Types of bonds in circulation and by form of income

In circulation there are state (federal, regional, municipal) securities and corporate ones - issued by legal entities. The date of transaction with bonds for their acquisition or disposal is the day of transfer of ownership.

According to the categories of income generation, there is a division into 2 types of securities - coupon and zero-coupon. Depending on the type of security, forms of income are established: (click to expand)

- In the form of interest with a specified payment period for coupon bonds. Payment control is carried out using cut-off coupons.

- In the form of a discount - the difference between the face value and the purchase price.

Securities, the market value of which is not determined, must reach the par value of the book value by maturity. The difference is taken into account evenly as part of other income or expenses throughout the entire period of use.

Accounting for bonds by the issuer

Issuers carry out transactions with bonds related to the placement, payment of income, as well as redemption of securities. Companies that have issued bonds reflect the amounts in the accounts for short-term and long-term loans (account 66 and account 67).

Detailed accounting is carried out in accordance with the chronology of the issue, by acquirers and by cost. In the case of recording transactions for paid income, issuers must comply with certain conditions:

- Interest or discount is included in other expenses.

- Amounts are written off evenly across reporting periods, or simultaneously during the period of expenses.

- The write-off procedure must be specified in the company's accounting policies.

Standard issuer entries will be as follows:

| Business transaction | Wiring | |

| D | TO | |

| Placement of bonds at par value | 51 | 66 (67) |

| Interest accrued to be paid to the bond owner upon one-time write-off | 91.2 | 66 (67) |

| Interest accrued on write-offs evenly across periods | 97 91.2 | 66 (67) 97 |

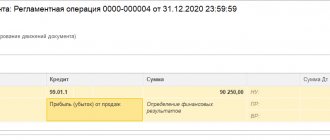

| The positive difference is taken into account in case of sale at a cost exceeding the nominal value | 51 | 98 |

| Uniform write-off of income in case of placement of bonds at a price exceeding the nominal | 98 | 91.1 |

Documentary form of securities

A security in the form of a bond is a document containing information about the details that allow it to be identified. The data contained on the document ensures the rights of the owner. The bond certifies only the material rights of the investor and does not affect non-property rights, for example, participation in the activities of the enterprise that issued the securities.

The form presented on paper or other media permitted by law is used. The placement of bonds into circulation is carried out through an issue that has a state registration number, and, if there is no need to register the issue, an identification number.

Bonds have pricing characteristics that allow holders to determine the costs and income received. Initially, the bond is assigned a par value - the price indicated on the document. When sold on the secondary circulation market, the bond acquires a market value - a market price that fluctuates during the circulation period.

At maturity, the bond primarily has a value equal to its par value.

Discount accounting

The accounting for a bond received at a discount differs depending on whether the bond is traded on the securities market or not.

Listed bonds are recorded at their original cost. Reflect income in the form of a discount at the time of its formation, that is, on the bond redemption date (the date the organization acquires the right to receive the specified income from the bond issuer). This follows from paragraphs 7 and 16, PBU 9/99, paragraph 34 PBU 19/02. In your accounting, make simultaneous entries for the disposal of financial investments and the receipt of payment from the issuer. The financial result of this operation will be a discount. For more information about this, see How to record the sale and other disposal of bonds in accounting.

For unquoted bonds, in the accounting policy for accounting purposes, the organization has the right to prescribe one of the following options:

- accounting for bonds at acquisition cost (initial cost) with subsequent adjustment for discount. In this case, the discount amount is equally included in other income of the organization;

- accounting for bonds at acquisition cost (initial cost) without taking into account discount.

Such rules follow from paragraphs 21–22 of PBU 19/02.

When evenly distributing the discount amount (first method), monthly increase the book value (initial) value of the bond and the financial result by the amount of the discount relating to the reporting period. Reflect it like this:

Debit 58-2 Credit 91-1 – income is recognized in the form of part of the discount on the bond.

Thus, with this accounting option, at the time the bond is redeemed (on time and in full), its book value will become equal to its nominal value. And the financial result from this operation is zero, since the entire discount amount will already be taken into account in the income of previous reporting periods (clause 22 of PBU 19/02 and clause 16 of PBU 9/99).

