We prepare the implementation: how invoices and delivery notes are issued

Each fact of economic activity is accompanied by the preparation of primary documents.

Based on them, the accountant records the completed transaction in accounting. Operations for the sale of products, work, services, etc. are no exception. During this operation, the seller must issue a primary document (for example, a bill of lading), on the basis of which the product, work, service is transferred (or ownership is transferred) to the buyer. If the seller pays VAT, then in general cases he issues an invoice to the buyer. But he can do this not at the time of transfer of the asset or ownership of it, but within five days after shipment. Thus, the delivery note and invoice are a single set of documents for the sale of goods, but they are intended to take into account various objects. To understand the difference between a delivery note and an invoice, let's look at each document separately.

How to hem?

Invoices and invoices are filed and stored separately, since each document has its own role. The only similar requirement is monthly recruitment.

Reference! An invoice is a warehouse document, filed in accordance with the date of issue or receipt of goods and materials, according to the register of invoices.

Such a register forms order according to the actual shipment or acceptance of goods. An invoice is a tax document. The seller files it in accordance with the sales book, strictly by numbering. The buyer according to the purchase book, which also forms the order of the actual receipt of the document.

What is a bill of lading used for?

A consignment note in the form TORG-12 is one of the types of primary documents on the basis of which the transfer, for example, of goods purchased for resale or products of own production to the buyer takes place. That is, the invoice is needed to record inventory items.

The form and instructions for filling out the consignment note were approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. However, according to the Law “On Accounting” dated December 6, 2011 No. 402-FZ, economic entities have the right:

- develop your own forms of primary documentation while maintaining the necessary details;

- supplement unified forms with essential details.

Is it necessary to indicate bank details in TORG-12? What if it doesn't have a seal? You will find answers to these and other controversial questions about filling out the document in ConsultantPlus. Trial access to the legal system is free.

Simultaneously with the issuance of the consignment note, accounting entries are generated for the sale of:

- Dt 62.1 Kt 90.1 - reflects the fact of sale of products or goods to the buyer;

- Dt 90.2 Kt 41, 43 - cost of goods or products sold.

Based on the delivery note, the buyer will reflect in his accounting the receipt of material assets by posting Dt 10, 15, 41... Kt 60.1.

Invoice – what is it?

Invoice (IF) is a document that certifies the actual shipment of goods, or the provision of services, as well as their cost. In accordance with paragraphs. 6.7 hours 2 tbsp. 9 of the Law of December 6, 2011 N 402-FZ, SF is not a primary accounting document.

Why is SF needed? An invoice is issued by sellers or performers to the buyer, or customer, after the buyer accepts the product or service.

Attention! The only purpose of an invoice is to record value added tax. As a result, this document is a tax document and has a strictly established template.

Based on the SF, the accounting department creates a “purchase book” and a “sales book.” Organizations conducting business under the simplified taxation system do not use them, since in such situations the second party has the right to use other documents, for example, a payment order, to account for VAT.

What is the difference between a bill of lading and other transfer documents?

We have already found out when a delivery note is issued, but in addition to it, other transfer documents can be issued during the sales process:

- invoice for the release of materials to the third party - form No. M-15;

- act of completion of work / provision of services;

- act of acceptance and transfer of fixed assets - form No. OS-1, etc.

From the names it is clear that the execution of the listed documents occurs depending on what property is being transferred: materials, work, services, fixed assets, intangible assets, etc.

All these documents are characterized by the fact that they must contain the details of the transferring and receiving parties, the name and, if necessary, characteristics of the transferred asset, quantity, price and value, the date when the asset was transferred, etc. The documents must be certified by the signatures of authorized persons with each party to the transaction and sealed (if any).

Look at what details should be present in the primary documents.

Is it possible to combine into one?

Since 2014, instead of an invoice and a delivery note, a common unified form has been installed - a universal transfer document (UDD), which is multifunctional and allows you to reduce the volume of primary documentation and document flow (the form can be downloaded below). UPD does not require prior confirmation of receipt of property rights, works, services or inventory items.

