Difference between new and used car

Depending on whether a car is purchased new or used, the act is drawn up by the accountant of the purchasing company or the seller of the car:

| New car | Used car |

| As usual, a dealer or showroom issues an invoice when selling a car, but does not deal with acceptance and transfer acts, so the responsibility falls on the buyer. | It makes sense to ask the seller to draw up the act. He will have to indicate in it information from the accounting system and data for calculating depreciation in the accounting system. This information includes:

You can accept UPD from the seller with the caveat that the data mentioned above will be indicated separately in the document. |

If you do not receive information about the useful life of a used car, all that remains is to accept it as equal to the useful life of a new vehicle, the values of which, of course, are not equal. This will significantly increase the company's costs and lead to incorrect calculations of depreciation and other indicators, and, as a result, to claims from tax inspectors.

The initial cost of the car consists of:

- the amount spent on the purchase of a car;

- expenses incurred during the purchase.

Costs related to purchasing a car

- State duty for traffic police services for car registration To avoid problems with the tax service, it is better to add the amount of the duty to the original cost of the car. The tax claims are related to the fact that money is written off over a long period of time, through depreciation expenses. In the case of a one-time attribution of expenses to other expenses, the company underestimates the income tax.

- Vehicle modernization. The tax inspectorate calls any addition to a car a modernization, since this will not change the characteristics and purpose of the car (and it doesn’t matter whether the car is new or used). There is an option for additional accounting. equipment costing more than 40 thousand rubles as an independent fixed asset. Or you can recognize an expense in the current period if the replenishment cost less than 40 thousand. However, designing a heater in this way can cause controversy because connecting it changes the characteristics of the car.

- Input VAT. VAT specified by the seller is also paid separately from the original cost. It is legal to take it into account as an expense under general conditions.

- Loan interest. In cases where the car was purchased with borrowed money, the overpayment on the loan is not included in the original cost. It is included in the lists of expenses as a percentage of any other debts, and the interest is necessarily normalized (the write-off occurs within the limits of the refinancing rate, multiplied by a coefficient of 1.8).

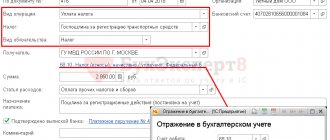

Registering a car with the traffic police

As already mentioned, the organization must register it with the State Traffic Safety Inspectorate of the Ministry of Internal Affairs of Russia within five days after purchasing the car.

For state registration of vehicles and other registration actions with vehicles, payment of a state fee is provided in the following amount: - for issuing state registration plates for vehicles - 400 rubles; – for issuing state registration plates for motor vehicles and trailers – 200 rubles; – for issuing a vehicle passport – 100 rubles; – for issuing a vehicle registration certificate – 100 rubles. After registration, the organization receives a vehicle registration certificate, state license plates, a technical passport of the vehicle with a state registration mark. In accounting, the costs of registration with the traffic police will be attributed to the increase in the initial cost of the fixed asset. However, this will only happen if payments are made before the car is accepted for accounting on account 01.

There are two points of view on the issue of reflecting such expenses in tax accounting. According to the tax authorities, the initial cost of a fixed asset should be determined as the amount of expenses for its acquisition, construction, production, delivery and bringing it to a state in which this fixed asset is suitable for use. But, since a car cannot be allowed to participate in road traffic without registration with the traffic police, payments for such registration form the initial cost of the car and represent costs associated with bringing the fixed asset to a condition in which it is suitable for use.

The Ministry of Finance of the Russian Federation adheres to a different one, based on the provisions of paragraphs. 1 clause 1 art. 264 of the Tax Code of the Russian Federation, points of view: other expenses associated with production and sales include amounts of taxes and fees accrued in the manner established by the Tax Code. State duty refers to federal taxes (Clause 10, Article 13 of the Tax Code of the Russian Federation), and the costs of its payment are included in other costs associated with sales.

So, both positions are based on the norms of the Tax Code, in paragraph 4 of Art. 252 of which it is stated that if some expenses with equal grounds can be attributed simultaneously to several groups of expenses, then the taxpayer has the right to independently determine which group he will assign such expenses to.

This means that taxpayers have the right to decide for themselves whether to include the fee for registration with the traffic police in the initial cost of the car or take it into account as part of other expenses. They must consolidate their choice in accounting policies for tax purposes.

