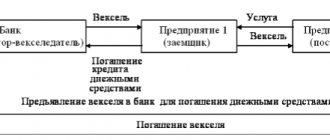

Simply put , a promissory note is similar to a promissory note. The document confirms that the one who issued the bill (the drawer) is obliged to pay money to the buyer (holder) of the bill. The payment of money on a bill is called “redemption of the bill.”

Bills of exchange are used as one of the ways to issue loans and credits, as well as as a means of payment for goods, work and services, said Yaroslav Chenchik, head of the corporate credit risks department of the Central Bank of the Russian Federation.

In Russia, promissory notes were actively used in the 1990s, but now they are not the most popular financial instrument, notes financial consultant Orkhan Talibzade. According to him, bills of exchange are now more common in the banking sector.

Purchasing promissory notes from Sberbank or other large companies is, in essence, a way to place free money for a certain period of time for the sake of guaranteed income, adds Konstantin Erokhin, partner of the international bar association J&S Legal counsels and trustees. Moreover, such a bill can be used as a means of payment between organizations of different forms of ownership, since it itself has a high value, the expert added.

Usage examples on "Secret"

“The second place in the number of complaints was taken by the sale of bills of exchange (about 400 complaints, or 22.8%). This is an atypical problem for recent years - such a large percentage of complaints came from holders of bills of exchange from the company FTK LLC, which is recognized as a “bill pyramid.” Depositors who purchased FTC bills under the guise of deposits actually paid interest on the old bills. The volume of the pyramid amounted to 4.5 billion rubles, and its victims were more than 2,500 people.”

(From the news about complaints from Russians to the Central Bank in 2022.)

“The bank noted that the dates of issuance of guarantees on bills raise doubts. One guarantee was issued by the director, who was on sick leave at that time, and the other by someone who was on vacation.”

(From the news about the seizure of the property of a State Duma deputy due to a dispute over bills.)

Ways to indicate the maturity of a bill

The bill obliges the repayment of the debt to the one who presents it (the holder).

There are two types of DCB:

- A simple bill (solo bill) is paid by the person who issued it (the drawer).

- The transferable draft (draft) is repaid by a third party at the request of the debtor.

The form must include the “Payment Date” information, without which the promissory note loses its legal force. Debt repayment occurs:

- upon presentation;

- within a specified time after presentation;

- after a set time from compilation;

- on a specific day.

Specifying other periods or more than one is not permitted.

Upon presentation

In this way, the debt is repaid, even if the “Payment due date” column is not filled in. The DSB is presented by the holder within a year from the date of preparation. The debtor has the right to reduce or increase this period.

The option is inconvenient for the payer, since he must be ready to transfer the required amount at any time.

Within a specified time after presentation

Such a security must be presented for acceptance or protest within a year after issue. The fact of presentation is confirmed by the payer’s signature in the acceptance section.

If the payer signed but did not mark the date, then it is considered that consent to payment was given on the last day of the period agreed upon for the provision of the DSB for acceptance. Or the moment of protest is determined - an appeal to a notary to record the fact of signing by the payer.

The time for payment after presentation of the bill of exchange is calculated similarly to the time provided for payment from the moment of drawing up.

After a set time from compilation

Unlike the previous version of indicating the deadline, the moment of preparation is recorded on the form.

Debt repayment can be negotiated in different ways:

- After a few months. The period begins on the day following the date of preparation (or presentation) and ends with the day of the month coinciding with the date of the beginning of the period. For example, if the CDB includes the condition “within 3 months”, it was presented (or compiled) by:

- April 23, 2022, then it must be paid on July 24, 2022, but not earlier;

- November 29, 2022, then the debt will be repaid on February 28, 2022, since February 30 does not exist;

- January 31, 2022, then payment will follow on May 6, 2022 (the nearest working date, since May 1-5 is a weekend).

- In half a month. In this case, 15 days are considered.

- In a few days. The debt is paid at the last of them.

