Based on the degree of use, fixed assets are divided into:

- in operation;

- in stock (reserve);

- under repair;

- at the stage of completion, additional equipment, reconstruction, modernization and partial liquidation;

- on conservation.

Fixed assets are reflected in accounting at their historical cost. The initial cost of a fixed asset is the amount of actual costs for its acquisition or creation. The balance sheet indicates only their residual value (the original cost minus the depreciation accrued on them).

Regulatory regulation of commissioning

Federal Law dated December 6, 2011 N 402-FZ defines accounting

Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 N 7 establishes unified documents

Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n approves the Regulations on accounting and reporting in the Russian Federation

Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n PBU 6/01

Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n approved the chart of accounts

Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n regulates accounting through methodological instructions

Decree of the Government of the Russian Federation dated January 1, 2002 N 1 provides the classification of fixed assets for the purpose of depreciation

The Tax Code of the Russian Federation, Part 2, determines the initial cost of more than 100,000 rubles for tax purposes

How to reflect business operations for major repairs that are carried out by contract?

Repair is the elimination of an OS malfunction to maintain it in working condition (see paragraph 16 of the letter of the State Statistics Committee of Russia dated 04/09/2001 No. MS-1-23/1480). Major repairs differ from current repairs in the cost and duration of the activities. During a major overhaul, faulty, damaged or worn structures and parts of the facility are replaced, including replacing them with more durable and economical ones (regulations on carrying out scheduled preventive maintenance of industrial buildings and structures MD 13-14.2000, approved by the resolution of the USSR State Construction Committee dated December 29. 1973 No. 279, clause 14.2 of article 1 of the Town Planning Code of the Russian Federation).

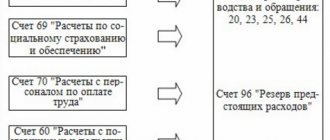

Costs for repairs of fixed assets are recognized as expenses for ordinary activities of the reporting period (clause 27 PBU 6/01, clause 7 PBU 10/99 “Organization expenses”, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n, hereinafter referred to as PBU 10 /99) and are reflected by posting (clause 67 of the Guidelines for fixed assets accounting, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, hereinafter referred to as the Guidelines for fixed assets accounting; Chart of accounts for the accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance Russia dated October 31, 2000 No. 94n, hereinafter referred to as the Chart of Accounts):

Debit 20 (44, 26) Credit 60 (10, 70, 69, 23)

- the amount of expenses incurred.

Expenses for the repair of fixed assets are considered as other expenses and are recognized for tax purposes in the reporting (tax) period in which they were incurred in the amount of actual costs (clause 1 of Article 260 of the Tax Code of the Russian Federation). In “1C: Accounting 8” edition 3.0, expenses for OS repairs carried out by contract are reflected in the standard accounting system document Receipt (act, invoice) with the transaction type Services (Fig. 2).

Rice. 2. Reflection of OS repair work performed by the contractor

To avoid disputes with regulatory authorities, the taxpayer must clearly understand the difference between the concepts of “repair” and “modernization (reconstruction)”.

If during the process of major repairs there is an improvement (increase) in the initially accepted standard indicators of the functioning of fixed assets, for example, useful life, power, quality of use (see paragraph 27 of PBU 6/01), then such repairs will most likely be reclassified as modernization or reconstruction.

The definition of completion, additional equipment, modernization, reconstruction and technical re-equipment is given in Article 257 of the Tax Code of the Russian Federation. The concept of modernization and reconstruction of a capital construction facility can also be found in Article 1 of the Civil Code of the Russian Federation.

Updates to the 1C: Accounting 8 program, edition 3.0, not only support legislative changes, but also expand service capabilities and increase the level of automation. Read about changes in working with directories and reports in the article “Changes in directories and standard reports in 1C: Accounting 8”.

Costs for modernization and reconstruction (as well as for completion, additional equipment and technical re-equipment) of fixed assets increase the initial cost of the object (clause 27 of PBU 6/01, clause 2 of Article 257 of the Tax Code of the Russian Federation), and then are written off through depreciation.

These costs are accounted for in accounting as follows:

Debit 08.3 Credit 60 (10, 70, 69, 23) Debit 01.01 Credit 08.03

- for the amount of expenses incurred (clause 70 of the Guidelines for fixed assets accounting, Chart of Accounts).

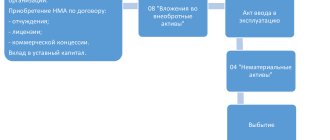

To reflect the costs of modernization and reconstruction carried out by contract, “1C: Accounting 8” edition 3.0 also uses the document Receipt (act, invoice) with the transaction type Services. But, unlike repair expenses, in the Accounts field you need to indicate not a cost account (26, 20 or 44), but account 08.03 “Construction of fixed assets” and the corresponding analytics (Construction object; Cost item; Method of construction). An increase in the initial cost of an object by the cost of the modernization performed is registered in the program using the document Modernization of OS (section OS and intangible assets).

Basis for commissioning

According to clause 8 of PBU 6/01, the initial cost of fixed assets acquired for a fee is recognized as the amount of the organization's actual costs for their acquisition, construction and production, excluding VAT and other refundable taxes.

Expert of the Legal Consulting Service GARANT E. Lazukova

Commissioning must be documented with primary documents, which indicates readiness for its use. From January 1, 2013, it is not necessary to use forms of primary documents from albums of unified forms. Commissioning can be done using the following forms:

- OS-1 – for 1 object (except buildings)

- OS-1a – for buildings and structures

- OS-1b – for groups of objects (except buildings)

If the document is developed independently, then it is necessary to keep in mind that the form is approved by the accounting policy and contains mandatory details (Part 2 of Article 9 of Law 402-FZ):

- Name

- date of compilation

- name of the organization making the document

- reflects the fact of activity

- natural and monetary meter (indicating units of measurement)

- positions of persons responsible for registration

- signatures with transcript to identify responsible persons

Important! When purchasing, manufacturing or constructing a fixed asset in one month, and reflected in account 01 in another, it is necessary to draw up documents reflecting its unreadiness for use.

