Commission composition and functionality

The members of the commission are the enterprise accountant and those employees who are responsible for ensuring the safety of the operating system. The main functionality of the commission is as follows:

- conducting an inspection of the asset that is being prepared for disposal, determining whether it can be used for some more time, as well as determining the feasibility of its restoration;

- determining the reason for the need to write off a fixed asset (this could be wear and tear, improper operation of the facility, accident, emergency, etc.);

- establishing a list of persons involved in the unscheduled early disposal of fixed assets. If the guilt of specific individuals is established, the commission makes proposals for disciplinary sanctions;

- determining the possibility of using individual components, parts, or any components of an object that is planned to be deregistered. These individual parts of the fixed asset must be valued at market value;

- if the main asset that is being disposed of contains metals (non-ferrous or precious), then the commission is obliged to monitor the process of their withdrawal, weigh them and put them in a warehouse;

- At the end of all procedures, the commission draws up a write-off act.

Important! According to the law, an organization has the right to create a commission not only upon disposal of fixed assets, but also upon disposal of any other assets (inventory, financial investments, etc.). The commission can be created for each group of assets separately, or there can be one that will be used for different purposes.

Rules for drawing up an order for writing off fixed assets

It is mandatory that an order be drawn up taking into account certain standards.

In this case, you need to take into account a package of documentation that will allow you to legally carry out the planned procedure. In each case, the order to write off a fixed asset is the most important document.

Regardless of the reasons for the planned procedure, a specially created commission must meet and conduct the necessary checks in order to confirm that the asset will no longer be profitable for the organization.

The commission always includes employees of the enterprise . The obligatory persons are: an accountant, as well as an employee who is responsible for the safety of the company’s property.

The composition of the full commission must be approved by the head of the enterprise.

The order provides the basis for further activities.

It is expected that members of the commission will conduct special inspections and assess the condition of the property, determine the possibility and feasibility of restoring the property.

After this, the reasons for further liquidation will be determined.

It is mandatory to identify all elements used as individual spare parts for the company’s business activities.

If the unsuitability of the operating facility has been confirmed by specialists, the manager must confirm this fact in a special order, which will allow measures to be taken to liquidate the fixed asset with the correct execution of the relevant act.

Why else can you create a commission?

In addition to carrying out the procedure for writing off fixed assets, a commission can be created for other purposes, in particular, in order to analyze how effectively other assets are used in the enterprise.

For example, calculating the performance level of an asset. Such a study could be carried out by a commission created to consider the need to sell assets. Or a commission can be created for the purpose of acquiring assets and properly processing the purchase.

Even the calculation of the period during which an object can be operated by an organization can be made by a commission specially assembled for this purpose. There can be very, very many areas of functionality. For any purpose within the framework of using the company’s assets, you can create a commission.

This is especially true when the organization does not know who should make this or that decision - for example, the car can no longer be used - what to do with it, who should decide it, how to formalize it. In this case, we assemble a commission and document all decisions with acts. During inspections, the organization will definitely not receive any complaints from supervisory authorities.

The procedure for writing off fixed assets

The procedure can only be performed in certain situations.

Regardless of the reason, the procedure for writing off fixed assets must be followed.

It should be noted that the movement of any type of property between different structures of one organization does not constitute a disposal.

See this article about the procedure for calculating and calculating depreciation of fixed assets.

In addition, upon completion of the operation of the property due to reconstruction or installation of additional equipment, the fact that the item has been removed from the account does not occur.

If the value of the object is lost or the property cannot guarantee income for the enterprise, evidence of changes in a certain part of the accounting must occur.

The event that occurs must be reflected in the income and expenses of the enterprise.

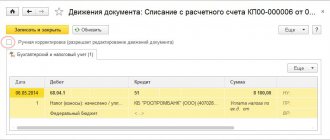

Focusing on the debit of account 91, it is necessary to reflect that the residual value of the equipment has been disposed of, as well as all subsequent expenses due to the procedure.

