Types of contracts

Since 2008, the concept of “author’s contract” has not been included in civil law. Instead, the Civil Code of the Russian Federation provides for the possibility of concluding such agreements on the transfer of copyright:

- agreement on the transfer of all exclusive rights to the work (Articles 1285 and 1234 of the Civil Code of the Russian Federation);

- a license agreement under which the rights to the work are transferred within the limits established by the agreement (Articles 1286 and 1235 of the Civil Code of the Russian Federation);

- author's order agreement (Article 1288 of the Civil Code of the Russian Federation).

Situation: what is meant by a copyright agreement for tax purposes?

Since 2008, the concept of “author’s agreement” has been absent from civil legislation, however, within the framework of tax legal relations, such a term is still used today (for example, in clarifications of regulatory agencies).

For tax purposes, concepts are used in the meaning in which they are enshrined in the relevant legislation. The exception is those cases when the Tax Code of the Russian Federation provides its own definitions. This follows from Article 11 of the Tax Code of the Russian Federation.

Civil legislation provides for three main types of contracts instead of copyright ones:

- agreement on the transfer of exclusive rights to a work (Articles 1285 and 1234 of the Civil Code of the Russian Federation);

- license agreement with the author (Articles 1286 and 1235 of the Civil Code of the Russian Federation);

- author's order agreement (Article 1288 of the Civil Code of the Russian Federation).

Therefore, when calculating taxes, a copyright agreement should mean these types of agreements.

Agreements on the alienation of patent rights

Another possible option is payment of remuneration under agreements on the alienation of the right to obtain a patent for an invention, utility model, or industrial design.

According to the law, the right to obtain a patent for an invention, utility model or industrial design initially belongs to its author (Clause 1 of Article 1357 of the Civil Code of the Russian Federation).

Moreover, such a right can be transferred to another person under an agreement on the alienation of the right to obtain a patent for an invention, utility model or industrial design (clauses 2, 3 of Article 1357 of the Civil Code of the Russian Federation).

According to the law, having received a patent, the patent holder will have the exclusive right to use the invention, utility model or industrial design. And he will be able to dispose of this exclusive right. Including - to transfer it under an agreement on the alienation of the exclusive right to an invention, utility model or industrial design and receive remuneration, which is subject to insurance contributions (clause 1 of Article 1358 of the Civil Code of the Russian Federation).

As a result, the remuneration paid by an organization to the author of an invention, utility model or industrial design under an agreement on the alienation of the right to obtain a patent for them is not subject to insurance premiums. The fact is that such an agreement is not named in paragraph 1 of Art. 420 Tax Code of the Russian Federation.

This conclusion was reached by the Russian Ministry of Finance in letter dated 10/08/2021 No. 03-15-07/82014, which is given in letter of the Federal Tax Service of Russia dated 10/12/2021 No. BS-4-11/14457.

Accounting

Works of science, literature and art (including computer programs) and other intellectual property that are the subject of agreements on the transfer of copyright may be accounted for as intangible assets (clause 4 of PBU 14/2007). To do this, the conditions specified in paragraph 3 of PBU 14/2007 must be met.

In accounting, reflect settlements under copyright transfer agreements on account 76 “Settlements with various debtors and creditors” (Instructions for the chart of accounts). Use account 70 “Settlements with personnel for wages” if royalties are paid to an employee under an employment contract (Instructions for the chart of accounts).

Reflect the accrual of remuneration under the copyright transfer agreement with the following entries:

Debit 08 Credit 76 (70)

– remuneration has been accrued under the agreement on the transfer of copyright if the received work forms an intangible asset;

Debit 20 (44...) Credit 76 (70)

– remuneration has been accrued under the agreement on the transfer of copyright.

The latter posting is used in the following cases:

- the resulting work cannot be recognized as an intangible asset (does not meet the conditions specified in clause 3 of PBU 14/2007), and remuneration is paid in the form of periodic payments for the temporary use of the copyright object;

- periodic payments are accrued after the completion of the formation of the value of the intangible asset.

This conclusion follows from the Instructions for the chart of accounts and paragraph 16 of PBU 14/2007, paragraph 18 of PBU 10/99.

If remuneration is paid in a fixed one-time amount for the temporary use of a work, the following must be taken into account. According to paragraph 39 of PBU 14/2007, such payments are reflected as deferred expenses and are subject to write-off during the term of the contract. From the set of norms of paragraph 65 of the Regulations on Accounting and Reporting, paragraph 39 of PBU 14/2007 and the Instructions for the Chart of Accounts, we can conclude that a fixed one-time payment must be taken into account in account 97 “Deferred Expenses” and reflected in the following entry:

Debit 97 Credit 76 (70)

– remuneration has been accrued under the agreement on the transfer of copyright (remuneration is paid in a fixed amount for the temporary use of the work).

An example of how remuneration under an agreement on the transfer of copyright paid to a citizen who is not an employee of the organization is reflected in accounting. The obtained exclusive right to a work forms an intangible asset

Alpha LLC concluded with A.S. Kondratyev, who is not an employee of the organization and is not registered as an entrepreneur, an agreement to publish his book. The production of printed materials is the main activity of the organization.

In April, Kondratiev transferred the book and all rights to it to the organization (an acceptance certificate was signed).

