What is the document used for?

The main purpose of the TORG-12 form is to document the fact of the sale of goods to another organization. Thanks to the presence of such paper, the seller takes into account the remaining quantity of products in the warehouse, and the buyer takes into account the quantity of the cargo received.

Properly completed TORG-12 forms are used when transporting various products . Based on them, the released material assets are written off from the enterprise's account.

The delivery note is a document attached to the transported cargo. On the basis of the form, the transfer and receipt of valuables is carried out, and later, the receipt of goods - the crediting of funds. This receipt must be subject to registration. The procedure is carried out in conjunction with the preparation of primary documentation, which is the TORG-12 form.

The paper is drawn up at the time the client purchases the goods . Based on the recorded reporting, the products are processed and delivered to the buyer.

Why do you need an invoice?

In Russian legislation, document flow using invoices is regulated very superficially. The use of relevant documents is largely based on business traditions that have developed in the field of trade.

Among those few sources of law that regulate the use of invoices, one can highlight the letter of the RF Committee on Trade dated July 10, 1996 No. 1-794/32-5. In accordance with the norms of clause 2.1.2 of this regulation, the movement of goods from the seller to the buyer must be certified by shipping papers, in particular invoices. The provisions of clause 2.1.2 of letter No. 1-794/32-5 also note that invoices can act as both expenditure and receipt documents and must be executed by financially responsible persons during the release of goods or upon their acceptance by the organization.

Clause 2.1.9 of letter No. 1-794/32-5 states that an invoice may also be required when returning goods to the supplier (if a defect is discovered in the product during sales, the product is of low quality or has limited completeness).

In accordance with clause 2.2.4 of letter No. 1-794/32-5, when goods are released to financially responsible persons for the period of their work shift, an invoice must be issued.

Thus, the regulatory legal act under consideration establishes 2 main types of invoices:

- a document through which the transfer of goods from the seller to the buyer or from the buyer to the supplier is formalized if the product is defective;

- a document through which the transfer of goods to the disposal of the seller is formalized, who can sell the relevant products during the work shift.

In what form is it compiled?

The invoice form is generated based on the following forms:

- TORG-12 . This form is used when selling goods to another organization.

- TORG-13 . This form is used when moving within the organization.

- TORG-14 . This form is used in small retail trade. Compiled for such products for which a product report is not issued.

The forms were approved by Resolution No. 132 of the State Statistics Committee of Russia dated December 25, 1998.

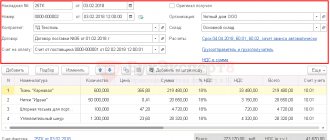

The TORG-12 form contains the following details:

- name of the selling organization and TIN;

- name of the product or material;

- unit of measurement of products sold;

- quantity and amount of products received;

- person responsible for the transfer.

This information becomes the basis for recording the receipt of material assets in accounting. Indicators of the quantity and value of the cargo are transferred from the invoice to the register.

Enterprises in any economic sector are required to use a unified form of receipt paper.

Reference! The law allows the use of TORG-12 forms that were developed by the organization.

This type of reporting must contain the following data:

- Document's name.

- Name of the organization.

- Date of.

- Product Name.

- Cost of goods.

- Quantity of goods.

- Job title.

- Signatures of persons responsible for the release and receipt of goods.

- Seal.

Subject to legal norms, the invoice created by the organization can be used as a reliable document .

Acts of transfer for implementation

Acts of transfer for sale are used to control the quantity of goods transferred for sale to partners. To create a transfer act for sale, follow these steps: Follow steps 1-3 of creating a document, as described in the “Creating a Document” section. On the "Details"

in the

“Buyer”

, select the counterparty who is the seller. For more information on creating implementing organizations, see Part 1 of the “Fregat-Corporation” manual, section “All organizations”.

Setting the state of the transfer act for implementation

If necessary, you can set the status of the act of acceptance for implementation using the “Set status”

.