In this case, the loan must take into account the amount of depreciation, possible income from the sale of property or renting it out.

In order for the necessary procedure to be carried out legally, you should open not only account 01, but also a sub-account that will perform a certain task immediately.

Account 99 “Profits and losses” should be a direct reflection of all expenses of the enterprise.

For what period is the commission created?

The organization has the right to resolve this issue independently. The commission can operate on an ongoing basis, or it can be created for one-time situations, for a specific request.

Leaving it “permanently” makes sense if there is something to load it with. But if situations requiring the participation of a commission are rare, then it is more logical to create it on a temporary basis to resolve a specific issue.

The procedure for creating a commission and the specifics of its work are determined not only by the requirements of the law, but also by the specifics of each specific organization, the nature and scale of its activities. The work of commissions in an organization can be carried out on the basis of regulations being developed, which provide for issues of authority and responsibility of commission members.

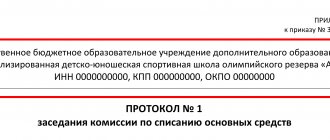

Drawing up an order to create a commission

There are no predefined and mandatory order forms. This is always an administrative act, drawn up in any form, but with the inclusion of a number of mandatory elements in the text.

Our users have the opportunity to download a standard template for an order for a commission on fixed assets and familiarize themselves with a sample of how to fill it out. During the filling process, you will need to enter the following information into the template:

- date and place of drawing up the order;

- serial number of the order in accordance with internal numbering;

- Business name;

- number of commission members;

- Full name and position of the chairman and secretary of the commission;

- deadline for creating the commission;

- tasks of the commission;

- manager's signature.

The appointed members of the commission familiarize themselves with the order against signature.

Reflection in accounting policies

As a rule, the presence of a commission and its functionality are prescribed in the accounting policy of the enterprise. To do this, it is enough to create an application to the accounting policy. What needs to be reflected in it:

- indicate which documents the commission is guided in its activities (for example, the Federal Law “On Accounting”, instructions for using the chart of accounts, etc.);

- stipulate that the composition of the commission will be approved by order of the head;

- determine the presence of a chairman and his functions.

The accounting policy can immediately reflect how often the commission will meet - for example, you can indicate that meetings are held as needed, but at least once every six months (absolutely any period can be specified at the discretion of the manager).

An important point that also needs to be highlighted is the number of commission members present at the meeting at which it is considered to have taken place and at which the commission is generally competent to make a decision (most often, this is two-thirds of the total number of participants).

If there is such a need, then experts and specialists in specific fields can be invited to the meeting. They are included on a voluntary basis. The employee who is the financially responsible person for the object that is on the disposal agenda cannot be involved as an expert.

How an order to write off fixed assets is created - an example and sample filling

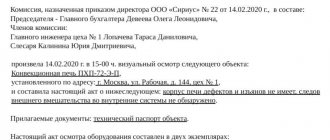

When writing off an asset, an enterprise must act sequentially, alternating the following steps:

- A commission is created for the disposal of fixed assets, which is approved by order of the head of the organization.

The order specifies a list of participants, among whom should be the chief accountant and persons to whom the objects are assigned. The commission checks how the OS works and whether it can be repaired; determines the reasons for departure; establishes which parts can be reused, etc.

Attention! Sample from ConsultantPlus See a sample order to create a commission for writing off fixed assets from K+. Trial access to K+ is free.

- The commission draws up its conclusion after checking the OS.

- Based on the commission’s findings, the manager makes a conclusion on further actions with the asset and signs an order for write-off or partial liquidation.

The guidelines do not indicate the need for an order. They require the creation of a single document - a write-off act, which is approved by all participants in the process: the commission and the manager. However, for example, the unified form of the OS-4 write-off act provides for an indication of the basis for its preparation. In addition, an order to write off fixed assets may be requested by the tax authorities to confirm the costs of writing off fixed assets. The Ministry of Finance also supports the execution of the order in its letter dated 07/09/2009 No. 03-03-06/1/454.