The readiness of the facility for operation can be determined by a special commission for the acceptance of acquired fixed assets, making a conclusion that is indicated in the commissioning act.

An inventory card or book must be prepared for the fixed asset (depending on the accounting used). In this case, you can use the following forms: No. OS-6, OS-6a, OS-6b.

You can prevent frequent errors in accounting for fixed assets

Seminar lecturer: O. A. Bukina , A. B. Pogrebs , L. A. Kotova , T. A. Novikova , E. V. Vorobyova , Y. V. Kalinin , A. A. Efremova

Seminar plan:

1. For recognition of an object as a fixed asset, the moment of actual commissioning is not decisive.

2. Reclassification will allow for the preparation of reliable financial statements.

3. It is useful to establish in the accounting policy the procedure for forming the initial cost of the acquired property.

4. A plot of land and a building to be demolished, acquired together, are accounted for separately.

5. Interest on the loan is included in the cost of investment assets only.

Proper accounting of the company's fixed assets will allow you to avoid additional charges for income tax, VAT and property tax. Today I will talk about the mistakes that companies most often make in both accounting and tax accounting when accounting for fixed assets.

Capital investments and equipment in a warehouse are not always fixed assets.

Let's start with the main thing: what are fixed assets and how to distinguish them from other assets. This issue is regulated by PBU 6/01 “Accounting for fixed assets”. There are two subtle points in it that I want to draw attention to.

The first is fixed assets in stock. For some reason, many people believe that an object is the main asset when it is put into operation. And if it has not been put into operation and is in a warehouse, then it should be reflected as capital investments in account 08. This is one of the serious accounting misconceptions. The fact is that a fixed asset is an object that is intended for use in the operation of a company. If an object is in a warehouse because there is simply no user for it, then it must be accounted for in account 01. This is also true for cases where the object was purchased as a reserve or surplus fixed asset. For example, a computer in a warehouse.

The excuse that the company did not fill out the OS form - 1 and the commissioning certificate does not work in this case. It is known that the primary document is drawn up immediately at the time of the transaction. If this is not possible, immediately after its completion. And not in a year, when they get around to putting the facility into operation and formalizing its acceptance for accounting as a fixed asset.

If we are talking about an object that requires installation, then it must be taken into account on account 07. And during the installation process, the object is already listed on account 08 until the completion of measures for its installation.

But this rule does not always work. Let's say a company is forming a new production division - an entire production facility. It is equipped with certain equipment. In this case, this equipment is included in the fixed assets simultaneously with the entire facility. Even if individually this equipment is already suitable for use. For example, elevators, fire extinguishing and video surveillance systems are independent objects. But they are included in fixed assets only together with the entire building as a whole. Until this moment they are listed on account 08.

The second is capital investment in leased fixed assets. What a common mistake here. It is known that if a company has made some investments in a leased property, then it registers them as fixed assets. Of course, with the consent of the lessor and the condition that he does not compensate for these costs.

Everyone remembers that fixed assets last at least 12 months. But if the lease agreement is concluded for 12 months or for a period of less than one year, then capital investment objects will not go to account 01. Because they last less than 12 months. In this case, the company recognizes them as deferred expenses. There are no other options: either in tax or accounting.

Reclassification of a fixed asset will allow for the preparation of reliable financial statements.

Now let's look at the reclassification of assets. This concept applies in the following situation. The company acquires an object and puts it into operation as a fixed asset. But then the manager decides that this object will be intended for sale. This often happens with real estate and equipment. Especially if the company wants to stop one of its activities. Then from account 01 such an object is transferred at its residual value to account 41. This is reclassification, or reclass.

Since the object ceases to be used, tax and accounting depreciation is no longer accrued on it. But in accounting it is still preserved. This object can then be reflected in the second section of the balance sheet as a current asset.

But this procedure can only be applied by those companies that have adopted such an accounting policy. This is necessary for convergence with international standards so that differences in balance sheets are minimal.

RISKS

But those companies that have already established the reclassification procedure in their accounting policies should think about property tax risks. Unfortunately, in the Russian accounting system there is no reclassification procedure. Not a single PBU says that if we change the classification of an object, then we can change its affiliation with certain assets. Specialists from the Ministry of Finance of Russia, in a letter dated March 2, 2010 No. 03 - 05 - 05 - 01/04, said that if you were born with a basic means, you will die with one: no transformations are expected in the process of life. And until the fixed assets are written off from the balance sheet, the company charges property tax on them. And a fixed asset can be written off from the balance sheet only due to liquidation, dismantling or sale.

SOLUTION

In order to avoid claims from tax authorities, companies producing reclasses do this. They set up their accounting program so that this part of account 41 falls into the property tax base. In this case, the objects fall into the required line of the balance sheet and the risks of quibbles on the part of the inspectorate are minimized.

More cautious companies continue to record objects on account 01. Although these “fixed assets” are intended for sale. That is, formally they are no longer fixed assets. Often they are simply preserved and depreciation is not charged. And property taxes are paid in accordance with the generally established procedure.

As for profitable investments. If a company purchases an object immediately for rental, then it is recorded in account 03. This is considered a profitable investment in material assets.

And if the acquired property was first exploited and then decided to rent it out only, then many companies are in a hurry to reclassify it. The amounts are large, and such transactions seriously affect reporting. The position of the Ministry of Finance here is the same: reclassification is not provided. But in practice, companies are still reclassified in this case. For them, the reliability of reporting is more important than following explanations.