For more information about setting the document status, see the “Setting the document status” section. Possible states of acts of acceptance for implementation coincide with the states of movement invoices. For more information about the status of overhead movements, see the section “Overhead movements”. Results of the operation:

As a result of creating an act of transfer for sale, the goods selected in the document specification will be posted to the seller's warehouse and written off from the warehouse of their organization. In this case, there will be no settlements with the seller. To register the sale of goods specified in the act of transfer for sale, follow these steps:

- Create an invoice as described in the section “Registering the receipt/dispatch of goods using an invoice.”

- On the “Details”

: - in the

“Seller”

, select the selling organization specified in the transfer certificate for sale.

— in the “From warehouse”

, indicate the distributor’s warehouse (has the same name as the selling organization).

As a result of the described actions, an invoice will be created, the amount of which will be taken into account in mutual settlements with the selling counterparty. The quantity of goods entered into the specification of the invoice will be written off from the warehouse of the selling organization.

Registration procedure

Compiling TORG-12 does not take much time. The main thing is to format it correctly and avoid mistakes. TORG-12 is completed by the materially responsible employee who releases the cargo .

Since this type of reporting is generated in two copies, the storekeeper or warehouse manager who draws up the paper fills out one copy for himself, and the second for the recipient of the products.

The invoice consists of two parts: main and tabular. Instructions for filling:

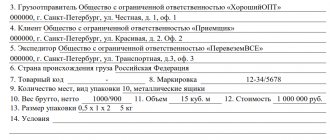

- "Shipper" . Here you should indicate the name of the organization that releases the goods or cargo.

- "Provider" . The name of the organization that supplies the products is written here. The information may be the same as the shipper or a different entity.

- "Payer" . This column contains the name of the organization that purchased the cargo.

- "Foundation" . This line indicates the number and date of the contract for the supply or sale of goods.

- The tabular part of the TORG-12 form is filled out . Here the names of the products, quantity, batch, amount and total cost are written down.

The employee who is responsible for receiving the goods in the organization that receives the cargo signs the first copy in the column “Cargo accepted” and puts a stamp of the recipient organization.

who released the goods, and the buyer who accepted the cargo also be affixed Deciphering signatures of administrative persons is required. The absence of a signature makes the invoice invalid and not subject to accounting, which involves entering data into the register.

Then, the square seal of the organization releasing the goods is affixed, and below is the official seal of the same enterprise. It is important to note that the organization releasing the cargo has the right not to affix a stamp. This will not affect the validity of the document. Also, the buyer may limit himself to affixing a signature with a transcript.

Important! Entries are made carefully. Letters and numbers are written legibly. A dash is placed in place of an unfilled column.

Those employees who sign the TORG-12 form are responsible for the information indicated in the document.

Correct filling of the invoice ↑

The receipt invoice documents the receipt of inventory items from suppliers. There is no standardized form for this document. To create an invoice, standard forms are used that are suitable for the occasion.

The materially responsible employee who releases the goods prepares the invoice. He makes one copy for himself, and the second for the recipient of the goods and materials.

The invoice form can be drawn up on the basis of such forms approved by Resolution of the State Statistics Committee No. 132 of December 25, 1998, such as:

| TORG-12 | The form of the consignment note used when selling goods and materials to a third party |

| TORG-13 | Invoice for internal movement, used to account for the movement of inventory items within an organization or between financially responsible persons |

| TORG-14 | An invoice and receipt used in small retail trade when registering the release of goods for which a commodity report is not prepared |

The basic requirements for filling out the invoice are as follows:

| It is possible to make an entry | Using ink, ballpoint pens, chemical pencils, technical means and any methods that allow you to preserve records during the archival storage period |

| The document must be formatted carefully | All letters and numbers are written clearly and legibly |

| All required details must be filled in strictly. | Other details must also be filled in; a dash is placed in place of any unfilled details. |

| The document is certified by the head of the organization | And the chief accountant or authorized persons |

| Signatures must be deciphered | In the document |

The persons who signed the document are responsible for the accuracy of the data and the correct execution of the invoice.

