is carried out for all months when the old salary was paid, and interest for late payment is added to it in accordance with Art. 236 Labor Code of the Russian Federation.

If wages are recalculated for the previous year, will there be arrears for personal income tax{q}

With proper documentation, there will be no personal income tax arrears. The following must be taken into account:

- If the accountant made a calculation error, as a result of which excess wages were paid, in this case an arrears of income tax occur, since the tax base was reduced by a larger amount than it should have been. The taxpayer has an obligation to adjust the tax return (Articles 54, 81 of the Tax Code of the Russian Federation).

- If the recalculation is made for other reasons (i.e. the accountant is not at fault), updated declarations do not need to be submitted.

- When deductions are made from salary, the personal income tax base is not reduced. If the salary itself is reduced, the tax is returned. When the salary increases, tax is withheld and paid when the recalculation is paid.

When changing the data in the 2-NDFL certificate for the previous period, corrective certificates must be entered into the Federal Tax Service (Appendix 1 to the procedure for filling out the 2-NDFL form, approved by Federal Tax Service order No. MMV-7-11/ [email protected] ), in which specify the amount of income received by the taxpayer.

https://www.youtube.com/watch{q}v=1ENaFRS3hh4

To recalculate wages up or down, the employer must have a basis. Reductions in wages and deductions from wages are possible in cases strictly established by law.

If the requirements of the Labor Code of the Russian Federation are met, an order is issued to increase/decrease/withhold the salary with a mandatory indication of the grounds and links to documents.

Who does not need recalculation of vacation pay for April, May, June

Recalculation will not be required for companies and individual entrepreneurs that continued to work during the period of self-isolation from March 30 to May 8, 2020. After all, employees received wages, these days were actually fully worked, and accordingly, vacation pay was accrued correctly.

Employees who worked remotely during the self-isolation period will also have vacation without recalculation of vacation pay.

The employer may not make a recalculation if the interests of the employees are not affected - that is, in the case when the vacation pay turned out to be more than if the non-working period was excluded. However, in this case, there may be risks of illegally accounting for expenses in the taxable base for income tax or under the simplified tax system “income minus expenses.”

Legal grounds

All citizens of the Russian Federation working on the basis of an employment contract have the right to annual paid leave, during which they will receive their average salary (Article 114 of the Labor Code of the Russian Federation).

This right is defined in the Constitution of the Russian Federation, and is described in more detail in the Labor Code of our country.

In addition, there are additional Decrees of the Russian Government (for example, No. 922), which clarify certain points, for example, the duration of vacation for certain categories of citizens.

Sample application for salary recalculation

An employee who discovers an underpayment of wages has the right to apply to the manager for a recalculation.

The application is drawn up in a standard manner, it indicates:

- name of company;

- Full name of the General Director;

- Full name of the applicant employee;

- request to recalculate for a certain period of work;

- basis for recalculation;

- date, signature.

The time for consideration of such an application by the Labor Code of the Russian Federation is not established; this is done within a reasonable time.

In response to the application received, the employer gives a reasoned refusal or issues an order to recalculate wages.

An application for vacation pay is written a few days before the start of the vacation. Since the legislation does not precisely define the deadlines for submitting this document, the employer has the right to establish its own internal rules.

We suggest you read: How to correctly write a receipt for a refund

If the employee writes a statement later, the employer has every reason to delay the payment of benefits.

For payment

First of all, each employee is required to write an application for payment of vacation benefits. It is on the basis of this document that he will be able to go on an annual vacation, receiving his average earnings for this.

Compiling this type of application is as simple as possible, since the employee is only required to indicate the details of the head of the company, his name and position, and then submit a request for leave based on the company’s internal documents (schedule for all employees).

After this, an order will be issued, after which the employee will be transferred to the accounting department and the vacation pay will be transferred.

Vacation pay to part-time workers is paid in accordance with the general procedure.

What is vacation pay{q} See here.

For recalculation

In some cases, employees have the right to recalculate benefits.

The reason for this may be various situations:

- early departure from vacation, as a result of which the employee plans to use the remaining days of rest later;

- wage indexation, as a result of which the average citizen’s salary increases;

- incorrect calculation of vacation pay, as a result of which a smaller amount was transferred to the employee.

In any of these situations, the employee must initially write a statement addressed to the manager, requesting a recalculation of the payment due to him.

In the document, the citizen must also indicate the reason on the basis of which this action will be carried out.

In what cases is it necessary

In the event of an increase in the minimum wage, a court decision, or for other reasons, management initiates an order to recalculate wages either to the entire staff as a whole or to an individual staff unit, depending on the actual circumstances. This regulatory act will be needed in the following cases:

- carrying out planned indexation;

- accounting error;

- resolutions of the labor inspectorate;

- overpaid advance payments;

- recalling an employee from vacation;

- the occurrence of certain events affecting the amount of earnings.

