According to Art. 221 of the Labor Code of the Russian Federation, in work with harmful and (or) dangerous working conditions, as well as in work performed in special temperature conditions or associated with pollution, workers are given free certified special clothing, special shoes and other personal protective equipment, as well as flushing and (or) neutralizing agents in accordance with standard standards, which are established in the manner determined by the Government of the Russian Federation.

Special clothing is personal protective equipment for employees of an organization. These include:

- special clothing;

- special shoes;

- safety equipment (overalls, suits, including insulating ones, jackets, trousers, dressing gowns, short fur coats, sheepskin coats, various shoes, mittens, glasses, helmets, gas masks, respirators, face protection, hearing protection, eye protection, and others types of special clothing and safety devices).

A specific list of labor tools taken into account as part of special clothing is determined by the organization, based on the specifics of the technological process in industries and other sectors of the economy [clauses 2,7,8 of Methodological Instructions No. 135n].

#BANNER1#

The employer, at his own expense, is obliged, in accordance with established standards, to ensure the timely issuance of special clothing, special shoes and other personal protective equipment, as well as their storage, washing, drying, repair and replacement (Part 3 of Article 221 of the Labor Code of the Russian Federation).

Accounting for workwear

The procedure for maintaining accounting records of workwear is determined by the Methodological Guidelines for the accounting of special tools, special devices, special equipment and special clothing (approved by Order of the Ministry of Finance of Russia dated December 26, 2002 No. 135n) (hereinafter referred to as the Guidelines).

Depending on the cost and useful life, workwear can be divided into three categories:

- First category : workwear with a useful life of less than 12 months.

- Second category : workwear with a useful life of more than 12 months, not included in fixed assets according to the cost criterion in accordance with PBU 6/01 “Accounting for fixed assets” (paragraph 4, clause 5 of PBU 6/01) and the accounting policy of the enterprise.

- Third category : workwear included in fixed assets (useful life of more than 12 months, costing more than 40,000 rubles).

Workwear belonging to the first category is taken into account as part of inventories, regardless of cost (clause 2 of the Guidelines).

At the same time, it can be written off to cost accounting accounts at a time in order to reduce the labor intensity of accounting work (clause 21 of the Methodological Instructions). Workwear, which belongs to the second category, is taken into account as part of inventories, but cannot be written off at a time to cost accounts. Its cost is repaid in a straight-line manner based on the useful life stipulated in the standard industry standards for the free issuance of workwear, as well as in the rules for providing workers with workwear (clause 26 of the Guidelines).

To ensure control over the safety of workwear after its commissioning, it is recorded on an off-balance sheet account (clause 23 of the Guidelines). In the 1C: Accounting 8 program, for these purposes, the off-balance sheet account MTs.02 “Working clothes in operation” is used.

Workwear, which belongs to the third category, is accounted for in the manner used for accounting for fixed assets.

Withholding the cost of uniforms upon dismissal

return: upon dismissal, upon transfer in the same enterprise to another job for which the issued protective clothing, safety shoes and safety devices are not provided for by the standards, as well as upon expiration of their wearing period in exchange for new ones received.

Special clothing, special shoes and other personal protective equipment are personal protective equipment for workers (clause 1 of the Intersectoral Rules for Providing Workers with Special Clothing, Special Footwear and Other Personal Protective Equipment, approved.

Tax accounting of workwear

The cost of workwear belonging to the first and second categories is included in material costs at a time as they are put into operation (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

Please note : As a result of accounting for the second category of workwear, a temporary difference arises, because in accounting, the cost of such workwear is written off gradually (in a linear manner), and in tax accounting, the write-off is performed at a time (material expenses).

The third category of workwear is reflected as part of depreciable property.

Retention of the cost of uniforms

1) for employees of bodies and institutions of justice of the Russian Federation with class ranks (Resolution of the Government of the Russian Federation of April 9, 2001 No. 281 “On the uniform of employees of bodies and institutions of justice of the Russian Federation with class ranks”);

Regulatory acts introducing uniforms for a number of categories of workers may provide for partial recovery of the cost of uniforms from recipients. Thus, employees of immigration control posts are issued uniforms with a 50% compensation for the cost of clothing, and employees of customs authorities - free of charge.

Accounting for workwear in the software "1C: Enterprise Accounting 8"

The procedure for accounting for workwear in the warehouse, putting it into operation and writing off its cost as production costs must be reflected in the accounting policy.

In the program “1C: Enterprise Accounting 8”, for accounting for workwear, accounts 10.10 “Special equipment and special clothing in the warehouse”, 10.11.1 “Special clothing in operation” are used, as well as the off-balance sheet account MTs.02 “Workwear in operation”.

