What changed

Government agencies received another reason to transfer subsidies. Budgetary institutions can reimburse their expenses for COVID-19 from targeted funds. They were also allowed not to cut expenses if the state task was not fulfilled due to the pandemic. In addition, both budgetary and autonomous institutions keep accounting for subsidies according to the new rules.

New for authorities. Regional government agencies can transfer subsidies to non-subordinate budgetary and autonomous institutions. This applies to targeted subsidies to prevent the deterioration of the economic situation, as well as to prevent and eliminate the consequences of coronavirus. The new rules are in force from April 1, 2022 (Part 9 of Article 2.1 of the Law of November 12, 2019 No. 367-FZ). Read the recommendations on which KVR and KOSGU to transfer subsidies to non-subordinate institutions.

New for Federal Agencies . Institutions that have suffered due to the coronavirus pandemic can spend government funds on priority expenses, regardless of the volume of government services provided. The remaining subsidies do not need to be returned, but rather pay salaries, transfer taxes, contributions, pay for utilities, protective equipment and disinfection. The new rules are effective from May 23, 2022. More details>>

In addition, targeted subsidies can be used to reimburse such expenses, including those paid through paid activities. Budgetary institutions were given the right to borrow money from other sources before receiving the targeted subsidy. The new rules will come into force on July 23, 2022. More details>> Previously, only autonomous institutions could borrow against targeted subsidies. Read the recommendations on how to carry out internal borrowing before the targeted coronavirus subsidy arrives.

New for all budgetary and autonomous institutions. From January 1, 2022, institutions reflect subsidies using new analytics codes, and also use the GHS “Revenue” in accounting. Compare the 2022 and 2022 analysis codes for all subsidies in the table.

| Type of subsidy | 2020 | 2019 |

| Subsidy for other current purposes Subsidy for other capital purposes Subsidies for capital investments | 150 “Gratuitary cash receipts” | 180 “Other income” |

| (Clause 12.1.5 of the Procedure for applying BCC No. 85n) | (Clause 12.1.7 of the Procedure for applying BCC No. 132n) |

Income from subsidies for government tasks of the institution is classified as income from sales. Reflect these incomes in accounting:

- on the day of signing the subsidy agreement - as part of deferred income;

- on the day when the state task was fulfilled - as part of current income.

Grants and targeted subsidies are classified as income from non-exchange transactions. Reflect them:

- in deferred income – on the day the agreement is signed;

- in the income of the current period - as the terms of the agreement are fulfilled.

Read in more detail when to recognize subsidies for government tasks, grants and targeted subsidies according to the GHS “Revenues”. The Ministry of Finance provided recommendations for accounting for subsidies in a letter dated 02/04/2020 No. 02-06-07/6939. Download standard entries for accounting for subsidies for budgetary and autonomous institutions.

Cases of misuse of subsidies

If we analyze the recent judicial practice, we can see that inspectors most often note the following cases as misuse of subsidies:

Payment for work (services) not provided for in the subsidy agreement and (or) government assignment.

In the Resolution of the Ninth Arbitration Court of Appeal dated June 21, 2016 No. 09AP-23860/2016 in case No. A40-1215/16, a claim was considered on the legality of bringing a budgetary institution to liability under Art. 15.14 of the Code of Administrative Offenses of the Russian Federation for misuse of subsidy funds.

From the case materials. Based on the results of an inspection carried out by Rosfinnadzor, an offense committed by the institution was recorded under Art. 15.14 of the Code of Administrative Offenses of the Russian Federation: the institution misused federal budget funds (subsidies), expressed in payment for voluntary vehicle insurance services (CASCO), the costs of which were not provided for in the subsidy agreement, as well as in the state assignment.

The institution was found guilty of committing an administrative offense, liability for which is provided for in Art. 15.14 Code of Administrative Offenses of the Russian Federation. The administrative penalty imposed on the institution is the minimum amount - in the form of an administrative fine in the amount of 5% of the amount of funds used for other purposes.