In the second method, bonds are accounted for at their original cost for the entire time they are owned by the organization. At the same time, the discount does not in any way affect the value of the asset and the financial results of the organization.

With this accounting option, the discount on the bond must be taken into account upon its disposal, in particular, at the time of redemption as a financial result from the operation.

This follows from clauses 21, 25 and 26 of PBU 19/02, clauses 7, 10.6 and 16 of PBU 9/99, clauses 11 and 14.1 of PBU 10/99.

If necessary, at the time of receiving the coupon (discount), add VAT. Record it in your accounts like this:

Debit 91-2 Credit 68 subaccount “Calculations for VAT” - VAT is charged on interest (discount) on the bond.

This follows from the Instructions for the chart of accounts (accounts 91, 68).

The procedure for calculating taxes on discount bonds depends on the tax system that the organization uses.

Accounting for bonds with coupon income

The cost of bonds with accumulated coupon income differs from the nominal value either down or up. The value of a bond is the sum of the market price and the amount that has changed the value of the security. Bonds with accrued coupon income are purchased on the secondary market.

Example No. 2 for determining the amount to write off the difference in excess of the actual purchase amount over the nominal amount

The LLC Kontakt enterprise purchased a bond of OJSC Kedr with a par value of 50,000 rubles at a price of 55,000 rubles. According to the terms of the agreement, the income from the investment will be 10% of the value of the bond with payment twice a year and maturity 5 years after purchase. The amount of costs exceeding the nominal value must be written off in equal parts over the reporting periods - 500 rubles per six months. In the accounting of Contact LLC, entries are made, accompanied by the following entries:

| Operation | Wiring | Amount, rub. |

| Payment has been made for the purchased asset | Dt 76 Kt 51 | 55 000 |

| The bond is taken into account in the amount of actual expenses | Dt 58/2 Kt 76 | 55 000 |

| Part of the excess of actual costs over nominal costs was written off | Dt 91/2 Kt 58/2 | 500 |

| Interest accrued on the bond | Dt 76 Kt 91/1 | 2 500 |

| Interest income received | Dt 51 Kt 76 | 2 500 |

A uniform write-off of the excess amount over the par value of the bonds as part of other expenses will allow you to obtain the par value by the maturity date. If the purchase amount (actual expenses) is less than the nominal value, the difference is accrued in equal parts as part of other income.

Accounting for bonds: entries

Important! Information on purchased bonds is reflected in account 58 “Financial investments”. Information for a detailed reflection of information is grouped by type of investment, company and cost.

Let's look at the main entries used when accounting for coupon bonds:

| Business transaction | Wiring | |

| D | TO | |

| Payment paid in cash to the issuer | 76 | 50 |

| Payment to the issuer is transferred from the current account | 76 | 51 |

| Registration | 58.2 | 76 |

| Calculation of interest for the reporting period | 76 | 91.1 |

| Income received in the form of interest is reflected | 51 | 76 |

| Redemption cost set | 76 | 91.1 |

| Issuer received payment | 51 | 76 |

| Securities deregistered | 91.2 | 58.2 |

Interest or discount from the cost of bonds is taken into account separately. Accrued income in accounting is defined as accounts receivable. Bonds for which the issuer has revalued are accounted for at the purchase price, and changes in value are not subject to reflection in accounting. The difference is taken into account by institutions entitled to revaluation.

Accounting for transactions on federal loan bonds (OFZ)

The issue and circulation of OFZ are determined by orders of the Ministry of Finance of the Russian Federation. The transfer of a security is carried out in the order of transfer of ownership rights with the conclusion of an agreement and sale at auction. The conditions for treatment are determined:

- Nominal purchase price.

- The value of the bond on each day of circulation. Published monthly on the official website of the Ministry of Finance of the Russian Federation.

- Start, end and maturity dates.

- Release form (documentary).

- Circle of potential owners.

The nominal value of OFZ in circulation is determined taking into account the consumer price index. In addition to the changed value on the maturity date, the owner of the OFZ receives coupon income. Depending on the conditions of issue, a constant or variable coupon income is used in the calculation.

