General characteristics of the account and its closure

According to the main types of classification of accounts. 23 is:

- In relation to the balance sheet, it is active, i.e. this account can only have a debit balance, which, when reporting, forms a balance sheet asset.

- In terms of economic content - a calculation account for accounting for business processes, and specifically production costs.

- In terms of detail - synthetic. It takes into account generalized data on the costs of auxiliary production in monetary terms. Analytical accounting can be organized by type of production, cost items, etc.

In addition, since on the account. 23, costs accumulate and the closing procedure is applied to it at the end of the reporting period. This will be discussed in more detail in the corresponding section.

1.2) Closing 23 accounts for 20

PROBLEM: In KA 2.4, the distribution base for production costs is formed only if there is a batch-forming document. In the absence of such a document, direct expenses and expenses will have to be closed manually

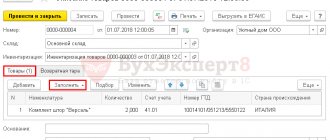

At the end of the month, the Accountant receives information about how many hours of auxiliary production equipment were spent servicing the main production. In 1C, such data must be entered into the document “Production without an order” in order to form a basis for allocating the costs of auxiliary production, which means determining the cost per hour of the OS of the auxiliary department.

In the document “Production without an order” on the “Main” tab, indicate in the “Division” field the division of auxiliary production (otherwise the posting for credit account 23 will not be displayed). One document is created for one area of activity.

On the “Products” tab, specify to fill out the Nomenclature with the “Work” type. In the “Direction of issue” column, fill in the value “Write off as expenses”, and in the “Recipient/item and analytics” column, indicate the recipient department of account 20 and the expense item of account 20.

If at the time of creating the document it is known exactly what area of activity the work listed on the “Products” tab went to, and it is important to attribute these costs strictly to a specific area of activity, then it should be indicated on the “Additional” tab in the appropriate field.

Document postings will be generated after the regulatory task “Distribution of costs and calculation of cost” is completed as part of the month-end closing, that is, at the moment when the cost of an hour of fixed assets is generated. First, KA 2.4 will make an irrational/extra posting: the cost on account 23 will move from a specific area of activity to no area of activity, and then will move to account 20 to the specified area of activity. There is no need to be afraid of double turnover.

For the document “Production without an order”, for which the direction of activity is unknown, distribution transactions after the month close will be generated on account 20 properly without the direction of activity.

Thus, auxiliary production services were distributed on account 20 according to areas of activity. Those costs that were closed on account 20 without an area of activity will be redistributed at the end of the month to work in progress by area of activity in accordance with the settings of the distribution rules.

Accounting objects and subaccounts

Account 23 reflects information about those productions that are not related to the main activities of the enterprise, but provide conditions for its functioning. For different types of business, the types of auxiliary production may be different. However, several categories can be distinguished for which subaccounts of account 23 are usually opened:

- Generation of energy of all types (electricity, heat, etc.).

- Transport divisions.

- Repair of vehicles, equipment, etc.

- Providing food for company employees.

- Production of tools, equipment, spare parts.

- Installation of individual structures, parts (for construction organizations).

- Construction of temporary structures.

- Canning of food products (for agricultural enterprises).

Necessary system settings for correct cost distribution

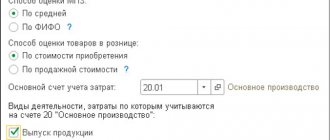

First of all, we note that for users to work correctly in the program, “Setting up accounting parameters” must be performed. For a manufacturing enterprise, on the “Types of Activities” tab, it is necessary to set the flag “Production of products, performance of work, provision of services” (Fig. 1).

Fig.1

The main settings that affect the closing of the month are made in the “Accounting Policies of the Organization”. It is recommended to set an accounting policy for each year, since some of the settings made in the accounting policy are periodic (for example, the list of direct tax accounting expenses is valid only during the year for which the accounting policy is set, and if the organization has introduced one accounting policy for 2 years, then in the second year all costs when closing the month in tax accounting will be classified as indirect). What tabs of the “Accounting Policy” affect the closing of the month in accounting?

- General information

- Production

- WIP

The flag “Production of products, performance of work, provision of services” in the accounting parameters settings is a common setting for all organizations for which accounting is maintained in the program. In the accounting policy on the “General Information” tab for each organization, it is necessary to duplicate this setting in order to show the program that this information is applicable for a specific organization (Fig. 2).