The court of first instance found that the agreement on the provision of a subsidy for the implementation of a state task established the obligation of the institution to use such a subsidy for the purpose of providing public services (performing work) in accordance with the requirements for quality and (or) volume (content), the procedure for providing public services (performing work ), defined in the state task. In case of non-fulfillment or improper fulfillment of obligations specified in the agreement, the institution is liable in accordance with the legislation of the Russian Federation.

Since the provision of voluntary vehicle insurance (CASCO) services is not provided for by the state task and agreement, these services could not be paid for using subsidies from the federal budget.

The Court of Appeal recognized the findings of the trial court as legal and reasonable.

The Decision of the Privolzhsky District Court of Kazan dated 02.02.2017 in cases No. 12-133/2017, 12-134/2017 (hereinafter referred to as Decision No. 12-133/2017) considered a dispute about the legality of payment from subsidies for state assignments for other services – legal advisory services.

From the materials presented to the court, the following can be seen. As part of the state assignment, an autonomous institution carries out activities to provide services and perform work in the field of education. By virtue of the agreement on the procedure and conditions for providing subsidies for state assignments, the institution undertakes to use subsidies for the purpose of providing public services (performing work) in accordance with the requirements for quality and (or) volume (content), the procedure for providing public services (performing work), defined in the state assignment .

The institution’s state assignment does not include consulting and legal services. In terms of the financial and economic activities of the institution, payment for consulting and legal services is not provided. All this indicates that the provision of consulting and legal services was not carried out within the framework of the state assignment of the institution. In addition, the costs of consulting and legal services were not necessary to ensure the performance of the functions of the institution.

Based on the above, it can be argued: the institution committed a violation in the use of subsidies allocated for the implementation of a state task, which was established by an inspection of the Treasury Department and reflected in the inspection report. Officials of the institution were brought to administrative responsibility under Art. 15.14 of the Code of Administrative Offenses of the Russian Federation for misuse of subsidy funds.

According to the inspectors, payment for legal services should be made from extra-budgetary funds available to the institution.

The court found the inspectors' conclusions to be justified.

Payment for unfulfilled work (services).

Let's consider the Decision of the Court of the Khanty-Mansiysk Autonomous Okrug dated 02/02/2017 in case No. 7-122/2017 (hereinafter referred to as Decision No. 7-122/2017). In it, for the second time, the case of an administrative offense, expressed in the misuse of subsidy funds, was reviewed.

According to the case materials, the capital repairs of the building were paid for using a targeted subsidy. The legal basis for the transfer of funds to the contractor (work performer) was the work acceptance certificate (form KS-2), signed by an official of the institution. During the inspection, it turned out that the work specified in this act was not actually completed by the contractor, therefore the actions of the official who signed the act resulted in the misuse of subsidy funds. In connection with the above, this employee of the institution was fined under Art. 15.14 Code of Administrative Offenses of the Russian Federation.

The court found the actions of the inspectors to be justified, and the guilt of the official in committing an administrative offense was proven. At the same time, the fact of reducing the institution’s obligations to the contractor by the amount of uncompleted work by terminating the contract was not taken into account.

In addition, the judges noted that for the administrative offense provided for in Art. 15.14 of the Code of Administrative Offenses of the Russian Federation, it has no legal significance for what specific purposes budget funds were allocated, provided that it is proven that these funds were allocated by their recipient unreasonably. In the case considered, the court found the signing of the act and the transfer of funds under it unjustified, since the work was not actually completed.

Maintenance of property not owned by the institution.

It is impossible to say unequivocally whether an institution’s expenses for the maintenance of property that does not belong to it, made at the expense of a subsidy for a government task, are recognized as misuse of funds. As a general rule, a subsidy provided from the budget for the implementation of a state task supports property assigned to the institution or acquired by it at the expense of the founder (clause 11 of Regulation No. 640, clause 6 of Article 9.2 of the Law on Non-Profit Organizations). At the same time, when calculating the subsidy, other standard costs for maintaining property that are directly related to the provision of services (performance of work) may be taken into account.

