For each expense item, in the 1C:ERP program it is possible to specify a distribution option, depending on the selected type of expense.

The allocation option determines the economic rationale for using the expenses recorded for a particular item. The following options are available:

- attributed to the cost of goods;

- write off to financial result;

- attributed to deferred expenses;

- reflect on production costs;

- classified as non-current assets.

If there is no need to distribute expenses, a separate option is available : Distribute manually (expenses for such an item can be reimbursed).

Distribution option “Attribute to cost of goods”

Expense items with the distribution option Attribute to the cost of goods are used to form the cost of material assets outside of production processes. The following distribution rules are available to distribute expenses:

- Proportional to the quantity of the item - the distribution base is determined by the quantity of the selected item.

- Proportional to the weight of the item - the distribution base is determined based on the weight characteristics of the selected item.

- Proportional to the volume of the item - the distribution base is determined based on the volumetric characteristics of the selected item.

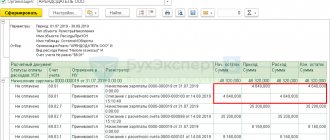

Figure 1 — Setting up cost distribution with the option “attributed to the cost of goods”

Depending on the type of expense, the following types of analytics are available:

- Warehouse – the amount of costs according to the selected rule is distributed to all items located in a specific storage location (warehouse). If a specific warehouse is not selected, then distribution is carried out across all warehouses.

- Item - the amount of costs increases the cost of the balances of a specific item item in all warehouses of the enterprise (for all characteristics, series and purposes).

- Purchase of goods and services - the amount of costs according to the selected distribution rule increases the cost of the balances of the item capitalized according to the selected documents Purchase of goods and services .

- Order to supplier, Order for movement, Order for assembly (disassembly), Assembly (disassembly), Movement of goods, Transfer of goods between organizations, Entering balances - the amount of costs according to the selected distribution rule increases the cost of the balances of the item specified in documents of the corresponding type.

Distribution option “Distribute to financial result”

Expense items with the distribution option Distribute to financial result ensure that general business (in the case of using direct costing) and commercial costs are taken into account, the economic (the procedure for inclusion in the cost) or financial (participation in the formation of the financial result) content is determined by the method of distribution.

Setting up distribution rules for expense items distributed to the financial result is performed using the elements of the list Distribution rules and indicators :

Figure 2 — Setting up cost distribution “write off to financial result”

In the list element card Rules for the distribution of expenses for expenses distributed to the financial result, the areas of activity to which expenses will be distributed are determined.

Figure 3 — Setting up distribution rules between areas of activity

The distribution of expenses for financial results by areas of activity can be configured:

- for all areas of activity on the basis - expenses will be distributed to all areas of the organization’s activities for which the financial result is formed;

- for the specified areas of activity on the basis - the areas of activity to which costs should be allocated are determined by the user using the Specify ;

- to areas of activity manually - the areas of activity to which expenses should be allocated, and the share of attribution of expenses to each of them are determined by the user.

To automatically distribute expenses across areas of activity according to the selected option, the basis on which expenses will be distributed between areas of activity is determined Distribution Rules

Figure 4 — Setting up distribution rules between areas of activity. Distribution base

To distribute expenses for financial results across areas of activity in proportion to direct expenses, the user determines the Indicator by which the distribution should be made.

Figure 5 — Setting up distribution rules between areas of activity. Index

Using the Specify , you can select specific values of the selected indicator (for example, materials, the cost of which is taken into account when calculating the distribution base). If the distribution of costs should not be carried out for all products, then using the hyperlink Specify groups (types) of products you can select the necessary types of products. When allocating expenses to a financial result, the division is determined in accordance with the division in which the distributed expenses were incurred.

Expense Items to Use list item card offers various types of analytics depending on the type of expense.

Expense analytics for an item allocated to the financial result is used for the purpose of subsequent detailing of expenses when analyzing them.

Calculation of proportions when distributing expenses

If TRUIP (goods, works, services, property rights) are used in taxable and non-taxable value added tax transactions, “input” VAT cannot be deducted in full; it must be distributed based on the proportion specified in clause 4 of Art. 170 Tax Code of the Russian Federation.

Cost of shipped TRUIP, operations for the sale of which are subject to taxation (exempt from taxation) /

The total cost of shipped TRUIP for the tax period.

