Reserve capital on the balance sheet is...

The amount of reserve capital is displayed in line 1360 of the balance sheet, which indicates that reserve capital is a component of the organization’s total capital, reflected in the final line 1300.

The fact that reserve capital is included in the company’s equity capital is also indicated in clause 66 of the Regulations on accounting and accounting, approved by order of the Ministry of Finance dated July 29, 1998 No. 34n (hereinafter referred to as PVBU).

ConsultantPlus experts explained in detail how to reflect reserve capital on the balance sheet and what nuances need to be taken into account when filling out this line. To do everything right, get trial access to the system and go to the Tax Guide. It's free.

You can learn about what a company’s equity capital is from our article “Equity on the balance sheet is...”.

Reserve capital - an asset or a liability?

The company's capital and reserves are considered its liabilities, so it is logical that reserve capital, as a component of equity capital, is, of course, a liability.

In addition, in accounting, information about the state and movement of reserve capital is summarized in account 82, which is also passive.

Reserve capital is intended to accumulate part of net retained earnings, which will subsequently be spent primarily on covering losses.

You will receive more information about liabilities and assets when studying the article “Balance Sheet (Assets and Liabilities, Sections, Types).”

Reserve capital for JSC and LLC - what are the differences?

Unlike LLCs, joint stock companies are required to accumulate reserve capital. For an LLC, the creation of a reserve fund is the right of the company in accordance with paragraph 1 of Art. 30 of the law of 02/08/1998 No. 228-FZ, and not an obligation. At the same time, the size and targeted nature of such a fund for an LLC are not regulated by law, but are prescribed in the charter.

The amount of reserve capital in joint-stock companies cannot be less than 5% of the authorized capital, while the founders can establish a larger size of this fund (clause 1, article 35 of the law of December 26, 1995 No. 208-FZ). The same legislative act specifies the intended use of the fund and the procedure for its formation.

Movement of capital

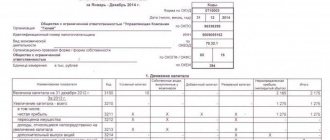

This section is a table in which indicators characterizing the reasons for changes in capital are listed on the left line by line, and capital items are presented in columns on the right:

- column 3 “Authorized capital”;

- column 4 “Own shares purchased from shareholders”;

- column 5 “Additional capital”;

- column 6 “Reserve capital”;

- column 7 “Retained earnings (uncovered loss)”;

- Column 8 “Total”.

The first line of section (3100) is named like this:

“The amount of capital as of December 31, 20__.”

This line reflects the data from the year before last. Let us show with an example what data needs to be shown in it. Example

LLC "Passive" is not a small enterprise and submits a report on changes in capital to the tax office. "Passive" reports for 2012. In line 3100, the accountant will reflect the value of each part of the capital as of December 31, 2010. In line 3200, you need to reflect the amount capital as of December 31 of the year preceding the reporting year. If you are reporting for 2012, it is 2011.

Column 3 “Authorized capital”

Here show changes in the authorized capital for the reporting and previous years. If the company’s capital increased or decreased, then indicate the sources of the increase (reasons for the decrease) in the line-by-line transcripts. Take the data for filling out this column from the accounting registers under account 80 “Authorized capital”.

Having shown the amount of the authorized capital, in the following lines “Increase in capital” reflect the amount of its increase. Decipher the sources through which the authorized capital increased. For this purpose, the report contains the following lines:

- “Additional issue of shares”;

- “Increase in the par value of shares”;

- "Reorganization of a legal entity."

The increase in the authorized capital is reflected in the credit of account 80 “Authorized capital”. Line 3210 indicates its credit turnover for the past year.

If during the last year the authorized capital decreased, then reflect the amount of the decrease in the lines “Decrease in capital”. At the same time, it is necessary to disclose why such a decrease occurred. For this purpose, the report contains the following lines:

- “Reduction in the par value of shares”;

- “Reducing the number of shares”;

- "Reorganization of a legal entity."

A decrease in the authorized capital is reflected in the debit of account 80 “Authorized capital”. Line 3220 indicates its debit turnover for the past year.

On line 3200, indicate the credit balance of account 80 at the end of last year.

Reflect the growth of the authorized capital in the reporting year in the same order as for the previous year.

It is indicated by the group of lines “Increase in capital”:

- 3314 “Additional issue of shares”;

- 3315 “Increase in the par value of shares”;

- 3316 “Reorganization of a legal entity.”