It includes an invoice and delivery note. When signing the UPD, the parties to the transaction confirm the sale and receipt of services, works, goods by issuing an invoice at the same time. This significantly reduces the time required for accounting operations.

These two different accounting documents, intended for conducting different operations while complementing each other, spontaneously raise questions about their content in the filled information and about the nuances of execution, in order to exclude possible errors.

Contents of the forms:

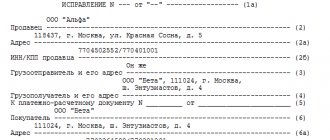

- The invoice contains:

- name of the organization of the seller and buyer;

- number and date;

- Product Name;

- quantity, grade, price, tax amount;

- basis for release of goods;

- signatures of financially responsible persons on his leave and reception;

- seal (stamp) impressions.

- The invoice contains:

- details of the organization of the seller and buyer, in accordance with the statutory documents;

- number and date;

- payment details;

- name of the product, its quantity, price, VAT amount;

- signatures of the manager and chief accountant, or authorized persons.

How to combine an invoice and a delivery note in one document is described in a separate article.

What is the purpose of an invoice and how is it different from a delivery note?

An invoice is a primary document used to record value added tax. The seller-taxpayer is obliged, when performing transactions subject to the specified tax, to issue an invoice, thus showing the accrual of VAT: Dt 90.3 Kt 68/VAT.

An invoice can be issued not only upon shipment, but also under other circumstances (for example, when funds are received from the buyer as an advance), when an invoice is not required, but VAT must be charged.

The buyer - a VAT payer has the right, on the basis of the received invoice, to accept the amount of VAT for deduction, reducing the amount of tax payable to the budget. The buyer's incoming VAT is reflected on the basis of posting Dt 19 Kt 60.1, and the tax deduction statement is Dt 68/VAT Kt 19. However, for this, the document must comply with all the requirements of tax legislation.

The form of the invoice and the rules for filling it out are given in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

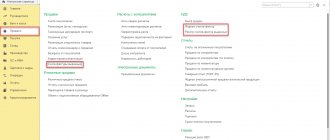

From 01.07.2021, an updated invoice form is in effect, as amended by Decree of the Government of the Russian Federation dated 02.04.2021 No. 534. The update of the form is due to the implementation of a goods traceability system. All taxpayers are required to use the new form, even if the goods are not included in the traceability system. Read more about the changes made to the document here.

You can download the new invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

The invoice, as well as the delivery note, must indicate the name of the product, its quantity, unit price and total cost, VAT rate and amount, amount including VAT. In addition, the details of the seller and buyer (shipper, consignee) are provided here. The document is certified by the signatures of authorized persons (usually the manager and chief accountant of the organization or individual entrepreneur). Unlike the consignment note, there is no space for printing in it.

What details of the consignment note in the TORG-12 form are required to be filled out in order to accept expenses for tax accounting and apply VAT deductions? You will find the answer to this question from 2nd class adviser to the State Civil Service of the Russian Federation E. S. Grigorenko in K+, having received trial access to the system for free.

TORG-12

A consignment note or its unified form TORG 12 is a document used when registering a transaction for the sale of goods.

TORG-12 was approved by a decree of the Federal State Statistics Service in 1998 (read about what a TORG-12 consignment note is and why this form is needed, and from this article you will learn how to fill out this document correctly). In accordance with the Tax Code of the Russian Federation, it is not necessary to use this particular form. But, as practice shows, tax authorities often “wrong up” other options, so to avoid problems and save time, it is better to use the generally accepted form of the invoice.

TN are drawn up in two copies, one of which remains with the seller, and the other with the buyer, signed on both sides. Be sure to check the presence of stamps.

We talked about how to correctly draw up a bill of lading for an individual entrepreneur and why it is needed, and from this material you will learn about the features of registering a technical document in electronic form and in the TORG-12 form.

Is it possible to issue a delivery note and an invoice in one document?

So, a delivery note is intended to account for inventory items, an invoice is intended to account for VAT. Is it possible to compose them in the form of one document?