Fig.2

After setting this flag, the “Production”, “Product Output”, “WIP” tabs automatically appear.

On the “ Production ” tab, the parameters for the distribution of accounts 20, 23, 25, 26 are set (Fig. 3).

Fig.3

The distribution of costs in account 20 is made according to sales revenue. In our example, the collection of costs on account 20 is carried out in the context of two item groups - “Semi-finished products” and “Finished products”. Revenue from sales for both types of activities is also collected by product groups.

Depending on what setting is set for account 20 in the organization’s accounting policy, the program will determine whether account 20 should be closed for a specific analytics. What is important for the program is not the fact of collecting revenue for a specific item group, but how the revenue was collected (by what document).

- When the “At planned prices” flag is set, when closing the month, the revenue collected on account 90.01 by the document “Act on the provision of production services” will serve as the basis for the distribution of costs.

- When the “By revenue” flag is set, when closing the month, the revenue collected in account 90.01 by the document “Sales of goods and services” will serve as the basis for the distribution of costs.

- When the “At planned prices and output volume” flag is set, when closing the month, the revenue collected in account 90.01 by any of the documents will serve as the basis for cost distribution.

If an organization produces products, then costs are allocated to the products produced.

For organizations that provide services, the program analyzes not the collection of costs for a specific type of document, but the entries in the accumulation registers that produce these documents:

- at planned prices - the register “Output of products and services at planned prices”, formed by the document “Act on the provision of production services”

- by revenue - the "Sales of services" register, formed by the document "Sales of goods and services"

The distribution of costs 23 accounts is made according to the volume of output (in this case, to calculate the distribution base, the accumulation register “Output of products and services at planned prices” is analyzed). If account 23 reflects transactions for the provision of internal services between departments, then at the end of the month for each department 23 of account for which the collection of costs was reflected, it is necessary to enter the document “Production Report for the Shift”, which indicates the direction of distribution.

Note that the settings made in the organization’s accounting policy determine which indicator will be filled in in the document - planned prices or output volume. The “By planned prices and output volume” option allows the user to independently determine in the document which of the two indicators he wants to indicate.

IMPORTANT! The item group account 23 must differ from the item groups for which sales revenue is collected.

Account 23 is the only cost account for which you can specify the direction of distribution. According to the indicated direction, the regulatory operation “Closing accounts 20, 23, 25, 26” will work.

The distribution of costs of account 26 can be done in two ways:

- using the “direct costing” method: at the end of the month, entry Dt 90.08 Kt 26 will be generated and the collected costs will be included in management expenses

- not using the direct costing method: at the end of the month, general business expenses will be included in the cost of products produced or services provided, and the posting Dt 20 Kt 26 will be generated

When choosing the “direct costing” method, no additional settings for the distribution of costs 26 accounts are required.

When choosing the second option, the flag in the “direct costing” field is not set, and using the “Set methods for distributing general production and general business expenses” button, the base for distributing costs account 26 is set.

The distribution of costs for account 25 is made according to the base specified by the button “Set methods for distributing general production and general business expenses.”

In the information register “Methods for the distribution of general production and general business expenses” it is necessary to set the time period from which the distribution base, cost account and distribution base are valid (Fig. 4). Please note that in this register you can make detailed settings for each division and each cost item. If this information is not specified, the program will perceive it as a distribution method for all items of the specified cost account.

Fig.4

In the “Distribution base” field (Fig. 5), an indicator is indicated according to which on account 20 the costs of account 25 (and 26 if direct costing is not used) are distributed between item groups.

Fig.5

Please note that among the indicators there is an option “Individual direct cost items”. For this setting, the “List of cost items” field is intended, which indicates the list of cost items by which the indicator for calculating the base will be determined.

