The FSS subordination code is a five-digit set of numbers that is assigned to an organization when registering as an insurer with the Social Insurance Fund. Knowing this code, you can find out the reason for registering the company, as well as in which department of the fund this registration took place. If this code is lost, it can be restored by contacting the fund. In addition, you can find out this code in other ways. In the article we will look at how to find out the FSS subordination code.

The procedure for registering with the FSS

According to Law 255-FZ, policyholders have the right to apply to the Social Insurance Fund for compensation if certain events occur. According to Art. 2.3 of this law, persons who pay payments to citizens of the Russian Federation must register with the Social Insurance Fund at their location. After registering the policyholder with the fund, he is assigned a registration number. In addition, he is also assigned a subordination code to the FSS. This code must meet certain requirements:

- presented digitally;

- consists of 5 digits.

When analyzing this indicator, you can determine the code of the FSS body at the location of the company and the reason for registration with the FSS. You can find out the specified values by the FSS code.

Important! The order of the Ministry of Labor and Social Policy of Russia contains requirements for the mandatory assignment of a subordination code. However, he does not consider options for defining his code.

How to find out the FSS branch code by TIN: step-by-step instructions

Having registered with the Social Insurance Fund, the registered person receives a notification. It indicates the registration number and subordination code. So, having it in hand, everything will be simple. But if for some reason you do not have this paper, then the check can be performed in another way. You can find out the Federal Tax Service branch code by TIN on the specialized resource of this department:

- Through your browser, go to the resource https://fss.ru/.

- In the menu on the left, click on the line “Open Data Portal”.

- On the next screen, follow the link leading to the service.

- Enter your organization's Taxpayer Identification Number.

- Click the "Search" button.

The system will generate a table where it will display the required code. Its first four digits show the FSS branch. By adding one more digit, for legal entities this is “1”, you will receive a subordination code.

Recently, the FSS has practically abandoned remote requests in this way. So you may need to send an application to the territorial FSS office to re-send the assigned data. The address can be found on the department's website.

What is the FSS subordination code and its decoding

The subordination code is assigned by the FSS when registering a company as an insurer. The fund must do this within 3 days from the moment the tax authority receives information about the emergence of a new legal entity (255-FZ). As for individual entrepreneurs, the period for them is 30 days from the date of submission of the contract with employees. After this, the policyholder receives a notification from the FSS containing the code of subordination, as well as the registration number under which the insurance took place. The main thing that the subordination code shows is which department of the fund the company belongs to. The company will have to submit reports to this department.

The decoding of the code is as follows (Order 959):

- The first four digits are the FSS code to which the organization belongs.

- The fifth digit indicates which category the policyholder belongs to.

For example, for entrepreneurs this figure is 3, for legal entities - 1, and for separate divisions - 2.

In addition, the subordination code can mean the following:

- The first four digits are the FSS code that registered the organization.

- The fifth digit is the reason for registration.

The first four digits can also mean a branch of the FSS, and not just a department.

Registration and registration registration in the Social Insurance Fund

Based on the information from the Unified State Register of Legal Entities received by the territorial body of the Social Insurance Fund from the registration tax authority, the Social Insurance Fund in its system generates a policyholder card in the “Pre-registration” state with a registration number automatically assigned to it.

The territorial Social Insurance Fund, responsible for registering policyholders, within 3 working days from the date of submission of information to the Unified State Register of Legal Entities:

- Determines the branch of the territorial body of the Social Insurance Fund that will interact with the policyholder and assigns a subordination code.

- Determines the class of professional risk for the insured to establish the size of the insurance tariff for compulsory social insurance against industrial accidents and occupational diseases.

- Issues 2 notifications - on registration as an insurer of a legal entity and on the insurance tariff (their forms have been approved since 01/01/2021 by order of the Social Insurance Fund dated 10/19/2020 No. 640).

- Saves the information entered into the policyholder card. In this case, the status of the policyholder is changed to “Registered”.

The policyholder's registration number is formed as a 10-digit digital code. From left to right they represent:

- code of the branch of the territorial body of the Social Insurance Fund that registered the policyholder (interacting with this policyholder), or code of the territorial body of the Social Insurance Fund (in the absence of branches) - 4 digits;

- unique serial number of the policyholder in the register of policyholders – 6 characters.

The subordination code is 5 digits from left to right:

- code of the branch of the territorial body of the Social Insurance Fund that registered the policyholder (interaction with him), or code of the territorial body of the Social Insurance Fund (in the absence of branches) - 4 characters;

- the fifth character is the symbol of the reason for registration (“1” – registration of a legal entity as an insured).

