Debit 91.2 Credit 62

This article is devoted to how to correctly reflect the adjustment of income and expenses of the previous period, not even from the point of view of 1C programs, but from the point of view of accounting and tax accounting methodology.

Accounting

According to Order of the Ministry of Finance of the Russian Federation dated July 22, 2003 N 67n “On the forms of financial statements of organizations”:

- In cases where incorrect reflection of business transactions of the current period is detected before the end of the reporting year, corrections are made by entries in the corresponding accounting accounts in the month of the reporting period when the distortions are identified.

- If an incorrect reflection of business transactions is detected in the reporting year after its completion, but for which the annual financial statements have not been approved in the prescribed manner, corrections are made by entries in December of the year for which the annual financial statements are prepared for approval and submission to the appropriate addresses.

- In cases where an organization reveals in the current reporting period that business transactions were incorrectly reflected in the accounting accounts last year, corrections are not made to the accounting records and financial statements for the previous reporting year (after the annual financial statements have been approved in the prescribed manner). Clause 11 of the Order of the Ministry of Finance of the Russian Federation dated July 22, 2003 N 67n.

In the documents “Adjustment of receipts” and “Adjustment of sales” the above legislative requirements are supported optionally. For this purpose, in the documents “Adjustment of receipts” and “Adjustment of sales” on the “Additional” tab there is the sign “Last year’s accounting is closed for adjustment (reporting signed).” When posting a document “Adjustment of sales” without this attribute, accounting entries are formed using accounts 90 and 99, for example, in the case of an upward adjustment of sales revenue:

Dt 76.K Kt 90.01.1 - for the amount of increase in cost

Dt 90.03 Kt 68.02 - for the amount of the VAT increase

Dt 62.01 Kt 76.K - for the amount of increase in cost

Dt 90.09 Kt 99.01.1 - financial result of adjustment

In this case, all postings are formed not by the date of the adjustment document, but by the date of the adjusted sales document, that is, last year.

When posting a document “Adjustment of sales” with the attribute set “Accounting for the previous year is closed for adjustment (reporting has been signed),” entries in accounting are generated through 91 accounts, for example, when adjusting sales in the direction of increasing income:

Dt 62.01 Kt 91.01 - for the amount of increase in cost

Dt 91.02.1 Kt 68.02 - for the amount of the VAT increase

Postings are generated by the date of the sales adjustment document. Analytics of account 91, that is, the item of other income and expenses, is indicated in the document on the “Additional” tab next to the sign “Last year’s accounting is closed for adjustment (reporting signed).”

Thus, in accounting we can independently regulate in what period and through which account we reflect the adjustment of income and expenses of the previous period.

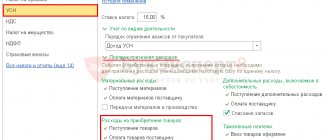

Tax accounting

The procedure for adjusting income and expenses for the previous year in tax accounting is regulated by Article 54 of the Tax Code of the Russian Federation:

Taxpayer organizations calculate the tax base at the end of each tax period on the basis of data from accounting registers and (or) on the basis of other documented data on objects subject to taxation or related to taxation.

If errors (distortions) are detected in the calculation of the tax base relating to previous tax (reporting) periods in the current tax (reporting) period, the tax base and tax amount are recalculated for the period in which these errors (distortions) were made.

(as amended by Federal Law dated July 27, 2006 N 137-FZ)

If it is impossible to determine the period of errors (distortions), the tax base and tax amount are recalculated for the tax (reporting) period in which the errors (distortions) were identified. The taxpayer has the right to recalculate the tax base and the amount of tax for the tax (reporting) period in which errors (distortions) relating to previous tax (reporting) periods were identified, also in cases where the errors (distortions) led to excessive payment of tax .

(paragraph introduced by Federal Law dated July 27, 2006 N 137-FZ, as amended by Federal Law dated November 26, 2008 N 224-FZ)

Thus, failure to reflect business transactions in the past period is an error that led to distortion of data for past periods. Therefore, upon receipt of supporting documents (clause 1 of Article 252 of the Tax Code of the Russian Federation) and in accordance with Art. 54, 272 of the Tax Code of the Russian Federation, by resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 09.09.2008 No. 4894/08:

- if the amount of income relating to the previous period increases, an updated tax return is submitted for the period to which the adjustment relates (paragraph 2, paragraph 1, article 54 of the Tax Code of the Russian Federation).