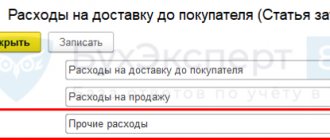

Account 44 is closed automatically, and the posting Dt 90.07 Kt 44.02 is generated. If in an organization, when collecting costs, a cost item with the type “Transportation costs” appears, then the distribution under this item is made in proportion to the balance of goods. The amount of direct expenses in terms of transportation costs related to the balance of unsold goods is determined by the average percentage for the current month, taking into account the carryover balance at the beginning of the month in the following order:

1. The amount of direct expenses attributable to the balance of unsold goods at the beginning of the month and incurred in the current month is determined;

2. The cost of purchasing goods sold in the current month and the cost of purchasing the balance of unsold goods at the end of the month are determined;

3. The average percentage is calculated as the ratio of the amount of direct expenses (clause 1 of this part) to the cost of goods (clause 2 of this part);

4. The amount of direct expenses related to the balance of unsold goods is determined as the product of the average percentage and the cost of the balance of goods at the end of the month” (Article 320, Chapter 25 of the Tax Code of the Russian Federation).

WIP tab indicates how the amount of work in progress is determined (Fig. 6). The user is given the opportunity to install one of two options:

- responsibility for determining the amount of work in progress falls on the shoulders of the accountant, who enters the document “Inventory of work in progress” and reflects in this document a list of item groups and the amount of costs that should remain in the work in progress.

- the amount of work in progress is determined by the program independently: costs for a product group for which there was no production are regarded as work in progress. At the same time, the accountant can also enter the document “Inventory of work in progress”, assigning an additional amount of costs to work in progress.

Fig.6

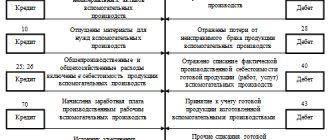

Postings by debit

The debit of account 23 - Auxiliary production - reflects expenses associated with the implementation of the corresponding production process. First of all, these are direct costs, the main of which are:

- Write-off of raw materials and materials:

Dt 23 Kt 10.

- Calculation of wages and contributions to extra-budgetary funds:

Dt 23 Kt 70;

Dt 23 Kt 69.

- Services and works purchased from third parties or individuals:

Dt 23 Kt 60 (76).

In addition, in the debit of the account. 23, part of the overhead costs that relate to the activities of auxiliary production is written off:

- Dt 23 Kt 25 - general production expenses are written off;

- Dt 23 Kt 26 - general business expenses are written off.

The costs of organizing production, if appropriate, can be taken into account directly in the account. 23, without using count. 25.

How to close account 23

When it is necessary to close account 23, direct expenses directly related to the production of products/performance of work/provision of services are written off to account 23 from the credit of inventory accounts, settlements with employees for wages, etc.

Also see “Accounting for inventories”.

Indirect costs associated with the management and maintenance of auxiliary production are written off in account 23 from the accounts:

- 25 “General production expenses”;

- 26 “General business expenses”.

KEEP IN MIND

If appropriate, production maintenance costs can be taken into account directly on account 23 without prior accumulation on account 25 “General production expenses”.

Losses from defects are written off to account 23 from the credit of account 28 “Defects in production”.

Loan transactions

The credit entries in account 23 primarily reflect write-offs of expenses. Corresponding accounts show which cost categories the accumulated amounts are distributed to:

- Dt 20 Kt 23 - costs are allocated to main production;

- Dt 25 Kt 23 - for general production expenses;

- Dt 26 Kt 23 - for general business expenses.

Accounting for the costs of repair departments is possible in two options, depending on whether the enterprise has a repair fund. If there is no such fund, then “repair” costs are written off as shown above.

If the fund is created, then its funds are accounted for in a separate subaccount to the account. 96 “Reserves for future expenses.” In this case, repair costs are written off from account 23 to debit 96:

Dt 96 Kt 23.

Also, auxiliary production can provide services on the side. For example, a repair department - to service equipment of other organizations, or a boiler room - to heat not only the company’s buildings, but also its neighbors. In this case, part of the costs related to “third-party” revenue is written off to the debit of the account. 90.2 “Cost of sales”:

Dt 90.2 Kt 23.

The sequence of closing sub-accounts of account 23 “Auxiliary production”.

In general, for account 23, the general principle of the order of closing accounts applies: from productions with a large number of consumers of services and a minimum of counter-costs to productions with a minimum number of consumers (within and outside of account 23) and large counter-services. In accordance with this, for most farms the following order of closing accounts of auxiliary production is most appropriate: electricity supply, water supply, gas supply, heat supply, horse-drawn transport, motor transport, repair production, machine and tractor fleet.

To simplify the closure of accounts of auxiliary productions, it is allowed not to attribute identified calculation differences to other productions within account 23, but to write them off only to other balance sheet accounts.