Example 1

Kukushkina fell ill the day after she went on vacation and spent almost two weeks on sick leave instead of Crimea. She did not extend her vacation for the period of incapacity, but decided to go back to work and reschedule her vacation to another time. Accordingly, Kukushkina needs to recalculate her salary in connection with sick leave during the vacation period: withhold vacation pay for the period of illness and accrue temporary disability benefits during this time.

Example 2

Monday marked thirty years since Pyotr Semenovich came to work at the plant. In accordance with the remuneration system adopted by the enterprise, for every 10 years worked, an additional payment to the salary is due. So the director not only congratulated the oldest employee, but also signed an order to recalculate the long-service bonus to Pyotr Semenovich.

Order for recalculation of wages

There is no unified form for an order for an upward recalculation, but such a document typically contains:

- name of the organization, if the order is not issued on letterhead;

- date and order number;

- a brief statement of the situation, the basis for issuing the order;

- Instructing an accountant or other responsible person to make a recalculation;

- Full name of the general director, his signature.

If recalculation is made downwards, you need to pay attention to the following points:

- Reducing your salary is possible only in situations strictly defined by law.

- The salary reduction is made by deductions for unearned advance payments, travel allowances, vacation days, due to a calculation error (Part 2 of Article 137 of the Labor Code of the Russian Federation).

- The employee's written consent to deductions from wages must be obtained.

- If, due to the fault of the employee, there was a failure to comply with labor standards or downtime, the conclusion of the labor dispute commission must first be obtained, which confirms these facts.

- If the enterprise is planning organizational events, as a result of which the salary will be reduced, then 2 months before their start, all employees must be notified and their signatures must be collected.

We offer for your reference a sample order for deduction from salary, since this situation is most often encountered in the work of an enterprise: Sample order for deduction from salary.

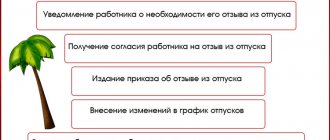

Transferring part of the vacation due to early return to work

The possibility of recall from vacation is provided for by law. The design features of this personnel event are determined by the requirements of Article 125 of the Labor Code of the Russian Federation.

From the point of view of reflecting a recall from vacation in the 1C: Salary and Personnel Management 8 program, edition 3, it is simply an early end to the vacation and the transfer of the unused part of the vacation to another time.

And just as in all previously discussed situations, the actions in the program depend on at what point in relation to the final payment for the month the recall from vacation occurs.

| Situation 5. Before payroll Employee S.S. Gorbunkov was granted (and registered in the program) Leave for the period from September 15, 2017 to September 28, 2017. Vacation pay for 14 days accrued 16,723.56 rubles. Personal income tax was calculated and withheld as of September 11, 2017 in the amount of RUB 2,174.00. Payment in the amount of 14,549.56 rubles. carried out on September 11, 2017 and reflected in the document Statement to the bank. From 09/26/2017 S.S. Gorbunkov was recalled from vacation due to production needs. Salaries for September have not yet been calculated. |

To reflect changes in the vacation end date in Situation 5, simply open the original Vacation document and correct the vacation end date in it to 09/25/2017.

The document recalculates both vacation pay and personal income tax. Now, for 11 days of vacation, the employee has been accrued 13,139.94 rubles, and is subject to personal income tax withholding in the amount of 1,708 rubles.

Vacation pay paid before the start of the vacation will be taken into account when calculating the amounts payable on salary. When calculating wages for September, three days of missed vacation will be paid according to the salary. Situation 5 presented above is displayed in the 6-NDFL report for 2022 in Section 2 as follows:

| Income received by the employee | Line Section 2 of form 6-NDFL | date | Line Section 2 of form 6-NDFL | Amount, rub. |

| Vacation | 100 | 11.09.2017 | 130 | 16 723,56 |

| 110 | 11.09.2017 | 140 | 2 174 | |

| 120 | 02.10.2017 | |||

| Salary for September | 100 | 30.09.2017 | 130 | 23 333,33 |

| 110 | 04.10.2017 | 140 | 2 568 | |

| 120 | 05.10.2017 |

The remaining three days of vacation will be provided to the employee at another agreed time.

Situation 6. After salary calculation

Employee S.S. Gorbunkov was granted leave for 28 days for the period from September 15, 2017 to October 12, 2017. Vacation pay for 28 calendar days was accrued in the amount of RUB 33,447.12. Personal income tax was calculated and withheld as of September 11, 2017 in the amount of 4,348 rubles. Vacation pay was paid including withheld tax on September 11, 2017. From 10.10.2017 S.S. Gorbunkov was recalled from vacation due to production needs. The salary for September has already been calculated. The recall from vacation did not in any way affect the salary calculation for September.