The royalty amount was 100,000 rubles. Kondratyev has the right to a professional deduction for personal income tax in the amount of 20,000 rubles. (RUB 100,000 × 20%). Therefore, the accountant withheld personal income tax in the amount of 10,400 rubles. ((RUB 100,000 – RUB 20,000) × 13%).

In May, Alpha paid Kondratiev money from the cash register in the amount of 89,600 rubles. (RUB 100,000 – RUB 10,400).

Alpha's accountant made the following entries in accounting.

In April:

Debit 08 Credit 76 – 100,000 rub. – royalties were awarded to Kondratiev.

In May:

Debit 76 Credit 50 – 89,600 rub. – royalties were paid to Kondratiev;

Debit 76 Credit 68 subaccount “Personal Income Tax Payments” – 10,400 rubles. – personal income tax was withheld from the royalties accrued to Kondratiev.

An example of how remuneration under an agreement on the transfer of copyright paid to a citizen who is not an employee of the organization is reflected in accounting. The obtained non-exclusive right to use the work does not form an intangible asset. Remuneration is deferred expense

In January 2016, Alpha LLC entered into an agreement with A.S. Kondratiev, who is not an employee of the organization and is not registered as an entrepreneur, an agreement on the transfer of copyright. Under the agreement, the organization receives the rights to use the musical work for two years (24 months) - from January 1, 2016 to December 31, 2022.

Under the terms of the agreement, in January 2016, Kondratyev is paid remuneration in the form of a fixed one-time payment in the amount of 144,000 rubles. The accountant withheld personal income tax from him in the amount of 18,720 rubles.

Alpha's accountant made the following entries for accrual of remuneration.

In January 2016:

Debit 97 Credit 76 – 144,000 rub. – remuneration has been accrued under the contract, the costs of which relate to future periods;

Debit 76 Credit 50 – 125,280 rub. (144,000 rubles – 18,720 rubles) – royalties were paid to Kondratiev;

Debit 76 Credit 68 subaccount “Personal Income Tax Payments” – 18,720 rubles. – personal income tax was withheld from the remuneration accrued to Kondratiev.

Every month from January 2016 to December 2022 inclusive, the accountant made the following entries:

Debit 20 Credit 97 – 6000 rub. (RUB 144,000: 24 months) – part of Kondratiev’s royalties, previously accounted for as future expenses, was written off as expenses for the current period.

Reflect the payment of remuneration by posting:

Debit 76 (70) Credit 50 (51, 52, 58...)

– remuneration has been paid under the agreement on the transfer of copyright.

Accounting and taxation of copyrights

COPYRIGHT ACCOUNTING

The regulatory document regulating the accounting of intangible assets, including copyrights, is the “Accounting Regulations “Accounting for Intangible Assets” PBU 14/2000, approved by Order of the Ministry of Finance of the Russian Federation dated October 16, 2000 No. 91n (hereinafter referred to as PBU 14 /2000).

According to the specified accounting standard, in order for an object to be recognized as an intangible asset by an organization when accepted for accounting, it is necessary that in relation to it the conditions established by paragraph 3 of PBU 14/2000 are simultaneously met:

- lack of material structure;

- Possibility of identification from other property;

- use in the production of products, when performing work or providing services, or for management needs;

- long-term use (more than 12 months or one operating cycle if it exceeds 12 months);

- the organization does not intend to subsequently resell this object;

- the ability to bring economic benefits to the organization;

- the presence of properly executed documents confirming the existence of the asset itself and the organization’s exclusive rights to the result of intellectual activity.

Consequently, intangible assets include objects that meet the above conditions and are objects of intellectual property.

In particular, paragraph 4 of PBU 14/2000 states that intangible assets may include objects that meet the above conditions, such as:

“the exclusive right of the patent holder to an invention, industrial design, utility model;

exclusive copyright for computer programs, databases;property right of the author or other copyright holder to the topology of integrated circuits;

the exclusive right of the owner to a trademark and service mark, the name of the place of origin of goods;

exclusive right of the patent holder to selection achievements"

Thus, only exclusive rights to the results of intellectual activity, confirmed by documents, can be included in intangible assets.

Note that in paragraph 4 of PBU 14/2000, exclusive copyrights for literary works are not indicated. But an organization can receive exclusive copyrights to the results of intellectual activity (literary work) created in the course of an employee of the organization performing an official task, or receive it under a contract - an order. The copyright for a work created in the performance of official duties or an official assignment of the employer belongs to the author of the official work; exclusive rights to use such a work belong to the employer with whom the author has an employment relationship, unless otherwise provided in the agreement between him and the author.

An organization can acquire the right to an object of intellectual property even if it enters into an author’s ordering agreement, and does not have an employment relationship with the author. The possibility of concluding such an agreement is provided for in Article 33 of Law No. 5351-1 “On Copyright”. Under an author's ordering agreement, the author undertakes to create a work in accordance with the terms of the agreement and transfer it to the customer, who is not the employer.

In addition, this is indicated by paragraph 7 of PBU 14/2000:

- the exclusive right to the results of intellectual activity obtained in the performance of official duties or a specific task of the employer belongs to the employer organization;

- the exclusive right to the results of intellectual activity obtained by the author (authors) under an agreement with a customer who is not an employer belongs to the customer organization;

- a certificate for a trademark or for the right to use the appellation of origin of a product is issued in the name of the organization.

