Dismissal of an employee is an operation without which no organization can function. Let's consider the features of reflecting in 1C settlements with an employee upon dismissal, as well as the procedure for calculating and paying compensation for unused vacation.

You will learn:

- when should a settlement be made with a dismissed employee;

- what document is used to document the calculation of compensation?

- how to withhold and pay personal income tax to the budget from compensation for vacation pay;

- how and when insurance premiums are calculated.

Step-by-step instruction

September 05 Kolokoltsev I.F. wrote a letter of resignation at the employee's initiative. On the same day, an order was issued for his dismissal on September 19.

The employee has worked for the Organization since December 26, 2016. Last October, Kolokoltsev was on vacation and fully used his right to annual paid leave of 28 calendar days.

On September 19, Kolokoltsev received the following calculation:

- compensation for unused vacation;

- wages for September.

On the same day, the funds, according to the calculation, were transferred to I.F. Kolokoltsev’s personal card. taking into account the fact that on August 26 he received an advance payment for September in the amount of 16,000 rubles. In addition, personal income tax was paid to the budget.

Step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Dismissal of an employee | |||||||

| 05 September | — | — | — | Order to dismiss an employee | Dismissal | ||

| Calculation of an employee upon dismissal | |||||||

| September 19 | 26 | 70 | 26 000 | 26 000 | 26 000 | Payroll | Payroll |

| 26 | 70 | 29 400 | 29 400 | 29 400 | Calculation of compensation for unused vacation | ||

| 70 | 68.01 | 7 202 | 7 202 | Withholding personal income tax | |||

| 26 | 69.01 | 1 606,60 | 1 606,60 | Calculation of contributions to the Social Insurance Fund | |||

| 26 | 69.03.1 | 2 825,40 | 2 825,40 | Calculation of contributions to the FFOMS | |||

| 26 | 69.02.7 | 12 188 | 12 188 | Calculation of contributions to the Pension Fund | |||

| 26 | 69.11 | 110,80 | 110,80 | Calculation of contributions to NS and PP | |||

| Paying salaries to an employee’s personal card | |||||||

| September 19 | — | — | 32 198 | Formation of payment statement | Statement to the bank - To employees' accounts | ||

| 70 | 51 | 32 198 | 32 198 | Salary payment | Debiting from a current account - Transferring wages to an employee | ||

| Payment of personal income tax to the budget | |||||||

| September 19 | 68.01 | 51 | 7 202 | Payment of personal income tax to the budget | Debiting from a current account – Tax payment | ||

Necessary notes

Severance pay is compensation in cash that the employer is obliged to pay in favor of the employee upon dismissal, or, in other words, termination of the employment contract, incl. in connection with a reduction in numbers or staff (clause 2, part 1, article 81 of the Labor Code of the Russian Federation). An employee who is laid off has the right to expect payment (in addition to compensation for unused vacation):

- wages within 2 months after notice of layoff;

- severance pay (paid on the day of dismissal);

- average earnings for the 2nd and 3rd months after dismissal.

If an employee is dismissed early, he is paid compensation: average monthly earnings for the period remaining until the date of dismissal specified in the notice of layoff (Article 180 of the Labor Code of the Russian Federation). The specified compensations are taken into account in expenses, neither personal income tax nor insurance premiums are assessed (see clarification of the Ministry of Finance of Russia dated February 15, 2021 No. 03-04-05/10004). Compensation for vacation not used by an employee is calculated as usual, with the exception of those who have worked for 5.5 months or more. up to 1 year (we compensate such employees for vacation as for 100% of the time worked (clause 28 of the Rules on regular and additional vacations, approved by the People's Commissariat of Labor of the USSR dated April 30, 1930 No. 169). This is briefly what you should know about payments, Now let’s look at how to process severance pay in 1C ZUP upon dismissal due to reduction.

Regulatory regulation

Providing compensation

Upon termination of the employment relationship, the employee is entitled to compensation for all days of unused vacation during all years of work in the organization (Article 127 of the Labor Code of the Russian Federation).

Leave to employees must be granted annually with preservation of their place of work (position) and average earnings (Article 114, Article 120 of the Labor Code of the Russian Federation).

In some cases, it is possible to replace annual leave with monetary compensation. For employees who continue to work in the organization, payment of compensation is possible only for additional vacation days exceeding 28 calendar days in the working year (Part 1 of Article 126 of the Labor Code of the Russian Federation).