Objects are transferred from account 01 to 03. Of course, not at the residual value, but at the original value. Depreciation remains in its account 02 and is not closed. The only thing that should not be forgotten is that this depreciation to form a balance must be subtracted from line 135 - income-generating investments. And not from line 130 - fixed assets.

If the main asset has not yet been put into operation, then it is better to mothball it.

Let’s say that the object is completely ready for operation, is in a warehouse and has not been put into operation. As I already said, it should already be listed as a fixed asset in account 01. The question arises whether to depreciate it or not.

It is not depreciated for tax purposes. Because it has not yet been put into operation. Therefore, for accounting purposes, it is recommended that these objects be placed in storage directly in the warehouse. Then depreciation and residual value in accounting and tax accounting will be the same.

But a situation may arise when conservation is impossible. For example, if a company expects to request these items from the warehouse in less than three months. Then you will have to calculate accounting depreciation. In this case, temporary differences will arise in accordance with PBU 18/02 “Accounting for calculations of corporate income tax.” This is additional work for an accountant. Therefore, I advise you to try to preserve such objects.

I would like to draw your attention to the fact that conservation is in its last years. This is due to the fact that IFRS does not provide for the concept of conservation. And our accounting system is gradually moving closer to international standards. (Read more about the specifics of applying IFRS on page 71)

Correct classification will help determine the primary documents.

Correctly classifying an object is necessary not only in order to determine the accounting accounts. It is also necessary to use appropriate source documents. If a company deals with fixed assets, then it uses a “primary” asset with the “OS” encoding.

NOTE

Here I recommend paying attention to the OS Act - 14. This is an act of taking into account equipment that requires installation. Companies often forget about this in practice. This is exactly the document with which equipment is accepted into the warehouse and registered under account 01. The tax office will definitely require it during the audit.

And if we classify assets as inventories, then other documents are used here – with the coding “M”.

There will be no difficulties in accounting if the purchased building is put into operation at the time of submitting documents for state registration.

Let's move on to the difficulties that arise when forming the initial cost of those fixed assets that companies buy and do not receive for free or through barter.

REAL ESTATE

Let's look at real estate first. There are two fundamentally different situations possible here: real estate is being built or purchased.

WE'RE BUILDING

If a company builds it itself, then it is initially the owner of such an object. And if he buys, then until the transaction is registered, the owner of the object is different. And this object is taken into account on the seller’s balance sheet.

LET'S BUY

In a real estate purchase transaction, it is important to highlight three dates. Signing the transfer and acceptance certificate, submitting documents for state registration and obtaining a certificate of ownership of the object. In time they always go in exactly this sequence. Although the signing of the act and the submission of documents for registration may coincide in date. But we will consider them separately.

In accordance with PBU 6/01, a company has the right to accept an object for accounting only at the time it receives ownership rights.

But the facility can be put into operation earlier. Namely, if it has already been transferred under the deed by the previous owner and the documents have been submitted for state registration. Then the object is included in the OS at the time of submission of documents.

Problems may only arise for companies that submitted documents but were denied registration of property rights. Possible reasons are incomplete documents, a voidable transaction, something not properly executed, etc. In this case, the company will have to correct the accounting error. Do not remove 01 from account, do not show disposal, but reverse this operation. If the object was listed on account 08, then it should remain there.

"CLARIFIED"

Looking ahead, I will say that in tax accounting in this case it is necessary to submit updated declarations. After all, the company did not have the right to depreciate such an object.

But in practice, companies very often begin to accept objects for account 01 at the moment of signing the transfer and acceptance certificate. That is, before submitting documents for state registration. There is simply confidence that within a short period of time the company will obtain the necessary legal documents and submit an application for registration. Therefore, it legally exploits this facility.

After signing the act, the object in some cases can be repaired. The legality of such actions depends on the future purpose of the object being repaired. This point needs to be fixed in the accounting policy. However, regulatory documents do not provide for such an accounting procedure.

But in practice, auditors look at it positively. The fact is that IFRS takes into account objects based on the principle of control, and not on the legal situation. But here there is control: the object is received. If it suddenly turns out that the object was transferred to the company under an invalid transaction, then the accounting error will have to be corrected.

TAX ACCOUNTING

In order to calculate income tax, the moment of submitting documents for state registration is important. Therefore, if in accounting the company put the object into operation and began to depreciate it at the time of signing the act, difficulties may arise. During this period of time, while the object is depreciated for accounting purposes, it cannot be depreciated for tax accounting purposes.

To summarize, I would like to note once again: accounting depreciation - from the moment the building is put into operation, tax amortization - from the moment the documents are submitted for state registration. It is optimal when these moments coincide.

Additional costs for installing an OS cannot always be included in their cost.

It is also important to understand the difference in accounting policies when we decide from a certain moment to account for a fixed asset in account 08 or in account 01.

The Russian Ministry of Finance allows tax depreciation of unfinished investments in fixed assets - letter of the Russian Ministry of Finance dated May 29, 2006 No. 03 - 06 - 01-04/107. That is, depreciation can be charged when an object is accounted for in both account 01 and account 08. This applies only to accounting.

But in order to begin to depreciate a fixed asset, you must first form its original cost. And when purchasing fixed assets, additional costs may arise. Let’s say an object is accounted for on account 08. And before it is transferred to account 01, the company spent money on its transportation and installation. Such costs are included in its initial cost.

If the company has already delivered the object to account 01, then all additional costs are considered as current. The initial cost can no longer be increased. At least accounting. After all, such costs are not reconstruction, modernization or additional equipment. There are no other cases of cost increases.

