Why is count 51 needed?

Account 51 is used to record the receipt and expenditure of the company's non-cash money in bank accounts.

On 51 accounts, records are kept only in rubles. To account for money in foreign currency, there is account 52 “Currency accounts”. Account 51 is active. Debit records the receipt of money, and credit records payments and write-offs. The account balance can only be in debit; it is reflected in the balance sheet in the “Cash” line.

Due to restrictions on cash payments, legal entities cannot operate without a current account. Therefore, 51 accounts are used by all companies.

Tax rules

The Tax Code provides two possible options for reflecting costs associated with banking services in tax accounting.

Option one – pp. 25 clause 1 art. 264 of the Tax Code of the Russian Federation . In accordance with this norm, other expenses associated with production and sales include expenses for postal, telephone, telegraph and other similar services, expenses for payment for communication services, computer centers and banks, including expenses for fax and satellite services communications, e-mail, and information systems.

Option two – pp. 15 clause 1 art. 265 Tax Code of the Russian Federation . This article defines the list of non-operating expenses taken into account when taxing profits. It also includes expenses for bank services, including services related to the sale of foreign currency when collecting taxes, fees, penalties and fines in the manner prescribed by Art. 46 of the Tax Code of the Russian Federation, with the installation and operation of electronic document management systems between the bank and clients, including client-bank systems.

So, expenses associated with paying for bank services can equally be attributed to other expenses associated with production and sales, and to non-operating expenses. At the same time, none of the mentioned tax norms specifies exactly what banking services (according to the terminology of the Law on Banks and Banking Activities - operations or transactions) are meant.

The mentioned norms also contain no restrictions regarding the list of types of services provided by banks to be taken into account for tax purposes. This circumstance was drawn attention to in letters of the Ministry of Finance of Russia dated January 26, 2006 No. 03-03-04/1/64 , Federal Tax Service of Moscow dated December 14, 2007 No. 20-12/119669 , Resolution of the Federal Antimonopoly Service dated November 24, 2008 No. F09- 8606/08-С3 .

This circumstance provides taxpayers, on the one hand, with a certain freedom of action in terms of establishing the procedure for recognizing such costs when taxing profits. After all, paragraph 4 of Art. 252 of the Tax Code of the Russian Federation states: if costs incurred can equally be attributed to several groups of expenses at the same time, the taxpayer has the right to independently determine in the accounting policy the procedure for reflecting these costs. On the other hand, it entails additional tax risks of disagreements with regulatory authorities. After all, the latter may have a different opinion from the taxpayer regarding the accounting procedure for the analyzed expenses.

Let's consider the features of recognizing the most common costs associated with paying for banking services.

Bank commissions

The use of borrowed funds (loans, lines of credit) involves the need to pay various bank fees - in particular, fees for reviewing a loan application, opening a loan account or line of credit, early repayment or extension of a loan, changing the terms of a loan agreement.

The size of the mentioned commissions can be a fixed value (set in absolute terms) or calculated. In the latter case, the commission amount is calculated as a percentage of the loan amount (or other indicator).

According to the authorities, commissions, calculated as a percentage of the amount of the loan issued, are equal to expenses in the form of interest on debt obligations and are subject to accounting in the manner established by Art. 269 Tax Code of the Russian Federation .

The Letter of the Ministry of Finance of Russia dated March 18, 2011 No. 03-03-06/1/145 states: if the commission fee (for example, for part of unused funds under an open credit line) is expressed as a percentage, expenses in the form of such remuneration should be taken into account on the basis pp. 2 p. 1 art. 265 of the Tax Code of the Russian Federation (that is, taking into account the restrictions provided for in Article 269 ).

In Letter No. 03-03-06/1/421 , the financial department made a similar conclusion regarding the fee for using a loan under overdraft conditions, calculated as a fixed percentage for the open credit limit.

In other words, financiers consider this type of commission as hidden interest on loans. A similar approach to the recognition of commissions is demonstrated by specialists from the Federal Tax Service ( Letter No. SA-4-9/9466 ).

The competent authorities make an exception only for bank commissions, established as a fixed amount in absolute value terms. Financiers allow such payments (for example, a commission for prolonging a previously concluded loan agreement) to be recognized as tax expenses in full, that is, without standardization. Officials note: these amounts can be included in other expenses on the basis of paragraphs. 25 clause 1 art. 264 of the Tax Code of the Russian Federation , subject to the provisions of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation ( letters of the Ministry of Finance of Russia dated October 19, 2011 No. 03-03-06/1/675 , dated December 23, 2009 No. 03-03-06/1/824 ).