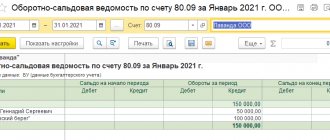

The amount of variable income is added up over individual payment periods. Accounting for OFZs must be taken into account separately from other types of securities. Detailed accounting is maintained for each bond, with data grouped according to the chronology of registration and price.

OFZs are not used to cover the cost of goods, work, services or other types of expenses within the framework of commercial activities.

Bond issue: Accounting and tax accounting

S. Guardin, Runa consulting group

Economic growth and increased competition are forcing companies to increasingly focus on the optimal sources of debt capital necessary for effective financial management. One such source is the issue of corporate bonds. It should be noted that the global bond market is estimated at $49 trillion, of which $30 trillion is in corporate bonds. Recently in Russia, with the development of the stock market, additional opportunities have also appeared for attracting financial resources expressed in the issue of bonds. According to Art. 33 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies” (hereinafter referred to as Law No. 208-FZ) and Art. 31 of the Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies” (hereinafter referred to as Law No. 14-FZ), the company has the right, in accordance with its charter, to place bonds.

Let's consider the main mechanisms for issuing bonds and how this process is reflected in tax and accounting.

Types of issue-grade securities

In accordance with Art. 143 of the Civil Code of the Russian Federation, bonds are classified as securities. According to the Federal Law of April 22, 1996 No. 39-FZ “On the Securities Market” (hereinafter referred to as Law No. 39-FZ), a bond is an issue-grade security that secures the right of its owner to receive from the issuer of the bond within the period specified in it nominal value or other property equivalent. A bond may also provide for the right of its owner to receive a fixed percentage of the nominal value of the bond or other property rights. The yield on a bond is interest and/or discount.

Issue-grade securities are divided into registered and bearer. Registered issue-grade securities are issued only in book-entry form, except for cases provided for by federal laws. Issue-grade bearer securities are issued only in documentary form; for each of them, its owner is issued a certificate.

Issue procedure

The issue and sale of bonds are carried out in accordance with the Standards for issuing securities and registering securities prospectuses, approved by order of the Federal Financial Markets Service dated March 16, 2005 No. 05-4/pz-n.

The decision on the issue (additional issue) of issue-grade securities of a business company is approved by the board of directors (supervisory board) or the body that, in accordance with the law, carries out the functions of the board of directors (supervisory board) of this business company. The decision on the issue (additional issue) of issue-grade securities of legal entities of other organizational and legal forms is approved by the highest management body, unless otherwise established by federal laws.

The decision to issue bonds, the fulfillment of the issuer's obligations under which is secured by a pledge, a bank guarantee or other methods provided for by federal law, must also contain information about the person who provided the security and the terms of the security.

When issuing registered bonds or documentary bonds with mandatory centralized storage, the decision must also contain an indication of the date on which a list of bond holders is compiled for the issuer to fulfill obligations under the bonds. Such a date cannot be earlier than 14 days before the due date for fulfillment of obligations under the bonds. In this case, the fulfillment of the obligation in relation to the owner included in the list of bond owners is recognized as proper, including in the case of alienation of bonds after the date of compilation of the list of bond owners.

The procedure for issuing securities, unless otherwise provided by this Law or other federal laws) includes the following stages (Article 19 of Law No. 39-FZ) (as amended on December 28, 2005 No. 194-FZ):

- making a decision on the placement of equity securities;

- approval of the decision on the issue (additional issue) of issue-grade securities;

- state registration of the issue (additional issue) of issue-grade securities;

- placement of issue-grade securities;

- state registration of a report on the results of the issue (additional issue) of issue-grade securities or submission to the registration authority of a notification on the results of the issue (additional issue) of issue-grade securities.

Accounting for expenses associated with the issue of bonds

In accordance with paragraphs. 3 p. 1 art. 265 of the Tax Code of the Russian Federation for income tax purposes, expenses for organizing the issue of one’s own securities, in particular for the preparation of a prospectus for the issue of securities, production and purchase of forms, registration of securities, expenses associated with servicing one’s own securities, including services registrar, depositary, underwriter and other similar expenses are included in non-operating expenses.