- when the amount of expenses related to the previous period increases, the taxpayer has the right to choose (paragraph 3, paragraph 1, article 54, paragraph 2, paragraph 1, article 81, subparagraph 3, paragraph 7, article 272 of the Tax Code of the Russian Federation, resolutions of the FAS North -Western District dated 06/05/2012 No. A44-3816/2011, dated 01/31/2011 No. A56-10165/2010, North Caucasus District dated 02/22/2012 No. A53-11894/2011, Moscow District dated 03/15/2013 No. A40-54227 /12-90-293, dated 08/14/2013 No. A40-110013/12-20-566, Ninth Arbitration Court of Appeal dated 03/26/2013 No. 09AP-6639/2013, letter of the Ministry of Finance of Russia dated 01/23/2012 No. 03-03-06 /1/24, dated 08/25/2011 No. 03-03-10/82, Federal Tax Service of Russia dated 03/11/2011 No. KE-4-3/3807): - submit an updated tax return for the period to which the primary accounting document relates; — or adjust the tax base in the current tax period (year).

At the same time, the taxpayer has the right to adjust the tax base of the current period only if, according to tax accounting data, the taxpayer has a profit in the period to which the error relates. If, according to tax accounting data, a loss is received, then there is no fact of excessive tax payment, therefore, an updated tax return is submitted (letters of the Ministry of Finance of Russia dated January 30, 2012 No. 03-03-06/1/40, dated October 5, 2010 No. 03-03- 06/1/627, dated 08/11/2011 No. 03-03-06/1/476, dated 03/15/2010 No. 03-02-07/1-105).

When carrying out the document “Adjustment of sales” (adjustment towards an increase in value) with an unspecified sign “Accounting for the previous year is closed for adjustment (reporting has been signed)”, postings to the NU are generated through account 90 by the date of the document being adjusted, that is, the date of the previous period:

Dt Kt 90.01.1 (NU) - by the amount of increase in cost

Dt 90.09 Kt 99.01 (NU) - financial result of adjustment

When posting the document “Adjustment of sales” (adjustment towards an increase in value) with the established sign “Last year’s accounting is closed for adjustment (reporting signed)”, the following entries are generated in NU:

Date of the document being adjusted:

Dt Kt 90.01.1 (NU) - by the amount of increase in cost

Dt 90.09 Kt 99.01 (NU) - financial result of adjustment

The date of the current period, that is, the date of the adjustment document:

Dt Kt 91.01.7 (PR) - by the amount of increase in cost

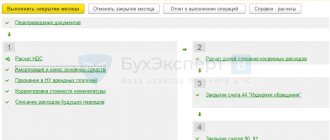

Thus, the developers of 1C are guided by the principle that accounting adjustments for previous periods in tax accounting should not affect (change) the tax base for the income tax of the current period. In cases provided for by law, documents can form accounting and tax accounting movements in the period in which the document being adjusted is drawn up. In this case, it may be necessary to re-reform the balance sheet and manually add additional income tax and penalties.

Do you still have questions about the program? The SITEK company will take care of solving 1C problems: consultations on working in the program, modifications, updating 1C and other services are provided by qualified specialists in the shortest possible time.

We invite you to familiarize yourself with our prices and tariff plans.

___________________________________________________________

Author of the article: Design Department Specialist Tatyana Izmestyeva. Article updated 09/11/2016

– the buyer of the product (goods) transfers payment for these products in cash. The basis for making the posting are: PKO, cash book, etc.

Debit 50 – Credit 62

– the buyer made an advance in cash for the upcoming delivery of finished products (goods) / performance of work / provision of services.

Turnover balance sheet

The internal accounting register, which contains information about interactions with buyers and customers, is the balance sheet (TCS). It is compiled for any period: day, month, quarter, etc.

Depending on the accounting requirements of the enterprise, the SALT can be generated both for each buyer and in general form. It is necessary for the timely recording and accumulation of data contained in primary documents, as well as for identifying errors in mutual settlements and eliminating them.

There is no single mandatory form of SALT account 62 for all organizations. Each organization itself can develop a form and approve it with internal documents in the Accounting Policy. Moreover, it must contain the details established by Part 4 of Art. 10 Federal Law dated December 6, 2011 No. 402-FZ:

- document's name;

- name of the organization keeping records;

- the period for which the document is drawn up;

- the amount of money turnover;

- grouping of accounting objects;

- positions of responsible persons and their signatures.

Example of filling out the OCB

entered into an agreement for the supply of containers for a confectionery factory. According to the terms of the contract, the company ships within three days after receipt of payment. In March, she made a payment in the amount of 160,000 rubles. Two days later the container arrived at the factory warehouse. The supplier's accountant made the following entries:

| the name of the operation | Debit | Credit | Sum |

| Advance payment received | 51 | 62.02 | 160 000 |

| The cost of shipped goods is written off | 90.02 | 41 | 120 000 |

| Revenue displayed | 62.01 | 90.01 | 160 000 |

| Settlement of advance payment | 62.02 | 62.01 | 160 000 |

| VAT accrued for payment | 90.03 | 68 |

The following entry will be made in the seller’s balance sheet for the month of March:

| Account/counterparties/ contracts | Balance at the beginning of the period | Period transactions | balance at the end of period | |||

| Debit | Credit | Debit | Credit | Debit | Credit | |

| Customer "Confectionery Factory" | — | — | 160 000 | 160 000 | ||

| TOTAL: | 160 000 | 160 000 | ||||

In the counterparties section, both regular and one-time clients are reflected. The opening balance takes into account all mutual settlements carried out before the start of the period with a specific customer. Turnover for the period is debit supplies and services rendered, as well as subsequent payments and credit advances. Amounts in SALT are recorded on the basis of primary documentation - payment documents, acceptance certificates, etc. The presence of a final balance indicates unfinished settlements with counterparties.

