How does an individual become an individual entrepreneur?

Any citizen can, in order to carry out profit-generating activities, at his own peril and risk, obtain the status of an individual entrepreneur. To do this, you need to go through the registration procedure with the Federal Tax Service of the Russian Federation based on the documents provided (for accounting for individual entrepreneurs and taxes). The registration procedure is described in Federal Law No. 129 on state registration of legal entities and individual entrepreneurs. In Art. 22.1 of the law provides a list of documents required for registration:

- application on form 21001;

- a copy of a document allowing personal identification: in this capacity, according to the law, only the citizen’s main document, that is, a passport;

- a receipt or check for payment of the registration fee (state duty) in the amount of 800 rubles. Find the details of the required tax office on the website of the Federal Tax Service of the Russian Federation.

IMPORTANT!

But if documents for registration are submitted electronically, through the Gosuslugi portal, the website of the Federal Tax Service or notaries, the amount of the fee is zero (clause 32, paragraph 3, article 333.35 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated July 18, 2019 No. GD-4- 19/ [email protected] , Letters of the Ministry of Finance of Russia dated August 28, 2018 No. 03-05-04-03/61166, dated April 16, 2019 No. 03-05-04-03/26952).

If the applicant is a stateless person, a foreigner, it is necessary to provide copies of the forms required by law (passport, certificate of residence, etc.). It may seem that filling out the application is the most difficult part. This form is quite simple, but there are certain design rules, which you can read about in the article published on our website. There is no need to have the signature certified by a notary if the application is submitted directly by a citizen intending to obtain individual entrepreneur status. In this case, the form is signed in the presence of a tax inspector.

Document validity period

Russian legislation does not establish the validity period for a certificate of absence from the Unified State Register of Individual Entrepreneurs. Moreover, there are no deadlines for both documents - both paper and pdf (electronic).

As a rule, a person requesting a certificate of absence of an individual individual entrepreneur from the Unified State Register of Individual Entrepreneurs immediately informs the citizen of the deadline for its submission. For example, it must be provided to the employer within 1 month.

If, on the part of the employer or other persons, there are no requirements for the deadline for submitting a certificate of non-registration as an individual entrepreneur, then this document is considered valid indefinitely.

FAQ

If you already have an individual entrepreneur and there are debts on it, is it possible to become self-employed?

You don’t have to close your individual entrepreneur and become a NAP payer. You can also close your individual entrepreneur and register as self-employed. In this case, all debts attributed to the individual entrepreneur will either have to be paid off or filed for bankruptcy, but the mere presence of debts does not interfere with the activities of a self-employed citizen.

Is it possible to write off debts for an open individual entrepreneur if there was no activity?

You can write off debt for both open and closed individual entrepreneurs through the bankruptcy procedure.

How to quickly close an individual entrepreneur with debts?

The procedure for closing an individual entrepreneur, both with and without debts, is identical. The only difference is that after the closure of the individual entrepreneur, all debts are transferred to the citizen who no longer conducts his business. It turns out that you first register the closure of an individual entrepreneur, and only after that you pay off the debt or file for bankruptcy of an individual.

When can the Federal Tax Service call an individual an entrepreneur and assess additional taxes?

More and more cases are becoming known when the Federal Tax Service of the Russian Federation recognizes in court that a person who, in accordance with the law, is not endowed with the status of an individual entrepreneur (not registered in the Unified State Register of Individual Entrepreneurs) is actually carrying out business activities. A satisfactory decision of the judicial authority threatens additional taxes for the established period of conducting activities that generate commercial income.

Signs of entrepreneurship, according to tax authorities, are the following cases (in accordance with Letter of the Federal Tax Service of Russia dated 05/07/2019 No. SA-4-7/8614):

- acquisition of property, the purposes of which clearly do not fall under personal and household purposes (office, property complex, commercial real estate);

- organizing production to make a profit (hiring personnel, purchasing materials and raw materials, developing technologies);

- establishing data in which the intention of a person can be traced (the relationship of transactions, the formation of a circle of clients and a base of counterparties, maintaining business records);

- sale of property previously acquired and used for profit (for example, a vehicle used for taxis), sale of property purchased from the municipality.

How to get a certificate stating that you are not an individual entrepreneur

A person can complete this paper in two ways: in person or online.

This is done through:

- official website of the Federal Tax Service;

- MFC branch located near the applicant’s place of residence;

- personal appeal from an individual to a Federal Tax Service employee;

- branch of the Russian Post.

Important! An inventory and notification of delivery of the package to the addressee must be completed for all papers. And a photocopy of the first page of the passport, the page with registration, sent by mail, must be certified by a notary.

Why does a citizen need to prove that he is not an individual entrepreneur?

Although such cases are usually not directly specified in the legislation, a certificate of absence of entrepreneurial activity is quite often used in practice. You may need this form:

- when applying for a job in a municipality, law enforcement agencies, joining the Armed Forces, opening an office of a lawyer or notary. All these persons are prohibited from engaging in entrepreneurship or running their own business;

- when applying for financial assistance;

- when queuing for subsidies;

- when registering housing preferences, etc.