Thus, when inspectors make a decision on misuse of subsidy funds, conclusive evidence must be provided that the expenses incurred by the institution are not related to its core activities. Otherwise, the inspector’s decision can always be challenged in court, and there is every chance that the court will side with the institution. To confirm this, we cite Resolution of the Supreme Court of the Russian Federation dated October 21, 2016 No. 7-AD16-2.

This court considered a dispute about the illegality of bringing an institution to administrative responsibility for the misuse of budget funds, which resulted in the allocation of subsidy funds for a state task for the maintenance of property that does not belong to the institution. Despite the fact that the property was not assigned to the institution, the latter provided the court with evidence that the costs of its maintenance were regular expenses directly related to the provision of services carried out within the framework of a government assignment. Taking into account such evidence, the court declared the decision of the inspectors on the misuse of budget funds and the decision to impose administrative liability unlawful.

Accounting with the founder

Select the section you need from the list.

| Subsidies for government tasks | Subsidies for other purposes |

| Grants in the form of subsidies | Subsidies for capital investments |

| Budget reporting |

SUBSIDIES FOR GOVERNMENT ASSIGNMENTS

Transfer the subsidy for government tasks based on the agreement. If the institution has not completed the task or has not completed it in full, it will return the remainder of the subsidy to the budget. The institution will reflect the scope of execution in the report on the state task.

Transfer subsidies to budgetary institutions according to KVR 611, to autonomous ones - according to KVR 621. The KOSGU code will always be 241. In accounting, reflect the LBO for subsidies, obligations assumed to institutions, as well as settlements with them for the transfer of subsidies and return of balances.

If the deadline for the report on the state task falls on the next year, the institution will submit a Notice (f. 0504805) in December of the reporting year. This is necessary to reflect interrelated settlement entries in the accounting of the founder and the institution.

More on the topic

All clarifications on accounting for subsidies for government tasks

- How to form a state task

- KVR and KOSGU for subsidies for government tasks

- Postings for subsidies for government tasks and return of the balance

- How to monitor the implementation of government tasks and accept reports

- When to generate a Notice (f. 0504805) regarding subsidies

- In what cases can a subsidy to an institution be reduced?

SUBSIDIES FOR OTHER PURPOSES

Transfer targeted subsidies to institutions on the basis of a contract or agreement. To authorize expenses, approve information on subsidies for each institution (f. 0501016). After using the grant, the institution will provide an expense report. Unused balance and inappropriate expenses will be returned to the budget.

Transfer subsidies for other purposes to subordinate budgetary institutions according to KVR 612, to autonomous ones - according to KVR 622. Depending on the purpose of the subsidy, use KOSGU codes 241 and 281. In accounting, reflect the LBO for subsidies, obligations assumed to institutions, as well as settlements with them for the transfer of subsidies and return of balances.

If the deadline for the subsidy report falls on the next year, the institution will submit a Notice (f. 0504805) in December of the reporting year. This is necessary to reflect interrelated settlement entries in the accounting of the founder and the institution.

More on the topic

All clarifications on accounting for subsidies for other purposes

- How to provide a targeted subsidy to a budgetary or autonomous institution

- How to check and approve Information on transactions with targeted subsidies (f. 0501016)

- KVR and KOSGU for targeted subsidies to subordinate institutions

- KVR and KOSGU for subsidies to non-subordinate institutions

- Postings for targeted subsidies and return of balances

- When institutions must submit a Notice (f. 0504805)

GRANTS IN THE FORM OF SUBSIDS

Provide grants based on the results of a competition between institutions. The basis is an agreement concluded with the winner.

Transfer grants in the form of subsidies to budgetary institutions according to KVR 613, to autonomous ones - according to KVR 623. Depending on the purpose of the grant, use KOSGU codes 241 and 281. In accounting, reflect the LBO for subsidies, obligations assumed to institutions, as well as settlements with them for the transfer of subsidies. The postings are the same as for targeted subsidies.