Since the issue of bonds is carried out in order to attract borrowed capital, operations related to their movement must be reflected in accounting in accordance with the accounting regulations “Accounting for loans and credits and the costs of servicing them” PBU 15/01, approved by order of the Ministry of Finance of Russia dated 2.08.01 No. 60n. Thus, according to paragraph 7 of PBU 15/01, in cases provided for by law, an organization can raise borrowed funds by issuing and selling bonds and bills.

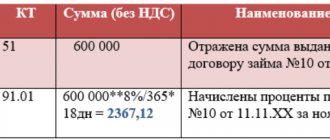

Costs associated with obtaining and using loans and credits include (clause 11 of PBU 15/01):

- interest payable by the lender and creditor on loans and credits received from them;

- interest, discount on bills and bonds due for payment (discount means the difference between the amount specified in the bill and the amount of funds actually received or their equivalents when placing this bill), formed from the moment interest is accrued under the terms of the agreement until their actual repayment (transfers);

- additional costs incurred in connection with obtaining loans and credits, issuing and placing debt obligations;

- exchange rate and amount differences related to interest payable on loans and credits received and denominated in foreign currency or conventional monetary units.

Thus, organizations can include in their costs expenses associated with payment for consulting and legal services, examinations, consumption of communication services and other costs directly related to the receipt and placement of loan obligations.

In this case, the borrower includes additional costs associated with the placement of loan obligations in the reporting period in which they were incurred. All expenses associated with the placement of securities, according to PBU 15/01, are operational and are reflected in account 91 “Other income and expenses.” At the same time, according to clause 20 of PBU 15/01, additional costs can be preliminarily taken into account as receivables with their subsequent inclusion in operating expenses during the repayment period of the above borrowed obligations.

According to paragraphs. 2 p. 1 art. 265 of the Tax Code of the Russian Federation, expenses in the form of interest on debt obligations of any type, including interest accrued on securities and other obligations issued (issued) by the taxpayer, for profit tax purposes are recognized as non-operating expenses, taking into account the features provided for in Art. 269 of the Tax Code of the Russian Federation.

According to paragraph 1 of Art. 269 of the Tax Code of the Russian Federation in the absence of debt obligations to Russian organizations issued in the same quarter on comparable terms, as well as at the choice of the taxpayer, the maximum amount of interest recognized as an expense (including interest and amount differences on obligations expressed in conventional monetary units at the rate established by agreement of the parties conventional monetary units), is taken to be equal to the refinancing rate of the Bank of Russia, increased by 1.1 times - when issuing a debt obligation in rubles and equal to 15% - for debt obligations in foreign currency. The refinancing rate of the Bank of Russia means:

in relation to debt obligations that do not contain conditions on changing the interest rate during the entire term of the debt obligation - the refinancing rate of the Bank of Russia in effect on the date of raising funds;

in relation to other debt obligations - the refinancing rate of the Bank of Russia, effective on the date of recognition of expenses in the form of interest. In accordance with paragraph 8 of Art. 272 of the Tax Code of the Russian Federation, when applying the method of calculating interest on loan agreements (and other debt obligations, including securities), the validity of which falls on more than one reporting period, the expense is recognized as incurred and is included in non-operating expenses at the end of the corresponding reporting period. If a debt obligation is repaid before the expiration of the reporting period, the expense is recognized as incurred and is included in the corresponding expenses on the date of repayment of the debt obligation.

Thus, for bonds whose circulation period exceeds one reporting period, interest must be accrued in tax accounting evenly at the end of each reporting period.

The accounting procedure for interest and discount is regulated by clause 18 of PBU 15/01. The issuing organization for placed bonds reflects the nominal value of issued and sold bonds as accounts payable and, depending on the period for which the bonds are issued, account 66 “Settlements for short-term loans and borrowings” or account 67 “Settlements for long-term loans and borrowings” is used. . In this case, accounts payable are indicated taking into account the interest on bonds due at the end of the reporting period.

Examples of bond placement on the primary and secondary markets

Example 1.

The par value of the bond is 10 rubles. The initial placement price is 100% of the nominal value of the bonds. In accounting, the receipt of borrowed funds is reflected by the entry:D-t 51, K-t 66 (67) - 10 rubles. — funds received from the placement of bonds.

