The final payment upon dismissal involves the payment of funds due to the latter for the entire period of his working activity. In this case, it is necessary to take into account the grounds for termination of the contract. After all, a citizen’s salary and other necessary payments will depend on this basis. In such a situation, the manager should not forget that full settlement with the resigning person must be made on the day when the employee last carries out his activities in this organization. Otherwise, the boss simply cannot avoid problems with the law.

Reasons

The final payment upon dismissal is made in all cases of termination of the employment contract and has specific deadlines for payments. But the amount of money that the person will ultimately receive will depend only on the grounds on which the relationship between the employee and his boss is terminated. According to the provisions of Article 140 of the Labor Code, the manager must pay all funds due to the citizen on the last day of his work. And if it is impossible to carry out this procedure at the specified time, it must be done the next day when the employee made a demand for settlement with him. Otherwise, management may be in big trouble if a person seeks protection of violated rights in court.

An employment contract can be terminated either at the request of the employer or at the initiative of the citizen himself, as well as for reasons beyond their control. In addition, the desire to terminate the employment agreement is often mutual. In the latter case, the final payment under the contract can be made not only on the final day of the person’s work, but also after this moment.

Features of calculating compensation for due leave

In some non-standard situations, calculating dismissal compensation for vacation days in general and determining the calculation period in particular can cause difficulties. Let's take a closer look at some of these cases.

- Those working on the basis of civil law contracts do not have the right to vacation compensation upon dismissal, since labor legislation does not apply in this case. However, some payments may be provided for by the local documentation of the enterprise.

- If a short-term employment contract lasting no more than 2 months is concluded with a specialist, then the period for payment of vacation pay is determined according to the rules of Art. 291 of the Labor Code of the Russian Federation, according to which an employee is entitled to 2 vacation days for a month’s work. However, if an open-ended employment contract is terminated earlier than 2 months, then this rule is not applicable.

- During their working career, seasonal specialists earn 2 vacation days monthly (Article 295 of the Labor Code of the Russian Federation). Based on this norm, the dismissal compensation for vacation for such an employee should be calculated.

- Dismissal leave compensation is paid to the employee regardless of the grounds on which he will be dismissed, including when the employment relationship is canceled during the probationary period or in connection with the employee’s misconduct. This follows from the letter of Rostrud dated 07/02/2009 No. 1917-6-1. If in this case the employee has not worked for the company for even six months, the compensation is calculated in proportion to the time worked. If an employee worked in an organization for less than half a month, the vacation period upon dismissal is not compensated (letter of Rostrud dated 06/08/2007 No. 1920-6).

Payments upon dismissal: their types

Regardless of the reasons for termination of the employment contract, a final settlement is required. Mandatory payments include:

- employee salary;

- compensation for vacation that was not used;

- severance pay upon termination of the relationship between the parties to the agreement under clause 2, part 1, art. 81 Labor Code of the Russian Federation.

Additional types of monetary support include: dismissal benefits by agreement of the two parties, as well as other types of material compensation established by the collective agreement.

Dismissal of a part-time worker

According to the Labor Code, part-time workers have the same rights as full-time employees. They have the same guarantees for compensation during dismissal. The rights of part-time workers include:

- payment of compensation upon dismissal, which consists of the same parts as the dismissal payment to the main employee, it is calculated according to uniform rules regulated for determining these indicators;

- payment of vacation days taking into account those received at part-time work;

- annual leave (at least two weeks).

That is, when calculating compensation for a part-time employee upon dismissal, you need to find out the period for calculations and determine the total wage debt in accordance with the Labor Code.

It is important to correctly calculate the amount of compensation for unpaid vacation, find out the billing period, taking into account the rules on regular and additional vacations. Moreover, it is necessary to take into account vacation payments that were provided in advance, which is not uncommon for part-time workers.

Calculate other payments that are related to the reason for leaving a part-time job (for example, due to layoffs), or specified by the company’s internal documentation.

Calculating compensation upon dismissal of an employee is an important element of the process of completing an employment contract. Moreover, the procedure for calculation during dismissal, despite detailed instructions in labor legislation, requires a careful approach, taking into account all the accompanying obligations of the organization, which are important for calculating the total amount of payment.

