Off-balance sheet accounting

To record assets and liabilities on the balance sheet, accounts 001 to 011 are intended (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n):

- on account 001 reflects leased assets;

- sch. 002 is intended for accounting for inventory items accepted for storage;

- sch. 003 is used to account for materials taken for processing;

- on account 004 reflects goods accepted for commission;

- sch. 005 is used to account for equipment for installation;

- sch. 006 is needed for BSO accounting;

- on account 007 accounts for uncollectible receivables;

Find out step by step how to write off receivables with an expired statute of limitations in ConsultantPlus. If you do not have access to the system, sign up for a trial demo access. It's free.

How to take it off balance sheet, read the article “Writing off accounts receivable to an off-balance sheet account.”

- sch. 008 and 009 are needed to reflect received and issued payment security, for example, deposit amounts for returnable packaging;

- sch. 010 is used to reflect the depreciation of housing facilities, external amenities, as well as fixed assets of non-profit organizations;

- sch. 011 contains information about operating systems owned by the organization, but leased to another company.

If necessary, an organization can develop and implement additional off-balance sheet accounts or sub-accounts to existing ones. These innovations should be reflected in the working chart of accounts of the organization's accounting policies.

What are the specifics of off-balance sheet accounting? Transactions using off-balance sheet accounts are carried out using a simple system, without the use of double entry. That is, one business transaction corresponds to an entry only in the debit or credit of one off-balance sheet account. However, just like assets and liabilities reflected on balance sheet accounts, transactions with off-balance sheet assets or liabilities must be reasonable and documented.

Find out more about off-balance sheet accounting in the material “Rules for maintaining accounting on off-balance sheet accounts.”

Information about assets and liabilities held in off-balance sheet accounts does not fall into the main accounting report - the balance sheet (Appendix 1 to the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n). But the company may, at its discretion, indicate information about objects recorded on off-balance sheet accounts in an explanatory note to the accounting records (Appendix 1 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n).

IMPORTANT! A legal entity is required to maintain off-balance sheet accounting, since the reflection of certain business operations and values using off-balance sheet accounts meets the requirements for the reliability of reporting. If you ignore off-balance sheet accounting, the reporting will cease to be reliable, and this is a violation of Art. 15.11 Code of Administrative Offenses of the Russian Federation. The minimum fine in this case is 5,000 rubles. But an individual entrepreneur is not required to keep accounting records (Clause 2, Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). If an individual entrepreneur decides to conduct accounting on his own initiative, then he should adhere to the appropriate accounting rules, including, if necessary, reflecting values and liabilities on the balance sheet.

The safety of property and the status of liabilities on the balance sheet must also be periodically checked. How to do this - read the article “Is it possible to carry out an inventory for off-balance sheet accounts?”

BUDGET REPORTING.

At the end of the financial year, as part of the balance sheet (0503130) [7], government institutions generate a certificate on the conclusion of budget accounting accounts for the reporting financial year (form 0503110) (hereinafter referred to as the certificate (form 0503110)) (clause 43 of Instruction No. 191n [8] ). It reflects turnover in budget accounting accounts that are subject to closure at the end of the reporting financial year in the prescribed manner, in the context of budgetary activities (Section 1) and activities with funds received at temporary disposal (Section 2).

Section 2 of the certificate (f. 0503110) is not formed by the recipient of budget funds, the administrator of sources of financing the budget deficit, or the administrator of budget revenues (clause 44 of Instruction No. 191n).

The state institution - the recipient of budget funds draws up Section. 1 certificate (f. 0503110) based on data on the corresponding account codes:

- 1 210 02 000 “Settlements with the financial authority for budget revenues”;

- 0 304 04 000 “Internal settlements”;

- 0 304 06 000 “Settlements with other creditors”;

- 1 304 05 000 “Settlements for payments from the budget with the financial authority”;

- 0 401 10 000 “Income of the current financial year”;

- 0 401 20 000 “Expenditures of the current financial year.”

The indicators generated for these accounts before the final transactions are carried out are reflected in columns 2, 3 of the certificate (form 0503110), and the amount of final transactions for closing accounts made on December 31 is reflected in columns 4 - 9 of the certificate (form 0503110).

Sample of filling out the certificate (f. 0503110)

Procedure for closing accounting accounts

At the end of the calendar year, all economic entities sum up the results of their activities. The main result of a company’s work is its financial result: profit or loss. To determine how effectively an organization operated, it is necessary to draw up accounting records and determine the financial result. And this procedure is impossible without closing some accounting accounts.