2. Closing the “Electricity supply ” subaccount. The cost of consumed electricity is charged to consumers' accounts on a monthly basis according to the planned kilowatt-hour estimate. At the end of the year, costs are adjusted for the amount of identified differences in the corresponding accounts (an additional entry for overexpenditure and a reversal entry for savings), for which a statement of adjustment entries (accounting certificate) is drawn up for closing the account, including all electricity consumers. Cost adjustment amounts for each consumer are allocated in proportion to the electricity consumed.

3. Closing the “Water Supply ” subaccount This analytical account is closed after closing the “Electricity Supply” account. During the year, consumed water is written off to consumer accounts at the planned cost. At the end of the year, the actual cost of a cubic meter of water and the amount of calculation differences are determined. The difference between the actual and planned cost per cubic meter of water is the coefficient by which the calculation difference is distributed to the accounts of water consumers. After distribution and write-off of the calculation difference, the “Water Supply” account is completely closed and has no balance in the final balance sheet of the farm.

4. Closing the sub-account “Drawn transport ” Closing the “Drug transport” account, unlike other accounts of auxiliary production, has a number of characteristic features. This is due to the fact that in addition to the main unit for calculating the cost of services (working day of transportation), the cost of the offspring is determined and adjusted accordingly using this account. When closing the Horse-Drawn Transport account and adjusting the cost of a working day of transportation and offspring, a certain sequence of calculations is used. Initially, the actual cost of one head of offspring and the calculation difference for the offspring are established. After the calculation difference for the offspring of draft animals has been determined and additionally written off (credit to account 23, debit to account 11), an amount remains on the horse-drawn transport account to be distributed to the accounts of consumers of live draft services. By dividing the remaining amount by the number of working days worked by manpower, the coefficient by which the remaining amount is distributed to consumer accounts is determined. When distributing the total amount of the calculation difference, working days of self-service transportation, as well as those related to already closed accounts of auxiliary production, are excluded from the calculation. After all the adjusting entries, the horse-drawn transport account is closed and has no balance on the balance sheet.

5 . Closing the sub-account “Road transport ”. During the year, work performed by motor transport is written off monthly on the credit of the motor transport account according to the planned cost and is charged to the debit of the accounts of service consumers. At the end of the year, after calculating the actual cost of road transportation, deviations of actual costs from planned ones are determined. When closing the “Road Transport” account and distributing deviations, you should keep in mind that they are not always written off to the accounts to which vehicle costs were allocated during the year.

6. Closing the sub-account “Repair production ” Regardless of the method used for accounting for repair costs, practically according to these sub-accounts, costs are written off and assigned to their intended purpose during the year as repairs are completed (including costs for completed repairs at the expense of the repair fund). In this case, as a rule, repair costs include the overhead (shop) costs of the repair shop in the standard amount. With this procedure, at the end of the year there is only a need to clarify and adjust the overhead expenses written off during the year to their actual amounts. Deviations of actual amounts of shop expenses from standard amounts are written off and distributed among repair objects in proportion to the standard amounts of overhead expenses allocated during the year.

7. Closing the subaccount “Machine and tractor fleet ” Under this subaccount, during the year, the cost of transport work performed (with the exception of such work in crop production) is written off from the loan according to the intended purpose at the planned cost of a conditional reference hectare based on the volume of work performed. After writing off the amounts for all items, the costs related to the transport work of tractors (with the exception of such work in crop production) remain in the subaccount. These amounts constitute the actual cost of transport work (excluding work in crop production). The final stage in closing the subaccount is to bring the planned cost of transport work to the actual cost by distributing the balance available on the subaccount in proportion to the transport work written off during the year in the planned assessment of a conditional reference hectare. After this, the subaccount is closed, and it has no balance in the final balance. It should be noted that the work of closing subaccount 3 is currently unjustifiably complicated due to the consolidation of cost accounting for agricultural and transport work on tractors in one analytical account. Separate analytical accounts under subaccount 23-3 take into account the costs of maintaining and operating self-propelled vehicles. Closing these analytical accounts at the end of the year comes down to the distribution and assignment of costs for depreciation, repairs and other expenses. After this, the analytical accounts for the maintenance and operation of self-propelled vehicles are closed; in the final balance sheet, these analytical accounts, as well as in general, subaccount 23-3, do not have a balance.

Topic: Closing general production and general expenses accounts.

