A resigning employee who has not taken any vacation at all is not an uncommon situation. However, in 1C there is no standard document for this accrual. Let's look at an example of how to calculate vacation compensation upon dismissal in 1C 8.3 Accounting.

From the article you will learn:

- when to make a calculation upon dismissal in 1C;

- how to calculate compensation for unused vacation in 1C 8.3;

- what document to use to formalize the accrual of compensation for unused vacation upon dismissal in 1C 8.3 Accounting.

Step-by-step instruction

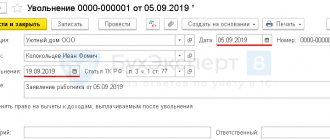

The head of the transport department, I. F. Kolokoltsev, is resigning, having worked for the Organization since December 26, 2016. Over the past year, Kolokoltsev fully used the right to annual paid leave, the duration of which in the organization is 28 calendar days.

On September 5, Kolokoltsev wrote a letter of resignation. On the same day, an order was issued for his dismissal effective September 19.

On September 19, Kolokoltsev received the following calculation:

- compensation for unused vacation;

- wages for September.

On the same day, settlements were made with the employee in the form of a transfer to a personal card, taking into account the fact that on August 25, Kolokoltsev I.F. received an advance for September in the amount of 16,000 rubles. Personal income tax was also paid to the budget.

Vacation followed by dismissal

Example.

Employee A. A. Berezkin, on his own initiative, decided to go on basic paid leave from April 3 to April 23, 2018 (21 calendar days) with subsequent dismissal.

Note that the employee has every right to use his vacation before dismissal - this is enshrined in Part 2 of Art. 127 Labor Code of the Russian Federation.

In the example under consideration, first of all, the accountant must accrue and pay vacation pay to the employee at least three calendar days before the start of the vacation - this is stated in Part 9 of Art. 136 of the Labor Code of the Russian Federation, that is, the deadline for payment of vacation pay is March 30, 2018.

In “1C: Salaries and Personnel Management 8”, ed. 3.0, accrual and calculation of vacation, as already indicated in previous examples, is carried out by the “Vacation” document. After which the program registers the dismissal of employee A.A. Berezkin. – this can be done using the “Dismissal” document (section “Personnel” - “Hires, transfers, dismissals”).

As noted in Art. 127 of the Labor Code of the Russian Federation, the day of dismissal is the last day of the employee’s vacation, that is, in our example, this date is April 23, 2022, and all final payments upon dismissal and issuance of a work book must be made on the day when the labor obligations between the employee and the employer cease , otherwise - on the last working day. In the described situation, Berezkin’s last day to go to work is the day before the start of the vacation (April 2, 2022), therefore, on this date it is necessary to make the final settlement with the employee, which includes payment of wages, compensation upon dismissal, etc. This is explained in the Letter of Rostrud dated December 24, 2007 No. 5277-6-1.

In order to ensure that the calculation of vacation compensation upon dismissal is correct, it is recommended that you first view the balance of unused vacation by the employee as of the date of dismissal (section “Personnel” - “Personnel reports” - report “Vacation balances” or “Certificate of vacation balances”). It is important to note that the length of service that gives the right to basic leave does not include the number of days of vacation followed by dismissal! As of April 3, employee Berezkin had used up all previously unspent vacation, so he is not entitled to vacation compensation upon dismissal for the period of service from April 3 to April 23, 2022.

If the base in the “Dismissal” document on the “Vacation Compensation” tab includes days of vacation followed by dismissal in the length of service that gives the right to annual leave, then they must be corrected manually.

Dismissal of an employee

To correctly reflect transactions for calculating the last salary and compensation for unused vacation in 1C 8.3 Accounting, dismiss the employee.

Dismissal document in the section Salaries and Personnel – Personnel Records – Personnel Documents – Create – Dismissal.

Study in detail the dismissal procedure and filling out the document using the example

Now let’s look at how to calculate compensation for unused vacation in 1C 8.3.

Creating a new accrual type

First, in the “Accruals” directory, you need to add an accrual with the name, for example, “Vacation Compensation”. In part of the window we indicate that income is subject to personal income tax. In the “Code” field you need to specify the accrual code.

There is a lot of debate about which code to indicate here, but I found an explanation of this issue from the director of the Glavbukh magazine. It turns out that the list of codes that are acceptable for indicating compensation for unused vacation is not included. Therefore, it is recommended to use code 4800 “Other income”. Although I know that many people use codes 2000 and 2012 without consequences from the inspection authorities.

In the section “Insurance premiums”, indicate the type of income “Fully subject to insurance premiums”.

In the next part, indicate that accounting is kept according to the article, and select paragraph 1, article 255 of the Tax Code of the Russian Federation.

Next, in the “Reflection in accounting” part of the window, indicate:

- Method: the one that suits you for attributing costs.

- If you are a UTII payer, also select the option you need.

Click the “record” button. This is what you should get:

Calculation upon dismissal in 1C 8.3 Accounting: step-by-step instructions

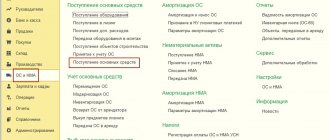

Compensation for unused vacation in 1C 8.3 Accounting is reflected in the Payroll in the Salaries and Personnel section - Salary - All accruals - Create button - Payroll.

In the document please indicate:

- Salary for a - the last month of work of the employee.

- from — the employee’s last day of work.

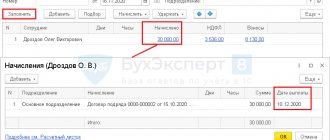

Click the Accrue select Accrual Compensation for unused vacation and indicate the amount of compensation calculated independently .

Check the accrued amounts and, if necessary, adjust them in the form using the Accrued .