Example

The joint-stock company produces both VAT-taxable and VAT-free products. The joint-stock company began its activities in January, and purchased materials in the amount of 1,200,000 rubles in a month. (including VAT 20,000 rubles). All materials have been paid for and submitted to production by March 31st. 10% of these materials were used in non-VAT taxable activities, 5% in taxable and non-taxable activities and 85% only in taxable activities.

Sales for the 1st quarter amounted to RUB 3,000,000. (excluding VAT), 200,000 rub. of which were classified as non-taxable activities.

Calculate the amount of VAT to be reimbursed and the amount of VAT that will be used as expenses for the 1st quarter.

Step 1.

Let us determine the ratio of VAT-free revenue to total revenue.

200 000 / 3 000 000 = 6,7 %

Step 2.

Based on the proportion obtained in step 1, we will distribute the total cost of goods and services.

| Indicators | Rub. |

| Materials used for taxable and non-VAT activities (1 000 000 * 5 %) | 50 000 |

| Distributed to VAT-free activities: (50,000 * 6.7%) | 3 350 |

| Distributed to activities subject to VAT: (50,000 * 93.3%) | 46 650 |

Step 3.

Using the proportion obtained in step 1, we determine the amount of “input” VAT to be reimbursed.

VAT on materials subject to write-off (included in the cost of materials):

| Indicators | Rub. |

| Input VAT on materials used in both taxable and non-VATable activities (200,000 * 5%) | 10 000 |

| VAT written off with the cost of materials (10,000 * 6.7%) | 670 |

| Total for the first quarter ((200,000 * 10%) + 670) | 20 670 |

| VAT refund0) | 179 330 |

In the example, only revenue is included in the calculation of the proportion - taxable and not subject to VAT. But in practice, when calculating the indicated proportion, other operations are also taken into account.

Include in the calculation the proportions: revenue, interest receivable when providing borrowed funds (letters of the Ministry of Finance dated 03/06/2018 No. 03-07-11/14170, dated 01/16/2017 No. 03-07-11/1282), profit from the sale of securities, income from derivative financial instruments, other income reflected in account 91/1 (sale of work clothes, work books, sale of fixed assets, etc.).

Please note, do not take into account the amount of the loan itself when calculating, only interest (subclause 4, clause 4.1, article 170 of the Tax Code of the Russian Federation, letters of the Ministry of Finance dated 04/02/2009 No. 03-07-07/27, dated 04/28/2008 No. 03-07- 08/104, letter of the Federal Tax Service of Russia dated November 6, 2009 No. 3-1-11/886). In letter dated January 10, 2020 No. 03-07-14/216, the Ministry of Finance clarified the information on interest: interest on the loan provided is taken into account when calculating the above proportion, but interest for the use of other people’s funds (Article 395 of the Civil Code of the Russian Federation), collected according to court - are not taken into account.

What is not included in the proportion is what does not correspond to the concept of sales: dividends, fines under business contracts, exchange rate differences, financial assistance, interest received on deposits (letter of the Ministry of Finance dated January 16, 2017 No. 03-07-11/1282).

Difficulties sometimes arise when calculating proportions

1. Shipment does not coincide with the transfer of ownership. When to consider implementation?

Shipment date = the date of the first drawing up of the primary document issued to the buyer (customer), carrier (letter of the Ministry of Finance dated 03/01/2012 No. 03-07-08/55).

If the goods are not shipped or transported, but ownership of it is transferred, the day of shipment is the date of transfer of ownership (clause 3 of Article 167 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated November 1, 2012 No. 03-07-11/473).

According to paragraph 1 of Art. 167 of the Tax Code of the Russian Federation, the moment of determining the tax base for VAT is the day of shipment (transfer) of the TRUIP or the day of receipt of the advance payment, therefore, even if the ownership of the shipped valuables is not transferred, the transaction is still included in the proportion.

2. Completion of work does not coincide with the date of signing of the act by the customer

The work performed by the contractor must be accepted by the customer (Article 720 of the Civil Code of the Russian Federation, Article 753 of the Civil Code of the Russian Federation). According to clause 1 of Article 39 of the Tax Code of the Russian Federation, the implementation of work is recognized as the transfer of the results of work performed by one person to another person. Until the work is accepted by the customer, the work is not implemented (letters from the Ministry of Finance dated October 13, 2016 No. 03-07-11/59833, dated December 3, 2015 No. 03-03-06/70541), we do not take them into account in the proportion.