To correctly reflect the change in the vacation end date in Situation 6, the program should:

1. Open the previously posted Vacation document and use the Correct link to create a new document. The correctional document is registered in October. The end date of the vacation is set to 10/09/2017. As a result of the recalculation made in this document on the Recalculation tab of the previous period, an overpayment was created. The employee received less vacation pay than was previously paid (Fig. 5). RUB 29,863.50 was credited again, and RUB 33,447.12 was reversed. Excess amounts paid, as well as the tax withheld when transferring them, will be taken into account automatically when generating the next payroll and during the next payroll calculation.

Rice. 5. Corrective document “Vacation”

Situation 6 is displayed in the 6-NDFL report for 2022 in Section 2 as follows:

| Income received by the employee | Line Section 2 of form 6-NDFL | date | Line Section 2 of form 6-NDFL | Amount, rub. |

| Vacation | 100 | 11.09.2017 | 130 | 33 447,12 |

| 110 | 11.09.2017 | 140 | 4 348 | |

| 120 | 02.10.2017 | |||

| Salary for September | 100 | 30.09.2017 | 130 | 16 666,67 |

| 110 | 04.10.2017 | 140 | 2 167 | |

| 120 | 05.10.2017 |

Transferring part of the October part of the vacation to another date does not affect the calculations for September.

The remaining three days of vacation will be provided to the employee at another agreed time.

How to write{q}

You must write an application for payment or recalculation of vacation pay, as well as in case of delay in benefits, on a blank A4 sheet of paper.

This can be done manually or by typing text on a computer. In this case, the color of the paste does not matter much, so both blue and black are allowed. It is also not clearly defined whether the document should be filled out in capital letters or block letters. The font and size of the printed version are also not important.

Sample

The application for vacation pay, a sample of which you can see below, is filled out quite simply. It is written in the name of the head of the company, whose name and position are indicated in the header of the application. After this, write the name of the employee planning to go on vacation.

The text of the application itself must include the terms of paid vacation.

We suggest you read: Is it possible to file a claim in court by mail{q}

In cases where there is a delay in vacation pay, the employee must also first write an application addressed to the employer before contacting the labor inspectorate.

In it, he must notify of the violation of his right to paid leave, and also indicate the possible consequences, that is, appeal to higher authorities if the problem is not eliminated in the near future.

Extension and transfer of vacation: features of accounting and reporting...

… insurance premiums

When extending vacation, there is no need to recalculate insurance premiums, since vacation pay is accrued for the entire period, and contributions are calculated on the date of accrual of vacation pay. When transferring vacations, recalculations of the contribution base are made automatically in the program. In this case, it is not necessary to submit updated calculations, since recalculations are not made as a result of an error in accordance with Article 81 of the Tax Code of the Russian Federation. In the reporting for the current period, all amounts will be calculated on an accrual basis, correctly.

… Personal income tax

The date of receipt of income in the form of vacation pay is the date of their payment. Vacation pay is received in full before the vacation; there will be no second payment. Therefore, in 6-NDFL, for the period in which the vacation was granted, the vacation and the personal income tax on it are reflected, and for the period when the vacation was extended, only those payments that were made in that month. When transferring vacation, vacation pay and personal income tax are recalculated and taken into account in the following payments.

…income tax

When extending or postponing vacation, vacation pay for the purpose of calculating income tax can be taken into account in full in the period of their payment, regardless of the date of provision of the extended part.

This is confirmed by judicial practice - decisions of the Federal Antimonopoly Service of the West Siberian District dated December 26, 2011 No. A27-6004/2011, Federal Antimonopoly Service of the Moscow District dated June 24, 2009 No. KA-A40/4219-09, Federal Antimonopoly Service of the Ural District dated December 8, 2008 No. Ф09-9111/ 08-С3. However, we would like to remind cautious users that the Federal Tax Service of Russia for the city of Moscow, in a letter dated August 25, 2008 No. 20-12/079463, indicated that the amount of average earnings for the days the employee did not take off should be recognized as an expense in the period when the employee will be given the rest of the vacation.

From the editor. For even more practical recommendations on registering vacations and examples of reflection in the program “1C: Salaries and Personnel Management 8” (ed. 3), see the video recording of the lecture by 1C experts, which took place in 1C: Lecture Hall on July 27, 2017.

Recalculation of vacation pay upon recall from vacation

Part 9 art. 137 of the Labor Code of the Russian Federation defines: payment of vacation pay is made no later than 3 days before the employee goes on vacation.