But it should be taken into account that if an organization in tax accounting decides to attribute the state fee for registration to other expenses, and in accounting includes these amounts in the initial cost of a fixed asset, then temporary differences will arise in accounting in accordance with the Accounting Regulations “Accounting” income tax expenses" (PBU 18/02), approved. By Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n.

Useful life of the vehicle

During the SPI, it is legal to write off the original cost of the car. For new cars, the terms are standardized according to the established Classification of Fixed Assets:

Important! Try to choose the minimum specified SPI, this will help you write off the cost of buying a car in the shortest possible time.

Difficulties arise with the SPI of used cars, it is calculated using the formula:

- SPI used = SPI of a similar new car - the period of operation by the previous owner.

A used SPI is included in the same depreciation group as the previous owner had it. It is better to charge depreciation, even if you have less than a year left to use the car. When a car was purchased from an individual who is not engaged in business, SPI is determined as based on new fixed assets that appeared.

Organizational property tax

Organizations that have property recognized as an object of taxation in accordance with Art. 374 of the Tax Code of the Russian Federation are recognized as tax payers (clause 1 of Article 373 of the Tax Code of the Russian Federation).

A car purchased by an organization, recorded on the organization’s balance sheet as an item of fixed assets in accordance with the established accounting procedure, on the basis of clause 1 of Art. 374 of the Tax Code of the Russian Federation is recognized as an object of taxation by the property tax of organizations.

The specifics of taxation for used property have not been determined. According to paragraph 1 of Art. 375 of the Tax Code of the Russian Federation, the tax base for a tax is defined as the average annual value of property recognized as an object of taxation, unless otherwise provided by Art. 375 Tax Code of the Russian Federation.

In this case, the organization will not be able to use the provisions provided for in paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, a benefit on the basis of which movable property (including a car), registered by an organization since 2013 and recorded as fixed assets, is not subject to corporate property tax, since this benefit does not apply to cases of acquisition of such objects from interdependent persons (see, for example, letter of the Ministry of Finance of Russia dated August 30, 2017 N 03-05-05-01/55522).

Accordingly, the purchased car is subject to corporate property tax in accordance with the generally established procedure.

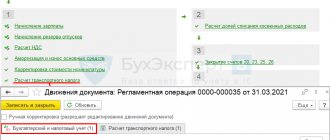

Calculation of depreciation on a purchased car

To correctly calculate depreciation, you need to have knowledge of two indicators:

- depreciation start date;

- SPI, during which the initial cost is written off.

| In accounting | In tax accounting |

| Depreciation begins on the first day of the month following the month the vehicle was registered as part of the operating system. To be clear, depreciation is calculated even for vehicles that are not used, if they are fit for use. | Depreciation is controlled from the first day of the month following the month when the car was actually used. Proof that this particular month was the month of start of use will be the date indicated in the act of putting the car into operation. |

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Consultations of auditors » Purchase of a car on lease. Accounting and tax accounting.

Question:

Our organization purchased a car on lease. The car must be accounted for according to the agreement on the balance sheet of the lessee (i.e. us).

Under the leasing agreement, according to the payment schedule, we paid an advance in the amount of 359,680 rubles, after receiving the car we received a certificate and invoice for this amount (lease payment for the temporary use of property) and then must pay monthly in the amount of 18,150-65 rubles. before payment of the amount of 766541-90 rubles. A one-time payment was also paid - consulting services in the amount of 17,700 rubles. The cost of registration with the traffic police is 2200 rubles. The lessor's costs for purchasing this car are 576,915 rubles.

We ask you to consistently describe the accounting and tax accounting entries, including VAT, the initial cost of the car and depreciation in accounting and tax accounting. Do we have the right to apply acceleration factor 3 in accounting and tax accounting?

The specialists of Accounting LLC answer:

Accounting

If, under the terms of the leasing agreement, the leased asset is taken into account on the balance sheet of the lessee, the value of the leased property is reflected by him in the debit of account 08 “Investments in non-current assets” in correspondence with the credit of account 76 “Settlements with various debtors and creditors”, subaccount 76-5 , for example, “Rental obligations”. The initial cost of leased property accepted for accounting is debited from account 08 to the debit of account 01 “Fixed assets”, subaccount, for example, 01-2 “Property received on lease” (paragraph 2 of clause 8 of the Instructions on reflecting operations on leasing agreement approved by Order of the Ministry of Finance of Russia dated 02.17.1997 N 15, Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated 31.10.2000 N 94n).