In this article we will look at three ways to pay off the cost of workwear :

- repay the cost upon transfer to operation;

- linear;

- proportional to the volume of products (works, services).

We will also consider how operations for the issuance of workwear above the norm are reflected.

Using specific examples, we will analyze what documents are used to generate entries for accounting for workwear and how the reflection of operations for issuing workwear for operation affects income tax. Let's look at the features of accounting using this situation as an example:

On June 15, 2013, Voskhod LLC purchased 5 pieces of overalls from the supplier Tekstilshchik LLC at a price of 1,180 rubles. (including VAT), rubber boots in the amount of 7 pairs at a price of 590 rubles. (including VAT) and gloves in the amount of 15 pairs at a price of 33.6 rubles. (including VAT).

The organization has established the following standards for the issuance of workwear: overalls - 1 piece per year, rubber boots - 1 pair for two years.

Deduction for workwear upon dismissal is legal

- To begin with, the technical director, production manager or labor safety inspector issues a Regulation on the issuance of workwear, which reflects the number of sets and the timing of their use. If necessary, he can reduce the service life of PPE, or order the manufacture of clothing from more durable and wear-resistant materials.

- If the enterprise has a trade union committee, then the terms of the Regulations are discussed with it.

- The Regulations can indicate the grounds for issuing clothing, the obligation of workers to properly use PPE, wear and tear periods, and the rules for filing applications for workwear; procedure for issuance, accounting and delivery; write-off conditions; care activities.

Since special clothing is classified as personal protective equipment, the procedure for issuing it is regulated by Order of the Ministry of Health and Social Development of the Russian Federation dated 06/01/2009 No. 290n “On approval of Inter-industry rules for providing workers with special clothing...”. This Order states that the provision of PPE to workers must be supported by relevant documents:

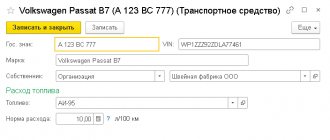

Receipts of workwear

The receipt of workwear, as well as any acquired material value, is reflected using the document “Receipt of goods and services”. The header of the document states:

- the warehouse where the purchased workwear is received;

- supplier counterparty;

- agreement under which the purchase is made.

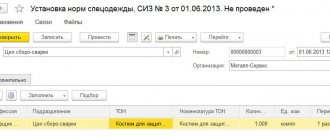

In the tabular part of the document, on the “Goods” tab, a list of purchased values is reflected, indicating the quantity, cost and VAT rate (Fig. 1).

Rice. 1

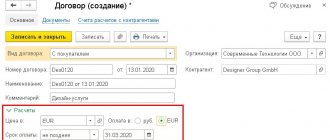

Based on the document “Receipt of goods and services”, the data of the invoice presented by the supplier is entered. To enter an invoice, you can follow the hyperlink, which is highlighted in blue at the bottom of the “Receipt of goods and services” document, or use the “Invoice” tab. The invoice must indicate the incoming number and date (Fig. 2).

Rice. 2

As a result of posting the document “Receipt of goods and services,” transactions are generated that reflect the receipt of workwear at the warehouse and the occurrence of debt to the supplier, as well as the amount of incoming VAT (Fig. 3).

Rice. 3

How to return workwear upon dismissal

First of all, it is necessary to determine the value of the lost property. In this case, the procurement documentation is raised. However, in some cases, if prices for any type of clothing have increased significantly, the employer may require the cost to be deducted from the employee’s salary, taking into account indexation.

In other circumstances, a different entry will be made, for example, if the employee compensates for damage in cash and not from salary, the note “cash” is made, and if it is withheld from the salary, “compensation for material damage.”

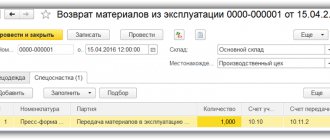

Transfer of workwear into operation

The issuance of workwear is reflected using the document “Transfer of materials for operation” (see Fig. 4).

You can go to the document log through the menu: Nomenclature and warehouse - Workwear and equipment - Transfer of materials into operation. Rice. 4

When adding a new document, on the “Workwear” tab, a list of workwear issued to employees is indicated (in our case, these are overalls, rubber boots and gloves) (Fig. 5).

Rice. 5

In the column “Purpose of use” there is information about the method of paying off the cost of workwear and the issuance standard. Let us consider in detail what information is indicated on the destination card.

