Over 11 thousand ex-company managers are on the Register of Disqualified Persons, which is also called the Federal Tax Service blacklist. These managers are deprived of the right to occupy “top” positions for a period of six months to 3 years. What offenses are included in the register of disqualified persons of the federal tax service, and what is the threat to the employer of hiring a disqualified person to a managerial position? We will answer these and other questions about the registry in our article.

In February 2014, the Federal Tax Service informed the public in letter No. SA-4-14/2279 that in Russia there is publicly available information on the Internet about persons who are deprived of the right to hold managerial positions for a period determined by the court. This open list of disqualified managers is called the Register of Disqualified Persons. The register is posted on the official website of the Federal Tax Service of Russia; using the specified parameters, you can check the presence or absence of any citizen of the Russian Federation in it. The register is not static; it is constantly updated with new names, while at the same time data on those whose disqualification period has expired is excluded from it.

11,893 managers are listed in the Register of Disqualified Persons (as of October 11, 2021).

Disqualifications can be costly

In the army of leaders there are approximately 11 thousand disqualified “tops” - not such a large number. The likelihood of encountering a disqualified manager is assessed by many as low, so employers often do not check their future managers against the Register of Disqualified Persons. But in vain! Firstly, there is a direct penalty of “ruble” for hiring a disqualified person; secondly, if the company that is your counterparty is managed by a disqualified person, then you may face troubles from the supervisory authorities.

What consequences await those who ignored disqualification:

- If a disqualified person manages a company during the period of disqualification, he faces an administrative fine in the amount of 5 thousand rubles.

- If an employer enters into an agreement (contract) with a disqualified person to manage a legal entity, the legal entity faces a fine of up to 100 thousand rubles.

- If the director of the counterparty company turns out to be a disqualified person, then you may be accused of failing to exercise due diligence when choosing a counterparty. And this, in turn, threatens inspections by supervisory authorities, additional assessment of income tax, etc. Also, an agreement signed by a disqualified person can be challenged in court.

Who needs it and why?

The Federal Tax Service maintains a register of disqualified persons: what it is and what the list is used for is stated in the Order of the Federal Tax Service No. ND-7-14/ dated December 31, 2014. The RDL is a list of persons who have received a disqualification order.

Disqualification is the deprivation of an individual's legal opportunity (Part 1 of Article 3.11 of the Code of Administrative Offenses of the Russian Federation):

- occupy and fill positions in the state and municipal service;

- occupy and fill civil service positions in any subject of the Russian Federation;

- manage a legal entity;

- conduct business activities to manage the organization;

- engage in activities in the field of medicine, pharmaceuticals, sports, conducting industrial safety assessments, and managing apartment buildings.

An individual is disqualified for a period of six months to 3 years (Part 2 of Article 3.11 of the Code of Administrative Offenses of the Russian Federation). To confirm the absence of disqualification, information is requested from the RDL - what this is is indicated in order No. ND-7-14/. This is a document that confirms the absence from the list (certificate of absence of the requested information) or presence on the list of disqualified citizens (extract from the FDP). The tax office maintains a list in accordance with the provisions of Art. 32.11 Code of Administrative Offenses of the Russian Federation.

IMPORTANT!

An individual is disqualified for violations of labor, economic legislation and the law on free competition. If a citizen has committed an administrative violation, he receives a disqualification order and ends up in the RDL. Information in the register of disqualified persons is entered by federal executive authorities authorized to maintain RDL no later than three working days from the date of receipt of a copy of such a resolution or judicial act on the revision of the disqualification decision. A disqualified person is not entitled to hold certain positions during the period specified in the resolution.

State and municipal authorities require a certificate of absence from the FDP. If an employer hires a person with disqualification to manage a legal entity, he will receive a fine of up to 100,000 rubles (Part 2 of Article 14.23 of the Code of Administrative Offenses of the Russian Federation). The violating citizen himself will be fired and fined 5,000 rubles (Part 1 of Article 14.23). Other situations when you will need a register of disqualified managers in 2022 and information from the list are joining a self-regulatory organization. Counterparties also have the right to request a certificate of absence from the RDL.

Why and for how long are they included in the list of disqualified persons?

Disqualification of an individual is a type of administrative punishment. Disqualification deprives a manager of the right to be a member of the executive body of a legal entity, to join the board of directors or supervisory board, or to hold the position of head of a legal entity.

The decision on disqualification is made by magistrates. Punishment for disqualification ranges from 6 months to 3 years. Analysis of the Register of Disqualified Persons shows that most often the courts deprive the right to manage an enterprise for 1-2 years. The mildest punishment – disqualification for six months – is extremely rare. The most severe punishment – disqualification “in full” for 3 years – is also not common, but still more than disqualification for six months.

Why the right to manage an enterprise is most often deprived of:

- Repeated or multiple violations of the legislation on state registration of legal entities and individual entrepreneurs. The official did not provide information or provided knowingly false information about the individual entrepreneur or legal entity for inclusion in the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs.

- The official violated labor and labor protection legislation if this person had previously been subject to administrative punishment for a similar offense.

- The official did not comply on time with the legal order (decision, presentation, resolution) of the services exercising state or municipal supervision and control.