Therefore, the company must make the right choice. If significant costs are expected, then the accounting policy should be adopted in favor of account 08. But since the accounting policy is a very conservative thing, you need to look far ahead. It is important to understand how it will be profitable to take into account objects and form their value in the long term, and not just today.

The cost of a building purchased for demolition can be included in the initial cost of the new facility.

The following situation. Very often land is purchased along with a property. At the same time, the object itself is intended for demolition.

LAND

Considering the land, the situation is simple. Since the land has an independent assessment, it is highlighted as a separate line in the contract. Land is accepted as an independent inventory item. Its cost is not included in the initial cost of the building or structure. Land is not depreciable property.

OBJECT FOR DEMOLITION

But it is not clear what to do with the demolition objects that stand on this site. The company definitely does not intend to put them into operation. And it is not going to use these objects for a period of more than a year. Therefore, there is no point in putting them on account 01. Regulatory documents practically do not regulate this situation. Therefore, companies have to imagine.

ON PRACTICE

What happens in practice: they purchase objects for demolition and put them on account 08. They are not depreciated, property taxes are not paid on them, and they are not put into operation. At the time of demolition, these investments in fixed assets are liquidated. That is, they are written off from account 08 to account 91.

Companies often try to include this residual value of a demolished object from account 08 into the cost of a new object under construction. That is, transfer the cost of such an object to account 01. The position here is as follows.

If a company purchased an object specifically for the purpose of demolition, then it is already listed in the technical inventory authorities as an object intended for demolition. If there are documents confirming this, then the company’s actions are legal. If there are no such documents, then you will have to write off this object from account 08 to account 91.

In practice, it happens that the object has completely collapsed, but is listed in the documents as normal. Then it should also be written off to account 91. Similarly, an object is written off for demolition if, in the opinion of the company, it is simply obsolete. That is, it is not dilapidated, not in disrepair, and it can be used, but for some reason it is not suitable for this.

In these cases, the tax authorities will not be able to prove that the land plot with this building was initially acquired only for the construction of a new property on it.

But there is another problem of accounting for objects purchased for demolition. The Ministry of Finance of Russia in a letter dated April 19, 2010 No. 03 - 03 - 06/1/277 noted the following. Useful returns received during the dismantling and liquidation of fixed assets for demolition are accounted for at the cost of non-operating income. This is done by posting D10 - K91 at market value and is included in the tax base for income tax. But these objects do not have a tax value when written off from account 10. That is, in accounting there will be a credit to account 10 in the form of an expense, but in tax accounting it will not. Because the dismantling was not of a fixed asset, as specified in the Tax Code, but of an unfinished construction project.

I would like to draw your attention to the fact that if a company highlights the tax value of these objects in tax accounting, then during the audit there may be a conflict with the tax authorities.

NEW ASSESSMENT

Let me remind you that useful returns that are identified during dismantling are included in expenses at market value relatively recently. From January 1 of this year. Before this, they were accepted in tax accounting as the amount of tax paid. That is, if the market value of some useful return is 100 rubles, the income tax is 20 rubles. And in tax accounting such an asset was accepted at a cost of only 20 rubles. Now all 100 rubles are accepted.

Business travel expenses in some cases increase the initial cost of the fixed asset.

Now a little digression on business trips. Travel expenses may also be included in the initial cost of a fixed asset. But only if the business trip is entirely related to the acquisition of fixed assets.

Let's say the driver went to drive the purchased car. All expenses for the advance report will be included in the price of the purchased vehicle. And this is the daily allowance, the cost of travel to the place where you receive the car, and the cost of accommodation in this place. And also the cost of fuels and lubricants necessary to bring the car from the place of sale.

If the business trip is of a mixed nature, then travel expenses are not even broken down. For example, visit a computer exhibition and buy several computers there. Or meet with suppliers and at the same time control the loading of fixed assets onto the railway platform. In this case, all costs go entirely to the operating expenses of the department whose employee went on this business trip.

In accounting, loan interest is taken into account only in the value of investment assets.

TAX ACCOUNTING

The next point is interest on the loan. In tax accounting, they are not included in the initial cost of the object under any circumstances. These are always non-operating expenses. But the Tax Code has many nuances in accounting for interest.

ACCOUNTING

From an accounting perspective, interest on loans is included in the cost of assets if they are classified as investment assets. That is, when a company buys cars, computers, and machine tools, these are not investment assets. In this case, interest on the loan is not included in the cost. Even if the company takes out a loan to purchase a car through leasing. An investment asset is an object that requires a long time and costs for its construction. Or to bring it to a state suitable for use. Investment assets include capital construction projects. As well as objects of intangible assets created on their own, and R&D objects.

Loan interest is included in the cost of investment assets according to the rules provided for by PBU 15/2008 “Accounting for expenses on loans and borrowings.”

I note that you cannot include interest on a loan in the initial cost of a property if its construction has not actually begun yet. If a company bought land and plans to build on it, then interest on the loan cannot be included in account 08. This is an unreasonable overestimation of capital investments.

The article was published in the magazine “Seminar for Accountants” No. 7, 2010

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Documents required for commissioning of real estate

To commission constructed real estate, the developer must obtain a special permit issued by the institution that authorized the construction (according to paragraph 2 of Article 55 of the Town Planning Code of the Russian Federation). To obtain a permit, the following documents are required:

- documents granting the right to a plot

- urban plan

- permission

- object acceptance certificate

- conclusion of Gosstroynadzor

- technical plan

Commissioning and posting must coincide.

Establishment of useful life (SPI)

The commission for accepting fixed assets for accounting establishes the SPI required for calculating depreciation from the month following registration. The period during which the original cost is written off is established based on the depreciation group, respectively, and the SPI, i.e. time of use for generating income, mode, number of shifts and operating conditions, repairs and other restrictions (for example, rental period). The SPI must be issued by order of the manager (in any form), and which can be revised as a result of reconstruction, retrofitting, etc. fixed asset.