Write-off of deferred expenses according to purpose

1. Closing account 97 “Deferred expenses”

2. Closing account 25 “General production expenses”

3. Closing account 26 “General business expenses”.

1. Closing account 97 “Future expenses” When writing off expenses for the reporting year from account 97, a statement is drawn up, the columns of which reflect each type of expense to be attributed to the expenses of the current year. The amounts of accrued depreciation for on-farm production reclamation funds, recorded in account 97 as a separate item, are written off in equal shares over three years to those cost accounting objects in subaccount 20-1 “Crop production”, which include the corresponding reclamation funds. Based on the statement for writing off costs, an entry is made to the debit of accounts in the areas of expenses and the credit of account 97 “Deferred expenses”. After writing off the costs attributable to the reporting period, account 97 remains a balance within the limits of the costs relating to future reporting periods.

2. Closing account 25 “General production expenses ” General production expenses in livestock farming are distributed among all types and groups of livestock recorded in subaccount 20-2 “Livestock husbandry”. The correct distribution of overhead costs is influenced by the sequence of closing analytical accounts of account 25. Therefore, you should adhere to the sequence that gives the greatest accuracy in the distribution of costs for cost calculation objects. Regardless of the method used for closing analytical accounts within account 25, the general closure of this account is done on the basis of a summary statement of cost distribution.

3. Closing account 26 “General business expenses ” Account 26 “General business expenses” is closed in the same way. The amounts recorded in this account, minus the amounts used to reduce unproductive expenses, are distributed at the end of the year to the accounts of main production, including work for the next year's harvest, and are attributed in the established amount to work performed by auxiliary production outside, construction work carried out in an economic way, planting and cultivating perennial plantings. To close account 26, a cost distribution sheet is drawn up, in which, for each object of accounting for expenses for main production, the basis for the distribution of costs is shown in the same way as for general production expenses.

How to close account 23

Closing a costing account is a procedure for allocating the costs collected on it to the cost of finished products (services). It is carried out at the end of each reporting period. This period is usually a month, since most recurring costs are accrued monthly.

The basis for distribution when closing account 23 depends on the specifics of the auxiliary production. If we are talking about energy resources, then Gcal or kWh is chosen as the base, for water supply - a cubic meter of water, for a transport section - t/km, etc. In the case when auxiliary production facilities provide services on the side, the corresponding costs for them must be taken into account and distributed separately.

In some cases, a debit balance may remain after closing, indicating the presence of work in progress. This could be, for example, unfinished complex repairs or the construction of a temporary structure.

***

Accounting account 23 is used to summarize information about the costs of divisions providing main production. The debit of the account collects expenses, and the credit reflects their distribution among accounting objects. The balance on account 23 indicates the presence of work in progress.

No or not reflected production of products, provision of services or balances of work in progress

When closing cost accounts 20, 23, 25, 26, the message is displayed: “Product output, provision of services or WIP balances are not reflected.” It is necessary to check how the basis for the distribution of direct expenses was set in the accounting policy (menu Enterprise → Accounting policy → Accounting policy of organizations, Production tab). The distribution base for direct costs can be: Based on the planned cost of production, Based on revenue.

If the distribution of direct costs is carried out according to the planned cost of production, then it is necessary to check whether the planned cost is equal to zero.

To do this, you need to generate a report Analysis of account 20(23) with detailing by subdivisions and Nomenclature groups, as well as check the compliance of the amounts of current expenses (debit turnover) and the amounts of the planned cost of production (credit turnover).

In this case, the debit and credit turnovers must be non-zero. If there is no turnover on the loan (zero), it follows that there was no production, then you need to reflect the balances of work in progress using the document “Inventory of work in progress.”

When direct expenses are distributed according to revenue, you need to check whether revenue for a given period is equal to zero. To do this, you need to generate a report “Analysis of subconto” with the subconto type Nomenclature groups, and also check the presence of turnover on accounts 90 and 20.23.

If no services were provided during the reporting period, then it is necessary to reflect the remaining WIP using the document “WIP Inventory”.