Calculation of compensation upon dismissal

Compensation for unused vacation upon dismissal is calculated using the formula:

Compensation for unused vacation is subject to personal income tax (clause 1 of Article 210 of the Tax Code of the Russian Federation, clause 3 of Article 217 of the Tax Code of the Russian Federation) and insurance contributions (clause 2 of clause 1 of Article 422 of the Tax Code of the Russian Federation).

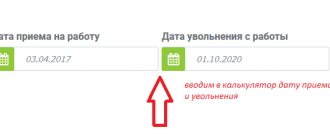

Number of unused vacation days

If an employee has worked part-time, the number of vacation days due to him is calculated based on the months worked during the working year:

Working year - a full 12 months worked by an employee from the date of his hiring to the date preceding the start of the new working year (clause 1 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR 04/30/1930 N 169, Letter of Rostrud dated 12/18/2012 N 1519-6-1).

In this case, a month is considered fully worked if the employee worked half the days or more in it. If less than half a month is worked, it is not counted (clause 35 of the Rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 N 169: valid to the extent that does not contradict the Labor Code of the Russian Federation).

In our example, we will calculate the number of days for which the employee is entitled to vacation. Working years of Kolokoltsev I.F.:

- 1 year - from December 26, 2016 to December 25, 2017, 28 cal. days used;

- Year 2 - from December 26, 2017 to December 25, 2018, 28 cal. days used;

- 3rd year - from December 26, 2018 to September 19, 2019, of which worked: 8 full months (from December 26, 2018 to August 25, 2019);

- 25 calendar days of the ninth month of the working year (from 08/26/2019 to 09/19/2019). This is more than half a month: therefore, the ninth month is counted in full.

Calculation of days of unused vacation Kolokoltseva I.F.:

- 28 days / 12 months x 9 months = 21 days

If, as a result of calculating the number of days of unused vacation, a fractional number is obtained, labor legislation does not require rounding it. However, if the employer decides to round the number of vacation days, arithmetic rules cannot be applied: they always round in favor of the employee (Letter of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005 N 4334-17).

Average daily earnings

The average daily earnings of an employee are calculated based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding his dismissal (Article 139 of the Labor Code of the Russian Federation), according to the formula:

29.3 is the average monthly number of calendar days established by the Government for calculating the average daily earnings for paying vacations and compensation for unused vacations (clause 10 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922) .

During the specified 12 months, there are periods excluded from the calculation: such when (clause 5 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922):

- the employee retained his average earnings in accordance with the law, for example, during business trips, vacations;

- the employee did not work due to downtime;

- the employee was absent due to temporary disability or pregnancy and childbirth;

- the employee was on vacation at his own expense and others.

In these cases, the average daily earnings are calculated using the formula:

When calculating compensation for unused vacation or changing the minimum wage in the accrual period, it is necessary to compare the average monthly earnings (to calculate compensation) with the minimum wage: it cannot be lower than the federal minimum wage in force on the date of accrual of compensation (clause 18 of the Regulations, approved by the Decree of the Government of the Russian Federation dated 12/24/2007 N 922).

More information about the compliance of average monthly earnings with the minimum wage

Let us determine the average daily earnings of an employee according to our example, taking into account that in Kolokoltsev’s billing period there are payments and days excluded from the calculation.

Let's calculate the number of days actually worked by the employee during the billing period. Days must be counted in calendar days, taking into account the daily average established by the Government of the Russian Federation (29.3).

- During the billing period, I. F. Kolokoltsev worked for 11 full months. The number of days actually worked during this period was: 11 x 29.3 = 322.3 cal. day

- In October he went on vacation for 28 calendar days, so the number of days of work in October is:

31 days in October - 28 days of vacation = 3 cal. day

- They must be recalculated taking into account the average monthly number of calendar days:

29.3 x 3/31 = 2.84 cal. day

- Total days worked in the billing period:

322,3 + 2,84 = 325.14 cal. days

- The amount of earnings in the billing period is 455,196 rubles.

- Calculation of average daily earnings:

RUB 455,196 / 325.14 cal. days = 1,400 rub.

Now let's calculate the amount of compensation for unused vacation.

- The number of days of Kolokoltsev’s unused vacation is 21 days .

- Compensation for unused vacation was: 1,400 rubles. x 21 days = 29,400 rub.