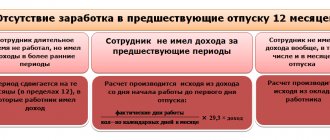

Vacation pay is calculated in accordance with clause 10 of the regulations, approved. Decree of the Government of the Russian Federation dated December 24, 2007 No. 922, according to which the average daily earnings (ADE) are first determined, which is then multiplied by the number of vacation days.

If an employee is recalled from vacation and returns to work early, he is not required to return vacation pay. There is no such provision in the Labor Code of the Russian Federation. In addition, it is impossible to make deductions from wages to pay off debt for overpaid vacation pay, since the list of grounds for making deductions is exhaustive.

In this case, the employer can take into account the amount of SDZ for the days of vacation not taken off against the salary of the next month, as an advance. That is, actually pay the usual salary minus vacation pay.

It will not be possible to save the employee’s debt, which will be closed the next time he goes on vacation, since vacation pay is paid every time the employee leaves for legal rest.

Recommended calculation procedure

The calculation algorithm itself has not changed. The calculation stages consist of the following steps:

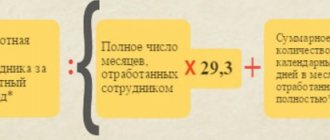

- the number of calendar days in the billing period (RP) is determined, that is, for the 12 calendar months preceding the month the vacation began. In this case, excluded days are deducted (for example, vacation at your own expense, business trip, downtime, temporary disability, etc.). If the month is fully worked, the average monthly number of calendar days is used in the calculation - 29.3 (Article 139 of the Labor Code of the Russian Federation), for months not fully worked, paid days are calculated proportionally;

- the income taken into account is summed up (amounts not related to remuneration for labor or calculated based on average earnings are not included);

- The average daily earnings are determined by dividing the amount of income by the number of days in the RP;

- the number of vacation days is multiplied by the average daily earnings - the amount of vacation pay is obtained.

When paying, the accounting department withholds personal income tax from vacation payments.

The only new rule that needs to be taken into account if the employer decides to be guided by the opinion of the Ministry of Labor is to exclude from the calculation of average earnings days and payments falling during the non-working period from March 30 to May 8, 2022.

An example of vacation pay recalculation for April 2022.

The salary of mechanic Smirnov is 18,000 rubles. On March 30 and 31, Smirnov, like all company employees, did not work. For the entire period from April 1, 2022 to March 31, 2022, earnings were accrued to him in full (including for non-working days on March 30 and 31). In April 2022, Smirnov goes on vacation for 28 days.

How the company initially accrued vacation pay to the employee (according to Rostrud’s methodology):

- salary for RP: 18,000 x 12 months. =216,000 rub.;

- average daily earnings: 216,000 / 12 months. / 29.3 = 614.33 rubles;

- vacation pay: 614.33 x 28 days. = 17,201.24 rubles;

- personal income tax withheld 13%: 17201.24 x 13% = 2236 rubles;

- Smirnov was given the amount of vacation pay in hand: 17,201.24 – 2236 = 14,965.24 rubles.

In May, the accounting department had to recalculate vacation pay for April after the Ministry of Labor issued clarifications:

- Non-working days are excluded from the RP - March 30 and 31; accordingly, the number of calendar days for calculating the average salary will change:

29.3 x 11 months. + 29.3 /31 days (calendar days in March) x 29 days. (worked by Smirnov in March 2022) = 349.7 days;

- The salary taken into account will decrease by the amount for 2 non-working days:

18,000 x 11 months + 18,000 / 21 work. days March x 19 working hours days in March = 214,285.71 rubles;

- Smirnov’s average daily earnings will be:

214 285, 71 rub. / 349.7 = 612.77 rub.

- employee's vacation pay: 612.77 x 28 = 17,157.56 rubles;

- Personal income tax on recalculated vacation pay will decrease: RUB 17,157.56. x 13% = 2230 rub. (i.e. 6 rubles were withheld excessively);

- The employee should have received: 17,157.56 – 2230 = 14,927.56 rubles.

Thus, Smirnov’s vacation pay became less: instead of 14,927.56 rubles. he received 14,965.24 rubles. The overpayment amounted to: 14,965.24 – 14,927.56 = 37.68 rubles.

As a result of recalculation of vacation pay for April, May, June 2022, the amount may not only decrease, but also increase. This will happen if accruals for March, April, May (specifically for the non-working period) have become smaller, for example, due to the lack of bonuses. Therefore, it is impossible to say for sure who will win in the end - the employee or the company. The amount of charges depends on each specific case. We described earlier in our article how to correct errors in the case of incorrectly accrued vacation pay.