- Setting payment at the beginning, middle or end of a specific month means the first, fifteenth or last day, respectively.

On a specific day

Debt repayment can be scheduled for a selected date. If the calendars of the place of issue of securities and the place of payment are different, then the date of repayment of the debt is determined based on the calendar adopted at the place of transfer of the debt.

Nuances

Bills of exchange are issued on paper and are not stored electronically. According to the law, there are a number of strict requirements for the execution of bills. This is the title, the amount payable, the date and place of drawing up (purchase) of the bill of exchange, the due date, the place of payment for the bill of exchange, the name of the creditor, the signature of the drawer and the details of the debtor.

Bank bills are not insured by the government, and they cannot be repaid before the specified period. Another significant risk is that bill holders belong to the third (last) line of creditors. This means that if the issuing bank’s license is revoked, there may be no money left to pay off debts to the holders of the bill.

Bill of exchange

Securities are considered the most common type of free finance investment. One option is a bill of exchange. This is a document confirming in writing the obligation to repay the debt.

The concept of a bill in simple words

The appearance of this type of securities is associated with the 13th-14th centuries, when this method of mutual settlements became the norm. It was first used in Italy as a world trade center. When there was a shortage of funds, they began to issue promissory notes to suppliers, which was equivalent to a promissory note. The document reflected the amount and date of the refund.

The bill of exchange appeared at the dawn of the development of the commodity market as a tool for obtaining material assets “for sale.”

In Russia, the concept of “bill of exchange” appeared in the 18th century. They were used in trade settlements with Germany. Translated from German, the term means “exchange,” which quite accurately reflects the essence of the asset. In modern legislation, the relationship of a bill to securities is enshrined in the Civil Code of the Russian Federation (Article 142). The relationship between the parties is regulated by Federal Law No. 48 of March 11, 1997 “On bills of exchange and promissory notes.”

This type of securities has the following features:

- Indisputability. The party who has undertaken the obligation to pay must repay the debt in any situation. Otherwise, recovery through the court is allowed.

- Monetary Repayment of obligations is carried out in monetary terms (exchange of goods in kind is not allowed).

- Appealability. The paper is transferred through an endorsement without any restrictions.

- Abstractness. The document is in no way connected with other transactions. If it is handed over, it immediately acquires legal force regardless of the fulfillment of additional obligations by both counterparties.

Bills of exchange are issued in the form of a strict reporting form with several degrees of protection to guarantee the absence of counterfeits. They allow you to conclude transactions without factoring, i.e. without involving banks as a guarantor.

Types of bills

In addition to promissory notes, there are transferable, bank, and treasury securities, which differ in issuer, presentation and redemption scheme. The document can be considered an order to repay the debt to the bearer, a third party. The issue depends on the ultimate purpose of the security and the type of organization of the issuer. Thus, treasury bills are always issued by the state in order to attract funds to pay off its expenses.

There are several types of securities of this type:

- Unconditional. To be paid in cash at the time of presentation.

- Guaranteed. Issued without exchange of funds, under a guarantee of conducting agreed business activities.

- Commercial. Usually issued on the security of goods or other material assets.

- Protested. Requires a notarized waiver of payment.

- Bearer. According to the terms of the document, it is repaid immediately upon presentation to the issuer.

- Urgent. Has a fixed validity period.

- Financial. Used in relationships between banks.

- Private. Issued by an individual.

There are variants of friendly bills used for mutual lending to two or more individuals. As well as domiciled bills, which allow you to transfer the right to repayment to third parties indicating another organization responsible for the obligations.

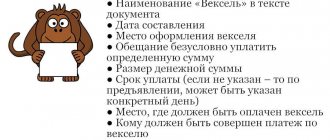

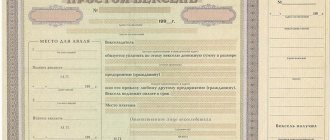

Required details

Depending on the issuer, papers can be issued on plain paper (by individuals, commercial organizations) or on forms with several degrees of protection against counterfeiting. The latter are more often issued by banking institutions or the state. In circulation there are papers indicating the remittor, the person receiving the payments, and without it. Then anyone can pay off the bill.