- Personal income tax - the amount of calculated personal income tax.

Follow the personal income tax to check the cumulative personal income tax calculation for an employee for the current tax period.

Postings

Test yourself! Take the test:

- Test No. 18. Salary settings in 1C

How to calculate and charge compensation

The amount of compensation upon dismissal in 1C 8.3 is calculated using the Payroll document.

In the document, click the Add button on the Accruals tab, add a new line, indicate the required employee, and select the calculation type: Leave compensation upon dismissal.

Calculation of compensation for unused vacation upon dismissal in 1C 8.3

Since automatic calculation of the amount and days of vacation compensation upon dismissal is not provided in 1C 8.3, this is done manually and then, based on this, the Amount and Number of days columns are filled in for information.

Based on Article 139 of the Labor Code of the Russian Federation, average daily earnings = earnings for the billing period/12/29.3.

Let’s say employee Skvortsov quits on June 6, 2016. According to the 1C 8.3 database Average daily earnings = 216,000.00 / 12 / 29.3 = 614.33 rubles. At the time of dismissal, to calculate the days of compensation, the employee worked 3 months and 22 days.

By virtue of clause 35 of the Rules on regular and additional leaves, surpluses that are less than 1/2 month are excluded. And excesses of more than 1/2 month are rounded up to the whole month.

Therefore, we take 4 months into account. 28 / 12*4 =9.33 days of vacation compensation:

Where to get data to calculate average earnings in 1C 8.3

Data on amounts of time worked in 1C 8.3 can be viewed in the report Brief summary of accruals, deductions and payments from the section Salaries and Personnel - Salary Reports. In the report settings, you should add selection by employee. Let's open the report settings to change:

Let's add the Employee field for selection:

Right-click on the added line and select Properties of user settings elements:

In the window that appears, check the Include in user settings checkbox:

Now in 1C 8.3, selection by employee will be available in the report header. Next, we display the number of days and hours worked in the summary table. To do this, set the cursor in the report structure table as shown in the figure below and add new columns on the Fields tab: Days worked and Hours worked:

The report will look like this:

Important: time worked is automatically entered only for the predefined accrual Payment by salary, which is initially present in the 1C 8.3 Accounting 3.0 configuration. But even for a predefined type of calculation, it is necessary to adjust the time worked if the employee had periods of absence. This does not apply to the types of accruals that are entered in separate documents: vacation, b/l. Program 1C 8.3 will subtract this period from the working time period.

If custom calculation types have been added, then in order for the time worked to be collected in a report in 1C 8.3, you must fill it out each time in the Payroll document on the Accruals tab. In this case, the data will be collected into the report correctly and automatically.

Save the report option by clicking the Report options button:

In the window that opens, enter the name of the report option and click Save:

Now in 1C 8.3 Accounting 3.0 there is easy access to the desired report version:

On the PROFBUKH8 website you can find other free materials on 1C Accounting 8.3 (8.2).

You can learn how to process transactions for payment of compensation for unused vacation, payment of sick leave benefits, calculation of average daily earnings during a business trip, deduction of alimony from salary, and payment of vacation pay in our course on working in 1C 8.3 Accounting in the HR and wages module. For more information about the course, watch our video:

Please rate this article:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Compensation for next vacation

To create, register and calculate vacation accruals in the 1C Salary program, there is a “Vacation” document. To create this document, go to the “Salary” menu, then follow the “Vacations” link to the list of vacation accrual documents.

In the list window, click the “Create” button. A window for filling in the details of the new document will open.

It is necessary to fill out the details “Organization”, “Employee”, the month in which the accruals will be reflected, and the calculation period. To be able to enter a vacation period, you need to check the “Vacation” checkbox.

To indicate the number of days of compensation, select the “Vacation compensation” checkbox (for example, 5 days). Thus, it turns out that the employee takes out a vacation for 20 days, but 5 of them he decided not to take time off, but to go to work. The company is obliged to compensate him for these 5 days when paying wages or in a lump sum.

After entering the necessary data, the document will be calculated (recalculated) automatically, provided that this is specified in the program settings. If automatic calculation is disabled, the system will give us a warning “Document not calculated”, and to calculate it you will need to press the arrow button (on the right, see figure):

Setting up the automatic calculation / recalculation of documents function is located in the “Settings” section, link “Payroll calculation”:

At the request of the employee, you can set the “Calculate salary for” attribute. In this case, the amount of wages from the previous month will be added to the calculated vacation amount (if, of course, it has not yet been paid).

Below in the document we see fields with calculated amounts. Some fields nearby, on the right, have an image of the “Pencil” symbol. By clicking on this icon, we will see a detailed breakdown of the amount specified in the details. Here, for example, is a breakdown of the calculated average employee earnings:

In some of these windows with detailed indicators, it is possible to adjust them.

Formula for calculating severance pay

The formula is:

Severance pay = Average daily salary* + Number of working days of the month following the month of dismissal

* Average daily earnings are calculated for the previous 12 months.

We do not take into account:

- social payments (material assistance, compensation payments for travel, training, food, etc.);

- sick leave;

- wages during downtime;

- accrual for the time when the employee did not work.

Personal income tax and insurance premiums for severance pay do not arise. As well as the average earnings, which remain the same for all three months of employment. Condition: in total, all these payments should not exceed three months of average monthly earnings. For employees from the Far North and equivalent places - six times the amount. Otherwise, the excess amount will have to be taxed (clause 3 of Article 217 of the Tax Code, paragraph 6 of subclause 2 of clause 1 of Article 422 of the Tax Code, subclauses 1 and 2 of clause 1 of Article 20.2 of the Law of July 24, 1998 No. 125-FZ).