The initial cost of property is formed based on all costs associated with its acquisition, with the exception of VAT and other refundable taxes (clause 8 of PBU 6/01).

Thus, the lessee must determine the initial cost of the leased property in the amount of the total amount payable under the lease agreement, minus VAT (other refundable taxes). We emphasize that if, according to the terms of the contract, the redemption price is separated from the leasing payments, it must also be taken into account when forming the initial cost of the property. In this case, the lessee prepares an accounting entry:

debit 08 “Investments in non-current assets” credit 76 “Settlements with various debtors and creditors.”

In addition, before the leasing object is put into operation, the lessee may incur additional expenses directly related to the receipt of the leased property. These may be delivery costs, customs payments (customs duties, customs duties), etc. Therefore, the initial cost also includes all costs of the lessee associated with obtaining the property, which were not included in the price of the leasing agreement (paragraph 2, clause 8 of the Instructions). In the case under consideration, consulting services increase the initial cost of the leased property by 17,700 rubles.

The accrual of the monthly lease payment is reflected in the debit of account 76, subaccount 76-5, in correspondence with account 76, subaccount, for example, 76-6 “Debt on leasing payments” (paragraph 2 of clause 9 of the Instructions).

In the situation under consideration, the amount of the monthly lease payment is 18,150.65 rubles, including VAT of 2,768.74 rubles. At the same time, 359,680 rubles. The lessee pays in advance after concluding the leasing agreement.

Note that the listed advance is not recognized as an expense of the lessee and is accounted for as part of accounts receivable in subaccount 76-6 with a separate reflection in analytical accounting (clauses 3, 16 of the Accounting Regulations “Organization Expenses” PBU 10/99, approved by Order of the Ministry of Finance Russia dated 05/06/1999 N 33n).

In addition, in this case, the lessee organization monthly accrues depreciation on the leased asset accepted on the balance sheet (clause 17 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n, clause 50 Methodological guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n).

The accrual of depreciation charges for an object of fixed assets begins on the first day of the month following the month in which this object was accepted for accounting, and stops on the first day of the month following the month of full repayment of the cost of this object or the writing off of this object from accounting (clause p. 21, 22 PBU 6/01). In this case, an accounting entry is made to the debit of account 20 “Main production” and the credit of account 02 “Depreciation of fixed assets”.

The legislation on accounting does not contain requirements for the mandatory registration of motor vehicles with the State Traffic Safety Inspectorate for the purposes of their acceptance for accounting.

The specified registration is also not mandatory for the start of operation of the car, since, as stated above, the purchased car can participate in road traffic (i.e. actually be used) without registering it with the State Traffic Safety Inspectorate during the validity period of the “Transit” registration plate or for five days after purchase.

In the event of a temporary interruption in the use of a vehicle put into operation (including due to late registration of the vehicle with the traffic police (clause 12 of the Basic Provisions for the admission of vehicles to operation and the duties of officials to ensure road safety)), no entries in the accounting records is not produced.

As for the amounts of state duties paid when registering a car with the State Traffic Safety Inspectorate, due to the fact that these state duties are paid after the vehicle is put into operation, they are not included in the actual costs of purchasing the car (paragraph 7, clause 8 of PBU 6/01). . Paid state duties are reflected as expenses for ordinary activities (clause 5 of PBU 10/99).

Value added tax (VAT)

If, under the terms of the leasing agreement, the leased asset is taken into account on the balance sheet of the lessee, then the total amount of VAT payable under the agreement to the lessor is reflected when the property is received by the organization in the debit of account 19 “Value added tax on acquired assets” and the credit of account 76, subaccount 76- 5.

The organization has the right to accept the specified amount for deduction as it receives invoices from the lessor (clause 1, clause 2, article 171 and clause 1, article 172 of the Tax Code of the Russian Federation).