How are payments to employees upon dismissal due to redundancy reflected in accounting?

Answer:

The amounts of recognized estimated liabilities for the payment of severance pay to the employee and for the payment of monetary compensation to the employee for all unused vacations form expenses for ordinary activities and are reflected in the reserve account for future expenses.

Upon actual fulfillment of the obligation to accrue severance pay to the employee, compensation for all unused vacations, the incurred costs are included in repayment of previously recognized estimated liabilities.

Salary for the current period of work before dismissal, additional compensation paid to the employee in the event of termination of the employment contract with him before the expiration of the notice period for dismissal, as well as the average earnings retained by the employee for the period of employment (minus severance pay) are taken into account as part of the expenses for ordinary activities on the date of their accrual, regardless of the time of actual payment of funds.

Rationale:

One of the grounds for termination of an employment contract at the initiative of the employer is a reduction in the number or staff of employees (clause 2, part 1, article 81 of the Labor Code of the Russian Federation). All laid-off employees must be notified of the upcoming dismissal at least two months before termination of the contract (Part 2 of Article 180 of the Labor Code of the Russian Federation).

Payments to employees upon dismissal due to reduction

Upon dismissal due to reduction, the employer is obliged to pay the employee the following amounts (part 1 of article 127, part 7 of article 136, part 1 of article 140, part 1, 4 of article 178, part 3 of article 180, part 1 Article 318 of the Labor Code of the Russian Federation):

- salary for the current period of work before dismissal;

— monetary compensation for all unused vacations;

— severance pay in the amount of average monthly earnings (unless the labor or collective agreement provides for an increased amount of benefits);

- additional compensation in the amount of average earnings in proportion to the time before the expiration of the notice period, if the employer dismisses the employee with his consent before the expiration of the two-month notice period;

— average earnings for the period of employment (if there are grounds).

On the day the employee is dismissed, the organization must make a settlement with the employee. If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment (part 4 of article 84.1, part 1 of article 140 of the Labor Code of the Russian Federation).

Accounting for redundancy payments

To account for settlements with a dismissed employee for payments due to him, account 70 “Settlements with personnel for wages” is used; settlements with an employee after dismissal can be reflected in account 76 “Settlements with various debtors and creditors” (Instructions for using the Chart of Accounts for Financial Accounting economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

Sub-accounts can be opened to balance sheet account 96 “Reserves for future expenses”:

— subaccount 96.OO “Estimated obligation to pay for vacations”;

— subaccount 96.ВС “Estimated liability for redundancy payments.”

The accounting entries will be as follows in accordance with the Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations:

1) on the date of notification of the employee about dismissal:

— Debit 20, 23, 26, 29, 44 “Sales expenses” Credit 96, subaccount 96.ВС - reflects the estimated obligation to pay severance pay based on the employee’s notification of the upcoming dismissal and an accounting certificate;

2) on the dates of accrual and dismissal of the employee:

— Debit 96 Credit 70 — severance pay was accrued to the employee at the expense of a previously created estimated liability based on the calculation note;

— Debit 70 Credit 51 “Current accounts” — severance pay was paid based on the bank statement on the current account;

— Debit 20, 23, 26, 29, 44 Credit 70 — the employee’s salary was accrued for the current period of work before dismissal on the basis of a dismissal order and a calculation note;

— Debit 70 Credit 51 “Current accounts” — wages were paid for the current period of work before dismissal based on the bank statement of the current account;

3) on the dates of accrual and payment of additional compensation to the employee upon his early dismissal before the expiration of the notice period for dismissal:

— Debit 20, 23, 26, 29, 44 Credit 70 — additional compensation was accrued to the employee upon early dismissal due to layoffs based on a dismissal order, a written statement from the employee, or a written offer from the employer to resign before the end of the notice period and the settlement note;

— Debit 70 Credit 51 — additional compensation was paid in case of early dismissal based on the bank statement of the current account;

4) on the dates of accrual and payment to the employee of average earnings maintained for the period of employment:

- Debit 20, 23, 26, 29, 44 Credit 76 - accrued average earnings retained by the former employee for the period of employment based on the application of the former employee, a copy of the pages of his work book, where there are no notes on employment after layoffs, and an accounting certificate;

— Debit 76 Credit 51 — the amount of average earnings saved for the period of employment was paid to the former employee based on a bank statement;

5) on the date of accrual and the date of payment of compensation for all unused vacations:

- Debit 96.ОО, 96.ВС Credit 70 - compensation was accrued to the employee for all unused vacations, if the amounts of previously recognized estimated liabilities are sufficient to cover the costs incurred, based on the dismissal order and the calculation note;

— Debit 96.ОО, 96.ВС Credit 69 — insurance premiums have been calculated for the amount of compensation for all unused vacations;

— Debit 70 Credit 51 — monetary compensation was paid to the employee for all unused vacations.

