Postings

Taxpayers Transport tax is paid by companies and entrepreneurs to whom vehicles are registered. Difficulties in

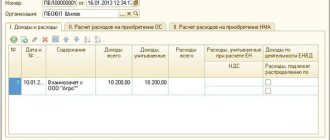

Accounting If the actual costs of acquiring the right to claim debt (receivables) under an assignment agreement

Materials are recognized in accounting as they are received. Accounting, incl. on admission

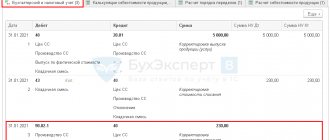

How to calculate the cost Costs associated with the production of products should be taken into account on account 20 “Main production”.

Settlement procedure The main conditions for offset are contained in the Civil Code of the Russian Federation. These include:

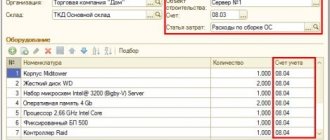

Creating a document “Transfer of equipment for installation” Creating a document – OS menu – Transfer of equipment

Agency agreements Type Name Agency agreement Agency agreement for the purchase of real estate Agency agreement for

How is transport tax calculated for pensioners? All citizens who own any type of transport, including

Expert consultation Since 2022, new rules for accounting of fixed assets (FPE) will apply,

Under a loan agreement, one party (the lender) transfers the ownership of money to the other party (the borrower) or