Documents confirming exclusive rights to the results of intellectual activity in this case are:

- any document confirming that the employee was entrusted with work, as a result of which an object of intellectual property was obtained;

- act of acceptance of completed work.

Consequently, if an organization has a properly executed document confirming the existence of an exclusive right of the organization, then such an exclusive right to a literary work can be recognized as an intangible asset (of course, provided that all other conditions listed in paragraph 3 of PBU 14/2000 are met).

The initial cost of intangible assets created by the organization itself, according to paragraph 7 of PBU 14/2000, is determined as the amount of actual costs of creation, production, excluding value added tax and other refundable taxes, except in cases provided for by the legislation of the Russian Federation.

Actual expenses include:

- spent material resources;

- salary;

- services of third-party organizations under counterparty (with performing) agreements;

- etc.

However, paragraph 8 of PBU 14/2000 establishes that the actual costs of creating intangible assets do not include general business and other similar expenses, except in cases where they are directly related to the acquisition of assets.

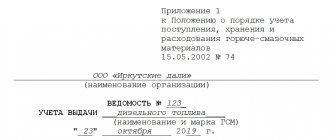

Acceptance of intangible assets (hereinafter intangible assets) for accounting must be documented. The primary document for accepting intangible assets for accounting is the registration card of form No. NMA-1 “Intangible Asset Accounting Card”. The form of the NMA-1 card was approved by Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71A “On approval of unified forms of primary accounting documentation for the accounting of labor and its payment, fixed assets and intangible assets, materials, low-value and wear-and-tear items, work in capital construction” .

This card is used for analytical accounting of all types of intangible assets received for use by the organization.

The card is kept in the accounting department for each object and is filled out in one copy based on the document for acceptance for accounting, acceptance and transfer (movement) of intangible assets and other documentation. Column 7 of the intangible asset-1 card indicates the amount of depreciation, which is calculated monthly according to rates calculated based on the original cost and useful life. In the section “Brief description of the object of intangible assets,” only the main indicators of the object are recorded, excluding duplication of data from the technical documentation available in the organization for this object.

All business transactions carried out by the organization must be documented with supporting documents. To account for the movement and disposal of intangible assets, forms of primary accounting documentation are not provided, therefore the organization must independently develop these forms and formalize their use in the order on accounting policies. It should be taken into account that in accordance with paragraph 2 of Article 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, primary accounting documents are accepted for accounting if they contain the following mandatory details:

- Title of the document;

- date of document preparation;

- name of the organization on behalf of which the document was drawn up;

- content of a business transaction;

- measuring business transactions in physical and monetary terms;

- the names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution;

- personal signatures of these persons;

Intangible assets have certain characteristics and in this regard, documents on their receipt and disposal must contain characteristics of intangible assets, the order and period of use, initial cost, depreciation rate, dates of commissioning and decommissioning and other details.

As a result of the creation of intangible assets, the organization’s expenses are reflected in the following entry:

| Debit | Credit |

| 08 “Investments in non-current assets” | 10 "Materials" |

| 08 “Investments in non-current assets” | 70 “Settlements with personnel for wages” |

| 08 “Investments in non-current assets” | 69 “Calculations for social insurance and security” |

| 08 “Investments in non-current assets” | 60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors” |

To summarize information on the presence and movement of intangible assets of an organization, the Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and Instructions for its application”, account 04 “Intangible assets” is intended.

Analytical accounting is maintained for each item of intangible assets. In accounting, the recognition of copyrights is reflected in the following entry:

| Debit | Credit |

| 04 "Intangible assets" | 08 “Investments in non-current assets” |

The amount of accumulated amortization during the use of intangible assets is reflected in the credit of account 05 “Amortization of intangible assets” in correspondence with the accounts of production costs (selling expenses).

Note that in accordance with paragraph 21 of PBU 14/2000, depreciation charges for intangible assets are reflected in accounting in one of the following ways: either by accumulating the corresponding amounts in a separate account, or by reducing the initial cost of the object. That is, with or without using account 05. Due to the fact that depreciation can be calculated in two possible ways, the organization must consolidate the method it has chosen in its accounting policy.

Depreciation of copyrights is carried out in accordance with paragraph 16 of PBU 14/2000. The amount of monthly depreciation deductions is equal to 1/12 of the annual amount.

The useful life of copyrights by an organization is determined based on the period for which they were acquired.

For intangible assets for which it is impossible to determine the useful life, depreciation rates are established for twenty years (but not more than the life of the organization).

In accordance with paragraph 22 of PBU 14/2000, the value of copyrights is written off when their use is ceased for the production purposes of the organization due to their assignment, termination of useful life or for other reasons.

INTANGIBLE ASSETS IN THE FORM OF COPYRIGHTS FOR TAX ACCOUNTING PURPOSES

For profit tax purposes, in accordance with paragraph 3 of Article 257 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), intangible assets are the results of intellectual activity acquired and (or) created by the taxpayer and other objects of intellectual property (exclusive rights to them) used in the production of products ( performance of work, provision of services) or for the management needs of the organization for a long time (lasting over 12 months).