Meanwhile, not all arbitrators agree with the position of the regulatory authorities. A typical example is the Resolution of the Federal Antimonopoly Service of the Moscow Region dated December 13, 2012 No. A40-271/12-91-2 , in which the arbitrators came to the following conclusions. The fee for opening a credit line is not interest on debt obligations, regardless of the methodology for determining the amount of the service fee. The specified remuneration is paid in a lump sum and is not related to the actual time of use of borrowed funds. Such expenses are payment for bank services, therefore they are reasonably taken into account by the company as part of non-operating expenses on the basis of paragraphs. 15 clause 1 art. 265 Tax Code of the Russian Federation .

Another judicial act is the Resolution of the Federal Antimonopoly Service of the Moscow Region dated October 11, 2012 No. A40-129907/11-75-520 . Here the dispute arose regarding the commission charged by the bank for issuing the loan. Taking the side of the taxpayer, the arbitrators indicated: based on the provisions of Art. 29 of the Law on Banks and Banking Activities and Art. 819 of the Civil Code of the Russian Federation, the bank’s commission for providing a loan is a banking operation related to its provision, and does not apply to debt obligations in the sense of paragraphs. 2 p. 1 art. 269 Tax Code of the Russian Federation . In this regard, payment of a commission to the bank, regardless of the method of determining its size (in a fixed amount or as a percentage of the amount of the loan provided), is an independent payment for banking services provided, taken into account when taxing profits as part of non-operating expenses.

A similar approach was demonstrated by the FAS PO arbitrators in Resolution No. A57-22510/2007 regarding the inclusion in tax expenses of the bank’s commission for maintaining a loan account.

At the same time, readers should pay attention to the Resolution of the Federal Antimonopoly Service of the Moscow Region dated 02/04/2013 No. A40-71012/12-99-408 . The judges decided: payment for the opportunity to receive funds on the terms of a credit line in accordance with paragraph 1 of Art. 272 of the Tax Code of the Russian Federation should be recognized as part of current expenses evenly over the period provided for by the transaction for opening a credit line. Since the loan was provided for a period until December 1, 2013, the organization was lawful in accordance with paragraph 8 of Art. 272 of the Tax Code of the Russian Federation recognized the specified fee (in the amount of 0.7% of the loan amount), paid to the bank at a time in 2006, in equal installments during the period stipulated by the loan agreement.

Accounting accounts in "1C: Accounting 8"

An accounting entry or accounting formula is a correspondence of accounts indicating the amount of transactions

The accounting entry is compiled only on the basis of primary accounting documents. Primary accounting documents include orders, contracts, acceptance certificates, payment orders, cash receipts and expenditure orders, invoices, orders, receipts, sales receipts, etc.

Primary documents are supporting documents on the basis of which accounting records are maintained and which certify the facts of business transactions. The primary document is drawn up at the time of the relevant transaction or immediately after its completion.

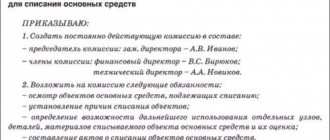

In general, to draw up a posting you need to:

- determine the essence of changes occurring with accounting objects as a result of a completed business transaction;

- select, according to the Chart of Accounts, suitable accounts for recording the amount of a business transaction using the double entry method - debit and credit.

After determining the correspondence of accounts as a result of this operation, an accounting entry is drawn up. If a transaction corresponds to only two accounts (one for debit, the other for credit), then it is called simple

.

Accounting entries in which more than two accounts interact are complex entries

.

You can make accounting entries in 1C:Accounting 8 through standard configuration documents and through manually entered transactions.

The document “1C: Accounting 8” allows you to enter information about a certain business transaction into the accounting system, record the date and time of the transaction, the amount and content of the transaction. Examples of program documents: Receipt of goods and services, Expense cash order, Receipt to current account, Depreciation and depreciation of fixed assets

etc.

Based on the document, accounting entries are automatically generated and recorded in the accounting registers (each accounting entry corresponds to one entry in the accounting register), and entries are also entered into specialized information registers and accumulation registers. In the 1C:Enterprise system, accounting for a business transaction is always associated with the document that generated it: if the document needs to be edited, then when it is edited, the entries in the registers will be created anew, and when the document is deleted, the entries in the registers will also be deleted.

Using the document "1C: Accounting 8" you can also obtain a printed form of the primary document, for example, a Payment order

,

Advance report

, etc.

