Account 63

Account 63 reflects the turnover and balances of transactions related to the formed reserves for doubtful debts of counterparties. This account may reflect the amounts of reserves formed in connection with:

- violation by suppliers of the terms and conditions of shipment of goods;

- non-compliance by customers with terms and conditions of payment for services (work) received.

The account also reflects the write-off of amounts of debts recognized as bad (by a court decision, in connection with liquidation, bankruptcy of the counterparty, expiration of the statute of limitations, under other conditions).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Operations to form a reserve are carried out according to Kt 63; for their write-off and downward adjustment, Dt 63 is used.

Let's look at typical wiring:

| Debit | Credit | Operation description | A document base |

| 91.2 | 63 | The amount of the reserve for doubtful debts was formed at the expense of other expenses | Minutes of the board's decision, accounts receivable statement, accounting certificate-calculation |

| 63 | 62 | The amount of debt recognized as uncollectible was written off from the reserve previously formed on account 63 | Minutes of the board's decision, accounts receivable statement, accounting statement, court decision, liquidation (bankruptcy) document, etc. |

| 63 | 91.1 | The amount of unused reserve that was restored was taken into account | Accounting certificate-calculation |

| 63 | 76.2 | Write-off of the reserve amount in connection with satisfaction of the claim | Letter of claim, accounting certificate-calculation |

How is account 63 used in accounting?

Using an account is relevant when interacting with unreliable counterparties: the main task of an accountant in this case is to create a financial “safety cushion” that allows the company to continue operating as usual.

Unreliable counterparties include companies whose transactions are not secured by certain guarantees and are accompanied by a high probability of lack of final settlement.

Only the director or an authorized person has the right to recognize a debt as doubtful. This is done on the basis of information documenting the following situations:

- bankruptcy of the debtor company;

- delay in payment;

- inability to produce ordered products, despite the previously transferred advance payment.

Opening an account 63 is mandatory for any commercial organization.

Formation of a reserve on account 63

In April 2016, an agreement was concluded between JSC Samorodok and LLC Yantar for the supply of souvenir products made from amber. According to the agreement, “Yantar” ships “Nugget” a batch of souvenir products worth 124,380 rubles, payment for which must be received within 20 days after shipment.

In fact, the following operations for shipment and payment of souvenir products were carried out:

- 04/03/2016 “Yantar” shipped “Nugget” a consignment of goods in full.

- By April 24, 2016, payment for souvenirs had not been received from “Nugget”.

- 05/12/2016 “Nugget” partially repaid the debt in the amount of 64,140 rubles.

- As of December 31, 2016, the balance of the debt had not been repaid by Nugget.

Due to a violation of the terms of the agreement by “Nugget”, the management of “Yantar” decided to recognize the debt of “Nugget” as doubtful, and therefore a reserve was created for the amount of the debt.

The Yantar accountant carried out these operations in the following way:

| Debit | Credit | Operation description | Sum | A document base |

| 91.2 | 63 | Reflects the amount of the reserve formed for the debt “Nugget” due to violation of the deadline for payment under the agreement | RUR 124,380 | Minutes of the board's decision, accounting statement-calculation, supply agreement, accounts receivable statement |

| 09 | 68 “Income tax” | OTA taken into account (deferred tax asset) 124.380 * 20% | RUB 24,876 | Accounting certificate-calculation |

| 51 | 62 “Goods shipped” | A partial amount was received from “Nugget” to pay off the debt on shipped souvenirs | RUR 64,140 | Bank statement |

| 63 | 91.1 | The amount of the reserve previously formed was partially reduced | RUR 64,140 | Accounting statement, bank statement |

| 68 “Income tax” | 09 | The amount of OTA accrued earlier was reduced due to a decrease in the amount of the reserve (RUB 64,140 * 20%) | RUB 12,828 | Accounting certificate-calculation |

| 63 | 91.1 | The amount of the reserve equal to the amount of the outstanding debt “Nugget, restored (RUB 124,380 – RUB 64,140) | 60,240 rub. | Accounting certificate-calculation |

| 68 “Income tax” | 09 | The amount of ONA repaid in connection with the reflection of the restored reserve is reflected | RUB 12,828 | Accounting certificate-calculation |

| 91.2 | 63 | Reflects the amount of the reserve formed for the “Nugget” debt outstanding at the end of 2016 | 60,240 rub. | Accounting certificate-calculation |

| 09 | 68 “Income tax” | IT is taken into account from the amount of debt outstanding by “Nugget” at the end of 2016 (RUB 60,240 * 20%) | RUR 12,048 | Accounting certificate-calculation |

Features of working with count 63

Account 63 is passive. The debit of the account is used to pay off debts, and the credit is used to create a reserve.