To recognize an intangible asset, the following conditions must be met:

- the intangible asset must be capable of bringing economic benefits (income) to the taxpayer;

- it is necessary to have properly executed documents confirming the existence of the intangible asset itself and (or) the taxpayer’s exclusive right to the results of intellectual activity, including patents, certificates, other documents of protection, an agreement for the assignment (acquisition) of a patent, a trademark.

In accordance with paragraph 1 of Article 256 of the Tax Code of the Russian Federation, intangible assets are recognized as depreciable property, however, the same article establishes a cost limitation when accepting intangible assets for accounting.

If the initial cost of an intangible asset is less than 10,000 rubles, then it is not recognized as depreciable property and can be included in full as part of the expenses taken into account when calculating income tax. It should be noted that the accounting standard PBU 14/2000 does not establish a cost limitation when accepting an intangible asset for accounting.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Personal income tax

Regardless of the taxation system that the organization uses, withhold personal income tax from remuneration to citizens under agreements on the transfer of copyrights (subclause 3, clause 1, article 208 of the Tax Code of the Russian Federation). An exception to this rule is the case when the heir is paid remuneration that belongs to the testator (author) on the day the inheritance is opened.

Situation: is it necessary to withhold personal income tax from the remuneration paid to the author, who is an entrepreneur?

Yes, it is necessary if this payment is not related to business activities.

If the creation of works and the transfer of rights to them are not the entrepreneurial activity of the author, then personal income tax must be withheld when paying remuneration. The Tax Code of the Russian Federation does not contain any exceptions regarding the taxation of payments under copyright agreements (clause 2 of Article 226 of the Tax Code of the Russian Federation).

If the creation of works and the transfer of rights to them are the subject of the author’s entrepreneurial activity, then do not withhold personal income tax from the remuneration amount. This is explained by the fact that for income received from business activities, the author himself is a personal income tax payer (subclause 1, clause 1, article 227 of the Tax Code of the Russian Federation).

Entrepreneurial activity should be understood as activity aimed at systematically generating income (Article 2 of the Civil Code of the Russian Federation). Thus, if an entrepreneur systematically works under copyright agreements in order to obtain commercial benefits, the remuneration accrued to him is recognized as income from business activities.

However, an organization can find out that the author has received income as part of a business activity in only two ways:

- or from the author-entrepreneur himself;

- or from the tax inspectorate upon request for information contained in the Unified State Register of Individual Entrepreneurs on types of activities (OKVED codes) (subparagraph “o”, paragraph 2, article 5, article 6 of the Law of August 8, 2001 No. 129- Federal Law).

The organization is not required to send a request to the tax office. Therefore, if the author has not presented documents confirming that work under an author’s contract is one of the types of his entrepreneurial activity, withhold personal income tax when paying remuneration.

For payments to Russian residents, calculate the tax at a rate of 13 percent (clause 1 of Article 224 of the Tax Code of the Russian Federation). Withhold personal income tax from payments to non-residents at a rate of 30 percent (paragraph 1, clause 3, article 224 of the Tax Code of the Russian Federation).

Situation: is it necessary to withhold personal income tax from the remuneration paid to the author under the author's order agreement? The author is a non-resident and creates a work in the territory of a foreign state.

Yes, it is necessary if the customer (Russian organization) is granted only the right to use the work.

Thus, under an author’s order agreement, the author can:

- provide only the right to use the work within the limits established by the contract;

- transfer to the customer all exclusive rights to the work.

This procedure is provided for in paragraph 2 of Article 1288 of the Civil Code of the Russian Federation.

Income received by a non-resident author from the use of a work in Russia is recognized as income from sources in Russia. And income received by a non-resident from sources in Russia is subject to personal income tax (clause 2 of article 209 of the Tax Code of the Russian Federation). Consequently, when paying such an author remuneration for the use of the work within the limits established by the contract, the Russian customer organization must withhold tax. This follows from the provisions of subparagraph 3 of paragraph 1 of Article 208 of the Tax Code of the Russian Federation.

In the case of transfer (alienation) of exclusive copyright to a work created on the territory of a foreign state, the income of the non-resident author is considered to be received from sources outside of Russia. This conclusion can be drawn from the provisions of subparagraph 6 of paragraph 3 of Article 208 of the Tax Code of the Russian Federation. If a non-resident receives income from sources outside of Russia, then such income is not subject to personal income tax (clause 2 of article 209 of the Tax Code of the Russian Federation). Consequently, when paying the author remuneration for the transfer of all exclusive rights to the work, the Russian customer organization should not withhold personal income tax.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated August 28, 2012 No. 03-04-06/6-259, dated December 16, 2008 No. 03-04-06-01/370.

Situation: at what rate to withhold personal income tax from remuneration under an author's order agreement, which provides for the customer's right to use the work? The non-resident author resides in another country.

As a general rule, such income is subject to personal income tax at a rate of 30 percent. If an agreement on the avoidance of double taxation has been concluded between Russia and the state of residence of the author, withhold personal income tax at the rate established by this agreement.