As already noted, bonds can be placed not only at par, but also at a price higher or lower than par. In this case, the placement of bonds at a price exceeding their par value is reflected in account 66 or 67 at par, and the excess amount is taken into account in the credit of account 98 “Deferred income”. The excess amount recorded in this account is subsequently written off evenly during the bond’s circulation period to account 91 “Other income and expenses.”

Example 2.

An organization places bonds on the secondary market at a price of 15 rubles. with a nominal value of 10 rubles. The repayment period is one year. This operation is reflected in the following entries:D-t 51, K-t 66 - 10 rub. — the funds received are reflected within the par value of the bond;

D-t 51, K-t 98 - 5 rubles. — funds received in excess of the par value of the bond are reflected.

Then monthly:

D-t 98, K-t 91-1 - 0.42 kopecks. — the deviation of the price from the nominal value is calculated.

If bonds are placed at a price below their par value, then the difference between the placement price and the par value of the bonds is accrued evenly during the period of circulation of the bonds from the credit of account 66 (67) to the debit of account 91 “Other income and expenses.” Thus, by the time of redemption, account 66 (67) will have the par value of the bond.

Example 3.

The placement price on the secondary market below par was 8 rubles. with a nominal value of 10 rubles. The repayment period is one year. In this case, the placement records will be as follows:D-t 51, K-t 66 - 8 rubles. — funds received from the placement of bonds.

Then every month:

D-t 91-1, K-t 66 - 0.17 kopecks. — the deviation of the price from the nominal value (discount) is calculated.

The amount of income on bonds declared by the issuing organization during its initial distribution (a fixed percentage of the nominal value) is paid within the terms specified in the prospectus and represents the amount of the coupon income. Coupon income is calculated in the same way as for borrowed funds.

Example 4.

Bonds with a par value of 10 rubles were issued. with a maturity of two years and a yield of 30% of the nominal value per year with payment of coupon income once a year.Every month we reflect the coupon income:

D-t 91, K-t 67 - 0.25 kopecks. (3 rubles - coupon income / 12 months) - interest accrued on the bond.

At the end of the year we make a note:

D-t 67, K-t 51 - 300 rub. — coupon income has been paid.

A similar entry is made when the bond is redeemed.

The issuing organization can redeem its bonds without waiting for their maturity.

In accounting, this is reflected in the same way as redemption (Article 413 of the Civil Code of the Russian Federation), with the difference that the amount of accumulated coupon income will be determined for the period the bond is held by the holder. If the redemption of the bond and its secondary placement occur before the payment of the coupon income, then the new buyer must actually pay for the bond at a cost that includes the par value and the accrued coupon income. In this case, the resulting difference should not be attributed to deferred income, since the coupon income will be paid subsequently when the bond is redeemed for the entire period when the bonds were with the first buyer and issuer. Redemption of a bond by conversion into shares of the issuing organization

This operation is only possible for joint stock companies. This is especially true when the issuer, for one reason or another, cannot repay its debt obligations and the issuing organization invites the bond owner to become a member of the company’s founders. In any case, the issuing organization first issues bonds, i.e. issues bonds, then converts them into ordinary shares. In accounting, this transaction is reflected as follows:

D-t 51, K-t 66 (67) - reflects the placement of a bond issue, which must be converted into shares of the organization within the period established by the prospectus,

D-t 66 (67), K-t 75 - the value of the bonds was repaid by converting them into shares within the prescribed period.

After state registration of changes to the constituent documents related to the increase in the authorized capital, an entry is made on the credit of account 80 “Authorized capital” in the amount of the increase in the authorized capital by issuing additional shares placed by conversion in correspondence with account 75 “Settlements with founders”.

The difference between the par value of the shares placed through conversion and the par value of the bonds converted into shares represents share premium. The amount of share premium received is reflected in the credit of account 83 “Additional capital” in correspondence with account 75.

Moreover, in accordance with paragraphs. 3 p. 1 art. 251 of the Tax Code of the Russian Federation for profit tax purposes, income in the form of property, property rights or non-property rights with a monetary value, which are received in the form of contributions (contributions) to the authorized (share) capital (fund) of the organization (including share premium in the form of excess of the placement price of shares (shares) above their nominal value) are not taken into account when determining the tax base.