Important! It is better to set the SPI for accounting and tax accounting purposes to be the same so as not to reflect temporary differences.

SPI is important for property taxation: the larger it is for accounting purposes, the longer the organization pays property tax. But this needs to be justified in the order.

How to reflect the modernization of a fully depreciated operating system in accounting and tax accounting?

Property with an expired useful life (SPI) and zero residual value may well be used in income-generating activities. The organization may modernize or reconstruct such property to restore its useful properties.

The costs of modernizing a fixed asset increase its initial cost both in accounting (clause 27 of PBU 6/01) and for profit tax purposes (clause 2 of Article 257 of the Tax Code of the Russian Federation), and then are written off through depreciation. However, the procedure for depreciation of modernized fixed assets in accounting and tax accounting differs.

In accounting, the annual amount of depreciation for a modernized fixed asset is determined based on its residual value and remaining useful life, which can be revised upward by the organization (clause 60 of the Guidelines for fixed assets accounting).

As a result of modernization of a fully depreciated asset, its residual value will correspond to the costs of modernization. But the useful life of such an object has already expired. Therefore, in order to pay off the costs of modernization, the organization is forced to increase the SPI, otherwise depreciation is impossible.

In tax accounting, part of the costs for modernizing the OS can be taken into account as expenses at a time, in the month of completion of the modernization work, by applying a depreciation premium (clause 9 of Article 258 of the Tax Code of the Russian Federation). After modernization, the useful life may increase or remain unchanged (Clause 1, Article 258 of the Tax Code of the Russian Federation).

As for calculating the amount of monthly depreciation of a modernized fixed asset when applying the linear method, this issue is not regulated by law.

According to the position of the Ministry of Finance of Russia (see, for example, letter dated November 16, 2016 No. 03-03-06/1/67358), starting from the month following the month of putting the modernized fixed asset into operation, depreciation on it is calculated based on the following indicators :

- the initial cost of the OS, increased by the amount of modernization;

- the depreciation rate that was initially applied to the asset when it was put into operation. If, after upgrading the asset's operating system, the useful life of the asset has increased, then the organization has the right to charge depreciation at the new rate, calculated on the basis of the new SPI. But the period can be increased only within the limits established for the depreciation group of a given asset.

A similar approach is applied if the organization has modernized an operating system that is fully depreciated and whose residual value is zero (letter of the Ministry of Finance of Russia dated October 25, 2016 No. 03-03-06/1/62131).

There is another point of view (see, for example, the resolution of the Arbitration Court of the East Siberian District dated June 4, 2015 No. F02-1262/2015, F02-1612/2015 in case No. A19-9978/2014), according to which the amount of depreciation charges is fully depreciated OS should be calculated based on:

- amounts of modernization (reconstruction);

- new depreciation rate, which must be determined based on the revised useful life, since the useful life before the modernization has expired.

In “1C: Accounting 8” edition 3.0, the position of a “cautious” taxpayer is supported, therefore the modernization of a fixed asset in tax accounting is calculated in accordance with the recommendations of the Ministry of Finance.

Example 1

| The organization Comfort-Service LLC applies the general taxation system (OSNO) and accounting provisions “Accounting for calculations of corporate income tax” PBU 18/02 (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n). In April 2022, Comfort-Service LLC decides to modernize a woodworking machine assigned to the second depreciation group, which is fully depreciated in accounting and tax accounting. The initial cost of the machine is RUB 180,000.00. When accounting for fixed assets, the useful life was set at 36 months. The amount of modernization costs excluding VAT amounted to RUB 90,000.00. Bonus depreciation does not apply. According to the accounting policy, Comfort-Service LLC uses the linear method of calculating depreciation in accounting and tax accounting. |

Let's register the fact of OS modernization with a document of the same name. On the Construction object tab, you need to indicate the amount of modernization costs accumulated for this object (90,000.00 rubles). They can be filled in automatically using the Calculate amounts button.

On the Fixed Assets tab, you need to fill in the list of OS objects to be upgraded (Add button). According to the conditions of Example 1, this is one object (woodworking machine).

In the Expiration date field The useful life established when the asset was accepted for accounting for accounting and tax purposes is automatically entered. Since the object is fully depreciated, for accounting purposes it is necessary to indicate a new SPI, for example, 51 months. For tax accounting purposes, the maximum period for this depreciation group is indicated, so it cannot be changed. When you click the Distribute button, the amounts of modernization costs are distributed in equal shares across all fixed assets indicated in the table.

After posting the OS Modernization document, the following accounting entry is generated:

Debit 01.01 Credit 08.03 - to increase the initial cost of the fixed asset (90,000.00 rubles).

For tax accounting purposes, the specified amount is also recorded in special resources of the accounting register:

Amount of NU Dt 01.01 and Amount of NU Kt 08.03

In addition to accounting and tax accounting movements, entries are also generated in periodic information registers that reflect information about the fixed asset.

For upgraded fixed assets for which the useful life has expired, the depreciation parameters must be clarified using the document Changing the fixed assets depreciation parameters (section fixed assets and intangible assets - fixed assets depreciation parameters). If this is not done, then next month when performing the routine operation Depreciation and depreciation of fixed assets, the program will interrupt processing and display an error message.

When entering the document Changing fixed asset depreciation parameters, the following details should be indicated in the header (see Fig. 3):

- the name of the event in the “life” of the fixed asset, which is reflected in this document;

- set the Reflect in accounting and Reflect in tax accounting flags.