In the form, indicate the credit turnover of account 80 “Authorized capital” for the reporting period.

If during the reporting year the company’s authorized capital decreased, fill in the lines in the “Decrease in Capital” section with the explanation:

- 3324 “Reduction in the par value of shares”;

- 3325 “Reduction in the number of shares”;

- 3326 “Reorganization of a legal entity.”

In the form, indicate the debit turnover of account 80 “Authorized capital” for the reporting period.

Reflect the amount of the authorized capital at the end of the reporting year on line 3300. This includes the credit balance of account 80 “Authorized capital” as of the end of the year.

Column 4 “Own shares purchased from shareholders”

This column reflects the value of shares that are purchased by the company from shareholders at their request or by decision of the board of directors. Limited liability companies reflect the value of shares in the authorized capital purchased from the participants (founders) of the company.

Column 5 “Additional capital”

Column 5 reflects data on the movement of the company’s additional capital. It changes, for example, as a result of the revaluation of fixed assets. To fill out column 5, use the data reflected in account 83 “Additional capital”.

First, give the amount of additional capital at the end of the year that preceded the previous year (reporting year minus two years).

Then, in the lines “Revaluation of property”, indicate the amount of increase or decrease in additional capital after the revaluation of the company’s property.

Write down the final amount of capital (including revaluation) in line 3300.

Attention!

The revaluation that you performed as of January 1, 2011 should be considered a revaluation as of December 31, 2010, and the amount of additional capital on line 3100 should be adjusted accordingly. This procedure for filling out the report follows from the requirement for retrospective reflection of changes in accounting policies in the financial statements (clauses 14 and 15 of PBU 1/2008, letter of the Ministry of Finance of Russia dated January 27, 2012 No. 07-02-18/01).

Reflect the amount of the company’s additional capital at the end of the last year, that is, 2011, in line 3200.

In the next line 3312, show the amount of the increase in additional capital from the revaluation of property carried out at the end of the reporting period, that is, 2012.

If, as a result of revaluation, additional capital has decreased, then write down the amount of the decrease in line 3322.

On lines 3213 and 3313 “Income attributable directly to the increase in capital”, show the amount of VAT transferred to your company by the participant (shareholder) when paying for their shares (shares) in non-cash. In accounting for this operation, the corresponding entry is Debit 19 Credit 83.

Reflect the amount of additional capital at the end of the reporting year in the final line 3300. This is the balance in account 83 “Additional capital” at the end of the reporting year.

Column 6 “Reserve capital”

The firm's reserve capital is formed from retained earnings. All joint stock companies are required to do this. In this case, the amount of reserve capital must be at least 5% of the authorized capital (clause 1, article 35 of the Law of December 26, 1995 No. 208-FZ).

This means that the charter of a joint stock company can provide for reserve capital in a larger amount.

Limited liability companies are not required to create a reserve fund. But at the request of the founders, enshrined in the charter and accounting policies, such companies can also create a reserve fund.

Account 82 “Reserve capital” is used to account for it. Therefore, to fill out column 6 “Reserve capital” of the report, use data on transactions on this account.

Information on changes in reserve capital in the report is also provided for two years and is reflected similarly to authorized and additional capital.

Column 7 “Retained earnings (uncovered loss)”

Here they reflect information about the movement of retained earnings (uncovered losses) of the company. It is formed from the profit remaining after paying income tax and contributions to reserve capital.

To fill out column 7, use the data from account 84 “Retained earnings (uncovered loss).”

If the company’s accounting policies changed during the previous and reporting year, this should affect the amount of retained earnings.

For example, in 2011, companies reduced the list of deferred expenses (due to changes in clause 65 of the PVBU). In particular, the amounts of carryover vacations listed in account 97 “Deferred expenses” as of January 1, 2011 should have been debited to account 84 “Retained earnings (uncovered loss)”, thereby reducing the retained earnings (increasing the uncovered loss) of the past, 2010

In the line “Revaluation of property”, show the amount of retained earnings from the revaluation of fixed assets and intangible assets.

Attention!

In 2011, the procedure for accounting for the results of revaluation of fixed assets and intangible assets was changed (clause 15 of PBU 6/01, clause 21 of PBU 14/2007). Thus, their initial markdown in previous years was reflected in account 84 “Retained earnings (uncovered loss)”, and in 2011 this amount was debited to account 91 “Other income and expenses”. The amended accounting policy should be extended to 2010. Consequently, in the reporting year, the lines “Revaluation of property” should not affect column 7 “Retained earnings (uncovered loss).”