It should also be noted that bonds can be purchased by both residents and non-residents of the Russian Federation. In the second case, the issuer is obliged to perform the functions of a tax agent. Yes, p.p. 1 clause 1 art. 208 of the Tax Code of the Russian Federation determines that interest paid by a Russian organization to individuals is subject to withholding tax at a rate of 13% for tax residents and 30% for non-residents. If a foreign organization operates in the Russian Federation through a permanent representative office, then tax is not withheld at the source of payment. In the case where a foreign organization does not have a permanent representative office in the Russian Federation, then, in accordance with paragraphs. 3 p. 1 art. 309 of the Tax Code of the Russian Federation, interest on debt obligations, including bonds, is subject to withholding tax at a rate of 20%.

Bond security

In conclusion, I would like to dwell on some more important points related to the issue of bonds. First of all, it is necessary to take into account that the company has the right to place bonds in an amount not exceeding the size of its authorized capital or the amount of security provided to the company for these purposes by third parties (Article 102 of the Civil Code of the Russian Federation and paragraph 2 of Article 31 of Law No. 14-FZ). In the absence of collateral, bonds may be placed no earlier than the third year of the company’s existence and subject to proper approval by the general meeting of the company’s participants of at least two annual balance sheets of the company.

In the case of the issue of bonds with security, the person who provided it is obliged to sign the securities prospectus, thereby confirming the reliability of the information about the security. Persons who have signed a securities prospectus, if they are at fault, bear joint and several liability with the issuer for damage caused to the owner of the securities as a result of unreliable, incomplete and/or misleading information contained in the prospectus, confirmed by them.

If an issue of issue-grade securities is declared invalid, all securities of this issue must be returned to the issuer, and the funds received by the issuer from the placement of the issue of securities declared invalid must be returned to the owners. The federal executive body for the securities market has the right to go to court to return funds to owners. All costs associated with declaring the issue of issue-grade securities invalid (failed) and returning funds to the owners are charged to the issuer. In the event of a violation, expressed in the release of securities into circulation in excess of those announced in the securities prospectus, the issuer is obliged to ensure the repurchase and redemption of such securities. If the issuer does not ensure their repurchase and repayment within two months, then the federal executive body for the securities market has the right to go to court to recover funds received unjustifiably by the issuer.

Creation of a reserve fund

To repay bonds, the company, in the absence of other funds, may create a reserve fund. In joint stock companies, the reserve fund is formed through mandatory annual contributions until it reaches the size established by the company's charter. The amount of annual contributions cannot be less than 5% of net profit. The reserve fund is intended to cover losses, as well as to repay bonds and repurchase shares of the company in the absence of other funds (Clause 1, Article 35 of Law No. 208-FZ).

Article 30 of Law No. 14-FZ gives a limited liability company the right to create a reserve fund and other funds in the manner and amount prescribed by the company's charter. The procedure for using the reserve fund is determined by the supreme management body of the company.

In LLCs, the creation of a reserve fund, unlike joint-stock companies, is voluntary. Thus, when approving the charter, the founders express in advance their consent to allocate part of the profit to the formation of reserve capital. An additional decision on this matter is not required, from which it follows that the allocation of profits to the formation of a reserve fund is a mandatory procedure that does not require a decision from the owners.

According to the Chart of Accounts, contributions to reserve capital from profits are reflected in the credit of account 82 “Reserve capital” in correspondence with the debit of account 84 “Retained earnings (uncovered loss)”.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Mortgage coverage with bonds

Property can serve as collateral for the bond. Collateral is provided to reduce the risk of the acquirer (investor). The essence and types of bonds do not change depending on the presence of mortgage collateral. Operations and document flow are similar to the circulation of bonds without collateral. In the event of loss of property serving as collateral, the investor receives the insured amount.

The circulation of covered securities is carried out by credit institutions or mortgage agents. Issuers of bonds must provide detailed information about the securities. Organizations registered as LLC or JSC act as mortgage agents. The enterprise must fulfill the following conditions:

- Clearly state in the Charter the procedure for issuing bonds and follow it throughout the entire period of activity.