Income from performers under copyright contracts containing conditions for granting the Russian customer the right to use the work is recognized as income from sources in Russia (subclause 3, clause 1, article 208 of the Tax Code of the Russian Federation). This means they are subject to personal income tax (clause 1 of article 207, clause 2 of article 209 of the Tax Code of the Russian Federation). In this case, the amount of personal income tax must be withheld and transferred to the budget by the Russian organization that pays the income, since in this case it is a tax agent (clause 1 of Article 226 of the Tax Code of the Russian Federation).

As a general rule, such income for non-residents is subject to personal income tax at a rate of 30 percent (clause 3 of Article 224 of the Tax Code of the Russian Federation).

At the same time, Article 7 of the Tax Code of the Russian Federation establishes the priority of the norms of international treaties of Russia over the norms of the Tax Code of the Russian Federation. Therefore, if there is an agreement on the avoidance of double taxation between Russia and the author’s country of residence, then personal income tax must be withheld at the rate established by this agreement. The list of current bilateral international treaties is given in the table.

Thus, when paying income to a non-resident under an author’s order agreement, withhold personal income tax at the rate established by the rules of the double taxation agreement concluded between Russia and the country of which the author is a resident. In this case, a person must document that he is a tax resident of a state with which Russia has concluded a corresponding agreement. This follows from paragraph 2 of Article 232 of the Tax Code of the Russian Federation.

Similar conclusions follow from the letter of the Federal Tax Service of Russia dated October 12, 2012 No. AS-3-3/3680.

If there is no corresponding agreement between Russia and the country where the author lives, or the person has not provided the organization paying the income with the necessary confirmation, withhold personal income tax from the amount of royalties at a rate of 30 percent.

An example of determining the personal income tax rate on the amount of royalties. A Russian organization pays royalties to a resident of another state

A Russian organization (publishing house) entered into an author's contract with a citizen of the Republic of Croatia, where the latter resides permanently. The agreement provides that the author grants the organization the right to use the literary work within the limits established by the agreement.

Currently, the Agreement between the Government of the Russian Federation and the Government of the Republic of Croatia dated October 2, 1995 is in force.

In accordance with parts 1, 2 and 3 of Article 12 of this agreement, remuneration for granting the right to use copyrights, the source of payment of which is the territory of Russia, may be subject to personal income tax both in Russia and in Croatia. However, the tax rate in Russia cannot exceed 10 percent.

The author has provided documentary evidence that he is a tax resident of the Republic of Croatia.

Consequently, when paying remuneration under an author’s order agreement to a tax resident of Croatia, a Russian organization must withhold personal income tax at a rate of 10 percent.

Situation: at what rate should personal income tax be withheld from royalties for non-resident foreign citizens who are highly qualified specialists? There is no agreement on the avoidance of double taxation between Russia and the specialist’s country of residence.

At a rate of 30 percent.

As a general rule, payments to foreign citizens who are recognized as highly qualified specialists are subject to personal income tax at a rate of 13 percent, regardless of their tax status. A rate of 13 percent applies to income received from employment. At the same time, a highly qualified specialist must carry out such activities in accordance with the requirements of Article 13.2 of the Law of July 25, 2002 No. 115-FZ. This is stated in paragraph 4 of paragraph 3 of Article 224 of the Tax Code of the Russian Federation.

In turn, the provisions of Article 13.2 of the Law of July 25, 2002 No. 115-FZ apply only to highly qualified specialists who work on the basis of:

- employment contracts;

- civil contracts for the performance of work (provision of services).

This conclusion can be drawn from paragraph 12 of paragraph 1 of Article 2 and subparagraph 2 of paragraph 6 of Article 13.2 of the Law of July 25, 2002 No. 115-FZ.

The agreement on the transfer of copyright is a civil law agreement for the transfer of property rights (Articles 1226, 1285, 1234, 1286, 1235, 1288 of the Civil Code of the Russian Federation). It does not apply to either an employment contract or a civil contract for the performance of work (rendering services).

Consequently, the provisions of paragraph 4 of paragraph 3 of Article 224 of the Tax Code of the Russian Federation do not apply to highly qualified specialists working under an agreement on the transfer of copyright. This means that personal income tax must be withheld from the royalties of such non-resident citizens at a rate of 30 percent (paragraph 1, paragraph 3, article 224 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 29, 2011 No. 03-04-06/6-154) .

Copyright royalties for proprietary works: how to calculate insurance premiums?

In letter dated February 24, 2021 No. 03-15-06/12543

The Russian Ministry of Finance has explained how to pay insurance premiums from remuneration for a work. This question has arisen before, the position of officials has not changed, but the question arises again and again.

When they want to emphasize the contrast between romantic creativity and “severe prose,” they remember the catchphrase “Inspiration cannot be sold, but you can sell the manuscript.” Surprisingly, for some people creativity is a routine job. How do royalties influence the formation of the base from which insurance premiums are calculated?

General standards

The objects of taxation of insurance premiums are:

payments and other remuneration in favor of individuals subject to compulsory insurance, in particular, within the framework of labor relations (clause 1 of article 420 of the Tax Code of the Russian Federation).

An official work is recognized

a work of science, literature or art created within the limits of the labor duties established for the employee (author) (Clause 1 of Article 1295 of the Civil Code of the Russian Federation). The exclusive right to an official work belongs to the employer, unless otherwise provided by the employment or civil law agreement between the employer and the author (Clause 2 of Article 1295 of the Civil Code of the Russian Federation).