Every month, the accountant checks the balances of the cost and financial results accounts:

- sch. 25, 26, 28 should be closed at the end of the month;

How to write off selling expenses - read the article “Accounting entries for business expenses.”

- sch. 20, 23, 29 may have work in progress, or may be completely closed - this depends on the specifics of the organization’s economic activities; on account 44 there may also be a balance - the company's transportation costs;

- sch. 90 and 91 do not have balances at the end of the month as a whole, however, amounts accumulate in each subaccount that are closed with final transactions at the end of the year.

By the end of the calendar year, the accountant needs to identify the financial result. It is determined by the amounts accumulated in the account. 99.

For information on the procedure for closing these accounts at the end of the year and calculating the amount of profit/loss, read the article “How and when to reform the balance sheet?”

FINANCIAL STATEMENTS.

For budgetary and autonomous institutions, as part of the annual reporting forms, a certificate is generated on the conclusion of the institution's accounting accounts for the reporting financial year (f. 0503710) (hereinafter referred to as the certificate (f. 0503710)) (clause 31 of Instruction No. 33n [6]).

The certificate (form 0503710) reflects the turnover of accounting accounts subject to due closure at the end of the reporting financial year, broken down by:

- activities with targeted funds;

- activities on state assignment;

- income-generating activity.

The specified form is filled out for the balance sheet of a state (municipal) institution (f. 0503730) based on data on the corresponding accounts of analytical accounting of accounts:

- 0 304 04 000 “Internal settlements”;

- 0 304 06 000 “Settlements with other creditors”;

- 0 401 10 000 “Income of the current financial year”;

- 0 401 20 000 “Expenditures of the current financial year.”

At the same time, columns 2 – 5 of the certificate (f. 0503710) reflect the sum of the indicators formed on the above accounts before the final transactions, and columns 6 – 13 – the sum of the final transactions to close accounts carried out on December 31 (at the end of the reporting financial year).

Consolidated certificate (f. 0503710). The head office generates a consolidated certificate (form 0503710) on the basis of certificates (form 0503710) submitted by separate divisions by summing up the indicators of the same name reflected in columns 2 - 13 according to the corresponding accounting account numbers.

Interrelated turnovers in terms of transactions for the gratuitous transfer (receipt) of financial, non-financial assets and liabilities between the head office and separate divisions are excluded from the set in the following order: according to the corresponding analytical account numbers, account 0 304 04 000 (columns 2, 7, 10; 3, 6, 11 and 4, 9, 12; 5, 8, 13 of the consolidated certificate (form 0503710) according to the indicators in columns 4, 5 of the certificate (form 0503725) according to account code 0 304 04 000) of separate divisions for activities with target funds and income-generating activities.

Sample of filling out a certificate (f. 0503710)

Which off-balance sheet accounts are closed at the end of the year?

As we have already found out, at the end of the calendar year, accounts for accounting costs and financial results are subject to closure. However, the accounting accounts that record the company's assets, capital, reserves, and liabilities are not closed at the end of the year. Information on them is accumulated in accordance with the purpose of the account and by the end of the year it forms the debit or credit balance of a particular account.

Since off-balance sheet accounts record not costs and financial results, but values, liabilities or individual business operations, there is no need to close off-balance sheet accounts at the end of the year. The ending debit or credit balance on these accounts on December 31 becomes the opening balance on January 1 of the following year, and off-balance sheet accounting continues to be maintained according to a simple scheme.

However, there are situations when off-balance sheet accounts may need to be closed. Let's look at the procedure for closing some off-balance sheet accounts in one of the most common accounting programs in the Russian Federation - "1C: Enterprise" configuration "Accounting". In this program, in addition to the 11 off-balance sheet accounts established by law, there are additional off-balance sheet accounts that have an alphabetic or alphanumeric code:

These accounts are used in accordance with their name, for example, to reflect special clothing transferred into operation, or receipts from customers when combining special treatment and special treatment. At the same time, amounts often remain on these off-balance sheet accounts due to incorrect conduct of business transactions on balance sheet accounts. We recommend that at the end of the calendar year you conduct an inventory of “program” off-balance sheet accounts and, if necessary, write off incorrectly recorded amounts.

ConsultantPlus experts explained in detail how to do this correctly. Get trial demo access to the system and upgrade to the Ready Solution for free.