Postings to account 23 “Auxiliary production”

Correspondence and main entries for the “Auxiliary Production” account are presented in the table below:

| Dt | CT | Wiring Description | A document base |

| 08.03/01 | 23/08.03 | Capitalization of OS from your repair shop | OS-1, 301-APK |

| 10 | 23 | Cost of services for delivery of materials from suppliers | 134-APK, 4-P, 4-S, 301-APK |

| 15 | 23 | Reflection of auxiliary production services when procuring materials | Calculation of distribution of services, 301-APK |

| 20.03 | 23.01 | Reflection of the repair of equipment/mechanisms of industrial (auxiliary) production in your repair shop | 302-APK |

| 21 | 23.01 | Own semi-finished products taken into account | 264-APK, Report on distribution of services |

| 23 | 23 | Counter services of auxiliary productions | 301-APK, Accounting certificate |

| 28 | 23 | Attribution of the cost of rejected products (works/services) of auxiliary production | Product defect report, Accounting certificate |

| 29 | 23 | Attribution of the cost of work/services of auxiliary production for servicing production facilities/farms | 301-APK, TTN, etc. |

| 41 | 23 | Capitalization of auxiliary production products | Accounting certificate, Acceptance note |

| 23 | 68 | Calculation of payments to road funds | Accounting information |

| 23 | 69 | Calculation of the unified social tax to the Social Insurance Fund, Pension Fund, etc. | T-49, Calculation of determining the share of the single tax, Accounting certificate |

| 23 | 70 | Calculation of wages to employees | T-49,136-APK, 137-APK, etc. |

| 23 | 71 | Payment of various expenses through accountable persons | AO-1 + documents for the purchase of MPZ |

| 23 | 73.03 | Write-off as expenses compensation for the use of personal cars of personnel for production needs | Agreement for the use of personal transport, Accounting certificate |

| 23 | 76.08 | Reflection by the tenant of the rental amount (on the balance sheet) | Lease agreement, Calculation of payments under the agreement, Accounting certificate |

| 23 | 91.01 | Reflection of surplus work in progress | INV-19, Manager's Order |

| 23 | 94 | Inclusion in costs of the cost of missing MC/losses | INV-3, INV-19, Manager's order |

| 23 | 96 | Inclusion in costs of deductions to the reserve for future expenses/payments of auxiliary production | Accounting certificate, Calculations of reserves |

Cost distribution using the example of Diana LLC

Let's look at how costs are distributed using the example of Diana LLC. During the month, on account 20, costs were collected for two product groups - “Finished products” and “Semi-finished products” in two production shops (Fig. 7).

Fig.7

The release of finished products and semi-finished products is also reflected in the corresponding product groups in two workshops at the planned cost (for a semi-finished product the planned cost is 14,000 rubles, for finished products 6,500 rubles).

At the end of the month, part of the semi-finished and finished products are sold to the final buyer (Fig. 8).

Fig.8

One unit of finished product, for which costs were written off in Shop 1, remained in work in progress. To reflect this operation, the accountant needs to enter the document “Inventory of work in progress.” The tabular part of the document indicates the nomenclature group of the work in progress and the amount of costs according to accounting and tax accounting data that must be left in work in progress. Please note that no postings are generated when posting a document, but when closing the month, the program will take into account the information specified by the user.

Fig.9

The auxiliary division provided services to Workshop 1, Workshop 2 and the Administration, as a result of which all costs collected in the nomenclature group “Services of auxiliary divisions” were decided to be distributed between these divisions taking into account the coefficients:

Shop 1 - 25 units.

Shop 2 – 22 units.

Administration – 6 units.

Before starting routine processing to close the month, the accountant needs to enter the document “Production Report for the Shift”, indicating in the tabular part of the document exactly where the collected costs should be distributed (Fig. 10).

Fig.10

To “transfer” the costs of invoice 23 to invoices 25 and 26, it is necessary to indicate the cost item to which these costs will “go”, otherwise, at the end of the month, postings Dt 25 Kt 23 and Dt 26 Kt 23 will be generated, and then the distribution of the amount that came with 23 invoices will not be processed. Let's create a separate cost item “Costs of auxiliary production” in order to see what amount of costs was transferred from the auxiliary workshop to other departments.

Let's analyze the collected costs in the accounting accounts and determine how the distribution should be carried out (Fig. 11).

Fig.11

1. When closing the month, the entire amount of sales expenses will be closed on account 90.07, i.e. a posting will be generated Dt 90.07 Kt 44.02 in the amount of 1,500 rubles.