Remuneration amount

the conditions and procedure for its payment by the employer are determined by the agreement between him and the employee.

The basic principle is this. If, according to the employment contract, the employee’s job function includes the creation of official works

, then the remuneration paid by the employer to the employee who is the author under the remuneration agreement

is recognized as subject to taxation with insurance contributions

as remuneration paid within the framework of the employment relationship.

If the creation of official works is not included in the employee’s labor functions, then the remuneration paid by the company to the employee-author under a remuneration agreement is not subject to insurance premiums. This was stated in the letter of the Federal Tax Service of Russia dated February 15, 2018 No. GD-4-11/ [email protected]

Features for the IT sector

There are areas of activity in which the creation of such works is put on stream. In particular, the field of information technology (IT). Similar rules apply to the creators of computer programs (letter of the Ministry of Labor of Russia dated December 16, 2014 No. 17-3/B-613). In their explanations, officials noted that computer programs are subject to copyright.

(Article 1259 of the Civil Code of the Russian Federation).

Copyrights for all types of computer programs (including operating systems and software packages), which can be expressed in any language and in any form, including source text and object code, are protected in the same way as copyrights for works

(Art. 1261 Civil Code of the Russian Federation).

The question arises: is it possible to apply preferential contribution rates to remuneration for the creation of official works in the IT field? We are talking about the rates provided for by the Tax Code of the Russian Federation (subparagraph 3, paragraph 1, subparagraph 1.1, paragraph 2 and paragraph 5 of Article 427):

- 6 %

– for compulsory pension insurance;

- 1,5 %

– for compulsory social insurance in case of temporary disability and in connection with maternity;

- 0,1 %

– for compulsory health insurance.

If such companies fulfill all the conditions for receiving accreditation benefits, income share (at least 90% of the total amount of all company income for 9 months of the year preceding the transition to preferential tariffs) and the average number of employees (at least 7 people), then they have right to benefits (letter of the Federal Tax Service of Russia dated February 26, 2020 No. BS-4-11 / [email protected] ).

If the program is created as part of an employment contract, then insurance premiums for remuneration can be calculated at preferential rates.

New rules

Let us also recall that the Decree of the Government of the Russian Federation dated November 16, 2020 No. 1848, starting from 2022, approved new rules for the payment of remuneration for official inventions, official utility models, official industrial designs, which establish the rates, procedure and terms of payment of the specified remuneration.

Thus, for the creation of an official invention, the employer pays the employee who is the author of such an invention a remuneration in the amount of 30% of his average salary. For the creation of a service utility model or service industrial design, the employer pays the employee who is their author a remuneration in the amount of 20% of his average salary.

At the same time, the rules do not apply to cases where the employer and employee conclude an agreement establishing the amount, conditions and procedure for paying remuneration (clause 1 of the new rules).

Professional deductions for personal income tax

If the author of the work transfers property rights, then he may be provided with professional tax deductions (clause 3 of Article 221 of the Tax Code of the Russian Federation). Do not provide professional deductions to other citizens (who are not authors, including the author’s heirs) (letter from the Ministry of Finance of Russia dated April 14, 2005 No. 03-05-01-04/101 and the Federal Tax Service of Russia dated January 12, 2012 No. ED-4-3/72).

Provide a professional tax deduction in the amount of expenses incurred by the author when creating the work, the property rights to which were transferred to the organization. In this case, expenses must be documented. If the author cannot document the expenses incurred, then reduce the amount of the remuneration by a fixed percentage. This is stated in paragraph 3 of Article 221 of the Tax Code of the Russian Federation.

Before providing a professional deduction, receive a statement from the author (paragraph 11 of article 221 of the Tax Code of the Russian Federation).

Keep in mind: if the work was created by the author in the performance of official duties or an official assignment, then do not provide professional deductions. In this case, the person does not have expenses incurred at his own expense. This means that he is not entitled to professional deductions. This follows from paragraph 3 of Article 221 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated June 6, 2005 No. 03-05-01-04/177.

Standard deductions for personal income tax

Situation: is it possible to provide standard tax deductions to Russian tax residents receiving remuneration under an author's agreement?

Yes, you can.

When providing a standard tax deduction, restrictions on the type of contract (labor or civil law (including author's contract)) are not provided for in Article 218 of the Tax Code of the Russian Federation.

A person has the right to receive a standard tax deduction for his child (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation). A deduction for yourself in the amount of 3000 or 500 rubles. provide to special categories of citizens.

To provide a standard deduction to a person who has transferred property rights to an organization under an author’s agreement, the following conditions must be met:

- obtain from the person all the necessary documents (clause 3 of Article 218 of the Tax Code of the Russian Federation);

- determine the size of the standard tax deduction that can be provided (clause 1 of article 218 of the Tax Code of the Russian Federation). For more information, see How and from whom to receive standard tax deductions.

Provide standard deductions to a person hired to work under an author's agreement only for those months during which this agreement is valid. When deciding whether to provide a deduction for children, the income received by the author from the beginning of the tax period (year) is taken into account.

Similar conclusions follow from letters of the Ministry of Finance of Russia dated April 7, 2011 No. 03-04-06/10-81, the Federal Tax Service of Russia dated March 4, 2009 No. 3-5-03/233 and the Federal Tax Service for Moscow dated June 1, 2010 No. 20-15/3/057717.