Rice. 3. Changing depreciation parameters

The table field indicates:

- a fixed asset whose depreciation parameters are changed;

- in the Expiration date field. (BU) - new SPI of the fixed asset in accounting in months (51 months);

- in the Depreciation period field. (BU) - useful life for calculating depreciation in accounting, that is, the difference between the new and previous useful life in months (15 months);

- in the Cost field to calculate depreciation. (BU) - the cost of modernizing a fixed asset for calculating depreciation in accounting (RUB 90,000.00);

- in the Expiration date field. (NU) - new useful life in months for calculating depreciation in tax accounting. If the useful life does not change, the previous useful life (36 months) is indicated in this column.

Next month, when performing the routine operation Depreciation and depreciation of fixed assets, the program will calculate depreciation according to the specified parameters and in accordance with the recommendations of the Ministry of Finance.

The amount of depreciation of the modernized machine will be:

- in accounting - 6,000.00 rubles. (RUB 90,000.00 / 15 months);

- in tax accounting - RUB 7,500.00. ((RUB 180,000.00 + RUB 90,000.00) / 36 months).

Commissioning accounting

In accounting, the initial cost of purchased fixed assets is the sum of all expenses of the organization, except for VAT and other refundable taxes.

The cost of these funds is reimbursed by calculating depreciation based on SPI, i.e. The more SPI, the slower its cost decreases.

In accounting (not in tax accounting) you can set any period and when determining it you can, but not necessarily, be guided by the Classification. But this period must be justified by the presented indicators, documentation, etc.

Accounting for the input of fixed assets

Accounting for the costs of commissioning a fixed asset must be carried out in the manner established by the organization.

| Operation | Debit | Credit |

| Receipt from the founders | ||

| Founders' debt | 75-1 | 80 |

| Receipt on account of contribution to the authorized capital | 08 | 75-1 |

| Construction by contract (third-party organization) | ||

| Formation of the cost of contract work | 08 | 60 |

| Construction in an economic way (by the organization itself) | ||

| Write-off of materials for construction | 08 | 10 |

| Payroll for employees (builders) | 08 | 70 |

| Purchase (without installation) | ||

| Accrual of payment amounts to the supplier | 08 | 60 |

| Delivery accounting | 08 | 76,60,23… |

| Purchase (with installation) | ||

| Accrual of payments to the supplier for equipment | 07 | 60 |

| Transfer of equipment for installation | 08 | 07 |

| Write-off of installation costs | 08 | 10,70,69… |

| Receive for free | ||

| Acceptance of fixed assets for accounting (account 91) | 01 | 91 |

| Putting the facility into operation | 01 | 08 |

At the same time, VAT is a refundable tax and is not taken into account in the initial cost.

Acceptance of fixed assets for accounting in 1C: Accounting 8 (version 2.1)

continues the series of training videos on working in 1C: Accounting on our YouTube channel!

The new video will provide you with step-by-step instructions for accounting for fixed assets in 1C 8.3.

Watch the new video Acceptance for accounting of fixed assets (fixed assets) for 1C: Accounting 8 edition 2.1.

Let's start with the fact that the entire block of documents, reference books and reports on fixed assets accounting is concentrated in the section “Fixed assets and intangible assets”

.

Receipt of equipment

the program is reflected in the document

“Receipt of Equipment”

- this is the same document “Receipt of Goods and Services”, simply with a pre-selected type of operation “Equipment”. Here the fixed asset is credited to the warehouse to account 08.1.1. On the “Equipment” tab, in the “Items” field, select an element from the “Items” directory, indicate the quantity, price, % VAT and accounting accounts.

After this, an accounting entry will be generated Dt 08.1.1 Kt 60.1

If additional expenses have been incurred that should increase the cost of the equipment, then to display them you can use the document “Receipt of additional expenses.” expenses."

If there is a need to supplement

equipment with some components, then for this purpose the document

“Item Assembling”

, the type of operation Assembling. The components themselves can either already be listed in the warehouse or be capitalized using the document “Receipt of goods and .

Next, the fixed asset must be taken into account. For this purpose, the document “Acceptance for accounting of fixed assets” is provided, the type of operation is “Equipment”

. Acceptance of fixed assets for accounting means that the formation of the value of the fixed asset is completed. As a rule, this occurs simultaneously with the commissioning of the fixed asset.

Filling out the document “Acceptance for accounting of fixed assets”:

— on the Fixed Assets tab

in the header you must indicate the account, equipment and warehouse where the equipment is accounted for.

— in the tabular section Fixed assets

you need to select an asset object from the directory; it can be pre-created or created directly in the “Acceptance for accounting of asset” document.

In the fixed asset card, you need to fill in the data only on the first tab “Basic information”; the data on the remaining tabs will be filled in according to the data in the document Acceptance for accounting of fixed assets after it has been completed.

In the tabular section for OS in the Inv. column. No.

a number equal to the fixed asset code is automatically assigned; it can be changed if necessary.

Let's continue filling out our document.

— in the tabular section “Precious metals”

You can indicate the composition of precious metals and their quantity for a fixed asset, if their (precious metals) composition can be determined based on the accompanying documents. If the quantity of precious metals at the time of acceptance of fixed assets for accounting is unknown, then when accepted for accounting in the Precious Metals tabular section:

* you can specify the types of metal and in the “Method of determination” column indicate the value “Commission”

* if nothing is known about the types of metals and their quantities, then simply skip filling out this tabular part.

Then the content of precious metals will be established by the commission upon write-off and reflected in the document “Write-off of fixed assets.”