Information provided by the reference and legal system "ConsultantPlus".

Dismissal of an employee

In order to correctly reflect in 1C the operations for calculating final wages and compensation for unused vacation, first of all, it is necessary to fire the employee.

The Dismissal document is created from the section Salaries and Personnel – Personnel Records – Personnel Documents – Create – Dismissal.

Study in detail the dismissal procedure and filling out the document using the example

Severance pay upon layoff

Article 178 of the Labor Code of the Russian Federation provides for payments when an employee is laid off 2022: The Labor Code regulates employers to pay laid-off employees:

- severance pay in the amount of average monthly payments;

- average monthly earnings during the employment period.

Most often, the second amount includes the first, however, if severance pay is due to all persons who were laid off, then only those employees who could not immediately find a new job will receive payment for the period of employment. As a general rule, the period of such payments is two months, but if an employee, after dismissal, registered with the employment service, no later than two weeks from the date on which his employment relationship with his previous employer was terminated, but was unable to find a new place of employment, then the organization will have to compensate him for payment upon layoff. In this case, the decision on payment of the average salary for the third month is made by the employment center.

Severance pay in the event of a layoff must be paid to each laid-off employee on the last working day, along with the main settlement payments: wages for hours worked and compensation for unused vacation. The employer does not have to compensate wages for the period of employment in advance; such compensation will be paid only two months from the date of layoff to persons unemployed at that time.

Let's look at an example:

Let’s say the management of Primer LLC decided to downsize and dismiss sales department specialist Marat Sergeevich Koshkin on January 18, 2022. He was able to get a job at a new company on March 16, 2020. Therefore, the former specialist is not entitled to compensation other than severance pay, since he was already working before the end of the stipulated period. Another employee, Petrov Semyon Sergeevich, laid off on the same day as Koshkin, was unemployed as of March 18, 2022. Therefore, he wrote a statement to his former employer, and can count on payment of compensation for average earnings for the second unemployed month. The basis for payment in this situation is the work book, in which there are no entries after the last one made about dismissal.

Calculation of an employee upon dismissal

Settings in 1C for calculating compensation

When installing the 1C program in the database, a predefined accrual type should be automatically created the Accruals : Leave compensation upon dismissal under the code KOT .

If it turns out that this accrual does not exist, then you should enter it into the Accruals from the section Salaries and Personnel - Directories and Settings - Salary Settings - Payroll - Accruals.

Please pay attention to filling out the fields:

Personal income tax section :

- switch - taxable ;

- income code - 2013 - Amount of compensation for unused vacation;

- Income category - Other income from work .

Section Insurance premiums :

- Type of income - Income entirely subject to insurance premiums ;

Section Income tax, type of expense under Art. 255 Tax Code of the Russian Federation :

- switch - taken into account in labor costs under article : - pp. 8, art. 255 of the Tax Code of the Russian Federation - Monetary compensation for unused vacation in accordance with the labor legislation of the Russian Federation;

- The checkbox Included in the basic accruals for calculating the “Regional coefficient” and “Northern bonus” accruals does not need to be set for the Accrual Compensation for unused vacation , since these accruals are already taken into account in the earnings that are used to calculate compensation.

Section Reflection in accounting :

- The method of reflection is not established. In this case, the compensation will be charged to the expense account set in the Expense Accounting the Employees directory for the salary of the employee to whom it is accrued. PDF

Compensation for an employee's unused vacation must be accounted for in the same cost account in which his salary is recorded.

The method of reflection in the Accruals takes precedence over the method specified in the Expense Accounting in the Employees . there is no need to set separate method of reflection in the Compensation for unused vacation (Accrual) .

Compensation for unused vacation is part of the salary, therefore, in accounting accounting, compensation is reflected as part of labor costs (clause 8 of PBU 10/99):

- Dt of the cost account, according to which the employee’s salary is calculated;

- CT “Settlements with personnel for remuneration” (chart of accounts 1C).