More on the topic

All clarifications on accounting for grants

- KVR and KOSGU for grants in the form of subsidies

- Postings for grants and targeted subsidies

- When institutions must submit a Notice (f. 0504805)

CAPITAL INVESTMENT SUBSIDIES

Provide subsidies for capital investments on the basis of an agreement. If, after the purchase or construction of real estate, the institution has an unused balance of the subsidy, the institution will return it to the budget. To authorize capital investment costs, approve information on subsidies for each institution (f. 0501016).

Reflect subsidies according to CVR group 410. Apply KOSGU depending on the economic content of expenses - 222, 224, 226, 296, 310, 330, 340, etc. In accounting, reflect LBO for subsidies, obligations assumed to institutions, settlements with them for subsidies, as well as the OCI indicator in the account 204.33.

If the deadline for the subsidy report falls on the next year, the institution will submit a Notice (f. 0504805) in December of the reporting year. This is necessary to reflect interrelated settlement entries in the accounting of the founder and the institution.

More on the topic

All clarifications on accounting for subsidies for capital investments

- How to conclude a capital investment subsidy agreement with an institution

- KVR and KOSGU for subsidies for capital investments

- Entries for capital investment subsidies

- Is it necessary to certify Information on transactions with targeted subsidies (f. 0501016) for subsidies for capital investments

- How to check and approve Information (f. 0501016)

- When institutions must submit a Notice (f. 0504805)

BUDGET REPORTING

Settlements with subordinate institutions for subsidies and grants should be reflected in the Debt Information (f. 0503169). Reflect obligations for subsidies and grants in the Report (f. 0503128). Reflect the return of subsidies from previous years from institutions in the Cash Flow Report (f. 0503123) and the Budget Execution Report (f. 0503127).

More on the topic

All clarifications on reporting

- How to reflect in the Information (f. 0503169) settlements with institutions for subsidies

- The procedure for filling out the Report on Budget Obligations (f. 0503128)

- How to reflect the return of subsidies from previous years in the Report (f. 0503123)

- How to reflect the return of subsidies from previous years in the Report (f. 0503127)

Return of remaining subsidies from previous years

Depending on the purpose of spending the funds, the return of funds to the budget or another source is reflected in different ways:

| By capital expenditure |

|

| For current expenses |

|

Accounting in institutions

Select the section you need from the list.

| Subsidies for government tasks | Subsidies for other purposes |

| Grants in the form of subsidies | Subsidies for capital investments |

| Financial statements | Borrowing subsidies |

SUBSIDIES FOR GOVERNMENT ASSIGNMENTS

Reflect the subsidy in accounting based on an agreement with the founder. If you do not complete the task or do not complete it in full, return the remainder of the subsidy to the budget. The amount of the return will be determined by the founder based on the state assignment report.

Reflect subsidies using analytics code 130 and KOSGU code 131. Reflect calculations on account 205.31 “Calculations for income from the provision of paid services (work)” according to KFO 4.

If the deadline for the report on the state task falls on the next year, give the founder a Notice (f. 0504805) in December of the reporting year. This is necessary to reflect interrelated settlement entries in the accounting of the founder and the institution.

More on the topic

All clarifications on accounting for subsidies for government tasks

- Analytics and KOSGU codes for subsidies for government tasks

- Accounting for subsidies for government tasks

- Accounting for the return of subsidies for government tasks to the budget

- Typical transactions for subsidies

- How to submit a report on the use of subsidies for government tasks

- In what case should the remaining subsidies for government tasks be returned to the budget?

- For what purposes should savings from government subsidies be used?

- Is it possible to pay off last year’s creditor using a subsidy for the current year’s government task?

- When to generate a Notice (f. 0504805) regarding subsidies

- Example of a Notice (f. 0504805) to the founder about closing settlements for subsidies

- How to reflect the purchase of a fixed asset from two sources: subsidies and paid activities

SUBSIDIES FOR OTHER PURPOSES

Reflect targeted subsidies in accounting based on a contract or agreement. To authorize expenses, provide information about subsidies to TOFK (f. 0501016). After using the subsidy, provide the founder with an expense report. Return unused balances and non-target expenses to the budget.