In this case, the contract provides for an advance payment in the amount of 359,680 rubles. The lessee who has transferred the prepayment to the lessor can deduct VAT from the prepayment amount (clause 12 of Article 171 of the Tax Code of the Russian Federation). The specified tax deduction is made in the presence of an invoice issued by the lessor upon receipt of the prepayment, a payment document confirming the transfer of the prepayment amount, and an agreement providing for the transfer of the prepayment (clause 9 of Article 172 of the Tax Code of the Russian Federation).

As lease payments are accrued, the corresponding amount of VAT accepted for deduction from the transferred prepayment is subject to restoration (clause 3, clause 3, article 170 of the Tax Code of the Russian Federation).

Corporate income tax

The advance amount transferred to the lessor is not recognized as an expense in tax accounting (Clause 14, Article 270 of the Tax Code of the Russian Federation).

For profit tax purposes, there is a special procedure for forming the initial cost of leased property, which differs from the procedure used in accounting (paragraph 3, paragraph 1, article 257 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated November 21, 2008 N 03-03-06/1 /645).

If, under the terms of the leasing agreement, the leased asset is taken into account on the balance sheet of the lessee, it includes the leased asset in the appropriate depreciation group (clause 10 of Article 258 of the Tax Code of the Russian Federation). In this case, the initial cost of the property that is the subject of leasing is recognized as the amount of expenses of the lessor for its acquisition, construction, delivery, production and bringing it to a state in which it is suitable for use, with the exception of amounts of taxes subject to deduction or taken into account as expenses in accordance with Tax Code of the Russian Federation (clause 1 of Article 257 of the Tax Code of the Russian Federation). It is necessary to obtain from the lessor data on the amount of actual costs for the acquisition of this fixed asset. In this case, the initial cost of the fixed asset item for the purpose of calculating income tax is 488,911 rubles. (RUB 576,915 - RUB 88,004 (provided that the question indicates the costs of purchasing the car by the lessor, including VAT).

In this case, the lessee's expenses associated with the delivery of the fixed asset received under the leasing agreement, bringing it to working condition, payment for consulting services, etc., are not taken into account in the initial cost of such an object. This position is set out in Letters of the Ministry of Finance of Russia dated 02/03/2012 N 03-03-06/1/64, dated 01/20/2011 N 03-03-06/1/19. Moreover, officials propose to take into account such expenses not at once, but in equal parts during the term of the leasing agreement in accordance with the rules of paragraph. 3 p. 1 art. 272 of the Tax Code of the Russian Federation (Letters of the Ministry of Finance of Russia dated July 27, 2012 N 03-03-06/1/363, dated February 3, 2012 N 03-03-06/1/64, dated October 19, 2011 N 03-03-06/1/ 677). The courts also come to the conclusion that such costs are not included in the initial cost of the fixed asset (Resolutions of the Federal Antimonopoly Service of the North-Western District dated October 2, 2009 N A56-41978/2008, FAS Ural District dated October 16, 2008 N F09-7442/08-C3) .

Thus, consulting services in the amount of 17,700 rubles. must be written off in tax accounting in equal parts during the term of the leasing agreement.

As in accounting, in tax accounting the lessee has the right to apply a special increasing coefficient to the basic depreciation rate, but not higher than 3 (clause 1, clause 2, article 259.3 of the Tax Code of the Russian Federation) (except for fixed assets of groups 1 - 3).

Accrual of depreciation begins on the 1st day of the month following the month the fixed asset object was put into operation, and stops on the 1st day of the month following the month when the cost of this object was completely written off or when this object was removed from the depreciable property by on any grounds (clause 4 of article 259, clause 5 of article 259.1 of the Tax Code of the Russian Federation).

In addition to depreciation deductions, monthly expenses in the form of lease payments are recognized in the tax accounting of the lessee minus the amount of depreciation on the leased property accrued in accordance with Art. Art. 259 - 259.2 of the Tax Code of the Russian Federation (paragraph 2, paragraph 10, paragraph 1, article 264, paragraph 3, paragraph 7, article 272 of the Tax Code of the Russian Federation).

As for the state fees paid when registering a car, they are included in other expenses on the date the obligation to pay them arises (clause 1, clause 1, article 264, clause 1, clause 7, article 272 of the Tax Code of the Russian Federation).

As depreciation is accrued in the accounting records of the lessee and expenses are recognized in tax accounting in the manner established by Chapter. 25 of the Tax Code of the Russian Federation, temporary differences and corresponding deferred tax assets and liabilities, accounted for according to the rules of PBU 18/02, may arise.