In NU, compensation for unused vacation is also taken into account in labor costs (clause 8 of Article 255 of the Tax Code of the Russian Federation) as part of direct or indirect expenses. The attribution of compensation costs to direct or indirect expenses depends on where the basic salary of the dismissed employee is allocated, according to the accounting policy.

In 1C, compensation for unused vacation will be reflected in the salary account specified in the Employees in the Expense Accounting .

Learn in more detail the definition of salary accounting methods (main postings)

Calculation of an employee upon dismissal

Compensation calculation is not automated in 1C and is reflected in the Payroll document in the Salaries and Personnel section - Salary - All accruals - Create button - Payroll calculation.

The document states:

- Salary for - the last month of work of the employee.

- from — the employee’s last day of work.

By clicking the Add , you must select the employee with whom the settlement is being made. The program will calculate wages based on the employee’s salary and the time worked by him on the date of dismissal.

Accrue button to select Accrual Compensation for unused vacation and indicate the calculated amount. The calculation of compensation must be done independently, for example, in an Excel table.

All amounts accrued to an employee can be viewed and, if necessary, adjusted in the Accruals , which opens by clicking on the link in the Accrued .

In the Accrual Payment Date column for accrual of Salary Payment is set automatically as the last day of the accrual month and cannot be adjusted.

To calculate Compensation for unused vacation, the payment date will be automatically set according to the date of the Payroll .

- Personal income tax - the amount of calculated personal income tax.

personal income tax link in the personal displays the calculation of personal income tax on an accrual basis for the employee for the current tax period.

The date of actual receipt of income in the form of wages, including compensation for unused vacation, is considered to be the last day of work for which income was accrued to the resigning employee (paragraph 2, paragraph 2, article 223 of the Tax Code of the Russian Federation).

In the personal income tax Salary Accrual document, the date will be recorded Date column

- actual receipt of income for both types of accrual - in the Dismissal Date Dismissal document . PDF

- personal income tax withholding - according to the date of the Payroll , which accrues wages and compensation.

Postings according to the document

The document generates transactions:

- Dt Kt - salary calculation for the last month of work;

- Dt Kt - calculation of compensation for unused vacation;

- Dt Kt 68.01 - calculation of personal income tax on the amount of wages and compensation;

- Dt Kt 69.01 - calculation of contributions to the Social Insurance Fund;

- Dt Kt 69.03.1 - calculation of contributions to the FFOMS;

- Dt Kt 69.11 - calculation of contributions to NS and PZ;

- Dr Kt 69.02.7 - calculation of contributions to the Pension Fund.

Despite the fact that the Salary Accrual was issued on the last day of the employee’s work, the calculation of salaries and contributions in the BU and NU accounts in 1C is carried out on the last day of the month.

Documenting

The organization must approve the forms of primary documents, including for calculating payments upon dismissal. As a basis, you can take form T-61 “Note-calculation upon termination (termination) of an employment contract with an employee (dismissal)” (approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1).

- Excel

Income tax return

In our example, the salary of I.F. Kolokoltsev is taken into account on account 26 “General business expenses” and in tax accounting refers to indirect (other) expenses.

In the income tax return, the costs of wages and compensation for unused vacation, as well as insurance premiums accrued from them, will be reflected in indirect expenses only after the Closing of accounts 20, 23, 25, 26 is carried out in the Closing of the month procedure: PDF

- Sheet 02 Appendix No. 2 page 040 “Indirect costs - total”: wages;

- compensation for unused vacation;

- insurance premiums;

- insurance premiums.

See also What to do so that page 041 is filled in automatically

Payments to a former employee in 1C:ZUP

Content:

1. Payment to former employees. Setting up the program in 1C:ZUP

2. Types of employee benefits

3. Setting up personal income tax

4. Setting up postings

Payment to former employees. Setting up the program in 1C:ZUP

Guarantees and compensation to employees related to termination of an employment contract are reflected in Chapter 27 of the Labor Code of the Russian Federation.

In System 1C: Salary and HR Management 3.1, the ability to reflect payments to former employees using the document “Payment to former employees” (section “Payments”) is implemented.

In order for the program to be able to work with the payment document to former employees, you must enable the “Pay income to former employees of the enterprise” setting - section “Settings”, “Payroll calculation”, o.