When and why do you need a certificate?

According to the law, in some life situations it is necessary to issue a certificate confirming the absence of your individual entrepreneur in the Unified State Register of Individual Entrepreneurs. So, it may be required:

- When applying for a job in the civil service or as a future security officer. After all, employees of individual departments (FSB, Ministry of Internal Affairs, prosecutor's office, etc.) do not have the right to be an individual entrepreneur and at the same time an employee of the department. This prohibition does not apply to cases of performing one’s direct duties.

- Military personnel are contract soldiers or conscripts. In this case, Law of the Russian Federation No. 76-FZ On the Status of the Military applies. According to paragraph 7 of Art. 10 of the Law of the Russian Federation No. 76-FZ, a military personnel does not have the right to engage in entrepreneurial activities.

- Notaries. According to the Supreme Court of the Russian Federation, privately practicing notaries cannot be classified as individual entrepreneurs.

- If an individual wants to become an individual entrepreneur and 5 years have passed since he was declared bankrupt.

- To receive financial assistance, housing subsidies - if the applicant or a member of his family is unemployed.

- When applying for employment in the State Duma.

As for civilian personnel, of which there are plenty in government departments, the above legal restrictions do not apply to them.

Thus, obtaining a certificate of absence of state registration of an individual as an individual entrepreneur is not a bureaucratic whim. Its registration in some situations is mandatory.

How to confirm the absence of individual entrepreneur status

The Federal Tax Service of Russia, in Letter No. GD-2-14/ [email protected] , explained to all former individual entrepreneurs and other citizens how to obtain a certificate of absence of individual entrepreneur status. In fact, such a certificate is the provision of information contained in the Unified State Register of Individual Entrepreneurs about a specific individual entrepreneur. Not only the citizen himself, but also any interested person with sufficient authority is allowed to obtain such information. The document is paid, the fee for its provision is 200 rubles. Quite often the question arises: where to get a certificate of absence of an individual entrepreneur, is it necessary to contact the Federal Tax Service at the place of registration. Currently, issuance is carried out at any territorial tax office. The form can be obtained in electronic form free of charge. An urgent certificate will cost twice as much (400 rubles). Find out the payment details directly from the territorial bodies of the Federal Tax Service or look on the websites of the Federal Tax Service for the constituent entities of the Russian Federation in the “Contacts and Appeals” section.

How much does it cost for a certificate stating that I am not an individual entrepreneur?

The cost of the certificate may vary. The amount depends on the selected option for receiving a response and the speed of registration. According to clause 1 of the Decree of the Government of the Russian Federation dated May 19, 2014 No. 462, the amount of payment is:

- for a non-urgent paper copy - 200 rubles;

- an urgent certificate on paper will cost 400 rubles;

- electronic certificate is free.

Payment is made by bank transfer - bank transfer from an account, through a terminal or through a bank operator. Details for the payment document can be found at the Federal Tax Service.

The electronic certificate is certified by an enhanced electronic signature of an authorized person, therefore a printed document is equivalent to a certificate with a handwritten signature of a representative of the Federal Tax Service (Letter of the Federal Tax Service dated July 12, 2017 No. GD-2-14 / [email protected] ).

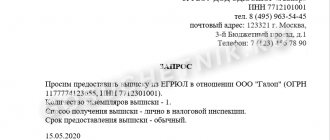

How to get a certificate from the tax office about the absence of an individual entrepreneur

To receive a document in paper form, you must first fill out an application to the tax office about the absence of an individual entrepreneur. Mandatory details for this form are not established by any legislative act; the application is written in free form. It is recommended to indicate the addressee - tax office, full information about the applicant, including registration and residence address, passport details. It is also important to correctly convey the essence of the request so that the Federal Tax Service employees understand what form is being requested. A signature and date of application are required. Please attach a receipt or check for payment of the required fee to your application.

An extract from the Unified State Register of Entrepreneurs in electronic form stating that there is no information about an individual in the register of entrepreneurs can be obtained free of charge, in accordance with Order of the Federal Tax Service of the Russian Federation dated November 12, 2012 No. ММВ-7-12 / [email protected] To do this, use the special service “ Providing information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs about a specific legal entity, individual entrepreneur in the form of an electronic document” on the website of the tax service and order a certificate of absence of an individual entrepreneur. The extract is generated by the system in PDF format and certified with an enhanced qualified electronic signature. The signature appears when the document is printed. Such a certificate is equivalent to a paper certificate - an extract from the Unified State Register of Individual Entrepreneurs, signed with the handwritten signature of a tax authority official and certified by the seal of the tax authority.

How and where to get it

There are two ways to order a certificate stating that I am not an individual entrepreneur. The first involves the use of the Federal Tax Service website, the second requires the need to personally appear at any department of the tax service.