What does wiring Dt 62 kt 91.1 mean? What does the accounting entry Dt 62 kt 91.1 mean?

In this case, the return of an advance in cash previously received from the buyer is reflected using the posting “Debit 62 – Credit 50”.

Debit 50 – Credit 90-1

– cash received for sold products (goods, works, services) to the organization’s cash desk.

Debit 50 – Credit 91-1

– the cash desk received funds from the sale of other property of the organization, as well as other income.

Debit 50 – Credit 91-1

– positive exchange rate difference on cash foreign currency is included in other income.

Debit 51 – Credit 62

– the buyer of the product (goods) transfers payment for these products to a bank account. The basis for making a transaction is: a bank statement, a payment order upon receipt of the account, a supporting document (a copy of the invoice for payment).

Debit 51 – Credit 62

– the buyer made an advance payment to the bank account for the upcoming delivery of finished products (goods)/performance of work/provision of services. In this case, the return of the advance previously received from the buyer from the current account is reflected using the posting “Debit 62 – Credit 51”.

Debit 51 – Credit 90-1

– funds for sold products (goods, works, services) have been transferred to the organization’s bank account.

Debit 51 – Credit 91-1

– funds from the sale of other property, as well as other income, were credited to the current account.

Debit 51 – Credit 98-1

– non-cash funds were credited to the current account as deferred income.

Debit 52 – Credit 62

– the buyer of the product (goods) transfers payment for these products in foreign currency to a foreign currency account in the bank.

Debit 52 – Credit 62

– the buyer made an advance payment to a foreign currency account at the bank for the upcoming delivery of finished products (goods)/performance of work/provision of services. In this case, the return of an advance previously received from the buyer from a foreign currency account is reflected using the posting “Debit 62 – Credit 52”.

Debit 52 – Credit 90-1

– funds in foreign currency were received (for products, goods, works or services sold) to the organization’s foreign currency account.

Debit 52 – Credit 91-1

– funds from the sale of other property, as well as other income, were transferred to the foreign currency account.

Debit 52 – Credit 91-1

– included in other income is a positive exchange rate difference in foreign currency in the organization’s foreign currency bank account.

Debit 55 – Credit 62

– the buyer of the product (goods) transfers payment for these products to a special bank account.

Debit 55 – Credit 62

– the buyer made an advance payment to a special bank account for the upcoming delivery of finished products (goods) / performance of work / provision of services. In this case, the return of an advance previously received from the buyer from a special account is reflected using the posting “Debit 62 - Credit 55”.

Debit 55 – Credit 91-1

– funds from the sale of other property, as well as other income, were credited to the current account.

Debit 58 – Credit 98-2

– securities received free of charge are capitalized. The basis for making the transaction are: transfer agreement, securities certificates.

Debit 60 – Credit 91-1

– included in other income is the amount of outstanding accounts payable due to the expiration of the statute of limitations or impossibility of collection.

Debit 60 – Credit 91-1

– the positive exchange rate difference on receivables from suppliers in foreign currency is included in other income.

Debit 61 – Credit 91-1

– included in other income is the amount of outstanding advance received from buyers due to the expiration of the statute of limitations.

Debit 62 – Credit 46

– the cost of the stages of work performed, paid by the customer, is written off. Wiring is carried out upon completion of all work.

Debit 62 – Credit 90-1

– revenue received from the sale of products (goods, works, services).

Debit 62 – Credit 91-1

– included in other income is a positive exchange rate difference on accounts receivable from customers in foreign currency.

Debit 66 – Credit 91-1

– included in other income is debt on a short-term loan (loan) not repaid within the established period due to the expiration of the statute of limitations. The basis for making the posting is: credit agreement (loan agreement), form N INV-17 “Act of inventory of settlements with buyers, suppliers and other debtors and creditors.”

Debit 66 – Credit 91-1

– included in other income is a positive exchange rate difference on a short-term loan (loan) in foreign currency. The basis for making the posting is: credit agreement (loan agreement).