Changes in accounting policies due to changes in accounting regulations in 2011–2012 must be taken into account when filling out the columns of comparative indicators (relating to previous years) of the balance sheet and profit and loss statement.

When disposing of fixed assets and intangible assets, the amount of their revaluation is transferred from additional capital to the company's retained earnings. This procedure was in effect in previous years and remains in effect in the reporting year.

In the final line 3300, show the credit balance of account 84 at the end of the reporting period.

Column 8 “Total”

The indicators in this column are calculated. To fill it out, summarize the data in columns 3 to 7, inclusive, for each line of the report.

How is reserve capital formed?

- In accordance with current legislation, the main source of reserve capital formation is deductions from net profit.

In joint stock companies, reserve capital is formed through deductions from net profit, and the amount of annual replenishment of reserve capital should not be less than 5% of net undistributed profit for the reporting period (paragraph 2, clause 1, article 35 of Law No. 208-FZ). Deductions from net profit in favor of the reserve fund are made until the limit established in the charter is reached.

Example:

The charter of Kolos-info JSC provides for the creation of a reserve fund in the amount of 6% of the authorized capital. The authorized capital at the time of the meeting of the board of directors (02.20.20XX) amounted to 90,000,000 rubles, reserve capital was formed at the level of 5,200,000 rubles. The net profit of Kolos-info JSC for the year 2020 amounted to 6,000,000 rubles.

In accordance with the charter, Kolos-info JSC must create reserve capital in the amount of 5,400,000 rubles (90,000,000 × 6%). To complete the formation of reserve capital, it remains to contribute another 200,000 rubles (5,400,000 – 5,200,000). At the meeting held on February 20, 20XX, it was decided to allocate 200,000 rubles from the net profit of 20XX to replenish the reserve fund.

EXPLANATIONS from ConsultantPlus: Is it possible to indicate in the charter of an LLC that profits are not distributed among the participants, but are sent to the reserve fund or for the statutory purposes of the company? How to reflect this? For answers to these and other questions, see the K+ legal reference system. If you do not have access to the K+ system, get a trial online access for free.

If the company happened to turn to a source of reserve capital to cover losses incurred at the end of the reporting period, then in the next period it will have to again make deductions from net profit until the statutory value is reached.

- In addition to the above method of replenishing reserve capital from a part of retained earnings, there is also the possibility in special cases of forming reserve capital from the property contributions of the founders.

Contributions made by shareholders that are transferred to the company in the form of property, according to clause 2 of PBU 9/99, are not recognized as income of the company. And in sub. 3.4 clause 1 art. 251 of the Tax Code states that income recognized for tax purposes does not include contributions of shareholders with property made in order to increase net assets and funds. This means that they can also be used to form reserve capital.

Based on the above, we can conclude that shareholders, in order to increase net assets, can make contributions with property (moral and property rights) also through the formation of reserve capital.

You will get more information about net assets by studying our articles:

- “How is the accounting value of net assets calculated?”;

- “What are the consequences of negative net assets?”

For example, many non-profit organizations create reserve funds at the expense of share contributions from participants (subclause 16, clause 3, article 1, subclause 1, clause 4, article 6 of the law of July 18, 2009 No. 190-FZ, clause 7, art. 34 of the Law of December 8, 1995 No. 193-FZ). And the chart of accounts for agricultural enterprises, approved by order of the Ministry of Agriculture dated June 13, 2001 No. 654, directly provides for the possibility of forming a reserve fund from contributions from participants.

Example 1:

In order to increase the size of net assets, the shareholders of the agricultural company decided to make a contribution to the reserve capital (hereinafter - RK) in the form of materials in the amount of 100,000 rubles.

In this regard, 2 entries will be made in accounting:

- Dt 10 Kt 75 in the amount of 100,000 rubles - upon receipt of materials from shareholders for the purposes stated above;

- Dt 75 Kt 82 in the amount of 100,000 rubles - formation of the Republic of Kazakhstan.

Example 2:

At the board of shareholders, they decided to increase net assets by making a contribution of 2,000,000 rubles to the RK JSC. Shareholders made contributions in the total amount of 2,000,000 rubles.

In this regard, 2 entries will be made in accounting:

- Dt 51 Kt 75.3 in the amount of 2,000,000 rubles - receipt of funds from shareholders to replenish the Republic of Kazakhstan;

- Dt 75.3 Kt 82 in the amount of 2,000,000 rubles - formation of the Republic of Kazakhstan from contributions made by shareholders.