In some cases, other unified forms may be used, which can also be classified as invoices.

How to fill out the invoice form MX-18, see the article: invoice MX-18. Why you need an M-15 consignment note, read here.

In particular, the invoice for strict reporting forms, approved by Resolution of the Ministry of Finance No. 21 of February 21, 2002.

When sending goods by sea, the M-10 form is used, approved by Resolution of the State Statistics Committee of the Russian Federation No. 104 of October 27, 2000.

How to fill out a form

As usual, the invoice includes two sections:

- main part;

- tabular part.

The main part of the invoice includes the following details:

| Organization | The subject to whom the values fall |

| Provider | Supplier name |

| Agreement | Supply contract information |

| Curator | Responsible employee who controls the execution of the transaction specified in the document |

| receipt date | Date of arrival of goods or material assets |

| Due date | Payment deadline for this invoice |

| Stock | Inventory receipt warehouse |

| Subdivision | The department that receives the valuables |

| Order | Links goods received on an invoice to a specific order |

| Base | Reference details (by proxy, through whom, etc.) |

| License | Filled in when goods subject to licensing are posted |

| Invoice | Provides a link to the invoice |

The tabular part of the invoice consists of the following indicators:

- nomenclature;

- characteristics;

- the consignment;

- quantity;

- unit of measurement (nomenclature item);

- price (of one item);

- amount (total cost of the received quantity);

- VAT rate;

- VAT amount;

- total (total cost of incoming valuables).

Completed example

A sample of filling out an invoice can be considered using the example of the TORG-14 form, used for issuing goods in small retail trade.

Such trade involves the sale of goods through kiosks, tents, stalls, auto shops, hand carts and the like.

The materially responsible employee draws up an invoice in two copies. One copy is transferred to the direct seller, and the second is stored in the warehouse (base, etc.).

Sample register of documents

Receipt invoices are subject to mandatory registration. For this purpose, an accompanying register of documents is used.

Its form TORG-31 is given in the album of unified forms of primary accounting documents.

Such a document is drawn up by the financially responsible person for receipt documents regarding transactions carried out during the reporting period.

The form is filled out in two copies. One is kept by the financially responsible person, and the other is transferred to the accounting department, against receipt and with attached documents.

Storage period in the organization

Receipt invoices refer to accounting and tax accounting documents.

The regulatory framework, according to which organizations must take into account and preserve documentation, includes Federal Law No. 125 “On Archiving” dated October 22, 2004 and Federal Law No. 129 “On Accounting” dated November 21, 1996 (with subsequent editing).

In accordance with the Law “On Accounting”, all documentation on the basis of which entries are made in the accounting accounts that form the financial statements are retained for at least five years.

The Tax Code specifies a period of four years for storing documents related to tax calculations. Thus, the organization is obliged to retain invoices for at least five years.

At the same time, documents must be stored in appropriate conditions and any document must have the proper form, allowing one to study all the data specified in it.

Storage of documents can be organized in the organization's office by equipping a special place in a locked safe or cabinet. It is also allowed to deposit documents in public or private archives.

It is advisable to send documents not used for work in a timely manner for archival storage in order to avoid unnecessary paper confusion.

Accounting Features

Primary documents must be registered without fail . For recording, use the accompanying register for submitting valuable paper reports. It has a form called TORG-31. This document is drawn up in two copies. One remains with the employee who is financially responsible, and the second form is sent to the accounting department along with the reports attached to it for subsequent accounting.

Since receipts relate to accounting and tax documents, the storage period in the organization, according to Federal Law No. 402 “On Accounting” dated December 6, 2011, is five years.

It is important to comply with the specified storage period to avoid tax and accounting violations. The papers are stored in the required conditions and must have an appropriate appearance, which will allow you to study the necessary data specified in the invoice at any time. After the specified time has passed, these forms must be properly disposed of.