Debit 67 – Credit 91-1

– included in other income is debt on a long-term loan (loan) not repaid within the established period due to the expiration of the statute of limitations. The basis for making the posting is: credit agreement (loan agreement), form N INV-17 “Act of inventory of settlements with buyers, suppliers and other debtors and creditors.”

Debit 67 – Credit 91-1

– included in other income is a positive exchange rate difference on a long-term loan (loan) in foreign currency. The basis for making the posting is: credit agreement (loan agreement).

Debit 71 – Credit 91-1

– included in other income due to the expiration of the statute of limitations, debt to the accountable person that was not repaid within the prescribed period. The basis for making the posting is: advance report.

Debit 71 – Credit 91-1

– included in other income is a positive exchange rate difference on debt in foreign currency to an accountable entity that was not repaid on time due to the expiration of the statute of limitations. The basis for making the posting is: advance report.

Debit 73-1 – Credit 91-1

– included in other income are interest accrued on loans provided to employees of the organization.

Debit 73-2 – Credit 98-4

– the difference between the price of missing valuables recovered from the guilty parties and their value at which they appear in the documents is taken into account.

Debit 75 – Credit 91-1

– included in other income is a positive exchange rate difference on debt to the participant (founder) in foreign currency.

Debit 76 – Credit 91-1

– included in other income is a positive exchange rate difference on debt to third parties in foreign currency.

Debit 76 – Credit 98-1

– accrued income for future periods that is due to be received from other organizations.

Debit 76-2 – Credit 91-1

– included in other income are the amounts of recognized (awarded) penalties, fines and penalties that were accrued for violations of business contracts. The basis for making the posting is: a business agreement, a decision to award a fine, etc.

Debit 76-3 – Credit 90-1

– included in the proceeds from the sale of the amount of dividends and income on securities (financial investments). The posting is made if the receipt of such income is an ordinary activity of the organization. The basis for making the posting is: a report on accrued and paid (used) dividends on shares of the enterprise (joint stock company).

Debit 76-3 – Credit 91-1

– included in other income are accrued amounts of dividends that are due to be received by the organization.

Debit 76-4 – Credit 91-1

– deposited amounts are included in other income due to the expiration of the limitation period during which they are subject to collection.

Debit 79-3 – Credit 90-1

– included in sales revenue are income from the provision of property for trust management (in the accounting of the management founder). The posting is made if the receipt of such income is an ordinary activity of the organization.

Debit 79-3 – Credit 91-1

– included in other income are those incomes that were received from the provision of property for trust management (in the accounting of the management founder).

Accounting for advances received

Payment of goods and materials prior to their shipment or transfer is accounted for separately on account 62; subaccount 62.2 “Advances received” is usually used, while subaccount 62.1 “Settlements with buyers and customers” is used to account for receivables from buyers. In the balance sheet, advances received are included in accounts payable, that is, they are shown as a liability; it is impossible to show advances minimized from accounts payable. In addition, upon receipt of an advance payment, the supplier must charge VAT (clause 1 of Article 167 of the Tax Code of the Russian Federation).

Example:

In July, Pchelka LLC (buyer) and Vasilek LLC (seller) signed an agreement for the purchase of paving slabs worth RUB 944,590. In the same month, Pchelka LLC made a full prepayment. The following entries are made in the accounting of Vasilek LLC:

- Dt 51 Kt 62.2 - 944,590 rub. — an advance payment from Pchelka LLC has been received into the bank account;

- Dt 76 subaccount “VAT on advances received” Kt 68 subaccount “VAT” 157,431.67 rub. (944,590 × 20/120) - VAT is charged upon receipt of an advance payment.

In August, Vasilek LLC shipped all the paving slabs to the buyer and recorded the following entries:

- Dt 62.1 Kt 90 — 1,944,590 rub. — revenue accrued;

- Dt 90.3 Kt 68 subaccount “VAT” - 157,431.67 rubles. — VAT is charged on sales;

- Dt 68 subaccount “VAT” Kt 76 subaccount “VAT on advances received” 157,431.67 rubles. — previously accrued VAT on the prepayment received is accepted for deduction;

- Dt 62.2 Kt 62.1 - 944,590 rub. — the previously received prepayment has been offset.

2) Contribution to the authorized (share) capital, mutual fund

Account 91 “Other income and expenses” is used to display information on non-operating income and arising costs of the company for operations not related to normal activities.

Account 91 in accounting is used by legal entities to collect information on the company’s income and expenses that are not related to normal activities.

Sch.91 is considered to be active-passive. The loan displays information about income from the following operations:

- provision of temporary use of the company’s own assets (corresponds with the accounts of mutual settlements and funds);

- provision of patents, intellectual property products, etc. for a fee;

- participation in the authorized capital of third-party companies;

- sale of own equipment;

- surplus goods and materials identified during the inventory;

- write-off of expired accounts payable;

- interest paid by counterparties for loans and credits provided;

- exchange differences;

- profit of previous years accepted in the reporting period, etc.