Read about the nuances of accounting for reserve capital in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

How can you use your emergency fund?

Organizations with a reserve obligation are usually limited in how they can use it. The law sets out certain goals, for example:

- for JSC - covering losses, repurchasing its shares;

- for unitary enterprises - only compensation for losses;

- credit cooperative - compensation for losses and unexpected expenses.

Organizations that form it according to their wishes decide for themselves what it can be spent on and prescribe the options in the charter. This applies to LLCs, HOAs, etc.

The reserve fund must be replenished until it reaches the size prescribed in the charter. Then you don’t have to make any contributions. But if the organization spends part of the reserve and it again falls below the required level, it will have to be replenished again until enough funds accumulate there.

How does the reserve capital increase/decrease?

In a situation where the board of directors has decided to increase the authorized capital, which is within its competence in accordance with Art. 65 of Law No. 208-FZ, and as a result of this it turned out that the size of the reserve fund has become less than the mandatory 5% of the capital, there is a need to increase the reserve capital.

The decision to increase the authorized capital by increasing the par value of shares is made by the general meeting of shareholders (Clause 2 of Article 28 of Law No. 208-FZ).

Example:

At the meeting of shareholders, it was decided to increase the authorized capital from 200,000,000 rubles to 300,000,000 rubles. At the same time, at the time of making this decision, the JSC already had reserve capital in the amount of 10,000,000 rubles. Accordingly, after increasing the size of the charter capital to 300,000,000 rubles, the JSC will have to increase its reserve capital by 5,000,000 rubles (300,000,000 rubles × 5% – 10,000,000 rubles).

If a decision was made to reduce the size of the capital, then there is a basis for reducing the capital. This change can be legally carried out only after state registration of changes in the charter relating to the reduction in the size of the charter capital. The decrease in the RK in accounting is documented by posting Dt 82 Kt 84.

How is reserve capital formed and accounted for?

This type of capital must be at least five percent of the total savings of the enterprise. The reserve capital is formed through annual contributions until the amount stipulated by the charter has been accumulated. The charter of the same company determines exactly what part of the profit each year should be directed to the formation of reserves.

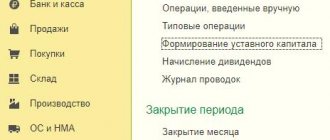

Shareholders make decisions at general meetings - this is the main document by which accountants formulate and record reserve capital. But the organization of such meetings is usually carried out after the end of the year in a financial sense.

What is the organization's charter and how to draw it up, read the link.

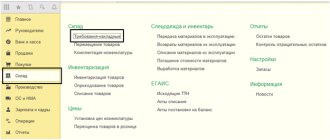

Components of capital.

Results

For joint stock companies, reserve capital for a specific intended use is a mandatory component of equity capital. Its size is strictly defined at the legislative level and cannot be less than 5% of the authorized capital. The composition of the Criminal Code of the joint-stock company is established by the norms of Art. 99 of the Civil Code of the Russian Federation and Art. 25 of Law No. 208-FZ.

When changing the company's charter capital, it is also necessary to review the amount of reserve capital.

If an increase in the capital has been made, and the size of the formed capital has become less than the limit, then it should begin to be filled from net profit or, in cases established by law, from property contributions from shareholders aimed at increasing net assets (or share contributions). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Dimensions

The main source of formation of this capital is the company's retained earnings. It is understood as that part of the profit that was not spent in previous periods. Most often it is used for business development.

Joint stock companies

In relation to JSCs, Russian legislation establishes not only the obligation to transfer funds to funds. Their minimum size is also clearly regulated.

Today, the amount of formed reserves should not be less than 5% of the authorized capital.

The specific value is fixed in the constituent documents. If a new organization is created in accordance with the law, it can form a fund not at once, but gradually. Then, until the established amount of reserves is reached, the company’s responsibilities include annually setting aside at least 5% of the net profit received .

Limited Liability Companies

LLCs have no obligations to create reserve funds in Russia. Nevertheless, companies created in this form have the right to do so.

The organization's charter may have a clause on reserve capital. The procedure for its creation and the amount of required contributions are fixed here. Every year, after the formation and consideration of financial statements, the owners of the LLC at a meeting decide on how to distribute profits. They can use it for these purposes as well.

Companies with foreign participation

According to Russian legislation, companies created with the attraction of foreign investment are required to form such a fund. Its minimum size is determined at the level of 1/4 of the authorized capital .