There is another case where annual closure of off-balance sheet accounts is required. Above, we looked at off-balance sheet accounts from the chart of accounts for merchants. Budgetary organizations also have their own Unified Chart of Accounts (order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n), according to which off-balance sheet accounts 17 and 18 must be closed by public accountants at the end of the year: balances on them are not carried over to the next year, and the closure of accounts is reflected operation with a minus sign (clauses 365, 367 of the Unified Chart of Accounts).

Read more about budget accounting in the articles:

- “Accounting in budgetary institutions”;

- “Working chart of accounts for budget accounting for 2020-2021.”

Tax accounting of expenses

In tax accounting, expenses are also divided into direct and indirect (Clause 1, Article 318 and Article 320 of the Tax Code of the Russian Federation). Depending on the type of activity, their composition may differ.

Direct costs are included in the cost of finished products, and indirect costs are written off in the current period. In this case, it is necessary to independently determine the list of direct costs associated with the production of products, performance of work, provision of services and consolidate it in the accounting policy (clause 1 of Article 318 of the Tax Code of the Russian Federation).

For trade organizations, the list of direct costs is fixed and is given in Art. 320 Tax Code of the Russian Federation. Refer to the remaining expenses, except non-operating expenses, as indirect expenses and reduce the amount of income from sales of the current month by them.

It is important to correctly set up the composition of direct expenses in tax accounting; the correct reflection of expenses at the end of the month and their further reflection in reporting depends on this.

In the program “1C: Accounting 8th ed. 3.0" select the "Main" tab > "Settings" > "Taxes and reports" > "Income Tax" tab, open the "List of direct expenses" link. Expense items not specified in this register will be considered indirect by default and written off in full to account 90.08.1 “Administrative expenses for activities with the main taxation system” at the close of the month.

Please note: even if the list of direct costs of an organization does not change, the information register entry “Methods for determining direct production costs in OU” must be created for each year.

Results

Now you know which off-balance sheet accounts should be closed at the end of the year: commercial firms do not close off-balance sheet accounts, but budget organizations must close part of their off-balance sheet accounts.

If you use computer programs for accounting, before closing the year, you should inventory the balances of the off-balance sheet accounts provided by the program. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Setting up - preparatory stage

Before you start accounting in the program, you need to configure accounting parameters, create an accounting policy for each organization, as well as select a taxation system and specify the appropriate tax options. This can be done in the “Main” section. All this directly affects how movements to close the period will be formed. Based on this, the program will determine the composition of routine operations.

Next, all primary documents are entered into the information base - data on purchases, sales, invoices, cash flows at the cash desk, banking transactions, production is reflected, current expenses are supported by documents.

Calculation of shares of write-off of indirect expenses

This section contains only one, but very important operation for calculating the share of write-off of indirect costs.

This operation is used to determine how much the income tax base can be reduced. The program calculates shares and coefficients for expenses such as transport, hospitality, insurance, and advertising costs. The operation creates movements in special registers that will be used to close cost accounts (20, 23, 25, 26).

Example of closing account 90

Let's consider a simple example of accounting for operations for the sale of products on account 90 during the last three months of the year.

October: there were two shipments for 118,000 rubles. and by 47,200 rubles. The cost of the first batch of products is 80,000 rubles, the second – 30,000 rubles.

Account 90.1 for the loan reflects the sales value of the product, 90.2 - cost, 90.3 - VAT payable, 90.9 - financial result. In October, the score of 90 will look like this:

In subaccount 90.9, the financial result is calculated at the end of the month, which is defined as the difference between the debit and credit of the account.

The figure shows in red the balances at the end of the month for each subaccount. There is no need to calculate the account balance as a whole. At the beginning of the next month, the ending balance will be the beginning balance for each subaccount.

Postings:

November: the ending balance from October for each subaccount will be the opening balance, indicated in green in the figure. During November there was only one shipment of a batch of products with a cost of 80,000 rubles. at a sales price of 118,000 rubles. in view of VAT.

The 90 score looks like this at the end of November:

Financial result for the month = 118,000 - 80,000 - 11,800 = 26,200.

For each subaccount at the end of November, the turnover for the month is again calculated, to which the opening balance at the beginning of the month is added, after which the balance at the end of November for each subaccount is displayed.

December: The ending balance for November will be the opening balance for December (green in the figure below). During the month there were 2 shipments for 23,600 (cost price 15,000) and for 70,800 rubles. (cost price 50,000).

The 90 score looks like this at the end of December:

Next, account 90 needs to be closed; as a result of closing, it will take the following form (blue indicates the amount of transactions for closing the account).