In general, standard accounting system documents can generate accounting entries in various combinations, entries in special registers, and also offer or not offer printed forms of primary accounting documents, for example:

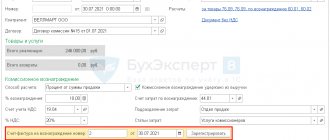

- in the document Invoice for payment to the buyer,

a printed form is available, but there are no entries in the accounting register and in special registers; - in the document Receipt to the current account

- there can be only one simple accounting entry, and there is no (as unnecessary) printed form of the document; - The document Sales of goods and services

contains a whole group of accounting entries, entries in registers, and also supports several options for printed forms.

You can view transactions using the DtKt

both from the document form and from the list of documents form.

If the automatically created records for some reason do not satisfy the user, then in the form for viewing document movements, you must set the Manual adjustment flag (allows editing of document movements).

This flag allows you to add new and edit existing document movements; the automatic generation of movements is disabled.

After removing the Manual adjustment...

, the document will be re-posted, and the movements will be restored automatically by the posting algorithm (Fig. 12).

Rice. 12. Form for viewing document movements

In the accounting register form (section Operations

hyperlink

Transaction log

) information in the list can only be viewed (Fig. 13). To find the necessary information, it is advisable to use the list selection and sorting settings.

Rice. 13. Accounting register

If the user does not find the business transaction he needs among the standard documents of 1C:Accounting 8, then in this case a manual Operation

(Section

Operations

, hyperlink

Operations entered manually

).

You can check the correctness of manually entered account correspondence using the accounting express check mechanism.

Correspondence of Accounts directory is intended to assist in registering business transactions.

(section

Main

hyperlink

Enter a business transaction

), which is a configuration navigator that will help the accountant, based on the content of the business transaction or the correspondence of the accounting accounts for the debit and (or) credit of the account, to understand which document needs to be reflected in the configuration.

You can select the required account correspondence by debit or credit accounts, by the content of the transaction (Fig. 14) or by the configuration document.

Rice. 14. Directory of correspondence accounts

To facilitate the entry of recurring business transactions, standard transactions are provided. To store a list of standard operations, as well as to create new standard operations, a reference book of standard operations is provided (section Operations

hyperlink

Typical operations

).

A typical operation is a template (standard scenario) for entering data about a business transaction and generating entries for accounting and tax accounting, as well as entries in accumulation and information registers.

The entered operation will be reflected in the operation log, as well as in the list of manually entered operations.

In the header of the directory element Typical operation

in the

Contents

, a brief content of the transaction is indicated (Fig. 15).

The information from this field will be filled in the field of the same name when creating the Operation

.

Rice. 15. Creating a new standard operation

The form displays elements of a typical operation on the following tabs:

- Accounting and tax accounting;

- List of parameters.

On the Accounting and Tax Accounting

a set of templates for automatic generation of accounting and tax accounting entries is displayed. Records are entered into the tabular part, each of which will correspond to the automatically generated invoice correspondence. When you select a value for a field, a form appears with a choice of filling options. There are three options:

- Parameter

(used for values that are not known in advance and are set at the time of document creation); - Value

(set in the

Operation

automatically with the value specified in the template and is not requested when entering the

Operation

); - Do not change

(applies only to periodic information registers, and the value of this field will be obtained from the infobase at the time of creation of the

Operation

).

On the Parameter List

All parameters used in this typical operation are displayed.

On this tab you can add new or change existing parameters, as well as manage the order of parameters. Order is used to display parameters in an Operation

.

To set up a template for filling information and accumulation registers, you need to add the required registers using the Select registers

(

More

-

Select registers

).

After selection, the selected registers will be displayed on additional tabs between the Accounting and Tax Accounting

and

List of Parameters

.

You can analyze data on accounting and tax accounts using standard reports:

- Turnover balance sheet;

- Account balance sheet;

- Account analysis;

- Account turnover;

- Account card;

- General ledger and others.

Payment for banks performing the functions of currency control agents

In accordance with the provisions of Federal Law No. 173-FZ , as well as taking into account Art. 421 of the Civil Code of the Russian Federation, authorized banks have the right to charge a fee for performing the functions of currency control agents from client organizations that have issued transaction passports under foreign trade contracts with these banks. At the same time, banks independently determine the amount and procedure for collecting the specified fee ( clause 3 of the Bank of Russia Information Letter dated March 31, 2005 No. 31 ).

The Ministry of Finance believes that the taxpayer can take into account the fee for performing the functions of currency control agents as part of other expenses associated with production and sales, based on paragraphs. 25 clause 1 art. 264 of the Tax Code of the Russian Federation ( letters dated 02/03/2012 No. 03-03-06/1/58 , dated 08/12/2011 No. 03-03-06/1/477 ).