Please note: The purpose of use is specified for each item separately (field “Nomenclature”), thus, the created purpose of use for overalls cannot be used in the future for gloves. In the name of the purpose of use, you can indicate how the workwear will be used, the useful life (up to a year or more than a year). The assignment card indicates the quantity according to the issuance standard, the method of repayment of the cost (according to accounting data), the useful life in months (important when using the “Linear” repayment option) and the method of reflecting expenses (i.e. cost account and analytics for which special clothing will be written off). (see pictures 6, 7, 8):

Rice. 6

As mentioned earlier, the cost of workwear with a useful life of less than a year is written off as expenses immediately at the time of putting it into operation (in our case, to account 20 “Main production”) both in accounting and tax accounting, as a result of which permanent and temporary differences do not arise . For such workwear, the cost repayment method is set to “Repay the cost upon commissioning” (Fig. 6).

Please note: The "Repayment Method" shown on the Usage Assignment Card reflects the accounting setting. In tax accounting, the cost is written off as expenses automatically. For workwear with a useful life of less than a year (for which write-off in accounting and tax accounting is carried out simultaneously), the “Useful life” indicator contains auxiliary information for analysis that does not affect the results of the document.

Let's create a use assignment for boots (Fig. 7). As noted earlier, if the useful life of workwear is more than 12 months, then in accounting the cost of such workwear will be written off as expenses gradually throughout the entire useful life in equal shares (linear method), and in tax accounting the write-off is made at a time, resulting in temporary difference.

Rice. 7

Please note : In the purpose of use, it is also possible to indicate the method of repayment of the cost “Proportional to the volume of products (works, services)”, but it is not applicable to workwear. It can only be used with special equipment.

When writing off the cost in proportion to the volume of products (works, services), the amount of repayment of the cost of special equipment is determined based on the natural indicator of the volume of products (works, services) in the reporting period and the ratio of the actual cost of the object of special equipment to the expected volume of output of products (works, services) for the entire expected useful life of the specified object.

The use of the method of writing off the cost in proportion to the volume of products (works, services) is recommended for those types of special equipment, the useful life of which is directly related to the quantity of produced products (works, services), for example, dies, molds, rolling rolls, etc.

Let’s also create a purpose of use for gloves issued in excess of the norm (Fig. 8).

Rice. 8

When issuing workwear in excess of the norm, a constant difference (DP) arises in the assessment of expenses, since write-off of workwear is carried out according to accounting data, and in tax accounting, the cost of write-off is not subject to income tax. A permanent difference occurs once in the current period. Thus, when writing off workwear in excess of the norms, the income tax adjustment is made once during the period of issue of workwear.

What do you need to pay attention to when adding a purpose for such workwear?

- In the “Method of repayment of cost”, the option “Repay the cost upon transfer to operation” is indicated, so that in accounting the cost of workwear is immediately charged to expenses (in our case, account 91.02) (Fig. 8).

- Filling out the “Method of reflecting expenses” (Fig. 9, 10).

Rice. 9

When adding a new method of reflecting expenses for the selected cost account, the analytics must be indicated - “Cost item” or the item “Other income and expenses”, depending on the selected cost account (Fig. 10).

Rice. 10

The item of other income and expenses acts as “Subconto 1” for account 91.02. Let’s create a new article with the title “Workwear beyond the norm.” When adding a new item, it is important to indicate that in tax accounting, expenses for this item are not accepted when calculating income tax: in the “Acceptance to NU” column, uncheck the box (Fig. 11, 12).

Rice. eleven

Rice. 12

As a result of this adjustment in accounting, the cost of workwear will be completely written off to account 91.02 “Other expenses”, and in tax accounting there will be a permanent difference that will affect the calculation of income tax.

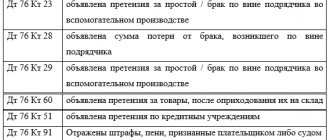

As a result of the document “Transfer of materials into operation”, the following transactions will be generated (Fig. 13):

Rice. 13

Let's analyze the transactions generated when posting the document.

Posting Dt 10.11.1 Kt 10.10 reflects the release of workwear from the warehouse into operation.

The cost of overalls “Overalls”, for which the method of repayment of the cost was established “Repay the cost upon transfer to operation”, is written off in Dt20.01 in full both in accounting and in tax accounting (entry No. 4) in the amount of 1,000 rubles.

The cost of workwear “Rubber boots” with a linear method of repayment of the cost is written off as expenses at a time only in tax accounting in the amount of 500 rubles. At the same time, the occurrence of a taxable temporary difference is recorded in accounts 20.01 and 10.11.1 (entry No. 5). The repayment of the cost of this workwear in accounting and the repayment of the resulting temporary difference will be carried out monthly throughout the entire useful life during the routine operation “Repayment of the cost of workwear and special equipment”.