Account debit – reflection of the company’s other expenses:

- bank commission costs;

- shortages and damage to products and goods and materials, for which the perpetrators have not been identified or there is a court conclusion refusing to reimburse costs;

- fines and penalties required to be paid due to violations of the terms of agreements with counterparties;

- charity;

- interest on loans and borrowings;

- costs associated with the write-off of fixed assets and other assets of the company (with the exception of cash);

- write-off of expired accounts receivable;

- legal costs;

- exchange differences;

- losses of previous years accepted in the reporting period, etc.

How to organize analytical accounting

In order to have more detailed information about mutual settlements with each buyer and customer, you need to keep analytical records: how much and when goods were shipped, how payment was made, whether there are debts.

On topic: what we reflect in line 1230 of the balance sheet: accounts receivable.

Currently, accounting is kept in computer accounting programs, which helps to easily conduct analytics both by subaccounts and by other criteria. Modern accounting automation is capable of collecting information on each customer, contract, invoice sent to the customer, payment method and term, etc. An accountant has the right to determine for himself how to build analytical accounting at an enterprise.

For your information . The most important information for a seller that analytics allows you to have is how much the buyer owes. Knowing this, you can properly build business relationships.

Subaccounts

For a detailed analysis of the organization’s emerging costs and recording the income received from operations not related to normal activities, the account provides for the opening of sub-accounts:

91.01 Information is collected on receipts recognized as income of the company, not related to ordinary activities (passive sub-account);

91.02 Information about the company’s expenses not related to ordinary activities (for example, expenses for bank services) - active subaccount;

91.09 This subaccount is the calculated financial result for transactions not related to the company’s normal activities.

Purpose of account 62

The account is intended to record information about transactions with counterparties purchasing its goods (work, services) from the organization.

As a general rule, account 62 reflects transactions on those products of the organization that relate to its main activities. To record one-time or atypical transactions for an organization, account 76 of the chart of accounts is intended (approved by order of the Ministry of Finance dated October 31, 2000 No. 94n). All the features of filling out the register for settlements with customers are given in the article Features of the balance sheet for account 62.

Dt 91 kt 76

To do this, the following conditions must be met:

there is confirmation of the company’s right to receive this revenue (existence of an agreement);

you can determine the full amount of revenue;

there is confidence that the company will receive economic benefits from this transaction: assets have been received as payment or there is confidence in their receipt in the future;

ownership of the sold products has been transferred to the buyer (the work has been completed and there is confirmation, for example, a document has been signed);

the costs associated with a given operation can be calculated.

The nuances of using subaccounts using the example: Dt 62.1 Kt 62.2

On account 62, analytical accounting should be provided according to the following parameters:

- According to issued invoices.

- For each counterparty.

- By groups of affiliated persons (with whom consolidated reporting should then be prepared).

- By payment characteristics (received prepayments, postpayments).

These tasks are solved, among other things, through the opening of sub-accounts to account 62.

Subaccounts are usually identified by an additional numeric coding of one or two characters added to the main account code. In the original chart of accounts, a unified standard for creating subaccounts for account 62 is not provided. But as a result of the widespread use of computer programs, assigning a subaccount code in practice is approximately the same.

For example:

- Account 62.1 (or 62.01 in most current versions of accounting programs) is assigned to account for postpaid settlements. When the goods have been shipped (services have been provided) but payment has not yet been received. The balance according to 62.1 is debit and means that the buyer (customer) owes the organization for the part of the transaction that it has already completed.

- Account 62.2 (or 62.02) is used to record received payments against future shipments (performance of work, provision of services). The balance is a credit balance and characterizes the size of the organization’s obligations to counterparties who have made prepayments for transactions.

Read more about accounting automation in the material “Review of programs for accounting expenses and income of an organization.”

Determination of other financial results

Information on sub-accounts for accounting for other income and expenses is accumulated during the reporting period. Each month, the debit balance of expenses is compared to the credit balance of the income subaccount. The result obtained is the financial result of non-operating activities - data from all sub-accounts will be reflected in one amount on sub-account 91.09. At the end of the month (closing operation), the financial result of the organization’s work from subaccount 91.09 is transferred to the debit or credit of account 99, respectively.

Read more about closing account 91 in accounting

Reflection of debt

First, you need to understand that there are two types of debt: receivables and payables.

A receivable arises under the condition that the products have been transferred to the buyer, but the fact of payment has not yet been made, i.e. the buyer enterprise is a debtor to the seller enterprise. Debtor companies in this case are called debtors.

Accounts payable are formed in a situation when a given organization has debts to other persons - creditors.

Today we will consider the possibilities of reflecting debt in accounting.