If the contractor goes to court, which confirms the completion of the work, VAT is accrued on the date the court decision enters into legal force (letter of the Ministry of Finance dated 02.02.2015 No. 03-07-10/3962). The courts support this opinion (see the resolution of the Eighth AAS dated December 16, 2014 No. 08AP-11734/2014 in case No. A70-5069/2014).

Conclusion:

include in the proportion the amount of work performed, subject to the signing of the act by the customer.

3. Implementation adjustments (including errors) – do they affect the composition of the proportion?

In such cases, the Ministry of Finance suggests focusing on the date of shipment and taking into account the shipment taking into account corrections (letters dated 07/09/2018 No. 03-07-11/47590 and dated 05/27/2016 No. 03-03-06/1/30737), i.e. , the proportion and amount of deductions will need to be recalculated.

4. Lack of shipments - no proportion?

The Tax Code of the Russian Federation does not specify the procedure. The Ministry of Finance proposes to focus on its own accounting policy for tax purposes (see letter dated March 11, 2015 No. 03-07-08/12672).

Options for calculating VAT deductions in the absence of shipments in the reporting period:

—

in proportion to the cost of shipped goods (work, services) for the subsequent tax period;

—

in proportion to the cost of shipped goods (work, services) for the previous tax period;

—

in proportion to all direct costs for the current tax period (quarter);

—

in proportion to any indicator of direct costs (wages, material costs) for the current tax period (quarter).

5. Based on what proportion should the expenses from the advance report be distributed - in the travel period or in the period of approval of the report?

If the employee’s trip relates to both the organization’s VAT-taxable activity and non-taxable activity, then the VAT charged by the carrier is deductible and taken into account in the cost of services in the corresponding quarter in amounts determined based on the proportion calculated for the same quarter. In this case, employee travel costs are taken into account as expenses on the date of approval of the employee’s advance report based on the ticket (route receipt) attached to this advance report (clauses 5, 7, 16, 18 PBU 10/99, clause 5 Clause 7 of Article 272 of the Tax Code of the Russian Federation).

VAT presented by the carrier is also accepted for deduction in the period in which the employee’s advance report is approved (clauses 2, 7 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation, clause 18 of the Rules for maintaining a purchase ledger).

6. How to draw up a proportion for a gratuitous transfer (clause 2 of Article 154 of the Tax Code)?

The taxpayer who is the transferring party, when calculating the proportion for the distribution of input VAT in the cost of transactions subject to VAT, must include the market value of the gratuitously transferred TRUIP. For the receiving party, receiving valuables free of charge will not affect the distribution of input VAT, since the transferring party does not charge VAT on the cost of the gratuitous transaction, but pays the tax to the budget independently.

Conclusion:

To correctly distribute tax deductions, you must adhere to the rules of the Tax Code of the Russian Federation when including income in the calculation of the proportion.

financial statements accounting

Send

Stammer

Tweet

Share

Share

Distribution option “Attribute to deferred expenses”

For expense items with the distribution option Refer to deferred expenses, costs are taken into account, the inclusion of which in the cost structure is deferred in time.

For expense items classified as deferred expenses, the types of analytics are determined. But in this case they are of a secondary nature, indicating only the place where costs arise.

Setting up distribution rules for expense items classified as deferred expenses is done using the elements of the Distribution Rules on the Deferred Expenses . The values of this tab are available when you select the option for distributing deferred expenses in the Expense .

Figure 6 — Setting up cost distribution rules as “attributed to future expenses”

Setting up a rule for distributing deferred expenses includes defining:

- the order of distribution of expenses By month, By calendar day or In a special order ;

- the date from which expenses will be distributed. You can start distributing expenses for future periods from the Date of occurrence of the expense or from the Beginning of the next month after the date of occurrence of the expense;

- the number of months over which expenses will be distributed;

- parameters of the expense write-off analytics, indicating the department and expense item with the corresponding analytics value.

Figure 7 - Setting up cost distribution rules as “attributed to future expenses”. Dates

The distribution parameters for a specific flow rate can be specified directly in the RBP Distribution .

On the Regulated accounting , you must specify the expense account in accounting and the Asset type , which determines the line of the balance sheet in which expenses not yet distributed for this item will be reflected.