Resources for account 63 can be created every month or once a quarter (both for the entire amount and for part of it). However, there are unspoken recommendations on the amount reserved for compensation of doubtful debts:

- if the debt period is from 45 to 90 days, then an amount equal to 50% of the debt should be pledged;

- if the period is more than 90 days, the amount is 100%.

This information is for advisory purposes only - the final decision is always made by the company's management.

In cases where reserve funds were not used before the end of the year, in accounting documents they are classified as an item of income of the enterprise for the period following the one in which the reserves were formed.

If there are several questionable organizations, a reserve is created for each of them.

Tax reserve formation operations

In January 2016, a contract for the supply of porcelain tableware was concluded between Sovremennik JSC and Smena LLC. According to the agreement, “Sovremennik” ships “Smena” a batch of dishes in the amount of 1,341,740 rubles, payment for which must be received within 20 days after shipment. The dishes were shipped to the Smena warehouse on April 12, 2016, but payment was not received from Smena by May 3, 2016.

To reflect the operation of creating a reserve in tax accounting, the Sovremennik accountant determined the revenue, which on an accrual basis amounted to:

- as of June 30, 2016 – RUB 17,410,000;

- as of September 30, 2016 – 21,520,000 rubles.

In the tax accounting of Sovremennik, on June 30, 2016, a reserve was created for the debt “Smena:

RUB 1,341,740 * 50% = 670.870 rub.

Due to the fact that as of September 30, 2016, the payment for “Smena” was overdue for more than 90 days, Sovremennik JSC has the right to create a reserve in tax accounting in the amount of up to 100% of the debt amount. In this case, the amount of the reserve should not exceed 10% of the amount of revenue as of September 30, 2016 – RUB 2,152,000. (RUB 21,520,000 * 10%).

In the tax accounting of Sovremennik, on September 30, 2016, a reserve was created for the debt “Smena:

(RUB 1,341,740 * 50%) * 2 = RUB 1,341,740

Due to Smena being declared bankrupt, the amount of debt was written off from the reserve.

The accounting records reflect the following:

| Debit | Credit | Operation description | Sum | A document base |

| 91.2 | 63 | A reserve has been formed for the debt of “Smena” | RUB 1,341,740 | Minutes of the board's decision, accounting certificate-calculation |

| 09 | 68 “Income tax” | The amount of IT is taken into account ((RUB 1,341,740 – RUB 670,870) * 20%) | RUR 134,174 | Accounting certificate-calculation |

| 68 “Income tax” | 09 | ONA extinguished | RUR 134,174 | accounting certificate-calculation |

| 63 | 62 “Goods shipped” | The write-off of the amount of bad debt “Smenya” is reflected | RUB 1,341,740 | Minutes of the board's decision, accounting certificate-calculation |

What is a reserve for doubtful debts and how to create it

In the event that the solvency of debtors leaves much to be desired, and the likelihood of debt repayment is reduced to zero, the organization can create a reserve fund aimed at mitigating the adverse consequences of this situation.

Doubtful debt is the debt of counterparties that is not repaid within the time limits established by contractual obligations and is not financially supported.

In order for the company to be able to create a reserve, an inventory of receivables should be carried out. The results of its implementation should be transferred to the head of the company, who determines whether there is a real need to create a fund.

Unlike accounting for accounting purposes, in tax accounting the creation of a reserve for doubtful debts is not a mandatory requirement. However, in the event that an organization nevertheless decides to form one, tax workers advise using the following rules:

- For a debt that is unlikely to be repaid and has a maturity of 45-90 days, the size of the fund is 50% of the amount of the debt;

- If the period of debt occurrence is more than 90 days, then the debt should be included in the reserve in full.

The creation of a reserve is formalized by order of the head of the company.

What should the accountant do if, before the end of the year following the year in which the reserve was formed, part of the funds remained unused? In this case, the remaining share of this financial ballast should be taken into account when preparing financial statements at the end of the year and attributed to the financial results of the organization.