The buyer is considered a specific person who purchases any material assets or services. Regardless of who the buyer will be and with whom the transaction will be carried out, accounting is required. To do this, you need to use account 62 “Settlements with buyers and customers”. The price of goods sold is indicated including VAT.

Account 62 was created to account for both the assets and liabilities of the organization. An organization can also open the following sub-accounts:

- The first is necessary for taking into account calculations in general cases.

- The second is used when calculating using an advance payment.

- The third is for accounting for receipt of bills.

Funds received from the sale of a product or service are considered income from a standard type of activity, therefore the debit of account 62 corresponds with the credit of account 90 “Sales”. But there are also some nuances here: if sales do not appear as the main activity of the organization, then it is necessary to credit the funds received to account 91 “Other income and expenses.” It is necessary to calculate VAT on the price indicated at the time of sale and pay it. How is the buyer's debt reflected (posting)?

The company reflects the shipment of goods: Debit 62 Credit 90.1 or Credit 91.1. At this moment, buyers owe money for shipped products.

When the organization has transferred the goods, accordingly, the ownership right is also with the buyer, which means that the resulting debt needs to be reflected in accounting.

For example, the entry might look like this:

Debit 62 Credit 90-1 – reflection of debt for goods received;

Or:

Debit 62 Credit 91-1 – indicate sales revenue.

If certain services were performed, then the following entry must be made:

Debit 62 Credit 90-1 (or 91-1) – reflects the customer’s debt for work performed or services provided.

Accounting entries for main business transactions from account 91

- Inventory results:

Dt91.02 Kt94 – shortages in excess of the norms of natural loss; defect, the culprits of the damage have not been found or there is a court decision refusing compensation;Dt 10,41,20,43 Kt91.01 – capitalization of surplus inventory, goods, work-in-progress products, etc.;

- Revaluation of fixed assets:

Dt91.02 Kt01 – reduction in the cost of fixed assets. - Write-off of assets:

Dt91.02 Kt04.10 – intangible assets, materials in connection with the sale or write-off;Dt91.02 Kt08 – investments in non-current assets are recognized as other expenses in connection with their write-off, sale or partial liquidation.

- Exchange differences:

Dt91.02 Kt50,60,62 – negative exchange rate differences on cash in foreign currency, accounts payable, accounts receivable;Dt50,60,67,62,66 Kt91.01 – positive exchange rate differences.

- Financial result for other operations:

Dt91.09 Kt99 – profit;Dt99 Kt91.09 – loss.

- Write-off of expired debts:

Dt91.02 Kt60.62 – accounts receivable;Dt60.62 Kt91.01 – write-off of accounts payable.

- Interest on loans and borrowings:

Dt91.02 Kt66.67 – payment of interest to counterparties;Dt73 Kt91.01 – accrual of interest for the use of company funds by employees.

- Penalties and fines accrued to an organization for non-compliance with the terms of contracts:

- Receipts of funds for sold property of the company:

Victor Stepanov, 2017-12-04

Debt repayment

When, according to the contract, one party has already provided a service or transferred a product, then one should expect that the debt will be paid soon. In case of repayment of the debt, you must again turn to account 62, but in a different way. The credit to account 62 will reflect the payment from the counterparty. With the credit of account 62, you most often need to use the debit of accounts 50, 51, 52, 55. Cash accounting is carried out according to these accounts. Consequently, the posting of repayment of customer debt will be carried out as follows:

Debit 50 Credit 62 – receipt of payment.

This line indicates that the buyers' debt has been repaid, the money has been transferred to the seller's account, and the posting has been completed correctly.

Sometimes it is necessary to take into account not only the actual settlement after the transfer of ownership, but also such types of settlements as an advance or a bill of exchange.

Accounting for advances

An advance payment is a payment made for the purchased product before its actual receipt.

First you need to open a second sub-account, which reflects the advances received.

Receiving an advance payment is carried out as follows (Db - Debit, Kr - Credit):

Db 51 Kr 62-2 – Making an advance payment (including VAT).

To pay tax, you need to use account 76 with an open sub-account “VAT on advances”. This is done as follows:

Db 76/VAT on advances Kr 68 – Calculation of tax on advance payments

We transfer products:

Db 62-1 Kr 90-1 – reflection of actual revenue from the sale of goods.

It is necessary to charge VAT on the goods transferred to the client:

Db90-3 Kr 62-1 – VAT calculation

We take into account previously received funds:

Db 62-2 Kr 62-1 – Accounting for advances to pay off debts

We take into account VAT:

Db 68 Kr 76/VAT on advances – Acceptance for deduction of VAT on goods that were paid with an advance.

Accounting for bills received

Settlements between organizations do not always occur only directly in monetary amounts. Bills of exchange are often used.