Reflect subsidies using analytics code 150. Depending on the purpose of the subsidy, use KOSGU codes 152 and 162. Reflect calculations using KFO 5 on accounts 205.52 and 205.62.

If the subsidy report is due in the next year, give the founder a Notice (f. 0504805) in December of the reporting year. This is necessary to reflect interrelated settlement entries in the accounting of the founder and the institution.

More on the topic

All clarifications on accounting for subsidies for other purposes

- Analytics and KOSGU codes for targeted subsidies

- Accounting for targeted subsidies

- Accounting for the return of balances of targeted subsidies to the budget

- How to reflect in accounting the return of a targeted subsidy due to paid activities

- Typical entries for subsidies

- How to submit a report on subsidies for other purposes

- When to return unused balances of targeted subsidies to the budget

- Which BCC should I use to return the remaining subsidy?

- When can subsidy savings be used for other purposes?

- When to generate a Notice (f. 0504805) regarding subsidies

- How to generate Information on transactions with targeted subsidies (f. 0501016)

GRANTS IN THE FORM OF SUBSIDS

Grants will be provided if you win a competition between institutions. The basis is an agreement concluded with the government agency that organizes the competition.

Reflect grants in the form of subsidies using analytics code 150. Depending on the purpose of the grant, use KOSGU codes 152 and 162. Reflect calculations using KFO 5 on accounts 205.52 and 205.62. The postings are the same as for targeted subsidies.

More on the topic

All clarifications on accounting for grants

- Analytics and KOSGU codes for grants in the form of subsidies

- Accounting for grants in the form of subsidies

- Typical entries for subsidies

- Should I take into account bonuses accrued from the grant when calculating vacation pay?

CAPITAL INVESTMENT SUBSIDIES

Subsidies for capital investments should be reflected in accounting based on the agreement. To authorize expenses, provide information about subsidies to TOFK (f. 0501016). After using the subsidy, register the property and provide the founder with a report on expenses. Return unused balances and non-target expenses to the budget.

Grants in the form of subsidies are carried out using analytics code 150 and KOSGU code 162. Calculations are reflected in account 205.62 “Calculations for capital receipts to budgetary and autonomous institutions from the public administration sector” according to KFO 6.

If the subsidy report is due in the next year, give the founder a Notice (f. 0504805) in December of the reporting year. This is necessary to reflect interrelated settlement entries in the accounting of the founder and the institution.

More on the topic

All clarifications on accounting for subsidies for capital investments

- Analytics and KOSGU codes for subsidies for capital investments

- Accounting for capital investment subsidies

- Accounting for capital investment objects

- Accounting for the return to the budget of balances of subsidies for capital investments

- Typical entries for subsidies

- How to submit a capital investment subsidy report

- How to return the balance of the subsidy for capital investments to the budget

- Which BCC should I use to return the remaining subsidy?

- Should I compile Information (f. 0501016) on subsidies for capital investments?

- When to generate a Notice (f. 0504805) regarding subsidies

- How to generate Information on transactions with subsidies (f. 0501016)

- How to transfer capital investments due to subsidies under KFO 6 into property under KFO 4

BORROWING SUBSIDIES

When there is a temporary shortage of money for one type of financial support, institutions borrow their own funds internally from other sources. There are three options for institutions to use money:

1. Within one personal account. For example, when there is not enough subsidy for a government task to pay a creditor under KFO 4, you can use funds at temporary disposal under KFO 3.

2. From another personal account. For example, before the targeted subsidy under KFO 5 is received in a separate personal account, the creditor can be paid through paid activities under KFO 2 from another personal account. Budgetary institutions were granted this right in 2022. More details>>

3. Within the total cash balance in the cash register.

More on the topic

All clarifications on borrowing subsidies

- How to borrow internally before the targeted coronavirus subsidy arrives

- Which entries should reflect the borrowing within the total balance - on the personal account or at the cash desk between KFO 2, 3 and 4

- What transactions should be used to reflect borrowing between different personal accounts - according to KFO 5 and KFO 2, 4

- Is it possible to carry out internal borrowing of government funds under KFO 4

- Is it possible to borrow money from other sources if the founder transfers the subsidy for other purposes late?