2. According to the distribution base of account 23 indicated in the document “Production Report for the Shift”, the entire cost of 3,044.4 rubles collected on account 23 should be distributed into 3 areas: 3. According to the accounting policy of the organization, costs of account 26 at the end of the period are closed on account 90.08 “Administrative expenses”. Taking into account the costs that came from account 23, the amount of general business expenses will be:

344,65+1 866,4=2 211,05

Thus, when performing the routine operation “Closing accounts 20, 23, 25, 26”, a posting of Dt 90.08 Kt 26 in the amount of 2,211.05 rubles will be generated.

4. When distributing, overhead costs are divided as follows:

- the entire amount of costs within the division is “transferred” from account 25 to account 20

- within the division, on account 20, distribution is made between product groups according to the base specified for the distribution of overhead costs

According to the accounting policy of Diana LLC, wages are used as the basis for the distribution of general production expenses. To calculate the distribution of costs, we will create a balance sheet for account 20 with detail down to divisions and item groups. At the same time, we will establish a selection by cost items with the type of expenses of the NU “Payment”, according to which the costs collected in account 25 are distributed (Fig. 12).

Fig.12

Do not forget that when distributing general production costs (Fig. 13), it is necessary to take into account the amount of auxiliary production costs that “came” to account 25 when distributed between areas.

The amount of costs for Workshop 1 is 10,876+1,436.04=12,312.04

The amount of costs for Workshop 2 is 6,972+1,263.71=8,235.71

Fig.13

| Coefficient | Cost amount | Wiring |

| 25 | 25/(25+22+6)*3 044,4=1 436,04 | Dt 25 Workshop 1 Kt 23 |

| 22 | 22/(25+22+6)*3 044,4=1 263,71 | Dt 25 Shop 2 Kt 23 |

| 6 | 6/(25+22+6)*3 044,4=344,65 | Dt 26 Administration Kt 233 |

| Coefficient | Cost amount | Nomenclature group |

| Workshop 1 | ||

| 560 | 12 312,04*560/1 560=4 419,71 | Finished products |

| 1000 | 12 312,04*1 000/1 560=7 892,33 | Semi-finished products |

| Workshop 2 | ||

| 650 | 8 235,71*650/900=5 948,01 | Finished products |

| 250 | 8 235,71*250/900=2 287,70 | Semi-finished products |

The amount of costs for account 20 before distribution by divisions and product groups is (Fig. 14):

Fig.14

You also need to remember that 2,389 rubles remain in the work in progress for the “Finished Products” product group for the Workshop 1 division.

It turns out that when closing cost accounts, the following costs will be collected on account 20:

| Subdivision | Nomenclature group | Amount of costs | Issue volume |

| Workshop 1 | Finished products | 7 166,8+4 419,71-2 389=9 197,51 | 1 PC. |

| Semi-finished products | 13 413,6+7 892,33=21 305,93 | 1 PC. | |

| Workshop 2 | Finished products | 650+5 947,01=6 597,01 | 1 PC. |

| Semi-finished products | 18 870,4+2 287,7=21 158,1 | 1 PC. |

Since the postings for writing off the cost of goods sold and semi-finished products were generated at the accounting price, then after all costs have been distributed, these postings must be adjusted to the fact. As can be seen in Fig. 14, the planned price for the production of finished products is 6,500 rubles, for semi-finished products - 14,000 rubles.

Regardless of which workshop produced the finished product or semi-finished product, when released to one warehouse, the cost per unit of production will be calculated as the average between two released units, i.e. (9,197.51+6,597.01)/2=15,794.52/2=7,897, 26 rub.

Cost of 1 piece. semi-finished product will be (21,305.93+21,158.1)/2=21,232.015 rubles.

Thus, entries generated when selling products must be adjusted as follows:

Dt 90.02 Kt 43 Finished products 7,897.26-6,500=1,397.26

Dt 90.02 Kt 43 Semi-finished product 21,232.015-14,000=7,232.015

Please note that in our example, for each division in the context of product groups, the production of only 1 unit of product was reflected, therefore the entire amount of collected costs was distributed to this unit. How is distribution made between released products if different product items are released within one division for the same product group?

PP "1C: Enterprise Accounting 8" distribution of costs between manufactured products is carried out in proportion to the volume of output, i.e. costs are collected using the “pot” method and distributed in equal terms across all manufactured products. It turns out that the cost per unit of products of different types within the combination “Division + Product group” is the same.