A bill is a debt security that is drawn up in a prescribed form. There are different types of bills, but in this example we will be interested in a promissory note, according to which the drawer, without special conditions, undertakes to pay the specified amount to the holder of the bill. When using such a bill, there are only two parties involved: the one who is owed, and the one who owes.

To account for bills of exchange, you need to open subaccount 3 – “Bill of bills received”. After the actual sale of the product, the previously received bill of exchange is repaid. In general, the wiring looks like this:

Db 62 Kr 90.1 – revenue taken into account from the sale of goods.

Db 90-3 Kr 68/VAT – Calculation of tax on products sold.

Db 62-3 Kr 62-1 – Accounting for bills of exchange.

Db 51 Kr 62-3 – Repayment of a previously received bill.

Reflection on debit and credit

Account 62 is active-passive, which means that the balance can be formed by both debit and credit.

It is better to display the opening and closing balances of the reporting period in expanded form on subaccounts. This is due to the fact that:

- A debit balance means that the buyer has not yet paid for goods shipped or services rendered (accounts receivable).

- The loan balance shows that an advance has been made, but the goods have not yet been shipped or the work has not been completed.

Analysis of analytical accounting allows you to maintain detailed records of transactions for each client of the enterprise.

Reflection on debit and credit

Account 62 is active-passive, which means that the balance can be formed by both debit and credit.

It is better to display the opening and closing balances of the reporting period in expanded form on subaccounts. This is due to the fact that:

- A debit balance means that the buyer has not yet paid for goods shipped or services rendered (accounts receivable).

- The loan balance shows that an advance has been made, but the goods have not yet been shipped or the work has not been completed.

Analysis of analytical accounting allows you to maintain detailed records of transactions for each client of the enterprise.

Account 62 “Settlements with buyers and customers”

For more detailed coverage of the features of accounting for settlements with buyers and customers, you must refer to the Instructions for using the Chart of Accounts.

62 accounting account is usually debited for the amounts of submitted settlement documents in correspondence with the credit of accounts 90 “Sales”, 91 “Other income and expenses”, and credited for the amount of payment received in the debit of accounts 50 “Cash”, 51 “Settlement accounts”, etc. .

Analytical accounting for account 62 must be maintained for each invoice presented to customers, and when making payments using scheduled payments - for each buyer and customer. Analytical accounting of settlements with buyers and customers should be organized in such a way that it is possible to obtain data on settlements with such counterparties:

- according to payment documents for which the due date has not yet arrived;

- for settlement documents not paid on time;

- on advances received;

- on bills of exchange for which the due date for receipt of funds has not arrived;

- on bills discounted (discounted) in banks;

- on bills for which funds were not received on time.

Documentation of settlements with buyers and customers depends on the features and procedure for settlements with buyers, whether cash or non-cash payments are made to buyers. As a rule, such documents are invoices, acts, invoices, cash and sales receipts. For example, the rules for paying customers in cash usually require the issuance of only cash register receipts, and when making payments for goods delivered, organizations draw up delivery notes and, if the transaction is subject to VAT, invoices.

In the case of the creation of “doubtful” reserves, the debt of buyers in the balance sheet is reflected minus the created reserve (clause 35 of PBU 4/99).

However, it is impossible to answer unequivocally the question of whether settlements with buyers and customers are an asset or a liability. After all, according to settlements with buyers and customers, both accounts receivable (there is a shipment, but no payment) and accounts payable (when receiving advances) can be formed. In the first case, information on settlements with buyers and customers will be reflected in the balance sheet asset as part of accounts receivable, and in the second - in the liability side as part of short-term liabilities. The above means that accounting account 62 is an active-passive account.

In modern conditions, improving the accounting of settlements with buyers and customers comes down mainly to increasing the efficiency of data on settlements with buyers and speeding up the exchange of documents between counterparties. One of the elements in the development of the system of settlements with customers is the introduction of electronic document management.

Accounting entries for transferring balances from the 62nd to the 76th account

Using the account And the turnover and balance generated by the seller duplicate the buyer’s data. The information obtained is clearly used by the parties to the transaction when conducting reconciliations by drawing up reports. For the convenience of direct users of executives, managers, accountants, account 62 in the accounting department has analytics on counterparties, invoice documents, acts, contracts. Additionally, if necessary, you can classify mutual settlements: The main thing is to provide external and internal users with reliable and timely information. If the activity is carried out by a group of interconnected enterprises account 62, the postings are given below and are carried out separately in relation to such operations.

Osv 62 accounts

The formation of a balance sheet for account 62 in the accounting of an organization makes it possible to quickly monitor:

- the size of the batch of goods shipped to buyers and customers in monetary equivalent - receivables from counterparties;

- amounts of advances transferred by customers on account of future deliveries - the company's accounts payable to customers;

- mutual settlements with buyers and customers according to the terms of supply contracts (for example, partial payment in advance, final payment upon delivery, etc.);

- accounting errors in specialized software products.