On paper

It is possible to obtain a paper certificate from the tax office stating that I am not an entrepreneur, accompanied by the following documents:

- applicant's passport;

- certificate confirming the assignment of a TIN;

- a completed application for a certificate;

- receipts for payment of state duty.

If the applicant grants the right to contact the Federal Tax Service to his representative, he must issue a power of attorney with notarization. The disadvantages of this option are the time wasted traveling to the tax authorities and the need to pay for the service. Details for payment are indicated on the Internet resource of the Federal Tax Service. If applied in person, the certificate will be issued within 5 days.

Important! The state duty is 200 rubles. For urgent delivery you will have to pay the same amount.

Options for obtaining a certificate stating that you are not an individual entrepreneur are to send an application by registered mail. In this case, it is imperative to issue a notification of delivery to the addressee. You can also contact the MFC and submit your application to its employees.

In electronic

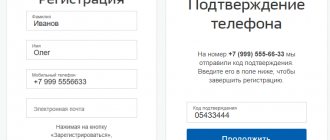

It is possible to obtain a certificate of absence of an individual entrepreneur from the tax office via the Internet. To make such a document, you must:

- Go to the Federal Tax Service website.

- Go through authorization (the service is available only to registered users) by entering your password and login.

- Select the “Individual Entrepreneur” category.

- Enter your TIN.

- Wait for the document to be ready.

The certificate will be sent electronically in PDF format to the email address specified during the registration process. The document contains an enhanced digital signature with visualization. Such a signature is considered equivalent to the handwritten signature of the tax official authorized to issue such documentation.

A certificate confirming the absence of individual entrepreneur status is available for downloading for five days. If the user does not meet this deadline, he will have to form an electronic request again.

Important! The certificate is provided in electronic format free of charge.

The personal account on the tax service website is a very convenient tool for obtaining various information and documents, as well as resolving other issues. After registration, the user has the opportunity to consult with tax authorities, submit a declaration in Form 3-NDFL, or check the status of their own debt to the Federal Tax Service.

To complete the registration procedure, you must contact any tax department or MFC. There is absolutely no need to choose an institution based on your place of registration. The inspector needs to provide a passport to verify the data, after which the inspection employee prints out the registration card. It contains the user's initial password and login.

Important! The password must be changed within a month from the date of registration, otherwise you will have to register again.

After receiving your registration card, you need to go to the Federal Tax Service website in the individuals section. In the upper left corner there will be a button to enter your personal account. Here you should check your data and confirm your consent to their processing. You need to fill out every line offered by the system. Next, indicate a new password and current email address.

A link will be sent to this address allowing you to activate your email. If you plan to send documentation to the Federal Tax Service in the future, you need to issue an EDS key certificate.

It is also possible to log into your personal account on the tax service website in another way: using the password and login received on the State Services portal. But this applies only to those individuals who have confirmed their identity at the service center. They will not have to visit tax officials to register a personal account. If the confirmation code for the State Services resource is received by mail, you will not be able to log into your account on the Federal Tax Service website. Tax accruals are confidential information, therefore access to it is provided only after confirmation of the user’s identity.

How to order a certificate on the State Services website

Now it is possible to obtain a certificate of absence of an individual entrepreneur through State Services or the MFC. In the first case, registration on the portal will be required; the registration procedure itself requires only a computer and Internet access and is carried out without personal communication with inspectors. You need to go to the “Providing information from the State Register” service, enter verification information, enter the TIN in the column for individual entrepreneurs and send a request. There is no need to pay a state fee, nor do you need to provide other forms. The data is sent to an email address within 24 hours and is available for downloading within five days. This sample is equivalent to the original.

Where to get

When registering as an entrepreneur or deregistering, the Tax Service enters information about a businessman - new or former - into a separate register of individual entrepreneurs (USRIP). At the request of the interested person, a certificate of lack of registration as an individual entrepreneur is generated on the basis of information in the Unified State Register of Individual Entrepreneurs as of the date of application. This document confirms the fact that you are not an individual entrepreneur and are not engaged in commercial activities.

Federal Law No. 129-FZ of August 8, 2001 states that the Tax Service of the Russian Federation is the only state body where a certificate of absence of entrepreneurial activity is issued. And to obtain official information, you should go to the Federal Tax Service and its territorial inspectorates. Both legal entities and ordinary citizens have the right to apply: the law makes no exceptions. And to obtain information about an individual entrepreneur or a person without such status, you will only need the TIN of the person you are interested in or your own.

Despite the abundance of offers on the Internet, there are few options where to obtain a certificate of absence of an individual entrepreneur:

- paid option - at the tax office;

- free method - through the online service of the Federal Tax Service;

- contacting the same tax office through the MFC;

- submitting an application by mail or in person.

Some sources write that it is possible to obtain a certificate of absence of an individual entrepreneur using the public services service. This is wrong. The government services website has detailed information on how to request the paper, how much it costs, and how long it takes to prepare the documents at the Federal Tax Service. But it is impossible to write an application and receive a certificate of absence of an individual entrepreneur through government services.