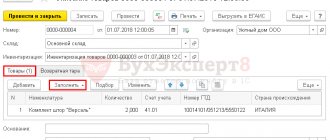

Closing the month in 1C

It is recommended that you update your configuration before performing this action. You can do this yourself, or by contacting First Bit. Legislation is constantly changing, all changes are implemented in the program and are available in current releases.

Go to the menu Operations – Closing the period. Select the month, the screen will display a list of operations that will be performed.

Important feature #1

: accounting policies are established for each year. If it was opened in January 2022, then the incoming balances will be posted on December 31, 2018, and the accounting period that we will close will begin in January 2022.

Important feature #2

: routine operations are performed sequentially, month after month. If for some reason in April you reposted a document for January, then the chain of documents and calculations in the information base will be broken, closing January, as well as February and March, will have to be done again.

Let's look at what the end of the month consists of. Period. Organization. Each organization has its own list and its own operations. Re-posting of documents (restores the sequence by date and time).

Closing cost accounts and distributing expenses by activity

Cost Accounts

This group represents the operation of closing cost accounts (20, 23, 25, 26). The program checks all conditions in accordance with the accounting policies of the organization and determines the amounts of the formation of transactions and creates movements in the registers. For this operation, you can generate calculation certificates, view the cost, distribution and write-off of indirect expenses.

Closing 44 accounts

Closing 44 accounts was allocated as a separate operation. It writes off transportation and distribution costs. Expenses are written off according to calculated coefficients. You can open a calculation certificate for transportation costs and write-off of indirect costs.

Calculation of doubtful debts

The following is a calculation of reserves for doubtful debts. The program determines overdue accounts receivable for 62 and 76 accounts and creates a reserve. You can print out the corresponding calculation certificate.

Operations for entrepreneurs presented

This is the recognition of paid insurance premiums as expenses, the recognition of advances as other income and the distribution of expenses by type of activity if there are several of them.

Transactions for organizations on the simplified tax system are presented

This is the distribution of expenses by type of activity, if there are several of them, and the distribution of expenses between the simplified tax system and UTII in the case of combining taxation systems.

Payroll, depreciation and tax transactions

Salary

The program allows you to calculate salaries and contributions, or download this data from an external program. If the salary is calculated in 1C:BP 3.0, and for some reason the accrual document was not created, the program will perform this operation automatically.

If the accounting policy specifies the formation of vacation reserves, the program will also calculate these amounts.

VAT

This block is where VAT is calculated.

Depreciation

Depreciation of fixed assets and intangible assets is calculated, and R&D expenses will be written off. Leasing payments will be recognized in tax accounting. You can generate calculation certificates from transactions, for example, on depreciation, in order to analyze the calculation of the program. In the same block, entries are generated for writing off the cost of workwear and special equipment.

Currency revaluation

Currency rates are automatically downloaded into the program daily from the Internet. To do this, the corresponding setting must be specified in the currency directory. Based on this information, currency funds are revalued every month.

Adjusting the cost of an item

The program provides several ways to evaluate the inventory: FIFO and average. The method is selected in the accounting policy of the organization. During the period, primary documents are entered into the database; in practice, it often happens that they are entered out of sequence and retroactively. There may also be picking and production operations, so there is a routine operation to adjust the cost of the item.

RBP

The purchase of licenses, software, and insurance are often recognized as deferred expenses. They are written off through an appropriate regulatory operation.

And 1C:BP 3.0 can calculate trade margins on goods sold.

Tax calculation

An important difference between this edition of the configuration and its predecessors is the ability to calculate such types of taxes as transport tax, property tax, land tax, and trade tax.

For the program to do this, you need to fill out the appropriate types of directories.

What you need to fill out to calculate taxes

For example, you can fill out data on vehicles in the vehicle registration directory. It has two types of operations: registration and deregistration. Car make and model, vehicle type code, license plate number, power and environmental class. The tax rate, benefit and to which Federal Tax Service the tax will be paid are determined.

The program has a register of information “registration of land plots”; there are two types of operations in it: registration and deregistration. Information about the plot, its cadastral number, cadastral value, BCC, land category code, whether it is housing and what type of property are entered.

Data from these registers, as well as tax calculations using routine operations, will allow you to automatically fill out the relevant declarations.

Expense transactions

Next are transactions for recognizing expenses for the acquisition of fixed assets and intangible assets under the simplified tax system, as well as write-off and exclusion of additional expenses and payments.