To make it easier for site users to understand what such an order is, ConsultantPlus experts gave an example of this document. You can order the write-off of fixed assets for free by receiving a trial demo access to the K+ system:

The given example of an order to write off fixed assets - a sample shows that drawing up such an order does not present any great difficulties. However, in order not to think about the content of the document again in future work, we recommend that you draw up your own sample order for writing off fixed assets and store it in templates.

- Based on the order, an act on write-off of the fixed assets is drawn up.

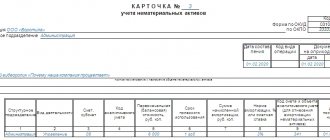

Standard forms of acts are provided:

- OS-4 - upon disposal of one OS (not for vehicles);

- OS-4a - upon disposal of vehicles;

- OS-4b - upon disposal of the OS group (not for vehicles).

These documents were approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7, but they are not mandatory. An organization can use primary documents developed independently, subject to compliance with the requirements for their preparation (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). The act must be approved by the manager.

- Based on the act, notes are made in the OS inventory card and entries in accounting.

If the OS is transferred into the ownership of other owners, then the documentary basis for its write-off is the acceptance certificate.

Order for commission on fixed assets sample and drafting example

ORDER N ____ FOR THE COMMISSION ON FIXED ASSETS

In connection with __________________________________________ (specify reasons)

I order: 1. Create a permanent commission consisting of: 1.1. The chairman of the commission is ________________________________________. 1.2. Deputy Chairman of the Commission - ______________________________. 1.3. Members of the commission: — ___________________________________________________________________; (position, full name) - ___________________________________________________________________; (position, full name) - ___________________________________________________________________; (position, full name) - ___________________________________________________________________. (position, full name)

2. Assign the following responsibilities to the commission: - inspection of fixed assets subject to write-off; — establishing the reasons for the write-off of objects (physical and moral wear and tear, reconstruction, violation of operating conditions, accidents, natural disasters and other emergencies, long-term non-use of the object for the production of products, performance of work and provision of services, or for management needs); — determination of the possibility of further use of individual components, parts, materials of written-off fixed assets and their assessment based on the prices of their possible use.

3. List of fixed assets that need to be inspected by the commission: - ___________________________________________________________________; — ___________________________________________________________________; - ___________________________________________________________________.

4. Based on the results of the commission’s inspection of the specified objects, draw up an expert opinion of the commission members and draw up an act for writing off fixed assets.

5. Conduct an inspection and submit the inspection results within _____________.

6. The write-off act, approved by the head of the organization, together with the technical documentation for fixed assets, is subject to transfer to the accounting department of the organization.

7. The following persons should be familiarized with the order: — ___________________________________________________________________; (position, full name) - ___________________________________________________________________; (position, full name) - ___________________________________________________________________; (position, full name)

Manage the organization: _______________ ___________________________ (personal signature) (signature transcript)

M.P.

"____" ______________ 20__

AGREED (indicate all interested parties and their signatures) ___________________________________________________________________; (position, full name) _______________ ___________________________ (personal signature) (signature transcript)

"____" ______________ 20__

FAQ

Who should be on the write-off committee?

The composition of the commission for writing off fixed assets is determined by order and approved by the head of the enterprise.

The commission for write-off of assets is headed by a chairman - a representative of the management team.

Among the members of the commission there is usually a person responsible for the storage of fixed assets, as well as a representative of the accounting department.

The responsibilities of the commission include not only identifying fixed assets that are not suitable for further use, but also establishing the reasons for write-off (moral or physical wear and tear, breakdown, etc.), drawing up the necessary documents, including an act for writing off fixed assets.

Forms for writing off fixed assets

Currently, forms for writing off fixed assets allow you to determine the reasons and goals of the event:

- sale of an object in order to generate profit for the company;

- liquidation _ This circumstance may be due to various emergency situations, including accidents, natural disasters;

- transfer to another enterprise;

- transfer of an object to other persons . In this case, funds are not taken into account, so payment does not occur.

Transfer under contracts that indicate a donation.