FINANCIAL STATEMENTS

Reflect unused balances of subsidies in the Balance Sheet (f. 0503730) in the lines for accounts 205.00 and 201.11. If you return balances to the budget, reflect the transactions in the Report on the Execution of the FHD Plan (f. 0503737) and in the Cash Flow Report (f. 0503723). Disclose information about activities financed by targeted subsidies in the Information (f. 0503766).

More on the topic

All clarifications on reporting

- How to reflect the balance of the targeted subsidy in the Balance Sheet (f. 0503730)

- How to reflect the return of the balance of last year’s subsidy to the budget in the Report (f. 0503737)

- How to reflect the return of the balance of last year’s subsidy to the budget in the Report (f. 0503723)

- How to compile Information on the implementation of activities within the framework of subsidies for other purposes and for capital investment purposes (f. 0503766)

Providing subsidies from the budget

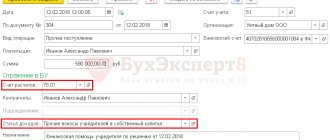

1. The receipt of a subsidy from the budget to the personal account of the institution is reflected in the menu “Cash” - “Settlement and payment documents” by the document “Cash Receipt” based on the Extract from the personal account. Based on the document, the following accounting entries are generated:

DT 4.201.11.510 – KT 4.205.31.661

DT 4.17.01.131

DT 4.508.10.131 – CT 4.507.10.131 – reflects the implementation of the current year’s plan for income in the form of a subsidy for the completion of the task.

Responsibility for violations

Responsibility is provided for violations in the provision and use of subsidies. To avoid misuse, review expenses in three stages: during planning, during execution and during audit.

More on the topic

All liability clarifications

- Responsibility for misuse of subsidies

- Responsibility for violations in the provision of subsidies

- How to independently check the legality of using subsidies

- Cases when state control reveals non-targeting

- How to independently check the effectiveness of subsidies

- What is the penalty for failure to fulfill government orders?

- Under which BCC should compensation for damage due to non-targeting be transferred to the budget?

Irtaeva E.P.

The chief accountant should not pay a fine for “non-targeting” if the director is charged with the same offense

This conclusion is given in Decision No. 12-133/2017. According to the case materials, in an autonomous educational institution, representatives of the Treasury Department conducted an audit of the correct use of subsidy funds provided to the institution to carry out a state task. During the audit, the misuse of these funds was established: the subsidy was used to cover expenses (payment for legal services) that were not provided for by the state assignment and were not necessary to ensure the performance of the functions of the institution.

Based on the results of the inspection, administrative liability is imposed under Part 1 of Art. 15.14 of the Code of Administrative Offenses of the Russian Federation, officials were involved who signed documents on payment of these expenses: the acting director of the institution and the chief accountant. Having disagreed with the decision, chief accountant S. filed a complaint with the court.

In court, she explained: despite the fact that she has the right to sign financial documents, decisions on all financial issues are made by the head of the institution, without whose signature these documents are invalid. In addition, the charter of the institution was presented to the court, in one of the paragraphs of which it is stated that the director bears personal responsibility for violation of the budgetary legislation of the Russian Federation, the state of the financial and economic activities of the institution, the use of allocated budgetary and other funds.

According to the explanations of the chief accountant, payment for the disputed services was made on the basis of a concluded contract and an act of services rendered, which were signed by the director of the institution within his competence and in accordance with the provisions of the institution’s charter.

Taking into account the above arguments and evidence, the chief accountant's complaint was satisfied. Since she did not have the sole ability to manage the subsidy funds, the court found that there was no need to prosecute two officials for committing the same administrative offense. In this regard, the court canceled the auditors’ decision regarding the chief accountant on the basis of clause 7, part 1, art. 24.5 of the Code of Administrative Offenses of the Russian Federation (that is, it terminated the proceedings in connection with the presence of a resolution on the imposition of an administrative penalty against another official for the same fact of committing illegal actions).