- Determine the maximum number of bonds allowed for issue and limit the issue to the constituent documents and is included in the Charter.

- Do not hire employees.

Record keeping is transferred to a specialized organization. Voluntary termination of the existence of an organization is permitted upon full repayment of obligations.

Presentation of bonds for payment: simplified tax system

If the organization presenting the bond for redemption applies a simplified procedure, then when calculating the single tax, follow this procedure.

The operation to repay the bond should also be taken into account according to the rules of Article 280 of the Tax Code of the Russian Federation (clause 1 of Article 346.15 and clause 3 of Article 249 of the Tax Code of the Russian Federation).

Generate income and expenses as you pay (Article 346.17 of the Tax Code of the Russian Federation). At the same time, follow the procedure that a simplified organization must apply depending on the chosen object of taxation.

If an organization calculates a single tax on income, do not take into account expenses when calculating the tax (for example, the price of a bond or the coupon income paid upon its acquisition) (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If an organization calculates a single tax on the difference between income and expenses, the tax base can be reduced by the cost of purchasing the bond (subclause 23, clause 1, article 346.16 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 24, 2011 No. 03-11-06/2 /08 and the Federal Tax Service of Russia dated February 14, 2005 No. 22-1-12/181). The written off amount of losses incurred in the previous tax period under the simplified tax system will also help reduce the tax base.

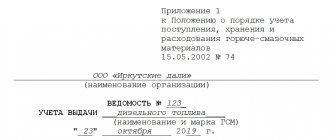

Securities reporting

Issuers issuing bonds are required to disclose information in reports published quarterly. Reporting begins from the first quarter after the issue of bonds and is carried out until the obligations are repaid, the issue is determined to be invalid, and the documents are declared invalid.

The reporting is presented in the form established in the document approved by the Bank of Russia on December 30, 2014 No. 454-P “Regulations on the disclosure of information by issuers of equity securities.” The reporting contains information about the issuer, its activities, liabilities, liquidity of securities, and investments made.

The issuer must submit a complete package of financial statements including all forms. The following information is subject to disclosure in the issuer's financial statements:

- Availability and change in the amount of debt on loans issued by bonds.

- Amounts, maturity dates of bonds.

- The amount of expenses incurred during the issue and circulation of bonds.

Presentation of bonds for payment: OSNO

If the organization presenting the bond for redemption applies a general taxation system, then follow this procedure when calculating taxes.

Bond redemption operations do not affect the calculation of VAT. Since transactions with securities (including bonds) are not subject to VAT (Articles 142–143 of the Civil Code of the Russian Federation and subparagraph 12, paragraph 2, Article 149 of the Tax Code of the Russian Federation).

Determine the basis for calculating income tax on any transactions with securities according to the rules of Article 280 of the Tax Code of the Russian Federation. Determine the taxable profit (loss) from the redemption (partial redemption) of a bond in the same way as when selling a bond. When calculating income tax, recognize income and expenses depending on the method of their determination (accrual method or cash method). This procedure follows from the provisions of paragraph 15 of Article 274, paragraphs 2, 3 and 6 of Article 280 and paragraph 2 of Article 329 of the Tax Code of the Russian Federation.

The selling price of a bond is the par value of the bond received upon its redemption. It is not necessary to determine the settlement price of the bond (to control whether the disposal price of the security corresponds to the level of market prices) (letter of the Ministry of Finance of Russia dated March 2, 2006 No. 03-03-04/1/162).

There is no such indicator as the amount of accumulated coupon income (ACI) presented to the buyer upon redemption. Instead, when calculating the result, the income of the organization includes the amount of income received from the issuer when the bond is redeemed.

As part of the expenses, in addition to the purchase price of the bond, also take into account the amount of accumulated coupon income (discount) paid to the seller when purchasing the bond. Do this only if the issuer has not paid this amount in previous reporting (tax) periods. If the payment took place, the amount of NKD paid to the seller was already taken into account as an expense in the declaration for the previous reporting period when the money was received from the issuer. This procedure follows from paragraphs 2–3 of Article 280 of the Tax Code of the Russian Federation and paragraphs 13.1.2 and 13.1.3 of the Procedure approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

As part of expenses when calculating income tax, you can also take into account other costs directly related to the acquisition and sale of bonds. Take them into account depending on the type (for example, advertising services, intermediary services, depository, bank, etc.). This procedure follows from paragraphs 2–3 of Article 280, Article 272, paragraph 3 of Article 273 and Article 329 of the Tax Code of the Russian Federation.