Combining an invoice and delivery note into one document

An invoice and a delivery note (TORG-12) can be combined into one document.

Options for combining an invoice and a delivery note into one document

In order to create one document instead of an invoice and a delivery note, there are two options:

Option 1. Use the form of a universal transfer document (UDD) recommended by the Federal Tax Service. In this case, “1” must be indicated in the “Status” field of the UPD.

Option 2. Develop the form of the combined document yourself. To do this you should:

1) supplement the invoice form with the following details (part 2 of article 9 of Law N 402-FZ, clause 9 of the Rules for filling out an invoice)):

- a description of the business transaction - the release of goods (for example, “the goods were released” or “the cargo was released”);

- the title of the position of the representative of your company who released the goods, with his signature, surname and initials;

- a description of the business transaction - acceptance of goods (for example, “received the goods” or “received the goods”);

- the title of the position of the company representative - buyer or consignee, with his signature, surname and initials;

2) by order of the head of the organization, to approve such an amended invoice form as a primary document as an annex to the accounting policies.

However, you cannot exclude any invoice details from the combined document.

The procedure for issuing and registering a combined document

The supplemented invoice or UPD must be drawn up:

- upon shipment, and not within five calendar days from the date of shipment;

- in two copies, one of which is given to the buyer, and the second is recorded in the sales book - just like a regular invoice.

An amended invoice or UPD for the purposes of calculating VAT, income tax, as well as accounting will be documents confirming the shipment.

The buyer's procedure for handling the combined document

Based on the amended invoice or UPD, the buyer can:

- accept goods for accounting;

- deduct VAT, just like on a regular invoice;

- take into account the cost of goods in tax expenses.

Differences from other documents

The TORG-12 form belongs to the category of primary documents and has a number of features not found in other papers.

From the receipt order

The differences between a delivery note and a receipt order are as follows:

- Purpose . The form in form TORG-12 is the primary document, as it confirms the transfer of goods and is issued at the time of release of the cargo. A receipt order does not have such features; its preparation requires a receipt paper or other relevant document. The order confirms that the products arrived at the warehouse in a certain quantity on the corresponding day.

- Form . These papers also differ in the filling structure. There are columns in the order that the invoice does not have. For example, warehouse number, order number, account code, and so on.

If TORG-12 is present, then there is no need for a receipt order. Since the supplier’s paper is stamped with the same details of the organization as in the order.

Thus, a document for received products is considered received if it contains details and a seal. And it is capable of equivalently replacing an order.

From invoice

The differences between these documents are in the following aspects:

- An invoice is drawn up for payment for goods and services, and the TORG-12 form is issued only when the cargo is released.

- The receipt paper is drawn up in two copies, and the invoice is drawn up in one.

- An invoice is not a documentary confirmation of the fact of transfer of goods. It represents the basis for VAT accounting.

- Based on the invoice, claims cannot be made against the supplier of the products. These types of reporting are not interchangeable. They complement each other and are issued simultaneously upon transfer of goods.

There are different types of invoices, we suggest you read about the consignment note, demand-invoice, UPD, consumables, for the release of goods and materials to the outside, for the transfer of finished products to the storage location, return.

Any trading procedure performed by an enterprise should be documented - primary documents must be drawn up for accounting purposes.

The main primary paper is the invoice. Without it, not a single purchase or sale transaction of any product, cargo or material value is carried out. It is important to prepare these types of reports correctly, store papers carefully and not make legal mistakes.

Sales through the cash register/returns through the cash register

Documents of this type are generated AUTOMATICALLY

when registering sales/returns through the

Fregat POS

.

Documents of the type “Sales through the cash register”

are analogous to an invoice and in the same way affect the movement of goods and mutual settlements with the counterparty.

For more information about working with expense invoices, see the section “Receipt and expense invoices. Documents of the “Returns by cash register”

are analogous to a receipt and in the same way affect the movement of goods and mutual settlements with the counterparty. For more information about working with receipt invoices, see the section “Receipt and expense invoices”.