If the contract is valid for several months, and the remuneration is not paid monthly (for example, in a lump sum upon expiration of the contract), then provide standard tax deductions for each month of the contract, including those months in which the remuneration was not paid. This conclusion follows from letters of the Ministry of Finance of Russia dated January 13, 2012 No. 03-04-05/8-10, dated July 21, 2011 No. 03-04-06/8-175, dated August 19, 2008 No. 03- 04-06-01/254, dated July 15, 2008 No. 03-04-06-01/203, dated October 12, 2007 No. 03-04-06-01/353, Federal Tax Service of Russia dated October 9, 2007 No. 04-1-02/002656. This approach is confirmed by the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 14, 2009 No. 4431/09.

An example of providing standard and professional tax deductions to residents receiving remuneration under a copyright transfer agreement

Alpha LLC concluded with A.S. Kondratyev signed an agreement in January to publish his article in the journal. Kondratiev is a resident of Russia. In March, Kondratiev transferred the article and all rights to it to the organization (a transfer and acceptance certificate was signed).

The royalty amount is 10,000 rubles.

Kondratyev wrote an application for professional tax deductions for personal income tax in a fixed amount. Therefore, when calculating the tax, the amount of remuneration was reduced by 20 percent (clause 3 of Article 221 of the Tax Code of the Russian Federation).

Kondratyev has an only child (age 10 years), so the employee is entitled to a standard tax deduction in the amount of 1,400 rubles, provided for in subparagraph 4 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation. To provide a standard deduction, the employee wrote a corresponding application.

For the period January–March, Kondratiev received income only from Alpha.

The tax base for personal income tax withheld from Kondratiev for March amounted to 3,800 rubles. (RUB 10,000 – RUB 10,000 × 20% – RUB 1,400/month × 3 months).

When paying royalties to Kondratiev, personal income tax was withheld in the amount of 494 rubles. (RUB 3,800 × 13%).

The author of a work of science, literature or art is recognized as the citizen whose creative work created the work. Intellectual rights to works of science, literature or art are copyrights (Article 1255, Article 1257 of the Civil Code of the Russian Federation).Royalty is a royalty that is provided for in an agreement for the alienation or provision of copyright. The author of a work usually enters into an agreement with the publishing house for the provision of rights to use (licensing agreement). The publishing license agreement imposes on the publisher the obligation to publish the work (Article 1286, Article 1287 of the Civil Code of the Russian Federation).

A copyright contract can also be concluded with the author of the work, under which the author undertakes to create the work stipulated by the contract. As a rule, an author's order agreement is concluded with the condition that the publishing house is granted the right to use the work (Article 1288 of the Civil Code of the Russian Federation).

The amount of royalty in the contract can be determined as a percentage of income for the corresponding type of use of the work or as a fixed amount.

The contract should specifically note who will own the ownership of the manuscript or other tangible medium of the work, since copyright does not depend on the right of ownership of the tangible medium (Article 1227 of the Civil Code of the Russian Federation). If the author transfers under a license agreement only the right to use his work, and not the ownership of its material medium (manuscript), the publishing house, after processing the materials, is obliged to return the manuscript to the author.

If the author is an employee of the publishing house and his official duties include writing articles, then according to paragraph 1 of Article 1295 of the Civil Code of the Russian Federation, he owns copyrights, including (Article 1255 of the Civil Code of the Russian Federation): - the right of authorship, - the author’s right to a name, - the right to the inviolability of the work - the right to publish the work.

At the same time, the exclusive right to the work will belong to the employer (publisher), unless otherwise provided by the employment contract between the author and the employer (Clause 2 of Article 1295 of the Civil Code of the Russian Federation).

For accounting purposes, expenses for paying royalties to the author of a literary work are expenses for the publishing house for ordinary activities in accordance with clause 5 of PBU 10/99.

On the date of transfer by the author of the rights to use the literary work created by him, the publishing house’s accounting reflects the debt to the author for the payment of remuneration (royalties) by an entry on the credit of account 76 “Settlements with various debtors and creditors” and the debit of account 20 “Main production”. An entry is made for the amount of remuneration paid to the author from the publisher’s cash desk: Debit 76 “Settlements with various debtors and creditors” Credit 50 “Cash”.

On the debit of account 20 “Main production” in correspondence with the credit of the account. 70 “Settlements with personnel for wages” reflects payments to publishing house employees whose official duties include writing articles, if the exclusive rights to the work (article) belong to the publishing house.

For profit tax purposes, a publishing house's expenses for payment of royalties are recognized as expenses associated with production and sales (clause 37, clause 1, article 264 of the Tax Code of the Russian Federation).

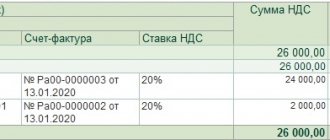

According to paragraph 3 of paragraph 1 of Article 208 and Article 209 of the Tax Code of the Russian Federation, income received by an individual (taxpayer) from the use of copyright or other related rights in the Russian Federation is recognized as an object of taxation under the personal income tax (NDFL). In accordance with clause 1 of Article 226 of the Tax Code of the Russian Federation, the organization (tax agent), from which or as a result of relations with which the taxpayer (individual) received income, is obliged to calculate, withhold from the taxpayer and pay to the budget the amount of calculated personal income tax. According to clause 4 of Article 226 of the Tax Code of the Russian Federation, the tax agent withholds the accrued amount of personal income tax from the taxpayer at the expense of any funds paid by the tax agent to the taxpayer, upon actual payment of these funds to the taxpayer or on his behalf to third parties. In this case, the withheld tax amount cannot exceed 50 percent of the payment amount.