The following details are required for the document:

- Bill mark. For example, “promissory note”.

- Place and date of document preparation.

- Guarantees of unconditional payment of the amount of funds specified in the papers.

- Payment term. Splitting into multiple transactions is not allowed.

- Place of payment. The exact address of the payer's location.

- Full name and address of the bill holder.

The document is certified by the signature of the owner of the security. Subsequently, it becomes one of the key signs of identifying the recipient of payments. If the type of bill of exchange is drawn up, empty columns are required to indicate the address and name of the payer. Without their inclusion, such a document turns into “simple”. All items must be filled in without abbreviations. If any errors are detected, the security is invalidated. What a bill looks like can be seen in the sample provided by the issuer.

Endorsement design options

In a business environment, a bill of exchange is often used as a means of payment and can systematically change owners until maturity. The reverse side of the document serves this purpose, where several lines are provided to indicate the new owner of the asset. An endorsement is a signature confirming the transfer of rights to a third party.

There are several types of endorsement:

- Blank. The signature/sometimes seal of the former owner indicates a change in the person entitled to present the paper for redemption. The new owner must independently indicate his name in the document.

- Nominal (order). The document indicates the name of the person at whose request monetary transactions can be carried out.

- Non-negotiable. Removes liability for non-payment of obligations from the endorsee. If the issuer of securities refuses to repay debts, the new owner himself decides on the issue of collection.

The ability to transfer rights of claim allows you to use a bill of exchange for the resale of debt obligations along with other assets. The endorsement is absolute; after transfer, there is no right of return without the signature of the new owner.

Types of transactions on bills of exchange

The banking system most often turns out to be an organization that issues bills. Securities allow banks to attract even more funds for issuing loans and other financial transactions. The acquirers are legal entities/individuals, regardless of the type and scale of their activities.

The bill system is not limited; securities are issued according to the demand for money.

The turnover of securities involves the following operations:

- Release. The issuer is the state, financial institution, or organization with commercial activities.

- Sale. Implementation for the purpose of collecting investments and financing projects.

- Accounting. Strict control of issued/returned bills of exchange is expected in order to prevent the appearance of counterfeit documents on the market.

- Issue. Bills of exchange can be used instead of cash (as agreed by the parties).

- Acceptance with payment of the stipulated amount. Redemption of a security.

- Application for mutual settlements between enterprises. This form involves the refusal of bank factoring and loan processing.

The list of transactions with promissory notes and bills of exchange completely coincides with the accounting policy of commercial organizations: each document issued is subject to recording in the database, where the date of issue/return is subsequently recorded. The issuer is guided by the series and number, which are unique for each document.

Making payments

Repayment of the bill is carried out upon the expiration of the period, if one was specified, or at the first request of the owner of the securities. In this case, compliance with the conditions is required - submission of the claim within the appropriate period, strictly at the specified place of the payer, when applying to the specified person.

The profitability of the bill is known in advance.

Payments should be made in compliance with the following rules:

- Contact the address indicated in the bill of exchange, unless otherwise provided by the bill of exchange itself.

- The application for repayment is made in writing, indicating the details of both parties.

- Before transferring the original to the payer, it is recommended to make a copy of the document to eliminate possible fraud.

Those who own urgent bills should be especially careful. If you do not contact the payer in a timely manner, the date of issue of funds may become uncertain. Practice establishes a period of one calendar year when the holder of securities is obliged to contact the payer. After this period, payments aimed at repaying the debt are made exclusively by agreement. In case of refusal of a voluntary return of funds, the owner of the bills has the right to go to court.

Cost of bills

The issue of bills allows a banking institution and government authorities to replenish the budget and attract additional investments. Therefore, the pricing policy is treated with due attention - the cost of the bill must be available on the mass market and at the same time ensure good dynamics of cash flows.

