Postings

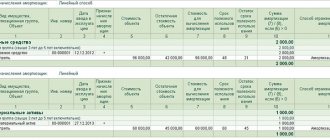

Procedure for accounting for liquidation expenses Costs for liquidation of fixed assets are accepted as part of non-operating

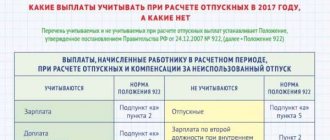

Calculation period for 2022 To correctly calculate vacation, you need the Regulation from the resolution

How to organize accounting of the volume of work performed in food shops? What forms of documents should I use? How

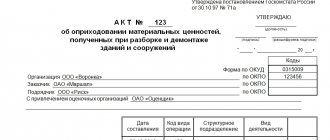

The obligation to use form M-35 to draw up a capitalization act Since recent times, the obligation to use many

Do you need an advance invoice? An invoice (hereinafter also referred to as invoice) is a document confirming: Moment

Income tax: payment order in 2022 All organizations carrying out business activities are required to

Accounting for financial results of transactions is reflected through a set of records made throughout the reporting period.

Control over the calculation and payment of insurance premiums from 2022 is largely carried out by the Federal Tax Service.

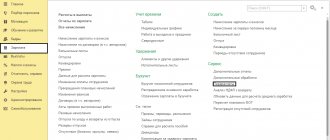

To automatically include losses from the sale of fixed assets in expenses in 1C: Accounting 8

Loan from the founder of an LLC If the organization has financial problems and does not have enough own funds