On the Accounting tab

you must choose the accounting procedure: depreciation or the cost is not repaid. Specify:

* MOL on which the OS will be listed;

*Method of admission

* Accounting account (default is 01.1);

* Depreciation (depreciation) account: (by default this is account 02.1);

* check the Accrue depreciation checkbox if depreciation for this asset should be accrued from the month following the month of commissioning; * Method of calculating depreciation (usually linear);

But depending on the depreciation calculation method used, the following details must be additionally filled in:

- When using the reducing balance method,

in the Acceleration factor field, the acceleration factor used when calculating depreciation is indicated. - When applying the method of calculating depreciation in proportion to the volume of production (work)

:

o Output parameter - the name of the characteristic, the volume of which is used to calculate depreciation.

o Estimated volume of output - the estimated volume of products (work), based on which depreciation will be calculated. The volume is indicated in units of measurement of the production parameter.

· When using the linear depreciation method - SPI in months.

* Depreciation schedule for the year - not filled out if depreciation is accrued monthly, used only in organizations with a seasonal nature of production.

On the Tax Accounting tab

filling in the data occurs in the same way. One feature is the presence of the Include investment deduction as expenses flag. The flag is set if an investment deduction is expected to be accrued on fixed assets. If it is established, the amount of the investment deduction (in percentage) is additionally indicated, as well as the cost account and the corresponding analytics for including the investment deduction in expenses.

On the Advanced tab

you can specify the members of the commission who should be reflected in the printed forms for the document. This can be done manually by clicking the “Add” button, or you can first create a document “Organization Commission”, in which, for the document type “Acceptance for accounting of fixed assets”, indicate the composition of the commission, which will automatically be included in the document.

When carried out, the document will generate an accounting entry for the acceptance of an asset for accounting: D 01.1 K 08.1.1

.

Now the fixed asset is considered accepted for accounting. Depreciation on it will be accrued at the end of the month using the “Closing of the month”, namely the routine operation Depreciation of fixed assets

.

Subscribe to our YouTube channel, watch our training videos and work in 1C:Accounting easily!

Example of transactions when purchasing fixed assets

Alpha and Omega LLC acquired a fixed asset for 236,000 rubles from Beta and Gamma LLC. (including VAT 36,000 rubles) for use in production activities. Both organizations are VAT payers. The transactions will be reflected in the accounting records as follows:

| Operation | Debit | Credit | Sum | Base |

| Fixed asset has arrived | 08 | 60 | 200000 | Acceptance certificate |

| VAT on fixed assets is reflected | 19 (VAT subaccount) | 60 | 36000 | Invoice |

| Payment for fixed assets (including VAT) | 60 | 51 | 236000 | Payment order |

| Submission of VAT for deduction | 68 | 19 (VAT subaccount) | 36000 | Book of purchases |

| Commissioning | 01 | 08 | 200000 | Act OS-1 |

Tax accounting of introduced fixed assets

The procedure for calculating the initial cost of an introduced fixed asset does not depend on whether new fixed assets are being introduced or used ones and the entire amount of costs for the acquisition (manufacturing), delivery, repair (modernization) is taken into account, minus VAT and excise taxes, but when purchasing a fixed asset that has already been used by the seller, the reflection of the residual value according to the supplier’s documents and already accrued depreciation should not be taken into account.

When commissioning, it is necessary to establish a period of use as in accounting, determined independently on the date of commissioning, taking into account the classification. But for used fixed assets, the depreciation rate should take into account the SPI, when operated by previous owners based on their useful life:

- by classification (also applies to the acquisition of property from individuals - not individual entrepreneurs)

- established by classification and reduced by the period of use by the former owners in fact

- established by the previous owner and reduced by the period of use by the previous owners in fact

Moment of inclusion of an asset in fixed assets

The accrual of property tax is associated with the fact that property is reflected in accounting as a fixed asset. However, the legislation on accounting (PBU 6/01) does not give an exact answer at what point property should be recognized as a fixed asset.

Based on an analysis of judicial practice, the article examines various approaches to determining the moment of inclusion of a capital construction project in the composition of fixed assets.

Real estate is put into operation from the date of receipt of permission to put the facility into operation

In accordance with clauses 1, 2 of Art. 55 of the Town Planning Code of the Russian Federation, a permit to put an object into operation is a document that certifies the completion of construction […] in full in accordance with the construction permit, the compliance of the constructed […] capital construction project with the town planning plan of the land plot and design documentation and is the basis for putting the facility into operation.

Consequently, in order to comply with the requirements of urban planning legislation, the moment of completion of construction and the moment of putting the facility into operation is the date of receipt of permission to put the facility into operation. It is after this date that it is allowed to operate the facility in accordance with the norms of urban planning legislation.

An analysis of tax and accounting legislation and judicial practice confirms that, as a general rule, it is obtaining permission to put a property into operation that is the basis for including the cost of a fixed asset in the tax base for property tax.

In accordance with Art. 374 of the Tax Code of the Russian Federation, the objects of taxation for Russian organizations are movable and immovable […] taken into account on the balance sheet as fixed assets in the manner established for accounting.

The Regulations on Accounting of Fixed Assets (PBU 6/01) provide 4 conditions for including an asset in fixed assets (clause 4 of PBU 6/01):

- The purpose of the asset for use in the organization’s activities (production or rental);

- Operation for a period exceeding 12 months;

- The purpose of the asset is for the organization to obtain economic benefits in the future;

- The organization does not plan to sell the asset.

As can be seen from the above conditions, the main substantive criterion for including an asset in fixed assets is its purpose for use in production or transfer for temporary use (rent).

Typically, a completed building or structure is intended to be used for its intended purpose only after receiving permission to put it into operation, since the operation of the building without permission is not allowed.

The courts are guided by this logic when considering the issue of when an asset should be included in fixed assets and, consequently, in the property tax base.

For example, the Federal Antimonopoly Service of the North-Western District, in its Resolution dated December 17, 2008 in case No. A21-1145/2008, considered the following situation.