On the other hand, the amount secured by the bill of exchange can become a sign of assessing the reliability of the asset. An inflated value may indicate a lack of collateral and high risks after the expiration of the period specified in the document (or it will begin to actively evade fulfillment of the obligation). The market value of the bill may fall or rise when the financial condition of the issuer or the situation on the world market changes, but the amount to be returned will always remain the same.

A reduced price of securities (compared to par value) may indicate that the issuer is in a crisis situation and is likely to be unable to repay the debt even through legal proceedings. If we are talking about an interest-bearing bill, you should independently recalculate the value of the asset and the rationality of repurchasing from the previous owner. If the transaction has already taken place, and the new owner has identified shortcomings, he will not be able to make claims against the seller. You will have to deal with the issuer.

Validity periods

Deposits in bills of exchange have a distinctive feature - the return of funds strictly on the specified date. There are no consecutive payments or deferments. If the payment day falls on a weekend or holiday, the due date is extended to the first working date.

Repayment of debt obligations is carried out upon written application.

According to the maturity date, bills are divided into types:

- Upon presentation. The owner of securities applies for redemption on any day of the year, without any restrictions.

- Some time after presentation. The rule is applied for bills of exchange with a high value so that the payer has time to collect the required amount of money for a lump sum payment.

- Some time after compilation. When issuing a bill of exchange, a validity period is provided, after which the buyer is obliged to appear for repayment.

- On a specific date. A method similar to the previous one, used when issuing bills for the international market, so that the features of calculating the term do not in any way affect the maturity date.

If the holder of a bill of exchange has a document without a date of issue or due date for payment, such a security is considered invalid. With such shortcomings, the owner will not always be able to obtain protection of rights even through the courts. When repaying later than the specified day, please note that no interest is charged for additional days.

Differences from promissory notes and other securities

There are several advantages to dealing with promissory notes as “IOUs.” On the one hand, the essence of the documents is almost the same - one party confirms in writing the receipt of a certain amount of money as a loan. On the other hand, a bill of exchange as an officially recognized security is an independent object of civil law.

This is reflected in the following benefits:

- The bill can be sold as an ordinary product. This is easier to do than transferring the right to collect debt with a regular loan.

- Securities are exchanged at the current rate with other assets.

- Bills of exchange can be used to replenish the authorized capital of an enterprise.

Despite its general nature, the bill frees its owners from troublesome procedures in the form of signing assignment agreements. In the case of standard credit relations, the debtor has to be notified of this fact, while a bill of exchange acts as a traditional product, albeit with a certain “validity period” (you can receive money from it only after the date specified in the documents).

Errors in use

A bill of exchange can be confused with a bond. Both securities are types of debt instruments: the investor deposits his funds for a certain time in order to receive income. Both bills and bonds can be bought, transferred and sold until maturity.

However, there are also differences. Bonds are traded on the stock exchange, they are mass securities: a company issues bonds to the market, and anyone can buy them. Bondholders typically receive periodic coupon payments, but in the case of bills of exchange such payments are not provided, only interest upon redemption.

“The labor-intensive process of issuing bonds, in comparison with the relatively easy process of issuing bills, is compensated by its higher degree of transparency and lower risk,” explained Yaroslav Chenchik. The expert added that companies often use bonds to attract financing for large projects, and bills of exchange to solve current problems.

Types of stock instruments

One of the most important markets in the economic system of any country is the securities market.

It performs a number of functions that have a direct impact on the stability of the economy, as well as its potential for growth. The most important functions of the stock market include:

- obtaining income from assets and free cash flows;

- formation of market prices for stock instruments, impact on the balance of supply and demand;

- creation of a single information field accessible to all participants;

- regulation of relations within the market between participants in transactions;

- distribution of financial risks;

- creating conditions for the movement of money and capital assets between sectors of the economy;

- attracting citizens to investment activities by transferring savings into investments;

- additional financing of the budget without additional emission of money supply.