Providing a professional tax deduction to taxpayers receiving royalties is provided for in clause 3 of Article 221 of the Tax Code of the Russian Federation. To do this, the author must submit an application to the publisher and document the costs associated with generating income. If these expenses cannot be documented, the publishing house, based on a written application from the taxpayer, provides a tax deduction in the amount of 20% (for literary works) and 30% (for artistic and graphic works) of the royalty amount.

The amount of personal income tax withheld from an individual’s income is reflected in the debit of account 76 “Settlements with various debtors and creditors” and the credit of account 68 “Calculations for taxes and fees”.

The author's royalties are used to accrue insurance contributions to the Pension Fund of the Russian Federation, the federal fund and territorial funds of compulsory health insurance. The amount of accrued contributions is reflected in the credit of the corresponding sub-accounts opened to account 69 “Calculations for social insurance and security”, in correspondence with account 20 “Main production”.

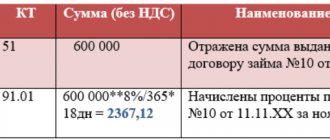

Example

The publishing house “AiN” published an article by R.Yu. Klimov in 2010. He was awarded a royalty in the amount of 7,000 rubles. The author submitted an application with a request to apply a professional tax deduction as a percentage of the amount of accrued income. In the accounting records of the publishing house, the accrual and payment of royalties is reflected in the following entries: Debit 20 “Main production” Credit 76 – 7,000 rubles. — royalties accrued; Debit 20 “Main production” Credit 69 – 1,617 rub. (RUB 7,000 x (20.0% + 1.1% + 2.0%) – contributions to the Pension Fund of the Russian Federation, the federal fund and territorial compulsory health insurance funds have been accrued; Debit 76 “Settlements with various debtors and creditors” Credit 68 sub/account “Settlements for personal income tax” - 728 rubles ((7,000 rubles - 7,000 rubles x 20%) x 13%) - personal income tax withheld; Debit 76 “Settlements with various debtors and creditors” Credit 50 “Cash desk” - 6,272 rubles (7000 - 728) - royalties paid.

Personal income tax withholding date

Include the remuneration under the author's agreement in the personal income tax base on the day the remuneration is paid (in cash or in kind) (clause 1 of article 223 of the Tax Code of the Russian Federation). If a person receives remuneration in cash, transfer the calculated tax to the budget within the following time frame:

- on the day of receiving money from the bank, if the organization pays remuneration in cash received from the current account;

- on the day the money is transferred to the citizen’s account, if the organization pays the remuneration by bank transfer;

- the day after the award is issued, if the organization pays it from other sources (for example, from cash proceeds).

These deadlines are established in paragraph 6 of Article 226 of the Tax Code of the Russian Federation.

If a person receives remuneration in kind, withhold the calculated tax from any monetary rewards paid to him (Clause 4 of Article 226 of the Tax Code of the Russian Federation). If personal income tax cannot be withheld, notify the tax office at the place of registration of the organization, as well as the citizen to whom the income was paid (clause 5 of Article 226 of the Tax Code of the Russian Federation).

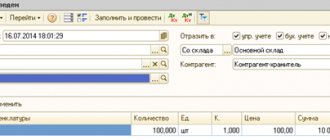

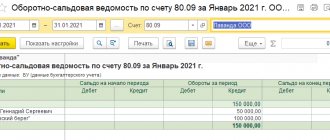

Changes in accounting for account 76.09 in release 2.4.12.64

In release 2.4.12 in the ERP system, changes occurred in the “Vedomost” document; the “Accounted as” attribute was added to the document header.

It is not required to be filled out and may contain the following values: Payments for wages, Payments to contractors, Other payments to personnel.

If this detail is not filled in, then when you click the “Fill” button, all data on accruals is filled in, including salary and copyright agreements (GPC agreements).

After filling out, the system allows you to post a “Statement” and create a “Write-off of non-cash funds” on the basis, but errors occur when generating transactions.

The system splits the transactions into account 70 and account 76.09, but the amount in the transaction indicates the entire statement, and does not break it down into the breakdown amounts from the statement.

Therefore, for correct accounting in release 2.4.12.64, it is necessary to fill in the “Accounted as” attribute. If you now set this detail in the statement to the value “Payroll calculations”, an error will occur.

This error is due to the fact that, depending on the selected value of the “Accounted as” attribute, only accruals for wages, or only accruals for settlements with counterparties, or only other settlements with personnel are included in the statement.

Therefore, in release 2.4.12.64, it is impossible to simultaneously fill out data on employee salaries, contracts and other settlements in the statement, since if the “Accounted as” attribute is not filled out, incorrect entries are generated, and if it is filled in, you can fill in data for only one type of accounting.

There were no changes in the posting of the document “Write-off of non-cash funds”.