The procedure for issuing and withholding settlement

It is understood that all monies due must be paid to the employee.

At the same time, some of them can sometimes be withheld. In a specific case, we are talking about vacation pay when an employee is dismissed for the rest that he took, but the period of work was not fully worked out, and the citizen decided to terminate his relationship with this organization and wrote a letter of resignation. Information provided by the legal portal BukvaPrava https://bukvaprava.ru/

Vacation pay calculation

The company from which the employee is resigning must necessarily pay him compensation for vacation that was not used during the entire period of employment. In the case where a person has not been there for several years, the amount of payments is accordingly made for all this time. If a citizen terminates his employment relationship with an organization on his own initiative, and the period of work is not completely completed, then in this case deductions are made from his salary for the vacation used. In this case, the accounting department will have to calculate the exact number of days or months of work of the person.

The amount of vacation pay upon dismissal is calculated as follows:

- The number of days of annual paid leave is taken, for example 28. Then it is divided by the number of months in the year, i.e. 12. Then the resulting number (2.33) is multiplied by the number of months worked in the working period, for example 4.

- If you multiply 2.33 by 4, you get 9.32 unused vacation days. This number is then multiplied by daily earnings, for example 900 rubles. It turns out 8388 rubles. This is the money that a person is entitled to as compensation for unused vacation. Personal income tax will be withheld from the same amount - 13%.

The final payment to the employee should not be delayed by the boss. It must be done on time, regardless of which of the grounds specified in the Labor Code the citizen is dismissed from.

Calculation of compensation for unrealized additional leave

In accordance with the current legislative framework, a number of workers have the right not only to an annual vacation period, but also to additional vacation days received for any specific features of the work environment.

These additional days of rest include vacations:

- for unfavorable working conditions;

- the special nature of work activity;

- irregular working hours;

- labor in the northern regions, etc.

In addition, additional vacation days may be provided for by the organization’s local documents as an option for bonuses for work.

According to Part 1 of Art. 127 of the Labor Code of the Russian Federation, upon termination of the employment relationship, the employee is provided with monetary compensation for all unrealized vacations. This means that the unrealized additional vacation must also be compensated. At the same time, since Part 2 of Art. 120 of the Labor Code of the Russian Federation prescribes, when determining the total duration of an employee’s vacation period, to sum up annual and additional leave; there is no need to separately calculate the amount of payment specifically for additional leave. In this case, it is enough to base your calculations on the total duration of leave due to the resigning employee and use one of the calculation methods described above. Simply put, the amount of dismissal compensation is calculated for all vacations at once.

When it is impossible to make deductions for unworked vacation

In a number of cases provided for by law, deduction for vacation upon dismissal is not made. The following situations fall into this category:

- Liquidation of the employer's organization.

- Staff reduction.

- Termination of an employment contract when a citizen is unable to perform duties due to illness.

- Conscription into the army.

- With a complete loss of previous working ability.

- Reinstatement to previous position by court decision.

- Termination of an employment contract upon the occurrence of circumstances beyond the control of the parties.

How to calculate an employee taking into account vacation compensation in 2022

In accordance with Art. 115 of the Labor Code of the Russian Federation, each employee is granted annual basic leave lasting 28 calendar days. In order to qualify for full leave, you must work at the company for 12 months. By simple calculations, you can understand that for each month worked, 2.33 vacation days are accrued.

In order to correctly calculate the amount of compensation, the accountant needs to multiply the number of vacation days that are accrued to the employee for the month worked by the number of months worked for a particular employer. Please note that this formula does not take into account previously used vacation.

Calculation of compensation upon dismissal for unused vacation is carried out using the following formula:

Compensation =» 28 days. / "12 months * number of complete work months – number of uses vacation days

The resulting number of days of production, which is subject to monetary compensation, is multiplied by the employee’s average salary for the last 6 months (average daily earnings). You can calculate preliminary compensation for unused vacation online using a special calculator.

Many categories of citizens are entitled to additional leave (provided only after the main one has been fully used). Therefore, the accountant must take this into account when preparing the calculation.