Rice. 1 “Program settings”

Types of employee benefits

Using the document, you can assign various types of payments to employees (elements of the “Types of payments to former employees” directory are used): maintained average earnings during employment, financial assistance, reimbursement of the cost of medicines to former employees and other payments. The list of types of payments is open and it can be supplemented with types of payments that are provided for by the local regulations of the enterprise.

Setting up personal income tax

For each element of the “Types of payments to former employees” directory, you need to indicate the personal income tax code and the type of income for calculating insurance premiums.

Rice. 2 “Document “Payment to former employees”

For each type of income in the document, it is possible to indicate the code and amount of personal income tax deduction. For example, deduction code 504 “Deduction from the amount of compensation (payment) by employers to their employees, their spouses, parents and children, their former employees (age pensioners), as well as to disabled people, the cost of medications purchased by them (for them), prescribed to them by their attending physician” , the amount of the required deduction = 4,000 rubles per year for personal income tax code 2770 “Reimbursement (payment) by employers to their employees and their family members, former retired employees, as well as disabled people for the cost of medicines.”

Rice. 3 “Setting up personal income tax”

The amounts registered in the document “Payment to Former Employees” do not create a debt of the organization to former employees, i.e. they are not taken into account either when filling out salary payment forms or when generating analytical reports on wages.

Setting up postings

The concept of the 1C: Salary and Personnel Management 3.1 system is such that all monetary settlements with third parties (including former employees) are made in the accounting program (subsystem).

Registration of payments with the document payment to former employees in 1C is carried out solely for the purpose of calculating personal income tax and/or insurance contributions and reflecting them in the relevant reports.

Also, the amounts of the document “Payment to former employees” are taken into account when generating data to reflect salaries in accounting. In the document you must fill in the method of reflecting the payment in accounting.

Rice. 4 “Setting up transactions in a document”

The registered payment will automatically (when you click the “Fill” button) go into the “Reflection of salary in accounting” document. Based on our example, the “Accrued salary and contributions” and “Accrued personal income tax” tabs will be filled in.

Rice. 5 “Reflection of transactions in accounting”

Rice. 6 “Personal income tax accrued from the accrual to the former employee”

After receiving data from the 1C:ZUP 3.1 system, the following transactions will be generated in the accounting program for the accruals received:

Dt 91.02 Kt 76.09 (10,000 rub.)

Dt 76.09 Kt 68.02 (780 rub.)

In the accounting program, it will be necessary to reflect the payment to the former employee using the documents “Write-off from the current account” or “Cash debit order”:

Dt 76.09 Kt 51 (50) (9220 rub.).

Specialist

Marianna Kostryukova.

Payment of personal income tax to the budget

Personal income tax on compensation for unused vacation is paid no later than the day following the day it is paid to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Payment of personal income tax to the budget is reflected in the document Write-off from the current account transaction type Tax payment in the Bank and cash desk section - Bank - Bank statements - Write-off button.

The document states:

- Transaction type - Tax payment ;

- Tax - personal income tax when performing the duties of a tax agent ;

- Type of liability - Tax ;

- for - September 2019 , the month of income accrual (payments upon dismissal).

Learn more about reflecting personal income tax payments to the budget

Postings according to the document

The document generates the posting:

- Dt 68.01 Kt - payment of personal income tax to the budget for September.

Payment for early dismissal

Next, we will talk about another payment, which is often called a voluntary dismissal benefit. This is additional compensation to the employee for resigning on his own before the company is liquidated or staff is reduced.

The fact is that in the event of liquidation or layoff, the employer is obliged to warn the employee no later than 2 months before the date of dismissal. However, the employee may agree to leave earlier than the appointed date.

Many believe that in this case loses But that's not true. In addition to severance pay and compensation for unused vacation, as well as compensation for the period of employment, the employee has the right to receive additional compensation. Its size is also tied to average earnings and is, in fact, the salary for the time that the employee does not work until the appointed date of dismissal.

is often not profitable to pay this benefit, because the employee will receive it not for work, but for agreeing to leave earlier. But sometimes this is the best option, because the employer during the liquidation process cannot provide all employees with jobs and safe working conditions.