Self-separation

The list of direct expenses is approximate, and the organization has the right to independently establish one different from that given in the Tax Code. This list should be fixed in the accounting policy (letters of the Ministry of Finance of Russia dated May 25, 2010 No. 03-03-06/2/101, dated November 12, 2009 No. 03-03-06/1/742, Federal Tax Service of Russia for the city of Moscow dated February 2, 2010 No. 16-12 / [email protected] ). Although there is an opinion that when dividing costs into direct and indirect, the taxpayer should be guided by the above provisions of Article 318 of the Tax Code (letter of the Ministry of Finance of Russia dated May 29, 2009 No. 03-03-06/1/355). In other words, the list of direct expenses given in the code is mandatory, and the organization, at its discretion, can add others to them.

We are of the opinion that the organization has the right to independently decide which expenses are recognized as direct. In this case, you should justify your decision. After all, during a tax audit, inspectors will definitely be interested in indirect expenses and will try to prove their direct origin. The court also pointed out this: excluding material costs from direct costs and including them in indirect costs without proper economic justification entails an illegal understatement of the income tax base. Regardless of the fact that the organization has the right to determine the list of direct expenses itself in its accounting policy, material costs can be classified as indirect expenses only if there is no real possibility of classifying them as direct (clause 1 of Article 252 of the Tax Code of the Russian Federation, resolution of the Federal Antimonopoly Service of the Ural District dated 25 February 2010 No. Ф09-799/10-С3).

Important

If in the accounting policy the organization has not determined which expenses are considered direct, then by default officials believe that direct expenses correspond to the list specified in Article 318 of the Tax Code (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated November 6, 2009 No. F03-4942/2009) . When legislation introduces changes to this list, the organization will be required to take into account the corresponding changes from the moment they enter into force (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated November 20, 2009 No. A82-7247/2008-99). Therefore, it is better to independently approve the list of direct expenses in the accounting policy.

As practice shows, it is not always possible to clearly classify specific types of costs as direct or indirect costs. It depends on the type of activity. In this regard, the organization should register such costs separately in the accounting policy and classify them as direct or indirect expenses, that is, add specifics on “disputed” expenses. These actions will serve as a good shield against the nagging of tax authorities (Resolution of the Federal Antimonopoly Service of the Ural District dated April 28, 2008 No. F09-2757/08-S3).

Distribution option “Reflect on production costs”

Expense items with the distribution option Reflect on production costs are used to form production costs attributable to the cost of manufactured products.

The type of cost analytics determines the cost object, which can be a division, a production order, a selected type of other expenses, or operating objects.

Itemized costs can be allocated to production batches, left in work in progress, or redistributed to other expense items (asset/liability items). Rules for the distribution of itemized expenses are specified using elements of the directory Distribution Rules and Indicators and are specified during distribution. The distribution rule can be configured comprehensively, simultaneously specifying the distribution into batches and expense items and cost shares for each option.

Options for setting up costs for distribution of production batches:

- Manually - production batches ( Production Stages and Production Documents without Orders ) will be manually selected during distribution.

- According to the rule - expenses will be distributed between departments and outputs in departments according to the specified rule.

The rule defines:

- Which departments are the costs allocated to? The current, subordinate and superior division are determined relative to the cost division;

- distribution base between divisions and parties. When distributing according to a single base for all selected divisions, parties are determined between which costs are distributed according to the selected distribution option and selections. Screenings can be specified on quantitative and cost bases.

Figure 8 — Setting up rules for distributing costs by department

The inclusion of itemized expenses in products is carried out as the distribution base “enters” into products. For distribution bases associated with products (quantity, volume, weight of products), the moment of “entry” depends on the consumption itself, and therefore it can only be associated with the actual products released. In order to leave part of the itemized costs in work in progress and distribute them in the future to planned products, it is necessary to use the distribution bases “taking into account future outputs”.

Figure 9 — Setting up rules for distributing costs between product lots

The planned indicator (cost, volume, etc.) of products per batch is taken as the distribution base.

On the distribution base formed according to the rule, you can additionally impose selection by groups (types) of products. The selection can be specified in the settings of the rule itself or specified directly in the distribution documents Expense distribution in addition to the rule selected in them.

In cases where an expense item is distributed among other expense items, the distribution rules must include a list of expense items indicating the cost shares.

For expense items with the distribution option Reflect on production costs, you can specify a costing item for which these costs will be included in the cost (the Costing Item on the Main ).

It is possible to specify different distribution rules for an expense item in the context of accounting types, organizations and divisions using Distribution Settings , which can be accessed from the expense item using the hyperlink Configure distribution rules by organizations and divisions .