Rationing of fuels and lubricants

Previously, the Ministry of Finance proposed rationing fuel and lubricants for correct tax accounting, but at the moment the financial department has recognized this as a right of organizations, not an obligation, due to the absence of such requirements in the tax code. Based on the foregoing, an enterprise registered for tax purposes under a simplified form of taxation can take into account the amounts spent on fuel and lubricants in full or within the limits of the norms.

If it was decided to use the standards, then you need to know that they may not coincide with the standards of the Ministry of Transport. The data reflected in the technical documentation of the machine manufacturer is suitable. Or there is an opportunity to identify your own indicators based on measurements and calculations carried out at the enterprise. Local tax authorities may still require compliance, so you will need to be able to defend your position.

The purchased fuel is credited to account 10 “Materials” subaccount “Fuel”. The write-off is carried out on the basis of data from waybills and receipts for the purchase of fuel and lubricants in full upon the fact. Cost accounts: 20, 26, 44, 91... It is also recommended to have a separate sub-account for the purchase of fuels and lubricants in excess of the standards.

Mandatory civil liability insurance

The organization is obliged to insure its civil liability no later than 5 days from the date of ownership.

Insurance rates for compulsory insurance are established by Decree of the Government of the Russian Federation dated December 8, 2005 No. 739. These amounts will not be included in the initial cost of the car. In the accounting of an organization, the costs of obtaining a compulsory civil liability insurance policy are taken into account as part of expenses for ordinary activities. The policy is usually issued for a period of one year; in the future it is subject to renewal. Costs incurred by the organization in the reporting period, but related to the following reporting periods, “are subject to write-off in the manner established by the organization (uniformly, in proportion to the volume of production, etc.) during the period to which they relate.” Thus, the cost of insurance is taken into account as part of the expenses of future expenses, and then written off monthly as expenses of the reporting period during the policy period in the manner prescribed in the accounting policies of the organization for accounting purposes. In tax accounting, the costs of compulsory insurance are classified as other expenses within the limits of insurance tariffs approved in accordance with the legislation of the Russian Federation (clause 3 of Article 263 of the Tax Code of the Russian Federation). If the terms of the insurance contract “provide for payment of the premium in a one-time payment, then under contracts concluded for more than one reporting period, expenses are recognized evenly over the term of the contract in proportion to the number of calendar days of the contract in the reporting period.” Therefore, in order to avoid the occurrence of differences and the need to apply PBU 18/02, it is advisable to reflect in accounting the procedure for writing off such expenses similar to the procedure in tax accounting.

Example An organization purchased a car on October 10, 2006. On October 14, an employee of the company issued an MTPL policy; its validity period was: October 14, 2006 – October 13, 2007. The cost of insurance was 12,045 rubles. The accounting policy provides for the same procedure for writing off expenses for both accounting and tax accounting (that is, in proportion to the number of calendar days of the agreement in the reporting period).

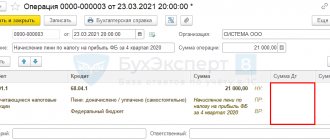

Let's calculate the amount of insurance expenses in tax accounting.

For one calendar day, insurance costs will be: 12,045 rubles. / 365 days = 33 rub.

In the fourth quarter In 2006, part of the cost of the policy must be recognized as an expense (from October 14 to December 31, that is, 79 days).

Amount of expenses for the fourth quarter. 2006 will be 2607 rubles. (33 rub. x 79 days);

for the first quarter 2007 (90 days) – 2970 rub. (33 rub. x 90 days);

for the second quarter 2007 (91 days) – 3003 rubles. (33 rubles x 91 days);

for the third quarter 2007 (92 days) – 3036 rubles. (33 rubles x 92 days);

for the fourth quarter 2007 (13 days) – 429 rubles. (33 rub. x 13 days).

Accounting entries for October 2006:

Debit 71 Credit 50 – 12,045 rub. – the employee was given money from the cash register to purchase an MTPL policy.

Debit 76 Credit 71 – 12,045 rub. – the employee purchased a compulsory motor liability insurance policy.

Debit 97 Credit 76 – 12,045 rub. – the MTPL policy is included in deferred expenses.