6-NDFL

Tax amounts are calculated by tax agents on the date of actual receipt of income on an accrual basis from the beginning of the tax period (clause 3 of Article 226 of the Tax Code of the Russian Federation). In the reporting, the date of receipt of income is reflected on page 100 of Section 2 of Form 6-NDFL. Its definition depends on the type of income. For compensation for unused vacation and other amounts upon dismissal, income will be received on the day it is paid to the taxpayer (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

In 1C, for our example, the date of actual receipt of income is indicated in the Date of the document Write-off from the current account . PDF

In Form 6-NDFL, the accrual and payment of annual leave is reflected in:

Section 1 “Generalized indicators”:

- line 020 - 55,400, amount of accrued income;

- pp. 040 - 7 202, amount of calculated tax;

- pp. 070 - 7 202, amount of tax withheld.

Section 2 “Dates and amounts of income actually received and withheld personal income tax”: PDF

- page 100 - 09.19.2019, date of actual receipt of income;

- page 110 - 09/19/2019, tax withholding date.

- page 120 - 09/20/2019, tax payment deadline.

- pp. 130 - 55,400, the amount of income actually received.

- pp. 140 - 7,202, amount of tax withheld.

Checking mutual settlements

Mutual settlements with an employee

You can check mutual settlements with an employee using the report Balance sheet for the account “Settlements with personnel for wages” in the Reports section - Standard reports - Account balance sheet.

It is logical to generate the report on the date of dismissal: in our example it is September 19. However, entries in accounting for calculating compensation and wages upon dismissal in the account “Settlements with personnel for wages” were generated only on September 30. Therefore, the report must be generated on this date.

The report shows that there is no debt to the dismissed employee at the end of the month.

Mutual settlements with the budget for personal income tax

To check the calculations with the budget for personal income tax, you can generate the report Analysis of account 68.01 “Personal income tax when performing the duties of a tax agent” in the section Reports - Standard reports - Account analysis.

In our example, payment of compensation and wages was carried out on September 19, the deadline for transferring personal income tax was September 20, i.e. the day following the day of payment. But in the accounting system, under the credit of account 68.01 “Personal income tax when performing the duties of a tax agent,” personal income tax, like wages, was accrued on September 30.

The absence of a final balance in account 68.01 “Personal income tax when performing the duties of a tax agent” means that there is no debt to pay personal income tax to the budget.

The accountant is used to this report, but it does not give an up-to-date picture of mutual settlements with the budget for personal income tax, since data on withheld and transferred personal income tax is accumulated in personal income tax registers, and not in accounting accounts. Therefore, we recommend that you use the report Control of personal income tax payment deadlines . In our opinion, it is more informative.

Control of personal income tax payment deadlines

To check the calculations with the budget for personal income tax, as well as the deadlines for payment, you can generate a report Control of deadlines for personal income tax payment in the section Salaries and personnel - Salary - Salary reports - Control of deadlines for personal income tax payment.

In our example, payment of compensation and wages was carried out on September 19, the deadline for transferring personal income tax was September 20, i.e. the day following the day of payment. We will generate a report for the period September 19-20 for Kolokoltsev I.F. To generate the necessary data, use the Settings to set:

- View - Advanced .

Selections tab by clicking the Add selection :

- Field - Individual ;

- Condition - Equal to ;

- Meaning - Kolokoltsev Ivan Fomich ;

- — In the header of the report.

Fields and sorting tab - do not change the existing settings.

Structure tab on the Add :

- Grouped fields - Recorder , check the box.

After completing the setup of the Personal Income Tax Payment Deadline Control , you must click the Close and generate . The program will generate a report.

- Write-off from the current account dated 09.19.2019 N 5 - a document of payment to the employee of amounts upon dismissal, established the deadline for paying the debt to the budget - 09.20.2019.

- Write-off from the current account dated September 19, 2019 N 6 - personal income tax payment document, repaid the debt to pay tax to the budget.

The absence of a final balance on the personal income tax payment due date indicates that personal income tax was paid to the budget on time.

Test yourself! Take a test on this topic using the link >>

See also:

- When to issue a work permit and make payments if an employee goes on vacation and then immediately quits

- Salary settings in 1C

- Payroll

- Accrual of vacation pay

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Calculation of compensation for unused vacation upon dismissal in 1C 8.3 Accounting 3.0: step-by-step instructions A resigning employee who has not taken any vacation at all is not an uncommon situation. However…

- Test No. 60. Compensation for unused vacation upon dismissal...

- How to calculate compensation for unused vacation upon dismissal, if from the first day of hiring the employee was on a business trip...

- Payment to an employee upon dismissal...