Gloves that were issued in excess of the norm (entry No. 6) were immediately written off in accounting in full (20 rubles) as other expenses (account 91.02), and in tax accounting a constant difference was formed, with which when calculating income tax tax adjustment will be made.

To control the availability of protective clothing in operation, for the cost of the protective clothing transferred into operation, when posting a document, entries are made in the debit of the off-balance sheet account MTs.02 “Working clothing in operation” (entries No. 7, 8 and 9).

Important! On all balance sheet accounts the equality BU=NU+PR+VR must always be satisfied (except for accounts 90 and 91, where this equality may not be satisfied for the amount of VAT).

To analyze the fulfillment of this requirement, when generating the balance sheet in the report settings, you need to enable “Control” of the fulfillment of this equality (Fig. 14).

Fig.14

Working clothes when dismissing an employee

Specially designed clothing and footwear are widely used by employers. The workwear combines several functions at once. Its main advantage, what it was originally intended to serve, is its protective function. There are special industries in which it is impossible to do without issuing it.

- Pick up your personal workwear card and see exactly what positions are assigned to the person leaving. To do this, it is necessary to establish correct, and most importantly, timely accounting of issued and written off overalls.

- A certificate is issued stating what the person has and what its residual value is. The help indicates positions even with a zero value.

- The overalls are prepared by those leaving for delivery in full and in their pure form are handed over to the storekeeper or other person in charge of this issue.

- If returned in poor condition, a special commission may be assembled to make a decision on the possibility of accepting such things and whose fault they became unusable.

- Based on the results of the acceptance and delivery, a decision is made on how much should be withheld from the resigning employee or not at all.

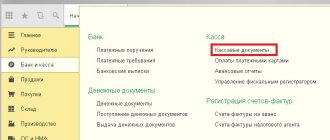

Repayment of the cost of workwear

Repayment of the cost of workwear is carried out using the regulatory operation “Repayment of the cost of workwear”.

Please note that for workwear with a useful life of more than a year, repayment of the cost will be made starting from the month following the month of commissioning. Thus, during the current month, no postings will be generated when performing a routine operation. We will pay off the cost for the next month (July).

To start a routine operation, you need to go to the menu: Accounting, taxes, reporting - Closing the period - Regular operations (Fig. 15).

Rice. 15

As a result of posting the document, a transaction will be generated to pay off the cost of the boots (Fig. 16).

Rice. 16

When posting a document to the debit of account 20.01 “Main production” in accounting, the cost of workwear is written off, calculated as follows: 500 rubles. / 24 months = 20.83 rubles per month. The repayment of the taxable temporary difference in the amount of 20.83 rubles that arose at the time of commissioning is also recorded.

Let's return to the month of transfer of workwear into operation and consider what postings will be generated at the close of the month. We will reflect the proceeds from the sale by providing a service worth RUB 11,800. (including VAT=18%) (Fig. 17).

Rice. 17

When posting the document, sales revenue and VAT will be reflected (Fig. 18).

Fig.18

In our example, there are costs from the commissioning of workwear and revenue from the provision of services. Let's find out how the formed permanent and temporary differences affect the calculation of income tax. To do this, let’s run the “Month Closing” processing.

Menu: Accounting, taxes, reporting - Closing the period - Closing the month (Fig. 19).

Rice. 19

Let’s analyze the entries generated by the regulatory operation “Calculation of income tax” (Fig. 20)

Rice. 20

From the amount of accounting profit (RUB 8,980), the conditional income tax expense is calculated:

8,980 * 20% = 1,796 rub.

Dt 99.02.1Kt 68.04.2 1,796 rub.

Fig.21

When putting boots into service (with a useful life of 2 years), the cost of the boots was 500 rubles in tax accounting. In accounting, this cost will be repaid over the useful life (2 years), and therefore, at the time the boots are put into operation, a taxable temporary difference (TDT) in the amount of 500 rubles arises, from which the deferred tax liability is calculated at the end of the month.

Dt 68.04.2 Kt 77,500 rub.*20%=100 rub.

Starting from the month following the month of commissioning, the cost of the boots will be repaid in accounting and the deferred tax liability that arose in the month of commissioning will begin to be repaid. Repayment of the resulting IT will be made over the remaining useful life in equal shares:

Dt 77 Kt 68.04.2 500 rub./24 months*20%=4.17 rub.