There are certain situations when a company, by law, does not have the right to form a reserve to cover the debts of its debtors. From 2022, if an organization has a counter-debt to a counterparty who has not fulfilled its financial obligations under the contract, it is unlawful to classify existing receivables as doubtful. Accordingly, in this case, the formation of a reserve is possible only for the amount of the excess of the doubtful debt over the company’s counter-obligation.

Postings for using the reserve

As of 04/01/2016, the accounting records of Artemis JSC include the amount of unused reserve in the amount of 43,120 rubles. The list of doubtful and bad debts of Artemis JSC as of 04/01/2016 looks like this:

| Contractor's name | Operation description | Debt amount | Maturity | Overdue period | Debt classification |

| JSC “Hercules” | a batch of agricultural implements was shipped in favor of the counterparty under a supply agreement | RUR 168,410 | 09.04.2016 | 83 days | dubious |

| JSC “Minotaur” | the counterparty was provided with services for setting up agricultural equipment and machinery under the contract | RUR 41,960 | 08.02.2016 | 371 days | hopeless (JSC “Minotaur” was liquidated) |

A reserve has been created for the amount of doubtful debts of “Hercules”.

Due to the liquidation of Minotaur and the classification of the debt as bad, the amount of debt was written off from the previously formed reserve.

Based on the operations performed, the amount of the reserve as of 04/01/2016 amounted to 169,570 rubles. (43,120 rubles + 168,410 rubles – 41,960 rubles).

Let's look at the entries made by Artemis's accountant:

| Debit | Credit | Operation description | Sum | A document base |

| 91.2 | 63 | The amount of the reserve formed as of 04/01/2016 is reflected in other expenses | RUR 169,570 | Accounting statement, accounts receivable statement |

| 63 | 62 | The debts of “Minotaur”, recognized as uncollectible due to its liquidation, were written off from reserve amounts | RUR 41,960 | Accounting statement, accounts receivable statement |

| 63 | 91.1 | The restoration of the amount of the reserve unused at the end of 2016 is reflected | RUR 169,570 | Accounting statement, accounts receivable statement |

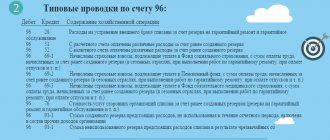

Typical accounting entries

So, typical entries when creating designated reserve funds look like this:

1) Dt 91.2

Kt 63 – formation of a reserve fund for other expenses;

2) Dt 63

Kt 62 – recognizing the amount of debt as bad and writing it off from the fund;

3) Dt 63

Kt 91.1 – accounting for the unused amount of the fund;

4) Dt 63

Kt 76.2 – write-off of fund funds due to debt repayment.

Restoring the reserve amount

In February 2016, a contract for the supply of flower products was concluded between JSC Crocus and LLC Ficus. According to the agreement, “Crocus” ships “Ficus” a batch of Dutch tulips in the amount of 84,340 rubles, payment for which must be received within 18 days after shipment. On 02/04/2016, tulips arrived at the Ficus warehouse (full batch). Payment was not received from Ficus by February 23, 2016, and therefore a reserve was formed. The debt was repaid on 02/28/14, the reserve was restored.

Operations to form and restore the reserve on Crocus’ balance sheet were carried out as follows:

| Debit | Credit | Operation description | Sum | A document base |

| 91.2 | 63 | Reflects the amount of the reserve formed for the debt of “Ficus” due to the violation of the deadline for payment under the contract for flower products | RUR 84,340 | Minutes of the board's decision, accounting certificate-calculation |

| 63 | 91.1 | The amount of the reserve for the debts of “Ficus” was restored due to the latter’s repayment of debt under the contract for the supply of flower products | RUR 84,340 | Bank statement, accounting statement, supply agreement |

Results

The presence of information about reserves for doubtful debts in accounting is necessary to inform users of reporting about the volume of such debts as part of accounts receivable. Organizations must create a reserve for all debts of their customers for which payment terms have expired and there are no guarantees. An individual entrepreneur has the right to create or not create a doubtful reserve at his own discretion.

The procedure for calculating the amount of reserves for doubtful debts in accounting is established by the organization independently and is necessarily recorded in its accounting policies.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.