Not all categories of employees are granted leave based on calendar days. In accordance with Art. 295 of the Labor Code of the Russian Federation, employees who are employed in seasonal work are granted vacation at the rate of two vacation days for each month of work. For this category of employees, compensation for unused vacation is calculated according to the standard scheme. However, the number of unused days is calculated using the formula:

number of unused days \u003d" number of months worked. * 2 - number of vacation days used

Important: compensation for unused vacation days must be transferred (or handed over) to the employee on the last working day.

It should be noted that not all unused types of vacation are subject to financial compensation upon dismissal. Days of educational and sabbatical leave are not taken into account when calculating the amount of payments during termination of employment.

There are often cases when a dismissed employee takes vacation days in advance (in advance). That is, in essence, he did not work enough to rest. In this situation, the accountant will have to withhold part of the employee’s salary as compensation for early vacation use.

The terms of payment upon dismissal were violated by the employer

An employer who has violated the payment deadline when dismissing an employee must pay the latter compensation for the delay in payments in the amount of no less than 1/150 of the Central Bank key rate in effect during the period of delay (Article 236 of the Labor Code of the Russian Federation). Compensation is calculated for each day of delay, starting from the day following the day when the employer was supposed to make payment upon dismissal, up to and including the day of actual payment.

What else does the employer face if he does not pay on the day of dismissal?

If the employer violates the deadline for issuing the dismissal payment, and the employee complains about him to the labor inspectorate, then the employer faces a fine in the amount of (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- from 30,000 to 50,000 rub. for organization;

- from 10,000 to 20,000 rub. for officials of the organization;

- from 1000 to 5000 rub. for an individual entrepreneur.

Moreover, in the event of a repeated violation, the amount of the fine will be significantly higher (RFKoAPh. 7, Art. 5.27).

General information

Upon completion of the employment agreement, the organization is required to make all payments to the employee on the day of dismissal. The billing period and calculation of compensation for dismissal on the last day of the month most often includes:

- dismissal payments due to the reason for leaving work (by agreement of the parties, in case of layoff);

- compensation for missed vacation;

- unpaid wages;

- other dismissal payments that are provided by the enterprise.

The main point is the issue of correct calculation of the amounts that belong to the resigning employee. In addition to the Labor Code of the Russian Federation, the regulatory framework also consists of:

- letter of the Ministry of Finance dated February 12, 2016 No. 03−04−06/7535;

- letter of Rostrud dated December 19, 2014 No. 1519−6−1;

- Government Resolution No. 922 “On the implementation of order...”.

What taxes are paid on vacation compensation?

Regardless of the taxation system used by the enterprise, personal income tax and insurance premiums must be withheld from vacation compensation. It is important to take into account several nuances:

- When calculating income tax, the date of receipt of income is considered to be the day the compensation is paid.

- The amount of accrued income tax must be entered on an accrual basis into the calculation of 6-NDFL and reflected according to the income code 2013 in 2-NDFL.

- If vacation compensation is not paid due to dismissal, you must additionally accrue unified social tax on it.

To stay up to date with current changes in tax legislation and reporting requirements, take part in webinars for accountants.

To determine income tax, depending on the method used by the enterprise for accounting for income and expenses, compensation includes:

- in the number of direct or indirect expenses - using the accrual method;

- as expenses at the time of issue to the employee - using the cash method.

Methodology for calculating average daily earnings for payments for unused vacation

The principle of calculating the average daily earnings in this case is almost identical to the previous one: the same calculation period is taken (12 months), the total earnings are looked for, to which the profit required by law (salary increase, bonuses, etc.) is added.

The difference lies in the calculation of days worked in the billing period, since in order to be granted paid leave, an employee must have at least six months of work experience. So, we perform the following actions.

- We count the number of months worked and compare them with the length of service required for vacation. If an integer number of months have been worked, we use the indicator without changes. If there is a shortfall before the end of the month or the processing of an incomplete month, we apply the following principle: days that are less than 15 are discarded, the number of days greater than 15 is counted as a month. The result is an integer - the number of months for which the employee is entitled to days of paid rest.