On September 30, 2005, a real estate lease agreement was concluded between the taxpayer and the tenant; the acceptance committee act was signed in November 2005. The taxpayer included real estate in fixed assets starting from December 1, 2005, and began calculating property tax from the same date. The tax inspectorate considered that it was necessary to begin paying tax from October 2005, i.e. after the conclusion of the lease agreement. The court recognized the taxpayer’s position as legitimate, stating the following:

“Buildings can be included in fixed assets only after they have been accepted into operation in the prescribed manner. According to paragraph 8 of the resolution of the Council of Ministers of the USSR dated January 23, 1981 N 105 “On the acceptance into operation of completed construction facilities,” the date of commissioning of the facility is considered the date of signing the act by the state acceptance commission. Thus, the Company leased out objects that were legally accounted for in account 01 after the execution and approval of the act dated November 10, 2005” [1].

A similar conclusion can be drawn from the analysis of the Methodological Recommendations for Accounting of Fixed Assets (approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n).

In accordance with clause 23 of the Methodological Recommendations, fixed assets are accepted for accounting at historical cost. The initial cost includes costs associated with bringing the asset into a condition suitable for use (clause 32 of the Methodological Recommendations).

Therefore, until the measures related to bringing the asset into a condition suitable for use are completed, its transfer to fixed assets will not be legal, since the initial cost has not been formed. In particular, such measures should include obtaining all permits that remove legal obstacles to the use of fixed assets.

***

However, the date of receipt of permission to put a facility into operation is not an absolute basis for the occurrence of tax consequences.

An analysis of judicial practice shows that the inclusion of a building in fixed assets at the time of obtaining permission to commission is only a legal presumption [2] of determining the moment of commissioning (and the assessment of property taxes).

As judicial practice shows, this presumption can be rebutted in two cases:

- if the object began to be actually used before the date of receipt of permission for commissioning, or

- if the object cannot be used for its intended purpose after receiving permission to operate.

The actual moment of commissioning occurs before obtaining permission

Judicial practice of applying tax legislation is based on the principle of autonomy of tax legislation [3] and the concept of priority of substance over form.

Neither tax nor accounting laws link the transfer of an asset to account 01 (inclusion in fixed assets) with whether the requirements of industry legislation have been met (for example, in the construction industry). The only meaningful criterion for transferring an asset to fixed assets, as indicated above, is its readiness (purpose) for use in the organization’s activities. If the asset began to be operated before the date of receipt of the commissioning permit, then it is obvious that this asset is ready for use in the organization's activities.

Therefore, from the point of view of accounting and tax legislation, in the situation considered, it is the date of actual entry that should have legal significance for the calculation of property tax.

Since such a conclusion (about the actual operation of the object before receiving permission for its operation) indicates a violation by the taxpayer of the norms of urban planning legislation, the fact of operation of the object before the date of receipt of the permission must be proven by the tax authority.

In some cases, this will not pose much difficulty for the inspectorate. For example, in a situation where an organization created only for the purpose of operating an asset begins to record revenue from the sale of goods (services) produced using this asset.

In this situation, in our opinion, an additional argument in favor of the fact that the asset is not a fixed asset will be a documented argument that the asset is used in commissioning work associated with testing under load, for example, load-bearing structures, foundation , equipment. In this case, the asset is not actually used as a fixed asset, but work is carried out to bring the asset to the condition necessary for use.

The actual moment of commissioning occurs after obtaining permission

As a general rule, the obligation to pay property tax cannot depend on the discretion of the taxpayer on the issue of when exactly to begin the actual operation of the property.

However, situations are possible when obtaining permission to put an object into operation does not indicate an objective possibility of using the asset for the purposes specified in subclause. 1 clause 4 PBU 6/01. In particular, if, after receiving permission to put the facility into operation, the real estate property cannot be used for its intended purpose.

This situation was assessed by the Presidium of the Supreme Arbitration Court of the Russian Federation in Resolution No. VAS-4451/10 dated November 16, 2010.

From the circumstances of the case it follows that the taxpayer received permission to put the facility into operation and registered ownership of the hotel and administrative complex. However, after obtaining permission (and registering ownership), the building required significant capital investments (in finishing of the premises). In this regard, the taxpayer believed that the building was objectively unable to be used in the organization’s activities, since it did not correspond to its purpose.

The court of first instance satisfied the taxpayer's demands, stating the following:

“The construction of the building shell and its subsequent interior decoration should be considered as a single process of creating a hotel and administrative complex, upon completion of which an object that meets the characteristics of a fixed asset appears.”

However, the Federal Antimonopoly Service of the North-West Zone considered it legal to charge additional property tax from the moment of registration of ownership of the real estate property in July 2007.

As a result of the consideration of this case, the Presidium of the Supreme Arbitration Court of the Russian Federation supported the conclusions set out in the Decision of the Arbitration Court of First Instance.

[1] The Federal Antimonopoly Service of the Ural District came to a similar conclusion in Resolution dated September 30, 2009 No. Ф09-7348/09-С3

[2] That is assumption of the presence of any fact (in our case, the fact of putting the facility into operation) with proof of another fact (in our case, the fact of issuing a permit

[3] For example, this principle was the basis for the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation in case No. 5600/07 of September 18, 2007, adopted in favor of the taxpayer

Answers to common questions

Question No. 1 : When purchasing from an individual, can it be accepted for accounting on the basis of a purchase and sale agreement and a transfer and acceptance certificate?

Answer : An individual seller does not have the obligation to provide forms OS-1 (OS-1a), therefore, to accept property for accounting, it is sufficient to accept transfer and acceptance certificates in any form, but with the obligatory indication of details, in accordance with 402-FZ for primary documentation.

Question No. 2 : Is it necessary to put into operation what is planned to be rented out (leasing)?

Answer : In order to start using it as a rental property (to generate income), it must be put into operation on account 03: D03 K08.