The date of registration of the legal entity as an insurer and the date of registration. accounting is the date of entry into the Unified State Register of Legal Entities containing information about the state registration of a legal entity.

At the end of each working day, the FSS information system generates files on all changes in the registration and accounting data of policyholders and sends them to the registration authority.

Notification of registration and Notification of insurance tariff no later than 3 working days are sent to the policyholder with an enhanced qualified electronic signature via the Internet, including:

- to your personal account on the State Services website;

- by email address in the Unified State Register of Legal Entities.

These notifications can also be issued on paper when making a request in person. Duration – 3 working days from the date of receipt of the relevant request.

If the location of the policyholder changes, the territorial body/branch of the Social Insurance Fund at the new location, no later than 3 working days from the date of receipt of the policyholder’s card in the system from the previous place of registration, carries out registration, issues notifications and sends them to the policyholder.

The date of registration with the territorial body/branch of the Social Insurance Fund at the new location of the policyholder is the date of making an entry in the Unified State Register of Legal Entities about the new address of its location. In this case, the date of registration as an insurer and reg. the number does not change.

The role of the subordination code in the FSS

The FSS subordination code allows you to find out where the company is located and its territorial affiliation. In addition, classifying companies in the database will be easier this way. Companies and entrepreneurs that are not insured by the Social Insurance Fund will be fined a fairly large amount. Quite often, confusion arises in all the codes and companies confuse the numbers that were issued to them during registration with the subordination codes. However, these are different numbers and they differ primarily in the number of characters. For example, the registration number is represented by 10 digits, and the Social Insurance Fund code is only 5. You need to indicate the company’s subordination code in cases where it sends reports to government agencies. These reports can be sent both electronically and on paper. For this purpose, each document contains special lines for entering the necessary data.

Important! If there are errors in the code or it is not specified, then this report may not be accepted. And this may threaten the company with penalties. Therefore, it is simply necessary to indicate the subordination code.

After the reform took place in the Social Insurance Fund, many companies stopped evading sick leave payments to their employees. But at the same time, employers now have more difficulties associated with sending reports to the Social Insurance Fund.

Thus, the main role of the FSS subordination code is as follows:

- Allows you to find out information about the organization.

- It is one of the ways to prevent illegal use of a communication network.

- Allows you to simplify the classification of organizations to a simple one, accessible to the Social Insurance Fund.

In addition, the classifier allows you to find the desired fund branch using a special classifier.

Responsibility for late submission and errors in the calculation of 4-FSS

For each calendar month (including incomplete ones) for which the organization is late in submitting the report, it will have to pay from 5 to 30% of the amount of accrued contributions, excluding benefits paid, but not less than 1000 rubles.

For a zero report, officials will impose a fine at the minimum rate, but if it contains indicators, then even a few days of delay will cost 30% of the amount of contributions.

Responsibility for incorrect report form has been introduced. If, by law, the employer is required to submit it electronically, but filled it out and submitted it on paper, then Social Insurance specialists will impose a fine of 200 rubles (clause 2 of Article 26.30 125-FZ). In this case, the employee of the organization responsible for reporting will be fined from 300 to 500 rubles under Part 2 of Art. 15.33 Code of Administrative Offenses of the Russian Federation.

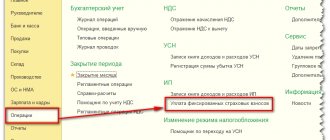

Filling out online

On the websites of accounting software developers My Business, Kontur, Nebo and others, it is possible to fill out the 4-FSS form online on the FSS portal for free. Some sites allow you to do this freely, but usually the services require a small fee (up to 1000 rubles).

It is possible to fill out form 4-FSS on the official website of the FSS portal: please note that the data on the site will not be saved, the generated report must be downloaded and then sent to the department through the document sending gateway.

How to find out the FSS subordination code: methods

Important! The subordination code can be found in the registration certificate. If this certificate is lost or there is no way to view it, then you can use it in other ways.

| Methods | Procedure |

| Personal appeal to the FSS | To do this, you will need to have a tax identification number, a passport, and a document confirming the authority of the applicant. |

| Via the official website of the FSS | After registration on the website, you will be able to obtain the necessary information on the TIN of the organization or individual entrepreneur. |

How to find out the FSS registration number by TIN

From the registration notice

Below is a photo of the registration notice from it where you can see the registration number of the policyholder, and below is the subordination code.

On the FSS website (the best way)

- We go to the FSS website - https://portal.fss.ru/fss/insurant/searchInn and enter the TIN in the field:

- We receive the answer - information about the policyholder as in picture 2, everything is simple. If a company has separate divisions, then the search results will contain several lines.