Maybe. Such a document has been in effect since 2013 - from the moment the Federal Tax Service issued a letter dated October 21, 2013 No. ММВ-20-3 / [email protected] in order to facilitate the document flow of business entities. The letter contains a new form with the details of both documents. It was called UTD (universal transfer document).

Our legislation periodically adjusts the invoice form, and therefore the UTD form also changes.

UPD replaces:

- set of invoice and transfer document;

- transfer document.

The law does not oblige the use of UPD; this is voluntary. If a business entity decides that the UTD will be issued during shipment, then it is better to register such a decision in the accounting policy.

Sharing

Can an invoice and a delivery note be issued for the same product? SF and TN not only can, but also must be issued for the same product. Since, as we have already discussed above, this documentation performs different functions in accounting: the invoice reflects VAT, and delivery notes for the transfer of goods (about who should sign the columns “received the goods”, “received the goods” and others, you can find out here ).

Do the numbers for one product have to match?

There are no requirements under the Tax Code, as well as other regulations stating that the SF and TN numbers must match. The main thing is to ensure that the VAT amounts coincide in both cases. Each organization has the right to choose the order and type of numbering of its documents independently.

Which document should be drawn up first?

Can SF be discharged before TN? Since the SF confirms the VAT on the transferred goods, it cannot be written out in advance to the TN, except in cases where the transaction agreement provides for prepayment. The invoice must be issued no later than five days after shipment of the goods.

Is it possible to combine them?

In 2013, the Federal Tax Service introduced the UTD form into circulation - a universal transfer document that contains elements of tax and accounting. It is based on the invoice base, the rest is an element of the delivery note.

Reference! UPD can be used both as a uniting invoice with a primary document, and only as a primary document. It confirms the costs that are necessary to calculate income tax, as well as VAT deductions.

UPD can display operations such as:

- shipment of goods;

- results of work performed;

- provision of services;

- transfer of property rights.

The UPD contains the “status” attribute; if you specify “1” in this field, then the UPD will be considered as a primary document and an invoice, if “2”, then only as a primary document.

Is registration with different dates acceptable?

The invoice may have different dates from the delivery note. But you need to consider:

- The SF must be issued no later than five days after shipment of the goods, that is, TN.

- If one of the five days is a weekend, then the required date is postponed to the next working day.

There is no liability for violating this five-day deadline, however, the Ministry of Finance indicates that the buyer cannot claim a deduction for late documents.

Invoices and delivery notes are important documents, control over the completion and storage of which must not be overlooked in order to protect yourself from further problems and misunderstandings with counterparties or inspection authorities. And the choice of the form of the consignment note or the use of the opportunity to work with a universal transfer document, first of all, remains with the entrepreneur himself.

Results

So what is the difference between an invoice and a delivery note?

They are intended to reflect two different accounting objects in the accounting and tax registers. The delivery note takes into account inventory items, and the invoice takes into account VAT. Both documents are issued upon shipment or upon transfer of title, but the invoice is issued immediately at the time of shipment, and the invoice is issued within 5 days after that. The information reflected in these two documents overlaps to some extent. That is why, in order to simplify document flow, tax authorities have developed a single form that combines the details of the invoice and the primary transfer document. A sample UPD is shown above. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What are they for?

The invoice confirms the transfer of goods and materials to the buyer and serves to write off the goods from the seller's warehouse, and for the buyer it is the basis for accepting the purchased goods and materials into the warehouse, in the quantity and value specified in the invoice.

The invoice is a confirmation for the tax office of accepting the offset or refund of the VAT amount from the state budget. When generating primary documentation, the following questions arise: Can an invoice be issued before a delivery note?

In accordance with the Tax Code of the Russian Federation, the seller must issue an invoice within 5 calendar days from the date of transfer (shipment) of goods and materials to the buyer, where the date of shipment of goods is considered the day of drawing up the first primary document, namely the invoice.

Attention! An invoice issued earlier than the day of transfer of goods and materials - the date of the invoice, means a violation of the established deadlines for its preparation.

Such an action leads to the impossibility of accepting the invoice in accounting and, as a consequence, to non-offset or non-reimbursement of calculated tax amounts from the budget.

The tax authority regards this act as an offense, which is the basis for imposing penalties.

