Postings

What is the document used for? The main purpose of the TORG-12 form is to document

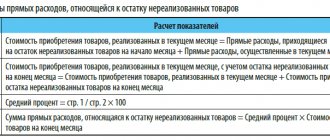

ACCOUNTING FOR TRANSPORTATION COSTS Transportation costs are an integral part of the total costs of organizations. In their

What are insurance premiums Insurance premiums are mandatory payments that organizations and individuals

In the process of carrying out their activities, companies carry out operations with liquid assets not only in national,

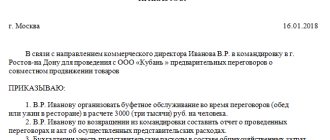

Representation expenses: what is included In the composition of a company's representation expenses you can include a wide range of

General rules of accounting for the 08th account Basic documents that an accountant must follow in

Quarterly property tax reporting has been cancelled. The law has introduced three changes to the calculation procedure.

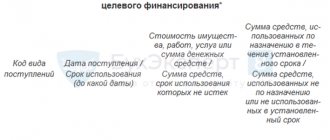

The essence of autonomous institutions and the directions of their work Autonomous institutions (AI) mean non-profit organizations

Choose a favorable tax base There are two tax base options with different rates on the simplified tax system.

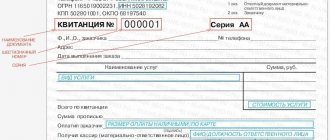

BSO is a strict reporting form, analogous to a cash receipt. From July 1, 2019 BSO