Debit 20 (25, 26, 44) Credit 97 – 594 rub. (33 rubles x 18 days) – the cost of the MTPL policy for October 2006 was included in expenses.

Typical mistakes in accounting for a purchased car

Mistake #1. Refusal to charge depreciation in cases where the SPI of a used car is less than one year old.

Such actions may cause disputes with the tax office. Even if the car was used by the previous owner for quite a long time, and the new owner will have to use the car for a short period of time, depreciation should still be calculated. Inspectors will find discrepancies if the machine has been used longer than expected.

Mistake #2. In the case when the purchased used car is fully depreciated, the company independently calculates the useful life and deliberately underestimates it in order to write off the cost of the car as quickly as possible.

This cannot be done, since in the future the tax inspector will notice that the car was used for a longer period, which means depreciation was calculated incorrectly. This would mean that taxes were underestimated improperly.

Mistake #3. Payment of transport tax by the enterprise on a rented car.

TN must be paid by the owner of the car (paragraph 1 of Article 357 of the Tax Code of the Russian Federation), not by the lessee, unless the car is registered to a company for leasing. But even for a rented car, an environmental tax must be taken into account, since it is paid by the user of the vehicle.

Primary means: before registration with the traffic police or after?

Without registering a vehicle in the prescribed manner with the State Traffic Safety Inspectorate, operating the vehicle on the roads is prohibited.

In accordance with clause 3 of the Decree of the Government of the Russian Federation of August 12, 1994 No. 938 “On state registration of motor vehicles and other types of self-propelled equipment on the territory of the Russian Federation,” owners of vehicles or persons on behalf of the owners who own, use or legally dispose of vehicles, are obliged to register them in the prescribed manner or change their registration data with the traffic police. Do this during the validity period of the “Transit” registration plate or within 5 days after the acquisition, customs clearance, deregistration of vehicles, replacement of license plate units or the occurrence of other circumstances requiring a change in registration data. Consequently, if a car is not purchased for resale and it is expected to participate in road traffic, then the organization is obliged to register the vehicle with the traffic police. However, registration of a car is not a prerequisite for accepting an asset for accounting as an item of fixed assets. Moreover, the car can actually be used for a certain period of time (during the validity period of the “Transit” registration plate) without registration. Therefore, according to the author, in order to register a car on account 01, you do not need to wait until it is registered with the traffic police. This fact is important for calculating property tax if the purchase of a car and its registration were carried out in different reporting (tax) periods (for example, they purchased a car in December, but registered it only in January).

On the other hand, one cannot fail to take into account another point of view, according to which, before registering a vehicle with the traffic police, the car does not meet all the conditions for recognition as a fixed asset, since it is not ready for use and cannot bring economic benefits.

The question of the date of acceptance of the car for registration is important for obtaining the right to a tax deduction for VAT. Input VAT on a purchased car is accepted for deduction only after the fixed asset is reflected in account 01, subject to the conditions established by Art. 171, 172 of the Tax Code of the Russian Federation, namely:

- VAT is presented on the territory of the Russian Federation or paid when importing goods into the territory of the Russian Federation;

- the car was purchased to carry out transactions subject to VAT;

- the VAT amount is presented on the basis of the invoice.

If an organization accepts VAT as a deduction before registering a vehicle with the State Traffic Safety Inspectorate, there is a risk that the tax authorities will refuse the deduction.

Judicial practice on this issue has developed in favor of taxpayers, but in order to avoid a dispute with regulatory authorities, it is better to still accept VAT as a deduction after registering the car with the traffic police. In addition, without disputes with the tax authorities, in tax accounting the car is included in the depreciable property only after commissioning, which is possible only after the registration of the vehicle with the traffic police is completed. Therefore, in accounting, it will be advisable to accept a car for accounting after its timely registration (Letter of the Office of the Ministry of Science of the Russian Federation for Moscow dated May 12, 2004 No. 26-12/32341.

Since the situation regarding the moment of accepting a car for accounting as an object of fixed assets is not regulated by law, the organization should define this issue in its accounting policies for accounting purposes.

When accepting a car for registration, you need to draw up an OS-1 act on the acceptance and transfer of fixed assets and open an inventory card in the OS-6 form, approved. Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7 “On approval of unified forms of primary accounting documentation for accounting of fixed assets.”