The balance sheet of 62 accounts allows for operational monitoring of the company’s mutual settlements with buyers and customers. The report can be generated daily, broken down by counterparties, counterparties and agreements with them, and also provides for a more in-depth reading of data for each settlement document (advance payments or shipments of goods).

As a rule, according to the supply agreement, settlements with counterparties for the shipment of goods or the provision of services and performance of work are carried out in one of the following sequences:

- Postpayment (funds are transferred after the goods arrive at the warehouses, after the full provision of the agreed list of services);

- Prepayment (shipment of goods or performance of work is carried out after full payment);

- Mixed payments (partial advance payment, final payment after receipt of assets).

In the company's accounting, all settlements with buyers and customers regarding the purchase of inventory, provision of any services (including utilities) and work are displayed on account 62.

This account is active-passive and can have a debit or credit balance depending on the calculations made (the accounting displays all supplies or services rendered, regardless of the order in which funds are transferred for them).

Data is entered on the basis of closing documentation in correspondence with the corresponding accounts for accounting for shipped goods (43.41, etc.), cash (50.51, etc.).

For a detailed analysis of the account, it is possible to open additional sub-accounts:

62.02 – accounting for advance payments received by the organization on account of future shipments;

62.01 – accounting of settlements with buyers and customers according to the terms of the supply agreement.

Addition from the author! It is possible to open additional sub-accounts for keeping records of settlements in foreign currency.

Formation of SALT according to account 62

The generated balance sheet is a table indicating counterparties and settlements with them:

Balance sheet for account 62 Account Balance at the beginning of the period Turnover for the period Balance at the end of the period

| Counterparties | Debit | Credit | Debit | Credit | Debit | Credit |

| Treaties | ||||||

| Documents of settlements with the counterparty | ||||||

| Total |

Statement structure:

- Name of counterparties – buyers and customers. All counterparties are displayed here, both under permanent supply contracts and one-time transactions. The balance at the beginning of the formed period determines the amount of the organization's debt for previously made supplies (debit balance) and advance payments received (credit opening balance).

- Settlements with counterparties arising during the period under review are displayed in the turnover column: credit - payments received, debit - shipment of products to customers, provision of services, performance of work (displayed only on the basis of the generated closing documentation - TORG-12, act of provision of services, UPD, etc. .d.).

- The ending balance indicates unfinished settlements with counterparties and allows you to quickly monitor document flow and received payments.

balance sheet for account 62 to be filled out in Excel.

Formation of Osv 62 accounts in 1C

When maintaining accounting records in specialized 1C software products, it is possible to generate a detailed statement that will separately display all advance payments received, customer debt for shipped goods, and settlements in foreign currency.

Note from the author! In accounting programs, situations arise when, when generating a report on subaccounts, the same amount is displayed on different subaccounts. This error can be corrected by re-entering the documents in the correct sequence.

If the restoration did not lead to the correction of the error, then you should pay attention to the established settlement rules according to the agreement: automatic offset of payments or linking payments to specific documentation.

This error must be corrected, since the information affects the reliability of the financial statements (lines 1230, 1520).

The period for the formation of the balance sheet for settlements with buyers and customers is determined in an arbitrary interval depending on the purposes of monitoring (from one business day to several years), therefore SALT is one of the most convenient ways to check mutual settlements with counterparties (it is possible to create an interim report on to a specific buyer repeating the data of the reconciliation report).

The procedure for creating a report in 1C:

- In the menu, select Reports – Account balance sheet;

- Determine the period of interest and select the account for which the report will be generated (it is possible to generate a statement separately for each subaccount);

- Select report detailing: analysis of individual buyers and customers or detailed monitoring of all settlement documents for each counterparty;

- Create a statement and analyze the results.

Something to keep in mind! The SALT data for account 62 must fully correspond to the card for this account and the general SALT for all accounting accounts of the organization.

Case Study

Limited Liability Company "Yakor" entered into a supply agreement for the shipment of a batch of auto parts to its regular customer "Verona" LLC. The total price under the contract is 45 thousand rubles (including VAT 18% 6864 rubles 40 kopecks). According to the agreement of the parties, payment is made by transferring funds in full to the bank account of Yakor LLC 4 working days before the goods are shipped from the warehouse.

Accounting entries for business transactions in the accounting of Anchor LLC

- Dt51 Kt62.02

45 thousand rubles - funds received from Verona LLC - Dt90.02.1 Kt41

25 thousand rubles. – the cost of shipped goods is written off. - Dt62.02 Kt62.01

45 thousand rubles - offset of the received advance payment. - Dt62.01 Kt90.01.1

45 thousand rubles - the received revenue of Anchor LLC is displayed. - Dt90.03 Kt68.02

6864.40 rub. – VAT payable to the budget has been accrued