What is Database Code

One of the columns is called Database Code; it consists of 4 characters that indicate the FSS body assigned to the organization. In order to find out the subordination code from it, you need to add the “registration reason symbol”, for a legal entity the value is 1, for a separate division - 2.

Through the Unified State Register of Legal Entities on the tax website

- Follow the link to the tax website - https://egrul.nalog.ru/index.html.

- Enter the TIN, download the pdf file using the “get extract” button.

- In the section “Information on registration as an insurer in the executive body of the Social Insurance Fund of the Russian Federation” of the extract from the Unified State Register of Legal Entities (in our example, line 34) there will be data on the organization’s FSS registration number.

On the tax website we find out a number consisting of 15 characters, this can be confusing, since there are 10 cells in the 4-FSS report. The fact is that the first 10 characters are the FSS registration number, the remaining 5 are the FSS subordination code.

By personal contact to the FSS

The director of the company or an employee with a correctly executed power of attorney and passport can apply. Before visiting the branch, we advise you to call in advance and clarify what other information may be needed.

Paid methods

In order to find out the FSS registration number, you can contact paid services such as Kontur.Focus, Screen@Astral, Synapse, Unirate24. You can work with these services if you already have access to them; if not, the above free methods are quite sufficient.

Why can’t I find the Social Insurance Fund number using the Taxpayer Identification Number? The point may be that the company registration procedure has not yet been completed, and the program has not pulled up all the data. You can wait a few days, or contact the FSS by phone directly to clarify the issue.

Personal appeal to the FSS

One way to find out your code is to personally contact the fund. In this case, reliable information is provided and there should be no problems when preparing and submitting reports. If the code is incorrectly determined, the company may face large fines. Particularly large fines threaten those companies that employ a large number of employees. Therefore, the best way to find out the code would be to personally contact the FSS. To do this, you will need to have the following documents with you:

- TIN;

- representative's passport;

- an order confirming that a company representative has the right to request such information.

Please remember that other documents may be required. For more information, please contact your FSS branch.

What are direct payments?

This is a payment scheme in which insured persons (employees) receive almost all benefits directly from the Social Insurance Fund. Employers act as intermediaries - they submit documents to social insurance for the assignment and calculation of benefits.

The Social Insurance Fund pays directly to employees:

- sick leave for illness or injury, starting from the 4th day of incapacity for work;

- sick leave due to an accident at work and (or) occupational disease;

- maternity benefits;

- a one-time benefit for women when registering in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance;

- leave for an employee injured at work (in addition to the annual paid one).

Since 2022, direct payments have been valid throughout Russia; the credit system has been abolished for everyone. If, for example, you pay an employee’s sick leave in full, you will not be able to reimburse such expenses from social insurance. It will not be possible to reduce the accrued insurance premiums on them.

Additional information for individual entrepreneurs

In addition to the subordination code, the entrepreneur is also assigned a registration number after registration. Subsequently, this number for the entrepreneur will remain unchanged. These codes are required when an entrepreneur prepares reports. The first four codes of this code also indicate in which fund the entrepreneur is registered. And the next 6 digits indicate the serial number of the entrepreneur. For an individual entrepreneur, the subordination code must end with the number 3. If the last number is a different number, the entrepreneur must contact the Social Insurance Fund. The entrepreneur's accounting file is formed from documents received by the Social Insurance Fund office. The fund must store this data in electronic form. When changing place of residence, the entrepreneur will also have to change the Social Insurance Fund. After moving, he will have to submit an application for registration to the local office. After this, his subordination code will change, since a new code will be assigned in the new department.

If all of his employees are fired, the entrepreneur may be deregistered from the Social Insurance Fund. This is due to the fact that he no longer has the need to pay insurance premiums. To deregister, an entrepreneur submits a free-form application to the Social Insurance Fund. After submitting the application, deregistration will occur within 2 weeks. In reporting documents, a special field may be allocated for the subordination code. It is represented by four cells, and the fifth is followed by a space. Despite this, all five digits of the code are entered, and the space is omitted.

Let's sum it up

- The subordination code is assigned by the FSS when registering an organization, individual entrepreneur or separate division as an insurer.

- You can find out the code from the notification received from the FSS, or by looking at the organization’s TIN on the FSS website using a special service.

- The subordination code is indicated in the report on Form 4-FSS and displays information about the territorial unit of the FSS that registered the policyholder.

- The first four characters of the code indicate territorial affiliation, the fifth character indicates the basis of registration (as who the employer is registered with the Social Insurance Fund).