Checking disqualified persons in Kontur.Focus

You can check a potential partner for disqualification in the Kontur.Focus system , where data from the Federal Tax Service website is checked daily. On the company card there is a block “Special Registers of the Federal Tax Service”, which displays data on a disqualified person. Contour.Focus automatically checks the appearance of a company or individual in one of these lists if the “Counterparty Monitoring” function is enabled. Also available are lists of mass addresses and mass leaders, persons with unpaid taxes in debt over a thousand rubles, companies that neglect to submit reports, and those with whom the tax authorities could not contact through official contacts.

The function is available on Premium and Premium+ .

What data is entered into the Register of Disqualified Persons

The Register of Disqualified Persons contains the following information about the disqualified person:

- Full name, date and place of birth of the disqualified person,

- position of a disqualified person,

- the name of the organization in which the disqualified person committed the offense,

- article of the Code of Administrative Offenses of the Russian Federation under which the offense was committed,

- the name of the structure that compiled the protocol on the administrative offense,

- Full name and position of the judge who issued the disqualification order,v

- period of disqualification,

- clarification of the period of disqualification with specific dates “from” and “to”.

What documents are needed

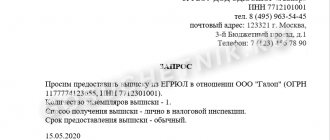

A request for information from the RDL is submitted:

- an individual to obtain a certificate or extract for himself;

- government agency;

- a legal entity to make personnel or management decisions.

Order of the Federal Tax Service of the Russian Federation No. ND-7-14/700 dated December 31, 2014 lists the details and documents that must be provided when generating a request from the RDL. For organization:

- full legal name of the applicant;

- details of the applicant (OGRN, INN, address).

For a citizen:

- FULL NAME.;

- date, place of birth and address.

Information about the person requested: Full name, date and place of birth.

The applicant indicates the preferred method of receiving a response: mail or email.

IMPORTANT!

Government agencies and citizens receive certified documents from the RDL free of charge. Legal entities pay a fee of 100 rubles per certificate.

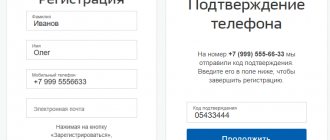

How to check for disqualification in “manual” mode

The register of disqualified persons is located in the bowels of the tax inspectorate website; you can obtain information from it using a special search service on the Federal Tax Service website. To do this, you need to indicate the details of the individual (full name, date of birth, name of the organization, TIN of the organization). In the absence of details, the entire list of disqualified persons is issued, which, by the way, is updated daily.

There is no charge for electronic information from the register of disqualified persons, but data on paper costs 100 rubles. You need to receive a paper certificate of the absence of disqualified persons or a certificate of inclusion in the register of an individual based on a request. The request can be sent electronically through the Federal Tax Service website, submitted to the tax office in person or by mail to any territorial inspectorate.

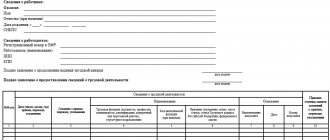

Based on the request, tax authorities must prepare a document within five working days. This may be a certificate confirming the absence of disqualified persons in the register or an extract from the register.

Extract from the register of disqualified persons

When and why do you need a certificate?

It is not always needed. The Federal Tax Service provides open access to current register information upon request online. Receive a certificate stating that there is no information about an individual in the FDP:

- when registering LLC, JSC and other legal entities;

- when applying for a job;

- when applying for a job;

- during reorganization and re-registration of a company;

- when concluding transactions.

IMPORTANT!

An employer is not directly liable if it fails to screen a candidate for a position for disqualification. But according to Part 2 of Art. 14.23 of the Administrative Code for concluding an employment contract with such a person provides for a fine of up to 100,000 rubles.

When concluding an agreement to manage an organization, according to Article 32.11 of the Administrative Code, the representative is obliged to request information about the presence or absence of disqualification of the applicant. A citizen also has responsibility if he manages a legal entity during the period of punishment. The amount of the administrative fine under paragraph 1 of Art. 14.23 of the Administrative Code is 5,000 rubles.

How to check quickly and not get burned by disqualification

The SBIS Counterparty Check will help simplify the process of checking counterparties, which will “automatically” check all managers of the organization for disqualification. If necessary, the fact of verification can be confirmed by a due diligence report, which can also be prepared using VLSI.

And VLSI Electronic Reporting is designed to reduce the risk of being among the disqualified. With it, submitting reports is faster and easier, and all regulations of supervisory authorities are under control. Our specialists will help you connect and configure VLSI. You will also be offered reporting services.

Our specialists are ready to tell you more about all the possibilities of VLSI. Leave a request on the website and get answers to your questions today.

Rate this article:

Failure to submit tax reports during the year

If for some reason the organization did not provide the appropriate reports to the tax office, this certainly indicates the dishonesty of the counterparty and the dubiousness of the activities being carried out.

Even if the enterprise had no activity, a zero declaration must be submitted to the tax office.

Failure to submit tax reports during the year

To avoid concluding contracts with unreliable counterparties, in the Kontur.Focus service you can obtain information about organizations that evade reporting and paying taxes. Assess whether your counterparty operates within the law.