Are you an expert in this subject area?

We offer to become the author of the Directory Working Conditions All relations in the market are carried out using securities. The economic essence of the stock market comes down to production and transactions with them.

About fifteen types of securities are used in Russia. An investor who wants to receive additional financing or income from his free funds, as a rule, resorts to the formation of a package of stock documents. This approach is called an investment portfolio. It allows its owner to create a flexible instrument for generating income on their assets at different times and with varying degrees of risk. The use of securities with varying degrees of liquidity, maturities and riskiness makes it possible to reduce losses across the entire package of documents that form the investment portfolio.

Currently, electronic types of documents are increasingly used. However, there are securities that must be issued only in paper form. One of these is a bill.

Criticism

According to Andrey Guskov, head of the client service department at Accent Capital, the Central Bank has repeatedly paid close attention to the bills. The regulator believes that their issuance may involve banks in dubious transactions for cashing out or withdrawing money abroad.

In 2011, the Central Bank amended Instruction 110-I “On Mandatory Standards for Banks”, according to which increased risk coefficients began to be applied to bills when calculating capital adequacy standards for banks. This significantly reduced interest in the instrument on the part of banks.

How much can a bill of exchange cost?

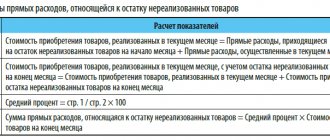

When purchasing a bill of exchange, the bank incurs costs associated with the fact that it does not lend out the money spent on the purchase of the bill of exchange and does not receive income. In addition, there is a risk of non-payment of the bill (for example, out of a hundred bills, on average, two turn out to be “bad”). Therefore, when buying a bill of exchange, the bank will make some discount (deduction) from the amount that it will have to receive on this bill of exchange in order to compensate itself for 1) the loss of interest and 2) the loss of “bad” bills. This discount is called a discount (from the English discount - “deduction”), and the purchase of bills of exchange is called discounting of bills. Thus, the price of the bill of exchange is correspondingly less than the amount of payment specified in the bill of exchange.

Example 1

Let's assume that the bank wants to buy a bill of exchange that will pay $1,000 rubles in three months. For simplicity, let's also assume that the bank is absolutely sure of payment and the costs consist only of the loss of interest, which is $1\%$ for three months.

The bank will agree to buy a bill for such an amount of money $Pd$, which, if lent for three months at $1\%$, will bring $1000$ rubles. By writing the interest rate $1\%$ as $0.01$, we get the following equality, which must be satisfied for the bank to receive the desired amount $Pd + Pd \ 0.01= Pd \ (1 + 0.01) = 1000$ (rubles ).

From here we can calculate that the price of the bill $Pd$ must be equal to $990.1$ rubles for the banker to agree to buy it. The deduction from the upcoming payment amount on the bill (discount) is therefore equal to $9.9$ rubles.

If there is a risk of non-payment on the bill, then the discount will be greater than this value, and the greater the risk, the greater the discount will be. Very “bad” bills, the probability of non-payment of which is very high (if, for example, they were issued by an unreliable merchant), can be bought by the bank at half price.

The appearance of bills makes it possible to reduce the required amount of money in circulation and facilitates the conclusion of trade transactions (you do not have to resort to the services of a banker).

Picture 1.

What is a bill of exchange

A bill is a security that is similar to a promissory note, which states obligations to repay money within a specified period and in a certain place.

Let's look at an example:

Masha borrowed 500,000 rubles from Olya. But Olya is not stupid, even though she and Masha are friends, the loan amount is still impressive, so she asked the debtor to write a handwritten receipt, where she indicated the place of issue, date, and amount. At the end, both ladies left their autographs.

Will this be considered a bill of exchange? No. In this case, an ordinary promissory note appears, although in its content it is very similar to a bill of exchange.

How, then, does a bill of exchange differ from an ordinary girlfriend’s receipt?