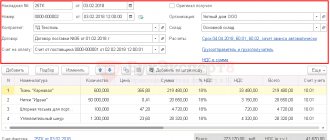

How to fill out a document: algorithm

You can use the completed invoice form as an example.

Worth considering:

- Made in duplicate for both participants.

- Signing by representatives is accompanied by a transcript.

- When issuing inventory items according to the RN, the basis must be indicated.

This paper is usually drawn up earlier than the power of attorney to receive the goods. Therefore, first, the details for the supply agreement are written down. And when delivering products, new information is included here.

If additional documentation is attached, then the primary document contains an indication of this. When registering the number of the invoice itself and the date of its creation, the latter must coincide with the moment of shipment, unless there were other agreements between the customer and the supplier. Compilation in advance (that is, retroactively) is not prohibited in order to enter all final and missing information at the time of the transaction. Most often, RNs in an organization are formed at the end of the shift of the employees responsible for this or based on the results of the operating day.

Persons who signed the paper are held accountable even under criminal law. For example, in case of theft or theft by intruders. Therefore, it is worth monitoring the availability of all items (including paintings). It’s easy to fill out an invoice using the online sample. The question arises about further steps when obtaining a RN.

Who should draw up the document

Compilation is carried out by an authorized person. Often this is an accounting employee. What exactly the position will be called is not so important. The main thing is that a person has the knowledge and authority to do this within the framework of his activities. Also, these responsibilities are delegated to warehouse employees (storekeepers and managers), supply managers, etc. The employer must have signed liability agreements and powers of attorney with all such employees. That is, this is a financially responsible personnel unit. If an incorrect RN is used, the cost designations of the goods and materials specified in it are excluded from the list of gross expenses when audited by government agencies. This leads to the imposition of unnecessary penalties and taxation.

The manager can also do this directly. Then he will not need to formalize additional agreements and arrangements with his subordinates.

Normative base

Russian laws regulate the document flow of such “consumables” in general terms. You can take note of the letter of the Trade Committee No. 1-794/32-5 dated 96. Here, clause 2.1.2 talks about the movement of goods from sellers to buyers, which is accompanied by relevant documentation. Clause 2.1.9 states that the discussed RN is also in demand for the purchaser himself when returning the purchased item due to its non-compliance with the stated characteristics, quantity or quality. Clause 2.2.4 determines the need for it when issuing products to employees of the same enterprise.

The rules for the formulation of primary documents are regulated by the State Statistics Committee. But since 2013, according to Federal Law No. 402 (which updated Law No. 129 “On Accounting”), the use of standard forms has become a recommendation. That is, business entities can develop their own designs. But they must be approved internally. It is easier for many companies to use the TORG-12 and TORG-14 forms previously invented at the state level.

That is, the legislative framework establishes 3 main types of “consumables” under discussion:

- documentation for processing the transfer of goods from the supplier to the consumer or in the event of claims;

- to confirm the transfer of goods and materials to the customer, who is given the right to resell them;

- to reflect the process of issuing valuables from the warehouse within the enterprise and to continue its stable operation.

Why do you need an invoice?

Subject to the principles of formulation, use, and accounting, no losses are guaranteed (according to documents). Both during the functioning of the subject, and after final checks and summing up for a certain time period. It is required for the act of transfer of valuables. And not necessarily in the form of their sale to acquirers. Although this situation is indeed acceptable. Then there is a direct resemblance to a sales document.

The relationship between sellers and buyers (it does not matter whether it is a legal entity or an individual entrepreneur) is implemented with the unconditional registration of the discussed RN. In the described case, this is done by the party receiving financial profit. Once completed, the form is signed first by the supplier and then by the recipient. It is the presented paper that will serve in the future as the basis for the formation of financial statements. Including the act of writing off the products placed at the disposal of the clientele. An invoice is a document for expenses and receipts in the described circumstances.

But the universal nature of the paper discussed here is expressed in the permission to use it even when distributing inventory and materials within one organization, that is, for work purposes (between departments, structures and employees). This is how the delivery from the warehouse without payment is recorded.