For income tax purposes, manufacturing costs are classified as direct or indirect. The classification of expense items with the distribution option Reflect on production costs as direct or indirect is determined by the value of the switch For the purpose of determining expenses of the current tax period on the Regulated accounting of the list item card Expense .

Methods for classifying costs

By virtue of clause 134 of Instruction No. 157n, the institution organizes accounting of the institution’s expenses by economic elements and costing items (depending on industry characteristics), the method of inclusion in the cost (direct and invoices), as well as in connection with technical and economic factors (conditionally constant and conditional variables (invoices) for the purpose of rationing, limiting, etc.).

Clause 138 of Instruction No. 157n provides for the following types of expenses by cost groups:

– direct, directly attributable to the cost of finished products, works, services; – overhead costs of production of finished products, works, services; – general economic.

At the same time, in the Regulations on the formation of the state task for the provision of public services (performance of work) in relation to federal government institutions and financial support for the implementation of the state task, approved by Decree of the Government of the Russian Federation of June 26, 2015 No. 640, the division occurs into two groups:

– costs directly related to the provision of public services; – expenses for general economic needs for the provision of public services.

According to the Methodological Recommendations, total costs are formed by summing direct and indirect costs. Specific types of costs provided for in this document are given in the table.

Classification of costs of medical institutions

| Cost classification | Calculation procedure and cost items |

| Direct costs | Costs of income centers and auxiliary units involved in the provision of medical services, according to the following items: 1) salaries of employees of income centers, accrued on all bases; 2) the salary of the main personnel of auxiliary units, accrued on all bases; 3) accruals for wages; 4) the cost of material resources fully or partially consumed in the process of providing medical services (medicines and medicines, dressings, reagents and chemicals, medical products, medical instruments, food, other supplies); 5) work and services - in terms of payment for the cost of laboratory and instrumental studies carried out in other organizations (in the absence of a laboratory and diagnostic equipment in the medical institution), catering in the absence of a catering unit; 6) the share of wear and tear on soft equipment in the process of providing medical services; 7) the share of wear and tear of equipment used in the process of providing medical services |

| Indirect costs | 1) expenses of general institutional units for all items; 2) expenses of auxiliary departments that are not included in the structure of direct costs attributed to the direct costs of income centers; 3) other payments to employees of income centers; 4) social security of employees; 5) costs of the medical organization as a whole: – for communication services; – for transport services; – for utilities; – for the maintenance of real estate objects; – for the maintenance of movable property; – for depreciation of equipment not used in the provision of medical care and other fixed assets; – for general business expenses; – for other services and work; - other expenses |

| Total costs | The sum of direct costs and the share of indirect costs attributable to the income center according to accepted methods of cost distribution. |

Distribution option “Attribute to non-current assets”

Expense items with the distribution option Attribute to non-current assets provide reflection of expenses associated with the formation of the value of non-current assets. The type of analytics divides items according to the reflection of expenses related to the formation of the initial cost:

- fixed assets (fixed assets);

- carrying out capital construction (for construction projects);

- intangible assets (IMA);

- expenses for carrying out research and development work (R&D).

Setting up reflection in accounting and the procedure for accepting for tax accounting expenses attributable to the value of non-current assets is set directly in the item card of the Expense .

We are ready to provide a full range of services for setting up and supporting 1C:ERP, and also provide this configuration for rent.

Two main distribution options in 1C

1C:UPP stands for 1C for managing a manufacturing enterprise. This program configuration is intended to create a complete picture of all flows within a manufacturing company. The cost accounting block can include occurrence, movement and disposal:

- MPZ,

- semi-finished products,

- finished products,

- work performed and services provided,

- general production and general business expenses,

- storage and transportation costs,

- other production costs.

ATTENTION! Since 2022, the new FSBU 5/2019 “Reserves” has become mandatory for use. PBU 5/01 has become invalid.

You can check whether you have correctly organized inventory accounting according to the new standard using a ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial demo access. It's free.

In addition to direct costs, the value of which in the cost of a unit of production can be clearly determined, there are costs that are distributed over the cost of production. This distribution is determined by the applied accounting policy of the enterprise.

For more information on how production-related costs may or may not be distributed (written off), read: “Planning costs for production and sales of products.”

Technically established distribution is carried out in two main ways - by introducing the appropriate commands into the working document or automatically. Let's look at these methods in more detail.