Thus, determine the taxable profit (loss) from the redemption of the bond using the formula:

| Taxable profit (loss) from bond redemption | = | The par value of a bond received at maturity | + | Amount of accrual received from the issuer upon redemption of a bond | – | Bond acquisition price (including acquisition costs) | – | The amount of income tax paid when purchasing a bond (if it was not previously taken into account for tax purposes) |

Form the financial result (profit or loss) from the sale of non-negotiable bonds separately from the profit (loss) from the main activity (clause 22 of Article 280 of the Tax Code of the Russian Federation). But income (expenses) from transactions with negotiable bonds must be taken into account in the generally established manner in the general tax base (clause 21, article 280 of the Tax Code of the Russian Federation).

Partial redemption of bonds

Situation: how to take into account the partial repayment by the issuer of a bond with debt amortization in accounting and when calculating income tax?

Bonds with debt amortization, in addition to coupon income (discount), require repayment of the nominal value of the bond in parts during its circulation period (see, for example, paragraph 3 of Article 12 of the Law of November 11, 2003 No. 152-FZ). For example, when issuing a mortgage-backed bond, it may be stipulated that 50 percent of the cost is repaid on the 546th calendar day from the start date of the placement. And the remaining 50 percent of the nominal value - on the 1092nd calendar day from the start date of placement.

The legislation does not have a clear answer to the question of how to take into account the partial repayment of a bond's par value in accounting.

There is a point of view that when receiving such a payment from the issuer in accounting you need to:

- reflect the partial disposal of the financial investment (in proportion to the redeemed share) and determine the result of this operation - for bonds traded on the securities market (clause 25 of PBU 19/02);

- reduce the cost of the bond by the difference between the initial cost of the bond and the new value of the bond's par value while at the same time attributing this difference to the organization's expenses (clause 22 of PBU 19/02) - for bonds not traded on the securities market.

In this case, you need to make the following wiring:

Debit 50 (51) Credit 76 – funds received to repay part of the bond’s par value;

Debit 76 Credit 91-1 – income from repayment of part of the bond’s par value is taken into account;

Debit 91-2 Credit 58-2 – part of the bond’s value attributable to the redeemable share of the bond is written off.

This posting scheme follows from the Instructions for the chart of accounts.

At the same time, accounting rules do not provide for the possibility of partial disposal of financial investments (section IV of PBU 19/02). They also do not provide for the ability to adjust their book value. This possibility exists only in relation to the original cost of unlisted securities. This conclusion can be drawn from paragraph 22 of PBU 19/02.

Therefore, the part of the bond's face value received from the issuer as payment can be recognized as received in advance. And therefore, do not include it in the organization’s income and do not adjust the value of the bond until its full repayment (clause 3 of PBU 9/99). In this case, you need to use account 76 “Settlements with other debtors and creditors”, to which you need to open a subaccount “Settlements with the issuer for partial repayment of a bond with debt amortization”:

Debit 51 Credit 76 subaccount “Settlements with the issuer for partial repayment of the bond with debt amortization” - funds were received to repay part of the bond’s par value.

In this situation, the organization has the right to choose how to account for the partial repayment of the bond with debt amortization in accounting.

When calculating income tax, the tax base for transactions with securities is determined upon their sale (redemption, partial redemption) or other disposal (clauses 2–7 of Article 280 of the Tax Code of the Russian Federation). When bonds are partially repaid, the organization also has a tax base for transactions with securities. In this case, generate income based on the cost of the bonds partially redeemed by the issuer, and expenses based on part of the purchase price of the bonds, determined in proportion to the redeemed value of the bonds. This follows from the provisions of paragraph 3 of Article 280 of the Tax Code of the Russian Federation. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated March 4, 2013 No. 03-03-06/2/6367.