Since this month the organization issued special clothing in excess of the norm, a constant difference arose when generating posting Dt 91.02Kt 10.11.1. From the resulting permanent difference, a permanent tax liability (PNO) is calculated in the amount of 20 rubles * 20% = 4 rubles.

Dt 99.02.3 Kt 68.04.2 4 rub.

Calculated income tax in the amount of RUB 1,700. distributed by type of budget: federal and regional.

1,700 rub. / 20% * 2% = 170 rub. to the Federal Budget (posting No. 1)

1,700 rub. / 20% * 18% = 1,530 rub. to the Regional budget (posting No. 2)

170 rub. + 1,530 rub. = 1,700 rub.

Let's consider what transactions will be generated next month. For ease of calculation, we will again reflect sales revenue in the amount of 11,800 rubles. (including VAT=18%).

When carrying out the regulatory operation “Calculation of income tax” for July, the following transactions will be generated (Fig. 22).

Rice. 22

From the accounting profit (RUB 9,979.15), the conditional income tax expense is calculated (RUB 1,995.83):

9,979.15 * 20% = 1,995.83 rub.

Dt 99.02.1 Kt 68.04.2 RUB 1,995.83

Fig.23

In July, the deferred tax liability 77Kt 68.04.2 begins to be repaid in the amount of 4.17 rubles. The income tax is adjusted by this amount, which, taking into account the deferred tax liability, amounted to 2,000 rubles.

The calculated income tax in the amount of 2,000 rubles is distributed to the Federal budget (2%) and Regional (18%).

2,000 rub. / 20% * 2% = 200 rub. (wiring No. 1)

2,000 rub. / 20% * 18% = 1,800 rub. (wiring No. 2)

Postings generated at the close of July will be generated over the next 23 months (until the cost of the boots is repaid), provided that no additional permanent and temporary differences arise.

Deduction for uniform upon dismissal

For damage caused, the employee bears financial responsibility within the limits of his average monthly earnings. unless otherwise provided by this Code or other federal laws. Recovery from the guilty employee of the amount of damage caused, not exceeding the average monthly earnings, is carried out by order of the employer. The order can be made no later than one month from the date of final determination by the employer of the amount of damage caused by the employee. If the month period has expired or the employee does not agree to voluntarily compensate for the damage caused to the employer, and the amount of damage caused to be recovered from the employee exceeds his average monthly earnings, then recovery can only be carried out by the court. An employee who is guilty of causing damage to the employer may voluntarily compensate for it in whole or in part.

The monthly amount of payments to repay the cost of clothing is determined by dividing the cost repaid at the expense of the employee by the number of months of wearing the clothing, taking into account restrictions on the amount of deductions. Payment repayment begins in the month following the month the clothing was issued.

Registration of deduction for workwear upon dismissal

At hazardous enterprises, as well as other organizations where workers must look the same, management provides sets of workwear. Their cost does not affect the salary, since they are given to employees absolutely free of charge. Formally, such clothing is considered one of the types of personal protective equipment along with equipment. In addition to masks, gas masks, bags, and other life-saving tools, PPE also includes special clothing: shoes, pants, jackets, peacoats, and so on. In order to look presentable at work, management must issue two such sets, however, there is no strict indication in this regard in Russian legislation. The Ministry of Health, however, has drawn up several rules for the issuance and use of personal protective equipment.

Important! Not only the employees themselves receive protective clothing, but also all other people who have access to the work site. Among them are management representatives who visit the site from time to time. Also, a student, intern or intern who plans to find a job in the future can receive temporary workwear. Workers performing part-time duties can also count on protective clothing.

Retention of the cost of uniforms

The grounds for withholding amounts from employees' wages are statements signed by them (on the release of products for a fee, on the provision of a repayable loan, on the withholding of funds to repay subscriptions to shares and other securities, etc.), obligations and agreements.

The monthly amount of payments to repay the cost of clothing is determined by dividing the cost repaid at the expense of the employee by the number of months of wear, taking into account restrictions on the amount of deductions. Payment repayment begins in the month following the month the clothing was issued. Thus, the last payment is made in the month following the month of expiration of the clothing period.

How is the cost of uniforms deducted?

The purchase of uniforms is intended for the employee to perform work duties, and the employer must provide employees with uniforms free of charge. Employees should not purchase uniforms at their own expense or compensate for their cost upon dismissal - they must hand them over to the employer.

The procedure for issuing uniforms is determined by an order or resolution of the relevant department, if the obligation to wear it is enshrined in law. If the employer, on his own initiative, wants to assign such an obligation to employees, then the procedure for issuing and wearing uniforms can be provided for in an internal document of the organization, for example, Labor Regulations or Regulations on the provision of uniforms.