- The number of vacation days that the employee would be entitled to during this period is calculated.

- From the total number of allotted rest days, you need to subtract the number of days that the employee managed to spend on vacation during this period.

- To determine the amount of compensation, the resulting figure is multiplied by the average daily earnings, calculated using the same formulas as for calculating severance pay.

How to reflect compensation in accounting

In accounting, compensation must be reflected among labor costs by postings:

- Debit 20 Credit 70 – compensation accrued (what);

- Debit 70 Credit 68 subaccount “Settlements for personal income tax” – personal income tax is withheld;

- Debit 70 Credit 50(51) – compensation issued (what kind).

If the institution is not a small business entity, a reserve for vacation pay must be created in the accounting records. In this case, compensation is recognized not as a current expense, but as the fulfillment of a previously provided obligation. After payment, it is written off to reduce the reserve for vacation pay.

Example of final calculation

An employee who terminates his employment relationship with a specific organization has the right to receive earned money and other compensation if the grounds for dismissal allow this. Consider the following example.

Employee Ivanov leaves the company of his own free will. Naturally, in this case he does not receive severance pay and does not receive average earnings for the third month before employment. But he has the right to payment of earned money for the entire time and compensation for vacation. The final payment to the employee in this situation will be made according to the T-61 form. This is a settlement note filled out upon termination of an employment relationship.

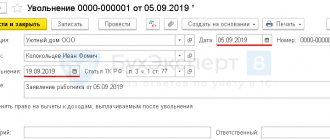

Ivanov wrote a statement in April and resigned on the 19th. Accordingly, he should be calculated and given remuneration for work from 1 to 18 inclusive. If his average salary is 20,000/22 working days (this is the number of them in April), the resulting amount per day is 909.09 rubles. It is multiplied by the number of days worked in the month of dismissal - 18. As a result, the amount comes out to 16363.22 - Ivanov’s salary for April. In addition, the organization first pays tax on this money, and then accountants issue the final payment to the citizen.

Since the person quits in April, but he only has scheduled vacation in June, and he did not use it, he is entitled to compensation. The calculation occurs in the following order:

Ivanov worked this year for 3 months and 18 days. But the count will be 4 full. Rounding to tenths and hundredths is not done, so the amount is calculated from 28 days of vacation/12 months a year = 2.33 days. After which 2.33*4 (months worked)=9.32 days. And only then 9.32*909.9 (daily earnings) = 8480.26 (vacation compensation).

Thus, the final payment is made from all amounts due to the employee. But in this case, this is only a salary and cash payment for vacation, because Ivanov quits on his own initiative. If he were laid off or fired due to liquidation, he would also receive severance pay, which is also paid with all funds (based on Article 140 of the Labor Code of the Russian Federation).

Calculation period when determining salary compensation

To calculate such components of dismissal compensation as arrears of wages and payment for unrealized vacation days, it is necessary to determine the calculation period from which to proceed. Thus, in relation to debts for remuneration for labor activities, it is necessary to rely on the dates of payment of wages established by the internal documentation of the enterprise. In general, according to the norms of the Labor Code of the Russian Federation (Part 6 of Article 136), the work of team members must be paid at least 2 times a month and no later than 15 days from the end of the period for which the salary was accrued. In this regard, organizations, as a rule, use a system that provides for the payment of wages for the past month at the beginning of the current month and the issuance of an advance towards the end of the current month.

Therefore, to determine the period for calculating the salary debt, it is necessary to know the date from which the employee plans to resign. For example, if an employee, resigning of his own free will, submitted an application in advance, indicating the date of dismissal as the 18th, the salary calculation period will be from the 1st to the 18th of the month.

In order to determine the amount of payment, it is necessary to find the average salary for 1 day of work of an employee by dividing the salary portion by the number of working days in the desired month. Further, in the case under consideration, the daily earnings received should be multiplied by the number of working days in the period from the 1st to the 18th of the month in question. The final amount of salary arrears upon dismissal will be found by subtracting from the resulting amount the advance paid to the employee, if one was transferred before the date of dismissal.